How to Turbocharge Your R&D Leaders’ Careers

Every manufacturing executive has talented innovation leaders in the middle ranks of his or her company—managing a lab or department, but eager to move up. How do you prepare them for the next step in leadership so they can become the executives of tomorrow?

The Innovation Research Interchange, the NAM’s innovation division, offers a program designed to fill this gap in manufacturing professionals’ career development. The Shaping Innovation Leaders program, a partnership with Northwestern University, takes place over one packed week in June every year, and gives these midlevel managers a comprehensive introduction to business strategy, accounting and finance, organizational behavior, brand management and much more.

It’s the starter pack for those seeking to advance in the manufacturing industry. If you have someone on your team who could benefit, here’s what you need to know.

Who it’s for: The course is targeted at managers who have 10–15 years of experience and usually a graduate degree (most often a Ph.D.). These managers typically have several direct reports, oversee a lab or department and handle their own budgets.

- Past participants have worked at major manufacturers and related companies of all sectors, including Mars and FM Global.

What they’ll learn: This one-week intensive residential program—this year taking place June 8–13—features classes in the morning and afternoon, and also includes lunch, dinner and evening study and networking sessions. The courses include:

- Understanding Financial Statements;

- Evaluating Financial Results and Investment Projects;

- Financial Strategy and Cost of Capital;

- Driving Profitable Growth;

- Defending Your Brand; and,

- Law for Technical Executives.

Who’s teaching: The program is taught by eminent Northwestern faculty, including award-winning professors in marketing, management and finance.

- The program’s director, Adjunct Professor of Executive Education Marian Powers, boasts a long career of developing finance textbooks and software and specializes in teaching financial reporting and analysis to executives.

Inside the classroom: Every session of the program introduces participants to skills they may not have encountered in their technical positions. To take just one example, the High-Performance Negotiation Skills session introduces these managers to the framework and tactics that high-level leaders use in handling challenges.

- The course helps participants answer essential questions, such as “How should you think differently about negotiating as part of a team? How should you think about coalition-building in deals with many parties? How can you negotiate effectively from positions of weakness as well as strength?”

- To answer these questions, participants will examine case studies from the manufacturing industry. All the program’s sessions draw on real-world, relevant examples, ensuring that participants receive a useful toolkit of strategies.

What they’re saying: “Above all, this course illustrates a framework behind the motivations of our marketing and business/finance counterparts,” said one participant.

- “We no longer have the excuse of ‘why do they do it that way!?’ but rather, we can help those functions more effectively and proactively.”

Learn more and register: To learn more about the Shaping Innovation Leaders program or to register, visit the IRI site. This year’s program is still accepting applicants.

Hydro CEO: U.S. Must Reuse More Aluminum

Aluminum is “an essential part of everything we do”—so we need to recycle more of it.

That’s the message from leading global aluminum and renewable energy company Hydro, based in Oslo, Norway, whose president and CEO, Eivind Kallevik, recently sat down with the NAM to discuss the importance of the metal to the U.S.

Ubiquitous and crucial: “Construction, automobiles, [energy and technology]—you’ll find an enormous amount of aluminum in all of that,” Kallevik told us. “Going forward, it will just become increasingly important.”

An energy imperative: The U.S. has an aging electrical grid—a matter on which the NAM has long issued a clarion call—and modernizing and expanding it to meet Americans’ energy appetite will require aluminum, and a lot of it.

- “There’s going to be a huge increase in demand for electricity, especially given [the growth in construction of] data centers,” said Kallevik.

- For vehicles to become more energy-efficient, they must be lighter, and “the best way of doing that is more aluminum.”

A workhorse: One of the metal’s best qualities is its ability to withstand nearly endless reuse, Kallevik said.

- “You can recycle it infinitely. If you sort it the right way, you will be able to take it back to exactly the same state it was in in the first place.”

- Hydro—which has operations in 17 states and employs thousands of people in the U.S.—has multiple aluminum recycling facilities throughout the country, including at sites in Pennsylvania, Indiana, Illinois, Louisiana, California and Texas.

Keep more at home: “The more [aluminum] you can keep onshore, the better it is” for manufacturing, the economy in general and national security, Kallevik continued, adding that aluminum is critical in many U.S. defense applications.

- “If the U.S. kept more scrap exports onshore, we would reduce dependence on third parties” for the metal, he said.

