Timmons, NAM Members Meet with Bessent, Congressional Leaders on Tax Reform

NAM President and CEO Jay Timmons will join congressional leaders for an “Invest in America” roundtable on Capitol Hill today to highlight the urgency of making the pro-manufacturing 2017 tax reforms permanent and more competitive.

The details: House Majority Whip Tom Emmer (R-MN), Treasury Secretary Scott Bessent, House Ways and Means Committee Chairman Jason Smith (R-MO) and other key Members of Congress will be in attendance. They will be joined by a group of NAM members of all sizes, representing manufacturing sectors such as metal fabricators, defense and pharmaceuticals and consumer-packaged goods, among others.

Timmons and Emmer: This morning, ahead of the closed-press meeting, Timmons and Emmer appeared on Fox Business’ “Mornings with Maria.” They reinforced the urgency of making these tax provisions permanent. Otherwise, “businesses in America are not going to invest” and “small businesses will get hit the worst,” according to Timmons.

Also this morning, Timmons and Emmer published a joint op-ed in Fox Business, which the White House amplified on social media.

- “The expiration of the Tax Cuts and Jobs Act would be detrimental to American businesses, manufacturers, consumers and families,” Timmons and Emmer wrote. “If Congress does not act to ensure President Donald Trump’s successful tax plan stays in place, taxes will go up for Americans at every income level. The average American would see a tax hike of 22 percent, over $1,600.”

- “A recent National Association of Manufacturers study indicated that failing to preserve these tax reforms will cost America 6 million jobs, $540 million in wages, and our economy will suffer a $1.1 trillion hit.”

GOP says: Emmer said on Monday that preserving tax reform was a “top priority” for Republican leaders.

- “The American people are hungry for an economic boom that is already underway,” Emmer told Fox News Digital. “But [it] will only be fully realized if Congress acts to continue the 2017 Trump tax cuts through reconciliation.”

- Bessent told the news outlet that “making President Trump’s Tax Cuts and Jobs Act permanent will help to secure the stable business environment that investors are seeking.”

- Timmons also spoke to Fox News Digital in an exclusive interview, saying “every day without action harms manufacturers’ ability to invest in America and plan for the future.”

NAM in action: The NAM is also launching a series of ads today featuring shop floor manufacturers advocating that the 2017 tax reforms be made permanent.

In the news: The roundtable was also covered by POLITICO’s Inside Congress and Morning Tax newsletters as well as Punchbowl.

NAM: Comprehensive Manufacturing Strategy, Not Increased Costs

The NAM is advocating for manufacturers’ trade policy priorities as part of a common-sense, comprehensive manufacturing strategy.

What’s going on: A proposed new entry fee on vessels entering U.S. ports would result in higher goods costs for consumers, according to the NAM. The administration is also proposing to put new tariffs on imported copper, timber and lumber products.

- The administration should instead “pursue a comprehensive manufacturing strategy that will create predictability and certainty to invest, plan and hire in America,” as the NAM recently told the Commerce Department.

Port fee would harm consumers: In February, the USTR put forth a proposal to charge up to $1.5 million for Chinese ships entering U.S. ports of call—but it’s a move the NAM said would prove harmful if put into effect.

- “This approach would effectively impose the minimum fee on nearly 100% of vessels making calls on U.S. ports, adding an estimated $600–$800 for each twenty-foot equivalent container unit. Shippers likely would pass the entirety of this cost through to their business customers, in many cases further raising the cost of manufacturing in the U.S,” the NAM told U.S. Trade Representative Jamieson Greer.

- In fact, manufacturers are already getting upwardly revised quotes of at least $1,500 more per container, the NAM continued.

- Instead of implementing the new fee, the USTR “should seek to directly remedy the non-market practices and subsidization of Chinese state enterprises that undermine global competition in the shipbuilding industry,” the NAM said.

Copper: The administration recently launched an investigation into whether copper imports pose a threat to national security.

- Though copper is critical to modern manufacturing, the U.S. copper sector’s vertical supply chain is currently “only capable of meeting 53% of domestic demand for refined copper cathode.” This makes importing copper necessary, the NAM told Commerce Secretary Howard Lutnick earlier this month.

