ICYMI: Iowa Manufacturer Expands, Credits Pro-Growth Tax Law

Vermeer Corporation Announces Plan to Build New Facility, Create 300+ Jobs

Washington, D.C. – Vermeer Corporation, an industrial and agricultural equipment producer based in Pella, Iowa, is crediting the pro-growth tax provisions of H.R. 1 with supporting the company’s plan to build an all-new 300,000-square-foot facility in the Des Moines metro that will create more than 300 jobs.

Vermeer said in a company statement, “We’re grateful for the state of Iowa, the pro-business environment, the skilled workforce here and economic policies, like Working Families Tax Cuts, that have helped support Vermeer’s long-term growth.”

Last August, National Association of Manufacturers Executive Vice President Erin Streeter joined Rep. Mariannette Miller-Meeks (R-IA) for a Made in America Manufacturing Tour across Iowa’s 1st District, where they visited Vermeer’s facility in Pella. During the tour, Vermeer President and CEO and NAM Executive Committee member Jason Andringa said H.R. 1 “sets up manufacturers for a generation of continued growth and advancement.”

Streeter praised Rep. Miller-Meeks’ leadership during the tour.

“H.R.1 is a landmark win for manufacturing—delivering pro-growth policies that will strengthen our industry for years to come. Without bold leadership from lawmakers like Rep. Miller-Meeks, manufacturers could have been crippled by the largest tax hike in history—jeopardizing the progress we made after the 2017 Tax Cuts and Jobs Act. Iowa’s 1st Congressional District is the first in the state for manufacturing. We want to thank her for protecting 13,000 jobs and $1.2 billion in wages at more than 800 manufacturing companies in her district alone.”

Background

KEY FACTS: If Congress had failed to preserve tax reform in 2025, the U.S. would have risked:

- 5.9 million lost jobs;

- A $540 billion reduction in employee compensation; and

- A $1.1 trillion shortfall in U.S. GDP.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Import Costs Edge Up as Export Prices Jump

U.S. import prices increased 0.2% in January, after a similar rise in December, with higher nonfuel prices more than offsetting lower prices for fuel in January. Over the past year, import prices declined 0.1%. Meanwhile, U.S. export prices rose 0.6% in January, with both higher nonagricultural and agricultural export prices driving the increase. Over the past year, export prices advanced 2.6%.

In January, U.S. import prices for manufacturing rose 0.8% over the year, with most of the industry experiencing price declines. Primary metal manufacturing experienced the most significant over-the-year U.S. import price increase in January, surging 26.1%. On the other hand, the greatest yearly decline in U.S. import prices occurred in beverage and tobacco product manufacturing, which fell 14.1% from January 2025. Meanwhile, U.S. export prices for manufacturing in January advanced 4.0% over the year, with primary metal manufacturing export prices exhibiting the largest rise (43.9%).

Fuel import prices fell 2.2% over the month in January, after declining 1.1% in December. Lower prices for petroleum drove the decrease, moving down 2.7%. Furthermore, prices for fuel imports plummeted 13.4% from January 2025. Meanwhile, natural gas prices jumped 36.4% over the year.

Nonfuel import prices increased 0.5% in January, after moving up 0.2% in December. Higher prices for nonfuel industrial supplies and materials, capital goods, automotive vehicles, consumer goods and foods, feeds and beverages drove the increase. The price index for nonfuel imports grew 1.2% over the past year and has not declined on a year-over-year basis since February 2024.

After no movement in December, agricultural export prices increased 0.2% in January. Over the past 12 months, agricultural export prices advanced 2.2%. Meanwhile, nonagricultural export prices rose 0.7% in January. Higher prices for capital goods, nonagricultural industrial supplies and materials, consumer goods and automotive vehicles led the gain. Over the past year, nonagricultural export prices advanced 2.7%.

U.S. Manufacturing Growth Weakest in Seven Months

The S&P Global Manufacturing PMI was 51.6 in February, down from the January reading of 52.4. New orders rose in February, but at a slower pace than the prior month. At the same time, exports declined for the eighth consecutive month as tariffs continued to drive up costs and hurt demand from Canada. Prices on inputs increased but at a slower rate than in January, while selling price inflation fell to a 14-month low. In sum, the rate of inflation remains elevated from a historical context in February but is lower than recent peaks.

Production rose at the weakest rate since September, and combined with marginal gains in sales, caused stocks of finished goods to remain unchanged following six months of accumulation. Employment gains were weak in February as backlogs of work declined. Meanwhile, vendor performance continued to worsen as a result of low stock availability, transportation delays and adverse weather.

