Timmons Presses for Comprehensive Manufacturing Strategy in NewsNation, FOX Business Interviews

In a one-on-one interview with NewsNation’s Blake Burman just hours before President Trump spoke at a town hall with the same network, NAM President and CEO Jay Timmons continued to underscore the need for a comprehensive manufacturing strategy to make long-term investments.

- “First and foremost, we have got to get those tax reforms from 2017—that rocket fuel that President Trump announced at our board meeting in 2017—renewed, and Congress needs to move that forward,” Timmons said.

- “Regulatory rebalancing is something that’s very important. It’s about $50,000 per employee per year in compliance costs; that’s pretty expensive. We also need energy dominance. [Trump is] well on his way to making that happen.”

- He added that we need “good, solid trade policy” so manufacturers don’t see added costs. “We’re waiting to see how all this comes out. And we’re hopeful.”

- “If you have a comprehensive manufacturing strategy that you’re implementing … that includes all of those things I just mentioned to bring down the cost of business doing business here in the United States, you absolutely will see more investment,” he continued. Trump “announced that $5 trillion has already been committed. You’ll see more jobs, and you’ll also see higher wages and benefits.”

The long view: “Massive facilities … take a little while,” Timmons told Burman. “That is a realization that I need Americans to understand.”

- Such sites typically take years, he said, with the exact number depending “on how localities and states are moving along the permitting process.”

- “I was George Allen’s chief of staff when he was governor of Virginia,” Timmons went on, “and he made a commitment that he was going to move large scale projects in a very expeditious way. And we had a huge chip manufacturer that made an announcement, and [the company] said the doors will open in one year. [T]hey did, and that’s because all of government was really focused on doing that. You’ve got that commitment from this administration, there’s no doubt about that, but it’s typically three to five years for a large-scale manufacturing operation to come to fruition, and you’re talking about a 30-year commitment.”

- “So that’s another reason we need permanence when it comes to tax policy and trade policy.”

FOX Business: Timmons recently spoke with a group of FOX Business reporters to discuss the comprehensive strategy needed from Congress, focusing specifically on tax, trade and the manufacturing workforce.

- In a story from that interview published today, he said: “The 2017 tax reforms that President Trump actually announced at our board meeting in 2017, [which he said] would be rocket fuel for the economy … indeed were. Those tax reforms led to record investment and job creation and wage growth for three years running after they were in enacted.”

NAM: Comprehensive Manufacturing Strategy Will “Ignite” Renaissance

The NAM’s comprehensive manufacturing strategy will be fundamental in “igniting the Industrial Renaissance of the United States,” the NAM told a House committee today ahead of a hearing of the same name.

What’s going on: “Manufacturers call on President Trump and Congress to implement a comprehensive manufacturing strategy that would create predictability and certainty to invest, plan and hire in America,” the NAM told the House Committee on Oversight and Government Reform.

- The purpose of the hearing was to examine how “cheap labor abroad, combined with overregulation and obstacles to permitting in the United States, contributed to the offshoring of American manufacturing and an overreliance on China to fulfill manufacturing needs.” It also emphasized “the importance of bringing manufacturing back to the United States.”

What we’re saying: The NAM has been advocating that the administration adopt a multipoint plan to see the manufacturing sector flourish. Today it urged President Trump and Congress to take the following actions from that strategy as soon as possible:

- Make 2017 tax reform permanent: Make permanent the pro-manufacturing tax measures scheduled to sunset at the end of 2025 and bring back already expired provisions. Failure to do so will put almost 6 million U.S. jobs at risk, according to a recent EY–NAM study.

- Rebalance federal regulations: Manufacturers now spend $350 billion a year to comply with federal regulations. That’s money that could be spent on factory expansions, hiring and/or wage raises, as NAM President and CEO Jay Timmons has pointed out. The NAM also recently urged 10 key federal agencies to revise or rescind dozens of onerous, anachronistic regulations.

- Expedite permitting reform: “America should be the undisputed leader in energy production and innovation, but we will not reach our full potential without permitting reform.” This must include expediting judicial review, accelerating the permitting process, creating enforceable deadlines and more.

