Manufacturers on 45X: Tax Credit Is Crucial to Building a Strong and Sustainable Domestic Advanced Manufacturing Supply Chain

Washington, D.C. – Following the release of guidance by the U.S. Department of the Treasury and the IRS for the Advanced Manufacturing Production Credit (Section 45X of the Internal Revenue Code), National Association of Manufacturers Managing Vice President of Policy Chris Netram released the following statement:

“Manufacturers welcome today’s announcement of final guidance on the 45X Advanced Manufacturing Production Credit and appreciate the administration’s willingness to make improvements that support manufacturing in the U.S. In particular, including critical mineral extraction and materials costs in the credit calculation will help bolster supply chain resiliency throughout the manufacturing sector. This tax credit will help manufacturers build a strong and sustainable domestic advanced manufacturing supply chain—from mining to processing to final product assembly.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Economic Uncertainty Fuels Lower Optimism for Manufacturers

Washington, D.C. – The National Association of Manufacturers released its Manufacturers’ Outlook Survey for Q3 2024, which, reflecting overall uncertainty across several challenges, shows a drop in manufacturing sentiment in the third quarter.

“The preelection uncertainty explains in part the drop in optimism, but economic pressures and policy threats are also at play. The good news is that there is something we can do about it,” said NAM President and CEO Jay Timmons. “We will work with lawmakers from both parties to halt the looming tax increases in 2025; address the risk of higher tariffs; restore balance to regulations; achieve permitting and energy security; and ease labor shortages and supply chain disruptions.

“Manufacturers are the backbone of the U.S. economy, creating jobs, investing in our communities and developing products that make life better for everyone. When policymakers take action to create a more competitive business climate for manufacturers, we can sustain America’s manufacturing resurgence—and strengthen our can-do spirit.

“This administration and Congress—and the next administration and Congress—should take this to heart, put aside politics, personality and process and focus on the right policies to strengthen the foundation of the American economy.”

Select Survey Findings:

- The NAM conducted the Q3 2024 Manufacturers’ Outlook Survey Sept. 5–20. In Q3, 62.9% of respondents felt either somewhat or very positive about their company’s outlook, falling from 71.9% in the second quarter. The average over the past four quarters is 67.4%.

- A weaker domestic economy was cited as manufacturers’ top concern in Q3 2024, with 68.4% claiming it is their primary challenge. This was followed by rising health care costs (62.9%) and an unfavorable business climate (60.5%). Attracting and retaining a quality workforce now ranks as the fourth-highest concern, after remaining at the top of this list since Q4 2017.

- Manufacturers want Congress to prevent tax increases. Nearly 9 out of 10 respondents agree that Congress should act before the end of 2025 to prevent scheduled tax increases on manufacturers. The 20% pass-through deduction, individual tax rates and the estate tax exemption threshold are scheduled to expire or become less competitive at the end of 2025.

- Tax increases will harm growth in manufacturing in the United States, with 92.3% of manufacturers contending that the corporate rate should remain at or below 21%. If the corporate rate is increased from 21% to 28%, more than 71% of respondents said this increased tax burden will impact their business negatively.

- Lawmakers need to act to address health care costs for manufacturing workers. More than 72% of respondents support congressional action to reduce health care costs by reforming pharmacy benefit managers, while less than 6% oppose and 21.7% are uncertain.

The NAM releases these results to the public each quarter. Further information on the survey is available here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Full Expensing: Q&A with Sen. James Lankford

The NAM recently talked to Sen. James Lankford (R-OK) to learn what he and his colleagues on the Senate Finance committee are focused on as critical provisions of the Tax Cuts and Jobs Act are set to expire next year. Here’s the full interview:

NAM: Senator Lankford, Congress is facing a “Tax Armageddon” next year, as crucial provisions from 2017’s Tax Cuts and Jobs Act are set to expire. As a member of the Senate Finance committee, what is your focus moving into next year’s debate?

