Timmons, NAM Members Meet with Bessent, Congressional Leaders on Tax Reform

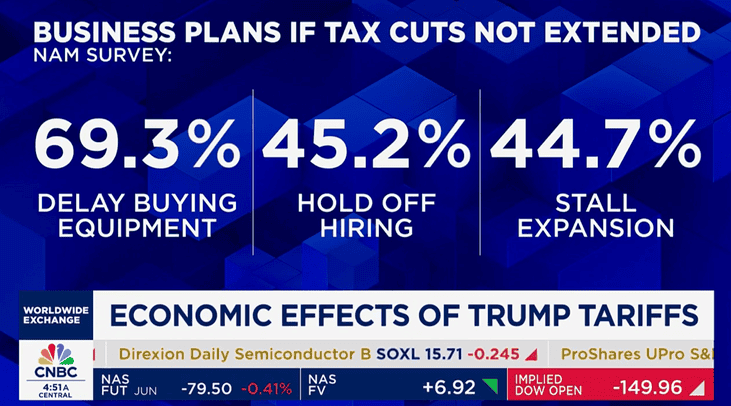

NAM President and CEO Jay Timmons will join congressional leaders for an “Invest in America” roundtable on Capitol Hill today to highlight the urgency of making the pro-manufacturing 2017 tax reforms permanent and more competitive.

The details: House Majority Whip Tom Emmer (R-MN), Treasury Secretary Scott Bessent, House Ways and Means Committee Chairman Jason Smith (R-MO) and other key Members of Congress will be in attendance. They will be joined by a group of NAM members of all sizes, representing manufacturing sectors such as metal fabricators, defense and pharmaceuticals and consumer-packaged goods, among others.

Timmons and Emmer: This morning, ahead of the closed-press meeting, Timmons and Emmer appeared on Fox Business’ “Mornings with Maria.” They reinforced the urgency of making these tax provisions permanent. Otherwise, “businesses in America are not going to invest” and “small businesses will get hit the worst,” according to Timmons.

Also this morning, Timmons and Emmer published a joint op-ed in Fox Business, which the White House amplified on social media.

- “The expiration of the Tax Cuts and Jobs Act would be detrimental to American businesses, manufacturers, consumers and families,” Timmons and Emmer wrote. “If Congress does not act to ensure President Donald Trump’s successful tax plan stays in place, taxes will go up for Americans at every income level. The average American would see a tax hike of 22 percent, over $1,600.”

- “A recent National Association of Manufacturers study indicated that failing to preserve these tax reforms will cost America 6 million jobs, $540 million in wages, and our economy will suffer a $1.1 trillion hit.”

GOP says: Emmer said on Monday that preserving tax reform was a “top priority” for Republican leaders.

- “The American people are hungry for an economic boom that is already underway,” Emmer told Fox News Digital. “But [it] will only be fully realized if Congress acts to continue the 2017 Trump tax cuts through reconciliation.”

- Bessent told the news outlet that “making President Trump’s Tax Cuts and Jobs Act permanent will help to secure the stable business environment that investors are seeking.”

- Timmons also spoke to Fox News Digital in an exclusive interview, saying “every day without action harms manufacturers’ ability to invest in America and plan for the future.”

NAM in action: The NAM is also launching a series of ads today featuring shop floor manufacturers advocating that the 2017 tax reforms be made permanent.

In the news: The roundtable was also covered by POLITICO’s Inside Congress and Morning Tax newsletters as well as Punchbowl.

NAM: Comprehensive Manufacturing Strategy, Not Increased Costs

The NAM is advocating for manufacturers’ trade policy priorities as part of a common-sense, comprehensive manufacturing strategy.

What’s going on: A proposed new entry fee on vessels entering U.S. ports would result in higher goods costs for consumers, according to the NAM. The administration is also proposing to put new tariffs on imported copper, timber and lumber products.

- The administration should instead “pursue a comprehensive manufacturing strategy that will create predictability and certainty to invest, plan and hire in America,” as the NAM recently told the Commerce Department.

Port fee would harm consumers: In February, the USTR put forth a proposal to charge up to $1.5 million for Chinese ships entering U.S. ports of call—but it’s a move the NAM said would prove harmful if put into effect.

- “This approach would effectively impose the minimum fee on nearly 100% of vessels making calls on U.S. ports, adding an estimated $600–$800 for each twenty-foot equivalent container unit. Shippers likely would pass the entirety of this cost through to their business customers, in many cases further raising the cost of manufacturing in the U.S,” the NAM told U.S. Trade Representative Jamieson Greer.