Policy and supply chains: Because building is a heavily energy-intensive process, “energy policy is going to be increasingly important” in the coming years, Kallevik went on.

- “To protect its industries, the U.S. needs to ensure a fair regulatory framework to ensure that everybody in a global context competes on a level playing field,” he told the NAM.

- And when it comes to shoring up domestic supplies of aluminum, “to be more self-sufficient, the short-term solution for the U.S. is recycling,” he said. “Use what’s on the ground today, and for tomorrow, build capacity.”

NAM to House: Regulate Proxy Firms, Protect Workers’ Retirement Savings

Congress should act now to ensure that manufacturers and manufacturing workers are protected from so-called “proxy advisory firms,” the NAM told House lawmakers this week at two congressional hearings.

Flaws abound: Proxy firms—powerful, unregulated entities that advise institutional investors on how to vote on proxy ballot measures at public companies—wield outsized influence and must be reformed, NAM Managing Vice President of Policy Charles Crain told the House Subcommittee on Capital Markets at a Tuesday hearing, “Exposing the Proxy Advisory Cartel: How ISS & Glass Lewis Influence Markets.”

- Proxy firms operate with undisclosed conflicts of interest, are unwilling to allow companies to review their draft reports, and are resistant to correcting mistakes in their final vote recommendations. Despite these flaws, proxy firms “still control a significant share of investors’ proxy votes—giving them sway over important corporate decisions,” Crain said.

- In 2020, after years of NAM advocacy, the Securities and Exchange Commission finally adopted a rule to rein in these powerful firms—yet today, proxy firms remain unregulated due to ongoing legal challenges and regulatory neglect.

- “The SEC’s 2020 rule has spent five years hung up in court,” Crain told the subcommittee. “The NAM has had to defend the rule across three separate cases—one of which has oral arguments scheduled for this Friday.”

SEC has authority: Although the largest and most influential proxy firm, Institutional Shareholder Services, “is now claiming in court that the SEC lacks the authority to regulate proxy voting advice at all,” the Securities Exchange Act of 1934 clearly provides the SEC the authority to regulate proxy solicitation, which includes the activities of proxy firms, the NAM said.

Tighten the reins now: “Even assuming that the NAM is successful in defending the SEC’s authority, there is more work for Congress to do,” Crain continued. This entails acting on six House bills that would:

- Create a comprehensive registration regime for proxy firms;

- Ensure that proxy firms remain subject to anti-fraud liability;

- Ban certain proxy firm conflicts of interest;

- Regulate the use of automated “robo-voting” systems;

- Ensure that investment managers carry out their fiduciary duties to their clients when hiring proxy firms; and

- Direct the SEC to conduct a thorough study on proxy firms and the proxy process.

Retirement savings in jeopardy: On Wednesday, Crain delivered a similar message for the House Subcommittee on Health, Employment, Labor, and Pensions at a hearing titled “Investing for the Future: ERISA’s Promise to Participants.”

- “More than 85% of manufacturing workers are eligible to participate in a workplace retirement plan. These Americans have probably never heard of a proxy firm, and they likely would be shocked to hear that their pension or 401(k) plan assets were being used in a way that could undermine their own retirement security,” Crain explained.

- But that’s exactly what’s happening when pension plan fiduciaries use “plan assets to pursue non-financial ESG goals—or blindly outsourc[e] the voting rights that come with those assets to unregulated and conflicted proxy firms,” he added.

- With their errors, conflicts of interest, political agendas, one-size-fits-all governance standards and more, proxy firms pose huge risks “to everyday Americans’ retirement security,” Crain said.

Manufacturers support guardrails: “That’s why manufacturers support appropriate guardrails to ensure that ERISA fiduciaries act in plan participants’ best interests when making investment and voting decisions,” Crain explained, adding that the Labor Department under the first Trump administration finalized rules to “do just that.”

- While the last administration largely rescinded those guardrails, Subcommittee Chairman Rick Allen (R-GA) recently introduced a measure that would require ERISA retirement plan fiduciaries to prioritize financial returns when making investment decisions on behalf of clients and to exercise closer oversight of proxy firms.

Stand up for workers: “Now is the time for Congress and the [Department of Labor] to stand up for these workers and ensure that ERISA plans are operating in their participants’ best interests,” Crain concluded.

