President Trump’s Proxy Firm Executive Order Will Protect Manufacturers and Main Street Investors

Washington, D.C. – Following the release of President Trump’s executive order to direct federal agencies to institute much-needed reforms to proxy advisory firms, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Manufacturers thank President Trump for taking action to rein in proxy advisory firms and depoliticize shareholder proposals—protecting manufacturers and Main Street investors alike. With Institutional Shareholder Services and Glass Lewis controlling 97% of the proxy advice market, manufacturers have long argued that these firms wield outsized, harmful influence on businesses—threatening growth and endangering shareholder returns.

“By directing federal agencies to protect manufacturers and Main Street investors from this duopoly, the president’s EO will increase transparency, reduce errors, mitigate conflicts of interest and depoliticize the proxy process. Manufacturers have been calling for these reforms for years, and we look forward to engaging with the SEC, DOL and FTC as they work to rein in these firms’ outsized influence.”

Background:

Following years of NAM advocacy, the SEC finalized a rule during the first Trump administration to rein in proxy firms; the rule was rescinded in 2021 following the change in presidential administrations.

Earlier this year, the NAM submitted detailed recommendations to the SEC of policies that would depoliticize the shareholder proposal process and provide meaningful oversight of proxy advisory firms. In November, the NAM released a new five-pager detailing specific steps Congress and the SEC should take to reform proxy firms and depoliticize corporate shareholder proposals.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

President Trump’s AI Executive Order Will Boost Innovation and Manufacturing Growth

Prevents Costly 50-State Regulatory Patchwork

Washington, D.C. – In response to President Trump’s executive order on state regulation of artificial intelligence, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“As the president demonstrates his commitment to both advancing American technological dominance and bolstering investment in manufacturing, he is rightly recognizing that winning the global race for AI hinges on getting AI policy right, which means avoiding a cumbersome 50-state patchwork of laws and regulations that would throttle interstate commerce, stifle innovation, limit AI adoption and erode America’s competitive edge.

“As we laid out in ‘Manufacturing’s Roadmap to AI and Energy Dominance,’ policymakers should review existing laws and regulations to identify barriers to innovation, ensure context-specific rules, encourage transparency and ensure a level playing field for developers and manufacturers alike. AI innovations are already transforming shop floors across the country. Fifty-one percent of manufacturers surveyed by the Manufacturing Leadership Council already have embedded AI in their operations, and 80% expect it to be essential for their operations by 2030.

“Manufacturers support the administration’s approach toward avoiding a 50-state patchwork that would prevent America from winning the global AI race. Instead of a complex, costly and burdensome patchwork, manufacturers back tailored rules that narrowly target specific use-cases and well-identified risks without diminishing the potential breakthroughs and economic impact that could be harnessed by American innovators. We encourage Congress to emulate the president’s risk-based approach with legislation that will codify his administration’s vision of a streamlined and nimble AI agenda to support competition and American innovation.”

-NAM-

Manufacturers Call for “12 Days of Permitting Reform” on Capitol Hill

Washington, D.C. – As the House considers critical permitting reform legislation before year’s end, manufacturers are urging House members to support commonsense reforms.

“The next two weeks in the House are going to be crucial to moving the needle on comprehensive, bipartisan permitting reform,” said National Association of Manufacturers President and CEO Jay Timmons. “In the spirit of the holiday season, we are calling for legislative action during this year-end work window to deliver a gift of a new, workable permitting system that will fuel America’s manufacturers. Over the next 12 days, the House is primed to tackle comprehensive permitting reform, which will boost American competitiveness and unlock greater investments in manufacturing in America.”

This week, manufacturers are urging House members to vote “yes” on the PERMIT Act. This legislation adopts the NAM’s key recommendations for modernizing the Clean Water Act—reforms that increase certainty for permittees, clarify the scope of the CWA and address bottlenecks that have delayed job-creating projects.

Manufacturers this week are also pressing for “yes” votes on the Improving Interagency Coordination for Pipeline Reviews Act, the ePermit Act and the Electric Supply Chain Act—all of which are critical to achieving manufacturers’ vision of energy and AI dominance.

As for next week, the House is planning to vote on the SPEED Act. This legislation is a cornerstone of Manufacturing’s Roadmap to AI and Energy Dominance, the NAM’s blueprint for securing America’s energy and AI leadership. By appropriately shortening environmental review timelines, limiting regulatory and legal uncertainty, expanding categorial exclusions, preventing duplicative reviews and reinforcing recent Supreme Court precedent on the scope of the National Environmental Policy Act, the SPEED Act will accelerate projects essential to meeting rising power demand and lowering energy costs.