Sen. Lankford: Extending the TCJA is crucial for American families and it creates certainty for businesses, particularly those policies encouraging investment and innovation. Failure to act will result in a tax increase for most American households and 96% of businesses. For greater predictability, Congress should push for as many permanent pro-growth policies as possible. One such policy is the full expensing of new investments, which allows businesses to deduct the cost of machinery and equipment in the year they are purchased. This measure has significantly incentivized capital investment, leading to job creation and economic expansion.

NAM: The 2017 tax reform package implemented full expensing for capital equipment purchases, which manufacturers overwhelmingly utilized in the years following. However, full expensing began to phase out in 2023 and will be completely eliminated from the tax code in 2027. What are you doing to protect this crucial policy?

Sen. Lankford: For the past 20 years, under Republican and Democratic administrations, bonus depreciation has been an essential element of good business tax policy. Bonus depreciation acknowledges that business expenses are not business profits, so they should not be taxed as profits. The 2017 tax bill expanded on that nonpartisan tax policy by allowing businesses to depreciate 100% of their capital and equipment during the purchase year, instead of over years and years of tax returns. That change doesn’t alter how much tax a business can deduct; it simply changes when they can deduct it. With 100% depreciation, a business can deduct its tax in a single year, instead of over several years. That allows a business to invest more capital, hire new employees faster and expand their business. My ALIGN Act will make bonus depreciation a permanent and predictable tax policy for our businesses and manufacturers, and it will encourage economic growth for decades to come.

NAM: As a Senator who was there during the Tax Cuts and Jobs Act, you know how impactful the legislation was for manufacturers to be able to compete on a global level. As we get closer to next year, what are you hearing from stakeholders on the need for pro-growth tax policy so American businesses can engage and grow around the world?

Sen. Lankford: I have connected with Oklahoma businesses—both large and small—to discuss tax policies that affect them and how we can ensure our tax system provides certainty while keeping the U.S. competitive internationally. We must not lose sight of how a competitive tax code drives American investment, which, in turn, strengthens our economic and national security. The TCJA struck a competitive balance with a 21% corporate tax rate and a 20% rate for pass-through businesses.

Some are calling for an increase in the corporate rate to 28%. However, the average corporate tax rate in the EU is 21.3%, with a global average of 23% across 181 jurisdictions. China has a corporate tax rate of 25%, with a reduced 15% rate for new sectors. Moreover, China has significantly expanded its R&D deduction, while the U.S. is shrinking ours. We should reverse the decline of our R&D deduction and permanently encourage businesses of all sizes to remain innovative here in America.

As the Senator from Oklahoma, I’m keenly aware of the connection between a competitive tax code and energy security. As we work to strengthen our national security, now is not the time to target American oil and gas producers. Looking ahead to 2025, I will fight to protect the current treatment of intangible drilling costs (IDCs) in the tax code. IDCs allow oil and natural gas companies to recover these costs more quickly, freeing up funds for reinvestment in development. This not only creates more jobs but also enhances our energy security and keeps energy prices low for American families.

NAM: Thank you, Senator. What else can NAM members do to stay engaged and be a resource for you going into next year?

Sen. Lankford: I encourage everyone to regularly communicate with their congressional delegation about the impacts a lapse in the TCJA would have on their businesses and communities. For example, full expensing drives investments in sectors ranging from rural broadband and agriculture to energy security and manufacturing. These investments directly boost local economic output, create jobs, and enhance the competitiveness of communities in the market. It’s important to share this story as Congress works on a tax bill in 2025.

Rep. Grothman Talks R&D, Taxes at Wisconsin Aluminum Foundry

Rep. Glenn Grothman (R-WI) visited Wisconsin Aluminum Foundry in Manitowoc, Wisconsin, as part of a series of facility visits from key members of Congress organized by the NAM. Rep. Grothman, representing a district with one of the largest percentages of its workforce employed in manufacturing, emphasized the importance of key tax policies that keep manufacturers competitive on a global scale.

