For This Pella Corp. Leader, Manufacturing Is an Easy Sell

When JaNette Barnett, vice president of field sales at Pella Corporation, is asked why she has spent nearly 30 years of her career in manufacturing, the answer comes easily. “I have always been drawn to the home improvement space, so it’s no surprise that my manufacturing experience has been centered in that sector—from cabinetry to lightbulbs, to plumbing to paint, and now windows.”

- “What makes this [sector] interesting to me is it delights our end consumer. It puts a smile on their face when they can transform their spaces in ways that make them feel at home.”

Barnett channels this joy into her efforts to modernize Pella’s sales team, a track record that won her recognition as part of the 2025 Women MAKE America Awards. Created by the Manufacturing Institute, the NAM’s workforce development and education affiliate, the awards honor 130 individuals who have achieved excellence in the manufacturing industry.

Barnett and the other honorees, selected by a panel of peers, will be celebrated at the Awards gala in Washington, D.C., on April 24, but we caught up with her earlier about her decades-long experience in the industry and advice for young people just starting out.

Her achievements: Barnett has been a game-changing leader for Pella’s field sales team, delivering a 30% year-over-year sales increase in 2024.

- Thanks to her extensive experience at previous companies, she has reconfigured its sales territories, overseen an expansion of the company’s sales team and improved its compensation structure—all of which has led to impressive engagement levels among Pella’s field sales personnel.

- Beyond that, Barnett is a highly respected mentor of young professionals at Pella and runs a foundation she named for her grandmother, the Betty Jefferson Memorial Fund, to support the education of Black, inner-city young people just as her grandmother did.

How it all began: As Barnett tells it, she fell into manufacturing two decades ago while looking for a job in marketing. She accepted a job in sales, but when she arrived, she found she’d been assigned to the production scheduling department instead—a job that involved walking the factory floor in steel-toed boots.

- “It wasn’t what I signed up for, but it was the best pivot ever,” said Barnett. “It put me in the heart of manufacturing—and as a sales and marketing leader, it gave me a different perspective on how products are made.”

Gaining insight: Her experience on the factory floor has informed her work ever since, even after she moved on to the corporate side of manufacturing. Today, she emphasizes that her holistic view of manufacturing impacts how she thinks about her sales work at Pella.

- “I truly believe that manufacturing is the heartbeat of the organization,” said Barnett. “Too often, that gets lost from a sales and marketing lens. We don’t always have a clear sense of the people behind the product getting made.”

Mentoring others: Barnett emphasized the importance of mentoring in introducing more people to the manufacturing industry. Especially at a time when manufacturing faces a significant employment gap—with more than 450,000 job openings today and an estimated 3.8 million positions needing to be filled by 2033—it is crucial to reach individuals who might not otherwise consider a career in the industry, she pointed out.

- “I believe mentoring is a form of paying it forward and bringing others along,” said Barnett. “There’s a need to bring new and fresh ideas to these places. And if people have aspirations to be in leadership, it’s my honor to help mentor them and help them understand that they can do the things they set their sights on.”

The last word: “My message has always been: You’re needed,” said Barnett. “We need you in this space. We need everything you can bring to the table.”

NAM Forge Your Path Series: Meet Liberty Pumps President and CEO Robyn Brookhart

Robyn Brookhart began her career in the pump industry in 1997 at her family’s business—Liberty Pumps, a manufacturer based in Bergen, New York, that makes pumping products for groundwater and wastewater removal in residential and commercial applications.

Through the years, she climbed the ladder at her company, holding a variety of positions in sales and marketing, customer service and manufacturing before serving in her current role as company president and CEO.

In 2021, Brookhart received the American Supply Association Women in Industry Alice A. Martin Woman of the Year Award, which recognizes women in the plumbing, heating, cooling and piping industries for significant accomplishment within those industries.

In the latest installment of the NAM’s “Forge Your Path” series, Brookhart talks about why connection is so critical to her company’s culture, why her mantra changes weekly, where she sees her company in five years and more.

