NAM to Congress: Advance R&D Tax Fix Now

To restore a U.S. tax landscape that promotes manufacturing competitiveness, Congress should act quickly in advancing bicameral, bipartisan legislation that would ensure the tax code once again supports innovation.

That was the message from the NAM and several manufacturers to lawmakers last week.

What’s going on: The NAM and company leadership from manufacturers Westminster Tool and Brewer Science visited Capitol Hill last week to brief legislators on a harmful change to the tax treatment of research and development.

- The briefing was held by the NAM-led R&D Coalition in cooperation with the offices of Reps. John Larson (D-CT) and Ron Estes (R-KS) and Sens. Maggie Hassan (D-NH) and Todd Young (R-IN).

- Larson and Estes introduced the American Innovation and R&D Competitiveness Act in the House, while Sens. Hassan and Young introduced the American Innovation and Jobs Act in the Senate. These are the measures manufacturers are urging legislators to pass.

Why it matters: “We paid $26,679 per full-time employee in additional federal tax this past year” because of the change, Westminster Tool Chief Financial Officer Colby Coombs told lawmakers at the briefing.

- “This increased federal tax on R&D forced us to cancel a major aviation contract that would have added … new jobs in our community and forgo a significant capital investment. Without fixing this issue, in 2023, we expect an additional tax bill of almost $18,000 per employee,” he continued.

- Added Brewer Science Government Programs Director Doyle Edwards: “We have lost IP to China in the past, and fight[ing] that in the courts is a no-win situation. So the only way to win is to out-invent them. And that’s what we invest our money to do. However, with [the tax change] … we’re allowing China to actually catch up.”

The background: For nearly seven decades, manufacturers could deduct their R&D expenses fully in the year in which the costs were incurred. However, since the change last year, businesses must instead deduct these expenses over a period of years, making R&D more costly.

Legislative fix: To protect manufacturers’ R&D, jobs and competitiveness, Congress should move immediately on bipartisan legislation to restore R&D expensing.

- “R&D is the lifeblood of advanced technology development for our company, for our industry, but really for the nation,” Edwards continued. “And so our message is, we need your help. We need your leadership to resolve this policy issue.”

Take action: Learn more about what the NAM is doing to advocate for sound tax policy at our R&D action center.

NAM Leads Inaugural North American Manufacturing Conference

On Sept. 19–20, the NAM convened the inaugural North American Manufacturing Conference in Washington, D.C., along with its counterpart associations from Mexico and Canada, the Confederation of Industrial Chambers of Mexico and Canadian Manufacturers & Exporters.

What’s going on: The conference provided an opportunity for North American manufacturing executives and government representatives to share perspectives on the opportunities and challenges facing the sector across the region. At the conference, industry leaders discussed the need to:

- Ensure that North America has the affordable and reliable energy needed to support the manufacturing industry;

- Support more regional competitiveness, greater growth and the success of the United States–Mexico–Canada Agreement; and

- Address regional workforce needs in the U.S., Mexico and Canada.

Deepening ties: On Wednesday, the NAM, CONCAMIN and CME signed a memorandum of understanding that will serve as a roadmap for future cooperation between the three organizations and support close economic ties between the U.S., Mexico and Canada.

- The memorandum calls for the organizations to share information about each one’s services and activities, and to work together to shape the continent’s future manufacturing agenda.

- In addition to leaders from the NAM, CONCAMIN and CME, speakers at the event included U.S. Trade Representative Katherine Tai, ExxonMobil Senior Vice President Neil Chapman, Toyota Motor North America Executive Vice President – Product Support and Chief Quality Officer Chris Nielsen, Rep. Adrian Smith (R-NE), Bombardier Head of U.S. Strategy Tonya Sudduth, Energy Transfer Co-CEO Tom Long and Caterpillar Inc. Chief Technology Officer and Senior Vice President of Integrated Components and Solutions Division Karl Weiss.

Common principles: “Shared values, shared prosperity” was a central theme of the conference, echoing President Biden’s remarks at the U.N. General Assembly earlier this week.

- “As president of the United States, I understand the duty my country has to lead in this critical moment; to work with countries in every region linking them in common cause; to join together with partners who share a common vision of the future of the world,” President Biden said in New York on Wednesday.

- “There’s never been a greater need for us to stand together,” NAM President and CEO Jay Timmons said. “The world is caught between different political and economic systems. Our system here in North America enriches lives and lifts people up into freedom and prosperity, while other systems oppress their people and rob them of their liberty,” he continued, adding that the USMCA, of which the NAM is a longtime advocate, serves as a reminder “of what we can achieve when we work together.”

