Q&A: Rep. Graves on Infrastructure and Transportation

The NAM recently interviewed Rep. Sam Graves (R-MO), chairman of the Transportation and Infrastructure Committee, about the surface transportation reauthorization bill and the importance of infrastructure to manufacturers nationwide. Here is the full text.

What are your priorities in the upcoming infrastructure bill to help drive manufacturing growth in the United States?

“Manufacturing, like every other aspect of our economy, depends on a strong transportation system and infrastructure. President Trump has prioritized bringing manufacturing back to the United States, and he’s already seen significant success. As chairman of the Transportation and Infrastructure Committee, I’m working to make sure we have an efficient, safe and reliable infrastructure that supports and facilitates the growth of manufacturing in the United States. The best way to do that is by passing a bill that focuses on building the infrastructure needed to move goods and people safely and efficiently. The next surface transportation reauthorization bill will focus on hard infrastructure, such as roads and bridges.

“Another main priority of mine is fixing the Highway Trust Fund, which serves as the main funding source at the federal level for road and bridge projects. We must address the solvency challenges facing the Highway Trust Fund and preserve our user-pays system. Right now, that system is broken, and it has been for some time. The best way to provide long-term certainty is to finally begin shoring up the Highway Trust Fund and ensuring that all users are paying into the system.

“Additionally, this bill is about looking forward and building an infrastructure for the future. Anticipating the transportation and infrastructure needs of the next 20 years is the best way to support economic growth and help our manufacturers as their industry continues to evolve.”

Why is it important that Congress pass a surface transportation reauthorization bill this year?

“The surface transportation reauthorization bill impacts all Americans—we all use or rely on roads, bridges and rails. Traditionally, this legislation provides tens of billions of dollars in annual funding to improve American highways, bridges, transit and other surface transportation infrastructure. It also provides funding for rail, trucking safety and other transportation programs.

“Surface transportation bills typically expire after five years. That multiyear time frame gives states the long-term funding certainty they need to plan and carry out many of their most critical projects. The current highway bill, which was part of the Infrastructure Investment and Jobs Act, expires on Sept. 30, 2026. Unless Congress acts before then, federal programs will be impacted, including that long-term certainty. This is unacceptable, and I’m committed to getting the next surface bill done on time and preventing potential project delays and uncertainty that can result from a lapse in long-term funding.”

How does investing in infrastructure benefit the people and manufacturers in your state/district?

“I represent all of North Missouri. Investing in our roads has never been more important for the future of our communities, large and small. For manufacturers to succeed, as well as to attract new companies, we’ve got to have good infrastructure. It’s critical for shipping Missouri-made products across the country, for receiving inputs and for farmers getting goods to market. As we work to bring manufacturing back to the United States, my district and many others see an opportunity to grow their local economy. To make that happen, we have to maintain and improve our infrastructure across the country.”

Why is the NAM’s leadership on this issue so critical to getting an infrastructure bill done this year?

“The NAM has over 14,000 members from every sector of manufacturing. The United States depends on a strong manufacturing industry, and the NAM provides a voice for our manufacturers, large and small. They are truly at the center of manufacturing in this country. So, when it comes to getting an infrastructure bill of this size done, we need to hear from all industries, especially our manufacturers. Whether it’s in the early stages of crafting the bill when we’re looking for feedback on existing policy and asking for priorities from the manufacturing industry—and we appreciate the NAM’s efforts in that process—or after the bill has been introduced and is working its way through the legislative process, organizations like the NAM have an important role in getting information out there about what the bill does and how it will benefit the country.”

ICYMI: “Ketchie CEO Credits Trump’s ‘Beautiful Bill’ with Helping Her Machine Shop Prosper”

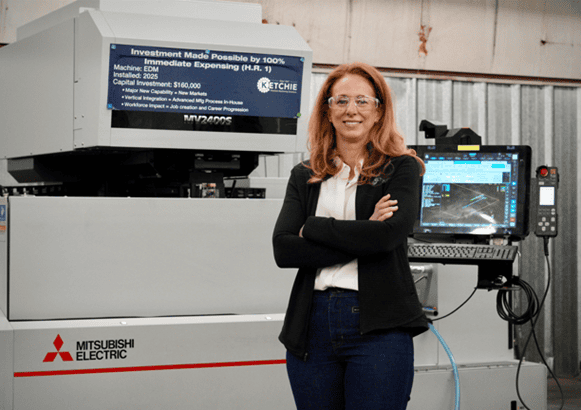

Washington, D.C. – As part of the 2026 National Association of Manufacturers State of Manufacturing Tour, Ketchie President and Owner Courtney Silver hosted the NAM for a discussion on how tax certainty due to the NAM-backed H.R. 1 has empowered manufacturers like her to reinvest in their workforce and facilities.