Expectations of new product launches and business expansion plans led firm confidence to rise to its highest level in eight months in February. Despite the gain in optimism, uncertainty over the political environment and the tariff picture continued to be a drag on hiring and investment, and that uncertainty doesn’t seem likely to abate soon.

Global Manufacturing PMI Hits 44-Month High

In February, growth in global manufacturing activity strengthened from January, rising from 50.9 to 51.9, a 44-month high. Output and new orders both expanded as production rose at the fastest pace since December 2021 and growth in new orders hit a four-year high. New export orders increased as international trade volumes improved for the first time since March 2025 but continued to contract in the U.S and eurozone. Meanwhile, lead times continued to slow, lengthening for the 21st consecutive month. Employment grew for the second consecutive month, although gains were minimal.

India, Taiwan, the Philippines and Greece had the highest PMI readings in February. On the other hand, Mexico, Brazil and Russia were some of the larger nations to register declines in activity. The upturn in manufacturing occurred across consumer, intermediate and investment goods in February, with rates of expansion improving for the intermediate and investment goods sectors.

Meanwhile, input price pressures strengthened in February, jumping to a 39-month high, while output prices rose at a slightly slower rate. Forward-looking indicators remained positive, with business optimism hitting a 21-month high and climbing above long-run averages for the first time since March 2024. Notable improvements in Japan, China, the eurozone and the U.S. helped buoy this increased optimism.

Payrolls Fall as Manufacturing Employment Drops

Nonfarm payroll employment declined by 92,000 in February, coming in below expectations of a nominal gain. Meanwhile, December and January’s job gains were revised downward by 69,000 to a loss of 17,000 jobs and a gain of 126,000 jobs, respectively. The industries with the most significant job gains in January—health care and construction—both shed jobs in February. The 12-month average stands at just 13,000 job gains per month. At the same time, the unemployment rate inched up 0.1 percentage point from January to 4.4% in February, while the labor force participation rate ticked down 0.1 percentage point to 62.0%.

After edging up in January after 13 consecutive months of declines, manufacturing employment decreased by 12,000 in February. On the other hand, the collective job losses in December and January of 3,000 were revised downward by 5,000 jobs to a decrease of 8,000 jobs. Manufacturing employment is down 98,000 over the year. Durable goods manufacturing employment fell by 4,000 in February, while nondurable goods employment dropped by 8,000. The most significant gain in manufacturing in February occurred in fabricated metal product manufacturing, which added 2,100 jobs over the month. Meanwhile, the most significant loss occurred in plastics and rubber products manufacturing, which shed 4,200 jobs over the month.

The employment-population ratio edged down 0.1 percentage point from January to 59.3% in February and is down 0.6 percentage points from a year ago. On the other hand, employed persons who are part-time workers for economic reasons declined by 477,000 from January to 4.4 million in February and are down from 4.9 million in February 2025. Native-born employment is up 877,000 from January and 128,000 over the year. Meanwhile, foreign-born employment is down 394,000 over the month and 519,000 over the year. At the same time, the native-born unemployment rate is up 0.3 percentage points over the year to 4.7% in February, while the foreign-born unemployment rate stayed the same at 4.7%.

Average hourly earnings for all private nonfarm payroll employees rose 0.4%, or 15 cents, reaching $37.32. Over the past year, earnings have grown 3.8%. The average workweek for all employees stayed the same at 34.3 hours but inched down by 0.1 hour to 40.1 hours for manufacturing employees.

Manufacturing Expands at a Slower Pace While Prices Surge

In February, the U.S. manufacturing sector expanded for the second consecutive month but at a slightly slower pace than the prior month, with the ISM Manufacturing® PMI decreasing to 52.4% from 52.6% in January. Demand indicators remained in expansion territory, with the New Orders, New Export Orders and Backlog of Orders Indexes at 55.8%, 50.3% and 56.6%, respectively. Meanwhile, the Customers’ Inventories Index continued to contract into “too low” territory, ticking up 0.1 percentage point to 38.8, which is also a positive sign for future production. Meanwhile, the Production Index expanded at a slower pace in February, decreasing from 55.9% to 53.5%.

The New Orders Index expanded for a second consecutive month in February but at a slower pace, falling 1.3 percentage points from January. Of the six largest manufacturing sectors, four—machinery, transportation equipment, chemical products and computer and electronic products—reported an increase in new orders. In a turnaround from recent months, respondents noted optimism about near-term demand.