- In fact, manufacturers are already getting upwardly revised quotes of at least $1,500 more per container, the NAM continued.

- Instead of implementing the new fee, the USTR “should seek to directly remedy the non-market practices and subsidization of Chinese state enterprises that undermine global competition in the shipbuilding industry,” the NAM said.

Copper: The administration recently launched an investigation into whether copper imports pose a threat to national security.

- Though copper is critical to modern manufacturing, the U.S. copper sector’s vertical supply chain is currently “only capable of meeting 53% of domestic demand for refined copper cathode.” This makes importing copper necessary, the NAM told Commerce Secretary Howard Lutnick earlier this month.

- The NAM supports the Trump administration’s efforts to increase U.S. copper production and processing. Rather than impose tariffs, the administration should employ an NAM-crafted strategy: one that focuses “on making pro-growth tax reforms permanent, expediting permitting reform, restoring regulatory certainty, strengthening the manufacturing workforce and implementing effective trade policy,” the NAM told Lutnick.

Timber: The administration has also begun to investigate timber and lumber imports, and President Trump has promised to prioritize increasing U.S. timber production to decrease American reliance on imports. The NAM agrees, it told Lutnick in a separate communication—but new tariffs are not the answer.

Trump Doubles Down on Tariff Posture

President Donald Trump is going all-in on tariffs—leading to volatility for markets, manufacturers and America’s trading partners.

Weekend update: Over the weekend, the president called the sweeping new trade actions “an economic revolution,” urging supporters on Truth Social to “HANG TOUGH.” By Monday, he was threatening an additional 50% tariff on China by Wednesday unless it reverses its retaliatory moves. “All talks with China concerning their requested meetings with us will be terminated!” he said.

Behind the scenes: According to the administration, more than 50 countries have reached out to open tariff negotiations, but multiple sources say that there’s no structured process. “The phone lines are open,” a White House official said. “But for businesses looking for certainty, the message is clear: Don’t wait, come build in America.”

From tariffs to structural demands: Manufacturers hoping that a tariff deal could end the standoff may be disappointed. On CNBC’s “Squawk Box,” White House trade adviser Peter Navarro dismissed Vietnam’s proposed zero-tariff deal as “meaningless” without changes to what he called “non-tariff cheating”—ranging from value-added tax systems to intellectual property theft and product dumping.

- Later in the interview, he amended this statement somewhat, saying zero tariffs would be “a small first start.” “The goal here, ultimately, is to have people make things here,” he added.

- Navarro also claimed that the tariffs would lead to “the biggest tax cut in American history.”

Zoom In: While Navarro predicted a market rebound and eventual growth, businesses are still waiting for clarity.

Global reactions: EU officials announced plans to negotiate but warned of countermeasures and new import surveillance. Yesterday, Israel held in-person talks with President Trump. China has responded by devaluing the yuan against the dollar and promising to “fight to the end” of a trade war.

What it means for you: The NAM is calling for smart, strategic trade policy—solutions that restore certainty, strengthen U.S. manufacturing and protect supply chains.

- As NAM President and CEO Jay Timmons said: “The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.”

- The NAM is actively engaging policymakers, elevating member voices and providing key data and inputs on trade actions that put manufacturing growth at risk.

Tariffs: 1930 Versus 2025

The U.S. stock market saw its worst day yesterday since the early days of the pandemic, following President Trump’s latest round of tariffs. These tariffs, when combined with other U.S. tariffs in 2025, make the U.S. average effective tariff rate 22.5%—the highest rate since 1909, according to The Budget Lab at Yale.

Manufacturers already had record-high concerns about trade uncertainties before this latest announcement, as the NAM’s Q1 Manufacturers’ Outlook Survey found. Now, the uncertainty and instability have only increased, reminding observers the last time the U.S. imposed sweeping tariffs—with disastrous consequences.

Back then: The Tariff Act of 1930, also known as the Smoot-Hawley Act, was signed into law by President Herbert Hoover. Originally intended to protect the U.S. agricultural industry, it was later expanded to cover a broad swath of the U.S. economy, as CNBC recounts.

- The Smoot-Hawley Act imposed tariffs on approximately 25% of all imports to the U.S., according to Santa Clara University economic historian Kris James Mitchener.

