Corning Confronts R&D Hurdles

This story can also be found within the NAM’s R&D action center.

Corning Incorporated has been turning out innovations for well over a century and a half—since 1851, to be exact. But a recent change in tax policy that makes R&D more expensive could have a significant impact on the company’s ability to build on its impressive history.

- “We have a wonderful track record for innovation,” said Tymon Daniels, vice president of tax at Corning, a material sciences manufacturing company with a focus on glass.

- “In 1897, when Thomas Edison was working on electric lights, he came to us to make the glass bulbs. 110 years later, when Steve Jobs was working on the iPhone, he came to us to make the glass used for the screen. More recently, we figured out a way to make special glass vials that sped up production of the COVID vaccine. … We’ve been able to do this because of R&D.”

The issue: Until the beginning of 2022, businesses could deduct 100% of their R&D expenses in the same year they incurred the expenses. Starting this year, however, a tax law change requires businesses to amortize or spread their R&D expenses out over a period of five years, making it more expensive to invest in growth and innovation.

The impact: According to Daniels, the abrupt change in a policy that has existed for decades poses a serious challenge for the company.

- “The R&D deduction has been in existence for over 70 years—a very good tax policy. Requiring the amortization of R&D expenses is a dramatic shift to a very bad tax policy,” said Daniels. “It causes a significant spike in cash taxes.”

The trade-offs: At a time when company leaders are trying to make decisions about how to invest finite resources, a significant increase in the tax burden can hinder future growth plans, Daniels emphasized.

- “Our C-suite is trying to make decisions about big issues like capital expenditures and jobs,” said Daniels. “This makes those decisions harder and comes at a time when the economic outlook is highly uncertain.”

The action: Corning is asking Congress to find a solution, and quickly.

- “We need lawmakers to extend the full deductibility of R&D expenses,” said Daniels. “If Congress can’t make a permanent fix, then at least making full deductibility retroactive to 2022 and extending it through 2025 would still be good. Otherwise, the impact to Corning may be extra cash taxes of roughly $150 million in 2022 alone.”

The last word: “Requiring the amortization of R&D is all I’m thinking about right now,” said Daniels.

“We’re Gonna Get Hit Hard”: How an R&D Tax Policy Change Hurts Manufacturers

This story can also be found within the NAM’s R&D action center.

Miltec UV operates at the cutting edge of the manufacturing industry, developing new UV lamp systems for curing inks and coatings for everything from optical fiber to soup can lids. But after a tax law change went into effect in 2022, the Maryland-based manufacturer found that R&D became much more expensive—hampering its investments and tamping down its growth.

- Until the beginning of 2022, businesses could deduct 100% of their R&D expenses in the same year they incurred the expenses. Starting this year, however, a tax law change requires businesses to spread their deductions out over a period of five years, making it more expensive to invest in growth and innovation.

We spoke with Miltec UV President Bob Blandford to understand how the change was impacting his company and consumers in the United States and around the world.

The impact: Because the law changes the way businesses have handled investments for decades, companies like Miltec UV are having to grapple with a significant new cost that they had not anticipated previously.

- “Absent congressional action, we’re gonna get hit hard,” said Blandford. “Our taxes are going to go up dramatically. That’s cash getting sucked out of the business. So that’s going to get pretty ugly.”

A critical moment: Miltec UV is facing this challenge at a time when its leaders believe an exciting new opportunity is right around the corner. The company has developed a new technology for lithium-ion batteries, which could be used for next-generation electric vehicles.

- Over the past 11 years, Miltec UV has developed manufacturing electrodes used in these batteries, which will allow manufacturers to reduce costs and eliminate the toxic solvents used in existing battery manufacturing processes.

Yet, the new tax change threatens to place significant burdens on their development of this technology.

- “The problem is in the auto world; once they say go, it’s about a five-year process,” said Blandford. “They have to prototype, prove it, test it, then make the batteries. And during that time, we need to support R&D and support the business. So amortizing R&D over five years is a showstopper.”

