Manufacturers Announce Addition of Innovation Research Interchange

Key Milestone in Vision to Be One-Stop Shop for Manufacturing

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons today announced plans to continue the NAM’s ambitious organizational growth by combining with the Innovation Research Interchange.

The IRI is a leader in helping companies drive innovation and develop the cutting-edge technologies that keep manufacturing strong. The NAM’s growing array of services and thought leadership represents another key milestone in the vision adopted by the NAM Board of Directors to become the one-stop shop for manufacturers.

“The modern association must constantly innovate and evolve to best serve its industry, and with the addition of the Innovation Research Interchange, NAM members will have access to the widest array of expertise and services in the history of the association. With this transformational development, the NAM and our industry will benefit from world-class R&D thought leadership and the proven strategies that the IRI has perfected. The IRI will continue to support organizations in their mission to drive innovation, and it will enjoy access to the largest network of manufacturing companies and leaders,” said Timmons. “This development enhances the value proposition for NAM members and is part of our ongoing commitment to provide programming that exceeds our members’ expectations.”

IRI President Ed Bernstein will continue to lead the IRI’s day-to-day operations as vice president and executive director, reporting to NAM Chief Operating Officer Todd Boppell.

“The NAM is the perfect partner for the IRI,” said Bernstein. “Together, we will be the preeminent thought leadership organization for innovation management. We have a proud history of helping manufacturers and others lead R&D that produces lifechanging products and technologies. As part of the NAM, we will be able to equip even more industry leaders with the tools to ensure that innovation is impactful throughout the entire enterprise.”

The combination with the IRI follows the NAM’s acquisition of the Manufacturing Leadership Council in 2018. “As a member of the Manufacturing Leadership Council, I’ve seen firsthand how the MLC has been strengthened since becoming part of the NAM,” said Entegris Director of Digital Transformation and IRI Board Chairman Steven Moskowitz. “The access to even more resources and an incredible network has been invaluable—especially through the ongoing pandemic and supply chain disruptions. That’s why I believe that bringing the IRI, MLC and NAM together is the right move for everyone—IRI members, NAM members and the entire industry. The combination of the IRI, MLC and NAM will not only provide continued leadership from each individual organization for their members, but also create opportunities for new value across the entire product lifecycle, thus demonstrating the old adage that the total is greater than the sum of the parts. This positions all of us for even greater success and creates the future-facing organization we need.”

As part of the transition, IRI staff will join the NAM team. More information on the IRI can be found here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs 12.5 million men and women, contributes $2.52 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

-Innovation Research Interchange-

Innovation Research Interchange (formerly the Industrial Research Institute) is an inclusive membership organization with hundreds of global members in private-sector companies, federally funded laboratories, universities and others. Founded in 1938, we lead and advance the field of innovation management by creating contemporary practices. Some of the world’s most widely adopted models—such as “open innovation,” “front end of innovation” and “stage-gate”—were born from the work of our members. We value strength in cooperation and partner with other organizations at the forefront of developments in innovation management, creating a hub for all to convene and contribute in an experimental, noncompetitive and noncommercial environment. For more information, visit www.iriweb.org.

Philip Bell to Chair NAM’s Council of Manufacturing Associations

Washington, D.C. – The National Association of Manufacturers announced new 2022 leadership for its Council of Manufacturing Associations at the CMA 2022 Winter Leadership Conference. Philip Bell, president of the Steel Manufacturers Association, will serve as chair, and Melissa Hockstad, president and CEO of the American Cleaning Institute, will serve as vice chair. Made up of 220 industry-specific manufacturing associations representing 130,000 companies worldwide, the CMA creates powerful partnerships across the industry and ensures manufacturers have the strongest possible voice.

“Steelmakers and manufacturers are a force for good in the world. We support innovation, efficiency and sustainability. We help our employees build their lives, our customers build their businesses and the communities where we operate build their futures,” said Bell. “During this very dynamic time in our country, I am honored to articulate the important role manufacturing plays in America’s economic success and national security.

“Americans are counting on manufacturers to lead our economic recovery, deliver promising career opportunities and solve our global health crises, and the collaboration made possible through the CMA empowers our entire industry to rise to the challenge,” said NAM President and CEO Jay Timmons. “Philip and Melissa are trusted and tested leaders who will continue to cultivate the collaborative, cooperative spirit that has made the CMA such a consequential organization for our industry and country. I look forward to working with them to advance policies and plans that uphold the values that have made America exceptional and keep manufacturing strong: free enterprise, competitiveness, individual liberty and equal opportunity.”