- The NAM supports the Trump administration’s efforts to increase U.S. copper production and processing. Rather than impose tariffs, the administration should employ an NAM-crafted strategy: one that focuses “on making pro-growth tax reforms permanent, expediting permitting reform, restoring regulatory certainty, strengthening the manufacturing workforce and implementing effective trade policy,” the NAM told Lutnick.

Timber: The administration has also begun to investigate timber and lumber imports, and President Trump has promised to prioritize increasing U.S. timber production to decrease American reliance on imports. The NAM agrees, it told Lutnick in a separate communication—but new tariffs are not the answer.

Trump Doubles Down on Tariff Posture

President Donald Trump is going all-in on tariffs—leading to volatility for markets, manufacturers and America’s trading partners.

Weekend update: Over the weekend, the president called the sweeping new trade actions “an economic revolution,” urging supporters on Truth Social to “HANG TOUGH.” By Monday, he was threatening an additional 50% tariff on China by Wednesday unless it reverses its retaliatory moves. “All talks with China concerning their requested meetings with us will be terminated!” he said.

Behind the scenes: According to the administration, more than 50 countries have reached out to open tariff negotiations, but multiple sources say that there’s no structured process. “The phone lines are open,” a White House official said. “But for businesses looking for certainty, the message is clear: Don’t wait, come build in America.”

From tariffs to structural demands: Manufacturers hoping that a tariff deal could end the standoff may be disappointed. On CNBC’s “Squawk Box,” White House trade adviser Peter Navarro dismissed Vietnam’s proposed zero-tariff deal as “meaningless” without changes to what he called “non-tariff cheating”—ranging from value-added tax systems to intellectual property theft and product dumping.

- Later in the interview, he amended this statement somewhat, saying zero tariffs would be “a small first start.” “The goal here, ultimately, is to have people make things here,” he added.

- Navarro also claimed that the tariffs would lead to “the biggest tax cut in American history.”

Zoom In: While Navarro predicted a market rebound and eventual growth, businesses are still waiting for clarity.

Global reactions: EU officials announced plans to negotiate but warned of countermeasures and new import surveillance. Yesterday, Israel held in-person talks with President Trump. China has responded by devaluing the yuan against the dollar and promising to “fight to the end” of a trade war.

What it means for you: The NAM is calling for smart, strategic trade policy—solutions that restore certainty, strengthen U.S. manufacturing and protect supply chains.

- As NAM President and CEO Jay Timmons said: “The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.”

- The NAM is actively engaging policymakers, elevating member voices and providing key data and inputs on trade actions that put manufacturing growth at risk.

As Tariffs Hit, Manufacturers Brace for Impact

Urge Congress to Act Now on a Comprehensive Manufacturing Strategy That Starts with Making the 2017 Tax Reforms Permanent

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement on the latest tariffs announced today:

“Needless to say, today’s announcement was complicated, and manufacturers are scrambling to determine the exact implications for their operations. The stakes for manufacturers could not be higher. Many manufacturers in the United States already operate with thin margins. The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.

“Manufacturers build things in America to sell around the world—and manufacturers in America share President Trump’s goal of supporting manufacturing investment, growth and expansion here at home. The president has the opportunity to achieve this vital goal while also minimizing disruptions and cost increases across our industry. To empower manufacturers to drive the U.S. economy, the administration should:

- minimize tariff costs for manufacturers that are investing and expanding in the U.S.;

- ensure tariff-free access to critical inputs that manufacturers use to make things in America; and

- secure better terms for manufacturers by negotiating ‘zero-for-zero’ tariffs for American-made products in our trading partners’ markets—that means they don’t charge us, and we don’t charge them.

“A clear, strategic approach to trade must be part of a comprehensive manufacturing strategy that starts with an urgent appeal to Congress to make the 2017 tax reforms permanent. When these tax cuts were signed into law, it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale. Manufacturers will work with the Trump administration and Congress to advance policies that help manufacturers grow and thrive—because when manufacturing wins, America wins.”