Q: What is one lesson or insight you’ve gained in leadership that you haven’t widely shared before but that has been a key part of your company’s success? How did you come to this realization, and how has it impacted your leadership?

Brookhart: “At Liberty Pumps, we take tremendous pride in our culture. Connection and being present are deeply rooted in the way that we function and interact with one another—not just internally, but also with our customers and suppliers. Every conversation matters, and I make it a point to be present and give people my full attention. I believe this is foundational in establishing and maintaining trust, ensuring people feel seen and heard and in opening my eyes to perspectives that may differ from my own.

“When I look back over the 28 years I’ve been at Liberty, I see this as a thread that’s always been. It’s been key to making sure our workforce knows they’re valued.

I’m a heart-centered leader. This doesn’t mean I don’t make tough decisions, but it does mean that I do consider how any decision I make will impact other people.”

Q: Can you share a quote or mantra that defines your approach to leadership? How has this mantra influenced your decision-making and leadership?

Brookhart: “That’s a great question. This might change week by week. It can be a single word, an affirmation or a quote that really resonates. Words carry energy and have a certain power to them. This week, my word happens to be ‘cultivate.’ Other examples have been, ‘where attention goes, energy flows,’ ‘don’t just wish for it; work for it’ and this quote by Ralph Waldo Emerson: ‘The only person you are destined to become is the person you decide to be.’

“Identifying a word or phrase is like setting an intention, and I find that setting an intention helps guide the direction of my decision making and is a factor in how I prioritize my work for the week.”

Q: What accomplishments at your organization are you the most proud of and why?

Brookhart: “This might sound like a mundane response, but I’m proud of the way that our employees (whom we call members) show up to do amazing work every day. Yes, the major next-level outcomes matter of course, but the collaboration, creativity and care that people give to their work each day is what really lights me up.”

Q: Where do you see your company in the next five years, and what are you hoping to achieve?

Brookhart: “I’m confident we’ll see significant growth with products that we’ve launched recently and products that are on the horizon. We’re tapping into new markets and expanding our offerings to existing markets. There’s a ton of potential, and knowing that is a big part of what energizes our engineering and sales and marketing teams.

“I also foresee the expanded use of automation throughout our factory. With the continuous growth trajectory we’ve been on, the volume of pumps that we’re building and shipping has been increasing steadily. To help keep pace and alleviate potential ergonomic issues, strategically implementing automation has been and will continue to be crucial.

“I’m also thinking about the overall customer experience. Customer service is one of our strengths, as feedback from the field affirms. We have an amazing team, and I imagine that as great as we are now with prioritizing customer satisfaction, we’ll be even better in five years!”

Q: What are the past three books that you’ve read or podcasts that you’ve listened to that you would recommend to your peers and why?

Brookhart: “I’m constantly reading and listening to podcasts and audio books. I feel like there’s so much to learn and not enough time. However, three of my favorite books that I’ve also encouraged our leadership team to read are ‘Atomic Habits’ by James Clear, ‘Insight’ by Tasha Eurich and ‘Think Again’ by Adam Grant.

“‘Think Again’ is about perspective and the importance of staying curious.

“‘Insight’ is about self-awareness. It shines a spotlight on how we see ourselves versus how others might see us, and how we, as leaders, can solicit honest feedback to gain clarity on how others view our behavior.

“‘Atomic Habits,’ as the name suggests, is about how to incorporate beneficial habits into our lives, while also releasing those that don’t serve us well. As with the other two, it’s well-written, interesting and backed by science.

“As for podcasts I enjoy, I tend to nerd-out on the topic of health span. So, my list primarily includes podcasters who are functional medicine doctors and medical professors.”