The CMA’s mission is focused on bolstering the industry’s nationwide grassroots mobilization efforts and improving the competitiveness of manufacturers in the United States. CMA members work with the NAM to unite the manufacturing association community, and ultimately the broader business community, around strategies for increased manufacturing job creation, investment and innovation in America.

Bell is a 25-year industry veteran. Prior to leading the SMA, Bell served as director of external communications and public affairs for Gerdau Long Steel North America based in Tampa, Florida. Bell previously served as CMA vice chair.

Newly appointed 2022 CMA board members include the following:

- Alison Bodor, president and CEO, American Frozen Food Institute

- Nicole Harris, president and CEO, National Glass Association

- David Loftus, president and CEO, Electronic Components Industry Association

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.5 million men and women, contributes $2.52 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

When and How Will Manufacturing Achieve Net-Zero Emissions?

When it comes to sustainability, the question is no longer whether manufacturing needs to work to create a greener industrial future—it’s when.

To help manufacturers advance their sustainability efforts and achieve net-zero emissions by 2050, the NAM’s Manufacturing Leadership Council has dedicated the December/January issue of the Manufacturing Leadership Journal to Manufacturing 4.0 sustainability.

Key Highlights from the Latest ML Journal

- Sustainability survey: Review the results of the MLC’s latest M4.0 sustainability survey to understand manufacturing-leader sentiment about climate change. Learn how the pandemic is changing the way leaders prioritize sustainability and net-zero strategies. Plus, find out how sustainability can affect future growth and competitiveness.

- Practical examples: See what forward-thinking companies such as Procter & Gamble are doing to slash emissions and fight climate change. Also, discover M4.0 strategies and technologies to help you develop your own net-zero action plan.

- Current conversation: Understand the successes, opportunities and challenges in the race to achieve net zero by 2050. Hear from thought leaders such as MLC Co-Founder David Brousell and Lisle Corporation President Mary Lisle Landhuis.

- Potential obstacles: Learn the roadblocks to developing a sustainability program and how to overcome them. Know the challenges of adopting a circular-economy mindset and why it’s well worth having.

Why the ML Journal matters: Sustainability is just one of the exciting topics discussed in the ML Journal. Throughout the year, you’ll find case studies, interviews, technology showcases and deep insights on M4.0 from manufacturers working on the front lines. The Journal is a quick, easy way to stay current on the digital revolution—and sharpen your company’s competitive edge.

Click here to receive trial access to the entire December/January issue on M4.0 sustainability or to browse articles on a range of topics from past issues.

NAM Announces Promotions

Timmons: “We are ready to create the future for our industry and our country, with a focus on 2030 and beyond.”

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons today announced an evolution of the NAM management team that will expand capabilities, leadership opportunities and innovations and strengthen manufacturing in the United States for 2030 and beyond. Amid an unprecedented pandemic, historic workforce shortages, supply chain and opportunity gap challenges, new and emerging threats to U.S. manufacturing and the country, the digital transformation and once-in-a-generation policy and legal achievements, manufacturers in the U.S. and the NAM continue to play an outsized role in creating the future for people, communities and the country.

These leadership promotions will bolster the NAM’s impact as the industry’s unified voice. They will promote, perpetuate and preserve the values that guide manufacturers’ unrivaled contributions to society and make America exceptional: free enterprise, competitiveness, individual liberty and equal opportunity.

“More than six years ago, the NAM Board of Directors put its support behind a vision to strengthen our association and make the NAM a ‘one-stop shop’ for manufacturers by expanding and diversifying the NAM’s portfolio of offerings in advocacy, operational excellence, legal action, workforce development and news and insights,” said Timmons. “The NAM’s record-breaking results in 2020 and 2021—in the face of crises many of us have never seen in our lifetimes—were a direct result of turning that vision into reality with an entire team resolutely focused on supporting manufacturers and America’s business sector every day. So, now we are putting more responsibility in the hands of this immensely talented team that has proven in the best and worst circumstances to be the strongest, most effective voice and resource for manufacturers in the United States. We are ready to create the future for our industry and our country, with a focus on 2030 and beyond.”

