Rep. Grothman Talks R&D, Taxes at Wisconsin Aluminum Foundry

Rep. Glenn Grothman (R-WI) visited Wisconsin Aluminum Foundry in Manitowoc, Wisconsin, as part of a series of facility visits from key members of Congress organized by the NAM. Rep. Grothman, representing a district with one of the largest percentages of its workforce employed in manufacturing, emphasized the importance of key tax policies that keep manufacturers competitive on a global scale.

During the visit, Rep. Grothman toured the facility with Wisconsin Aluminum Foundry CEO Sachin Shivaram and held a roundtable discussion with company and union leadership. Representatives from Wisconsin Manufacturers & Commerce also participated in discussions about the challenges facing manufacturers.

Innovation and R&D: Shivaram showcased the Foundry’s advanced aluminum and bronze casting capabilities during the tour. He also expressed concern about changes in R&D tax treatment, which have increased the cost of innovation.

- “R&D is essential to the future of our business,” said Shivaram, stressing that restoring full R&D expensing is crucial for manufacturers like Wisconsin Aluminum Foundry. With the expiration of first-year R&D expensing in 2022, the burden of financing R&D has become a major obstacle for small and medium-sized manufacturers.

- Rep. Grothman, who strongly supports restoring full R&D expensing, said, “Manufacturers need every incentive to innovate and grow. If we want to maintain our competitive edge, we need to ensure that tax policy encourages, not discourages, investment in R&D.”

Preserving tax reforms: The roundtable addressed the importance of preserving the 2017 Tax Cuts and Jobs Act, which benefited manufacturers by lowering the corporate tax rate and providing a 20% pass-through deduction for small businesses. These provisions are set to expire in 2025, creating uncertainty for manufacturers.

- Rep. Grothman pointed to Wisconsin’s manufacturing and agriculture credit as a model for federal tax policy going forward. The MAC, which substantially reduces state taxes on manufacturing income, has proven effective in supporting Wisconsin’s manufacturers.

- “We should look at expanding these kinds of targeted incentives nationwide,” Rep. Grothman said, noting that a similar approach at the federal level could bolster U.S. manufacturing and global competitiveness.

The local view: WMC President and CEO Kurt Bauer echoed the concerns about the expiration of the 2017 tax reforms.

- “If these tax provisions are allowed to expire, it would put significant strain on Wisconsin’s manufacturers,” Bauer said. “The ability to reinvest in equipment, innovation and workers is crucial for maintaining our global competitiveness, and losing these tax incentives would make that much harder.”

Workforce development: The roundtable also covered workforce development, a critical issue for an industry facing a shortage of skilled workers.

- Shivaram, who chairs the Governor’s Council on Workforce Investment, stressed the importance of expanding access to skills-based education and apprenticeship programs to meet the needs of modern manufacturing. “We need policies that help us train and retain the workforce of the future,” he said.

- Rep. Grothman echoed this sentiment, pledging to support federal workforce development initiatives that prepare workers for careers in advanced manufacturing. “A skilled labor force is the foundation of manufacturing’s future,” he said.

Closing thoughts: “It is critical that tax policy continue to support manufacturers, who are the backbone of our economy,” said Rep. Grothman. “If we allow tax reform to expire, it would result in devastating tax increases—stalling job creation and innovation. It’s on us in Congress to work together to preserve tax reform and encourage investment, protect jobs and keep American manufacturers competitive on the global stage.”

Fighting for a Competitive Future: A Conversation with Sen. James Lankford

As Congress faces the looming expiration of key provisions from the 2017 Tax Cuts and Jobs Act, Sen. James Lankford (R-OK) emphasizes the urgency of extending these policies to safeguard American businesses and families from tax increases.

Ensuring certainty: Sen. Lankford underscored the importance of creating predictability for businesses by making pro-growth policies permanent. “Extending the TCJA is crucial for American families, and it creates certainty for businesses, particularly those policies encouraging investment and innovation,” he told the NAM in a recent conversation. “Failure to act will result in a tax increase for most American households and 96% of businesses. For greater predictability, Congress should push for as many permanent pro-growth policies as possible.”