How Connecticut Is Strengthening the Manufacturing Supply Chain

If you are a buyer at a big manufacturing firm, you probably discover new suppliers through a mixture of Googling, networking and serendipity. But what if you could search a single database full of suppliers in your state and across the country, view their exact capabilities and certifications and then contact them directly? Or simply list your needs and have qualified suppliers respond to your post, then select the ones who meet your criteria?

You can do all that on CONNEX Marketplace, sponsored by the NAM and run by i5 Services. Think of it as manufacturers’ version of Facebook, LinkedIn or Match.com—the perfect place to find brand-new links for your supply chain. Today, the database boasts 165,000 companies of every size and sector, with more than 300 large buying organizations searching for suppliers on the platform.

One state is way out ahead in the quest to re-localize and strengthen supply chains via CONNEX, and that is, fittingly, Connecticut. We chatted with Connecticut Chief Manufacturing Officer Paul Lavoie about his big vision for the small state and the way it has reshaped national supply chains already.

Making connections: The only chief manufacturing officer in any U.S. state government, Lavoie has a simple mandate: help manufacturing grow in Connecticut.

- As a state official, however, he can’t personally introduce one company to another to help them do business. He needed an intermediary, and CONNEX was the answer.

- While all manufacturers can subscribe to CONNEX to access the national database for a fee, some states have funded state-specific instantiations of the database that in-state companies can use as well. The state governments, manufacturing extension partnerships or other associations cover the costs and help recruit more in-state firms to use the platform, enriching it for everyone.

- Lavoie saw the potential of the state-specific model, created Connecticut’s version in 2022 and began a transformation of its manufacturing sector.

Supply chain success: Today, nearly 600 Connecticut companies have built full profiles on CONNEX, out of a total of 2,504 state-based firms in the database.

- Large manufacturers and other major buyers from across the U.S. have contacted Connecticut manufacturers due to their presence in CONNEX, including Northrop Grumman, the U.S. Army and Hill Air Force Base.

- One large Connecticut company had been working with a supplier in Texas, but CONNEX showed that a similar supplier was located just a few miles away from its facility.

- That supplier now serves several large manufacturers within Connecticut and is “the poster child for shortening supply chains and growing an ecosystem,” said Lavoie.

- And lastly, another Connecticut manufacturer was forced by recent tariffs to find an inspection service within the United States, having previously used a Canadian firm. CONNEX helped the manufacturer find a company in Vermont that provided the same service.

The big guys: Thanks to the efforts of i5 Services President and CEO Alan Davis and Lavoie himself, CONNEX is building out its stable of major manufacturers.

- Several aerospace giants in Connecticut have joined, including RTX. Along with Northrop Grumman, other global companies seeking suppliers through CONNEX include Siemens, General Dynamics, PR Hoffman, Applied Materials and Medtronic.

- Big companies know they need to shorten and secure their supply chains, Lavoie told us—and CONNEX is the perfect tool to help them.

How it works: When a company joins CONNEX, the first step is to build out its profile. This involves providing information about its capabilities, factory equipment, processes, certifications, materials, industry sectors, NAICS/SIC codes, capability statements and more.

- In Connecticut, Lavoie’s office helps manufacturers complete their profiles, providing “concierge service” and even going through the process with manufacturers by phone.

- Once a company is signed up, it can start searching for and sending direct notifications to qualified suppliers or buyers.

- CONNEX also features an Exchange Center, where companies can post their RFQs, RFPs or RFIs. The average contract value of each opportunity posted in the Exchange Center is more than $1 million, and after suppliers respond to a post, they can usually expect an interview within about two weeks.

The last word: Due to the funding from Lavoie’s state office, CONNEX is “an amazing business development tool with no additional costs to Connecticut manufacturers,” he pointed out. “Not only does CONNEX help manufacturers throughout the country strengthen and shorten their supply chains, but it enables state governments and MEPs to strengthen their states’ economies.”

Timmons, NAM Members Meet with Bessent, Congressional Leaders on Tax Reform

NAM President and CEO Jay Timmons will join congressional leaders for an “Invest in America” roundtable on Capitol Hill today to highlight the urgency of making the pro-manufacturing 2017 tax reforms permanent and more competitive.