Manufacturers also strongly back the Energy and Commerce Committee’s Environment Subcommittee action to advance key legislation to reform the Clean Air Act. From modernizing the New Source Review and National Ambient Air Quality Standards programs, to improving how the Environmental Protection Agency deals with wildfires and international emissions, these bills are integral to comprehensive permitting reform so manufacturers can get shovels in the ground quicker to expand investments and jobs.

“Congress has an opportunity over the next 12 days to demonstrate strong, bipartisan momentum on comprehensive permitting reform for America’s manufacturers. Manufacturers urge policymakers to seize the moment—pass the PERMIT Act and companion bills this week and the SPEED Act next week—and make it easier and more cost-efficient for manufacturers to get shovels in the ground on job-creating projects,” said Timmons.

Timmons added, “Permitting reform will strengthen manufacturing in America. To turn this holiday package into real progress for the country, the Senate must take up the mantle in the new year and advance comprehensive permitting reforms that will empower manufacturers across the country to compete, invest and grow.”

Background:

Manufacturers have been building the case for commonsense permitting reform as part of a comprehensive manufacturing strategy to unleash investment, strengthen our energy future and cement U.S. leadership in emerging technologies, including AI. Eighty percent of manufacturers say the length and complexity of the permitting process is harmful to increasing investment, 87% say they would expand operations, hire more workers or increase wages and benefits if permitting were streamlined, and 68% of manufacturers with permittable projects say they could expand more quickly with a modernized federal permitting system.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers Welcome Interior’s Offshore Leasing Plan to Unleash American Energy Dominance

Washington, D.C. – Following the Department of the Interior’s announcement today of a new offshore leasing program, National Association of Manufacturers Managing Vice President of Policy Charles Crain released the following statement:

“Manufacturers welcome the Department of the Interior’s plan to expand offshore oil and gas development. Secretary of the Interior Doug Burgum is taking a critical step to unleash American energy dominance and drive down energy prices. Today’s action also underscores the need to advance streamlined, durable permitting reform that ensures new energy projects can move forward quickly while protecting the environment.”

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

ICYMI: NAM’s Charles Crain Testifies Before House Small Business Committee

Washington, D.C. – Today, National Association of Manufacturers Managing Vice President of Policy Charles Crain testified before the House Small Business Committee at its hearing, “Made in the USA: How Main Street Is Revitalizing Domestic Manufacturing.”

In his testimony, Crain thanked the Small Business Committee for its leadership on the recent tax reform package, which made pro-growth, pro-manufacturing tax policy a permanent part of the tax code, giving small and medium-sized manufacturers much-needed certainty. However, by addressing other ongoing challenges, Congress can strengthen and protect the success of H.R. 1.

In his opening remarks, Crain outlined the opportunities:

“Congress and the administration can pursue what we’ve called a ‘comprehensive manufacturing strategy.’

- That means rebalancing unworkable regulations and reforming America’s broken permitting process;

- It means investing in our nation’s infrastructure and supporting American energy dominance;

- It means providing trade certainty that empowers manufacturers to make things in America;

- And it means investing in the manufacturing workforce of the future.

“We need all of these policies to build on the success of tax reform, to unlock small manufacturing growth and to drive a true manufacturing renaissance.”

He closed his remarks by encouraging the committee to build on this year’s success:

“This is the road to a manufacturing renaissance. It runs through a comprehensive manufacturing strategy—ensuring that all parts of the federal government are rowing in the same direction: toward an empowered, emboldened, exceptional manufacturing industry.

“Backed by the right policy choices, small manufacturers will deliver—for our communities, for our country and for our preeminence on the world stage.

“Because when manufacturing wins, America wins.”

Read Crain’s full written testimony here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

New NAM Roadmap Ties America’s AI and Energy Future to Urgent Need for Permitting Reform

WASHINGTON, D.C.— The National Association of Manufacturers today released Manufacturing’s Roadmap to AI and Energy Dominance, a blueprint outlining the steps policymakers must take to strengthen America’s energy and artificial intelligence dominance—including comprehensive permitting reform.