- Some sounded the alarm at the time. Before signing the law in June 1930, President Hoover received “a petition signed by more than 1,000 economists asking him to veto the bill.”

A spiral: “Smoot-Hawley raised the average tariff on dutiable imports to 47% from 40%, [Dartmouth economist Doug] Irwin said. Depression-era price deflation ultimately helped push that average to almost 60% in 1932, he added.”

- Compare that to now: the latest tariff rates will be higher than the Smoot-Hawley levels, as reported by CNBC .

Manufacturers hurt: Following the passage of Smoot-Hawley, Argentina, Australia, Canada, Cuba, France, Italy, Mexico, Spain and Switzerland all responded with retaliatory tariffs on U.S. goods. These tariffs often fell on manufactured products, weakening the sector amid the economic catastrophe of the Depression.

- For example, France, Spain, Italy and Switzerland increased tariffs on American cars, effectively closing off those markets to major American exports.

- In all, “U.S. exports to retaliating nations fell by about 28% to 32%, said Mitchener. Further, nations that protested Smoot-Hawley also reduced their U.S. imports by 15% to 23%.”

Long-lasting pain: The Dow Jones Industrial Average slid following the imposition of the tariffs, bottoming out in July 1932.

History lesson: Smoot-Hawley has long been condemned by American leaders of both parties as a mistake that severely damaged the American economy.

- Before taking office, Roosevelt denounced the Smoot-Hawley Act, saying it “compelled the world to build tariff fences so high that world trade is decreasing to vanishing point.” He would sign the Reciprocal Trade Agreements Act, which reduced tariffs with trading partners on a reciprocal basis, in 1934.

- When President Ronald Reagan spoke to the NAM’s Annual Meeting in 1986, he said, “I well remember the antitrade frenzy in the late twenties that produced the Smoot-Hawley tariffs, greasing the skids for our descent into the Great Depression and the most destructive war this world has ever seen. That’s one episode of history I’m determined we will never repeat.”

Modern realities: President Trump has insisted that “we’re bringing wealth back to America” through these sweeping tariffs (CNBC). But manufacturers are urging caution, especially when future tax policy is so uncertain.

- One family-owned U.S. textile manufacturer, founded in 1887, warns that tariffs will dramatically raise the prices of its components, such as fabric, thread, yarn and fiber—none of which it can source in the U.S. “Tariffs would force us to curtail employment or close facilities if our customers would not accept higher prices,” the company said.

- Another manufacturer, an employee-owned firm, makes products and systems that control, monitor and protect utility and industrial electric power systems—which is critical for the coming buildout of new power generators and the electrical grid to meet the demand for AI datacenters. Tariffs will materially harm its ability to enable this essential economic growth.

- A third manufacturing company, a 100-year-old Wisconsin company specializing in custom-designed thermal solutions and large-scale HVAC cooling systems used in agriculture, mining, oil and gas and more, says that “tariffs on Canada and Mexico could cause us to take cost-cutting measures, including workforce reductions.”

- Last, a manufacturer that has made chemicals in the U.S. since the late 1800s reports that tariffs may set back its plans for expansion in North America, “which is already five times more expensive for us than in Asia and three times more expensive than in Europe.” The company will be less able to support crucial semiconductor manufacturing, and may even have to close low-margin business lines in the U.S.

The last word: “[M]anufacturers are scrambling to determine the exact implications for their operations [of the April 2 tariffs],” NAM President and CEO Jay Timmons said on Wednesday. “The stakes for manufacturers could not be higher. Many manufacturers in the United States already operate with thin margins. The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.”

Manufacturers Speak About Impact of Tariffs

Across the country, manufacturers are telling their stories of shop floor operations under U.S. tariffs, the first of which went into effect March 13. The consensus: tariffs have made things harder all around

- Jeremy Rosenbeck is president of Cincinnati, Ohio–area manufacturer Republic Wire, Inc., which makes copper wire products for the construction industry. In anticipation of tariffs, Rosenbeck “over the winter [ordered] an extra two months’ worth of copper rod (worth tens of millions) to give him enough tariff-free raw material for his business if a new trade agreement isn’t quickly worked out” (Cincinnati Enquirer).

- Republic Wire has nearly 200 employees and each year does approximately $500 million in sales. About 10% of that is outside the U.S.