- Implement commonsense trade policies: “Building things in America only works if we can sell them around the world,” the NAM told the House members. “That is why manufacturers urge President Trump and Congress to provide greater predictability and a clear runway to allow them to adjust to new trade realities, while also making way for exemptions for critical inputs, enabling reciprocity in manufacturing trade.”

Manufacturers Share Immediate Impacts Under Latest Tariffs

As three of the largest U.S. retailers—Walmart, Home Depot and Target—this week warned President Trump that his tariff policy could empty store shelves within weeks, upend supply chains and raise consumer prices, the tariffs already in place on imported goods are having effects on those who make things in America.

Speaking up: Manufacturers in the U.S. are sharing their stories of increased cost pressures and uncertainty, both the result of new tariffs. Makers of everything from machinery to bicycles to food service equipment are reporting ill effects.

- For Craig Souser, president and CEO of robotic packaging solutions manufacturer JLS Automation in York, Pennsylvania, steel tariffs in particular have had a big—and negative—effect on business.

- “[W]e’re seeing increased costs [in steel] that will eventually get passed along to the customer,” Souser told the York Dispatch (subscription).

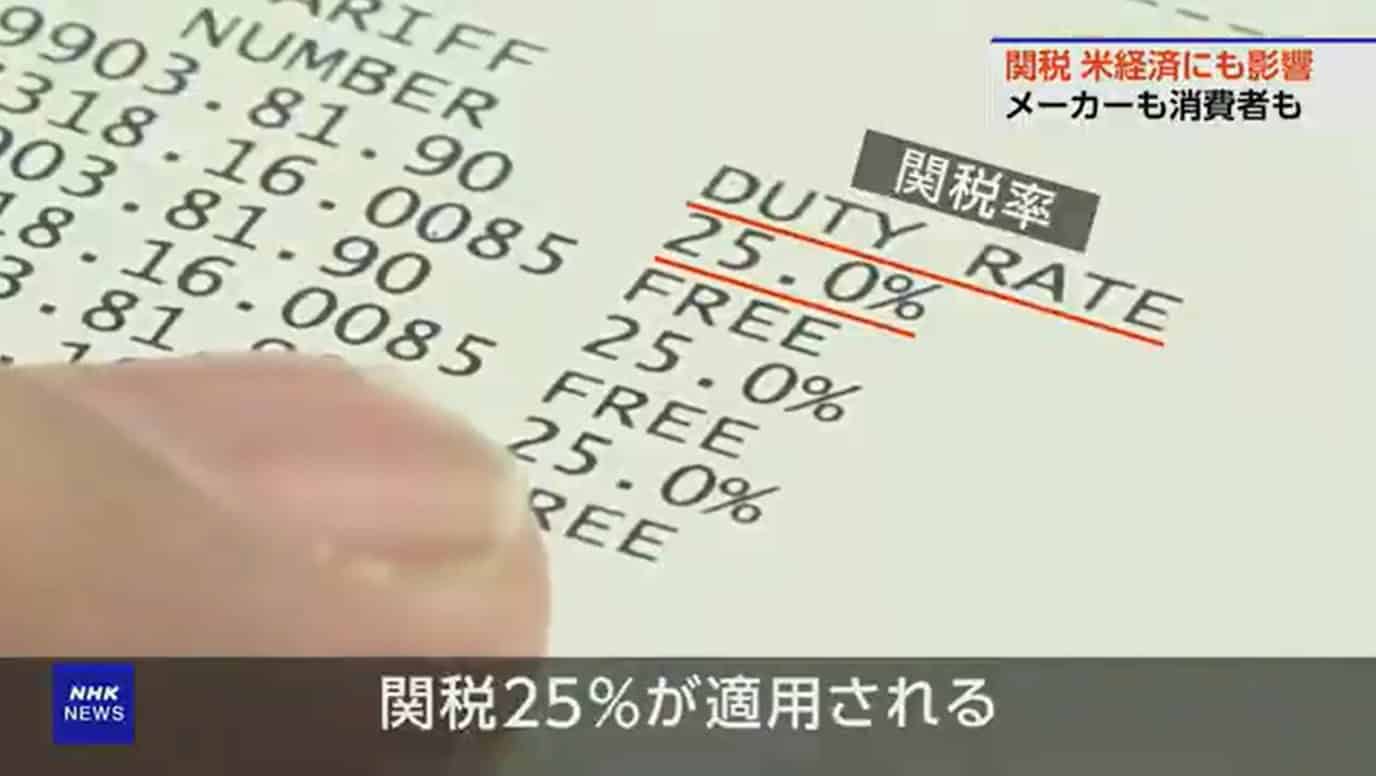

“Writing the checks”: Chuck Dardas, president and chief operating officer of Michigan automotive parts manufacturer AlphaUSA, told NHK News recently that his small business and others like it are the ones “writing the checks for” the new tariffs—and it’s not something they can keep up.