Strengthening the region: Throughout the conference, discussions focused on three components of a successful North American economy—growth, resilience and competitiveness—and the critical role manufacturers play in that system.

- “Today, we live in a new reality,” CONCAMIN President José Antonio Abugaber Andonie said. “The commercial competition with China, the pandemic, the conflict in Ukraine … [all] place us before a second great industrial transformation in North America. … Some call it nearshoring, friend-shoring, ally-shoring or reshoring. No matter the name, the truth is that this phenomenon is modifying the structure of international industrial organization. North America is the epicenter of this transformation.”

- Added CME President and CEO Dennis A. Darby: “Manufacturers are an important driver of economic development and prosperity. We are key players in the changes and challenges of the 21st century.”

New Study: U.S. Health Care Supply Chain Resilience Demands Balanced Regulatory Environment

Washington, D.C. – The National Association of Manufacturers released a new study outlining steps to improve health care supply chain resilience to allow manufacturers in the United States to better prepare for and adapt to the next disruption. The study analyzes lessons learned from the COVID-19 pandemic, during which manufacturers across the United States produced critical health care supplies in a highly unpredictable environment that affected every industry level.

“During the COVID-19 pandemic, manufacturers in the United States helped lead our response and recovery and learned many lessons in the process,” said NAM Chief Economist Chad Moutray. “Policymakers should utilize these lessons to bolster our supply chain for the next disruption. This analysis, which was conducted by the Manufacturing Policy Initiative at Indiana University, reveals that there are key policy actions needed to strengthen the manufacturing supply chain. Research shows a more balanced regulatory agenda, with an emphasis on clarity, predictability and coordination, will help mitigate the effects of the next disruption.”

Key Themes

Seven key lessons from the pandemic can be examined for future efforts to build resilience:

- Speed matters: Manufacturers need to be able to serve demand quickly.

- Information matters: Manufacturers need timely access to accurate information.

- Costs matter: Firms face the costs of taking action within the supply chain, as well as the costs of managing market unpredictability and policy environment uncertainty.

- Networks matter: Partnerships can support information sharing and networks to help manufacturers navigate the disruption.

- Size matters: Small and medium-sized manufacturers and new firms can be differently—and uniquely—challenged compared with established larger manufacturers.

- Technology matters: Technology can enable manufacturers to enhance production, innovate or improve efficiency, as well as support broader efforts to build partnerships.

- Flexibility matters: Responses can come from unexpected sources and need a flexible policy environment.

Areas of Opportunity

The report identifies four key areas of opportunity to enhance health care supply chain resilience:

- Fostering a conducive regulatory environment: Manufacturers and their partners need clear and streamlined regulations as well as a flexible regulatory framework in advance of the next disruption.

- Supporting partnerships for stronger information sharing and networks: Sustained information channels between manufacturers and policymakers will improve access to information for all parties and mitigate disruptions.

- Ensuring a healthier “baseline” industry: Small business plays a pivotal role in the U.S. Robust entrepreneurship and scaling of new manufacturers contribute to a more competitive industry.

- Prioritizing changing workforce needs: Workforce development must be prioritized so that manufacturers can pivot across product lines and sectors to meet the needs of the next disruption.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Overregulation and Workforce Challenges Weigh Heavily on Manufacturing Sector

Optimism Sinks to Pandemic Lows in Q3 Outlook Survey

Washington, D.C. – The National Association of Manufacturers released its Manufacturers’ Outlook Survey for the third quarter of 2023, which registered the lowest level of optimism among NAM members (65.1%) since Q2 2020, as the sector continues to confront a tight labor market, unbalanced federal regulations and critical policy debates in Congress.

“Manufacturers continue to be challenged in today’s economy, but what this survey makes clear is that unbalanced federal regulations are harming families and communities, with nearly two out of three manufacturers reporting that the regulatory burden is preventing them from hiring more workers or increasing pay and benefits,” said NAM President and CEO Jay Timmons. “Congress and the administration can help correct this trend by restoring sensible regulations, enacting further permitting reforms, taking action to keep our tax code competitive and other bipartisan steps to strengthen manufacturing in America and build on the progress we achieved with tax reform, the Bipartisan Infrastructure Law, the CHIPS and Science Act and more.”

Key Survey Findings:

- Only 65.1% of respondents felt positive in their company’s outlook, edging down from 67.0% in the second quarter. It was the fourth straight reading below the historical average (74.9%).

- Concern about an unfavorable business climate was the highest in six years (Q2 2017).