The New Export Orders Index expanded for a second consecutive month in February and at a slightly faster pace, 0.1 percentage point higher than January. Nonetheless, respondents remain concerned about trade frictions, with a negative comment for every positive comment. Meanwhile, the Imports Index expanded for the first time since March, up 4.9 percentage points from January to 54.9%, the highest increase since February 2022.

The Employment Index contracted for the 13th consecutive month but at a slower pace than the prior month, up 0.7 percentage points from January to 48.8%. Of the six largest manufacturing sectors, two—transportation equipment and machinery—reported increased employment. Companies focused on holding off on filling open positions to restrict headcounts due to uncertainty around near- to mid-term demand. For every comment on hiring, 1.4 respondents noted reduced headcounts.

The Prices Index surged 11.5 percentage points from January to 70.5%, indicating raw materials prices grew for the 17th straight month in February and at a much faster pace than the prior month. Of the six largest manufacturing sectors, all reported increased prices. The increase continues to be driven by higher steel and aluminum prices impacting the entire supply chain, as well as the tariffs applied to most imported goods. Roughly 45.4% of companies reported paying higher prices, up from 29.0% in January and from 21.0% in January 2025.

Permitting Reform Talks Restart—A Welcome Sign for Manufacturers

Washington, D.C. – Following the decision by Sens. Martin Heinrich (D-NM) and Sheldon Whitehouse (D-RI) to reopen permitting reform negotiations, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Permitting reform is one of the key pillars of a comprehensive manufacturing strategy that will help clear the skies for manufacturers. We thank Sens. Whitehouse and Heinrich for reopening negotiations on this critical issue. The stakes couldn’t be higher for manufacturers: America’s permitting system is broken—with projects taking up to 80% longer to move forward than in peer nations. America cannot lead the world in all forms of energy, AI and advanced manufacturing while projects remain stuck in yearslong permitting delays. Coming off the NAM State of Manufacturing Tour, the message has been clear—America needs a faster, more reliable permitting system to build the infrastructure that powers growth and keeps our industry competitive. 2026 must be the year of permitting reform. We want ribbon cuttings, not red tape, so manufacturers can build new shop floors, energy facilities and new infrastructure here in the United States.

“In addition to our champions in the House of Representatives—including Natural Resources Committee Chairman Bruce Westerman (R-AR), Transportation and Infrastructure Committee Chairman Sam Graves (R-MO) and Rep. Jared Golden (D-ME)—we are grateful to Sens. Whitehouse, Heinrich, Shelley Moore Capito (R-WV) and Mike Lee (R-UT) for their continued efforts to advance bipartisan, comprehensive permitting reform—an essential pillar of a comprehensive manufacturing strategy and an all-of-the-above approach to energy. By modernizing our broken permitting system, Congress can deliver the certainty manufacturers need to build faster, invest with confidence and improve the quality of life for all Americans.”

Background:

In February, the NAM launched “Building to Win,” a six-figure campaign urging Congress to pass robust infrastructure investments and reauthorize critical federal highway programs before they expire on Sept. 30. As part of the launch, the NAM unveiled a new infrastructure policy roadmap, including original analysis on the economic costs of congestion on manufacturers and a set of core infrastructure policy pillars. The NAM also debuted a new ad underscoring the importance of infrastructure investment and permitting reform to manufacturing competitiveness.

Permitting reform has long been a top legislative priority for the NAM. In the final weeks of 2025, the NAM pushed for permitting reform measures that advanced in the House—including the passage of the SPEED ACT. Manufacturers are calling on the Senate to take the helm and build on that momentum by advancing the SPEED Act, a cornerstone of the NAM’s “Manufacturing’s Roadmap to AI and Energy Dominance.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Q&A: Rep. Graves on Infrastructure and Transportation

The NAM recently interviewed Rep. Sam Graves (R-MO), chairman of the Transportation and Infrastructure Committee, about the surface transportation reauthorization bill and the importance of infrastructure to manufacturers nationwide. Here is the full text.

What are your priorities in the upcoming infrastructure bill to help drive manufacturing growth in the United States?

“Manufacturing, like every other aspect of our economy, depends on a strong transportation system and infrastructure. President Trump has prioritized bringing manufacturing back to the United States, and he’s already seen significant success. As chairman of the Transportation and Infrastructure Committee, I’m working to make sure we have an efficient, safe and reliable infrastructure that supports and facilitates the growth of manufacturing in the United States. The best way to do that is by passing a bill that focuses on building the infrastructure needed to move goods and people safely and efficiently. The next surface transportation reauthorization bill will focus on hard infrastructure, such as roads and bridges.