During the visit, Rep. Grothman toured the facility with Wisconsin Aluminum Foundry CEO Sachin Shivaram and held a roundtable discussion with company and union leadership. Representatives from Wisconsin Manufacturers & Commerce also participated in discussions about the challenges facing manufacturers.

Innovation and R&D: Shivaram showcased the Foundry’s advanced aluminum and bronze casting capabilities during the tour. He also expressed concern about changes in R&D tax treatment, which have increased the cost of innovation.

- “R&D is essential to the future of our business,” said Shivaram, stressing that restoring full R&D expensing is crucial for manufacturers like Wisconsin Aluminum Foundry. With the expiration of first-year R&D expensing in 2022, the burden of financing R&D has become a major obstacle for small and medium-sized manufacturers.

- Rep. Grothman, who strongly supports restoring full R&D expensing, said, “Manufacturers need every incentive to innovate and grow. If we want to maintain our competitive edge, we need to ensure that tax policy encourages, not discourages, investment in R&D.”

Preserving tax reforms: The roundtable addressed the importance of preserving the 2017 Tax Cuts and Jobs Act, which benefited manufacturers by lowering the corporate tax rate and providing a 20% pass-through deduction for small businesses. These provisions are set to expire in 2025, creating uncertainty for manufacturers.

- Rep. Grothman pointed to Wisconsin’s manufacturing and agriculture credit as a model for federal tax policy going forward. The MAC, which substantially reduces state taxes on manufacturing income, has proven effective in supporting Wisconsin’s manufacturers.

- “We should look at expanding these kinds of targeted incentives nationwide,” Rep. Grothman said, noting that a similar approach at the federal level could bolster U.S. manufacturing and global competitiveness.

The local view: WMC President and CEO Kurt Bauer echoed the concerns about the expiration of the 2017 tax reforms.

- “If these tax provisions are allowed to expire, it would put significant strain on Wisconsin’s manufacturers,” Bauer said. “The ability to reinvest in equipment, innovation and workers is crucial for maintaining our global competitiveness, and losing these tax incentives would make that much harder.”

Workforce development: The roundtable also covered workforce development, a critical issue for an industry facing a shortage of skilled workers.

- Shivaram, who chairs the Governor’s Council on Workforce Investment, stressed the importance of expanding access to skills-based education and apprenticeship programs to meet the needs of modern manufacturing. “We need policies that help us train and retain the workforce of the future,” he said.

- Rep. Grothman echoed this sentiment, pledging to support federal workforce development initiatives that prepare workers for careers in advanced manufacturing. “A skilled labor force is the foundation of manufacturing’s future,” he said.

Closing thoughts: “It is critical that tax policy continue to support manufacturers, who are the backbone of our economy,” said Rep. Grothman. “If we allow tax reform to expire, it would result in devastating tax increases—stalling job creation and innovation. It’s on us in Congress to work together to preserve tax reform and encourage investment, protect jobs and keep American manufacturers competitive on the global stage.”

Fighting for a Competitive Future: A Conversation with Sen. James Lankford

As Congress faces the looming expiration of key provisions from the 2017 Tax Cuts and Jobs Act, Sen. James Lankford (R-OK) emphasizes the urgency of extending these policies to safeguard American businesses and families from tax increases.

Ensuring certainty: Sen. Lankford underscored the importance of creating predictability for businesses by making pro-growth policies permanent. “Extending the TCJA is crucial for American families, and it creates certainty for businesses, particularly those policies encouraging investment and innovation,” he told the NAM in a recent conversation. “Failure to act will result in a tax increase for most American households and 96% of businesses. For greater predictability, Congress should push for as many permanent pro-growth policies as possible.”

One policy Sen. Lankford is particularly focused on preserving is full expensing for capital investments, which allows businesses to immediately deduct the cost of machinery and equipment. This measure, he said, has fueled capital investment and accelerated job creation.

