NAM: Biden’s LNG Ban Threatens 900,000 Jobs

The liquefied natural gas export industry has turned the U.S. into a powerhouse of cleaner energy, benefiting its trading partners around the world. The Biden administration’s ongoing ban on new LNG export licenses, however, is throttling an industry that could produce many more billions in revenue and a startling 900,000 jobs by 2044.

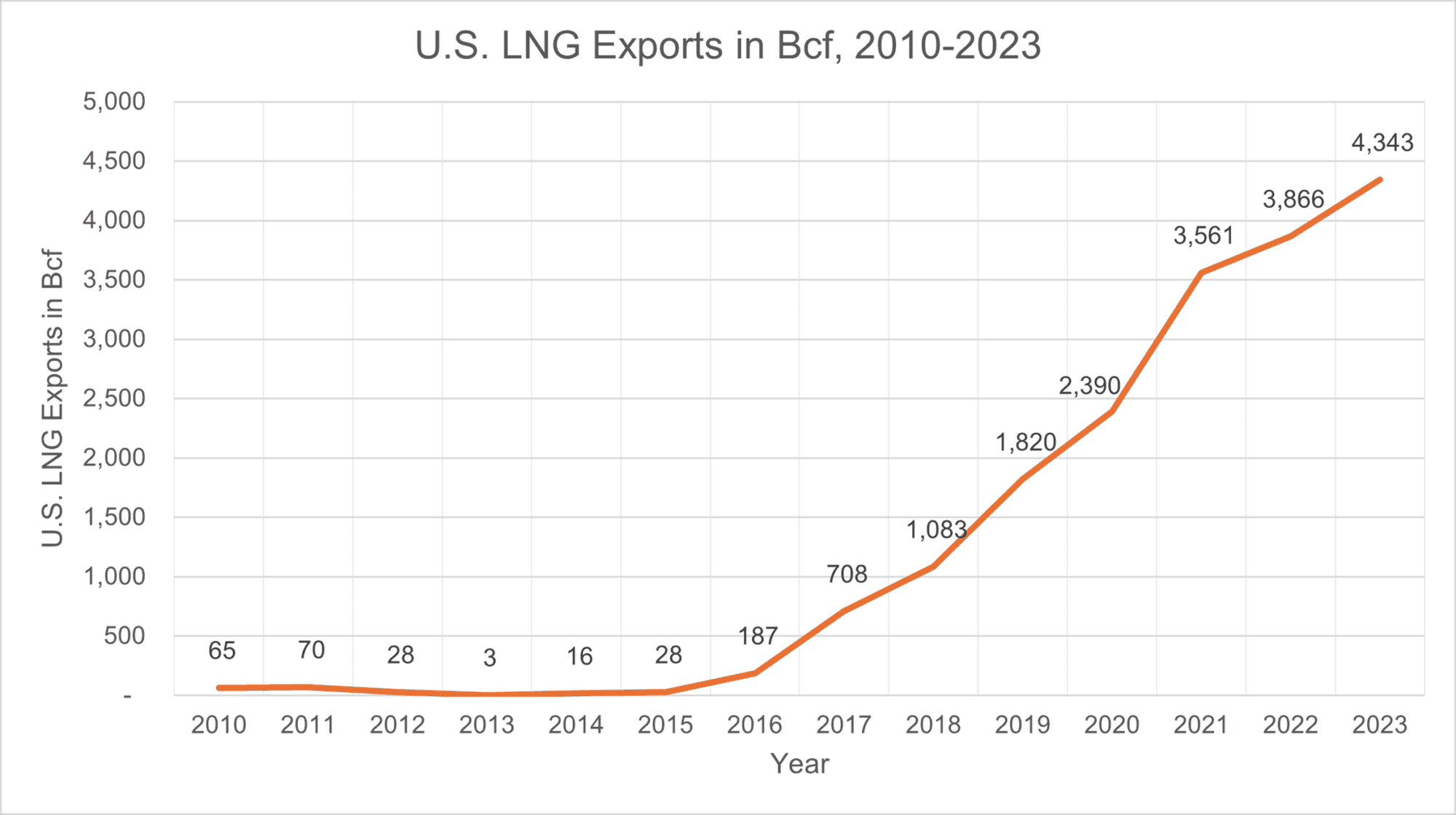

The data: A new study from the NAM and PwC shows that the U.S. LNG revolution could extend its upward climb, as shown on the graph above. Today, the industry is a huge source of jobs and profit:

- U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- The LNG industry contributes $43.8 billion to U.S. GDP.