The NAM ends 2021 with a net membership retention rate on track to be in the top historical tier in the 126-year history of the association. Initiatives realized during the pandemic spurred tremendous growth for the association in 2020 and 2021. Those initiatives included efforts to mobilize and support manufacturers’ pandemic response and personal protective equipment production; advance vaccinations; provide greater operational insights to the industry; run momentous campaigns for policy and legal wins, notably infrastructure investment and pandemic relief; and deliver comprehensive solutions to the industry’s most pressing issues, including workforce development.

“Our capability to drive solutions for manufacturers is central to everything we do, and we are aligning this team to provide even more solutions moving forward,” said Timmons.

The following leadership promotions become effective Jan. 1:

- Erin Streeter will be named Executive Vice President of the NAM. Currently serving as Senior Vice President of Communications and Brand Strategy, Erin will work alongside the President and CEO to set the strategic direction of the association and align and integrate teams, strengthen internal and external communications and grow audiences toward that direction. She will continue to oversee all brand, communications and marketing activities but will also add public affairs and mobilization as well as advocacy campaigns to her portfolio. The integration of these critical portfolios will ensure the NAM is positioned to advance the needs and priorities of manufacturers by providing first-in-class advocacy.

- Carolyn Lee has been named President of The Manufacturing Institute by its board of directors. The workforce crisis of more than 1 million open jobs today isn’t just an existential threat to manufacturing in America; it also threatens the security of our country. To meet this moment, the MI continues to break new ground in supporting manufacturers’ efforts to recruit and retain a skilled, diverse workforce. Carolyn’s focus for 2022 will be on developing a strategic growth plan and expanding partnerships and thought leadership to carry the MI and the industry into the future.

- Carolyn has asked Keith Smith to serve as Chief Administrative Officer of the MI. In this new role, Keith will work with Carolyn and the MI team to develop and implement a new organizational growth plan and help achieve the strategic vision of the organization. As a member of the NAM Senior Staff, Keith will also continue his leadership of the Association Partnerships Division as an NAM Senior Vice President, overseeing the NAM’s membership programs with association partners at the national, state and local levels.

- In addition to her current responsibilities as NAM Chief of Staff, Alyssa Shooshan will assume leadership of NAM Board strategy. Alyssa will advance board engagement, initiatives, mobilization, partnerships and programming.

Six current NAM vice presidents will be promoted to the newly created role of managing vice president. This group will be charged with leading the NAM’s Leadership Team in creating new opportunities in advocacy, membership value/thought leadership and culture/operations. In addition to serving as counselors to the NAM President and CEO, they will work with senior staff on all issues impacting the association.

- Adria Brockman, Managing Vice President of Membership

- Jamie Hennigan, Managing Vice President of Communications and Public Affairs

- Chrys Kefalas, Managing Vice President of Brand Strategy

- Daryl Muller, Managing Vice President of Membership

- Chris Netram, Managing Vice President of Tax and Domestic Economic Policy

- Shonzia Thompson, Managing Vice President of Association Partnerships

Based on considerable input from across the association, the following team members will be promoted to vice president and named to the NAM Leadership Team, which meets quarterly to help enhance and strengthen the organization’s service to manufacturers and the country. The Leadership Team will be charged to work with the managing vice presidents in a select area of the team’s portfolio.

- Rob Damschen, Vice President of Strategic Communications

- Mark Isaacson, Vice President of Executive Communications and Chief Speechwriter

- Brian James, Vice President of Conference and Office Operations

- Mike O’Brien, Vice President of Public Affairs and Advocacy

- Chris Schmitt, Vice President of Strategic Partnerships

- Patrick Smith, Vice President of Member and Board Relations

- Megan Stewart, Vice President of National Department

In recognition of the expansive growth of the MI, the following MI vice presidents will be named to the NAM’s Leadership Team:

- Gardner Carrick, MI Vice President of Workforce Solutions

- Herb Grant, MI Vice President of Program Execution

- AJ Jorgenson, MI Vice President of Strategic Engagement and Inclusion

- David McKnight, MI Vice President of Strategic Partnerships

A new group of leadership influencers, recognized by their peers as agents of organization-wide progress, was also appointed for one-year terms to work directly with the NAM Leadership Team to provide insight and counsel on key issues that affect the strategic direction of the NAM.