Protecting full expensing with the ALIGN Act: Full expensing has been a bipartisan tool in tax policy for two decades, Sen. Lankford points out, highlighting that the TCJA allowed businesses to deduct 100% of capital expenses in the year of purchase. His ALIGN Act aims to make full expensing a permanent fixture in the tax code, fostering long-term economic growth.

- “That change doesn’t alter how much tax a business can deduct; it simply changes when they can deduct it. With 100% depreciation, a business can deduct its tax in a single year, instead of over several years. That allows a business to invest more capital, hire new employees faster and expand their business.”

Global competitiveness and energy security: Drawing from conversations with Oklahoma businesses, Sen. Lankford stressed that keeping the U.S. tax code competitive is critical. While some push for a corporate tax increase, he warned this would undermine America’s global position.

- “The average corporate tax rate in the EU is 21.3%, with a global average of 23% across 181 jurisdictions. China has a corporate tax rate of 25%, with a reduced 15% rate for new sectors. Moreover, China has significantly expanded its R&D deduction, while the U.S. is shrinking ours. We should reverse the decline of our R&D deduction and permanently encourage businesses of all sizes to remain innovative here in America.”

The final word: “I encourage everyone to regularly communicate with their congressional delegation about the impacts a lapse in the TCJA would have on their businesses and communities,” Sen. Lankford said. “It’s important to share this story as Congress works on a tax bill in 2025.”

Read the full interview with Sen. Lankford here.

Small Manufacturers: Congress Must Restore Full Expensing

As part of the NAM’s “Manufacturing Wins” tax campaign, small and medium-sized manufacturers are urging Congress to make full expensing of capital equipment purchases permanent, warning that the phaseout of this pro-growth tax provision is harming their ability to invest, grow and compete.

What’s happening: Tax reform allowed manufacturers to immediately expense 100% of the cost of capital equipment purchases. But this provision started to be phased out in 2023, dropping by 20%. It will drop by a further 20% every year until 2027, when it will expire completely.

- Seventy-eight percent of manufacturers said that the expiration of full expensing and other pro-growth tax provisions has decreased their ability to expand U.S. manufacturing activity, according to an NAM Manufacturers’ Outlook Survey from last year.

What’s at stake for manufacturers: Capital-intensive industries like manufacturing are the primary beneficiaries of full expensing.

- Lori Miles-Olund, president of Miles Fiberglass & Composites in Clackamas, Oregon, explained the benefits for her company: “We were able to purchase new equipment that not only made our production more environmentally friendly but also safer and more efficient for employees.”

- Colin Murphy, president and owner of Simmons Knife & Saw in Glendale Heights, Illinois, emphasized how critical full expensing is for global competitiveness: “To remain competitive, we need to continually innovate and consistently invest in new machinery and equipment. But with rising tax bills, it’s becoming harder to do so.”

Delayed investments: Some manufacturers are holding off on equipment purchases due to the uncertain tax landscape.

- “I know exactly where the next capital investment should be installed, but I’ve been delaying this decision,” said Courtney Silver, president and owner of Ketchie in Concord, North Carolina. “[Full expensing] dropped to 60% [in 2024], and the fact that I can’t expense the full value of this investment changes the return on investment calculation.”

- In Hodgkins, Illinois, Pioneer Service recently moved from a 24,000-square-foot building to a 62,000-square-foot building, but it can’t take advantage of all this space without full capital equipment expensing. “We had 13 more machines on order that we’ve put a hold on,” explained CEO and Co-Owner Aneesa Muthana. “Thirteen machines equivalent to about $5 million in capital, and that’s completely on hold until we know what’s going to happen next.”

Calling on Congress: If Congress does not act, accelerated depreciation will be entirely absent from the U.S. tax code for the first time in decades. “This isn’t just about numbers on my financial statements and my tax returns—this is about taking care of people here and in communities across this country working for small manufacturers,” said Silver.

- “Congress must act now to support American manufacturers,” said Murphy. “Our ability to invest in our communities, create jobs and innovate is at risk.”