- “We’re at a critical place now—we’re so close to commercializing it—and now we’re having to pay more taxes out,” said Blandford. “It hurts.”

A burden for employees: If not reversed, the harmful tax change will eat into profits, which Blandford is concerned may impact important benefits for employees. Earlier this year, Miltec UV signed on to the NAM Manufacturers Retirement program—an association-wide 401(k) retirement and savings plan—as a way to improve benefits for employees. The program, which has resulted in cost savings for employees, has proved extremely popular, he added.

- However, “The tax change will have a tremendous negative impact on cash flow, so everything will be on the table,” including retirement benefits, Blandford said.

- “Our team is important to us, and the last thing we want to do is have a negative effect on paychecks and benefits,” said Blandford. “This absolutely will have a spillover effect on every part of the business.”

The last word: “Miltec funds 100% of the company’s R&D costs through the profits of its commercial business as opposed to outside investment,” Blandford said.

- “Spreading the R&D deduction over a five-year period means that each year we will now face a higher tax burden due to the inability to immediately deduct R&D expenses. That is real money that is desperately needed to stay competitive with employee salaries, benefits and even to support new R&D positions that we now are trying to fill.”

Get involved: The NAM has deployed a digital R&D Action Center that manufacturers can visit for critical R&D policy updates, industry stories and an opportunity to engage directly with their members of Congress: https://nam.org/protect-innovation/

Manufacturers: An Expanded IP Waiver Would Jeopardize American Innovation and the Ability to Combat Future Pandemics

Washington, D.C. – Following the announcement by the Office of the U.S. Trade Representative calling for a delay in a World Trade Organization decision on whether to expand a waiver of intellectual property, National Association of Manufacturers Vice President of International Economic Affairs Ken Monahan released the following statement:

“An expanded intellectual property waiver would jeopardize American innovations that are fundamental to fighting current and future pandemics and undermine U.S. technology leadership over our commercial rivals, such as China. Manufacturers welcome USTR’s announcement supporting a delay in the decision on whether or not to expand the WTO’s waiver on COVID-19 products and domestic supply chains and urge all WTO members to fully consider the consequences of such an expanded waiver.

“Efforts could be better spent focusing on other effective international approaches to deal with ongoing and potential global health crises.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.9 million men and women, contributes $2.77 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Timmons Talks Workforce, Immigration and Tax Reform

The NAM took its competitiveness agenda on a media tour last week. In appearances on CNBC, Bloomberg and Yahoo! Finance, NAM President and CEO Jay Timmons called for policy moves that will benefit manufacturers and the U.S. as a whole.

Immigration and workforce: Timmons noted that despite the addition of 14,000 jobs in November, manufacturing continues to see a workforce gap of about 830,000 every month. But there’s a solution we’ve been overlooking, he continued.

- “We have 100,000 Ukrainians we invited here,” Timmons told Yahoo! Finance anchor Seana Smith. “We have 100,000 Afghans that we invited here. But we don’t give them the ability to work. We don’t give them a work permit. They’re in line, waiting to get that work permit. That’s just crazy. We have 200,000 people that could work today if we could just get through the bureaucracy.”

Talent: “Right now, things are very good in the sector, and I think it portends for a bright future for the economy,” Timmons told Michael Santoli on CNBC’s “Closing Bell.” However, filling open jobs remains a top priority.

- “The National Association of Manufacturers and the Manufacturing Institute have a ‘Creators Wanted’ campaign [that’s] trying to inspire that next generation, trying to bring more women into the workforce, trying to bring veterans into the workforce, working on second chance hiring,” Timmons said. “We’re doing everything we can to attract folks into the sector, and I think we’re being successful in doing that.”

Keep the change(s): Timmons also discussed the need to keep in place the tax reforms of 2017, some of which expire at the end of 2022. These changes have enabled many manufacturers to invest in their businesses, raise wages and grow.