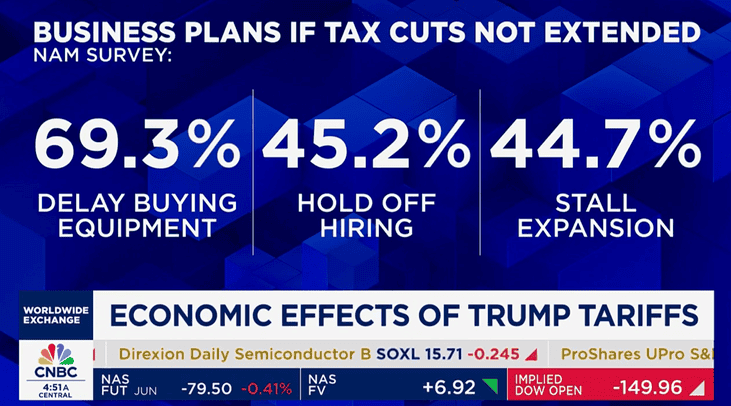

Background: In March, the NAM released its Q1 2025 Manufacturers’ Outlook Survey, highlighting rising concerns within the industry over trade uncertainties and increasing raw material costs. Trade uncertainties surged to the top of manufacturers’ challenges, cited by 76.2% of respondents—up 20 percentage points from the last quarter of 2024 and 40 points from the third quarter. Increased raw material costs was the second most cited concern, noted by 62.3% of respondents. These trade-related pressures contributed to a slight dip in overall optimism for their companies in the first quarter of 2025, down modestly from 70.9% in the fourth quarter to 69.7%.

According to another recent NAM survey of its members regarding the impact of tariffs on manufacturers, 87% of small and medium-sized manufacturers indicated that they may need to raise prices, and one-third could slow hiring.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

ICYMI: NAM’s Jay Timmons Discusses Tariffs, Tax Reform, Manufacturing Investment on CNBC’s “Worldwide Exchange”

Watch Jay Timmons on “Worldwide Exchange”

Timmons on Upcoming Tariff Announcement

“We don’t know what the actual proposal is going to be, or the actual plan is going to be from the president today, but in any scenario, it’s going to add cost to manufacturers, especially for those inputs that are coming into the United States for finished goods and already finished products. So manufacturers are bracing. We’ve got 14,000 members right now who, frankly, don’t know what the future holds in terms of additional costs, and that’s why you’re seeing this type of concern and sentiment among manufacturers. In fact, three-quarters of manufacturers who we surveyed rate trade uncertainty as their number one concern right now.”

Timmons on Tax Reform, Lowering Costs for Manufacturers

“I think it’s pretty safe to say that everybody would like more things made here in this country, because that’s good for the economy. That’s good for jobs. What is not good, though, is driving up the cost of actually making those things here in the United States. So the first thing that we need … is we need to see Congress, frankly, do its job and get the tax reforms from 2017 renewed, so that … we have the certainty in the tax code. Also the administration is working on reducing the regulatory burden. That’s a lot of costs. That’s about $50,000 per employee per year for a small manufacturer. And then, of course, energy inputs and the cost of energy is important, as well as workforce challenges. We have 500,000 open jobs, for instance, in manufacturing today. So you add all that up, if we could have those advancements and those things that will bring costs down, that’s good for investment here in the United States. Adding costs for inputs, like critical minerals, for instance, really does not help us in the long term.”

…

“There was a lot of enthusiasm when the president came in and talked about strengthening manufacturing here in the United States, talked about an agenda that would lower costs. … If we don’t get the tax reforms renewed, that is an additional cost. If tariffs are imposed, that’s an additional cost. So that’s why you’re seeing consumer sentiment lower. You’re seeing the PMI index that … is now in contraction. That means that manufacturers are putting these decisions on hold. They’re waiting to see whether they should invest and hire, and that’s not good for the economy.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Timmons: Tariffs Will Add Costs for Manufacturers

As manufacturers await the announcement of the Trump administration’s sweeping reciprocal tariffs at approximately 4:00 p.m. EDT today, NAM President and CEO Jay Timmons warned that “any scenario … is going to add cost[s] to manufacturers.”

What’s going on: Timmons, appearing on CNBC’s “Worldwide Exchange” this morning, told show anchor Frank Holland that while the world still doesn’t know what the latest tariffs will include, manufacturers are concerned—and they have good reason to be.