One policy Sen. Lankford is particularly focused on preserving is full expensing for capital investments, which allows businesses to immediately deduct the cost of machinery and equipment. This measure, he said, has fueled capital investment and accelerated job creation.

Protecting full expensing with the ALIGN Act: Full expensing has been a bipartisan tool in tax policy for two decades, Sen. Lankford points out, highlighting that the TCJA allowed businesses to deduct 100% of capital expenses in the year of purchase. His ALIGN Act aims to make full expensing a permanent fixture in the tax code, fostering long-term economic growth.

- “That change doesn’t alter how much tax a business can deduct; it simply changes when they can deduct it. With 100% depreciation, a business can deduct its tax in a single year, instead of over several years. That allows a business to invest more capital, hire new employees faster and expand their business.”

Global competitiveness and energy security: Drawing from conversations with Oklahoma businesses, Sen. Lankford stressed that keeping the U.S. tax code competitive is critical. While some push for a corporate tax increase, he warned this would undermine America’s global position.

- “The average corporate tax rate in the EU is 21.3%, with a global average of 23% across 181 jurisdictions. China has a corporate tax rate of 25%, with a reduced 15% rate for new sectors. Moreover, China has significantly expanded its R&D deduction, while the U.S. is shrinking ours. We should reverse the decline of our R&D deduction and permanently encourage businesses of all sizes to remain innovative here in America.”

The final word: “I encourage everyone to regularly communicate with their congressional delegation about the impacts a lapse in the TCJA would have on their businesses and communities,” Sen. Lankford said. “It’s important to share this story as Congress works on a tax bill in 2025.”

Read the full interview with Sen. Lankford here.

Small Manufacturers: Congress Must Restore Full Expensing

As part of the NAM’s “Manufacturing Wins” tax campaign, small and medium-sized manufacturers are urging Congress to make full expensing of capital equipment purchases permanent, warning that the phaseout of this pro-growth tax provision is harming their ability to invest, grow and compete.

What’s happening: Tax reform allowed manufacturers to immediately expense 100% of the cost of capital equipment purchases. But this provision started to be phased out in 2023, dropping by 20%. It will drop by a further 20% every year until 2027, when it will expire completely.

- Seventy-eight percent of manufacturers said that the expiration of full expensing and other pro-growth tax provisions has decreased their ability to expand U.S. manufacturing activity, according to an NAM Manufacturers’ Outlook Survey from last year.

What’s at stake for manufacturers: Capital-intensive industries like manufacturing are the primary beneficiaries of full expensing.

- Lori Miles-Olund, president of Miles Fiberglass & Composites in Clackamas, Oregon, explained the benefits for her company: “We were able to purchase new equipment that not only made our production more environmentally friendly but also safer and more efficient for employees.”

- Colin Murphy, president and owner of Simmons Knife & Saw in Glendale Heights, Illinois, emphasized how critical full expensing is for global competitiveness: “To remain competitive, we need to continually innovate and consistently invest in new machinery and equipment. But with rising tax bills, it’s becoming harder to do so.”

Delayed investments: Some manufacturers are holding off on equipment purchases due to the uncertain tax landscape.

- “I know exactly where the next capital investment should be installed, but I’ve been delaying this decision,” said Courtney Silver, president and owner of Ketchie in Concord, North Carolina. “[Full expensing] dropped to 60% [in 2024], and the fact that I can’t expense the full value of this investment changes the return on investment calculation.”

- In Hodgkins, Illinois, Pioneer Service recently moved from a 24,000-square-foot building to a 62,000-square-foot building, but it can’t take advantage of all this space without full capital equipment expensing. “We had 13 more machines on order that we’ve put a hold on,” explained CEO and Co-Owner Aneesa Muthana. “Thirteen machines equivalent to about $5 million in capital, and that’s completely on hold until we know what’s going to happen next.”

Calling on Congress: If Congress does not act, accelerated depreciation will be entirely absent from the U.S. tax code for the first time in decades. “This isn’t just about numbers on my financial statements and my tax returns—this is about taking care of people here and in communities across this country working for small manufacturers,” said Silver.

- “Congress must act now to support American manufacturers,” said Murphy. “Our ability to invest in our communities, create jobs and innovate is at risk.”