- Cameron Alvarez, Art Director

- Kristie Arslan, Senior Director, Member and Board Relations

- Penny Brown, Content Director, Manufacturing Leadership Council

- Julie Chase, Senior Compliance Counsel

- Charles Crain, Senior Director, Tax and Domestic Economic Policy

- Kirk Fordham, Senior Director, Member and Board Relations

- Jeni Littlepage, Senior Manager, Benefits Administration

- Ryan Ong, Director, International Business Policy

- Cassi Zumbiel, Director, Workforce Programs and Policy, MI

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.5 million men and women, contributes $2.52 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

9 Key Considerations for Digital Twins in Manufacturing

Many manufacturers are ahead of the curve when it comes to digital 4.0, but not all may know about the numerous potential benefits of digital twins. A virtual replica of a physical product, asset or system, a digital twin makes the physical computable. It offers manufacturers a range of advantages, including better business visibility, increased product reliability and new revenue streams.

Is digital twinning right for your business? Below are some key considerations to weigh as you think about adopting this advanced manufacturing technology.

- Digital twins are not complete representations of a product.

Digital twins are akin to algorithms. They are highly reliant on data input, and since it’s nearly impossible to turn every aspect of a physical product into data, digital twins are not precisely twins, though they are pretty close. A digital twin is created by outfitting a product with sensors that can track functionality. These can then be used to study simulations of the product’s performance. So digital twins are made up of models and data, but their complexity is reliant on the data used to create them. - Digital twins evolve over time.

As a product moves through its lifecycle, the information in its digital twin will shift in response to its performance, technical configurations and environmental parameters. - Information and data are key across a product’s lifecycle.

For a digital twin to remain relevant and useful over time, make sure you are utilizing a data structure that can be easily used and exchanged over different systems and applications. - You can use digital threads to enable digital twins.

Digital threads are a communication framework that link all elements of a product’s data, from design to obsolescence. Using them reduces the complexity of digital-twin implementation and increases digital twins’ accuracy. - Transparency is critical.

Identify, classify and correlate data across various sources so there’s transparency and automated information-identification processing. These are crucial for smooth digital-twin deployment. - Open format is best.

In contrast to a proprietary system, which ties an organization’s data to specific systems, limiting its use, an open format ensures that your digital twins can be easily updated, scaled and extended when new models and data representing new outcomes become available. - Your device management plan matters.

In addition to ensuring that data is in a format that can be accessed and used over time, you should make similar considerations for devices that will access that data (i.e., phones, tablets and laptops). Make sure that your device plan can keep up with your needs for monitoring, updating and security. - The cloud is your friend.

Cloud-based computing, storage, analytics and artificial intelligence/machine learning services enable operational technology and information technology managers to build, deploy and grow solutions quickly and affordably. - There are costs and benefits.

Digital twins today may be expensive to build and maintain, but they enable technical agility and speed that foster easier scaling—and save money in the long run to boot.

Learn more about digital twins: As decision-makers in manufacturing embrace digital transformation, it is imperative to consider digital twins as key pieces of the process. For more insights on digital twins in manufacturing, read Digital Twins: The Key to Unlocking Value and Innovation.

AI Roadmap: How Manufacturers Can Amplify Intelligence with Artificial Intelligence

Artificial intelligence offers manufacturers a host of benefits. These include better visibility into supply chains, insights from predictive analytics and the ability to respond to unexpected changes in demand more efficiently and quickly. Here’s a six-step roadmap for manufacturers looking to integrate AI into their business.

Six-Step AI Roadmap for Manufacturers

- Acknowledge AI’s potential

Engage the C-suite in dialogue about how best to use AI. Allocate resources for specific AI projects and set priorities across the business. Pick company AI “agents” who can create business cases, develop metrics and put AI solutions into action. - Transform and plan

Create an AI plan that includes key performance indicators in line with your business strategy. Establish a special data unit to address needs AI could help support, such as data collection and cleansing. - Build your data foundation and structure

Convert any remaining nondigital data, “clean up” other data sources so they don’t contain errors or duplicates and add structure to boost your data quality and effectiveness. - Create an external “partnership ecosystem”

If your business doesn’t have in-house AI expertise, engage outside experts such as start-ups, academic specialists and consultancies. - Leverage in-house AI expertise

Employ outside AI experts to teach other staff members about data science. Your existing workforce will need this information to learn new skills and fulfill new responsibilities. - Create architecture and infrastructure

Consider using standardized infrastructure service offerings that can slot easily into your existing business setup. This will make integration much smoother.

