Permitting Reform Talks Restart—A Welcome Sign for Manufacturers

Washington, D.C. – Following the decision by Sens. Martin Heinrich (D-NM) and Sheldon Whitehouse (D-RI) to reopen permitting reform negotiations, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Permitting reform is one of the key pillars of a comprehensive manufacturing strategy that will help clear the skies for manufacturers. We thank Sens. Whitehouse and Heinrich for reopening negotiations on this critical issue. The stakes couldn’t be higher for manufacturers: America’s permitting system is broken—with projects taking up to 80% longer to move forward than in peer nations. America cannot lead the world in all forms of energy, AI and advanced manufacturing while projects remain stuck in yearslong permitting delays. Coming off the NAM State of Manufacturing Tour, the message has been clear—America needs a faster, more reliable permitting system to build the infrastructure that powers growth and keeps our industry competitive. 2026 must be the year of permitting reform. We want ribbon cuttings, not red tape, so manufacturers can build new shop floors, energy facilities and new infrastructure here in the United States.

“In addition to our champions in the House of Representatives—including Natural Resources Committee Chairman Bruce Westerman (R-AR), Transportation and Infrastructure Committee Chairman Sam Graves (R-MO) and Rep. Jared Golden (D-ME)—we are grateful to Sens. Whitehouse, Heinrich, Shelley Moore Capito (R-WV) and Mike Lee (R-UT) for their continued efforts to advance bipartisan, comprehensive permitting reform—an essential pillar of a comprehensive manufacturing strategy and an all-of-the-above approach to energy. By modernizing our broken permitting system, Congress can deliver the certainty manufacturers need to build faster, invest with confidence and improve the quality of life for all Americans.”

Background:

In February, the NAM launched “Building to Win,” a six-figure campaign urging Congress to pass robust infrastructure investments and reauthorize critical federal highway programs before they expire on Sept. 30. As part of the launch, the NAM unveiled a new infrastructure policy roadmap, including original analysis on the economic costs of congestion on manufacturers and a set of core infrastructure policy pillars. The NAM also debuted a new ad underscoring the importance of infrastructure investment and permitting reform to manufacturing competitiveness.

Permitting reform has long been a top legislative priority for the NAM. In the final weeks of 2025, the NAM pushed for permitting reform measures that advanced in the House—including the passage of the SPEED ACT. Manufacturers are calling on the Senate to take the helm and build on that momentum by advancing the SPEED Act, a cornerstone of the NAM’s “Manufacturing’s Roadmap to AI and Energy Dominance.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Q&A: Rep. Graves on Infrastructure and Transportation

The NAM recently interviewed Rep. Sam Graves (R-MO), chairman of the Transportation and Infrastructure Committee, about the surface transportation reauthorization bill and the importance of infrastructure to manufacturers nationwide. Here is the full text.

What are your priorities in the upcoming infrastructure bill to help drive manufacturing growth in the United States?

“Manufacturing, like every other aspect of our economy, depends on a strong transportation system and infrastructure. President Trump has prioritized bringing manufacturing back to the United States, and he’s already seen significant success. As chairman of the Transportation and Infrastructure Committee, I’m working to make sure we have an efficient, safe and reliable infrastructure that supports and facilitates the growth of manufacturing in the United States. The best way to do that is by passing a bill that focuses on building the infrastructure needed to move goods and people safely and efficiently. The next surface transportation reauthorization bill will focus on hard infrastructure, such as roads and bridges.

“Another main priority of mine is fixing the Highway Trust Fund, which serves as the main funding source at the federal level for road and bridge projects. We must address the solvency challenges facing the Highway Trust Fund and preserve our user-pays system. Right now, that system is broken, and it has been for some time. The best way to provide long-term certainty is to finally begin shoring up the Highway Trust Fund and ensuring that all users are paying into the system.

“Additionally, this bill is about looking forward and building an infrastructure for the future. Anticipating the transportation and infrastructure needs of the next 20 years is the best way to support economic growth and help our manufacturers as their industry continues to evolve.”

Why is it important that Congress pass a surface transportation reauthorization bill this year?

“The surface transportation reauthorization bill impacts all Americans—we all use or rely on roads, bridges and rails. Traditionally, this legislation provides tens of billions of dollars in annual funding to improve American highways, bridges, transit and other surface transportation infrastructure. It also provides funding for rail, trucking safety and other transportation programs.