In the news: Bloomberg (subscription) covered Crain’s testimony, as did Pensions & Investments (subscription) in two articles.

What’s next: As Crain previewed in his testimony, the NAM Legal Center will participate in oral arguments on Friday, May 2, before the U.S. Court of Appeals for the DC Circuit—arguing that the SEC has the authority to regulate proxy firms, and that the agency’s 2020 rule doing so was lawful.

- “Is this high stakes? Absolutely,” Crain told Bloomberg. “Is this the end of the fight if the NAM were to lose? No, it’s not.”

Timmons Presses for Comprehensive Manufacturing Strategy in NewsNation, FOX Business Interviews

In a one-on-one interview with NewsNation’s Blake Burman just hours before President Trump spoke at a town hall with the same network, NAM President and CEO Jay Timmons continued to underscore the need for a comprehensive manufacturing strategy to make long-term investments.

- “First and foremost, we have got to get those tax reforms from 2017—that rocket fuel that President Trump announced at our board meeting in 2017—renewed, and Congress needs to move that forward,” Timmons said.

- “Regulatory rebalancing is something that’s very important. It’s about $50,000 per employee per year in compliance costs; that’s pretty expensive. We also need energy dominance. [Trump is] well on his way to making that happen.”

- He added that we need “good, solid trade policy” so manufacturers don’t see added costs. “We’re waiting to see how all this comes out. And we’re hopeful.”

- “If you have a comprehensive manufacturing strategy that you’re implementing … that includes all of those things I just mentioned to bring down the cost of business doing business here in the United States, you absolutely will see more investment,” he continued. Trump “announced that $5 trillion has already been committed. You’ll see more jobs, and you’ll also see higher wages and benefits.”

The long view: “Massive facilities … take a little while,” Timmons told Burman. “That is a realization that I need Americans to understand.”

- Such sites typically take years, he said, with the exact number depending “on how localities and states are moving along the permitting process.”

- “I was George Allen’s chief of staff when he was governor of Virginia,” Timmons went on, “and he made a commitment that he was going to move large scale projects in a very expeditious way. And we had a huge chip manufacturer that made an announcement, and [the company] said the doors will open in one year. [T]hey did, and that’s because all of government was really focused on doing that. You’ve got that commitment from this administration, there’s no doubt about that, but it’s typically three to five years for a large-scale manufacturing operation to come to fruition, and you’re talking about a 30-year commitment.”

- “So that’s another reason we need permanence when it comes to tax policy and trade policy.”

FOX Business: Timmons recently spoke with a group of FOX Business reporters to discuss the comprehensive strategy needed from Congress, focusing specifically on tax, trade and the manufacturing workforce.

- In a story from that interview published today, he said: “The 2017 tax reforms that President Trump actually announced at our board meeting in 2017, [which he said] would be rocket fuel for the economy … indeed were. Those tax reforms led to record investment and job creation and wage growth for three years running after they were in enacted.”

NAM: Comprehensive Manufacturing Strategy Will “Ignite” Renaissance

The NAM’s comprehensive manufacturing strategy will be fundamental in “igniting the Industrial Renaissance of the United States,” the NAM told a House committee today ahead of a hearing of the same name.

What’s going on: “Manufacturers call on President Trump and Congress to implement a comprehensive manufacturing strategy that would create predictability and certainty to invest, plan and hire in America,” the NAM told the House Committee on Oversight and Government Reform.

- The purpose of the hearing was to examine how “cheap labor abroad, combined with overregulation and obstacles to permitting in the United States, contributed to the offshoring of American manufacturing and an overreliance on China to fulfill manufacturing needs.” It also emphasized “the importance of bringing manufacturing back to the United States.”

What we’re saying: The NAM has been advocating that the administration adopt a multipoint plan to see the manufacturing sector flourish. Today it urged President Trump and Congress to take the following actions from that strategy as soon as possible:

- Make 2017 tax reform permanent: Make permanent the pro-manufacturing tax measures scheduled to sunset at the end of 2025 and bring back already expired provisions. Failure to do so will put almost 6 million U.S. jobs at risk, according to a recent EY–NAM study.

- Rebalance federal regulations: Manufacturers now spend $350 billion a year to comply with federal regulations. That’s money that could be spent on factory expansions, hiring and/or wage raises, as NAM President and CEO Jay Timmons has pointed out. The NAM also recently urged 10 key federal agencies to revise or rescind dozens of onerous, anachronistic regulations.