Rep. Miller-Meeks Calls for PBM Reform at Cemen Tech

Rep. Mariannette Miller-Meeks (R-IA) visited Cemen Tech in Indianola, Iowa, for an employee town hall about how pharmacy benefit managers increase prices for manufacturing workers.

The event, hosted by Cemen Tech Chief Financial Officer Josh Maurer, allowed workers to engage directly with Rep. Miller-Meeks on the affordability of their health care, including prescription medicines.

The issue: The town hall focused on the need to reform PBMs, underregulated middlemen that drive up the costs of prescription medicines for manufacturers like Cemen Tech, the world’s largest manufacturer of on-demand concrete mixing equipment.

- Rep. Miller-Meeks discussed the DRUG Act, NAM-supported legislation that she introduced, which seeks to lower health care costs by delinking PBMs’ compensation from the list price of medicines—removing their incentive to push for higher prices.

- “PBMs distort the market, increasing the cost of prescription drugs for businesses and their workers,” Rep. Miller-Meeks explained. “That’s why I’m working in Congress to pass PBM reform that reins in these powerful actors.”

Manufacturers’ concerns: “We’ve seen health care expenses skyrocket, and a big part of that is due to the lack of transparency surrounding PBMs,” Maurer said during the town hall.

- “Cemen Tech and other small manufacturers like us are committed to providing affordable health care to employees, but it’s becoming increasingly difficult. PBM reform that addresses these rising costs is absolutely necessary.”

Addressing employee concerns: Cemen Tech employees also spoke about their struggles with the growing burden of health care costs across the board. Rep. Miller-Meeks explained that her proposed reform would have far-reaching effects: “It’s not only about reducing drug prices—it’s about ensuring that businesses can afford to continue providing health care benefits to their workers,” she said.

NAM in action: In addition to supporting the “delinking” provisions in the DRUG Act, the NAM is working with Congress on legislation to make PBMs’ opaque business practices more transparent and to ensure that savings from rebates are passed directly to manufacturers and their workers rather than being pocketed by PBMs.

The bottom line: “Manufacturers like Cemen Tech are essential to our economy, and ensuring they can thrive means addressing the rising costs of health care,” said Rep. Miller-Meeks. “PBM reform will free up manufacturers to do what they do best—build facilities, develop new product lines, increase wages and benefits and help the American economy grow.”

Department of Energy’s LNG Export Pause Puts 900,000 Jobs at Risk According to New Research

Economic Cost Could Exceed $216 Billion, Climate Goals At Risk

Washington, D.C. – As the Biden administration continues its efforts to boost the availability of clean energy in the United States and around the world, an ongoing pause in liquefied natural gas export licenses threatens economic stability as well as progress made by manufacturers in America. A staggering 900,000 jobs could be at risk according to a new study released today by the National Association of Manufacturers.

“With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential. LNG exports also play a key role in meeting clean energy goals. But clamping down on our energy sector unnecessarily puts jobs and economic growth at risk, while pushing other nations to use higher emissions alternatives,” said NAM President and CEO Jay Timmons. “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

Conducted in partnership with PwC, the analysis uses the government’s own projections to conclude that robust LNG export activities could contribute up to $216 billion to U.S. GDP and generate $46 billion in tax revenue in 2044 if projects proceed as planned. A pause on LNG exports threatens these gains.

Timmons added, “The Biden administration’s ill-advised decision to stop LNG exports could cost Americans dearly, while leaving our geopolitical allies—particularly in Europe—out in the cold. The data is clear: halting LNG export licenses puts nearly a million jobs at risk. The LNG freeze also deprives us of an important tool of soft power to bolster trading partners who share our values. This study provides policymakers—present and future—a clear path to create jobs and hundreds of billions of dollars in economic growth by harnessing America’s abundant supply of LNG.”

Current Economic Benefits by the Numbers:

- Job creation: U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- Economic output: The LNG industry contributes $43.8 billion to U.S. GDP.

- Tax revenue: Federal, state and local governments receive $11.0 billion in tax revenues, thanks to U.S. LNG exports.