- “We have had four consecutive years of record wage growth in the sector. That has been made possible … by the tax reforms enacted in 2017,” Timmons said on Bloomberg’s “Balance of Power.” “We have had record investment, record job creation and record wage growth because of those reforms that were made.”

- However, “[i]mmediate expensing, interest deductibility and the research and development tax credit are all coming to an end at the end of this month,” Timmons continued. “We need Congress to renew that to be able to keep those great reforms of 2017 in place.”

NAM, KAM Win on SEC Bond Rule Interpretation

In response to advocacy by the NAM and the Kentucky Association of Manufacturers, the Securities and Exchange Commission has granted privately held companies temporary relief from a punishing new rule interpretation that would have required them to expose confidential financial information to the public.

The background: In 2020, the SEC finalized a rule designed to increase disclosure obligations for companies issuing over-the-counter equity securities (“penny stocks”). The following year the SEC published a new interpretation of the rule, to take effect in January 2023, which broadened the disclosure requirement to include private companies issuing corporate bonds.

- Late last month, following an emergency petition for interim relief from the NAM and the KAM, the SEC granted a two-year stay of the new interpretation—so private companies will not face the new public disclosure obligations until January 2025.

- Corporate bonds can only be purchased by large institutional investors (which already have access to issuers’ financial information), not retail investors, so the risks of fraud that spurred the 2020 rule are nonexistent in this market.

A victory—for now: “This is a win for private and family-owned manufacturers raising capital for job-creating investments and planning for growth,” NAM Senior Director of Tax and Domestic Economic Policy Charles Crain said.

Damaging effect: The NAM recently released a study showing the significant economic damage that would result from forcing private businesses to disclose confidential and proprietary financial information publicly. Among the key findings:

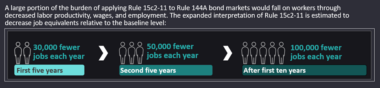

- The U.S. economy would lose 30,000 jobs per year in the early years after the new interpretation takes effect, rising to 50,000 lost jobs per year after five years and 100,000 lost jobs per year after a decade.

- Companies would face decreased liquidity and higher capital costs, including an increase in borrowing costs of up to 13%.

What we’re doing: The NAM and the KAM have filed a petition for rulemaking calling on the SEC to reverse course by clarifying—either by rule or exemptive order—that corporate bond issuers are not required to make public financial disclosures.

- The NAM and KAM have also asked Congress to protect manufacturers from the damage the new interpretation would cause.

The last word: “A two-year delay is a step in the right direction, but the SEC must act to permanently reverse this novel and misguided rule interpretation,” Crain said. “Especially at a time of rising interest rates, the bond market needs stability and manufacturers need low-cost and efficient access to capital.”

NAM Pushes for a Robust U.S. Trade Agenda

The negotiation and implementation of robust, new trade agreements are an essential part of a manufacturing competitiveness agenda. As we head into a new year, the NAM is pressing for the kind of strong rules and partnerships the industry needs.

Forging new trade agreements: The NAM is urging policymakers to negotiate a series of substantial new trade pacts that strengthen trade ties with U.S. allies and other trading partners and expand on open trade in general. Important initiatives include:

- Negotiating regional accords, including the Indo-Pacific Economic Framework and the Americas Partnership for Economic Prosperity, which support manufacturing jobs in the U.S. by including key provisions that open markets, strengthen U.S. innovation and technology leadership, raise global standards and establish best-in-class trade rules; and

- Reengaging in trade agreement talks with the United Kingdom and Kenya and exploring trade agreements with additional markets in Latin America, Africa and beyond.

Enforcing existing pacts: The NAM is also pressing for the comprehensive enforcement of existing U.S. trade agreements—including the full implementation of the United States–Mexico–Canada Agreement and the U.S.–China “Phase One” Trade Agreement. As a strong supporter and advocate for the USMCA, the NAM is advocating the reversal of Mexican and Canadian policies that are against the letter and spirit of the agreement.