- Some 56% of imports to the U.S. are inputs for manufacturing, Holland said, citing NAM data. “That’s why you’re seeing this type of concern and sentiment among manufacturers,” Timmons said in response to a question about what the figure means for tariffs’ impact on the industry.

- Trade uncertainty is the top concern of the majority of manufacturers right now, Timmons said, citing the NAM’s most recent Manufacturers’ Outlook Survey. “That is up 40 percentage points over the last six months,” he told Holland. “That’s a huge jump.”

What it means: While “everybody would like more things made here in this country, because that’s good for the economy, that’s good for jobs,” new tariffs will drive “up the cost of actually making those things here in the United States,” Timmons continued.

What should be done: Manufacturers need certainty, not the nail-biting anxiety that comes from constant changes to the rules.

- “The first thing that we need to see is we need to see Congress do its job and get the tax reforms from 2017 renewed so that we have the certainty in the tax code,” said Timmons.

- Manufacturers also require relief from arduous regulatory burdens, which comes to “about $50,000 per employee per year for a small manufacturer,” Timmons told Holland, adding that the Trump administration is already working to cut those costs.

The bottom line: “There was a lot of enthusiasm when the president came in and talked about strengthening manufacturing here in the United States [and] talked about an agenda that would lower costs,” Timmons concluded.

- “But … if we don’t get the tax reforms renewed, that is an additional cost. If tariffs are imposed, that’s an additional cost. … Manufacturers … are waiting to see whether they should invest and hire. That’s not good for the economy.”