- Expedite permitting reform: “America should be the undisputed leader in energy production and innovation, but we will not reach our full potential without permitting reform.” This must include expediting judicial review, accelerating the permitting process, creating enforceable deadlines and more.

- Implement commonsense trade policies: “Building things in America only works if we can sell them around the world,” the NAM told the House members. “That is why manufacturers urge President Trump and Congress to provide greater predictability and a clear runway to allow them to adjust to new trade realities, while also making way for exemptions for critical inputs, enabling reciprocity in manufacturing trade.”

Komatsu Expands and Innovates in the U.S.

Komatsu is a household name in Japan, but it’s making big moves in the U.S., too.

An all-of-the-above strategy: The commercial equipment maker, whose product catalogue runs the gamut from bulldozers and log loaders to autonomous haulage systems for mines, has launched multiple new innovations in recent months.

- In March, it introduced two new wheel loader models with improved fuel efficiency, more engine power and faster speeds.

- Last fall, Komatsu announced the launch of its first commercialized truck in its Power Agnostic series, vehicles capable of running on multiple fuel types, including diesel, hydrogen fuel cells and batteries.

Expansions underway: The global manufacturing giant is also expanding. In late 2024, it announced the construction of new facilities in Mesa, Arizona, and Peoria, Illinois.

- The Mesa project, slated for completion in 2026, will triple the square footage of the company’s current operational footprint in the area. The new sales and service facility will support the company’s mining customers throughout the Southwestern U.S.

- The Peoria expansion, which will replace an existing structure built in the 1970s, “will provide a collaborative space for engineering, sales, manufacturing, management and other functions,” according to the company. It will incorporate solar panels, stormwater reclamation systems and other sustainable technologies.

- A Komatsu 980E-5SE mining truck—winner of the Makers Madness contest’s “2024 Coolest Thing Made in Illinois” award from NAM state partner the Illinois Manufacturers’ Association—will be installed permanently outside the new Peoria building, which is scheduled to be finished by the end of 2025. The truck is manufactured at the site.

All in on mining: It’s fair to say Komatsu has a special focus on mining. In September, following its acquisition of German mining equipment manufacturer GHH Group GmbH, it showcased an expanded lineup of underground mining machinery at the MINExpo tradeshow in Las Vegas.

- It also recently unveiled its Modular ecosystem, an “interoperable mine management platform” to give mining customers access to all connected operational data in one place.

In the works: At the 2025 Consumer Electronics Show in Las Vegas in January, Komatsu exhibited some exciting in-development projects, including the prototype of an electric underwater bulldozer and artwork for planned construction machinery capable of working on the moon.

- The bulldozer—currently a concept vehicle with no planned introduction data as of yet—is a driverless, remote-controlled, electric-powered vehicle. This will be the second iteration of an underwater, battery-operated bulldozer from Komatsu; the first, the D155W, rolled off conveyor belts in Japan in the 1970s.

- “We’ve found that a lot of those machines built a long time ago are still in use,” said Komatsu Chief Digital Officer Michael Gidaspow. “People need this product, so they are keeping them running. Japan has a lot of coastline and coastal infrastructure to maintain, so this kind of dozer is so important there.” The planned update utilizes the latest technology, including automated blade control and teleoperation. It is powered by batteries, whereas the original had a diesel engine, Gidaspow added.

- Komatsu’s lunar construction machinery work is part of the Artemis Program aimed at getting humans back on the moon. “Life on the moon will demand roads, housing and other infrastructure, and lunar construction machines will be indispensable for building all this,” according to the company. “Once we only dreamed of humans living on the moon. Today we are making it a growing possibility.”

Manufacturers Share Immediate Impacts Under Latest Tariffs

As three of the largest U.S. retailers—Walmart, Home Depot and Target—this week warned President Trump that his tariff policy could empty store shelves within weeks, upend supply chains and raise consumer prices, the tariffs already in place on imported goods are having effects on those who make things in America.

Speaking up: Manufacturers in the U.S. are sharing their stories of increased cost pressures and uncertainty, both the result of new tariffs. Makers of everything from machinery to bicycles to food service equipment are reporting ill effects.

- For Craig Souser, president and CEO of robotic packaging solutions manufacturer JLS Automation in York, Pennsylvania, steel tariffs in particular have had a big—and negative—effect on business.