“Another main priority of mine is fixing the Highway Trust Fund, which serves as the main funding source at the federal level for road and bridge projects. We must address the solvency challenges facing the Highway Trust Fund and preserve our user-pays system. Right now, that system is broken, and it has been for some time. The best way to provide long-term certainty is to finally begin shoring up the Highway Trust Fund and ensuring that all users are paying into the system.

“Additionally, this bill is about looking forward and building an infrastructure for the future. Anticipating the transportation and infrastructure needs of the next 20 years is the best way to support economic growth and help our manufacturers as their industry continues to evolve.”

Why is it important that Congress pass a surface transportation reauthorization bill this year?

“The surface transportation reauthorization bill impacts all Americans—we all use or rely on roads, bridges and rails. Traditionally, this legislation provides tens of billions of dollars in annual funding to improve American highways, bridges, transit and other surface transportation infrastructure. It also provides funding for rail, trucking safety and other transportation programs.

“Surface transportation bills typically expire after five years. That multiyear time frame gives states the long-term funding certainty they need to plan and carry out many of their most critical projects. The current highway bill, which was part of the Infrastructure Investment and Jobs Act, expires on Sept. 30, 2026. Unless Congress acts before then, federal programs will be impacted, including that long-term certainty. This is unacceptable, and I’m committed to getting the next surface bill done on time and preventing potential project delays and uncertainty that can result from a lapse in long-term funding.”

How does investing in infrastructure benefit the people and manufacturers in your state/district?

“I represent all of North Missouri. Investing in our roads has never been more important for the future of our communities, large and small. For manufacturers to succeed, as well as to attract new companies, we’ve got to have good infrastructure. It’s critical for shipping Missouri-made products across the country, for receiving inputs and for farmers getting goods to market. As we work to bring manufacturing back to the United States, my district and many others see an opportunity to grow their local economy. To make that happen, we have to maintain and improve our infrastructure across the country.”

Why is the NAM’s leadership on this issue so critical to getting an infrastructure bill done this year?

“The NAM has over 14,000 members from every sector of manufacturing. The United States depends on a strong manufacturing industry, and the NAM provides a voice for our manufacturers, large and small. They are truly at the center of manufacturing in this country. So, when it comes to getting an infrastructure bill of this size done, we need to hear from all industries, especially our manufacturers. Whether it’s in the early stages of crafting the bill when we’re looking for feedback on existing policy and asking for priorities from the manufacturing industry—and we appreciate the NAM’s efforts in that process—or after the bill has been introduced and is working its way through the legislative process, organizations like the NAM have an important role in getting information out there about what the bill does and how it will benefit the country.”

ICYMI: “Ketchie CEO Credits Trump’s ‘Beautiful Bill’ with Helping Her Machine Shop Prosper”

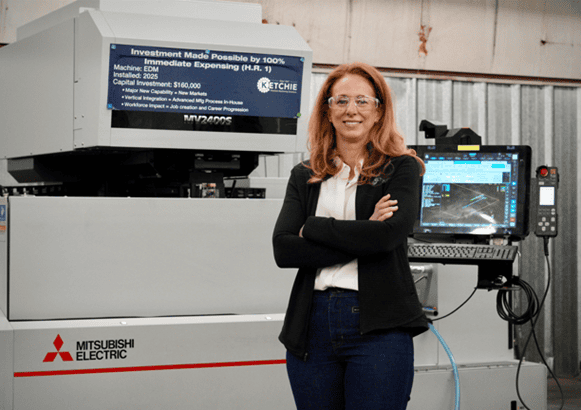

Washington, D.C. – As part of the 2026 National Association of Manufacturers State of Manufacturing Tour, Ketchie President and Owner Courtney Silver hosted the NAM for a discussion on how tax certainty due to the NAM-backed H.R. 1 has empowered manufacturers like her to reinvest in their workforce and facilities.

The tour stop was covered by Business North Carolina. Excerpts of the report can be found below. Bolding has been added.

—-

Ketchie CEO credits Trump’s ‘beautiful bill’ with helping her machine shop prosper

Business North Carolina

Kevin Ellis

Feb. 23, 2026

https://businessnc.com/ketchie-ceo-credits-trumps-beautiful-bill-with-helping-her-machine-shop-prosper/

Miguel Carrillo describes himself as a “machine nerd,” and he had an engaged audience on Monday watching him operate a $700,000 device brought in last year to Concord-based Ketchie, the machine shop where he works.