Future Benefits Undermined by an LNG Export Ban:

- Jobs threatened: Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk if the ban on U.S. LNG exports continues through 2044.

- The economic fallout: An LNG export ban would stifle between $122.5 billion and $215.7 billion in annual contributions to U.S. GDP during the same period.

- Communities shortchanged: Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM: Biden’s LNG Ban Threatens 900,000 Jobs

The liquefied natural gas export industry has turned the U.S. into a powerhouse of cleaner energy, benefiting its trading partners around the world. The Biden administration’s ongoing ban on new LNG export licenses, however, is throttling an industry that could produce many more billions in revenue and a startling 900,000 jobs by 2044.

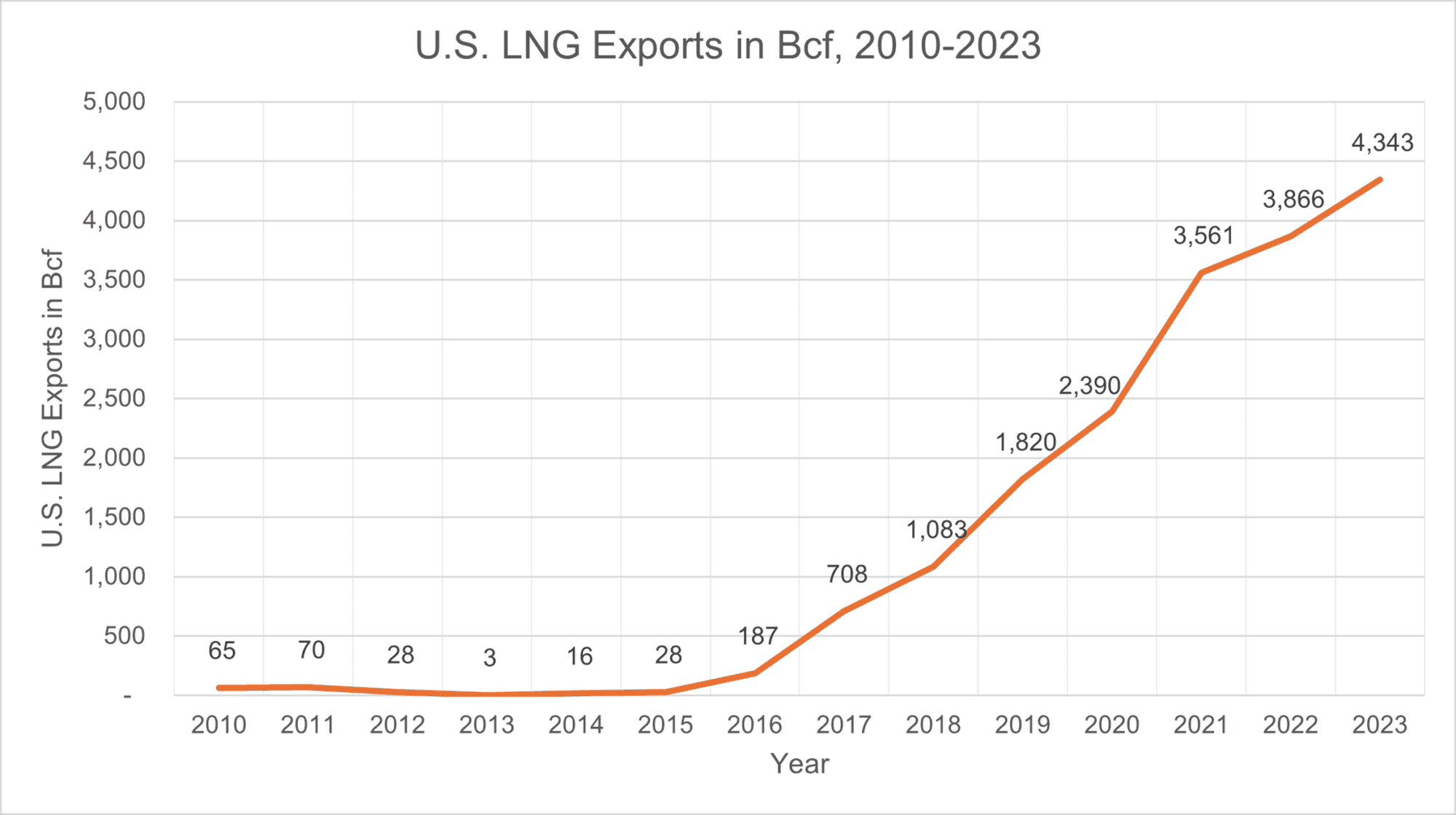

The data: A new study from the NAM and PwC shows that the U.S. LNG revolution could extend its upward climb, as shown on the graph above. Today, the industry is a huge source of jobs and profit:

- U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- The LNG industry contributes $43.8 billion to U.S. GDP.

- And lastly, federal, state and local governments receive $11.0 billion in tax and royalty revenues, thanks to U.S. LNG exports.

But that pales in comparison to the industry’s potential over the next two decades. The study projects the likely growth of the industry through 2044, showing all that is at stake if the ban remains in place until then:

- Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk.

- The ban would also stifle between $122.5 billion and $215.7 billion in contributions to U.S. GDP during the same period.

- Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

Public opinion: The American public is squarely behind the LNG export industry, showing overwhelming approval in an NAM poll taken in March.

- Eighty-seven percent of respondents agreed the U.S. should continue to export natural gas.

- Seventy-six percent of respondents agreed with building more energy infrastructure, such as port terminals.

The last word: “With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential,” said NAM President and CEO Jay Timmons.

- “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

Improving Medical Supply Chain Resiliency

Medical supply chains are critical to ensuring the health and security of Americans—and Congress should act to bolster their resiliency, the NAM told members of Congress this month.

What’s going on: “The COVID-19 pandemic brought to light the risks and instability resulting from concentration and choke points in medical supply chains, though the pandemic also showed how medical supply chains can quickly adjust to external shocks,” NAM Managing Vice President of Policy Chris Netram told Reps. Brad Wenstrup (R-OH), Blake Moore (R-UT) and August Pfluger (R-TX) in response to a request for information on how to improve medical supply chains.

What should be done: The NAM recommended that Congress should work with manufacturers “on a comprehensive approach to find ways to onshore, near-shore and friend-shore more of the medical supply chain,” Netram continued.

There are several actions the federal government should take to fortify medical supply chains, including:

- “[C]reating an environment where small businesses can continue to thrive” and where large companies can maintain their pandemic-era practices of “leveraging sources of domestic production when feasible, working with existing smaller suppliers to improve their reliability” and sourcing goods through new suppliers;

- Streamlining the Food and Drug Administration’s new-supplier certification process;

- Taking “creative steps to incentivize onshoring, near-shoring and friend-shoring, as opposed to imposing punitive or unworkable requirements to do so”;

- Passing the Medical Supply Chain Resiliency Act (H.R. 4307/S. 2115), which would authorize the president to strategically create new trade agreements specific to medical goods with our allies and partners;

- Strategically refining Section 301 tariffs on imports from China;

- Restoring “immediate research and development expensing and full expensing of capital equipment purchases,” ensuring “that the corporate tax rate does not exceed 21%” and making the pass-through deduction permanent; and

- Completing “reauthorization of the Workforce Innovation and Opportunity Act and expansion of Pell grant eligibility to short-term training programs,” as well as supporting solutions that incentivize companies to collaborate to reduce the manufacturing-worker shortage.

The bottom line: “[A]n approach that creates incentives that reduce the cost and complexity of moving supply chains can help U.S. manufacturers to be more resilient in the face of a future global crisis and better able to serve patients who depend on these products,” Netram said.

NAM Emphasizes USMCA, Protecting Investors in Mexico Meetings

In high-level meetings with government, manufacturing and trade group leaders held in Mexico last week, the NAM hammered home a key message: For North American manufacturing to remain globally competitive, Mexico must protect investor holdings in the country.

What’s going on: During a jam-packed three-day visit to Mexico City, NAM President and CEO Jay Timmons and an NAM contingent met with top officials in the new Sheinbaum administration, as well as leadership at multiple agencies and associations.