Why does AI matter? Manufacturers that create AI-friendly cultures today are positioning themselves to boost customer and employee satisfaction tomorrow—and they’re gaining a competitive edge to boot.

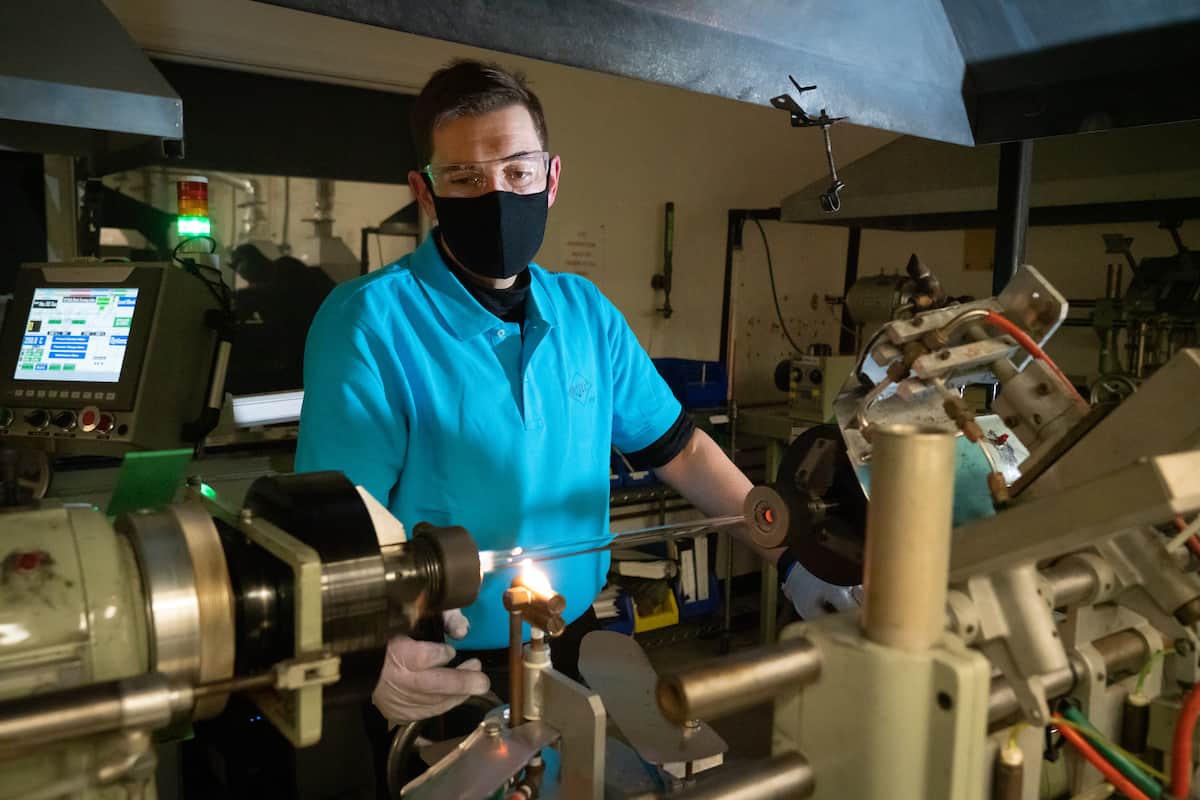

The Company That Puts UV Light to Work

Did you know that several of the components in your car may have passed under high-intensity UV light prior to your purchase? You may have heard that manufacturers coat headlights with a UV protective film to keep them from getting scratched by road debris, but several other components are also manufactured using UV—including windshield borders and the protective coating on interior trim. The process is called UV “curing,” which dries coatings consistently, efficiently, durably—and without releasing harmful chemicals into the atmosphere, as other drying processes do.

The NAM got a firsthand look at this technology recently, thanks to manufacturer Miltec UV of Stevensville, Maryland. The company manufactures UV systems that cure products like optical fiber, semiconductors, prefinished hardwood floors and cars, supplying this technology across the country and around the world. NAM Director of Photography David Bohrer visited Miltec’s facility to check it out.

Here, an employee at the Bulb division is making a UV bulb. Miltec manufactures thousands of bulbs each year for export around the globe:

When dealing with UV technology, safety comes first. Here, an employee working in the Li-ion Battery Research and Development lab is assembling coin cell batteries in a glove box. The batteries will be used as test samples.