- In June, NAM President and CEO Jay Timmons laid out a series of challenges that manufacturers in the U.S. are facing in Mexico, telling the Biden administration: “Failure to prioritize enforcement of these commercial challenges will undermine the long-term credibility of the USMCA.”

Implementing a comprehensive China trade strategy: The NAM has long advocated for a comprehensive strategy for the U.S. trade relationship with China. While the U.S. and China have moved forward with important conversations, the Biden administration should implement a clear China trade and economic strategy that can strengthen our ability to compete economically with and in China, as well as hold China accountable for its behaviors.

- “The U.S. must develop, and strategically use, a full playbook of legislative and enforcement tools to pressure China to stop its discriminatory economic policies and level the playing field for manufacturers and workers in the U.S.,” NAM Vice President of International Economic Affairs Ken Monahan told the Office of the United States Trade Representative in September.

- Monahan also urged the immediate launch of a “comprehensive, transparent and robust Section 301 tariff exclusion process with meaningful retroactivity” to ensure that such measures aren’t undermining efforts to strengthen manufacturing in the U.S.

Next steps: “Manufacturers need open global markets to ensure that we benefit from the same principles that we seek here at home: nondiscrimination, fairness, equal opportunity and competition,” said Monahan. “As we look to 2023 and beyond, the forging of ambitious new U.S. trade agreements, robust enforcement of our existing accords and the implementation of a comprehensive U.S. trade strategy toward China will be vital as we advance that agenda.”

Manufacturers: President Biden and Congress Have Averted a Holiday Crisis

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement after President Biden signed H.J. Res. 100 into law, concluding the collective bargaining process between Class I railroads and all labor unions representing the freight rail workforce and eliminating the threat of a disastrous rail strike.

“Thanks to swift action from President Biden and his administration, and bipartisan cooperation in Congress, a holiday supply chain disaster has been averted.

“Earlier this year, manufacturers called for and supported the creation of the Presidential Emergency Board to rectify the stalemate between the unions and railways. But when it became clear they wouldn’t reach a negotiated resolution, we called on Congress to act, as a freight rail shutdown would have been devastating to the manufacturing industry, the U.S. economy and all American families.

“We thank President Biden, Secretaries Walsh and Buttigieg as well as manufacturing allies in Congress for listening to our industry and working quickly to avert this crisis.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.9 million men and women, contributes $2.77 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org

Manufacturers Release New Economic Analysis Pushing Back on SEC Bond Rule Interpretation

NAM and Kentucky Association of Manufacturers File Rulemaking Petitions to Protect Private Companies from Harmful Public Disclosure Mandate

Washington, D.C. – The National Association of Manufacturers released a new economic analysis on the damaging impact of the Securities and Exchange Commission’s attempt to force private companies to disclose financial information publicly.

The SEC’s new rule interpretation would apply to private companies that raise capital via corporate bond issuances under SEC Rule 144A. If the new interpretation takes effect as scheduled in January 2023, these businesses will face decreased liquidity and increased borrowing costs—leading to significant job losses and a decline in U.S. GDP.

Key Findings:

These impacts will be felt across the economy, resulting in 30,000 jobs lost each year over the first five years the new interpretation is in effect. The job losses will increase over time—rising to 50,000 jobs lost each year after five years and 100,000 jobs lost each year after 10 years.

These job losses are attributable directly to the decreased liquidity and increased borrowing costs associated with the SEC’s new interpretation.

NAM Speaks Out:

NAM Managing Vice President of Tax and Domestic Economic Policy Chris Netram released the following statement:

“At a time of rising interest rates and economic uncertainty, manufacturers cannot afford for the SEC to roil the bond markets arbitrarily. With tens of thousands of jobs at stake, the SEC must act by year’s end to reverse this misguided interpretation.”