- “[W]e’re seeing increased costs [in steel] that will eventually get passed along to the customer,” Souser told the York Dispatch (subscription).

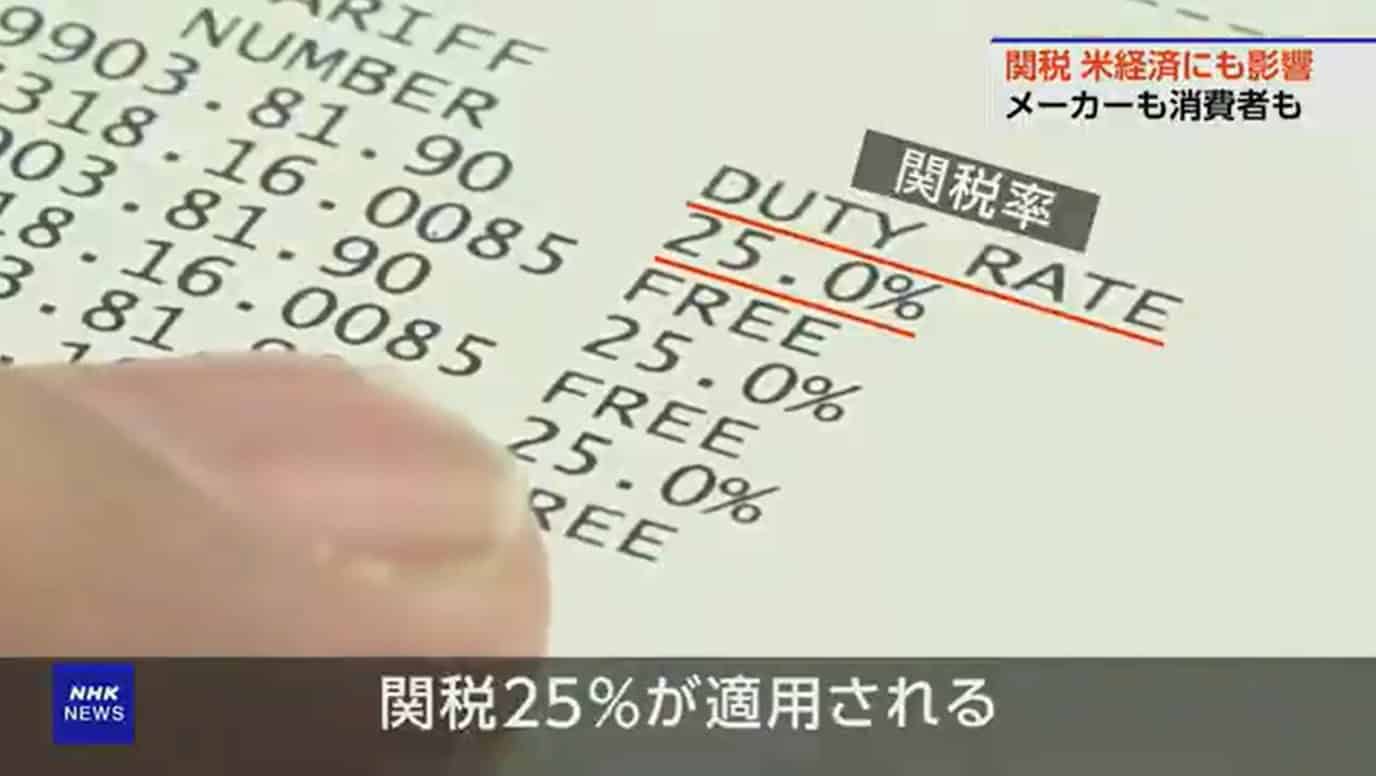

“Writing the checks”: Chuck Dardas, president and chief operating officer of Michigan automotive parts manufacturer AlphaUSA, told NHK News recently that his small business and others like it are the ones “writing the checks for” the new tariffs—and it’s not something they can keep up.

- “To absorb 25% or 50% in tariffs, it’s a task that we cannot in the long term endure,” Dardas said. “It’ll cause our company and many other companies our size to probably go out of existence.”

The unknown: Perhaps the hardest part about the new tariffs: the uncertainty they bring, NAM board member Lisa Winton, CEO and co-owner of Georgia-based machinery maker Winton Machine Company, told NPR earlier this month.