The tour stop was covered by Business North Carolina. Excerpts of the report can be found below. Bolding has been added.

—-

Ketchie CEO credits Trump’s ‘beautiful bill’ with helping her machine shop prosper

Business North Carolina

Kevin Ellis

Feb. 23, 2026

https://businessnc.com/ketchie-ceo-credits-trumps-beautiful-bill-with-helping-her-machine-shop-prosper/

Miguel Carrillo describes himself as a “machine nerd,” and he had an engaged audience on Monday watching him operate a $700,000 device brought in last year to Concord-based Ketchie, the machine shop where he works.

Ketchie may only have 20 employees, but it was a stop on the State of Manufacturing Tour that National Association of Manufacturers President Jay Timmons began last week in Cleveland and will continue across the country after visiting three Charlotte-area sites on Monday. Tagging along with Timmons at Ketchie was Acting Deputy Secretary of the U.S. Treasury Derek Theurer, U.S. Rep. Tim Moore of Cleveland County and NC Chamber President Gary Salamido.

Ketchie CEO Courtney Silver was a supporter of the “One Big Beautiful Bill,” the legislation signed into law last year by President Donald Trump. She testified at congressional hearings before its passage about how it would help small businesses. Timmons said he had heard so much about Ketchie’s new machines, he wanted to see them in action.

The tax bill that eliminates income tax on overtime and tips for some workers also allows businesses to reduce their tax bills on investments immediately, rather than spreading the reduction out over several years, says Silver.

“When you can expense an investment in the year it was purchased, it provides cash flow to companies and continues to allow them to make new investments,” says Silver.

Ketchie purchased three machines last year that combined cost more than $1.1 million, plus made about $400,000 in other investments, including AI software that has cut some hour-long processes down to five minutes.

“I would have never made those investments without immediate expensing,” Silver says. She says she’s also looking to add five workers to her shop.

“This is a perfect example of what you can do to help build America and American manufacturing with the right policies in place,” says Timmons.

Theurer said it was nice to see advanced manufacturing take place in a North Carolina factory rather than spending his day on policy in the nation’s capital.

“This type of investment is what we intended to see when we made our big tax policy and worked for smarter regulation,” said Theurer.

…

Ketchie supplies metal parts to railroad, aerospace and heavy industry manufacturers, such as Charlotte steelmaker Nucor, Davidson-based HVAC company Trane and Norfolk Southern. The company was started in 1947 by Edgar Ketchie, the grandfather of Silver’s late husband.

On Monday, Carrillo was machining a steel part needed by an industrial recycling company. The Dual Spindle 5-Axis Machining Center that Ketchie bought last year doesn’t require Carrillo to reset the machine for the other side of the metal part, which is about half the size of a deck of cards, but grooved. It means quicker production and fewer human errors, he says.

“It allows me to step out and allows the machine to do the heavy lifting,” says Carillo. The advanced manufacturing aspect attracted the 2024 graduate of A.L. Brown High School to work at Ketchie after starting in a job shadowing program while a high school junior. “It’s nice when a machine can do one thing, but it’s really nice when a machine can do a lot of things.”

…

—-

Background

Learn more about Silver’s testimony before Congress in 2025 on the importance of preserving the pro-manufacturing policies of the Tax Cuts and Jobs Act here.

KEY FACTS: If Congress had failed to preserve tax reform in 2025, the U.S. would have risked:

- 5.9 million lost jobs;

- A $540 billion reduction in employee compensation; and

- A $1.1 trillion shortfall in U.S. GDP.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers on U.S. Military Operations in Iran

PHOENIX – Following the announcement of the United States military operations in Iran, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Manufacturers in the United States have always stood ready when our nation calls. From serving as the Arsenal of Democracy to equipping those who defend freedom today, our industry has the capacity to support U.S. objectives across multiple theaters and sustained operations. Today, manufacturers honor the courage and commitment of the men and women in uniform who stand watch and carry out this mission.