“Surface transportation bills typically expire after five years. That multiyear time frame gives states the long-term funding certainty they need to plan and carry out many of their most critical projects. The current highway bill, which was part of the Infrastructure Investment and Jobs Act, expires on Sept. 30, 2026. Unless Congress acts before then, federal programs will be impacted, including that long-term certainty. This is unacceptable, and I’m committed to getting the next surface bill done on time and preventing potential project delays and uncertainty that can result from a lapse in long-term funding.”

How does investing in infrastructure benefit the people and manufacturers in your state/district?

“I represent all of North Missouri. Investing in our roads has never been more important for the future of our communities, large and small. For manufacturers to succeed, as well as to attract new companies, we’ve got to have good infrastructure. It’s critical for shipping Missouri-made products across the country, for receiving inputs and for farmers getting goods to market. As we work to bring manufacturing back to the United States, my district and many others see an opportunity to grow their local economy. To make that happen, we have to maintain and improve our infrastructure across the country.”

Why is the NAM’s leadership on this issue so critical to getting an infrastructure bill done this year?

“The NAM has over 14,000 members from every sector of manufacturing. The United States depends on a strong manufacturing industry, and the NAM provides a voice for our manufacturers, large and small. They are truly at the center of manufacturing in this country. So, when it comes to getting an infrastructure bill of this size done, we need to hear from all industries, especially our manufacturers. Whether it’s in the early stages of crafting the bill when we’re looking for feedback on existing policy and asking for priorities from the manufacturing industry—and we appreciate the NAM’s efforts in that process—or after the bill has been introduced and is working its way through the legislative process, organizations like the NAM have an important role in getting information out there about what the bill does and how it will benefit the country.”

ICYMI: “Ketchie CEO Credits Trump’s ‘Beautiful Bill’ with Helping Her Machine Shop Prosper”

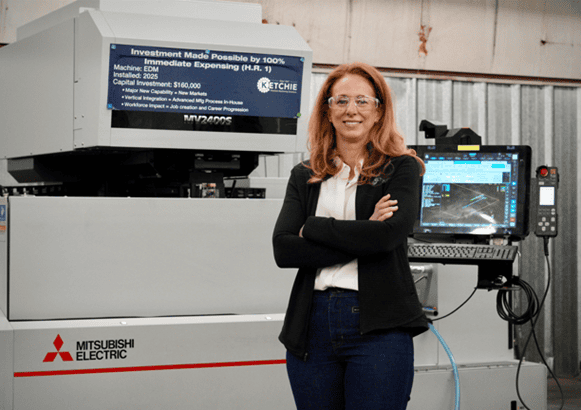

Washington, D.C. – As part of the 2026 National Association of Manufacturers State of Manufacturing Tour, Ketchie President and Owner Courtney Silver hosted the NAM for a discussion on how tax certainty due to the NAM-backed H.R. 1 has empowered manufacturers like her to reinvest in their workforce and facilities.

The tour stop was covered by Business North Carolina. Excerpts of the report can be found below. Bolding has been added.

—-

Ketchie CEO credits Trump’s ‘beautiful bill’ with helping her machine shop prosper

Business North Carolina

Kevin Ellis

Feb. 23, 2026

https://businessnc.com/ketchie-ceo-credits-trumps-beautiful-bill-with-helping-her-machine-shop-prosper/

Miguel Carrillo describes himself as a “machine nerd,” and he had an engaged audience on Monday watching him operate a $700,000 device brought in last year to Concord-based Ketchie, the machine shop where he works.

Ketchie may only have 20 employees, but it was a stop on the State of Manufacturing Tour that National Association of Manufacturers President Jay Timmons began last week in Cleveland and will continue across the country after visiting three Charlotte-area sites on Monday. Tagging along with Timmons at Ketchie was Acting Deputy Secretary of the U.S. Treasury Derek Theurer, U.S. Rep. Tim Moore of Cleveland County and NC Chamber President Gary Salamido.

Ketchie CEO Courtney Silver was a supporter of the “One Big Beautiful Bill,” the legislation signed into law last year by President Donald Trump. She testified at congressional hearings before its passage about how it would help small businesses. Timmons said he had heard so much about Ketchie’s new machines, he wanted to see them in action.

The tax bill that eliminates income tax on overtime and tips for some workers also allows businesses to reduce their tax bills on investments immediately, rather than spreading the reduction out over several years, says Silver.

“When you can expense an investment in the year it was purchased, it provides cash flow to companies and continues to allow them to make new investments,” says Silver.