- And lastly, federal, state and local governments receive $11.0 billion in tax and royalty revenues, thanks to U.S. LNG exports.

But that pales in comparison to the industry’s potential over the next two decades. The study projects the likely growth of the industry through 2044, showing all that is at stake if the ban remains in place until then:

- Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk.

- The ban would also stifle between $122.5 billion and $215.7 billion in contributions to U.S. GDP during the same period.

- Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

Public opinion: The American public is squarely behind the LNG export industry, showing overwhelming approval in an NAM poll taken in March.

- Eighty-seven percent of respondents agreed the U.S. should continue to export natural gas.

- Seventy-six percent of respondents agreed with building more energy infrastructure, such as port terminals.

The last word: “With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential,” said NAM President and CEO Jay Timmons.

- “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

Improving Medical Supply Chain Resiliency

Medical supply chains are critical to ensuring the health and security of Americans—and Congress should act to bolster their resiliency, the NAM told members of Congress this month.

What’s going on: “The COVID-19 pandemic brought to light the risks and instability resulting from concentration and choke points in medical supply chains, though the pandemic also showed how medical supply chains can quickly adjust to external shocks,” NAM Managing Vice President of Policy Chris Netram told Reps. Brad Wenstrup (R-OH), Blake Moore (R-UT) and August Pfluger (R-TX) in response to a request for information on how to improve medical supply chains.

What should be done: The NAM recommended that Congress should work with manufacturers “on a comprehensive approach to find ways to onshore, near-shore and friend-shore more of the medical supply chain,” Netram continued.

There are several actions the federal government should take to fortify medical supply chains, including:

- “[C]reating an environment where small businesses can continue to thrive” and where large companies can maintain their pandemic-era practices of “leveraging sources of domestic production when feasible, working with existing smaller suppliers to improve their reliability” and sourcing goods through new suppliers;

- Streamlining the Food and Drug Administration’s new-supplier certification process;

- Taking “creative steps to incentivize onshoring, near-shoring and friend-shoring, as opposed to imposing punitive or unworkable requirements to do so”;

- Passing the Medical Supply Chain Resiliency Act (H.R. 4307/S. 2115), which would authorize the president to strategically create new trade agreements specific to medical goods with our allies and partners;

- Strategically refining Section 301 tariffs on imports from China;

- Restoring “immediate research and development expensing and full expensing of capital equipment purchases,” ensuring “that the corporate tax rate does not exceed 21%” and making the pass-through deduction permanent; and

- Completing “reauthorization of the Workforce Innovation and Opportunity Act and expansion of Pell grant eligibility to short-term training programs,” as well as supporting solutions that incentivize companies to collaborate to reduce the manufacturing-worker shortage.

The bottom line: “[A]n approach that creates incentives that reduce the cost and complexity of moving supply chains can help U.S. manufacturers to be more resilient in the face of a future global crisis and better able to serve patients who depend on these products,” Netram said.

NAM Emphasizes USMCA, Protecting Investors in Mexico Meetings

In high-level meetings with government, manufacturing and trade group leaders held in Mexico last week, the NAM hammered home a key message: For North American manufacturing to remain globally competitive, Mexico must protect investor holdings in the country.

What’s going on: During a jam-packed three-day visit to Mexico City, NAM President and CEO Jay Timmons and an NAM contingent met with top officials in the new Sheinbaum administration, as well as leadership at multiple agencies and associations.

- These included newly appointed Deputy Trade Minister Luis Rosendo Gutiérrez, the Business Coordinating Council (CCE), the Confederation of Industrial Chambers of Mexico (CONCAMIN), the Mexico Business Council (CMN), the National Council of the Export Manufacturing Industry (INDEX) and others.

What they said: The NAM’s main message at each gathering was the same: Companies investing in Mexico need assurance that their portfolios will be protected regardless of the fate of proposed judicial reforms in the country.