“Since November 4, 1979, the United States has endured hostility and terrorism from a rogue government in Tehran. Time and again, the Iranian regime has sponsored international terrorism, destabilized its region, violated the rights of its own people and disrupted legitimate commerce and maritime security.

“Through Operation Epic Fury, President Trump has initiated major combat operations with these stated objectives:

- Eliminating imminent threats posed by the regime,

- Preventing Iran from developing nuclear weapons,

- Neutralizing military infrastructure that threatens regional and global security,

- Countering destabilizing regional aggression, and

- Supporting the Iranian people’s right to determine their own future.

“At moments of consequence, national unity matters. Congress should fully engage to ensure clarity of mission, alignment of authority and the sustained support of the American people.

“We also call upon allied governments and partner business associations around the globe to stand together to protect regional stability, safeguard global commerce and reinforce the collective resolve that keeps peace through credible strength.

“When security, commerce and liberty are threatened, the United States must lead with strength, resolve and the support of its people.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM Wraps National Tour in Phoenix Urging Action on Infrastructure and Permitting Reform

2026 NAM State of Manufacturing Tour Makes Final Stop in Phoenix, Arizona

PHOENIX – The National Association of Manufacturers, official partner of America250, concluded its 2026 NAM State of Manufacturing Tour in Phoenix under the theme “Building for the Future.”

After 10 days on a cross-country tour, manufacturing leaders delivered a final, urgent message: the time is now for Congress to pass robust infrastructure investments and commonsense, comprehensive permitting reform.

“Arizona shows what happens when competitiveness leads,” said NAM President and CEO Jay Timmons. “It didn’t happen by chance—it happened because this state has chosen to lead on taxes, workforce and a business climate. But even here, federal permitting delays threaten progress. If we’re serious about semiconductors, critical minerals and energy infrastructure, it’s time to build the next generation of robust infrastructure we need, and 2026 must be the year of permitting reform.”

In Phoenix, the NAM partnered with the Arizona Chamber of Commerce & Industry for a full day of events highlighting the state’s leadership in industrial growth. The visit began with a roundtable discussion on permitting reform with business and community leaders, followed by tours of EMD Electronics—a trusted partner to the semiconductor industry—and Four Peaks Brewery, the largest and oldest craft brewery in Arizona. Together, the stops showcased the diverse reach of manufacturing in the state— from critical minerals and semiconductors to food and beverage production.

“Arizona has proven that smart policy and regulatory clarity drive investment and growth. But at the federal level, permitting delays are slowing projects that matter to our economy and national security,” said Arizona Chamber of Commerce & Industry President and CEO Danny Seiden. “If America wants to lead in advanced manufacturing, we need a system that is predictable, efficient, and built for today’s demands. We’re proud to partner with the NAM to advance practical reforms that strengthen U.S. competitiveness.”

“Arizona has become a premier destination for semiconductor manufacturing, and we’re proud to be part of that dynamic and growing ecosystem,” said Katherine Dei Cas, Executive Vice President, EMD Electronics, the Electronics business of Merck KGaA, Darmstadt, Germany. “We continue to invest in our capabilities and our people while ensuring continued proximity to customers to enable the operational excellence required in advanced manufacturing. Strong collaboration among industry, community, and government partners is essential to sustaining this momentum and ensuring semiconductor innovation.”

Spanning seven states—New York, Ohio, Pennsylvania, North Carolina, Wisconsin, Texas and Arizona—, the tour brought together manufacturing leaders, workers, educators, students and elected officials to highlight the policies and conditions needed for the United States to compete and win in a global economy, —focusing on innovation, tax policy, permitting reform, energy dominance, workforce and trade policy.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.953 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Powering the Future: Manufacturers Spotlight Energy Leadership and Infrastructure at Schneider Electric, Port of Houston

2026 NAM State of Manufacturing Tour Stops in Houston, Texas

HOUSTON – The National Association of Manufacturers, official partner of America250, continued its 2026 NAM State of Manufacturing Tour today in Houston, Texas, under the theme, “Powering the Future.” Throughout the day, leaders underscored how abundant, affordable energy and modern infrastructure is essential to a competitive manufacturing sector.