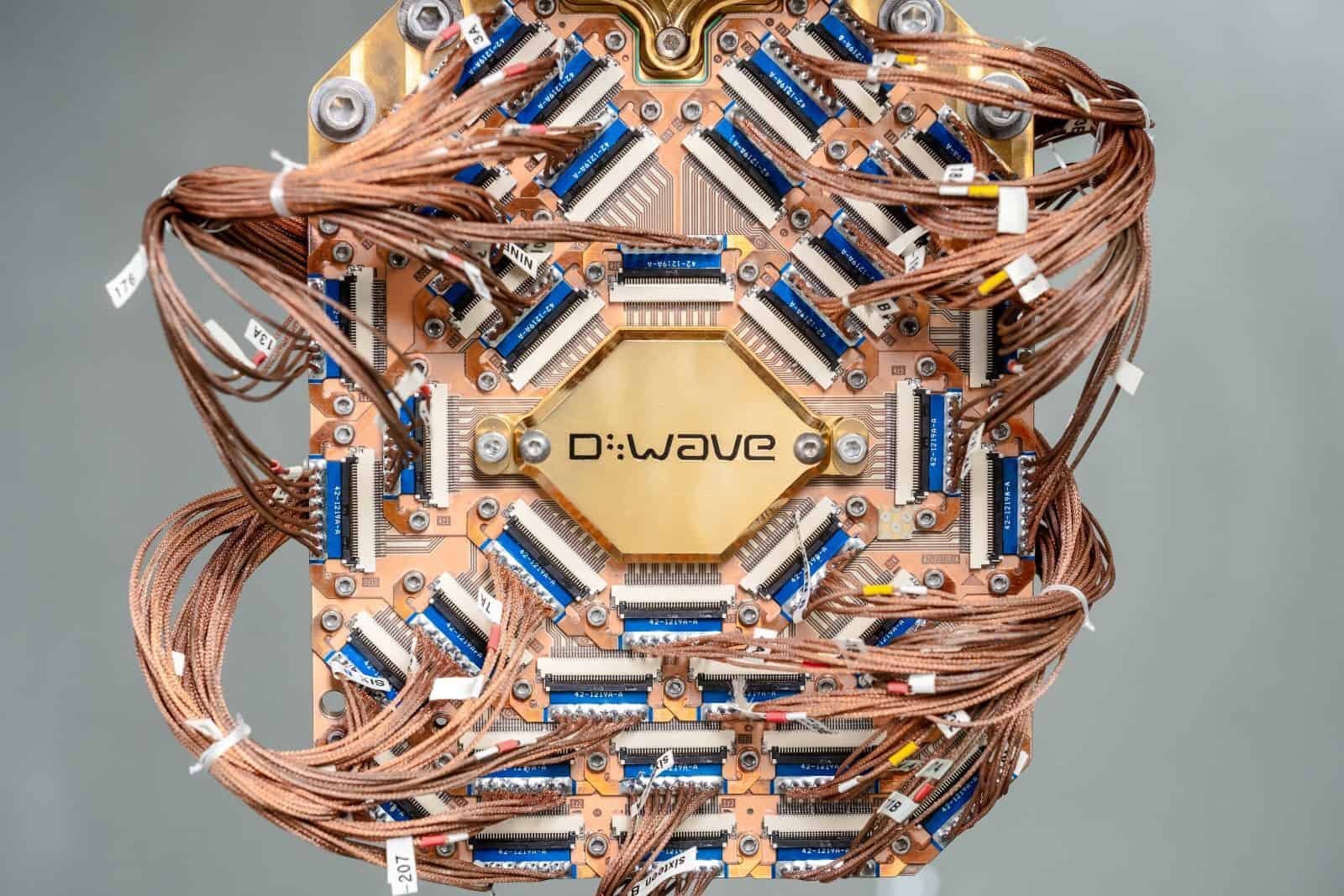

D-Wave Achieves “Quantum Supremacy”

Quantum computing firm D-Wave has achieved a singular breakthrough: it has simulated the “properties of magnetic materials,” opening up the opportunity to “invent” new materials without having to produce them physically in a lab, as D-Wave CEO Alan Baratz told Fast Company.

What it means: The achievement, first published in Science earlier this month, marks the first time a quantum computer has solved a useful, real-world problem that a classical computer couldn’t manage.

- In fact, “To simulate the property of magnetic materials on a classical computer—as the D-Wave team recently did using its quantum computer—would require nearly 1 million years and more energy than the entire world utilizes over the course of a year. D-Wave’s team did it in 20 minutes,” according to Fast Company.

Quantum vs. classical: “Rather than store information using bits represented by 0s or 1s as conventional digital computers do, quantum computers use quantum bits, or qubits, to encode information as 0s, 1s or both at the same time,” D-Wave explains on its site.

- “This superposition of states—along with the other quantum mechanical phenomena of entanglement and tunneling—enables quantum computers to manipulate enormous combinations of states at once.”

- D-Wave’s annealing quantum computer uses these capabilities to solve problems by finding the “lowest energy state” in an enormous range of possible solutions.

- “To imagine this, think of a traveler looking for the best solution by finding the lowest valley in the energy landscape that represents the problem,” as D-Wave puts it.

The possibilities are vast: Being able to simulate materials without creating and testing them in the lab offers significant opportunities for the manufacturing industry and could save companies huge amounts of time and resources. D-Wave foresees that these simulated materials could have applications in everything from “pacemakers to cellphones,” as it told Fast Company.

- “There’s no shortage of potential applications,” said D-Wave Chief Scientist Mohammad Amin.

Further innovation: Another impact of quantum computing is its potential to revolutionize blockchain technology, D-Wave told us.

- “Manufacturers are increasingly adopting blockchain technology to enhance supply chain transparency, track product origins, improve inventory management, and streamline operations. This adoption has led to increased efficiency and reduced costs,” said D-Wave Global Government Relations and Public Affairs Leader Allison Schwartz.

- “Annealing quantum computing offers a potential solution by providing a faster and more environmentally friendly alternative to manufacturers’ current mining operations using classical computers.”

Manufacturers on the Hill Urge Action on Tax Reform Permanency

Shop floor manufacturers and NAM staff met with members of Congress yesterday and continue these meetings today on Capitol Hill to hammer home the importance of making the 2017 tax reforms permanent and getting a comprehensive reconciliation bill done now. House and Senate Republicans are working on a strategy for a tax package as part of a reconciliation bill that includes extending the 2017 Tax Cuts and Jobs Act.

- In its Morning Tax newsletter, POLITICO (subscription) reported on this week’s fly-in, naming the NAM “a powerhouse business lobby” meeting with several members of Congress as the 2025 tax bill continues to “get more intense.”