The details: House Majority Whip Tom Emmer (R-MN), Treasury Secretary Scott Bessent, House Ways and Means Committee Chairman Jason Smith (R-MO) and other key Members of Congress will be in attendance. They will be joined by a group of NAM members of all sizes, representing manufacturing sectors such as metal fabricators, defense and pharmaceuticals and consumer-packaged goods, among others.

Timmons and Emmer: This morning, ahead of the closed-press meeting, Timmons and Emmer appeared on Fox Business’ “Mornings with Maria.” They reinforced the urgency of making these tax provisions permanent. Otherwise, “businesses in America are not going to invest” and “small businesses will get hit the worst,” according to Timmons.

Also this morning, Timmons and Emmer published a joint op-ed in Fox Business, which the White House amplified on social media.

- “The expiration of the Tax Cuts and Jobs Act would be detrimental to American businesses, manufacturers, consumers and families,” Timmons and Emmer wrote. “If Congress does not act to ensure President Donald Trump’s successful tax plan stays in place, taxes will go up for Americans at every income level. The average American would see a tax hike of 22 percent, over $1,600.”

- “A recent National Association of Manufacturers study indicated that failing to preserve these tax reforms will cost America 6 million jobs, $540 million in wages, and our economy will suffer a $1.1 trillion hit.”

GOP says: Emmer said on Monday that preserving tax reform was a “top priority” for Republican leaders.

- “The American people are hungry for an economic boom that is already underway,” Emmer told Fox News Digital. “But [it] will only be fully realized if Congress acts to continue the 2017 Trump tax cuts through reconciliation.”

- Bessent told the news outlet that “making President Trump’s Tax Cuts and Jobs Act permanent will help to secure the stable business environment that investors are seeking.”

- Timmons also spoke to Fox News Digital in an exclusive interview, saying “every day without action harms manufacturers’ ability to invest in America and plan for the future.”

NAM in action: The NAM is also launching a series of ads today featuring shop floor manufacturers advocating that the 2017 tax reforms be made permanent.

In the news: The roundtable was also covered by POLITICO’s Inside Congress and Morning Tax newsletters as well as Punchbowl.

NAM: Comprehensive Manufacturing Strategy, Not Increased Costs

The NAM is advocating for manufacturers’ trade policy priorities as part of a common-sense, comprehensive manufacturing strategy.

What’s going on: A proposed new entry fee on vessels entering U.S. ports would result in higher goods costs for consumers, according to the NAM. The administration is also proposing to put new tariffs on imported copper, timber and lumber products.

- The administration should instead “pursue a comprehensive manufacturing strategy that will create predictability and certainty to invest, plan and hire in America,” as the NAM recently told the Commerce Department.

Port fee would harm consumers: In February, the USTR put forth a proposal to charge up to $1.5 million for Chinese ships entering U.S. ports of call—but it’s a move the NAM said would prove harmful if put into effect.

- “This approach would effectively impose the minimum fee on nearly 100% of vessels making calls on U.S. ports, adding an estimated $600–$800 for each twenty-foot equivalent container unit. Shippers likely would pass the entirety of this cost through to their business customers, in many cases further raising the cost of manufacturing in the U.S,” the NAM told U.S. Trade Representative Jamieson Greer.

- In fact, manufacturers are already getting upwardly revised quotes of at least $1,500 more per container, the NAM continued.

- Instead of implementing the new fee, the USTR “should seek to directly remedy the non-market practices and subsidization of Chinese state enterprises that undermine global competition in the shipbuilding industry,” the NAM said.

Copper: The administration recently launched an investigation into whether copper imports pose a threat to national security.

- Though copper is critical to modern manufacturing, the U.S. copper sector’s vertical supply chain is currently “only capable of meeting 53% of domestic demand for refined copper cathode.” This makes importing copper necessary, the NAM told Commerce Secretary Howard Lutnick earlier this month.