- Rosenbeck, who says he “understand[s] what they’re trying to do with the tariffs,” nonetheless told the Enquirer that spring is a bad time for uncertainty in the construction sector, as it’s when builders make their plans for the rest of the year. “Higher prices on materials could mean fewer construction projects, which could mean a slowdown for the industry, fewer jobs and a drag on the economy as a whole,” the outlet notes.

Where the burden falls: Chuck Dardas, president and chief operating officer of 67-year-old Michigan automotive manufacturing firm AlphaUSA, wrote in a recent op-ed for The Detroit News that while the Trump administration says tariffs will rebalance the scales, “the truth is that the burden falls squarely on American manufacturers and, ultimately, the American consumer.”

- For AlphaUSA, that’s because “as an S Corporation, our net income flows directly to our tax returns,” Dardas wrote. “If tariffs wipe out our income, it’s akin to a 100% income tax. There’s no profit, no reinvestment and no sustainability. This isn’t just a theoretical concern—it’s a very real possibility. If our paycheck goes to zero, how do we pay our bills? How do we reinvest in our business? How do we survive?”

- The sticker prices of vehicles are too high already, “and these tariffs will only push them higher. Inflationary pressures are mounting, and the Federal Reserve’s decision to hold off on rate changes underscores the precariousness of the situation.”

- Opposition to the tariffs, Dardas continued, “is not about politics. It’s about facts.” Manufacturers that rely on foreign imports cannot simply make the change to domestic sourcing with the flip of a switch. “[E]ven if we could pivot back to American manufacturers for … particular components, that’s not saying that they’re going to be less expensive” domestically, he said this week on radio show “All Talk with Kevin Dietz .” “They could be even more than the tariffs we could very well be faced with still buying the parts from Canada.”

“An existential threat”: If the tariffs remain in place long term, small manufacturers might not be able to hold out long enough to see their promised benefit, either, Dardas told the BBC’s “World Business Report” late last month.

- “If these go on for a long period of time, it’s an existential threat to companies our size,” he said. “We’re not that big, and there [are] a lot of us [smaller manufacturers] out here as well.”

As Tariffs Hit, Manufacturers Brace for Impact

Urge Congress to Act Now on a Comprehensive Manufacturing Strategy That Starts with Making the 2017 Tax Reforms Permanent

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement on the latest tariffs announced today:

“Needless to say, today’s announcement was complicated, and manufacturers are scrambling to determine the exact implications for their operations. The stakes for manufacturers could not be higher. Many manufacturers in the United States already operate with thin margins. The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.

“Manufacturers build things in America to sell around the world—and manufacturers in America share President Trump’s goal of supporting manufacturing investment, growth and expansion here at home. The president has the opportunity to achieve this vital goal while also minimizing disruptions and cost increases across our industry. To empower manufacturers to drive the U.S. economy, the administration should:

- minimize tariff costs for manufacturers that are investing and expanding in the U.S.;

- ensure tariff-free access to critical inputs that manufacturers use to make things in America; and

- secure better terms for manufacturers by negotiating ‘zero-for-zero’ tariffs for American-made products in our trading partners’ markets—that means they don’t charge us, and we don’t charge them.

“A clear, strategic approach to trade must be part of a comprehensive manufacturing strategy that starts with an urgent appeal to Congress to make the 2017 tax reforms permanent. When these tax cuts were signed into law, it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale. Manufacturers will work with the Trump administration and Congress to advance policies that help manufacturers grow and thrive—because when manufacturing wins, America wins.”

Background: In March, the NAM released its Q1 2025 Manufacturers’ Outlook Survey, highlighting rising concerns within the industry over trade uncertainties and increasing raw material costs. Trade uncertainties surged to the top of manufacturers’ challenges, cited by 76.2% of respondents—up 20 percentage points from the last quarter of 2024 and 40 points from the third quarter. Increased raw material costs was the second most cited concern, noted by 62.3% of respondents. These trade-related pressures contributed to a slight dip in overall optimism for their companies in the first quarter of 2025, down modestly from 70.9% in the fourth quarter to 69.7%.