- The survey found that 69.1% of small manufacturers, and 63.2% of all respondents, would hire more workers or increase compensation if the regulatory burden decreased.

- More than 70% of manufacturers would purchase more capital equipment if the regulatory burden on manufacturers decreased, with 48.6% increasing compensation, 48.6% hiring more workers, 42.5% expanding their U.S. facilities and 38.4% investing in research.

- The top challenges facing manufacturers include attracting and retaining a quality workforce (72.1%), weaker domestic economy (60.7%), rising health care/insurance costs (60.1%), unfavorable business climate (56.7%), increased raw material costs (45.5%) and supply chain challenges (37.8%).

You can learn more at the NAM’s online regulatory action center here.

The NAM releases these results to the public each quarter. Further information on the survey is available here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM, KAM Bring Suit Against SEC

The NAM and the Kentucky Association of Manufacturers are hitting back against an attempt by the Securities and Exchange Commission to force privately held businesses to make public financial disclosures.

What’s going on: On Tuesday, the NAM and KAM filed suit in federal court challenging the SEC’s novel reinterpretation of its Rule 15c2-11.

- The reinterpretation—on which the SEC has not granted companies the opportunity to comment—would require private firms to release confidential financial information publicly.

The background: Rule 15c2-11 requires disclosures to protect investors in publicly traded companies issuing so-called “penny stocks.” But the SEC has broadened the rule’s application to include privately held companies that issue corporate bonds to large institutional investors under an entirely different regulation, called Rule 144A.

- Everyday investors can’t purchase corporate bonds issued under Rule 144A, so there is no reason to require public disclosures from these businesses.

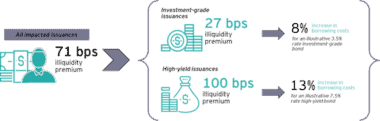

Why it’s important: Expanding Rule 15c2-11 will mean higher borrowing costs and reduced liquidity in both the manufacturing industry and throughout the larger economy, according to a new EY report released by the NAM.

- The reinterpretation would lead to job losses of more than 100,000 every year, according to the analysis.

Manufacturers speak out: “The SEC never allowed public comment on its novel reinterpretation of Rule 15c2-11, there is no conceivable benefit to the new standard and the SEC did not consider the impact that its about-face will have on privately held businesses,” said NAM Chief Legal Officer Linda Kelly. “The NAM Legal Center is filing suit to hold the SEC accountable and protect manufacturing growth, job creation and U.S. competitiveness.”

- KAM President and CEO Frank Jemley added: “The SEC’s unlawful overreach threatens privately held manufacturers in Kentucky and across the country, so the Kentucky Association of Manufacturers is proud to join the NAM in this important litigation.”

Manufacturers Sue SEC to Protect Private Businesses, Release Data on Harmful Impact of Novel Rule Interpretation

Washington, D.C. – The National Association of Manufacturers and the Kentucky Association of Manufacturers filed a lawsuit in federal court today challenging the Securities and Exchange Commission’s attempt to impose unwarranted public disclosure requirements on privately held businesses.

The SEC has adopted a novel reinterpretation of SEC Rule 15c2-11, imposing the rule’s public disclosure requirements on private companies that raise capital via corporate bond issuances under SEC Rule 144A—without giving manufacturers the opportunity to provide comment on the damaging impacts of such a consequential change.

According to EY economic analysis released by the NAM today, the SEC’s expansion of Rule 15c2-11 will result in decreased liquidity and increased borrowing costs in the manufacturing industry and throughout the economy—leading to job losses exceeding 100,000 annually.

“The SEC’s attempt to force private companies to disclose confidential financial information publicly is a clear violation of the Administrative Procedure Act,” said NAM Chief Legal Officer Linda Kelly. “The SEC never allowed public comment on its novel reinterpretation of Rule 15c2-11, there is no conceivable benefit to the new standard, and the SEC did not consider the impact that its about-face will have on privately held businesses—which could exceed 100,000 lost jobs each year. The NAM Legal Center is filing suit to hold the SEC accountable and protect manufacturing growth, job creation and U.S. competitiveness.”

“The SEC’s unlawful overreach threatens privately held manufacturers in Kentucky and across the country, so the Kentucky Association of Manufacturers is proud to join the NAM in this important litigation on behalf of all manufacturers in the U.S. to counter the SEC’s regulatory onslaught,” said KAM President and CEO Frank Jemley.

