To Increase Aluminum Supply, Recycle More

To bolster domestic aluminum supply chains, the U.S. may need to simply do more of something we already do: recycle (The Wall Street Journal, subscription).

What’s going on: “U.S. primary aluminum production has dwindled over the past 25 years. Yet facilities like Hydro’s two-year-old plant in southwest Michigan have made the country a leading producer of secondary aluminum from scrap, feeding metal to brewers, builders and automakers.”

- “Recycling is the answer,” said Duncan Pitchford, who heads Norsk Hydro’s upstream aluminum business in the U.S. and is an NAM board member. “The metal is already here.”

Why it’s important: While construction of a new aluminum smelter to make primary aluminum from refined bauxite would take years and require an investment of billions of dollars, aluminum recycling plants can be built relatively quickly and inexpensively.

- They also use less energy, according to Pitchford.

The impact of tariffs: Recycling makes economic sense for the U.S. given the new 50% tariff on aluminum imports.

- “The added cost is walloping beverage companies and manufacturers … [but] [a]utomakers and other big aluminum users have yet to raise prices much in response.” according to the Journal.

- “Analysts say it is a matter of time before the stockpiles of metal that arrived in the U.S. ahead of the June increase are depleted and companies start passing on higher aluminum costs.”

The challenge: Americans are catching on to the importance of aluminum recycling, with 14 “remelt” projects announced in the U.S. since 2022. Still, “[m]ore than $1 billion worth of beverage cans were dumped in U.S. landfills just last year … A lack of sorting operations means that a lot of the aluminum in junked cars, demolition debris and old electronics winds up in landfills.”

- The U.S. also exports much of its aluminum scrap, sending about 2.4 million metric tons overseas in 2024.

The way things were: “The U.S. once dominated the aluminum business. … [and] remained the world’s top producer through 2000,” when smelters began to shutter, “squeezed” by less expensive imports and increasing energy pieces.

The electricity factor: Electricity costs make up about 40% of the price tag for the creation of new aluminum.

- For many years domestic smelters received low-cost hydropower from federal utilities, but when those arrangements ended, smelters had to begin paying market rates for their electricity.

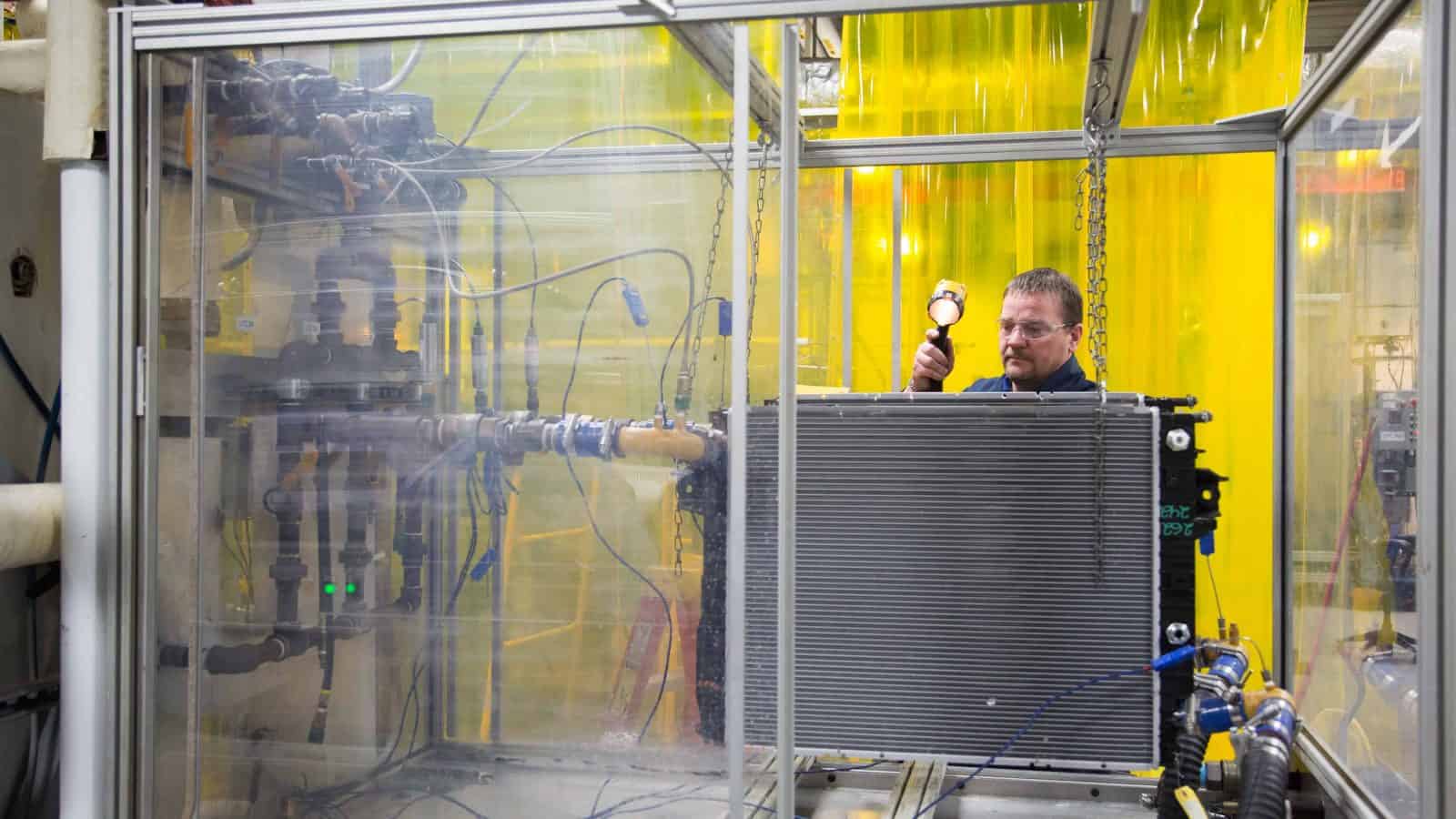

What Hydro’s doing: Approximately 15 million pounds of scrap — including “shredded cars, old window and door frames and overhead electrical wire”— arrives at Hydro’s Michigan plant each month for recycling. (The facility does not recycle cans.)

- Much of the metal the plant takes in comes from “a sorting hub near Grand Rapids, where Hydro uses laser-induced breakdown spectroscopy technology to mechanically separate scrap by alloy.”