- “To absorb 25% or 50% in tariffs, it’s a task that we cannot in the long term endure,” Dardas said. “It’ll cause our company and many other companies our size to probably go out of existence.”

The unknown: Perhaps the hardest part about the new tariffs: the uncertainty they bring, NAM board member Lisa Winton, CEO and co-owner of Georgia-based machinery maker Winton Machine Company, told NPR earlier this month.

- “We just noticed our first invoice that had a tariff line on it,” she said. “There’s just so much unknown right now, and I think that’s the most difficult thing—to make decisions for your company financially when you just don’t know all the pieces to the puzzle.”

No time: Arnold Kamler, chairman of Kent International, a New Jersey bicycle manufacturer, told Fox Business last week that while his business was already moving overseas production to the U.S. when tariffs hit, it has yet to complete the move—and that’s been a problem for his small outfit.

- “We’ve managed to move almost half of our production out of China already, but that’s only [almost] half,” he said. “We need more time. … [W]e’re a small company.”

- During the pandemic, “[e]verybody bought a bicycle”—but “things got very slow after that. … All the money we made during the pandemic is all gone, plus a lot more. Then we have these tariffs. [If the Trump administration had said], ‘Look … in nine months, 10 months, this will be the tariff,’” that might have been doable, he went on. “But we g[ot] two weeks’ notice. It’s impossible to run a company to plan for” that.

Passing on the costs: In Ohio, Wasserstrom Company President Brad Wasserstrom told 10 WBNS that his Columbus-based food service and supply company will most likely have to raise customer prices to pay for the new tariffs.

- “[W]e’re negotiating with suppliers when we can, if there’s any flexibility in what they’re passing on to us,” Wasserstrom said. “Some have been able to do something to help us out. They’re not passing through maybe the full tariff. But very few have said they’re going to pass on nothing.”

Manufacturers to Federal Agencies: Rebalance Regulations to Strengthen Manufacturing in the U.S.

The NAM Backs President Trump’s Executive Order 14219 with Policy Proposals to Reconsider Dozens of Costly Regulations Stifling Growth and Jobs

Washington, D.C. – In response to the President’s call for industry input on a new era of balanced, sensible and pro-growth regulation, the National Association of Manufacturers submitted recommendations to key federal agencies highlighting dozens of burdensome and outdated regulations that are driving up costs and undermining manufacturing competitiveness.

“Rebalancing regulations is a critical pillar of our comprehensive manufacturing strategy—which also includes making the 2017 tax reforms permanent, expediting permitting reform to unleash American energy, strengthening the manufacturing workforce and implementing commonsense trade policies,” said NAM President and CEO Jay Timmons. “Manufacturers are spending $350 billion each year just to comply with federal regulations—money that could be spent on expanding factories and production lines, hiring new workers or raising wages. The administration is already answering the calls of manufacturers across the country to reconsider and rebalance regulations that are holding manufacturers back. Using these recommendations as a guidepost, manufacturers look forward to continuing to work with the administration to fix rules that cost too much, trap projects in red tape, chill investment, do not make sense and harm the 13 million men and women who make things in the United States.”

The NAM has identified at least 44 regulations across 10 agencies that the Trump administration should consider revising or rescinding under Executive Order 14219, “Ensuring Lawful Governance and Implementing the President’s ‘Department of Government Efficiency’ Deregulatory Initiative.” Today’s action builds on the momentum of a December 2024 letter from the NAM and more than 100 manufacturing organizations to the transition team detailing regulatory actions the incoming administration could take to right-size regulations that stunted manufacturing growth and job creation. The administration has acted decisively on key manufacturing priorities already: lifting the liquefied natural gas export ban on day one, rescinding Securities and Exchange Commission Staff Legal Bulletin 14L in February and announcing in March that it plans to revise the Environmental Protection Agency’s PM2.5 and Power Plants rules.