- The NAM supports the Trump administration’s efforts to increase U.S. copper production and processing. Rather than impose tariffs, the administration should employ an NAM-crafted strategy: one that focuses “on making pro-growth tax reforms permanent, expediting permitting reform, restoring regulatory certainty, strengthening the manufacturing workforce and implementing effective trade policy,” the NAM told Lutnick.

Timber: The administration has also begun to investigate timber and lumber imports, and President Trump has promised to prioritize increasing U.S. timber production to decrease American reliance on imports. The NAM agrees, it told Lutnick in a separate communication—but new tariffs are not the answer.

Trump Doubles Down on Tariff Posture

President Donald Trump is going all-in on tariffs—leading to volatility for markets, manufacturers and America’s trading partners.

Weekend update: Over the weekend, the president called the sweeping new trade actions “an economic revolution,” urging supporters on Truth Social to “HANG TOUGH.” By Monday, he was threatening an additional 50% tariff on China by Wednesday unless it reverses its retaliatory moves. “All talks with China concerning their requested meetings with us will be terminated!” he said.

Behind the scenes: According to the administration, more than 50 countries have reached out to open tariff negotiations, but multiple sources say that there’s no structured process. “The phone lines are open,” a White House official said. “But for businesses looking for certainty, the message is clear: Don’t wait, come build in America.”

From tariffs to structural demands: Manufacturers hoping that a tariff deal could end the standoff may be disappointed. On CNBC’s “Squawk Box,” White House trade adviser Peter Navarro dismissed Vietnam’s proposed zero-tariff deal as “meaningless” without changes to what he called “non-tariff cheating”—ranging from value-added tax systems to intellectual property theft and product dumping.

- Later in the interview, he amended this statement somewhat, saying zero tariffs would be “a small first start.” “The goal here, ultimately, is to have people make things here,” he added.

- Navarro also claimed that the tariffs would lead to “the biggest tax cut in American history.”

Zoom In: While Navarro predicted a market rebound and eventual growth, businesses are still waiting for clarity.

Global reactions: EU officials announced plans to negotiate but warned of countermeasures and new import surveillance. Yesterday, Israel held in-person talks with President Trump. China has responded by devaluing the yuan against the dollar and promising to “fight to the end” of a trade war.

What it means for you: The NAM is calling for smart, strategic trade policy—solutions that restore certainty, strengthen U.S. manufacturing and protect supply chains.

- As NAM President and CEO Jay Timmons said: “The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.”

- The NAM is actively engaging policymakers, elevating member voices and providing key data and inputs on trade actions that put manufacturing growth at risk.

Timmons: Tariffs Will Add Costs for Manufacturers

As manufacturers await the announcement of the Trump administration’s sweeping reciprocal tariffs at approximately 4:00 p.m. EDT today, NAM President and CEO Jay Timmons warned that “any scenario … is going to add cost[s] to manufacturers.”

What’s going on: Timmons, appearing on CNBC’s “Worldwide Exchange” this morning, told show anchor Frank Holland that while the world still doesn’t know what the latest tariffs will include, manufacturers are concerned—and they have good reason to be.

- Some 56% of imports to the U.S. are inputs for manufacturing, Holland said, citing NAM data. “That’s why you’re seeing this type of concern and sentiment among manufacturers,” Timmons said in response to a question about what the figure means for tariffs’ impact on the industry.

- Trade uncertainty is the top concern of the majority of manufacturers right now, Timmons said, citing the NAM’s most recent Manufacturers’ Outlook Survey. “That is up 40 percentage points over the last six months,” he told Holland. “That’s a huge jump.”

What it means: While “everybody would like more things made here in this country, because that’s good for the economy, that’s good for jobs,” new tariffs will drive “up the cost of actually making those things here in the United States,” Timmons continued.

