J&J: Price Controls, PBMs Problematic

Drug price controls will “chill” critical innovation in pharmaceutical manufacturing and do nothing to address the underlying causes of high medication costs, Johnson & Johnson leaders said recently.

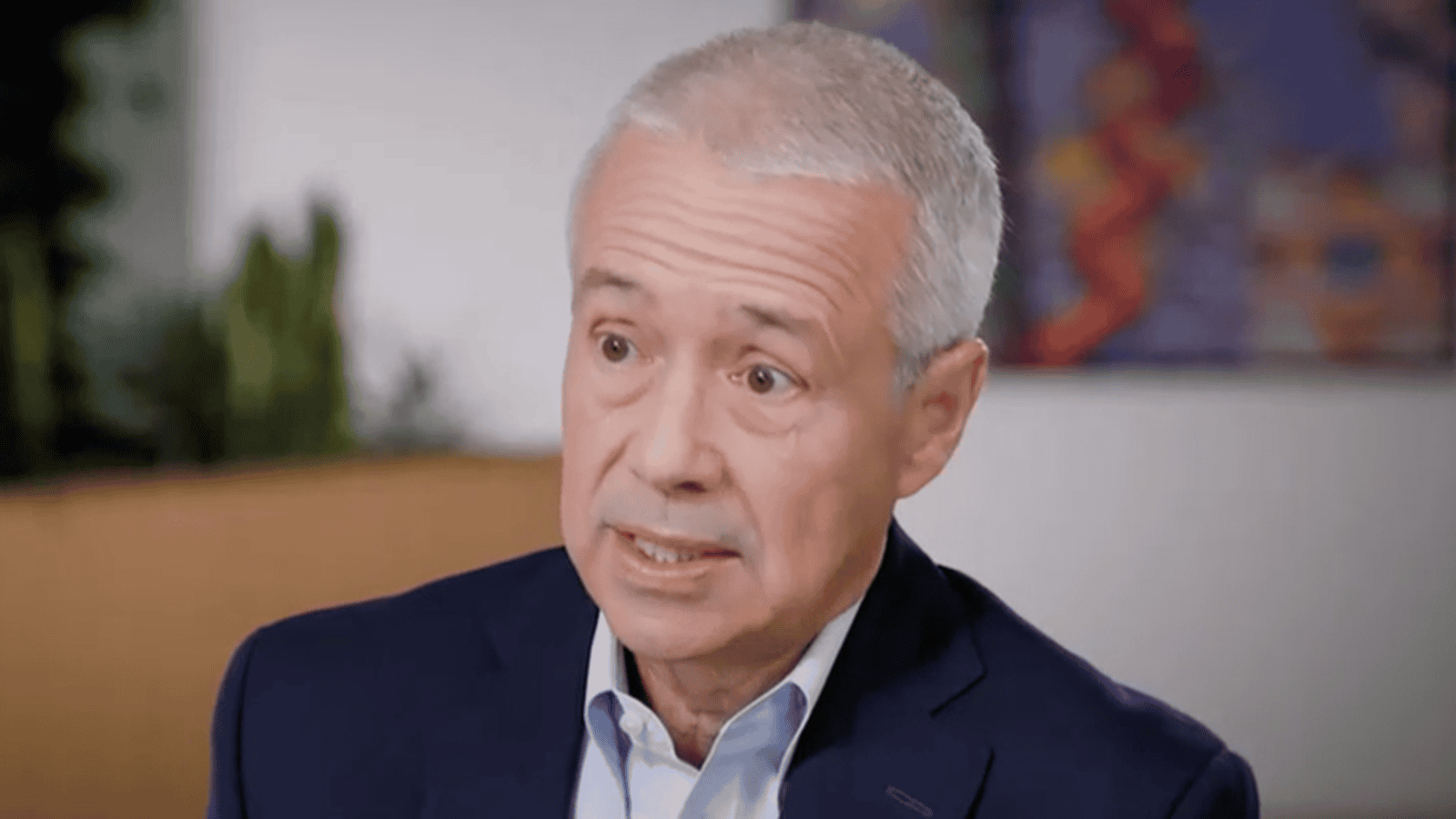

What’s going on: J&J Chairman and CEO Joaquin Duato and Executive Vice President and Chief Financial Officer Joseph Wolk told Bloomberg TV earlier this month that the pharmaceutical price controls mandated by the 2022 Inflation Reduction Act do a disservice to patients everywhere.

- “[T]he Inflation Reduction Act … is something that is misguided, and it’s going to chill innovation,” Duato told Bloomberg’s David Gura earlier this month. “When you chill innovation on investment in [research and development], then you have [fewer] cures.”

- The IRA gave the federal government authority to set prices for certain prescription medications in Medicare. In August, the Biden administration released the first 10 Medicare prescription drugs subject to those price controls, which go into effect in 2026.

- “I’d like to see a much more fact-based dialogue around the topic of drug pricing,” Wolk added. “About six years ago, Johnson & Johnson … was paying about 25% in discounts and rebates off [the] list price [of medications]. Today, that [figure is] 60%, yet the patients aren’t receiving the benefit of those discounts.”

The background: Pharmacy benefit managers are supposed to pass the manufacturer discounts they receive on to health plans and patients—but instead, they frequently pocket the discounts, the NAM has told Congress on several occasions.

- That’s one of several problematic business practices Congress must end by enacting comprehensive PBM reform, the NAM has said.

- Such legislation would do far more to benefit consumers than capping drug prices.

Cause and effect: The result of price controls will be fewer breakthrough cures and treatments for patients suffering from various illnesses, J&J told Bloomberg TV.

- “The number of medicines that will be there will be [lower], just because [fewer] investors would be putting money into developing new medicines,” Duato continued. “It’s going to be less attractive for investors to put money there.”

- And as Wolk said in another Bloomberg segment: “Investing in R&D, prioritizing R&D years in advance for [a drug] that may happen 10 years down the road is critically important.”

What should be done: If Congress truly wants to help patients with the cost of medications, it must focus on “the middlemen who are really driving up prices: pharmacy benefit managers,” NAM President and CEO Jay Timmons said recently.