The NAM’s submissions in response to EO 14219 target burdensome regulations at the following agencies: the EPA, SEC, Department of the Interior, Department of Energy, Department of Labor, Cybersecurity and Infrastructure Security Agency, Department of Health and Human Services, National Institute of Standards and Technology, Federal Trade Commission and Department of the Treasury.

Background:

EO 14219, issued on Feb. 19, directs federal agencies to conduct a top-to-bottom review of existing regulations within their jurisdiction and identify, within 60 days, those that impose significant costs that outweigh their benefits; exceed statutory authority; disproportionately hurt small businesses; or impede innovation, R&D, economic development and more.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Timmons, NAM Members Meet with Bessent, Congressional Leaders on Tax Reform

NAM President and CEO Jay Timmons will join congressional leaders for an “Invest in America” roundtable on Capitol Hill today to highlight the urgency of making the pro-manufacturing 2017 tax reforms permanent and more competitive.

The details: House Majority Whip Tom Emmer (R-MN), Treasury Secretary Scott Bessent, House Ways and Means Committee Chairman Jason Smith (R-MO) and other key Members of Congress will be in attendance. They will be joined by a group of NAM members of all sizes, representing manufacturing sectors such as metal fabricators, defense and pharmaceuticals and consumer-packaged goods, among others.

Timmons and Emmer: This morning, ahead of the closed-press meeting, Timmons and Emmer appeared on Fox Business’ “Mornings with Maria.” They reinforced the urgency of making these tax provisions permanent. Otherwise, “businesses in America are not going to invest” and “small businesses will get hit the worst,” according to Timmons.

Also this morning, Timmons and Emmer published a joint op-ed in Fox Business, which the White House amplified on social media.

- “The expiration of the Tax Cuts and Jobs Act would be detrimental to American businesses, manufacturers, consumers and families,” Timmons and Emmer wrote. “If Congress does not act to ensure President Donald Trump’s successful tax plan stays in place, taxes will go up for Americans at every income level. The average American would see a tax hike of 22 percent, over $1,600.”

- “A recent National Association of Manufacturers study indicated that failing to preserve these tax reforms will cost America 6 million jobs, $540 million in wages, and our economy will suffer a $1.1 trillion hit.”

GOP says: Emmer said on Monday that preserving tax reform was a “top priority” for Republican leaders.

- “The American people are hungry for an economic boom that is already underway,” Emmer told Fox News Digital. “But [it] will only be fully realized if Congress acts to continue the 2017 Trump tax cuts through reconciliation.”

- Bessent told the news outlet that “making President Trump’s Tax Cuts and Jobs Act permanent will help to secure the stable business environment that investors are seeking.”

- Timmons also spoke to Fox News Digital in an exclusive interview, saying “every day without action harms manufacturers’ ability to invest in America and plan for the future.”

NAM in action: The NAM is also launching a series of ads today featuring shop floor manufacturers advocating that the 2017 tax reforms be made permanent.

In the news: The roundtable was also covered by POLITICO’s Inside Congress and Morning Tax newsletters as well as Punchbowl.

NAM: Comprehensive Manufacturing Strategy, Not Increased Costs

The NAM is advocating for manufacturers’ trade policy priorities as part of a common-sense, comprehensive manufacturing strategy.

What’s going on: A proposed new entry fee on vessels entering U.S. ports would result in higher goods costs for consumers, according to the NAM. The administration is also proposing to put new tariffs on imported copper, timber and lumber products.

- The administration should instead “pursue a comprehensive manufacturing strategy that will create predictability and certainty to invest, plan and hire in America,” as the NAM recently told the Commerce Department.

Port fee would harm consumers: In February, the USTR put forth a proposal to charge up to $1.5 million for Chinese ships entering U.S. ports of call—but it’s a move the NAM said would prove harmful if put into effect.

- “This approach would effectively impose the minimum fee on nearly 100% of vessels making calls on U.S. ports, adding an estimated $600–$800 for each twenty-foot equivalent container unit. Shippers likely would pass the entirety of this cost through to their business customers, in many cases further raising the cost of manufacturing in the U.S,” the NAM told U.S. Trade Representative Jamieson Greer.

