Small Manufacturers: Congress Must Restore Full Expensing

As part of the NAM’s “Manufacturing Wins” tax campaign, small and medium-sized manufacturers are urging Congress to make full expensing of capital equipment purchases permanent, warning that the phaseout of this pro-growth tax provision is harming their ability to invest, grow and compete.

What’s happening: Tax reform allowed manufacturers to immediately expense 100% of the cost of capital equipment purchases. But this provision started to be phased out in 2023, dropping by 20%. It will drop by a further 20% every year until 2027, when it will expire completely.

- Seventy-eight percent of manufacturers said that the expiration of full expensing and other pro-growth tax provisions has decreased their ability to expand U.S. manufacturing activity, according to an NAM Manufacturers’ Outlook Survey from last year.

What’s at stake for manufacturers: Capital-intensive industries like manufacturing are the primary beneficiaries of full expensing.

- Lori Miles-Olund, president of Miles Fiberglass & Composites in Clackamas, Oregon, explained the benefits for her company: “We were able to purchase new equipment that not only made our production more environmentally friendly but also safer and more efficient for employees.”

- Colin Murphy, president and owner of Simmons Knife & Saw in Glendale Heights, Illinois, emphasized how critical full expensing is for global competitiveness: “To remain competitive, we need to continually innovate and consistently invest in new machinery and equipment. But with rising tax bills, it’s becoming harder to do so.”

Delayed investments: Some manufacturers are holding off on equipment purchases due to the uncertain tax landscape.

- “I know exactly where the next capital investment should be installed, but I’ve been delaying this decision,” said Courtney Silver, president and owner of Ketchie in Concord, North Carolina. “[Full expensing] dropped to 60% [in 2024], and the fact that I can’t expense the full value of this investment changes the return on investment calculation.”

- In Hodgkins, Illinois, Pioneer Service recently moved from a 24,000-square-foot building to a 62,000-square-foot building, but it can’t take advantage of all this space without full capital equipment expensing. “We had 13 more machines on order that we’ve put a hold on,” explained CEO and Co-Owner Aneesa Muthana. “Thirteen machines equivalent to about $5 million in capital, and that’s completely on hold until we know what’s going to happen next.”

Calling on Congress: If Congress does not act, accelerated depreciation will be entirely absent from the U.S. tax code for the first time in decades. “This isn’t just about numbers on my financial statements and my tax returns—this is about taking care of people here and in communities across this country working for small manufacturers,” said Silver.

- “Congress must act now to support American manufacturers,” said Murphy. “Our ability to invest in our communities, create jobs and innovate is at risk.”

AO Smith’s Water Heaters Drive Building Efficiency

At AO Smith, the name of the game is efficiency. Though the company produces an array of water heaters, boilers, storage tanks and water treatment and filtration equipment, one goal is the same for every product: It should do more with less. This is especially true for hydronic and water heating appliances as these are energy intensive.

“On average, water heating loads are 25–30% of a home or building’s carbon profile,” said AO Smith Corporate Vice President of Government, Regulatory and Industry Affairs Joshua Greene.

- “After space heating and cooling, water heating is the next largest energy load in a home or commercial building. If you’re concerned about your energy spend, using heat pump technology is the most efficient way in which to reduce the overall spend on those heating loads.”

Efficiency in action: Recently, one of the Milwaukee, Wisconsin–based company’s water heating products—the CHP-120 fully integrated heat pump water heater—was installed in a Hilton property in New Haven, Connecticut, the all-electric Hotel Marcel, which opened in 2022 in the former headquarters of the Armstrong Rubber Company. Unlike conventional water heaters, which generate heat directly, heat pumps use electricity to move heat around.

- Hotel Marcel is the sole U.S. hotel to earn the U.S. Green Building Council’s Leadership in Energy and Environmental Design Platinum status in a decade.

The differentiator: The CHP-120 is the only unitary (one-piece) commercial heat pump water heater on the market. Comparable items use a split system in which one part, the compressor, sits outside of the building.

- The design enables Hotel Marcel and other customers to put the entire unit inside in a single room and “get the benefit of taking moisture out of the air in that room, then get to use the hot water that’s in the tank afterward, for laundry and other uses,” Greene told us.

- “So, it’s essentially free hot water—and you’re bringing down the ambient air temperature and humidity, which helps offset energy that would have been needed to cool that area.”

Gaining popularity: Current heat pump water heater customers are mostly residential homeowners, but in the commercial market, the technology has been growing at a rapid pace, Greene continued, because the energy savings “go straight to companies’ bottom line.”