Why this is a critical moment: When the 2017 tax cuts were signed into law, “it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale,” said NAM President and CEO Jay Timmons earlier this month.

- “That fuel is about to run out as key provisions have expired, and others are about to lapse. … We must ensure these historic, pro-growth manufacturing provisions are made permanent and even more competitive so manufacturers can plan, grow and succeed.”

“Exactly what the country needed”: Manufacturers traveled hundreds of miles from their shop floors to urge Congress to keep the rocket fuel for manufacturers and the American economy.

- “The Tax Cuts and Jobs Act of 2017 was huge for us,” said Tom Onsrud, CEO of the 51-year-old industrial CNC machine maker C.R. Onsrud, Inc., in Troutman, North Carolina. “It was rocket fuel. As soon as it passed, our backlog exploded. We started employing more people. We went from about 100 people to 220 people. Our floor space was maxed out. … It was exactly what the country needed.”

- One of the provisions, the immediate research and development tax credit, allowed the family-owned business to “expense equipment [costs] quickly,” Onsrud added. “That was huge for us.” That provision, however, expired in 2022.

“Vital to our company”: Stephen Bullock, president of concrete paving equipment manufacturer Power Curbers in Salisbury, North Carolina, is in Washington this week to make sure Congress knows just how important the tax reform measures have been to his small company.

- “We rely on them,” Bullock said. “We spend a lot of time and resources and money in research and development. Without [the tax provisions], it would be impossible for our company to support manufacturing. We’ve got to stay ahead of the game with new machinery, new offerings for our customers. So … anything we can do to realize those tax advantages sooner rather than later helps us very much from a cash-flow standpoint.”

- The TCJA “allowed us to expand and hire additional staff so that we [could] fund new programs, new machinery.”

“Tripled our business”: Steve Macias, co-owner of machining company Pivot Manufacturing, traveled from even farther away—Phoenix, Arizona—to make sure Congress heard what he had to say.

- “The tax reforms of 2017 … allowed us to grow our company in a way that we hadn’t [been able to] previously,” Macias told the NAM. “We were a small machine shop that did prototype and R&D work, and we’d been in business for 17 years. The tax cuts kind of gave us the kick … to take a leap and buy some production equipment, which has allowed us to virtually triple our business over the last eight years.”

- “Legislators need to understand the impact of tax reform,” Macias went on. “I’m a machine shop in Phoenix, Arizona, and there are hundreds of machine shops across the U.S., but there are also thousands upon tens of thousands of small manufacturing companies that made the same decisions we did based on those tax policies.”

Schneider Electric to Invest More Than $700 Million in U.S.

Global energy management and digital transformation giant Schneider Electric will invest more than $700 million in U.S. operations over the next two years, the company announced yesterday (The Dallas Morning News, subscription).

What’s going on: “Schneider said it intends to leverage the investment to ‘support the country’s focus on bolstering the nation’s energy infrastructure to power AI growth, boost domestic manufacturing and strengthen energy security.’”

- The investment—the largest planned single capital expenditure in Schneider Electric’s 135-plus-year history—will be used to expand manufacturing facilities across the U.S. and to boost “smart factory transformation” across Texas, Massachusetts, Missouri and Tennessee, among other states.

- The company is the latest in a string of large manufacturers to announce sizeable domestic investments. Last week, biopharmaceutical firm Johnson & Johnson said it would spend more than $55 billion in the U.S. over the next four years.

- The announcement comes less than a year after the opening of Schneider Electric’s 105,000-square-foot facility in Red Oak, Texas, to support the data center boom in the Dallas–Fort Worth area.

Where else funds will go: The money will also be used to expand a campus in El Paso, Texas, “to keep up with growing demand to increase production of switchgear and power distribution products,” and to open a Houston innovation center that will offer AI-powered automation solutions.

Our take: “Schneider Electric’s significant investment is a clear sign that manufacturing in America is moving forward—driving economic growth, innovation and job creation across the country,” NAM President and CEO Jay Timmons said in a statement quoted in the article.

- “By expanding their operations with a focus on energy security, automation and AI, Schneider Electric is not only strengthening America’s competitiveness but also creating new opportunities and powering our nation’s future.”