- In fact, manufacturers are already getting upwardly revised quotes of at least $1,500 more per container, the NAM continued.

- Instead of implementing the new fee, the USTR “should seek to directly remedy the non-market practices and subsidization of Chinese state enterprises that undermine global competition in the shipbuilding industry,” the NAM said.

Copper: The administration recently launched an investigation into whether copper imports pose a threat to national security.

- Though copper is critical to modern manufacturing, the U.S. copper sector’s vertical supply chain is currently “only capable of meeting 53% of domestic demand for refined copper cathode.” This makes importing copper necessary, the NAM told Commerce Secretary Howard Lutnick earlier this month.

- The NAM supports the Trump administration’s efforts to increase U.S. copper production and processing. Rather than impose tariffs, the administration should employ an NAM-crafted strategy: one that focuses “on making pro-growth tax reforms permanent, expediting permitting reform, restoring regulatory certainty, strengthening the manufacturing workforce and implementing effective trade policy,” the NAM told Lutnick.

Timber: The administration has also begun to investigate timber and lumber imports, and President Trump has promised to prioritize increasing U.S. timber production to decrease American reliance on imports. The NAM agrees, it told Lutnick in a separate communication—but new tariffs are not the answer.

Trump Doubles Down on Tariff Posture

President Donald Trump is going all-in on tariffs—leading to volatility for markets, manufacturers and America’s trading partners.

Weekend update: Over the weekend, the president called the sweeping new trade actions “an economic revolution,” urging supporters on Truth Social to “HANG TOUGH.” By Monday, he was threatening an additional 50% tariff on China by Wednesday unless it reverses its retaliatory moves. “All talks with China concerning their requested meetings with us will be terminated!” he said.

Behind the scenes: According to the administration, more than 50 countries have reached out to open tariff negotiations, but multiple sources say that there’s no structured process. “The phone lines are open,” a White House official said. “But for businesses looking for certainty, the message is clear: Don’t wait, come build in America.”

From tariffs to structural demands: Manufacturers hoping that a tariff deal could end the standoff may be disappointed. On CNBC’s “Squawk Box,” White House trade adviser Peter Navarro dismissed Vietnam’s proposed zero-tariff deal as “meaningless” without changes to what he called “non-tariff cheating”—ranging from value-added tax systems to intellectual property theft and product dumping.

- Later in the interview, he amended this statement somewhat, saying zero tariffs would be “a small first start.” “The goal here, ultimately, is to have people make things here,” he added.

- Navarro also claimed that the tariffs would lead to “the biggest tax cut in American history.”

Zoom In: While Navarro predicted a market rebound and eventual growth, businesses are still waiting for clarity.

Global reactions: EU officials announced plans to negotiate but warned of countermeasures and new import surveillance. Yesterday, Israel held in-person talks with President Trump. China has responded by devaluing the yuan against the dollar and promising to “fight to the end” of a trade war.

What it means for you: The NAM is calling for smart, strategic trade policy—solutions that restore certainty, strengthen U.S. manufacturing and protect supply chains.

- As NAM President and CEO Jay Timmons said: “The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.”

- The NAM is actively engaging policymakers, elevating member voices and providing key data and inputs on trade actions that put manufacturing growth at risk.

Tariffs: 1930 Versus 2025

The U.S. stock market saw its worst day yesterday since the early days of the pandemic, following President Trump’s latest round of tariffs. These tariffs, when combined with other U.S. tariffs in 2025, make the U.S. average effective tariff rate 22.5%—the highest rate since 1909, according to The Budget Lab at Yale.

Manufacturers already had record-high concerns about trade uncertainties before this latest announcement, as the NAM’s Q1 Manufacturers’ Outlook Survey found. Now, the uncertainty and instability have only increased, reminding observers the last time the U.S. imposed sweeping tariffs—with disastrous consequences.

Back then: The Tariff Act of 1930, also known as the Smoot-Hawley Act, was signed into law by President Herbert Hoover. Originally intended to protect the U.S. agricultural industry, it was later expanded to cover a broad swath of the U.S. economy, as CNBC recounts.

- The Smoot-Hawley Act imposed tariffs on approximately 25% of all imports to the U.S., according to Santa Clara University economic historian Kris James Mitchener.