The set of a sci-fi movie? Nope. It’s just the testing of a 16-lamp UV curing system that produces more than 530 KW of UV power. Ultimately, the customer will use this system to cure inks and coatings on a high-speed printing press that manufactures outdoor packaging bags, such as for Miracle-Gro.

Of course, you can’t go through an entire story about UV light without a cool picture of UV light—so here it is. This is a UV bulb after it’s been filled with an inert gas, which helps it illuminate its powerful UV light.

Miltec says: “Miltec UV is proud to be a member of the NAM and extremely grateful for all of the work that the NAM does to protect the jobs of our team members that do so much to help our company grow and succeed in the international market,” said Miltec President Bob Blandford. “We are also honored and blessed to have such a dedicated manufacturing team that truly understands the importance of making products in the USA and satisfying customers with reliable and high-performance products. With the help of tax cuts, Miltec UV is doing its part by creating more jobs, increasing salaries and offering end-of-year bonuses for its employees.”

How BASF Uses Enhanced Reality to Help Workers Learn

The human side of digital transformation was on full display at a recent virtual plant tour of BASF Chemical Intermediates Geismar, Louisiana, facility. Hosted by the NAM’s Manufacturing Leadership Council, the tour gave participants an inside look at how the company is using Voovio’s enhanced-reality technology to transform employee training.

Who they are: BASF Chemical Intermediates, a division of German multinational chemical manufacturer BASF, makes approximately 600 distinct products sold worldwide to the chemical, plastics, agricultural and consumer goods industries, among others.

What is Voovio? The company has partnered with simulation-software maker Voovio to design a customized training solution for its employees: a virtually accessible digital replica of the BASF plant.

- Using a computer or other digital device, employees can select plant components such as valves, pumps and control panels to get a detailed view of each. These components respond and perform virtually the same way they would in real life.

- Using the software, trainees can click on any piece of equipment in any workflow to see how it fits into each process.

Why use it? BASF wanted to make worker training faster, more interactive and more self-directed so employees could learn new skills and review existing ones more quickly and easily.

Scalable training model: The tailorable Voovio software offers different training-module levels based on each worker’s experience level and skills.

- Training modules include an equipment replica, tasks to be performed and an action checklist for completing a series of tasks.

- Employees get feedback from the software as they perform each virtual procedure, letting them know whether they’ve performed a task correctly.

Real-world application: Voovio also lets companies take the training into the production facility. Using an approved digital device, employees can perform test runs at any time to ensure they’re prepared to complete a job on the ground.

The verdict: BASF has already begun to reap the benefits of the software. Since implementing Voovio, it has seen a marked increase in both worker competency and productivity.

Sign up for a virtual plant tour: Don’t miss the MLC’s upcoming tour of Johnson & Johnson’s facilities on Wednesday, Dec. 1, from 11:00 a.m. to 1:00 p.m. EST. You will see how Johnson & Johnson uses mobility tools, advanced robotics and material handling, as well as adaptive process controls to drive improvements. After the tour, stay for the panel discussion on how to scale advanced manufacturing technologies to ensure a sustainable, reliable and adaptable product supply chain. Sign up today!

One Small Manufacturer Battles Thousands of Counterfeits

If you can buy anything online, how can you make sure that what you’re buying is genuine?

That’s a problem facing consumers and manufacturers alike. According to the NAM’s research, fake and counterfeit products cost the United States $131 billion and 325,000 jobs in 2019 alone—and estimates suggest that global trade in counterfeits exceeds $500 billion per year. The explosive rise of counterfeit goods has heavily impacted manufacturers, requiring them to fight back on a range of fronts.

For Clint Todd—the chief legal officer at Nite Ize, Inc., a manufacturer of mobile, pet and key accessories, as well as hardware, lighting and other products—that challenge is very real and only getting worse.

“In 2019, we took down 75,000 counterfeit listings and websites,” said Todd. “And we’re a small business, so you can guess how large the problem is countrywide.”

Why it’s happening: First, the online nature of e-commerce makes it more difficult to ensure accountability. Many counterfeit products are purchased through third-party sellers that may or may not provide real contact information.