NAM Forge Your Path Series: Meet CARR Machine & Tool President Jim Carr

Business is booming at CARR Machine & Tool, Inc., a manufacturer of precision machined parts for the aerospace, defense, semiconductor and medical industries.

The Elk Grove Village, Illinois–based company has seen record sales so far this year, and over the past five years, sales have skyrocketed 500%.

Spearheading this growth is Jim Carr, the company’s president and second-generation business owner and host of “my TRUE POSITION” podcast, who has transformed his shop floor by embracing technology, prioritizing culture and thinking outside the box.

In the latest installment of the NAM’s “Forge Your Path” series, Carr talks about how he got started in podcasting, his biggest accomplishments, where he sees his company in the next 10 years and more.

Q: How did you get started in podcasting, and what is the focus of “my TRUE POSITION”?

Carr: “Seeing a growing need for resources for thought leadership in manufacturing, I co-founded the ‘MakingChips’ podcast, which officially launched in January 2015. The podcast provides metalworking leaders content to enhance their careers and businesses, focusing on leadership, operations, technology and culture.

“In early 2022, I left ‘MakingChips’ to launch ‘my TRUE POSITION,’ a 20-minute, introspective show that provides manufacturing professionals immediate and actionable insight into high-level issues of running a small to medium-sized business.”

Q: What is one lesson or insight you’ve gained in leadership that you haven’t widely shared before but that has been a key part of your company’s success?

Carr: “I was raised in a manufacturing environment with a very poor company culture, so I knew when I took over CARR Machine & Tool in 2004, it was my job to really change the way that I believe a company should be run and to respect your employees. I thought that was very important. It’s been very powerful in the success of the company over the past 20 years.

“The thing that I don’t talk much about is the importance of bringing your personal brand into your corporate brand and having them aligned. Everyone has their true authentic self, but sometimes people are afraid to let others see that. When you can allow that into your corporate brand, it becomes powerful and authentic—and people are attracted to that authenticity.”

Q: Can you share a quote or mantra that defines your approach to leadership? How has this mantra influenced your decision-making and leadership?

Carr: “One that I have learned from my father, Richard, who I worked with for decades, is to keep pushing yourself. That doesn’t mean to work 150 hours a week, but to push yourself outside of your comfort zone. Sometimes we get complacent and can be afraid to venture outside of that comfort zone. It only takes a little bit of discomfort to make you grow. If you do that, you’ll have big wins over the long term.”

Q: What accomplishments at your company are you the most proud of and why?

Carr: “Having my son join the company 10 years ago provided a big paradigm shift in how we operate. Bringing him in and reading the book ‘Traction,’ which talks about how to use the Entrepreneurial Operating System as a systematized way to run your business and achieve success, were very impactful in our growth. Getting AS9100 accreditation—meaning that as a true aerospace manufacturing company, we are consistently demonstrating quality and safety in providing products that meet our customers’ needs—has also been important. Prioritizing company culture has been another big thing that has really changed the face of the company.

“One of the best things we did was move to a new 15,000-square-foot state-of-the-art facility about two blocks from where our other facility was located. We purchased brand-new five-axis precision machining. We’ve done a great job of implementing robotic automation. We have a quality control department now inspecting parts and documenting tolerances. We implemented a new ERP system, and it’s helped us scale. We’ve gone from a regular ‘mom and pop’ machine shop to a world-class AS9100 company with detailed documentations and mandates.”

Q: Where do you see your company in the next 10 years, and what are you hoping to achieve?

Carr: “We’re working on a 10-year succession plan right now as I hope to be fully retired by then. I’ll probably still be podcasting—if podcasting is still a thing in 10 years. I envision an even more state-of-the-art company where we’re using artificial intelligence technology. Also, achieving cybersecurity maturity model certification for dealing with government and classified information will be important.”

Q: What is one piece of advice you would give to a manufacturing leader?

Carr: “I think it’s important to network and have that human experience because there’s nothing like meeting people in person and learning about his or her experiences. Also, if you have the opportunity to join a board, do it as it’s a great way to network with like-minded individuals who know the industry and can help you navigate issues you may be experiencing.”