- Some sounded the alarm at the time. Before signing the law in June 1930, President Hoover received “a petition signed by more than 1,000 economists asking him to veto the bill.”

A spiral: “Smoot-Hawley raised the average tariff on dutiable imports to 47% from 40%, [Dartmouth economist Doug] Irwin said. Depression-era price deflation ultimately helped push that average to almost 60% in 1932, he added.”

- Compare that to now: the latest tariff rates will be higher than the Smoot-Hawley levels, as reported by CNBC .

Manufacturers hurt: Following the passage of Smoot-Hawley, Argentina, Australia, Canada, Cuba, France, Italy, Mexico, Spain and Switzerland all responded with retaliatory tariffs on U.S. goods. These tariffs often fell on manufactured products, weakening the sector amid the economic catastrophe of the Depression.

- For example, France, Spain, Italy and Switzerland increased tariffs on American cars, effectively closing off those markets to major American exports.

- In all, “U.S. exports to retaliating nations fell by about 28% to 32%, said Mitchener. Further, nations that protested Smoot-Hawley also reduced their U.S. imports by 15% to 23%.”

Long-lasting pain: The Dow Jones Industrial Average slid following the imposition of the tariffs, bottoming out in July 1932.

History lesson: Smoot-Hawley has long been condemned by American leaders of both parties as a mistake that severely damaged the American economy.

- Before taking office, Roosevelt denounced the Smoot-Hawley Act, saying it “compelled the world to build tariff fences so high that world trade is decreasing to vanishing point.” He would sign the Reciprocal Trade Agreements Act, which reduced tariffs with trading partners on a reciprocal basis, in 1934.

- When President Ronald Reagan spoke to the NAM’s Annual Meeting in 1986, he said, “I well remember the antitrade frenzy in the late twenties that produced the Smoot-Hawley tariffs, greasing the skids for our descent into the Great Depression and the most destructive war this world has ever seen. That’s one episode of history I’m determined we will never repeat.”

Modern realities: President Trump has insisted that “we’re bringing wealth back to America” through these sweeping tariffs (CNBC). But manufacturers are urging caution, especially when future tax policy is so uncertain.

- One family-owned U.S. textile manufacturer, founded in 1887, warns that tariffs will dramatically raise the prices of its components, such as fabric, thread, yarn and fiber—none of which it can source in the U.S. “Tariffs would force us to curtail employment or close facilities if our customers would not accept higher prices,” the company said.

- Another manufacturer, an employee-owned firm, makes products and systems that control, monitor and protect utility and industrial electric power systems—which is critical for the coming buildout of new power generators and the electrical grid to meet the demand for AI datacenters. Tariffs will materially harm its ability to enable this essential economic growth.

- A third manufacturing company, a 100-year-old Wisconsin company specializing in custom-designed thermal solutions and large-scale HVAC cooling systems used in agriculture, mining, oil and gas and more, says that “tariffs on Canada and Mexico could cause us to take cost-cutting measures, including workforce reductions.”

- Last, a manufacturer that has made chemicals in the U.S. since the late 1800s reports that tariffs may set back its plans for expansion in North America, “which is already five times more expensive for us than in Asia and three times more expensive than in Europe.” The company will be less able to support crucial semiconductor manufacturing, and may even have to close low-margin business lines in the U.S.

The last word: “[M]anufacturers are scrambling to determine the exact implications for their operations [of the April 2 tariffs],” NAM President and CEO Jay Timmons said on Wednesday. “The stakes for manufacturers could not be higher. Many manufacturers in the United States already operate with thin margins. The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.”

Manufacturers Speak About Impact of Tariffs

Across the country, manufacturers are telling their stories of shop floor operations under U.S. tariffs, the first of which went into effect March 13. The consensus: tariffs have made things harder all around

- Jeremy Rosenbeck is president of Cincinnati, Ohio–area manufacturer Republic Wire, Inc., which makes copper wire products for the construction industry. In anticipation of tariffs, Rosenbeck “over the winter [ordered] an extra two months’ worth of copper rod (worth tens of millions) to give him enough tariff-free raw material for his business if a new trade agreement isn’t quickly worked out” (Cincinnati Enquirer).

- Republic Wire has nearly 200 employees and each year does approximately $500 million in sales. About 10% of that is outside the U.S.