In Houston, the NAM partnered with the Greater Houston Partnership to highlight the region’s manufacturing strength, where nearly 1 million workers power a sector representing 7% of the Texas workforce. NAM President and CEO Jay Timmons, Executive Vice President Erin Streeter and other NAM leaders began the day at global energy technology leader Schneider Electric—an official tour sponsor alongside NTT DATA—for a visit to its newly opened 10,500 square foot Innovation Center, one of the world’s largest energy innovation hubs. The day concluded with a tour of Port Houston’s Bayport Container Terminal, demonstrating how modern trade infrastructure underpins domestic production and global leadership and the importance of the Port’s role as a global logistics hub to connect port infrastructure, manufacturing exports and supply chain resilience to national growth.

At Port Houston’s Bayport Container Terminal, leaders saw firsthand how world-class trade infrastructure fuels domestic production and reinforces America’s global competitiveness. As one of the nation’s most vital logistics gateways, the Port plays a critical role in connecting port infrastructure to manufacturing exports, strengthening supply chain resilience and driving national economic growth.

“Today’s tour stop was about powering the future—and there is no better place to have that conversation than Houston, the Energy Capital of the World,” said NAM President and CEO Jay Timmons. “Schneider Electric is a pioneer and a powerhouse for innovation and for the manufacturing sector. You cannot talk about the state of manufacturing in the United States without talking about the innovation and leadership right here at Schneider. And at the Port Houston’s Bayport Terminal, we saw why modern infrastructure is critical to moving American-made goods quickly and efficiently. If we want to lead the world in manufacturing, AI and advanced technologies, we need an all-of-the-above energy strategy that keeps prices affordable, strengthens our grid and accelerates permitting reform and we must invest in 21st century infrastructure—from roads and bridges to ports, rail and waterways—so that manufacturers can make things right here and move them everywhere. When Washington delivers smart energy policy and modern infrastructure, we unlock the greatest manufacturing era in our nation’s history.”

“Hosting the NAM and supporting its U.S. tour reflects our shared commitment to advancing energy technology innovations in this country,” said Andre Marino, Schneider Electric Senior Vice President, Industrial Automation North America. “Houston is home to the global energy conversation, and our Innovation Center here reflects our commitment to bring together electrification, automation, and industrial intelligence to enable smarter, more secure systems for our partners in Texas, across the U.S., and throughout the world.”

“We are honored to join the National Association of Manufacturers and our regional partners in highlighting Houston’s pivotal role in America’s supply chain,” said Port Houston CEO Charlie Jenkins, “Our commitment to investing in resilient infrastructure ensures the Houston Ship Channel remains a gateway for innovation, job creation, and global trade. By working together, we not only strengthen the economic vitality of our nation, our great state of Texas, and our region, but also reinforce Houston’s place at the forefront of U.S. manufacturing and logistics.”

From Houston, the 2026 NAM State of Manufacturing Tour heads west for its final stop— Phoenix, Arizona—on Friday, February 27, where leaders will focus on the urgent need to pass commonsense, comprehensive permitting reform. The tour made stops in New York, Ohio, Pennsylvania, North Carolina, Wisconsin, and Dallas, Texas prior to today’s events in Houston. Throughout the tour, the NAM has been meeting with policymakers, manufacturers of all sizes, students and business leaders, advocating for the people and policies that will ensure the United States is the best place in the world to do business. To learn more about the tour and the NAM’s mission, visit https://nam.org/stateofmfg/.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Building the Workforce of the Future: Manufacturers Spotlight Talent, Technology and Training in Dallas

2026 NAM State of Manufacturing Tour Stops in Dallas, Texas, for Manufacturing Institute’s State of the Manufacturing Workforce Address

DALLAS – The National Association of Manufacturers—the official partner of America250—continued its 2026 NAM State of Manufacturing Tour today in Dallas, Texas, under the theme “Building the Workforce of the Future.”

NAM President and CEO Jay Timmons, Manufacturing Institute President Carolyn Lee and Rockwell Automation Chairman and CEO and NAM Board Chair Blake Moret visited the Dallas College Garland Center and global leader in AI, digital business and technology services, NTT DATA, an official sponsor of the tour along with Schneider Electric. The stops today highlighted the challenges and opportunities shaping the future of manufacturing careers in America, while emphasizing the need for a highly skilled workforce to sustain innovation and economic growth.