- “Many states now offer rebates to help offset the higher upfront costs of the technology. As a result, we’re starting to install commercial heat pump water heaters in restaurants, schools, [more] hotels, multifamily housing” and more.

- A single CHP-120 installed in an apartment building, for example, can support several apartments depending upon on-site conditions, Greene said.

Overcoming barriers: Of the millions of water heaters (gas and electric) sold each year by manufacturers in the U.S., fewer than 3% are heat pump water heaters, Greene said. The main reason: price.

- “The average all-in project cost of a heat pump water heater is from $3,000 to $6,000” in the residential market, he went on. From a residential standpoint, “the average all-in cost of a 45-gallon gas or electric unit is about $800. It’s that cost delta that’s been the main impediment—but they’re 300 to 400 times more efficient, so one will save you 70% on your bill every month.”

- In the commercial market, heat pump water heating project costs are much higher due to size and other variables, but the energy savings can be exponentially larger, Greene added.

Regulation changes: With state and federal regulations and rebates, incentivizing high-efficiency technologies, heat pump water heater adoption—which is already on the uptick—will likely rise in many states in the coming years, according to Greene.

- “Now with robust federal tax credits and home energy rebates, coupled with utility rebates, they’re slicing that $3,000 to $6,000 [price tag] in half, and in places like California, you can get 80% or more of the cost covered.”

- AO Smith expects to stay busy, Greene said with a laugh.

Coming up: What’s next for a company that, in its 150-year history, has been at least three different businesses—having gone from automotive-frame maker to energy sector steel product manufacturer to leading global water technology company?

- “You can certainly expect to see continued innovation,” said Greene. “Our company has transformed a few times over the past century, and we will continue to evolve, with a focus on water technology, while adhering to the guiding principles and values that the Smith family established 150 years ago.”

NAM: Biden’s LNG Ban Threatens 900,000 Jobs

The liquefied natural gas export industry has turned the U.S. into a powerhouse of cleaner energy, benefiting its trading partners around the world. The Biden administration’s ongoing ban on new LNG export licenses, however, is throttling an industry that could produce many more billions in revenue and a startling 900,000 jobs by 2044.