EY analysis highlights the damaging economic impacts of the SEC’s actions:

The economic impacts of the SEC’s expansion of Rule 15c2-11 will be felt disproportionately in the manufacturing industry, which accounts for more than half of all nonfinancial issuers of corporate bonds under Rule 144A. Across the economy, the change will result in 30,000 jobs lost each year over the first five years the new interpretation is in effect. The job losses will increase over time—rising to 50,000 jobs lost each year after five years and 100,000 jobs lost each year after 10 years.

These job losses are attributable directly to the decreased liquidity and increased borrowing costs associated with the SEC’s new interpretation.

Background:

- SEC Rule 15c2-11 requires broker-dealers to ensure that key information about companies issuing over-the-counter equity securities is current and publicly available prior to quoting those issuers’ securities.

- SEC Rule 144A allows for resales of securities (primarily corporate debt issuances) to qualified institutional buyers—large financial institutions that own or manage more than $100 million in securities. Retail investors cannot purchase Rule 144A securities. Notably, under Rule 144A, issuers are obligated to make their financial and operational information available to QIBs.

- In September 2021, the SEC’s Division of Trading and Markets issued a no-action letter applying Rule 15c2-11 to Rule 144A debt. This decision contradicted the historical application of Rule 15c2-11 to OTC equity securities and bypassed important rulemaking safeguards required by the Administrative Procedure Act.

- The NAM and the KAM filed petitions for rulemaking with the SEC in November 2022 seeking both permanent and temporary relief from the application of Rule 15c2-11 to Rule 144A securities. Following the petitions, the SEC temporarily delayed enforcement of its novel reinterpretation until January 2025, but the agency has not acted to reverse this damaging decision permanently.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NLRB Revives Troubling “Card Check” Process

Bringing back parts of a policy it dropped more than half a century ago, the National Labor Relations Board moved late last week to reinstate an abridged version of “card check,” according to Reuters (subscription).

What’s going on: In a “3-1 decision in a case involving building materials company Cemex Construction Materials,” the NLRB unveiled a new framework last Friday that revives the 1949 Joy Silk doctrine, which holds that “employers must bargain with unions unless they have a good-faith doubt that majority support exists.”

The background: The board had tossed out the doctrine in the early 1970s after the Supreme Court’s decision in NLRB v. Gissel Packing Co., in which the court held that “the NLRB could force employers to bargain with unions when they engage in misconduct so severe that any election would be tainted.”

- This new decision “could provide a major boost to unions by allowing them to represent workers in certain cases when a majority sign cards in support of unionizing, rather than going through the lengthy and often litigious election process.”

- Last week’s move also came a day after the board finalized a return to Obama-era regulations purportedly aimed at speeding up union elections.

Why it’s problematic: Card check—which the NAM has long opposed—is inherently unfair and insecure, and it strips employees of their right to secret ballots, said NAM Director of Infrastructure & Labor Policy Ben Siegrist.

- “The NLRB’s decision could create a glide path to force unionization on workers without the necessary safeguards of an election, and it runs counter to 50 years of precedent established by the Supreme Court,” he said. “Effectively, this action contradicts the rights all employees have in determining their own representation.”

Manufacturers Signal Concerns with Proposed DOL Overtime Rule

NAM: DOL’s proposed rule would inject new regulatory burdens and compliance costs to an industry already reeling from workforce shortages

Washington, D.C. – In response to the U.S. Department of Labor’s issuance today of a proposed rule altering the exemptions for overtime eligibility under the Fair Labor Standards Act, National Association of Manufacturers Managing Vice President of Policy Chris Netram issued the following statement:

“Manufacturers have spent the past several years adapting operations and personnel management resources to meet the evolving needs of their workforce in a post-pandemic environment, including through improved wages and benefits and productive workplace accommodations. The DOL’s proposed rule would inject new regulatory burdens and compliance costs to an industry already reeling from workforce shortages and an onslaught of other unbalanced regulations.

“Creating new regulatory processes and imposing additional mandatory costs will act as a drag on the sector and upend productive employer–employee relations. We look forward to expressing our concerns with this proposal directly to the DOL and administration leaders as the process moves forward.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM: Auto Worker Strike Would Harm Economy

As manufacturers continue to reel from supply chain disruptions, the NAM is calling for a swift resolution to forestall a potentially devastating United Auto Workers strike.

What’s going on: The UAW is negotiating a new labor agreement with important automotive manufacturers, as the current contract expires Sept. 14.

Why it’s important: The automotive manufacturing industry in the U.S. is one of the strongest and most productive in the world, and it significantly supports the health of the U.S. economy.

- A strike of 143,000 UAW members against Detroit’s “Big Three” auto manufacturers could mean an economic loss of $5.617 billion after just 10 full days, according to a new report by Anderson Economic Group.