In Texas, nearly 1 million manufacturing workers drive a sector that contributes hundreds of billions of dollars to the state’s economy, representing between 11% and 13% of economic output and making it one of the biggest manufacturing workforces in the nation.

Lee gave the MI’s annual State of the Manufacturing Workforce address at NTT DATA’s North American headquarters. “For years, manufacturers have said the same thing: if you want a strong economy, you need a strong manufacturing workforce,” she said. “If you want innovation that leads the world, you need people with the skills to put it to work. Workforce is not a side issue. It’s the strategy. We have the chance to harness creativity, unleash competitiveness and build a stronger future. But that future is not possible without our single greatest asset: the manufacturing workforce. We don’t just need people. We need talent. And that means our workforce needs the skills to succeed.”

Timmons convened a panel with Lee, NTT DATA Products Industries Global Leader and NAM board member Prasoon Saxena and Celanese Senior Vice President and Chief Information Officer Sameer Purao, focused on AI and the workforce. The event concluded with a site tour of NTT DATA’s innovation center, showcasing how technology is advancing the manufacturing industry in the AI era.

“The strength of manufacturing and the 13 million Americans who make things in this country depends on how seriously we invest in those workers and the millions who follow,” said Timmons who also serves as chair of the MI’s Board. “At this moment of inflection, transformative technology demands a new generation of skills. A rapidly evolving industry requires us to train, upskill and retain our people with greater urgency. Leaders in Washington have a responsibility to advance policies that strengthen our workforce. The MI champions those policies every day.”

“We are proud to host the NAM and Manufacturing Institute today,” said Saxena. “We know that manufacturing’s future will be defined by how effectively we integrate advanced technologies like AI with a highly skilled workforce. Industry 5.0 is our north star where data and AI with human expertise converge to create resilient, sustainable operations.”

The group also toured one of the MI’s FAME chapters in Texas, whose mission is to drive workforce development initiatives across the state. “Texas has led the way with FAME expansion in recent years—which is something we had the opportunity to see firsthand this morning,” said Lee. “Dallas College has been an outstanding educational partner, serving two chapters in Texas, the FAME Dallas Chapter and Metro360 Chapter. It is a model for how durable solutions for manufacturers can thrive with community cooperation.”

“We were honored to welcome the NAM and MI to Dallas College and to showcase the strength of our Texas FAME program,” said Dr. Veronique Tran of Dallas College. “Through FAME, we are creating a direct, employer-led pathway into high-skill, high-wage manufacturing careers—combining classroom instruction with paid, hands-on experience that prepares students to contribute from day one. We are grateful for the collaboration with the MI and appreciate their leadership in scaling solutions that strengthen our workforce.”

From Dallas, the 2026 NAM State of Manufacturing Tour will go on to Houston, Texas, and conclude on Friday, Feb. 27, in Phoenix, Arizona. The tour made stops in New York, Ohio, Pennsylvania, North Carolina and Wisconsin prior to today’s events in Dallas. Throughout the tour, the NAM will continue meeting with policymakers, manufacturers of all sizes, students and business leaders, advocating for the people and policies that will ensure the United States is the best place in the world to do business. To learn more about the tour and the NAM’s mission, visit https://nam.org/stateofmfg/, and to learn more about the State of the Manufacturing Workforce address, visit https://themanufacturinginstitute.org/state-of-mfg-workforce.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

–The MI-

The Manufacturing Institute works to build and strengthen the manufacturing workforce for individual opportunity, community prosperity and a competitive manufacturing industry for the future. This is done through implementing groundbreaking initiatives, convening industry leaders, conducting innovative research and promoting public policy that supports the sector as it meets the opportunity of modern manufacturing. As the 501(c)3 nonprofit workforce development and education affiliate of the National Association of Manufacturers, the MI is a trusted adviser to manufacturers, equipping them with solutions to address the toughest workforce issues. For more information on the MI, please visit www.themanufacturinginstitute.org.