Rep. Miller-Meeks Calls for PBM Reform at Cemen Tech

Rep. Mariannette Miller-Meeks (R-IA) visited Cemen Tech in Indianola, Iowa, for an employee town hall about how pharmacy benefit managers increase prices for manufacturing workers.

The event, hosted by Cemen Tech Chief Financial Officer Josh Maurer, allowed workers to engage directly with Rep. Miller-Meeks on the affordability of their health care, including prescription medicines.

The issue: The town hall focused on the need to reform PBMs, underregulated middlemen that drive up the costs of prescription medicines for manufacturers like Cemen Tech, the world’s largest manufacturer of on-demand concrete mixing equipment.

- Rep. Miller-Meeks discussed the DRUG Act, NAM-supported legislation that she introduced, which seeks to lower health care costs by delinking PBMs’ compensation from the list price of medicines—removing their incentive to push for higher prices.

- “PBMs distort the market, increasing the cost of prescription drugs for businesses and their workers,” Rep. Miller-Meeks explained. “That’s why I’m working in Congress to pass PBM reform that reins in these powerful actors.”

Manufacturers’ concerns: “We’ve seen health care expenses skyrocket, and a big part of that is due to the lack of transparency surrounding PBMs,” Maurer said during the town hall.

- “Cemen Tech and other small manufacturers like us are committed to providing affordable health care to employees, but it’s becoming increasingly difficult. PBM reform that addresses these rising costs is absolutely necessary.”

Addressing employee concerns: Cemen Tech employees also spoke about their struggles with the growing burden of health care costs across the board. Rep. Miller-Meeks explained that her proposed reform would have far-reaching effects: “It’s not only about reducing drug prices—it’s about ensuring that businesses can afford to continue providing health care benefits to their workers,” she said.

NAM in action: In addition to supporting the “delinking” provisions in the DRUG Act, the NAM is working with Congress on legislation to make PBMs’ opaque business practices more transparent and to ensure that savings from rebates are passed directly to manufacturers and their workers rather than being pocketed by PBMs.

The bottom line: “Manufacturers like Cemen Tech are essential to our economy, and ensuring they can thrive means addressing the rising costs of health care,” said Rep. Miller-Meeks. “PBM reform will free up manufacturers to do what they do best—build facilities, develop new product lines, increase wages and benefits and help the American economy grow.”

Department of Energy’s LNG Export Pause Puts 900,000 Jobs at Risk According to New Research

Economic Cost Could Exceed $216 Billion, Climate Goals At Risk

Washington, D.C. – As the Biden administration continues its efforts to boost the availability of clean energy in the United States and around the world, an ongoing pause in liquefied natural gas export licenses threatens economic stability as well as progress made by manufacturers in America. A staggering 900,000 jobs could be at risk according to a new study released today by the National Association of Manufacturers.

“With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential. LNG exports also play a key role in meeting clean energy goals. But clamping down on our energy sector unnecessarily puts jobs and economic growth at risk, while pushing other nations to use higher emissions alternatives,” said NAM President and CEO Jay Timmons. “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

Conducted in partnership with PwC, the analysis uses the government’s own projections to conclude that robust LNG export activities could contribute up to $216 billion to U.S. GDP and generate $46 billion in tax revenue in 2044 if projects proceed as planned. A pause on LNG exports threatens these gains.

Timmons added, “The Biden administration’s ill-advised decision to stop LNG exports could cost Americans dearly, while leaving our geopolitical allies—particularly in Europe—out in the cold. The data is clear: halting LNG export licenses puts nearly a million jobs at risk. The LNG freeze also deprives us of an important tool of soft power to bolster trading partners who share our values. This study provides policymakers—present and future—a clear path to create jobs and hundreds of billions of dollars in economic growth by harnessing America’s abundant supply of LNG.”

Current Economic Benefits by the Numbers:

- Job creation: U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- Economic output: The LNG industry contributes $43.8 billion to U.S. GDP.