- The NAM also underscored the importance of the U.S.–Mexico–Canada Agreement, which is due for review in 2026, and the necessity of ensuring that the deal is upheld for all three parties.

- If its terms are respected, USMCA could help North American manufacturing outcompete China.

On China: This week, just days after his office’s meeting with the NAM, Gutiérrez announced that the Sheinbaum administration will seek U.S. manufacturers’ help to reshore—mainly from China—the production of some critical technologies (The Wall Street Journal, subscription).

- “We want to focus on supporting our domestic supply chains,” he told the Journal, adding that talks with U.S. companies are still in the informal stage.

The NAM says: “Manufacturing is at the heart of the USMCA,” said NAM Vice President of International Policy Andrea Durkin, who was part of the NAM group on the ground in Mexico. “The NAM intends to work to ensure that the agreement strengthens the competitiveness of manufacturers.”

NAM, Allies Urge Court to Vacate PFAS Rule

The EPA’s final rule setting national drinking water standards for PFAS should be vacated in its entirety, the NAM and two allies said in an opening brief filed in federal court Monday.

What’s going on: The NAM, the American Chemistry Council and U.S. chemical company Chemours asked the U.S. Court of Appeals for the D.C. Circuit to overturn the EPA’s rule, announced in April, which requires that municipal water systems nationwide remove six types of per- and polyfluoroalkyl substances from drinking water. Trade groups representing the water systems have also sued to overturn the rule.

The grounds: The rule is unlawful and must be set aside for the following reasons:

- The EPA used a deeply flawed cost-benefit analysis to justify the rule.

- The EPA conducted a woefully incomplete feasibility analysis that ignores whether the technology and facilities necessary for compliance actually exist.

- Critical parts of the rule exceed the agency’s statutory authority under the Safe Drinking Water Act and flout the act’s express procedural requirements.

- The EPA failed to consider reasonable alternatives or respond meaningfully to public comments that undercut its judgment.

- The agency “lacked sufficient data to regulate” HFPO-DA, one of the PFAS chemicals that falls under the rule.

Why it’s important: PFAS “are substances at the center of modern innovation and sustain many common technologies including semiconductors, telecommunications, defense systems, life-saving therapeutics and renewable energy sources,” according to the brief.

- The NAM and its co-petitioners “support rational regulation of PFAS that allows manufacturers to continue supporting critical industries, while developing new chemistries and minimizing any potential environmental impacts. But that requires a measured and evidence-based approach that the [r]ule lacks.”

What’s next: Briefing in this case will continue through the spring, with oral argument to follow and a decision from the D.C. Circuit expected in late 2025.

Manufacturers on Port Strike: By Resuming Work and Keeping Our Ports Operational, They Have Shown a Commitment to Listening to the Concerns of Our Industry

Washington, D.C. – Following news that the International Longshoremen’s Association and the United States Maritime Alliance have reached an agreement to extend the Master Contract until Jan. 15, 2025, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Manufacturers are encouraged that cooler heads have prevailed and the ports will reopen. By resuming work and keeping our ports operational, they have shown a commitment to listening to the concerns of manufacturers and other industries that rely on the efficient movement of goods through these critical gateways. This decision avoids the need for government intervention and invoking the Taft-Hartley Act, and it is a victory for all parties involved—preserving jobs, safeguarding supply chains and preventing further economic disruptions.

“Manufacturers depend on the stability of our ports to continue building, innovating, delivering products to American families and supporting communities across the country. We commend the International Longshoremen’s Association and the U.S. Maritime Alliance for coming together in the spirit of collaboration and urge both parties to use this time to reach a fair and lasting agreement. Another strike would jeopardize $2.1 billion in trade daily and could reduce GDP by as much as $5 billion per day. We cannot afford that level of economic destruction.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.87 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org

Small Manufacturers Sound the Alarm on Uncompetitive R&D Tax Policy

As part of its “Manufacturing Wins” tax campaign, the NAM’s small and medium-sized manufacturers are drawing lawmakers’ attention to R&D amortization, an uncompetitive tax policy that’s killing jobs and dragging down the world’s most innovative economy.