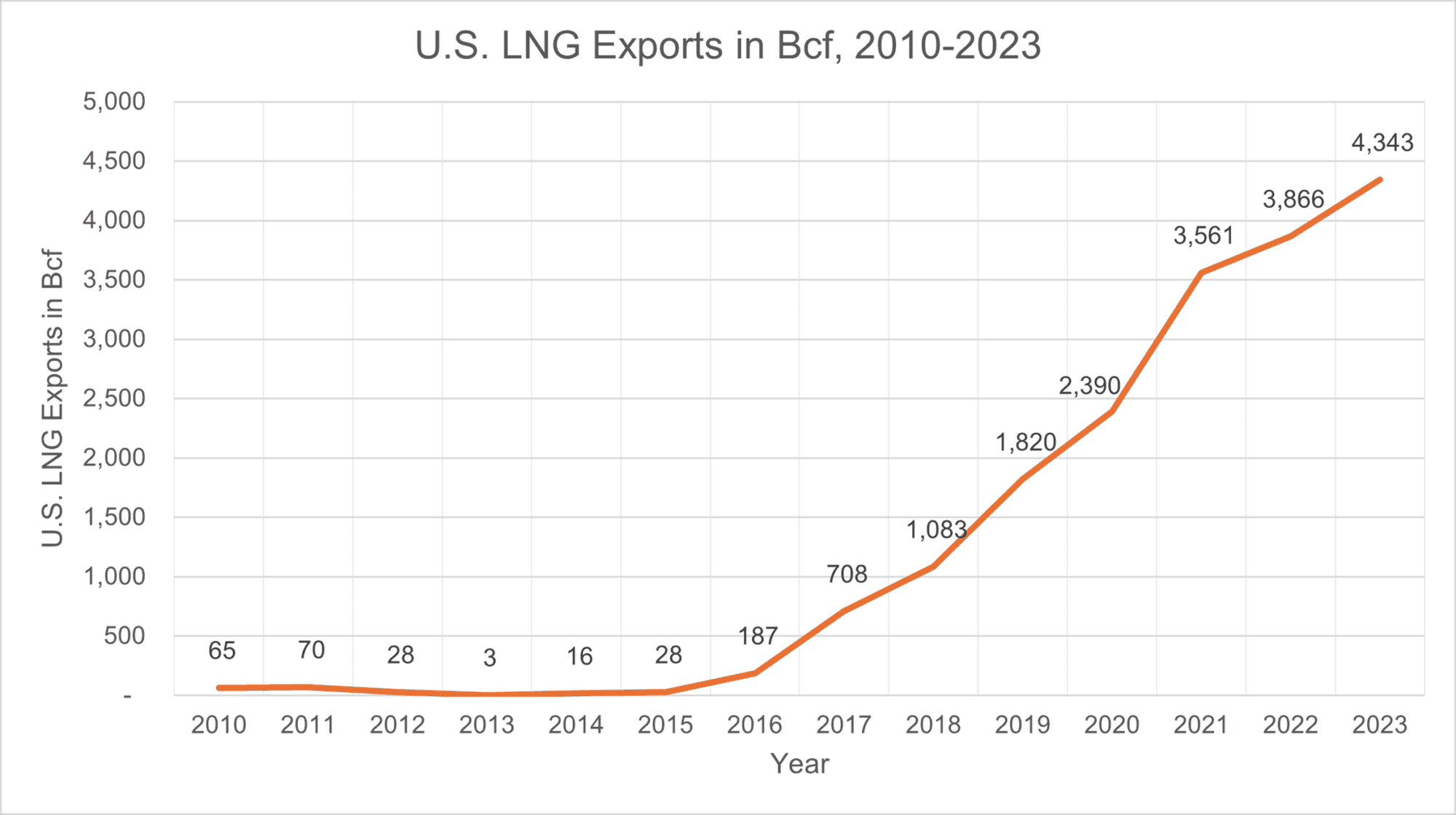

The data: A new study from the NAM and PwC shows that the U.S. LNG revolution could extend its upward climb, as shown on the graph above. Today, the industry is a huge source of jobs and profit:

- U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- The LNG industry contributes $43.8 billion to U.S. GDP.

- And lastly, federal, state and local governments receive $11.0 billion in tax and royalty revenues, thanks to U.S. LNG exports.

But that pales in comparison to the industry’s potential over the next two decades. The study projects the likely growth of the industry through 2044, showing all that is at stake if the ban remains in place until then:

- Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk.

- The ban would also stifle between $122.5 billion and $215.7 billion in contributions to U.S. GDP during the same period.

- Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

Public opinion: The American public is squarely behind the LNG export industry, showing overwhelming approval in an NAM poll taken in March.

- Eighty-seven percent of respondents agreed the U.S. should continue to export natural gas.

- Seventy-six percent of respondents agreed with building more energy infrastructure, such as port terminals.

The last word: “With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential,” said NAM President and CEO Jay Timmons.

- “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

Producer Prices Hold Steady as Energy Costs Drop

The Producer Price Index for final demand (also known as wholesale prices) was unchanged in September, after rising 0.2% in August. Over the past year, the final demand index rose 1.8% on an unadjusted basis, a slight decline from the 1.9% over-the-year increase in August. Prices for final demand excluding foods, energy and trade services inched up 0.1%, after rising 0.2% in August.

In September, prices for final demand services increased 0.2%, offsetting a 0.2% decline in prices for final demand goods. While both food (1.0%) and other goods (0.2%) prices saw an uptick, a 2.7% drop in energy prices more than balanced out those increases. The largest underlying increase was a 0.3% rise in transportation and warehousing services prices, although prices for both trade services and other services also increased slightly. The rise in transportation and warehousing services prices in September follows a significant price decline of 0.9% in August.

Prices within intermediate demand fell in September, continuing the declines from August. Processed goods for intermediate demand dropped 0.8%, with prices for processed energy goods leading the decrease. On the other hand, prices for processed foods and feeds rose 0.9%. Over the 12 months ending in September, prices for processed goods for intermediate demand fell 2.7%.

Meanwhile, prices for unprocessed goods for intermediate demand moved down 3.2% in September, after declining 3.1% in August. The decrease was driven by a 12.6% drop in unprocessed energy materials. In contrast, unprocessed foodstuffs and feedstuffs and nonfood materials less energy prices increased 2.7% and 1.9%, respectively. Over the 12 months ending in September, prices for unprocessed goods for intermediate demand fell a dramatic 9.5%.

Inflation Slows, But Core Prices Stay High

Consumer prices rose 0.2% over the month and 2.4% over the year in September, slightly above consensus expectations of a 2.3% year-over-year increase. This is the smallest over-the-year increase since February 2021. Core CPI, which excludes more volatile energy and food prices, ticked up slightly to a 3.3% increase over the year and remains higher than overall CPI.