NAM Action:

Today, the NAM and the Kentucky Association of Manufacturers are filing two petitions for rulemaking with the SEC seeking to stop the harm this new rule interpretation would cause.

The NAM and the KAM are calling on the SEC to reverse course by clarifying—either by rule or by exemptive order—that Rule 144A issuers are not required to make public financial disclosures. The NAM and the KAM are also seeking emergency interim relief to prevent the new interpretation from taking effect in January.

Background:

- SEC Rule 15c2-11 requires broker dealers to ensure that key information about issuers of over-the-counter equity securities is current and publicly available prior to quoting those issuers’ securities freely.

- SEC Rule 144A allows for resales of securities (primarily corporate debt issuances) to qualified institutional buyers—large financial institutions that own or manage more than $100 million in securities. Retail investors cannot purchase Rule 144A securities. Notably, under Rule 144A, issuers are obligated to make their financial and operational information available to QIBs.

- In September 2021 and December 2021, the SEC’s Division of Trading and Markets issued no-action letters applying Rule 15c2-11 to Rule 144A debt; the new requirements take effect in January 2023. This decision contradicted the historical application of Rule 15c2-11 to OTC equity securities and bypassed important rulemaking safeguards required by the Administrative Procedure Act.

- The NAM has weighed in with the SEC and Congress seeking to reverse this damaging interpretation.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.9 million men and women, contributes $2.77 trillion to the U.S. economy annually and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM Hosts Inaugural Manufacturing Legal Summit

Manufacturers face a minefield of legal and compliance issues every day—and too often, in-house counsel are forced to navigate some of the biggest issues affecting the industry alone.

The NAM’s Legal Center sought to change that dynamic at the first-ever Manufacturing Legal Summit, which took place Nov. 15–16 in Washington, D.C., where in-house counsel from manufacturing companies across the nation had a unique opportunity to convene and learn about the latest pressing challenges across the legal and regulatory landscape.

“The summit offered real-world, practical advice that will help in-house manufacturing counsel deal with their legal and regulatory challenges,” said NAM Chief Legal Officer and Corporate Secretary Linda Kelly.

Kelly and NAM Deputy General Counsel for Litigation Erica Klenicki told us more.

Exploring issues: The summit covered a range of topics, including the following:

- National Labor Relations Board: A session led by NLRB board member John Ring and labor law experts from Fisher Phillips provided critical insights on the priorities and activities of an aggressively pro-labor NLRB, and how manufacturing employers can prepare for the many significant legal changes coming in the weeks, months and years ahead.

- Supply chain: A panel centered around supply chain challenges, featuring the perspectives of GE Appliances’ vice president and general counsel and including an array of experts from the law firm Foley & Lardner, covered issues like supply chain due diligence and drafting contracts to prepare for inevitable supply chain bottlenecks.

- ESG: A panel of experts from McDermott, Will & Emery that also included Brunswick Corp. Executive Vice President, General Counsel, Secretary and Chief Commercial Officer Chris Dekker explored how the ever-evolving concept of ESG is affecting both public and private companies—including what manufacturers should expect from the Securities and Exchange Commission’s forthcoming climate disclosure and human capital management rules.

- Supreme Court: Another session covered the impacts of last year’s Supreme Court decisions and the likely outcomes of this year’s cases on issues of importance to manufacturers and the general public alike.

- Product liability: This panel featured in-house counsel from Johnson & Johnson, The Sherwin-Williams Company and Toyota North America, along with experts from the law firm Shook, Hardy & Bacon, discussing recent efforts by the trial bar to circumvent the traditional limits of product liability law. The panelists laid out the types of bad-faith product lawsuits that manufacturers often face—and how manufacturers should approach them.

- Drugs in the workplace: Especially at a time of legal ambiguity around marijuana, it can be challenging for employers to make and enforce rules about drug use. This session led by workplace legal expert Matt Nieman of Jackson Lewis laid out helpful approaches to creating a modern drug-free workplace.