- In practice, many platforms have not been held liable for counterfeit products sold on their platforms by these third-party sellers, even as they facilitate their sale. That means there’s often little manufacturers can do beyond asking the platforms to remove the listing.

- Second, a large proportion of the sellers of counterfeit goods are located in China and Hong Kong, making it much more challenging for U.S. companies to bring effective lawsuits, even if they do have accurate seller contact information.

“You have this odd confluence of laws and tech development and the involvement of another country that has driven this exponential increase in counterfeits,” said Todd. “You don’t have to be a rocket scientist to see how the inability to fight the problem has been detrimental to U.S. businesses.”

How manufacturers respond: Manufacturers and others have been forced into a piecemeal strategy that includes using software tracking services to find fraudulent trademarks and images; working with third-party sites to remove listings for knockoff merchandise; bringing lawsuits against counterfeiters where possible; and coordinating with the International Trade Commission. That strategy is challenging for lots of manufacturers but is particularly hard on small and medium-sized companies that may have fewer resources yet can be devastated when their products are ripped off.

What we need: The NAM’s report, “Countering Counterfeits,” details solutions for the federal government and the private sector, including:

- Requiring e-commerce platforms to reduce the availability of counterfeits;

- Modernizing enforcement laws and tactics to keep pace with counterfeiting technology;

- Streamlining government coordination;

- Improving private-sector collaboration; and

- Empowering consumers to avoid counterfeit goods.

As Todd put it, “It’ll take a multi-stakeholder approach. It’s not just the government. It’s not just manufacturers. It’s not just the online platforms. It has to be a coordinated approach with all those stakeholders to get to the heart of the matter.”

What the NAM is doing: The NAM is leading the effort against counterfeiting and has already made significant headway with policymakers. Among its recent highlights:

- After years of NAM advocacy, the Department of Homeland Security has implemented the Synthetics Trafficking and Overdose Prevention (STOP) Act of 2018, which steps up screenings for international mail shipments—one way in which counterfeits get into the U.S.

- In late 2020, Congress also implemented several NAM recommendations, including bolstering federal oversight at U.S. ports; cracking down on scammers and other bad actors exploiting the pandemic by producing fake goods or engaging in price gouging; and allowing the FDA to seize and destroy dangerous counterfeit medical devices.

- Both the Senate and House have seen the introduction of bipartisan bills that incorporate NAM recommendations on addressing the sale of counterfeits through online platforms.

The last word: “People need to understand the scope of the problem and how pervasive it has become,” said Todd. “Everyone needs to know how often counterfeits and knockoffs are affecting U.S. companies and how expensive and difficult it is to combat the problem with the tools we have at our disposal now.”