-NTT DATA-

NTT DATA is a $30+ billion business and technology services leader, serving 75% of the Fortune Global 100. We are committed to accelerating client success and positively impacting society through responsible innovation. We are one of the world’s leading AI and digital infrastructure providers, with unmatched capabilities in enterprise-scale AI, cloud, security, connectivity, data centers and application services. Our consulting and industry solutions help organizations and society move confidently and sustainably into the digital future. As a Global Top Employer, we have experts in more than 70 countries. We also offer clients access to a robust ecosystem of innovation centers as well as established and start-up partners. NTT DATA is part of NTT Group, which invests over $3 billion each year in R&D.

NAM Report Highlights U.S. Leadership in Food Innovation

RACINE, Wis. – As the 2026 NAM State of Manufacturing Tour continued its cross-country run, the NAM today released “Manufacturers Feed America,” a new report detailing how the United States food and beverage supply chain is a global leader in delivering safe, affordable, accessible and nutritious food and beverage options.

Anchored in world-class science and rigorous safety standards, the American food system strengthens American communities, fuels innovation and drives economic growth nationwide. The report includes policy recommendations to help policymakers avoid undermining the system that ensures American families can count on safe, abundant and affordable food every day. Understanding the history of the U.S. food and beverage regulatory system through the lens of American manufacturing helps explain why it has succeeded and how that success can be put at risk by replacing evidence-based safeguards with ideological approaches

From the headquarters of industrial and agricultural equipment manufacturer CNH, NAM President and CEO Jay Timmons said:

“Food manufacturers are focused on affordability and are committed to keeping America’s food supply safe, reliable and nutritious. By investing in innovation and strengthening safety standards, they help ensure that nutritious food remains accessible to families in every community. A thriving food and beverage sector strengthens communities, supports jobs and drives economic growth. Maintaining U.S. leadership in this sector is essential to long-term economic growth, supply chain resilience and global competitiveness.

“Manufacturing powers the engine that feeds America — from farm to processing to packaging to distribution. America’s manufacturers are leading the world in these life-enhancing innovations, making America the best place to invest, create jobs and grow communities. But fragmented or ideology-driven proposals could increase costs for families, reduce access to food and slow innovation—without improving public health.”

The nation’s largest manufacturing sector—the food and beverage industry—connects farms to factory floors to family tables every day, supporting 47 million jobs, generating $2.8 trillion in wages and contributing $9.5 trillion in economic output. This economic engine touches every community in the country and is especially vital in rural and regional areas where food-and-agriculture-related jobs anchor local communities.

The report comes as recent legislative and regulatory proposals create new restrictions on food ingredients and packaging, creating an unworkable patchwork of regulations that threatens to drive up costs, weaken delicate supply chains and undermine the science-based standards that enable farmers and manufacturers to deliver safe, abundant and affordable food to Americans nationwide.

Manufacturers across the food and beverage supply chain will continue to partner with policymakers on policies that respect science and operational realities, so that the U.S. can deliver an even stronger food system that supports public health, economic growth and global competitiveness—bolstering America as the best place in the world to make things and empowering manufacturers’ efforts to nourish the American people for generations to come.

The NAM also launched a digital hub, complete with video testimonials from representatives of America’s food and beverage manufacturers at every step of the supply chain as well as policy papers with educational information about food and beverage policies and the challenges posed by inconsistent regulatory regimes and standards based on ideology rather than science. For more information, visit nam.org/issues/manufacturers-feed-america/

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

733 10th St. NW, Suite 700 • Washington, DC 20001 • (202) 637-3000

Manufacturers Spotlight AI, Advanced Technologies and America’s Strong Food and Beverage Supply Chain in Milwaukee

2026 NAM State of Manufacturing Tour Stops in Milwaukee, Wisconsin

MILWAUKEE – The National Association of Manufacturers—official partner of America250—in partnership with Wisconsin Manufacturers & Commerce, continued its 2026 NAM State of Manufacturing Tour today in Milwaukee, Wisconsin, under the theme “Creating the Future.” Today’s visits included Rockwell Automation, Komatsu Mining Group and CNH.

The Milwaukee stops showcased how advanced manufacturing technologies power America’s industrial legacy and future—boosting productivity, strengthening supply chains and creating high-quality manufacturing careers. In Wisconsin, manufacturing supports 462,000 workers—more than 15% of the state’s workforce—cementing its role as an economic engine for the state.