- “We just noticed our first invoice that had a tariff line on it,” she said. “There’s just so much unknown right now, and I think that’s the most difficult thing—to make decisions for your company financially when you just don’t know all the pieces to the puzzle.”

No time: Arnold Kamler, chairman of Kent International, a New Jersey bicycle manufacturer, told Fox Business last week that while his business was already moving overseas production to the U.S. when tariffs hit, it has yet to complete the move—and that’s been a problem for his small outfit.

- “We’ve managed to move almost half of our production out of China already, but that’s only [almost] half,” he said. “We need more time. … [W]e’re a small company.”

- During the pandemic, “[e]verybody bought a bicycle”—but “things got very slow after that. … All the money we made during the pandemic is all gone, plus a lot more. Then we have these tariffs. [If the Trump administration had said], ‘Look … in nine months, 10 months, this will be the tariff,’” that might have been doable, he went on. “But we g[ot] two weeks’ notice. It’s impossible to run a company to plan for” that.

Passing on the costs: In Ohio, Wasserstrom Company President Brad Wasserstrom told 10 WBNS that his Columbus-based food service and supply company will most likely have to raise customer prices to pay for the new tariffs.

- “[W]e’re negotiating with suppliers when we can, if there’s any flexibility in what they’re passing on to us,” Wasserstrom said. “Some have been able to do something to help us out. They’re not passing through maybe the full tariff. But very few have said they’re going to pass on nothing.”

For This Pella Corp. Leader, Manufacturing Is an Easy Sell

When JaNette Barnett, vice president of field sales at Pella Corporation, is asked why she has spent nearly 30 years of her career in manufacturing, the answer comes easily. “I have always been drawn to the home improvement space, so it’s no surprise that my manufacturing experience has been centered in that sector—from cabinetry to lightbulbs, to plumbing to paint, and now windows.”

- “What makes this [sector] interesting to me is it delights our end consumer. It puts a smile on their face when they can transform their spaces in ways that make them feel at home.”

Barnett channels this joy into her efforts to modernize Pella’s sales team, a track record that won her recognition as part of the 2025 Women MAKE America Awards. Created by the Manufacturing Institute, the NAM’s workforce development and education affiliate, the awards honor 130 individuals who have achieved excellence in the manufacturing industry.

Barnett and the other honorees, selected by a panel of peers, will be celebrated at the Awards gala in Washington, D.C., on April 24, but we caught up with her earlier about her decades-long experience in the industry and advice for young people just starting out.

Her achievements: Barnett has been a game-changing leader for Pella’s field sales team, delivering a 30% year-over-year sales increase in 2024.

- Thanks to her extensive experience at previous companies, she has reconfigured its sales territories, overseen an expansion of the company’s sales team and improved its compensation structure—all of which has led to impressive engagement levels among Pella’s field sales personnel.

- Beyond that, Barnett is a highly respected mentor of young professionals at Pella and runs a foundation she named for her grandmother, the Betty Jefferson Memorial Fund, to support the education of Black, inner-city young people just as her grandmother did.

How it all began: As Barnett tells it, she fell into manufacturing two decades ago while looking for a job in marketing. She accepted a job in sales, but when she arrived, she found she’d been assigned to the production scheduling department instead—a job that involved walking the factory floor in steel-toed boots.

- “It wasn’t what I signed up for, but it was the best pivot ever,” said Barnett. “It put me in the heart of manufacturing—and as a sales and marketing leader, it gave me a different perspective on how products are made.”

Gaining insight: Her experience on the factory floor has informed her work ever since, even after she moved on to the corporate side of manufacturing. Today, she emphasizes that her holistic view of manufacturing impacts how she thinks about her sales work at Pella.

- “I truly believe that manufacturing is the heartbeat of the organization,” said Barnett. “Too often, that gets lost from a sales and marketing lens. We don’t always have a clear sense of the people behind the product getting made.”

Mentoring others: Barnett emphasized the importance of mentoring in introducing more people to the manufacturing industry. Especially at a time when manufacturing faces a significant employment gap—with more than 450,000 job openings today and an estimated 3.8 million positions needing to be filled by 2033—it is crucial to reach individuals who might not otherwise consider a career in the industry, she pointed out.

