Labor Department Announces Contractor Rule

The U.S. Department of Labor announced a rule that would classify gig workers as contractors rather than employees, according to The New York Times (subscription).

The rule: The new rule identifies two main factors as determinants of whether a person should be classified as a contractor or an employee.

- The first is how much a company controls the way a worker performs his or her job.

- The second is how much a worker can profit based on initiative, as opposed to earning a steady salary regardless of performance.

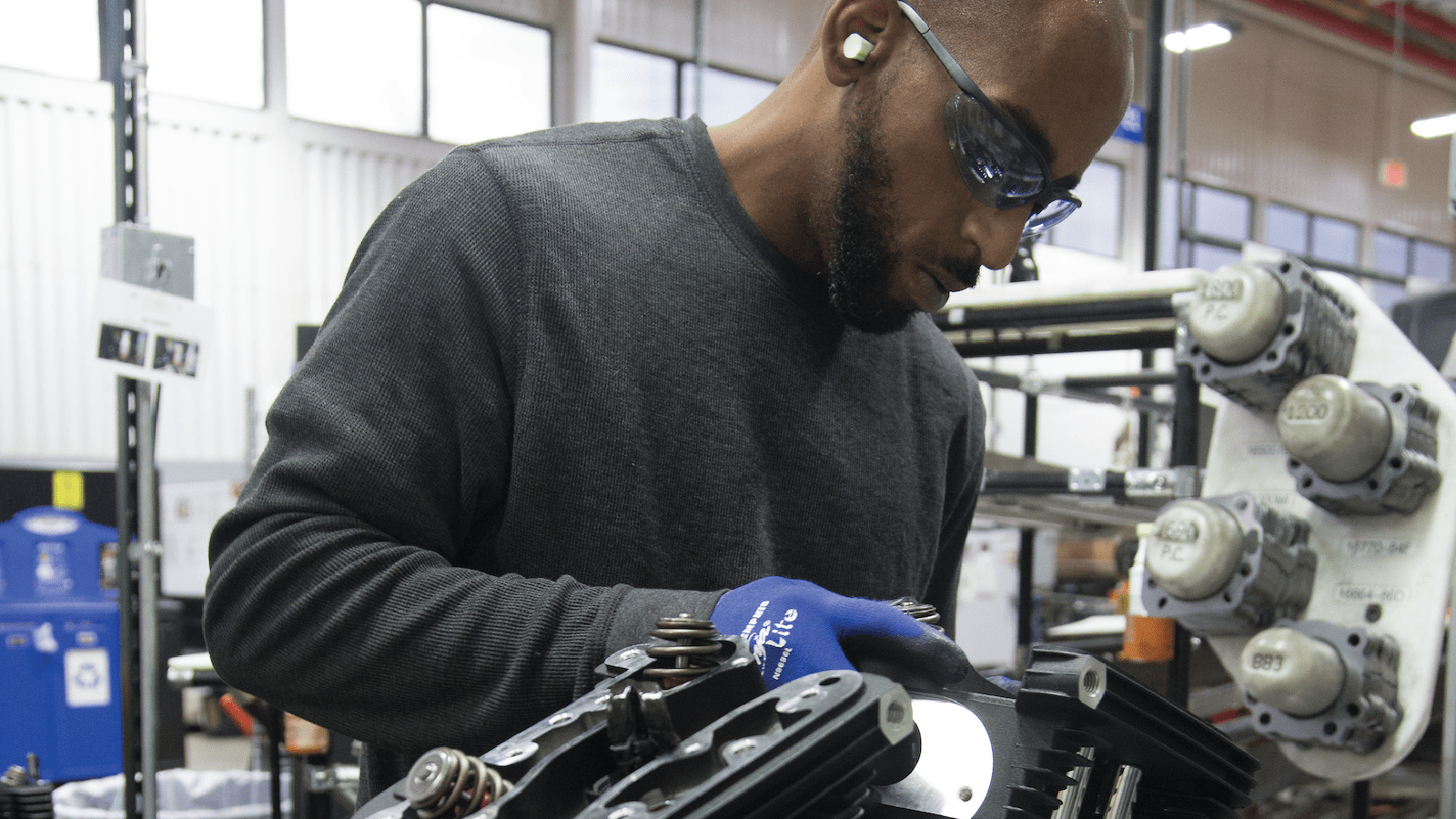

The upshot: The rule could likely shift the employment status of millions of Americans, including many in manufacturing. If they use contractors, companies do not have to pay the minimum wage, overtime, a portion of social security taxes, or unemployment insurance and workers’ compensation insurance.

A word from the NAM: “When finalized, the rule could solidify the use of independent contractors, including in manufacturing. Independent contractor arrangements benefit companies and workers by increasing flexibility and streamlining the human resources processes,” explains NAM Director of Labor and Employment Policy Drew Schneider. He adds:

- “Manufacturers are currently operating under a confusing patchwork of state and federal laws that have defined independent contractors in numerous ways, causing legal uncertainty and unnecessary compliance costs.”

- “Manufacturers and their business partners will benefit from a clear and updated independent contractor standard that protects this important business practice and allows NAM members to focus on producing America’s essential goods and services.”