Shelter increased 0.2% over the month and 4.9% over the year in September. Food, which rose just 0.1% over the month and 2.1% over the year in August, rose 0.4% over the month and 2.3% over the year in September. Together, these two indexes accounted for more than 75% of the monthly increase of the all-items index. Transportation services also remain high, rising 1.4% over the month and 8.5% over the year, with motor vehicle insurance increasing 16.3% over the year.

Energy costs, which fell 1.9% over the month and 6.8% over the year in September, helped restrain the headline inflation rate. This significant decline is partly due to energy prices being elevated in September 2023. While energy commodity prices are down over the year, electricity prices are up 3.7%.

Although the report came in hotter than expected, markets are still anticipating a 25-basis-point rate cut at the Federal Open Market Committee’s next meeting in November. Federal Reserve Bank of Chicago President Austan Goolsbee noted there would likely be more close call-type meetings in deciding the Fed’s interest rate target in the coming months.

Small Business Optimism Grows, But Uncertainty Soars

The NFIB Small Business Optimism Index rose 0.3 points in September to 91.5, marking the 33rd consecutive month below the 50-year average of 98. Meanwhile, the Uncertainty Index rose 11 points to 103, the highest reading ever recorded. This high level of uncertainty is making small business owners hesitant to invest in capital and inventory, with owners reporting the lowest level of capital outlays in September since July 2022 and inventory gains falling to the lowest reading since June 2020. Although price increases have slowed in recent months, inflation is the top concern for small business owners, with 23% identifying higher input and labor costs as their primary issue.

Filling job openings continues to be a top issue for small businesses and is acute particularly in manufacturing, transportation and construction. In September, 34% of small business owners reported jobs they could not fill.

A net 25% of small business owners plan price hikes in September. A net 32% of small business owners reported raising compensation, down one point from August and the lowest reading since April 2021. Following the Federal Reserve’s interest rate cut, a net 12% of owners reported paying a higher rate on their most recent loan, down 3 points from August and the lowest reading since March 2022. Profitability remained under pressure, mainly due to weaker sales.

The service sector continues to be holding up, while manufacturing and housing remain weak. The outlook for general business conditions remains negative but is improved from earlier in the year, while the current economic conditions and business climate were the top reasons cited for why it is not a good time to expand.

Improving Medical Supply Chain Resiliency

Medical supply chains are critical to ensuring the health and security of Americans—and Congress should act to bolster their resiliency, the NAM told members of Congress this month.

What’s going on: “The COVID-19 pandemic brought to light the risks and instability resulting from concentration and choke points in medical supply chains, though the pandemic also showed how medical supply chains can quickly adjust to external shocks,” NAM Managing Vice President of Policy Chris Netram told Reps. Brad Wenstrup (R-OH), Blake Moore (R-UT) and August Pfluger (R-TX) in response to a request for information on how to improve medical supply chains.

What should be done: The NAM recommended that Congress should work with manufacturers “on a comprehensive approach to find ways to onshore, near-shore and friend-shore more of the medical supply chain,” Netram continued.

There are several actions the federal government should take to fortify medical supply chains, including:

- “[C]reating an environment where small businesses can continue to thrive” and where large companies can maintain their pandemic-era practices of “leveraging sources of domestic production when feasible, working with existing smaller suppliers to improve their reliability” and sourcing goods through new suppliers;

- Streamlining the Food and Drug Administration’s new-supplier certification process;

- Taking “creative steps to incentivize onshoring, near-shoring and friend-shoring, as opposed to imposing punitive or unworkable requirements to do so”;

- Passing the Medical Supply Chain Resiliency Act (H.R. 4307/S. 2115), which would authorize the president to strategically create new trade agreements specific to medical goods with our allies and partners;

- Strategically refining Section 301 tariffs on imports from China;

- Restoring “immediate research and development expensing and full expensing of capital equipment purchases,” ensuring “that the corporate tax rate does not exceed 21%” and making the pass-through deduction permanent; and

- Completing “reauthorization of the Workforce Innovation and Opportunity Act and expansion of Pell grant eligibility to short-term training programs,” as well as supporting solutions that incentivize companies to collaborate to reduce the manufacturing-worker shortage.

The bottom line: “[A]n approach that creates incentives that reduce the cost and complexity of moving supply chains can help U.S. manufacturers to be more resilient in the face of a future global crisis and better able to serve patients who depend on these products,” Netram said.

NAM Emphasizes USMCA, Protecting Investors in Mexico Meetings

In high-level meetings with government, manufacturing and trade group leaders held in Mexico last week, the NAM hammered home a key message: For North American manufacturing to remain globally competitive, Mexico must protect investor holdings in the country.