Ketchie purchased three machines last year that combined cost more than $1.1 million, plus made about $400,000 in other investments, including AI software that has cut some hour-long processes down to five minutes.

“I would have never made those investments without immediate expensing,” Silver says. She says she’s also looking to add five workers to her shop.

“This is a perfect example of what you can do to help build America and American manufacturing with the right policies in place,” says Timmons.

Theurer said it was nice to see advanced manufacturing take place in a North Carolina factory rather than spending his day on policy in the nation’s capital.

“This type of investment is what we intended to see when we made our big tax policy and worked for smarter regulation,” said Theurer.

…

Ketchie supplies metal parts to railroad, aerospace and heavy industry manufacturers, such as Charlotte steelmaker Nucor, Davidson-based HVAC company Trane and Norfolk Southern. The company was started in 1947 by Edgar Ketchie, the grandfather of Silver’s late husband.

On Monday, Carrillo was machining a steel part needed by an industrial recycling company. The Dual Spindle 5-Axis Machining Center that Ketchie bought last year doesn’t require Carrillo to reset the machine for the other side of the metal part, which is about half the size of a deck of cards, but grooved. It means quicker production and fewer human errors, he says.

“It allows me to step out and allows the machine to do the heavy lifting,” says Carillo. The advanced manufacturing aspect attracted the 2024 graduate of A.L. Brown High School to work at Ketchie after starting in a job shadowing program while a high school junior. “It’s nice when a machine can do one thing, but it’s really nice when a machine can do a lot of things.”

…

—-

Background

Learn more about Silver’s testimony before Congress in 2025 on the importance of preserving the pro-manufacturing policies of the Tax Cuts and Jobs Act here.

KEY FACTS: If Congress had failed to preserve tax reform in 2025, the U.S. would have risked:

- 5.9 million lost jobs;

- A $540 billion reduction in employee compensation; and

- A $1.1 trillion shortfall in U.S. GDP.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Home Prices Rise at Slowest Annual Pace Since 2011

In December, the S&P Cotality Case-Shiller U.S. National Home Price NSA Index recorded a 1.3% annual gain, down from the 1.4% gain in November and the weakest full year gain since 2011. The 10-City Composite increased 1.9%, down from 2.0% the previous month, while the 20-City Composite rose 1.4% year-over-year, consistent with November’s gain. Among the 20 cities, Chicago again posted the highest annual gain at 5.3%, followed by New York at 5.1% and Cleveland at 4.0%. Meanwhile, Tampa again posted the lowest annual return, with prices falling 2.9%.

On a month-over-month basis, the U.S. National Index declined 0.3% before seasonal adjustment. At the same time, the 10-City Composite and 20-City Composite both edged down 0.1%. After seasonal adjustment, the U.S. National Index rose 0.4%, while the 10-City and 20-City Composites both grew 0.5%. The Northeast and Midwest continued to outperform other regions as the second half of the year exhibited weaker price growth. Meanwhile, in addition to Tampa, the Sun Belt market kept declining, including Denver (down 2.1%), Phoenix (down 1.5%), Dallas (down 1.5%) and Miami (down 1.5%).

The combination of high financing costs and prices continued to cap growth. Before seasonal adjustment, 15 of the 20 major metro areas saw price declines in December. Over the year, home prices trailed inflation. In comparison, home prices outpaced inflation by 3.7 percentage points over the prior decade, a trend that reversed starting in June 2025.

Consumer Confidence Rises as Expectations Improve

Consumer confidence increased 2.2 points in February to 91.2. Among its components, the Present Situation Index declined while the Expectations Index rose as consumers’ concerns regarding the present situation worsened, and concerns about the future eased.

The Present Situation Index, reflecting current business and labor market conditions, declined 1.8 points to 120.0. Meanwhile, the Expectations Index, which reflects consumers’ short-term outlook for income, business and labor market conditions, rose 4.8 points to 72.0, remaining below the recession signal threshold of 80 since February 2025.

Views of the current labor market situation improved slightly, with 28.0% of consumers saying jobs were “plentiful,” up from January (25.8%), while 20.6% said jobs were “hard to get,” up from January (19.0%). Looking to the future, 15.7% said they expect more jobs to be available, up from 14.8% the prior month, while 26.1% anticipate fewer jobs, down from 28.7% the previous month.