The problem: “Allowing companies like Sukup Manufacturing to immediately expense R&D investments had been part of the tax code for more than 70 years,” explained Steve Sukup, president and CEO of the Sheffield, Iowa–based company. “But since 2022, we have had to amortize our R&D expenses over five years.”

- “This affects manufacturers everywhere and has a dramatic impact on the U.S. economy, as the private sector accounts for more than 75% of total R&D spending—with small businesses accounting for approximately $90 billion of all private-sector R&D investments.”

- Another heavily impacted manufacturer is Husco of Waukesha, Wisconsin. “In 2024, we have $20 million less liquidity than we would have under the old R&D expensing rules,” said Husco President and CEO Austin Ramirez. “That $20 million represents almost our entire capital budget for 2024.”

Threatening jobs: “Limiting R&D doesn’t just limit innovation—it also has a direct impact on people’s jobs here,” said Tom Tredway, president of Erie Molded Packaging in Pennsylvania. “And these are quality, high-paying jobs—but they are at risk if immediate R&D expensing isn’t restored.”

- “Bringing a new medical device to market is a multiyear process, necessitating significant investments in R&D,” explained Chuck Wetherington, president of BTE Technologies in Hanover, Maryland. “Being required to amortize our R&D expenses has forced us to staff our technical team at a reduced level, slowing down the development of new products.”

Handing a win to China: “China allows a ‘super deduction’ for manufacturing R&D equal to 200% of research costs. That is what we are up against,” said Lisa Winton, who co-founded Winton Machine Company in Suwanee, Georgia. “Meanwhile, Belgium is the only other developed nation with an amortization requirement like the United States.”

- “When you look at the generosity of foreign support, especially China’s, versus the United States, it’s so lopsided,” said Daryl Bouwkamp, who serves as Vermeer Corporation’s senior director of international business development and government affairs. “China is trying to drive behavior toward R&D—and that’s something we’re lacking.”

- “Suddenly, China started manufacturing bagel baskets and shipping them to New York City for cheaper than I could get the steel,” recalled Drew Greenblatt, president and owner of Marlin Steel Wire Products. “We realized we couldn’t thrive in a commodities market. … We [need] to be able to say to buyers, ‘You must buy from the American innovative company because we’re coming up with such slick ideas that our product blows the competition away.’”

Innovation at risk: “[Now is the time] we most need to make investments in innovation, both around the technologies that we provide in our products enabling the United States’ economic growth and success [and] the technologies we use to produce the products that we make,” said Karl Hutter, CEO of Click Bond in Carson City, Nevada.

- Patricia Miller of M4 Factory in Woodstock, Illinois, highlighted that manufacturers are key to meeting the world’s most intractable challenges: “We need to keep those [companies] that are driving the future of innovation and manufacturing in the U.S. economically viable and competitive.”

The last word: “Congress not allowing manufacturers to immediately expense R&D expenses directly translates to fewer quality jobs in the manufacturing sector while our foreign competitors are implementing vastly more beneficial R&D benefits,” Tredway concluded.

R&D Expensing: Q&A with Sen. Young

The NAM recently talked to Sen. Todd Young (R-IN) about the importance of reinstating immediate expensing for research-and-development expenditures. Here’s the full interview:

NAM: Sen. Young, Congress is facing a “Tax Armageddon” next year, as crucial provisions from 2017’s Tax Cuts and Jobs Act are set to expire. As a member of the Senate Finance Committee, what is your focus moving into next year’s debate?

Sen. Young: The Tax Cuts and Jobs Act was a great success—millions of Americans, especially those in the middle class—saw their taxes go down. Corporate tax receipts went up. We stemmed the tide of corporate inversions, and many companies chose to return their operations and tax bases to the United States. If Congress does not act next year to extend provisions of the TCJA, we will undo all of these victories and inflict long-lasting damage on our economy. As we prepare for next year, I am focused on evaluating how best we can build upon our TCJA successes and continue to adopt pro-growth, fiscally responsible tax policy that helps hardworking Americans thrive.