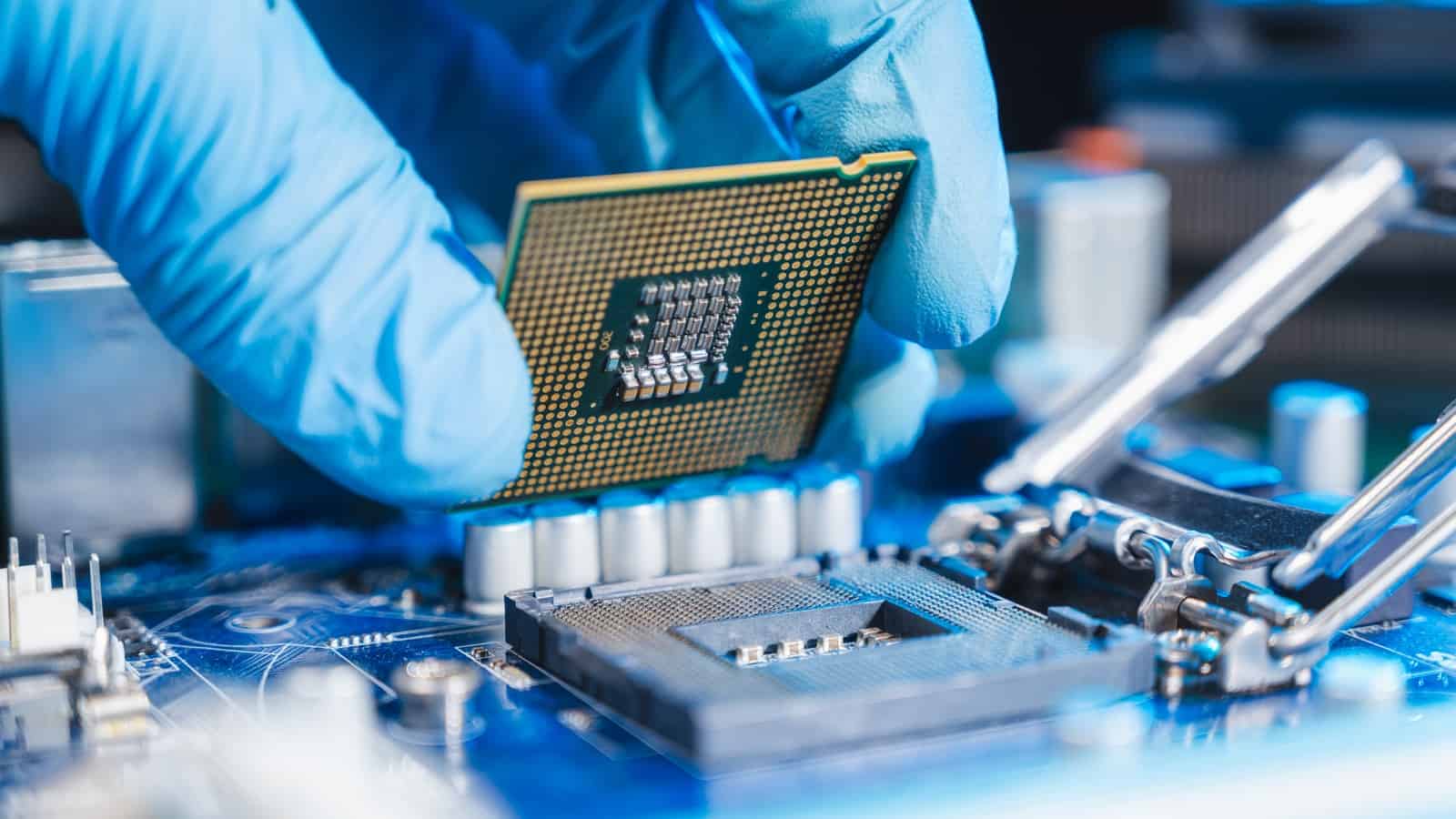

How Cloud Computing Could Help Chip Manufacturers

One small component is creating big delays in global supply chains: the ubiquitous semiconductor or chip. These components are not only essential to our phones, laptops and other electronics, but to the production process in just about every sector of the manufacturing industry. So, what would help us produce more of these desperately needed parts? According to Birlasoft Vice President and Global Business Head of Communications, Media & Technology Nitesh Mirchandani, the answer is cloud computing.

Why the shortage? As COVID-19 unfolded, millions of consumers purchased new laptops, smartphones, game consoles and other devices as they spent more time at home. This shortfall was compounded by the existing high demand for chips brought on by the growth in smart products—everything from thermostats and appliances to robot vacuum cleaners and GPS-enabled dog tags. COVID-19 also caused a wave of semiconductor factory closures that also exacerbated the problem. The result? A shortage that industry experts say could last through 2022.

Why the cloud? Cloud computing is the on-demand delivery of resources like data storage, software, networking and other services via the internet. Users either purchase a set subscription or pay by their level of usage—both cheaper and more flexible options than maintaining an on-site IT team for all needs. Cloud computing has several advantages for semiconductor manufacturers, according to Mirchandani:

- It speeds up time to market through swifter design and development. Because they can be accessed anywhere, cloud services enable teams to connect and collaborate more easily. Development cycles become quicker as teams connect better internally and with other parts of the business, including partners and suppliers.

- It enables data-driven business decisions. Thanks to the faster processing and analysis of cloud computing, manufacturers can get instant information on things like factory performance, supply disruptions or customer demand. Likewise, workers can be alerted to a machine that needs maintenance or to potential defects in materials or products.

- It provides service continuity. Internal IT teams often have limited resources. Cloud infrastructure is managed by specialists who can ensure uninterrupted service, so in-house IT teams don’t need to continuously maintain software through updates and patches.

Why it matters: Semiconductor shortages threaten to drag down the economy just as recovery is getting underway. Businesses rely on chip-enabled technologies for creating products, managing operations and maintaining the flow of goods and services. Consumers rely on them for smarter, safer homes and connections to work or school. Unless chip manufacturers can shore up production to meet demand, the ripple effect will create added distress for many sectors of the economy.