Mentions of high prices, inflation, trade and politics continued to top the list of topics influencing consumers’ views of the economy. At the same time, mentions of the labor market eased somewhat in February, while comments about immigration increased. Consumers’ 12-month inflation expectations remained elevated but were little changed from January, and the proportion of consumers expecting interest rates to remain high persisted. At the same time, the share of consumers who believe a recession “very likely” over the next year fell, and the small share thinking the economy is already in a recession dipped.

Buying plans for new cars stayed the same in February, while purchasing plans for homes were little changed, although they remained above levels seen a year ago. Consumers’ plans for buying big-ticket items overall improved in February, with used cars, furniture, TVs and smartphones remaining the most popular items among consumers. On the other hand, consumers’ intentions to purchase more services declined overall; however, restaurants, bars and take-out remained the top planned service spending category and edged up in February. Overall, consumers’ views of their current financial situation worsened after surging in January, and views of their future financial situation remained weak.

Wholesale Prices Rise as Service Costs Jump

The Producer Price Index for final demand (also known as wholesale prices) rose 0.5% over the month in January, after prices moved up 0.4% in December. Over the year, producer prices increased 2.9% in January, down from 3.0% in December. Meanwhile, prices for final demand excluding foods, energy and trade services ticked up 0.3% over the month in January after rising the same amount in December. Prices for these goods advanced 3.4% from January 2025.

Within final demand, prices for services jumped 0.8% in January, the largest gain since July, after advancing 0.7% in December. Meanwhile, prices for goods decreased 0.3% in January, after edging down 0.1% in December. Within the final demand services index, margins for professional and commercial equipment wholesaling surged 14.4%, accounting for more than 20% of the January increase. Within the final demand goods index, prices for gasoline fell 5.5%, accounting for nearly 80% of the January decline.

Prices for processed goods for intermediate demand stayed the same in January, consistent with the lack of movement in December. Within the index, prices for nonferrous metals soared 4.8% and 32.9% over the year, while the index for gasoline fell 5.5% and 15.7% year-over-year. Meanwhile, prices for industrial electric power dropped 2.9% from December but increased 3.0% from January 2025. Over the year, the index rose 2.6% after a 3.5% increase in December.

Meanwhile, prices for unprocessed goods for intermediate demand decreased 0.5% in January, after moving up 1.9% in December. The monthly decline was led by a 9.8% drop in raw milk, which plummeted 29.2% over the year. In contrast, prices for nonferrous scrap soared 8.5% in January and 42.3% from January 2025. Over the year, prices for unprocessed goods for intermediate demand decreased 6.1%, the largest 12-month drop since September 2024, after ticking down 0.5% in December.

Tenth District Manufacturing Expands as Orders Rebound

Manufacturing activity increased in the Tenth District in February, with the month-over-month composite index rising to 5 in February from 0 in January. Meanwhile, expectations for future activity jumped 8 points to 15. The month-over-month activity gain was due to an increase in durable manufacturing, which offset a decline in nondurable manufacturing. At the same time, the new orders index improved in February. The employment index was the only index to be negative this month. The Tenth Federal Reserve District encompasses the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma and Wyoming; and the northern half of New Mexico.

The production and shipments indexes turned positive, rising from -2 to 10 and from -2 to 11, respectively. Meanwhile, new orders jumped to 7, expanding for the first time since September. The employment index fell from 0 to -6, while the average employee workweek index ticked up from 4 to 6. The backlog of orders index turned positive for the first time in over a year, climbing from -11 to 8. At the same time, the pace of growth for prices paid and prices received both weakened slightly, with raw materials prices decreasing 2 points to 42 and prices received edging down 1 point to 18. On the other hand, over the year, the indexes for prices received and paid both increased, moving up to 58 and 81, respectively.

In February, survey respondents were asked special questions about their ability to pass through prices and the frequency of price changes. Nearly one-third of the firms (30%) reported they are able to pass through only up to 20% of higher costs from inputs and labor. Additionally, 10% can pass through 20% to 40%, 15% are able to pass through 40% to 60%, 13% can pass through 60% to 80% and 28% said they can pass through 80% to 100% of the increased cost from inputs and labor. When asked about price changes, 12% of firms reported they are changing prices much more often than last year, 36% somewhat more often, 4% somewhat less often and 2% much less often. At the same time, 46% of firms reported no change in the frequency of price changes compared to last year.