What should be done: Manufacturers need certainty, not the nail-biting anxiety that comes from constant changes to the rules.

- “The first thing that we need to see is we need to see Congress do its job and get the tax reforms from 2017 renewed so that we have the certainty in the tax code,” said Timmons.

- Manufacturers also require relief from arduous regulatory burdens, which comes to “about $50,000 per employee per year for a small manufacturer,” Timmons told Holland, adding that the Trump administration is already working to cut those costs.

The bottom line: “There was a lot of enthusiasm when the president came in and talked about strengthening manufacturing here in the United States [and] talked about an agenda that would lower costs,” Timmons concluded.

- “But … if we don’t get the tax reforms renewed, that is an additional cost. If tariffs are imposed, that’s an additional cost. … Manufacturers … are waiting to see whether they should invest and hire. That’s not good for the economy.”

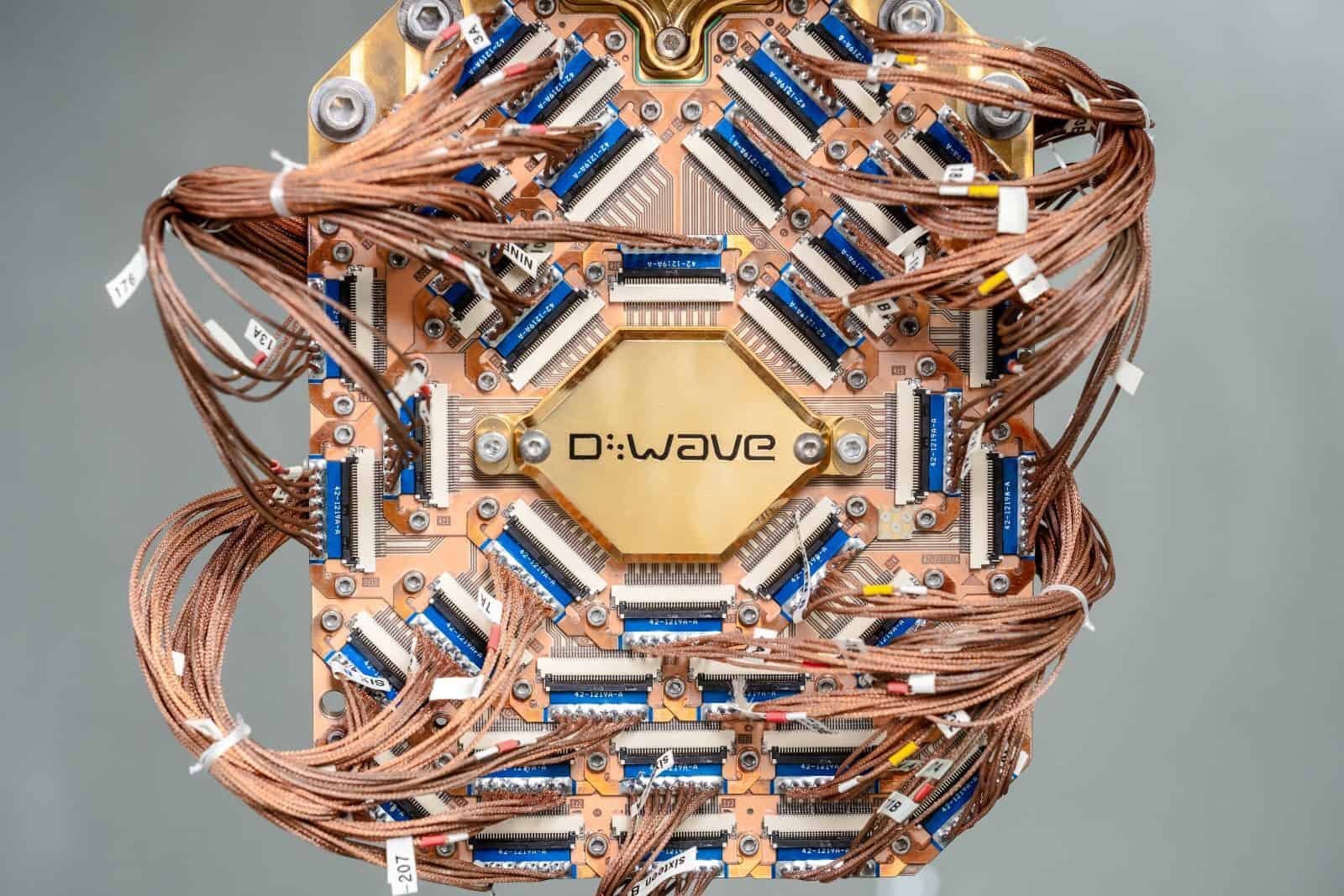

D-Wave Achieves “Quantum Supremacy”

Quantum computing firm D-Wave has achieved a singular breakthrough: it has simulated the “properties of magnetic materials,” opening up the opportunity to “invent” new materials without having to produce them physically in a lab, as D-Wave CEO Alan Baratz told Fast Company.

What it means: The achievement, first published in Science earlier this month, marks the first time a quantum computer has solved a useful, real-world problem that a classical computer couldn’t manage.

- In fact, “To simulate the property of magnetic materials on a classical computer—as the D-Wave team recently did using its quantum computer—would require nearly 1 million years and more energy than the entire world utilizes over the course of a year. D-Wave’s team did it in 20 minutes,” according to Fast Company.

Quantum vs. classical: “Rather than store information using bits represented by 0s or 1s as conventional digital computers do, quantum computers use quantum bits, or qubits, to encode information as 0s, 1s or both at the same time,” D-Wave explains on its site.

- “This superposition of states—along with the other quantum mechanical phenomena of entanglement and tunneling—enables quantum computers to manipulate enormous combinations of states at once.”

- D-Wave’s annealing quantum computer uses these capabilities to solve problems by finding the “lowest energy state” in an enormous range of possible solutions.