- Tax revenue: Federal, state and local governments receive $11.0 billion in tax revenues, thanks to U.S. LNG exports.

Future Benefits Undermined by an LNG Export Ban:

- Jobs threatened: Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk if the ban on U.S. LNG exports continues through 2044.

- The economic fallout: An LNG export ban would stifle between $122.5 billion and $215.7 billion in annual contributions to U.S. GDP during the same period.

- Communities shortchanged: Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM: Biden’s LNG Ban Threatens 900,000 Jobs

The liquefied natural gas export industry has turned the U.S. into a powerhouse of cleaner energy, benefiting its trading partners around the world. The Biden administration’s ongoing ban on new LNG export licenses, however, is throttling an industry that could produce many more billions in revenue and a startling 900,000 jobs by 2044.

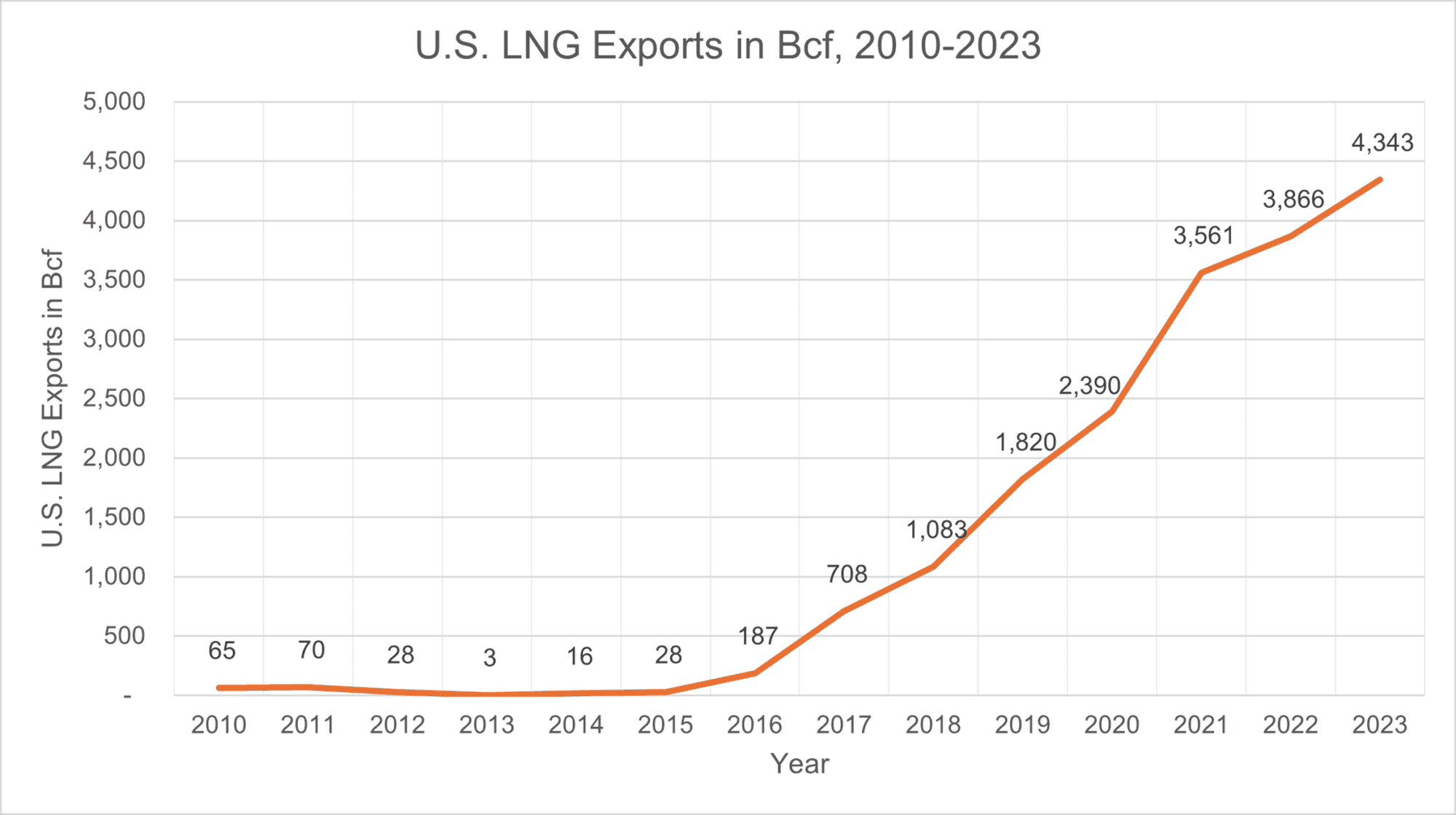

The data: A new study from the NAM and PwC shows that the U.S. LNG revolution could extend its upward climb, as shown on the graph above. Today, the industry is a huge source of jobs and profit:

- U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- The LNG industry contributes $43.8 billion to U.S. GDP.

- And lastly, federal, state and local governments receive $11.0 billion in tax and royalty revenues, thanks to U.S. LNG exports.

But that pales in comparison to the industry’s potential over the next two decades. The study projects the likely growth of the industry through 2044, showing all that is at stake if the ban remains in place until then:

- Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk.

- The ban would also stifle between $122.5 billion and $215.7 billion in contributions to U.S. GDP during the same period.

- Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

Public opinion: The American public is squarely behind the LNG export industry, showing overwhelming approval in an NAM poll taken in March.

- Eighty-seven percent of respondents agreed the U.S. should continue to export natural gas.

- Seventy-six percent of respondents agreed with building more energy infrastructure, such as port terminals.

The last word: “With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential,” said NAM President and CEO Jay Timmons.

- “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

Improving Medical Supply Chain Resiliency