- “I believe mentoring is a form of paying it forward and bringing others along,” said Barnett. “There’s a need to bring new and fresh ideas to these places. And if people have aspirations to be in leadership, it’s my honor to help mentor them and help them understand that they can do the things they set their sights on.”

The last word: “My message has always been: You’re needed,” said Barnett. “We need you in this space. We need everything you can bring to the table.”

NAM Forge Your Path Series: Meet Liberty Pumps President and CEO Robyn Brookhart

Robyn Brookhart began her career in the pump industry in 1997 at her family’s business—Liberty Pumps, a manufacturer based in Bergen, New York, that makes pumping products for groundwater and wastewater removal in residential and commercial applications.

Through the years, she climbed the ladder at her company, holding a variety of positions in sales and marketing, customer service and manufacturing before serving in her current role as company president and CEO.

In 2021, Brookhart received the American Supply Association Women in Industry Alice A. Martin Woman of the Year Award, which recognizes women in the plumbing, heating, cooling and piping industries for significant accomplishment within those industries.

In the latest installment of the NAM’s “Forge Your Path” series, Brookhart talks about why connection is so critical to her company’s culture, why her mantra changes weekly, where she sees her company in five years and more.

Q: What is one lesson or insight you’ve gained in leadership that you haven’t widely shared before but that has been a key part of your company’s success? How did you come to this realization, and how has it impacted your leadership?

Brookhart: “At Liberty Pumps, we take tremendous pride in our culture. Connection and being present are deeply rooted in the way that we function and interact with one another—not just internally, but also with our customers and suppliers. Every conversation matters, and I make it a point to be present and give people my full attention. I believe this is foundational in establishing and maintaining trust, ensuring people feel seen and heard and in opening my eyes to perspectives that may differ from my own.

“When I look back over the 28 years I’ve been at Liberty, I see this as a thread that’s always been. It’s been key to making sure our workforce knows they’re valued.

I’m a heart-centered leader. This doesn’t mean I don’t make tough decisions, but it does mean that I do consider how any decision I make will impact other people.”

Q: Can you share a quote or mantra that defines your approach to leadership? How has this mantra influenced your decision-making and leadership?

Brookhart: “That’s a great question. This might change week by week. It can be a single word, an affirmation or a quote that really resonates. Words carry energy and have a certain power to them. This week, my word happens to be ‘cultivate.’ Other examples have been, ‘where attention goes, energy flows,’ ‘don’t just wish for it; work for it’ and this quote by Ralph Waldo Emerson: ‘The only person you are destined to become is the person you decide to be.’

“Identifying a word or phrase is like setting an intention, and I find that setting an intention helps guide the direction of my decision making and is a factor in how I prioritize my work for the week.”

Q: What accomplishments at your organization are you the most proud of and why?

Brookhart: “This might sound like a mundane response, but I’m proud of the way that our employees (whom we call members) show up to do amazing work every day. Yes, the major next-level outcomes matter of course, but the collaboration, creativity and care that people give to their work each day is what really lights me up.”

Q: Where do you see your company in the next five years, and what are you hoping to achieve?

Brookhart: “I’m confident we’ll see significant growth with products that we’ve launched recently and products that are on the horizon. We’re tapping into new markets and expanding our offerings to existing markets. There’s a ton of potential, and knowing that is a big part of what energizes our engineering and sales and marketing teams.

“I also foresee the expanded use of automation throughout our factory. With the continuous growth trajectory we’ve been on, the volume of pumps that we’re building and shipping has been increasing steadily. To help keep pace and alleviate potential ergonomic issues, strategically implementing automation has been and will continue to be crucial.

“I’m also thinking about the overall customer experience. Customer service is one of our strengths, as feedback from the field affirms. We have an amazing team, and I imagine that as great as we are now with prioritizing customer satisfaction, we’ll be even better in five years!”

Q: What are the past three books that you’ve read or podcasts that you’ve listened to that you would recommend to your peers and why?

Brookhart: “I’m constantly reading and listening to podcasts and audio books. I feel like there’s so much to learn and not enough time. However, three of my favorite books that I’ve also encouraged our leadership team to read are ‘Atomic Habits’ by James Clear, ‘Insight’ by Tasha Eurich and ‘Think Again’ by Adam Grant.

“‘Think Again’ is about perspective and the importance of staying curious.

“‘Insight’ is about self-awareness. It shines a spotlight on how we see ourselves versus how others might see us, and how we, as leaders, can solicit honest feedback to gain clarity on how others view our behavior.