“When it comes to artificial intelligence, manufacturers have not just deployed advanced technologies; we’ve developed them,” said NAM President and CEO Jay Timmons. “What we saw today at Komatsu, Rockwell Automation and CNH is proof that AI is already transforming modern manufacturing. These tools make our manufacturing workers safer, our supply chains smarter and our products more advanced. The growth of manufacturing drives AI, and the growth of AI drives manufacturing. If America wants to lead on AI, America must support the manufacturers leading the way. That includes regulations that foster innovation—not stifle it.”

The day started with a tour of Komatsu’s state-of-the-art South Harbor Campus—a world-class example of how sustainable design and high-tech manufacturing can coexist. The group then visited Rockwell Automation, the world’s largest company dedicated to industrial automation and digital transformation, where Chairman and CEO and NAM Board Chair Blake Moret has led for the past decade. After the tour, Timmons, Moret and Manufacturing Institute President and Executive Director Carolyn Lee convened a roundtable discussion on “Responsible AI Leadership,” focused on how manufacturers are approaching AI and advanced technologies.

“At Rockwell Automation, we believe that the ‘Factory of the Future’ is built on the intersection of human ingenuity and intelligent machines,” said Moret. “What we saw today in Milwaukee—from Komatsu to the discussions here at Rockwell—is an industry moving at the speed necessary to compete and win. This tour is about making sure Washington understands that speed. Manufacturers need abundant, reliable energy, comprehensive permitting reform and investments in the manufacturing workforce to ensure the massive investments required for AI and automation can continue to flow into our communities and beyond.”

The day concluded at industrial and agricultural equipment manufacturer CNH, where demonstrations showed how precision technology is benefiting both the traditional manufacturing sector and the agricultural manufacturing sector.

“Wisconsin isn’t just a manufacturing state—it’s a manufacturing powerhouse,” said Wisconsin Manufacturers & Commerce President and CEO Kurt Bauer. “From advanced machinery and paper production to food processing and cutting-edge technologies, our manufacturers compete and win globally. We are proud to partner with the NAM to showcase Wisconsin’s strength during this stop on the NAM State of Manufacturing Tour to show the strength of Wisconsin’s manufacturing workers. At the same time, we must confront a serious workforce challenge—60% of Wisconsin employers say they cannot find enough workers, and labor force participation has been declining for decades. To sustain our leadership, we need policies from Washington that strengthen and supplement our world-class training efforts, expand workforce pathways, align education with employer needs and make it easier for individuals to enter and advance in manufacturing careers.”

From Milwaukee, the 2026 NAM State of Manufacturing Tour will go on to Dallas, Texas, where Lee will deliver the 2026 Manufacturing Institute’s State of the Manufacturing Workforce Address; Houston, Texas; and conclude Friday in Phoenix, Arizona. The tour made stops in New York, Ohio, Pennsylvania and North Carolina prior to today’s events in Milwaukee. Throughout the tour, the NAM will continue meeting with policymakers, manufacturers of all sizes, students and business leaders, advocating for the people and policies that will ensure the United States is the best place in the world to do business. To learn more about the tour and the NAM’s mission, visit https://nam.org/stateofmfg/.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM Tour Highlights How Tax Reform Fuels Growth in North Carolina

2026 NAM State of Manufacturing Tour Stops in Charlotte and Concord, North Carolina

CHARLOTTE – The National Association of Manufacturers—official partner of America250—in partnership with the North Carolina Chamber, continued its 2026 NAM State of Manufacturing Tour today in Charlotte and Concord, North Carolina, under the theme “Competing for the Future.”

The tour stop highlighted how the NAM-backed H.R. 1 is creating a more competitive tax environment—and why sustaining that certainty, along with regulatory rebalancing, modern infrastructure and reliable energy, is critical to driving continued investment and job creation across the sector. Today’s visits included Ketchie Inc., Siemens Energy and Electrolux.

“Here in North Carolina, we’re seeing exactly what tax certainty makes possible,” said NAM President and CEO Jay Timmons. “Thanks to President Trump and leaders in Congress, the pro-growth provisions in H.R. 1 were made permanent and strengthened, delivering a win for manufacturers of all sizes. To make the United States the best place in the world to do business and so manufacturers across North Carolina can keep investing, hiring and competing, we must build on that tax foundation we secured. That means enacting comprehensive, commonsense permitting reform to unleash American energy dominance, driving the funding we need for strong, modern infrastructure, modernizing regulations, investing in our manufacturing workforce and implementing smart AI policy—all through a comprehensive manufacturing strategy.”