- “To imagine this, think of a traveler looking for the best solution by finding the lowest valley in the energy landscape that represents the problem,” as D-Wave puts it.

The possibilities are vast: Being able to simulate materials without creating and testing them in the lab offers significant opportunities for the manufacturing industry and could save companies huge amounts of time and resources. D-Wave foresees that these simulated materials could have applications in everything from “pacemakers to cellphones,” as it told Fast Company.

- “There’s no shortage of potential applications,” said D-Wave Chief Scientist Mohammad Amin.

Further innovation: Another impact of quantum computing is its potential to revolutionize blockchain technology, D-Wave told us.

- “Manufacturers are increasingly adopting blockchain technology to enhance supply chain transparency, track product origins, improve inventory management, and streamline operations. This adoption has led to increased efficiency and reduced costs,” said D-Wave Global Government Relations and Public Affairs Leader Allison Schwartz.

- “Annealing quantum computing offers a potential solution by providing a faster and more environmentally friendly alternative to manufacturers’ current mining operations using classical computers.”

Manufacturers on the Hill Urge Action on Tax Reform Permanency

Shop floor manufacturers and NAM staff met with members of Congress yesterday and continue these meetings today on Capitol Hill to hammer home the importance of making the 2017 tax reforms permanent and getting a comprehensive reconciliation bill done now. House and Senate Republicans are working on a strategy for a tax package as part of a reconciliation bill that includes extending the 2017 Tax Cuts and Jobs Act.

- In its Morning Tax newsletter, POLITICO (subscription) reported on this week’s fly-in, naming the NAM “a powerhouse business lobby” meeting with several members of Congress as the 2025 tax bill continues to “get more intense.”

Why this is a critical moment: When the 2017 tax cuts were signed into law, “it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale,” said NAM President and CEO Jay Timmons earlier this month.

- “That fuel is about to run out as key provisions have expired, and others are about to lapse. … We must ensure these historic, pro-growth manufacturing provisions are made permanent and even more competitive so manufacturers can plan, grow and succeed.”