“‘Atomic Habits,’ as the name suggests, is about how to incorporate beneficial habits into our lives, while also releasing those that don’t serve us well. As with the other two, it’s well-written, interesting and backed by science.

“As for podcasts I enjoy, I tend to nerd-out on the topic of health span. So, my list primarily includes podcasters who are functional medicine doctors and medical professors.”

How Connecticut Is Strengthening the Manufacturing Supply Chain

If you are a buyer at a big manufacturing firm, you probably discover new suppliers through a mixture of Googling, networking and serendipity. But what if you could search a single database full of suppliers in your state and across the country, view their exact capabilities and certifications and then contact them directly? Or simply list your needs and have qualified suppliers respond to your post, then select the ones who meet your criteria?

You can do all that on CONNEX Marketplace, sponsored by the NAM and run by i5 Services. Think of it as manufacturers’ version of Facebook, LinkedIn or Match.com—the perfect place to find brand-new links for your supply chain. Today, the database boasts 165,000 companies of every size and sector, with more than 300 large buying organizations searching for suppliers on the platform.

One state is way out ahead in the quest to re-localize and strengthen supply chains via CONNEX, and that is, fittingly, Connecticut. We chatted with Connecticut Chief Manufacturing Officer Paul Lavoie about his big vision for the small state and the way it has reshaped national supply chains already.

Making connections: The only chief manufacturing officer in any U.S. state government, Lavoie has a simple mandate: help manufacturing grow in Connecticut.

- As a state official, however, he can’t personally introduce one company to another to help them do business. He needed an intermediary, and CONNEX was the answer.

- While all manufacturers can subscribe to CONNEX to access the national database for a fee, some states have funded state-specific instantiations of the database that in-state companies can use as well. The state governments, manufacturing extension partnerships or other associations cover the costs and help recruit more in-state firms to use the platform, enriching it for everyone.

- Lavoie saw the potential of the state-specific model, created Connecticut’s version in 2022 and began a transformation of its manufacturing sector.

Supply chain success: Today, nearly 600 Connecticut companies have built full profiles on CONNEX, out of a total of 2,504 state-based firms in the database.

- Large manufacturers and other major buyers from across the U.S. have contacted Connecticut manufacturers due to their presence in CONNEX, including Northrop Grumman, the U.S. Army and Hill Air Force Base.

- One large Connecticut company had been working with a supplier in Texas, but CONNEX showed that a similar supplier was located just a few miles away from its facility.

- That supplier now serves several large manufacturers within Connecticut and is “the poster child for shortening supply chains and growing an ecosystem,” said Lavoie.

- And lastly, another Connecticut manufacturer was forced by recent tariffs to find an inspection service within the United States, having previously used a Canadian firm. CONNEX helped the manufacturer find a company in Vermont that provided the same service.

The big guys: Thanks to the efforts of i5 Services President and CEO Alan Davis and Lavoie himself, CONNEX is building out its stable of major manufacturers.

- Several aerospace giants in Connecticut have joined, including RTX. Along with Northrop Grumman, other global companies seeking suppliers through CONNEX include Siemens, General Dynamics, PR Hoffman, Applied Materials and Medtronic.

- Big companies know they need to shorten and secure their supply chains, Lavoie told us—and CONNEX is the perfect tool to help them.

How it works: When a company joins CONNEX, the first step is to build out its profile. This involves providing information about its capabilities, factory equipment, processes, certifications, materials, industry sectors, NAICS/SIC codes, capability statements and more.

- In Connecticut, Lavoie’s office helps manufacturers complete their profiles, providing “concierge service” and even going through the process with manufacturers by phone.

- Once a company is signed up, it can start searching for and sending direct notifications to qualified suppliers or buyers.

- CONNEX also features an Exchange Center, where companies can post their RFQs, RFPs or RFIs. The average contract value of each opportunity posted in the Exchange Center is more than $1 million, and after suppliers respond to a post, they can usually expect an interview within about two weeks.

The last word: Due to the funding from Lavoie’s state office, CONNEX is “an amazing business development tool with no additional costs to Connecticut manufacturers,” he pointed out. “Not only does CONNEX help manufacturers throughout the country strengthen and shorten their supply chains, but it enables state governments and MEPs to strengthen their states’ economies.”