- Nationwide, every $1 spent in the transportation-equipment sector causes another $1.59 to be spent elsewhere—for a total economic impact of $2.59, according to NAM calculations using 2021 IMPLAN data.

- In 2022, the total value-added in motor vehicles and parts in the U.S. was $171.6 billion, according to the Bureau of Economic Analysis.

State-level impact: In 2019, a 42-day auto-worker strike at one of the Detroit manufacturers “sent the state of Michigan into a one-quarter recession” and resulted in an economic loss of $4.2 billion, according to reporting by The Detroit News.

- As of 2021, the latest year for which this data is available, Michigan’s total output from motor vehicles, bodies and trailers, and parts manufacturing was $37.5 billion, accounting for 37% of total manufacturing output in the state, according to the BEA.

- At the same time, Michigan had 175,745 full- and part-time employees in the sector, or 28.7% of all manufacturing employees in the state.

- Meanwhile, the total output of Illinois’ auto sector accounted for 19.3% of the state’s total manufacturing output, while employment came to 23.6% of the state’s manufacturing employees.

Undermining manufacturing in the U.S.: “Manufacturers in America, especially in the automotive sector, operate in an integrated supply chain, which means that small and medium-sized manufacturers around the country—in union and non-union shops—would endure the consequences of a stoppage. As we continue to emerge from the global pandemic and work to get our economy on a sustainable track, a strike would be devastating for working families across our country,” said NAM President and CEO Jay Timmons.

- “President Biden has prioritized strengthening manufacturing in America, but that will be quickly undermined if a strike occurs. The administration should be encouraging a swift resolution to avoid ripple effects throughout the broader manufacturing economy and in communities from coast to coast.”

Rep. Emmer, NAM Visit Glenn Metalcraft

Workforce challenges and the regulatory onslaught against manufacturers were some of the key topics covered during a recent NAM meeting with House Majority Whip Tom Emmer (R-MN) in Princeton, Minnesota.

What’s going on: Emmer met NAM leadership last Monday for a facility tour of heavy-gauge metal spinnings company Glenn Metalcraft, led by its president and CEO, Joe Glenn.

- On the walkthrough, Emmer got to see and hear the impact of the current legislative deluge hitting manufacturers.

- “My visit to Glenn Metalcraft demonstrated the need to address the regulatory state overwhelming manufacturers in the heartland,” Emmer said. “Small and medium-sized manufacturers are working hard to grow their businesses and increase compensation for employees, but those efforts are undermined by new regulations and the lack of permanent, competitive tax policies to promote research and development and capital investment.”

“Fighting to thrive”: Glenn spoke candidly about his and other manufacturers’ current struggles with the excessive mandates handed down by federal agencies.

- “Manufacturers across the country are fighting to thrive under the weight of an increasing number of unbalanced and often unfeasible regulations from agencies across the federal government—all amid an uncertain economic environment,” Glenn said before thanking Emmer for “giving us a voice.”

- The majority of manufacturers—more than 63%—say they now spend over 2,000 hours a year complying with federal mandates, according to the NAM’s Q2 2023 Manufacturers’ Outlook Survey.

Tax treatment of R&D: Emmer’s support of the American Innovation and R&D Competitiveness Act—which would permanently restore immediate research-and-development expensing for small businesses for 2022 and all subsequent years—has been instrumental in the legislation’s progress, NAM Managing Vice President of Communications and Public Affairs Jamie Hennigan told the whip. Now we just need to move the issue forward, he added.

- Glenn underscored the importance of full expensing when he told Emmer that it had helped his company open new facilities.

- Emmer agreed on the necessity of competitive tax provisions and said he, too, wanted to see them reinstated.

A persistent problem: NAM leaders and Glenn also addressed another ongoing challenge for manufacturers in their discussion with Emmer: the acute shortage of skilled workers.

- The difficulty of attracting and retaining skilled workers has consistently ranked among the top problems cited by manufacturers in the Outlook Survey, as Hennigan pointed out.

The last word: “Manufacturers have made it clear that the [Biden] administration’s regulatory agenda could easily derail manufacturing’s recent success,” NAM President and CEO Jay Timmons said in a statement after the visit.

- “Glenn Metalcraft and so many others are forced to make tough decisions as agencies issue unbalanced regulations that threaten our sector’s ability to grow and compete.”

- “The positive effects of tax reform, the Bipartisan Infrastructure Law and the CHIPS and Science Act are all being undermined by the growing regulatory burden, and I want to thank Whip Emmer for spotlighting this threat in his home state of Minnesota.”