Fifth District Manufacturing Contracts Further, but Outlook Improves

Manufacturing activity in the Fifth District contracted in February and at a faster pace than the previous month, with the composite manufacturing index decreasing from -6 to -10. At the same time, the local business conditions index declined from -8 in January to -15 in February. Despite current weakness, manufacturers are more optimistic about the future, with the outlook for future local business conditions rising from 19 in January to 22 in February. The Fifth District consists of Virginia, Maryland, the Carolinas, the District of Columbia and most of West Virginia.

Among its components, shipments and new orders remained negative and contracted at a faster pace, falling from -5 to -13 and from -6 to -9, respectively. The indexes for employment and vendor lead times ticked down, moving from -6 to -7 and from 0 to -1, respectively. Meanwhile, the share of firms reporting backlogs worsened, edging down from -13 to -14. On the other hand, the average growth rate of prices paid and prices received slowed in February.

Looking ahead, firms expect both price indexes to increase in the next 12 months but at a slower pace than forecasted in January. Expectations for future shipments and new orders remained positive but ticked down from 34 to 29 and from 36 to 35, respectively. Expectations for backlogs grew from 4 to 6. Meanwhile, firms’ expectations about equipment and software spending turned positive, increasing from -3 to -2. In sum, businesses in the Fifth District remained optimistic about future business conditions and investment plans.

Texas Factory Activity Improves as Wage Pressures Accelerate

In February, Texas factory activity improved after expanding the prior month. The production index increased from 11.2 to 12.5, remaining above the series average of 9.6. The new orders index ticked down 0.7 points to 11.1, while the capacity utilization index stepped up 4.7 points to 11.8. Meanwhile, the shipments index decreased 2.1 points to 9.9. The Eleventh District consists of all of Texas, northern Louisiana and southern New Mexico.

Perceptions of manufacturing business conditions strengthened in February, with the general business activity index rising 1.4 points to 0.2. At the same time, the company outlook index inched up 0.2 points to 3.1. On the other hand, the uncertainty index increased 1.7 points to 6.5 but remained below the series average of 16.8.

Labor market indicators suggested weaker growth in headcounts and a longer workweek in February, with the employment index edging down 0.7 points to 7.5 and the hours worked index rising 5.4 points to 6.1. Nearly 18.0% of firms reported net hiring, while a smaller percentage (10.5%) noted net layoffs.

Price pressures weakened slightly, while wage pressures accelerated in February. The prices paid for raw materials index declined 5.4 points to 31.7. Meanwhile, the prices received for finished goods index ticked down 0.6 points to 17.9 but remained far higher than the series average. The wages and benefits index jumped 14.5 points to 31.9, rising above the series average of 21.0.

The outlook for future manufacturing activity weakened in February, despite the future production index improving 5.1 points to 34.3. Moreover, the future company outlook index moved up 2.5 points to 25.7, while the future general business activity declined 3.9 points to 12.7, remaining above the series average.

Factory Orders Fall as Shipments Rise and Backlogs Grow

New orders for manufactured goods decreased 0.7% in December following a 2.7% increase in November. Meanwhile, new orders for manufactured goods grew 3.7% over the year. When excluding transportation, new orders inched up 0.4% over the month and 0.9% year-over-year in December. Orders for durable goods declined 1.4% following a 5.4% rise in November. Year to date, durable goods orders jumped 7.8%. Nondurable goods orders stayed the same in December after ticking down 0.1% in November. Nondurable goods orders decreased 0.3% over the year.

New orders for nondefense aircraft and parts led the decrease in durable goods orders, falling 24.8% following November’s 98.2% surge. In December, the largest monthly increase occurred in defense search and navigation equipment, which climbed 26.9% after declining 8.7% in November. The largest over-the-year changes occurred in nondefense aircraft and parts (up 106.2%) and photographic equipment (down 5.4%).

Factory shipments rose 0.5% in December after edging down 0.2% in November. Shipments over the year grew 1.7%. Shipments excluding transportation increased 0.4% in December following a 0.1% gain the previous month. Shipments for durable goods moved up 1.0% following a 0.3% decline in November and are up 3.7% year to date. Meanwhile, nondurable goods shipments stayed the same after ticking down 0.1% the prior month, and have declined 0.3% year to date.

Unfilled orders for all manufacturing industries increased 0.9% in December after rising 1.4% in November. Unfilled orders over the year jumped 10.3%. Inventories stepped up 0.9% year-over-year. The inventories-to-shipments ratio edged down from 1.57 to 1.56 in December. Meanwhile, the unfilled orders-to-shipments ratio for durable goods moved down to 7.01 from 7.04 in November.