- Cybersecurity: As cyberattacks against manufacturers rise, it’s important for lawyers to understand their responsibilities around protecting confidential company information and preventing breaches. Thanks to the expertise of representatives from Miller Johnson, a member of the Meritas network, participants learned about these topics through the lens of an attorney’s ethical obligations.

Building relationships: In addition to practical and engaging content, the event also offered participants opportunities to connect with one another and with the NAM legal team.

- “One of the many goals was to build a network, and there was a lot of enthusiasm for that,” said Kelly. “The event also brought greater visibility to the work of the Legal Center and helped show the legal departments of member companies how the NAM can be an effective partner.”

Convening talent: More than 120 participants registered for the event, comprising in-house counsel representing large and small manufacturers from every industrial sector, as well as legal experts from top law firms across the country.

- “This is the first time this group was in a room together,” said Klenicki. “It’s a group that faces a lot of the same pressures, so having everyone in the room together thinking through these issues was extremely valuable.”

A representative reaction: “The event brought together a terrific collection of manufacturing CLOs and senior law department leaders to discuss legal issues of importance to manufacturers,” said Dekker. “The informative and timely content was presented primarily by panels that included outside attorneys and in-house counsel ensuring the advice was actionable and practical.”

An annual affair: The Manufacturing Legal Summit will return Nov. 7–8, 2023, in Washington, D.C.

- “Being in the nation’s capital, where law and policy unfold, hearing from experts on these issues—it’s an exciting experience,” said Klenicki.

The NAM Outlines Post-Election Priorities

Though some midterm races remain uncalled, the NAM is preparing the next phase of its competitiveness agenda. Last Thursday, it offered members a breakdown of the election results so far and what they mean for manufacturing policies and priorities in the United States.

The briefing: Hosted by NAM Vice President of Government Relations Jordan Stoick, the conversation provided members with an overview of the NAM’s key issue areas, presented by several of the NAM’s policy experts.

- Tax: According to NAM Managing Vice President of Tax and Domestic Economic Policy Chris Netram, the NAM is pushing Congress to approve key tax incentives for manufacturers in a year-end package, including the reversal of a harmful change in the treatment of R&D expenses that took effect earlier this year and an extension of 100% bonus depreciation. Beyond the lame-duck session, the NAM will be fighting to make tax reform permanent, he added.

- Trade: According to NAM Vice President of International Economic Affairs Policy Ken Monahan, the NAM will be advocating reauthorization of the Miscellaneous Tariff Bill. Going forward, priorities will include guarding against the TRIPS waiver at the World Trade Organization (which would harm manufacturers’ intellectual property rights), defusing regulatory and market access challenges in Mexico and promoting a robust market-opening agenda overall.

- Energy: NAM Vice President of Energy and Resources Policy Rachel Jones said energy security is likely to remain a key focus of policymakers. She highlighted permitting reform as a possible area for bipartisan progress and noted that implementation of new climate incentives and programs will likely come with heightened oversight from the new Congress next year.

- Infrastructure: NAM Vice President of Infrastructure, Innovation and Human Resources Policy Robyn Boerstling noted that supply chain challenges are the most difficult issue facing manufacturers at the moment. She also provided an update on rail negotiations, addressed the National Labor Relations Board’s robust pro-labor agenda and spoke out in favor of the NAM’s commonsense immigration approach, among other issues.

The outlook: “The good news is that regardless of the outcome, the NAM remains uniquely positioned to continue to effectively advocate on your behalf with the Biden administration and with both parties, whoever’s in control on Capitol Hill,” said Stoick.

- “We’ve worked successfully with the administration and the current Congress over the past two years to achieve important policy wins on things like infrastructure and the CHIPS semiconductor and competition bill. And we’ve been successful at pushing back on harmful policies and overreach, including stopping what should be considered some of the worst parts of the tax increases that were proposed over the past two years.”