Medical supply chains are critical to ensuring the health and security of Americans—and Congress should act to bolster their resiliency, the NAM told members of Congress this month.

What’s going on: “The COVID-19 pandemic brought to light the risks and instability resulting from concentration and choke points in medical supply chains, though the pandemic also showed how medical supply chains can quickly adjust to external shocks,” NAM Managing Vice President of Policy Chris Netram told Reps. Brad Wenstrup (R-OH), Blake Moore (R-UT) and August Pfluger (R-TX) in response to a request for information on how to improve medical supply chains.

What should be done: The NAM recommended that Congress should work with manufacturers “on a comprehensive approach to find ways to onshore, near-shore and friend-shore more of the medical supply chain,” Netram continued.

There are several actions the federal government should take to fortify medical supply chains, including:

- “[C]reating an environment where small businesses can continue to thrive” and where large companies can maintain their pandemic-era practices of “leveraging sources of domestic production when feasible, working with existing smaller suppliers to improve their reliability” and sourcing goods through new suppliers;

- Streamlining the Food and Drug Administration’s new-supplier certification process;

- Taking “creative steps to incentivize onshoring, near-shoring and friend-shoring, as opposed to imposing punitive or unworkable requirements to do so”;

- Passing the Medical Supply Chain Resiliency Act (H.R. 4307/S. 2115), which would authorize the president to strategically create new trade agreements specific to medical goods with our allies and partners;

- Strategically refining Section 301 tariffs on imports from China;

- Restoring “immediate research and development expensing and full expensing of capital equipment purchases,” ensuring “that the corporate tax rate does not exceed 21%” and making the pass-through deduction permanent; and

- Completing “reauthorization of the Workforce Innovation and Opportunity Act and expansion of Pell grant eligibility to short-term training programs,” as well as supporting solutions that incentivize companies to collaborate to reduce the manufacturing-worker shortage.

The bottom line: “[A]n approach that creates incentives that reduce the cost and complexity of moving supply chains can help U.S. manufacturers to be more resilient in the face of a future global crisis and better able to serve patients who depend on these products,” Netram said.