NAM: As you know, for nearly 70 years, manufacturers in the U.S. were able to fully deduct their R&D expenses in the year incurred. Beginning in 2022, however, manufacturers were forced to spread their deductions over several years, greatly harming our ability to grow and compete. What is Congress doing to restore immediate R&D expensing?

Sen. Young: For several years now, I have advocated for the American Innovation and Jobs Act (S. 866), my bill with Sen. Maggie Hassan (D-NH) that would restore full and immediate expensing of R&D expenditures. We first introduced the bill back in 2020 well before the provision expired, and I am disappointed that we are now reaching the end of 2024—nearly three years after the law shifted to amortization of R&D investments—and Congress has yet to pass our bill to fix this crucial issue. As our global competitors, like China, are expanding their R&D incentives, we simply cannot allow our nation and our economy to be left behind. Congress must work to restore our R&D incentives as soon as possible, and this will be one of my top priorities heading into next year’s tax negotiations.

NAM: As a senator who was there during the Tax Cuts and Jobs Act, you know how impactful the legislation was for manufacturers to be able to compete on a global level. As we get closer to next year, what are you hearing from stakeholders on the need for pro-growth tax policy so American businesses can engage and grow around the world?

Sen. Young: At the risk of oversimplifying the issue, it really comes down to competitiveness. A lot of the work I have done in the tax space as well as in other areas is focused on ensuring that America’s position as a global leader remains strong. Without growth, our economy suffers and our ability to remain internationally competitive is diminished. This is a massive national security risk. So, as I look ahead to what next year may hold in the tax arena, I am focused on pro-growth tax policy. We need to be thinking creatively about ways we can add value to our economy and, in turn, ensure Americans are better off.

In different industries this takes on different forms; however, one common thread is the need for R&D. To grow and develop new products, businesses have to put significant amounts of capital into R&D costs, both domestically and internationally. That is why one of my core areas of focus continues to be restoring full and immediate expensing of R&D costs. It is vital for the health of our economy that we take this action, which allows safer and more innovative products to be brought to the marketplace; increases the number of [well]-paying, high-skilled jobs; and secures U.S. interests abroad by ensuring we remain globally competitive.

NAM: Thank you, Sen. Young. What else can NAM members do to stay engaged and be a resource for you going into next year?

Sen. Young: I have always appreciated the NAM’s partnership and advocacy as we work together on these important issues. I would encourage NAM members to continue sharing stories with their elected federal officials of the importance of these tax incentives, like R&D, that enable the creation of high-quality jobs, promote our national competitiveness and strengthen our economy. Your voice matters.

Manufacturers: Boeing Strike Is Poised to Have Significant Economic Consequences Across the Entire United States

Washington, D.C. – As a strike of 33,000 Boeing workers continued into its 20th day, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“The potential economic impact of this strike cannot be overstated. The aerospace industry directly supports more than 500,000 manufacturing workers in America, and the ongoing strike at Boeing’s Puget Sound facilities is poised to have significant economic consequences, not just in the Pacific Northwest but across the entire United States.”

The ongoing strike of 33,000 Boeing workers could total a regional economic loss of more than $1.65 billion after just 20 days, according to NAM calculations.

Timmons added, “This disruption will resonate far beyond Washington state. The aerospace supply chain and manufacturers in the U.S. are interconnected deeply, and a continued halt in production will have devastating effects on our country.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.87 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org

R&D Expensing: Q&A with Rep. Estes

The NAM recently talked to Rep. Ron Estes (R-KA), chair of the U.S. Innovation Tax Team, to learn what he and his colleagues are doing to fight for the return of immediate research-and-development expensing. Here’s the full interview:

NAM: Rep. Estes, Congress is facing a “Tax Armageddon” next year, as crucial provisions from 2017’s Tax Cuts and Jobs Act are set to expire. As a member of the Ways and Means Committee, what is your focus moving into next year’s debate?

Rep. Estes: The Tax Cuts and Jobs Act did so much to encourage economic growth and make the United States competitive globally. Today, about half of the members serving in Congress weren’t in office in 2017 when we passed this landmark legislation, so there’s a lot of educating that’s been happening, not just for the general public but for our members as well. Ways and Means Republicans are taking this opportunity to examine what worked and ways to improve and expand the legislation. Ways and Means Chairman Jason Smith (R-MO) established 10 tax teams to address various parts of the bill, and I’ve been leading the U.S Innovation Tax Team.