Manufacturers are leading the way—integrating AI into every part of their operations, from product design, to shop floor operations, to supply chain management. More than half of manufacturers (51%) already use AI, and 80% say it will be essential to grow or even maintain their business by 2030, according to the Manufacturing Leadership Council, the digital transformation division of the NAM.

The roadmap lays out principles that will advance U.S. energy production and, in turn, unlock the full potential of AI. AI is transforming manufacturing—but without abundant, affordable energy and a resilient and reliable power grid, America risks falling behind. AI-powered modern manufacturing depends on an ambitious energy and innovation policy framework—which can be achieved in part by reforms to America’s broken permitting system.

“Manufacturing sits at the crossroads of America’s energy dominance, AI leadership and the strength of our power grid,” said NAM President and CEO Jay Timmons. “If America wants to win the global race for AI, we must first win on energy. That means advancing the administration’s goals for energy dominance—through bipartisan, comprehensive permitting reform, modernized infrastructure and an all-of-the-above energy strategy that allows manufacturers to innovate, build and grow right here at home.”

AI-powered manufacturing depends on forward-looking energy and innovation policies. Policymakers must do the following:

- Reform America’s broken permitting process to get shovels in the ground faster—with fewer delays and less uncertainty. Eighty percent of manufacturers say that the length and complexity of the permitting process is harmful to increasing investment.

- Bolster American energy dominance. America’s energy demand is surging—and the pace isn’t slowing. Manufacturers need to be able to produce and use every energy source available to meet this critical moment. Ninety-four percent of manufacturers support permitting reforms around the buildout of energy generation, infrastructure and products.

- Ensure a reliable, resilient and affordable grid that can power manufacturing growth and data center operations. Eighty percent of manufacturers want the Trump administration to work with Congress to deliver comprehensive permitting reform legislation to increase energy generation and grid modernization to supply the energy needed to power both AI growth and traditional manufacturing.

- Strengthen American AI leadership by fostering innovation and preventing regulatory overreach. Eighty-seven percent of manufacturers say it is important for lawmakers to understand how manufacturers use AI.

Read the full roadmap here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

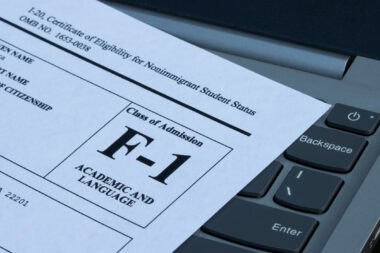

DHS Should Reconsider Proposed F-1 Visa Changes

With nearly 400,000 jobs open across the sector, the manufacturing industry in the U.S. needs ongoing access to a robust pipeline of skilled workers—but changes proposed to the F-1 student visa by the Department of Homeland Security threaten to reduce the talent in that pipeline, the NAM said recently.

What’s going on: “The F-1 visa … through its Curricular Practical Training (“CPT”) and Optional Practical Training (“OPT”) and STEM OPT options is a major source of high-skilled talent for the manufacturing industry in the U.S.,” the NAM told DHS in response to the agency’s draft reforms to the visa program.

- “[T]he proposed rule would impose changes that risk diminishing the appeal of an American education, making it harder for students to transition into careers that strengthen U.S. manufacturing. This would have a negative impact on the growth and international competitiveness of manufacturing in the United States, which is at odds with President Trump’s objective to bolster the domestic industry.”

What’s at stake: The primary change under consideration “is the switch of F-1 student visas from a duration of status (“D/S”) that remains in effect for as long as the student is enrolled in an academic program to a fixed time period that corresponds to the program’s length but cannot exceed four years.”

- “This would significantly diminish the attractiveness of U.S. universities for prospective international students, because it is at odds with the length of time that many if not most students take … to actually earn their degrees.”

- That change would also make it harder for international students to secure OPT or STEM OPT extensions, in turn inhibiting their “transition into the U.S. manufacturing workforce.”

Why it matters: “These proposed changes … would weaken manufacturers’ access to a plentiful pool of elite global talent upon which we depend to fulfill President Trump’s vision for a manufacturing renaissance in America,” the NAM concluded.

NAM to SEC: Prioritize Capital Formation and Regulatory Rebalancing

In recent years, the Securities and Exchange Commission has moved away from its charter to “facilitate capital formation, protect investors and maintain efficient markets”—but it can return to its original mission by adopting a series of reforms suggested by the NAM.