- Rosenbeck, who says he “understand[s] what they’re trying to do with the tariffs,” nonetheless told the Enquirer that spring is a bad time for uncertainty in the construction sector, as it’s when builders make their plans for the rest of the year. “Higher prices on materials could mean fewer construction projects, which could mean a slowdown for the industry, fewer jobs and a drag on the economy as a whole,” the outlet notes.

Where the burden falls: Chuck Dardas, president and chief operating officer of 67-year-old Michigan automotive manufacturing firm AlphaUSA, wrote in a recent op-ed for The Detroit News that while the Trump administration says tariffs will rebalance the scales, “the truth is that the burden falls squarely on American manufacturers and, ultimately, the American consumer.”

- For AlphaUSA, that’s because “as an S Corporation, our net income flows directly to our tax returns,” Dardas wrote. “If tariffs wipe out our income, it’s akin to a 100% income tax. There’s no profit, no reinvestment and no sustainability. This isn’t just a theoretical concern—it’s a very real possibility. If our paycheck goes to zero, how do we pay our bills? How do we reinvest in our business? How do we survive?”

- The sticker prices of vehicles are too high already, “and these tariffs will only push them higher. Inflationary pressures are mounting, and the Federal Reserve’s decision to hold off on rate changes underscores the precariousness of the situation.”

- Opposition to the tariffs, Dardas continued, “is not about politics. It’s about facts.” Manufacturers that rely on foreign imports cannot simply make the change to domestic sourcing with the flip of a switch. “[E]ven if we could pivot back to American manufacturers for … particular components, that’s not saying that they’re going to be less expensive” domestically, he said this week on radio show “All Talk with Kevin Dietz .” “They could be even more than the tariffs we could very well be faced with still buying the parts from Canada.”

“An existential threat”: If the tariffs remain in place long term, small manufacturers might not be able to hold out long enough to see their promised benefit, either, Dardas told the BBC’s “World Business Report” late last month.

- “If these go on for a long period of time, it’s an existential threat to companies our size,” he said. “We’re not that big, and there [are] a lot of us [smaller manufacturers] out here as well.”

As Tariffs Hit, Manufacturers Brace for Impact

Urge Congress to Act Now on a Comprehensive Manufacturing Strategy That Starts with Making the 2017 Tax Reforms Permanent

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement on the latest tariffs announced today:

“Needless to say, today’s announcement was complicated, and manufacturers are scrambling to determine the exact implications for their operations. The stakes for manufacturers could not be higher. Many manufacturers in the United States already operate with thin margins. The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.

“Manufacturers build things in America to sell around the world—and manufacturers in America share President Trump’s goal of supporting manufacturing investment, growth and expansion here at home. The president has the opportunity to achieve this vital goal while also minimizing disruptions and cost increases across our industry. To empower manufacturers to drive the U.S. economy, the administration should:

- minimize tariff costs for manufacturers that are investing and expanding in the U.S.;

- ensure tariff-free access to critical inputs that manufacturers use to make things in America; and

- secure better terms for manufacturers by negotiating ‘zero-for-zero’ tariffs for American-made products in our trading partners’ markets—that means they don’t charge us, and we don’t charge them.

“A clear, strategic approach to trade must be part of a comprehensive manufacturing strategy that starts with an urgent appeal to Congress to make the 2017 tax reforms permanent. When these tax cuts were signed into law, it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale. Manufacturers will work with the Trump administration and Congress to advance policies that help manufacturers grow and thrive—because when manufacturing wins, America wins.”

Background: In March, the NAM released its Q1 2025 Manufacturers’ Outlook Survey, highlighting rising concerns within the industry over trade uncertainties and increasing raw material costs. Trade uncertainties surged to the top of manufacturers’ challenges, cited by 76.2% of respondents—up 20 percentage points from the last quarter of 2024 and 40 points from the third quarter. Increased raw material costs was the second most cited concern, noted by 62.3% of respondents. These trade-related pressures contributed to a slight dip in overall optimism for their companies in the first quarter of 2025, down modestly from 70.9% in the fourth quarter to 69.7%.

According to another recent NAM survey of its members regarding the impact of tariffs on manufacturers, 87% of small and medium-sized manufacturers indicated that they may need to raise prices, and one-third could slow hiring.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.