- These included newly appointed Deputy Trade Minister Luis Rosendo Gutiérrez, the Business Coordinating Council (CCE), the Confederation of Industrial Chambers of Mexico (CONCAMIN), the Mexico Business Council (CMN), the National Council of the Export Manufacturing Industry (INDEX) and others.

What they said: The NAM’s main message at each gathering was the same: Companies investing in Mexico need assurance that their portfolios will be protected regardless of the fate of proposed judicial reforms in the country.

- The NAM also underscored the importance of the U.S.–Mexico–Canada Agreement, which is due for review in 2026, and the necessity of ensuring that the deal is upheld for all three parties.

- If its terms are respected, USMCA could help North American manufacturing outcompete China.

On China: This week, just days after his office’s meeting with the NAM, Gutiérrez announced that the Sheinbaum administration will seek U.S. manufacturers’ help to reshore—mainly from China—the production of some critical technologies (The Wall Street Journal, subscription).

- “We want to focus on supporting our domestic supply chains,” he told the Journal, adding that talks with U.S. companies are still in the informal stage.

The NAM says: “Manufacturing is at the heart of the USMCA,” said NAM Vice President of International Policy Andrea Durkin, who was part of the NAM group on the ground in Mexico. “The NAM intends to work to ensure that the agreement strengthens the competitiveness of manufacturers.”

NAM, Allies Urge Court to Vacate PFAS Rule

The EPA’s final rule setting national drinking water standards for PFAS should be vacated in its entirety, the NAM and two allies said in an opening brief filed in federal court Monday.

What’s going on: The NAM, the American Chemistry Council and U.S. chemical company Chemours asked the U.S. Court of Appeals for the D.C. Circuit to overturn the EPA’s rule, announced in April, which requires that municipal water systems nationwide remove six types of per- and polyfluoroalkyl substances from drinking water. Trade groups representing the water systems have also sued to overturn the rule.

The grounds: The rule is unlawful and must be set aside for the following reasons:

- The EPA used a deeply flawed cost-benefit analysis to justify the rule.

- The EPA conducted a woefully incomplete feasibility analysis that ignores whether the technology and facilities necessary for compliance actually exist.

- Critical parts of the rule exceed the agency’s statutory authority under the Safe Drinking Water Act and flout the act’s express procedural requirements.

- The EPA failed to consider reasonable alternatives or respond meaningfully to public comments that undercut its judgment.

- The agency “lacked sufficient data to regulate” HFPO-DA, one of the PFAS chemicals that falls under the rule.

Why it’s important: PFAS “are substances at the center of modern innovation and sustain many common technologies including semiconductors, telecommunications, defense systems, life-saving therapeutics and renewable energy sources,” according to the brief.

- The NAM and its co-petitioners “support rational regulation of PFAS that allows manufacturers to continue supporting critical industries, while developing new chemistries and minimizing any potential environmental impacts. But that requires a measured and evidence-based approach that the [r]ule lacks.”

What’s next: Briefing in this case will continue through the spring, with oral argument to follow and a decision from the D.C. Circuit expected in late 2025.

Manufacturers on Port Strike: By Resuming Work and Keeping Our Ports Operational, They Have Shown a Commitment to Listening to the Concerns of Our Industry

Washington, D.C. – Following news that the International Longshoremen’s Association and the United States Maritime Alliance have reached an agreement to extend the Master Contract until Jan. 15, 2025, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Manufacturers are encouraged that cooler heads have prevailed and the ports will reopen. By resuming work and keeping our ports operational, they have shown a commitment to listening to the concerns of manufacturers and other industries that rely on the efficient movement of goods through these critical gateways. This decision avoids the need for government intervention and invoking the Taft-Hartley Act, and it is a victory for all parties involved—preserving jobs, safeguarding supply chains and preventing further economic disruptions.

“Manufacturers depend on the stability of our ports to continue building, innovating, delivering products to American families and supporting communities across the country. We commend the International Longshoremen’s Association and the U.S. Maritime Alliance for coming together in the spirit of collaboration and urge both parties to use this time to reach a fair and lasting agreement. Another strike would jeopardize $2.1 billion in trade daily and could reduce GDP by as much as $5 billion per day. We cannot afford that level of economic destruction.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.87 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org