What’s going on: Following the SEC’s recent release of an updated regulatory agenda, the NAM submitted a 23-page letter with detailed recommendations for rightsizing regulatory burdens and supporting capital formation for manufacturers.

- Over the next six months, the SEC plans to propose rulemakings on shareholder proposal modernization, the simplification of filer status for reporting companies and the rationalization of disclosure practices.

- The NAM made specific recommendations for those rulemakings and suggested additional reforms for the SEC to consider.

What we said: To foster “growth at companies of all sizes,” the NAM suggested the SEC should adopt reforms to:

- Promote capital formation and improve the regulatory environment for IPO companies and smaller manufacturers, including a reduction in Sarbanes-Oxley Act audit attestation burdens;

- Depoliticize the shareholder proposal process by allowing the exclusion of environmental, social and political proposals unless they are material to a company;

- Provide meaningful oversight of proxy advisory firms, which continue to exercise outsized influence over public companies and their shareholders—despite the firms’ inflexible policies, lack of transparency and glaring conflicts of interest;

- Increase ownership transparency to improve investor outreach by public companies; and

- Consider additional changes to existing rules, including rescinding stringent rules on the reporting of cybersecurity incidents, scaling back conflict minerals disclosure requirements and modernizing executive compensation rules.

Why it’s important: Taking these steps will “prioritize capital formation and create a more hospitable environment for public companies,” the NAM told the SEC.

Shutdown Watch: What to Know Right Now

As the federal government shutdown moves into its second week, there’s no sign of “political or practical consequences that would create enough pressure to break the impasse” (The Wall Street Journal, subscription).

What’s going on: “All signs point to another week of posturing and repeat Senate votes that fail to get the 60 votes needed to reopen the government. Congressional leaders in both parties insist that they have the upper hand and that the other side bears the blame for the shutdown.”

The background: Funding for much of the federal government lapsed on Sept. 30 just ahead of the new fiscal year that started on Oct. 1.

- A House-passed measure to extend current funding levels to mid-November is stalled in the Senate.

- House members left Washington Sept. 19 and have yet to return.

What could be next: Agencies could begin federal worker layoffs if negotiations stall. But “two labor unions have filed a legal challenge to the possible mass firings,” and some scholars have questioned the legality of such terminations during a shutdown.

The effects so far: “[H]undreds of thousands of federal workers have been furloughed and others are working without pay. The Bureau of Labor Statistics didn’t release the monthly jobs report on its usual schedule. Some government-funded facilities, including the National Arboretum and National Gallery of Art in Washington, closed to the public.”

- Other functions, including Social Security payments, are continuing as usual.

What could be coming: If not resolved by midmonth, the shutdown will start “weighing on consumer spending and economic growth,” as federal workers will begin foregoing paychecks.

Questions and concerns: If your operations have been impacted, please reach out to your NAM membership representative.

CDC Committee Recommends Changes to Childhood Vaccine Schedule

Late last week, the Advisory Committee for Immunization Practices, which advises the Centers for Disease Control on vaccine safety and efficacy, recommended changes to the childhood vaccine schedule.

What’s going on: ACIP voted on a recommendation that children age 4 and under no longer receive the combined measles-mumps-rubella-varicella vaccine but instead receive two separate shots: one to vaccinate against measles, mumps, and rubella, and a separate varicella (chickenpox) shot.

Why it matters: The Vaccines for Children Program, and other federal health programs such as Medicaid, use ACIP recommendations to determine vaccine coverage. The committee’s vote—assuming the CDC director approves the recommendation, which is expected—means that these programs likely will no longer cover the MMRV shot for children under the age of 4.

- The combined MMRV vaccine has been proven safe and effective, according to the CDC itself.

- The vote also means private health insurers are no longer required to cover these vaccines. However, America’s Health Insurance Plans (AHIP) said its members will continue coverage of these and other previously recommended vaccines through the end of 2026.

What’s next: Acting CDC Director Jim O’Neill must approve ACIP’s recommendations. In the past, CDC directors have almost always taken recommendations from ACIP.

- Some states, including California, Colorado, Oregon, Nevada, and Washington, have issued their own guidance in an attempt to maintain access to these vaccines.

The NAM says: “Vaccines have revolutionized public health, saved millions from serious and deadly illnesses, and insulated our economy from destabilizing epidemics,” said NAM Vice President of Domestic Policy Jake Kuhns. “Continued access to immunizations is important to help keep manufacturing workers and their families safe and healthy.”