According to another recent NAM survey of its members regarding the impact of tariffs on manufacturers, 87% of small and medium-sized manufacturers indicated that they may need to raise prices, and one-third could slow hiring.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

ICYMI: NAM’s Jay Timmons Discusses Tariffs, Tax Reform, Manufacturing Investment on CNBC’s “Worldwide Exchange”

Watch Jay Timmons on “Worldwide Exchange”

Timmons on Upcoming Tariff Announcement

“We don’t know what the actual proposal is going to be, or the actual plan is going to be from the president today, but in any scenario, it’s going to add cost to manufacturers, especially for those inputs that are coming into the United States for finished goods and already finished products. So manufacturers are bracing. We’ve got 14,000 members right now who, frankly, don’t know what the future holds in terms of additional costs, and that’s why you’re seeing this type of concern and sentiment among manufacturers. In fact, three-quarters of manufacturers who we surveyed rate trade uncertainty as their number one concern right now.”

Timmons on Tax Reform, Lowering Costs for Manufacturers

“I think it’s pretty safe to say that everybody would like more things made here in this country, because that’s good for the economy. That’s good for jobs. What is not good, though, is driving up the cost of actually making those things here in the United States. So the first thing that we need … is we need to see Congress, frankly, do its job and get the tax reforms from 2017 renewed, so that … we have the certainty in the tax code. Also the administration is working on reducing the regulatory burden. That’s a lot of costs. That’s about $50,000 per employee per year for a small manufacturer. And then, of course, energy inputs and the cost of energy is important, as well as workforce challenges. We have 500,000 open jobs, for instance, in manufacturing today. So you add all that up, if we could have those advancements and those things that will bring costs down, that’s good for investment here in the United States. Adding costs for inputs, like critical minerals, for instance, really does not help us in the long term.”

…

“There was a lot of enthusiasm when the president came in and talked about strengthening manufacturing here in the United States, talked about an agenda that would lower costs. … If we don’t get the tax reforms renewed, that is an additional cost. If tariffs are imposed, that’s an additional cost. So that’s why you’re seeing consumer sentiment lower. You’re seeing the PMI index that … is now in contraction. That means that manufacturers are putting these decisions on hold. They’re waiting to see whether they should invest and hire, and that’s not good for the economy.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Timmons: Tariffs Will Add Costs for Manufacturers

As manufacturers await the announcement of the Trump administration’s sweeping reciprocal tariffs at approximately 4:00 p.m. EDT today, NAM President and CEO Jay Timmons warned that “any scenario … is going to add cost[s] to manufacturers.”

What’s going on: Timmons, appearing on CNBC’s “Worldwide Exchange” this morning, told show anchor Frank Holland that while the world still doesn’t know what the latest tariffs will include, manufacturers are concerned—and they have good reason to be.

- Some 56% of imports to the U.S. are inputs for manufacturing, Holland said, citing NAM data. “That’s why you’re seeing this type of concern and sentiment among manufacturers,” Timmons said in response to a question about what the figure means for tariffs’ impact on the industry.

- Trade uncertainty is the top concern of the majority of manufacturers right now, Timmons said, citing the NAM’s most recent Manufacturers’ Outlook Survey. “That is up 40 percentage points over the last six months,” he told Holland. “That’s a huge jump.”

What it means: While “everybody would like more things made here in this country, because that’s good for the economy, that’s good for jobs,” new tariffs will drive “up the cost of actually making those things here in the United States,” Timmons continued.

What should be done: Manufacturers need certainty, not the nail-biting anxiety that comes from constant changes to the rules.

- “The first thing that we need to see is we need to see Congress do its job and get the tax reforms from 2017 renewed so that we have the certainty in the tax code,” said Timmons.

- Manufacturers also require relief from arduous regulatory burdens, which comes to “about $50,000 per employee per year for a small manufacturer,” Timmons told Holland, adding that the Trump administration is already working to cut those costs.

The bottom line: “There was a lot of enthusiasm when the president came in and talked about strengthening manufacturing here in the United States [and] talked about an agenda that would lower costs,” Timmons concluded.

- “But … if we don’t get the tax reforms renewed, that is an additional cost. If tariffs are imposed, that’s an additional cost. … Manufacturers … are waiting to see whether they should invest and hire. That’s not good for the economy.”

Manufacturers on the Hill Urge Action on Tax Reform Permanency

Shop floor manufacturers and NAM staff met with members of Congress yesterday and continue these meetings today on Capitol Hill to hammer home the importance of making the 2017 tax reforms permanent and getting a comprehensive reconciliation bill done now. House and Senate Republicans are working on a strategy for a tax package as part of a reconciliation bill that includes extending the 2017 Tax Cuts and Jobs Act.