“Exactly what the country needed”: Manufacturers traveled hundreds of miles from their shop floors to urge Congress to keep the rocket fuel for manufacturers and the American economy.

- “The Tax Cuts and Jobs Act of 2017 was huge for us,” said Tom Onsrud, CEO of the 51-year-old industrial CNC machine maker C.R. Onsrud, Inc., in Troutman, North Carolina. “It was rocket fuel. As soon as it passed, our backlog exploded. We started employing more people. We went from about 100 people to 220 people. Our floor space was maxed out. … It was exactly what the country needed.”

- One of the provisions, the immediate research and development tax credit, allowed the family-owned business to “expense equipment [costs] quickly,” Onsrud added. “That was huge for us.” That provision, however, expired in 2022.

“Vital to our company”: Stephen Bullock, president of concrete paving equipment manufacturer Power Curbers in Salisbury, North Carolina, is in Washington this week to make sure Congress knows just how important the tax reform measures have been to his small company.

- “We rely on them,” Bullock said. “We spend a lot of time and resources and money in research and development. Without [the tax provisions], it would be impossible for our company to support manufacturing. We’ve got to stay ahead of the game with new machinery, new offerings for our customers. So … anything we can do to realize those tax advantages sooner rather than later helps us very much from a cash-flow standpoint.”

- The TCJA “allowed us to expand and hire additional staff so that we [could] fund new programs, new machinery.”

“Tripled our business”: Steve Macias, co-owner of machining company Pivot Manufacturing, traveled from even farther away—Phoenix, Arizona—to make sure Congress heard what he had to say.

- “The tax reforms of 2017 … allowed us to grow our company in a way that we hadn’t [been able to] previously,” Macias told the NAM. “We were a small machine shop that did prototype and R&D work, and we’d been in business for 17 years. The tax cuts kind of gave us the kick … to take a leap and buy some production equipment, which has allowed us to virtually triple our business over the last eight years.”

- “Legislators need to understand the impact of tax reform,” Macias went on. “I’m a machine shop in Phoenix, Arizona, and there are hundreds of machine shops across the U.S., but there are also thousands upon tens of thousands of small manufacturing companies that made the same decisions we did based on those tax policies.”

Schneider Electric to Invest More Than $700 Million in U.S.

Global energy management and digital transformation giant Schneider Electric will invest more than $700 million in U.S. operations over the next two years, the company announced yesterday (The Dallas Morning News, subscription).

What’s going on: “Schneider said it intends to leverage the investment to ‘support the country’s focus on bolstering the nation’s energy infrastructure to power AI growth, boost domestic manufacturing and strengthen energy security.’”

- The investment—the largest planned single capital expenditure in Schneider Electric’s 135-plus-year history—will be used to expand manufacturing facilities across the U.S. and to boost “smart factory transformation” across Texas, Massachusetts, Missouri and Tennessee, among other states.

- The company is the latest in a string of large manufacturers to announce sizeable domestic investments. Last week, biopharmaceutical firm Johnson & Johnson said it would spend more than $55 billion in the U.S. over the next four years.

- The announcement comes less than a year after the opening of Schneider Electric’s 105,000-square-foot facility in Red Oak, Texas, to support the data center boom in the Dallas–Fort Worth area.

Where else funds will go: The money will also be used to expand a campus in El Paso, Texas, “to keep up with growing demand to increase production of switchgear and power distribution products,” and to open a Houston innovation center that will offer AI-powered automation solutions.

Our take: “Schneider Electric’s significant investment is a clear sign that manufacturing in America is moving forward—driving economic growth, innovation and job creation across the country,” NAM President and CEO Jay Timmons said in a statement quoted in the article.

- “By expanding their operations with a focus on energy security, automation and AI, Schneider Electric is not only strengthening America’s competitiveness but also creating new opportunities and powering our nation’s future.”