What’s going on: During a jam-packed three-day visit to Mexico City, NAM President and CEO Jay Timmons and an NAM contingent met with top officials in the new Sheinbaum administration, as well as leadership at multiple agencies and associations.

- These included newly appointed Deputy Trade Minister Luis Rosendo Gutiérrez, the Business Coordinating Council (CCE), the Confederation of Industrial Chambers of Mexico (CONCAMIN), the Mexico Business Council (CMN), the National Council of the Export Manufacturing Industry (INDEX) and others.

What they said: The NAM’s main message at each gathering was the same: Companies investing in Mexico need assurance that their portfolios will be protected regardless of the fate of proposed judicial reforms in the country.

- The NAM also underscored the importance of the U.S.–Mexico–Canada Agreement, which is due for review in 2026, and the necessity of ensuring that the deal is upheld for all three parties.

- If its terms are respected, USMCA could help North American manufacturing outcompete China.

On China: This week, just days after his office’s meeting with the NAM, Gutiérrez announced that the Sheinbaum administration will seek U.S. manufacturers’ help to reshore—mainly from China—the production of some critical technologies (The Wall Street Journal, subscription).

- “We want to focus on supporting our domestic supply chains,” he told the Journal, adding that talks with U.S. companies are still in the informal stage.

The NAM says: “Manufacturing is at the heart of the USMCA,” said NAM Vice President of International Policy Andrea Durkin, who was part of the NAM group on the ground in Mexico. “The NAM intends to work to ensure that the agreement strengthens the competitiveness of manufacturers.”

New DOD Loan to Fund “Critical Technologies” Manufacturing

The Defense Department’s Office of Strategic Capital is now accepting applications for flexible direct loans to build, expand and/or modernize “critical technologies” facilities (Federal Register).

- It’s also seeking input from companies and trade associations on the Defense Department’s loan program, via a Request for Information open through Oct. 22 (Federal Register).

What’s going on: The OSC’s credit program, launched Sept. 30, aims “to attract and scale private capital in industries and technologies that are critical to America’s national and economic security,” according to the Defense Department. This is part one of the application process.

- The financing is geared toward manufacturers that must spend significantly on industrial or specialty equipment to create new assembly lines in existing facilities.

- The money is also intended to help them cover “soft” expenses, such as factory preparation and installation, associated with critical technology projects.

Why it’s important: “The funding from this program could benefit manufacturers of all sizes that are working to expand their businesses and product lines in critical areas of the economy,” said NAM Director of Energy and Natural Resources Policy Mike Davin.

- The OSC loans offer flexible terms, a U.S. Treasury-comparable interest rate, long repayment periods and deferred payments.

Who’s eligible: Manufacturers within the 31 “Covered Technology Categories”— which include advanced manufacturing, cybersecurity, battery storage and spacecraft—are encouraged to apply.

- There is no company-size or employee-number threshold or limit, and manufacturers with existing federal grants are eligible.

NAM, Allies Urge Court to Vacate PFAS Rule

The EPA’s final rule setting national drinking water standards for PFAS should be vacated in its entirety, the NAM and two allies said in an opening brief filed in federal court Monday.

What’s going on: The NAM, the American Chemistry Council and U.S. chemical company Chemours asked the U.S. Court of Appeals for the D.C. Circuit to overturn the EPA’s rule, announced in April, which requires that municipal water systems nationwide remove six types of per- and polyfluoroalkyl substances from drinking water. Trade groups representing the water systems have also sued to overturn the rule.

The grounds: The rule is unlawful and must be set aside for the following reasons:

- The EPA used a deeply flawed cost-benefit analysis to justify the rule.

- The EPA conducted a woefully incomplete feasibility analysis that ignores whether the technology and facilities necessary for compliance actually exist.

- Critical parts of the rule exceed the agency’s statutory authority under the Safe Drinking Water Act and flout the act’s express procedural requirements.

- The EPA failed to consider reasonable alternatives or respond meaningfully to public comments that undercut its judgment.

- The agency “lacked sufficient data to regulate” HFPO-DA, one of the PFAS chemicals that falls under the rule.

Why it’s important: PFAS “are substances at the center of modern innovation and sustain many common technologies including semiconductors, telecommunications, defense systems, life-saving therapeutics and renewable energy sources,” according to the brief.

- The NAM and its co-petitioners “support rational regulation of PFAS that allows manufacturers to continue supporting critical industries, while developing new chemistries and minimizing any potential environmental impacts. But that requires a measured and evidence-based approach that the [r]ule lacks.”

What’s next: Briefing in this case will continue through the spring, with oral argument to follow and a decision from the D.C. Circuit expected in late 2025.