- In its Morning Tax newsletter, POLITICO (subscription) reported on this week’s fly-in, naming the NAM “a powerhouse business lobby” meeting with several members of Congress as the 2025 tax bill continues to “get more intense.”

Why this is a critical moment: When the 2017 tax cuts were signed into law, “it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale,” said NAM President and CEO Jay Timmons earlier this month.

- “That fuel is about to run out as key provisions have expired, and others are about to lapse. … We must ensure these historic, pro-growth manufacturing provisions are made permanent and even more competitive so manufacturers can plan, grow and succeed.”

“Exactly what the country needed”: Manufacturers traveled hundreds of miles from their shop floors to urge Congress to keep the rocket fuel for manufacturers and the American economy.

- “The Tax Cuts and Jobs Act of 2017 was huge for us,” said Tom Onsrud, CEO of the 51-year-old industrial CNC machine maker C.R. Onsrud, Inc., in Troutman, North Carolina. “It was rocket fuel. As soon as it passed, our backlog exploded. We started employing more people. We went from about 100 people to 220 people. Our floor space was maxed out. … It was exactly what the country needed.”

- One of the provisions, the immediate research and development tax credit, allowed the family-owned business to “expense equipment [costs] quickly,” Onsrud added. “That was huge for us.” That provision, however, expired in 2022.

“Vital to our company”: Stephen Bullock, president of concrete paving equipment manufacturer Power Curbers in Salisbury, North Carolina, is in Washington this week to make sure Congress knows just how important the tax reform measures have been to his small company.

- “We rely on them,” Bullock said. “We spend a lot of time and resources and money in research and development. Without [the tax provisions], it would be impossible for our company to support manufacturing. We’ve got to stay ahead of the game with new machinery, new offerings for our customers. So … anything we can do to realize those tax advantages sooner rather than later helps us very much from a cash-flow standpoint.”

- The TCJA “allowed us to expand and hire additional staff so that we [could] fund new programs, new machinery.”

“Tripled our business”: Steve Macias, co-owner of machining company Pivot Manufacturing, traveled from even farther away—Phoenix, Arizona—to make sure Congress heard what he had to say.

- “The tax reforms of 2017 … allowed us to grow our company in a way that we hadn’t [been able to] previously,” Macias told the NAM. “We were a small machine shop that did prototype and R&D work, and we’d been in business for 17 years. The tax cuts kind of gave us the kick … to take a leap and buy some production equipment, which has allowed us to virtually triple our business over the last eight years.”

- “Legislators need to understand the impact of tax reform,” Macias went on. “I’m a machine shop in Phoenix, Arizona, and there are hundreds of machine shops across the U.S., but there are also thousands upon tens of thousands of small manufacturing companies that made the same decisions we did based on those tax policies.”

Critical Minerals Executive Order Strengthens U.S. Manufacturing

President Trump’s recent executive order to accelerate permitting and access to domestic critical minerals will help manufacturing—and America—win, NAM President and CEO Jay Timmons said.

What’s going on: The recent executive order aims to boost U.S. production of critical minerals—which include lithium and cobalt—“as well as uranium, copper, potash, gold and any other element, compound or material as determined by the Chair of the National Energy Dominance Council,” according to the EO.

- China dominates the global market for critical minerals, which are vital in the manufacture of everyday goods from cell phones and computers to advanced energy and defense technologies.

- Increasing American production of these crucial substances “can create jobs, fuel prosperity and significantly reduce our reliance on foreign nations,” according to the EO. “Transportation, infrastructure, defense capabilities and the next generation of technology rely upon a secure, predictable and affordable supply of minerals.”

What’s in it: The EO—which cites “overbearing federal regulation” for the lack of American critical mineral production—enumerates “staggered timelines for agencies across government to prioritize financing for domestic mineral projects, including loans, capital and technical assistance, and calls on the Department of Defense to accelerate domestic mineral production” (POLITICO Pro’s GREENWIRE).

- It also calls on the DOD to work with the U.S. International Development Finance Corporation to offer financing for the projects.

Aligned on regulations: The NAM has long called for regulatory reform to combat the onslaught of rules coming from the federal government—and this EO is a much-needed reform, said Timmons.

- “For too long, red tape and burdensome regulations have stood in the way of the basic building blocks that power manufacturing in the United States, especially mining and processing the minerals manufacturers rely on to create jobs and dominate on the world stage,” Timmons said. “The administration is addressing those barriers, making it easier for manufacturers to access the resources we need to build the future in America.”