Ketchie may only have 20 employees, but it was a stop on the State of Manufacturing Tour that National Association of Manufacturers President Jay Timmons began last week in Cleveland and will continue across the country after visiting three Charlotte-area sites on Monday. Tagging along with Timmons at Ketchie was Acting Deputy Secretary of the U.S. Treasury Derek Theurer, U.S. Rep. Tim Moore of Cleveland County and NC Chamber President Gary Salamido.

Ketchie CEO Courtney Silver was a supporter of the “One Big Beautiful Bill,” the legislation signed into law last year by President Donald Trump. She testified at congressional hearings before its passage about how it would help small businesses. Timmons said he had heard so much about Ketchie’s new machines, he wanted to see them in action.

The tax bill that eliminates income tax on overtime and tips for some workers also allows businesses to reduce their tax bills on investments immediately, rather than spreading the reduction out over several years, says Silver.

“When you can expense an investment in the year it was purchased, it provides cash flow to companies and continues to allow them to make new investments,” says Silver.

Ketchie purchased three machines last year that combined cost more than $1.1 million, plus made about $400,000 in other investments, including AI software that has cut some hour-long processes down to five minutes.

“I would have never made those investments without immediate expensing,” Silver says. She says she’s also looking to add five workers to her shop.

“This is a perfect example of what you can do to help build America and American manufacturing with the right policies in place,” says Timmons.

Theurer said it was nice to see advanced manufacturing take place in a North Carolina factory rather than spending his day on policy in the nation’s capital.

“This type of investment is what we intended to see when we made our big tax policy and worked for smarter regulation,” said Theurer.

…

Ketchie supplies metal parts to railroad, aerospace and heavy industry manufacturers, such as Charlotte steelmaker Nucor, Davidson-based HVAC company Trane and Norfolk Southern. The company was started in 1947 by Edgar Ketchie, the grandfather of Silver’s late husband.

On Monday, Carrillo was machining a steel part needed by an industrial recycling company. The Dual Spindle 5-Axis Machining Center that Ketchie bought last year doesn’t require Carrillo to reset the machine for the other side of the metal part, which is about half the size of a deck of cards, but grooved. It means quicker production and fewer human errors, he says.

“It allows me to step out and allows the machine to do the heavy lifting,” says Carillo. The advanced manufacturing aspect attracted the 2024 graduate of A.L. Brown High School to work at Ketchie after starting in a job shadowing program while a high school junior. “It’s nice when a machine can do one thing, but it’s really nice when a machine can do a lot of things.”

…

—-

Background

Learn more about Silver’s testimony before Congress in 2025 on the importance of preserving the pro-manufacturing policies of the Tax Cuts and Jobs Act here.

KEY FACTS: If Congress had failed to preserve tax reform in 2025, the U.S. would have risked:

- 5.9 million lost jobs;

- A $540 billion reduction in employee compensation; and

- A $1.1 trillion shortfall in U.S. GDP.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.95 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Home Prices Rise at Slowest Annual Pace Since 2011

In December, the S&P Cotality Case-Shiller U.S. National Home Price NSA Index recorded a 1.3% annual gain, down from the 1.4% gain in November and the weakest full year gain since 2011. The 10-City Composite increased 1.9%, down from 2.0% the previous month, while the 20-City Composite rose 1.4% year-over-year, consistent with November’s gain. Among the 20 cities, Chicago again posted the highest annual gain at 5.3%, followed by New York at 5.1% and Cleveland at 4.0%. Meanwhile, Tampa again posted the lowest annual return, with prices falling 2.9%.

On a month-over-month basis, the U.S. National Index declined 0.3% before seasonal adjustment. At the same time, the 10-City Composite and 20-City Composite both edged down 0.1%. After seasonal adjustment, the U.S. National Index rose 0.4%, while the 10-City and 20-City Composites both grew 0.5%. The Northeast and Midwest continued to outperform other regions as the second half of the year exhibited weaker price growth. Meanwhile, in addition to Tampa, the Sun Belt market kept declining, including Denver (down 2.1%), Phoenix (down 1.5%), Dallas (down 1.5%) and Miami (down 1.5%).

The combination of high financing costs and prices continued to cap growth. Before seasonal adjustment, 15 of the 20 major metro areas saw price declines in December. Over the year, home prices trailed inflation. In comparison, home prices outpaced inflation by 3.7 percentage points over the prior decade, a trend that reversed starting in June 2025.