NAM: As you well know, for nearly 70 years, manufacturers in the U.S. were able to fully deduct their R&D expenses in the year incurred. Beginning in 2022, however, manufacturers were forced to spread their deductions over several years, greatly harming our ability to grow and compete. What is Congress doing to restore immediate R&D expensing?

Rep. Estes: I’ve introduced legislation—the American Innovation and R&D Competitiveness Act—to address this issue. It’s bipartisan legislation that is supported by 220 colleagues, nearly evenly divided between Republicans and Democrats. Those provisions were also included in the House-passed Tax Relief for American Families and Workers Act, which would have been a welcome fix. However, election-year politics has stalled that bill in the Senate. But manufacturers and innovators need action on immediate R&D expensing now, and it’s something the Senate should still address before the next Congress begins in January.

NAM: Your U.S. Innovation Tax Team has been very busy this year, as you’ve held several roundtables and been receiving feedback focused on the importance of U.S. manufacturers having a chance to compete around the globe. As we get closer to next year, what is your tax team hearing from stakeholders on the need for American businesses to engage and grow around the world?

Rep. Estes: The U.S. Innovation Tax Team has hosted roundtables and listening sessions with innovators and manufacturers across the country. Their message has been consistent and clear: we need a stable tax code that encourages innovation through R&D immediate expensing, continues good policies like FDII [the foreign-derived intangible income deduction] and discourages foreign extraterritorial taxes that are out to pilfer from American innovators. A manufacturer in rural Kansas told me about how the change in immediate R&D expensing has changed their plans for expansion. This is a major employer in a small town, so the impact isn’t just about the business, but it’s also about the jobs that are impacted when R&D is stifled. At the same time, China is offering a 200% super deduction and is working to expand R&D in their country. We can’t cede our dominance in manufacturing, research and development.

NAM: Thank you, congressman. What else can NAM members do to stay engaged and be a resource for you going into next year?

Rep. Estes: The best thing for NAM members to do is to continue talking about the benefits of the Tax Cuts and Jobs Act and the importance of R&D expensing for manufacturers and workers. Unfortunately, there’s a lot of misinformation about the impact of the 2017 tax law, but even the New York Times admitted in 2019 that the Tax Cuts and Jobs Act benefitted most Americans, saying in their headline, “Face It: You (Probably) Got a Tax Cut,” and going on to say, “Studies consistently find that the 2017 law cut taxes for most Americans. Most of them don’t buy it.” Americans, small businesses, innovators and manufacturers need us to extend and expand the 2017 tax law to encourage the kind of economic growth we experienced just several years ago.

Why Manufacturers Need Immediate R&D Expensing

For more than two years, manufacturers have not been able to immediately deduct their R&D expenses—and it’s taken a toll, particularly on small businesses.

What’s going on: For more than 70 years, the U.S. tax code allowed manufacturers to immediately deduct their R&D expenditures. But since the expiration of this key provision in 2022, manufacturers have been required to amortize their R&D costs over a period of years.

Why it’s important: As a direct result of the expiration, manufacturers’ tax bills have increased, according to a new NAM tax explainer released as part of the NAM’s “Manufacturing Wins ” campaign. This means manufacturers are now less able to conduct groundbreaking research and support well-paying R&D jobs.

Uneven playing field: The U.S. is now one of just two developed nations that requires the amortization of R&D expenses.

- The policy makes the U.S. less competitive against China, which offers companies a 200% “super deduction” for R&D costs.

- In 2022, the first full year after the expiration of immediate R&D expensing, the European Union’s R&D growth surpassed that of the U.S. for the first time in nearly a decade—and China’s R&D growth was triple that of the U.S.

What should be done: The NAM is calling on Congress to restore immediate R&D expensing, along with other pro-growth tax provisions.

The last word: “It is imperative that the U.S. tax code support job-creating, life-changing R&D,” said NAM Vice President of Domestic Policy Charles Crain. “Congress must act to bolster manufacturing innovation and American competitiveness by reinstating immediate R&D expensing.”