Ketchie President and Owner Courtney Silver hosted the first stop of the day with a tour and panel discussion on how tax certainty due to the NAM-backed H.R. 1 has empowered manufacturers like her to reinvest in their workforce and facilities. Silver emphasized that pro-growth tax policies, such as permanent full expensing, have enabled business owners to remain agile and competitive. With that tax certainty in place, Ketchie has invested in new critical machinery—expanding capacity, increasing efficiency and positioning the company to hire, grow and compete for the long term.

The tour then moved to Siemens Energy, which recently announced a $421 million expansion in North Carolina to grow its large power transformer manufacturing and continue gas turbine production in Charlotte—an investment expected to create 500 new jobs statewide.

The day concluded at the North American headquarters of Electrolux, the global home appliance manufacturer, employing hundreds in the Charlotte region.

Throughout the day, business leaders highlighted the impact of North Carolina’s nearly 500,000 manufacturing workers who make up more than 11% of the workforce and power the largest manufacturing sector in the Southeast.

Timmons was joined by North Carolina Chamber President and CEO Gary Salamido and other NAM leaders throughout the day. Deputy Secretary of the Treasury Derek Theurer and Rep. Tim Moore (R-NC) participated in the visit to Ketchie.

“Thanks to America First policies, domestic manufacturing is back, and we’re seeing serious investments right here in North Carolina,” said Rep. Moore. “It was great to join the National Association of Manufacturers at Ketchie alongside Deputy Secretary of the Treasury Derek Theurer to see firsthand how tax certainty and pro-growth policies are giving companies the confidence to expand and compete with anyone in the world.”

“North Carolina’s manufacturers are a major driver of our state’s economy, contributing a higher-than-average 15% of our gross state product,” said Salamido. “With a manufacturing tradition like ours, we are proud to partner with the NAM to show the nation that our state is the premier destination for manufacturing, so long as pro-business policies allow for it.”

From Charlotte, the 2026 NAM State of Manufacturing Tour will go on to Milwaukee, Wisconsin; Dallas and Houston, Texas; and Phoenix, Arizona. The tour made stops in New York City, Cleveland and Pennsylvania prior to today’s events in Charlotte. Throughout the tour, the NAM will continue meeting with policymakers, manufacturers of all sizes, students and business leaders, advocating for the people and policies that will ensure the United States is the best place in the world to do business. To learn more about the tour and the NAM’s mission, visit https://nam.org/stateofmfg/.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers Respond to Supreme Court Decision

Philadelphia, Pa. – During the second stop of the 2026 National Association of Manufacturers’ State of Manufacturing Tour, NAM President and CEO Jay Timmons and Rockwell Automation Chairman and CEO and NAM Board Chair Blake Moret issued the following joint statement on today’s Supreme Court decision:

“Today’s decision underscores the importance of clarity and durability in U.S. trade policy.

“Manufacturers rely on stability to plan investments, grow operations and create jobs. Ongoing legal and policy uncertainty makes it more difficult to make the long-term decisions that drive American competitiveness.

“Now is the time for policymakers to work together to provide a clear and consistent framework for trade, one that strengthens domestic manufacturing, secures supply chains for critical inputs, empowers the administration to negotiate strong trade deals and ensures manufacturers can access the materials and components they need to grow, compete and create jobs in America and the export markets they need to sell U.S.-made goods around the world. If tariffs are utilized as a tool, they should be targeted to countries engaged in specific unfair trade practices, particularly by nonmarket economies.

“We share the president’s goal of ushering in the greatest manufacturing era in American history, and clear, durable trade policies will help manufacturers deliver on that promise. Strengthening supply chain resilience will ensure manufacturers can expand production, compete globally and power economic growth here at home.

“The NAM will continue working with leaders in Congress and the administration to advance durable solutions that support manufacturers, strengthen America’s industrial base and benefit the millions of Americans who depend on a strong manufacturing economy.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

733 10th St. NW, Suite 700 • Washington, DC 20001 • (202) 637-3000