NAM Leads Inaugural North American Manufacturing Conference

On Sept. 19–20, the NAM convened the inaugural North American Manufacturing Conference in Washington, D.C., along with its counterpart associations from Mexico and Canada, the Confederation of Industrial Chambers of Mexico and Canadian Manufacturers & Exporters.

What’s going on: The conference provided an opportunity for North American manufacturing executives and government representatives to share perspectives on the opportunities and challenges facing the sector across the region. At the conference, industry leaders discussed the need to:

- Ensure that North America has the affordable and reliable energy needed to support the manufacturing industry;

- Support more regional competitiveness, greater growth and the success of the United States–Mexico–Canada Agreement; and

- Address regional workforce needs in the U.S., Mexico and Canada.

Deepening ties: On Wednesday, the NAM, CONCAMIN and CME signed a memorandum of understanding that will serve as a roadmap for future cooperation between the three organizations and support close economic ties between the U.S., Mexico and Canada.

- The memorandum calls for the organizations to share information about each one’s services and activities, and to work together to shape the continent’s future manufacturing agenda.

- In addition to leaders from the NAM, CONCAMIN and CME, speakers at the event included U.S. Trade Representative Katherine Tai, ExxonMobil Senior Vice President Neil Chapman, Toyota Motor North America Executive Vice President – Product Support and Chief Quality Officer Chris Nielsen, Rep. Adrian Smith (R-NE), Bombardier Head of U.S. Strategy Tonya Sudduth, Energy Transfer Co-CEO Tom Long and Caterpillar Inc. Chief Technology Officer and Senior Vice President of Integrated Components and Solutions Division Karl Weiss.

Common principles: “Shared values, shared prosperity” was a central theme of the conference, echoing President Biden’s remarks at the U.N. General Assembly earlier this week.

- “As president of the United States, I understand the duty my country has to lead in this critical moment; to work with countries in every region linking them in common cause; to join together with partners who share a common vision of the future of the world,” President Biden said in New York on Wednesday.

- “There’s never been a greater need for us to stand together,” NAM President and CEO Jay Timmons said. “The world is caught between different political and economic systems. Our system here in North America enriches lives and lifts people up into freedom and prosperity, while other systems oppress their people and rob them of their liberty,” he continued, adding that the USMCA, of which the NAM is a longtime advocate, serves as a reminder “of what we can achieve when we work together.”

Strengthening the region: Throughout the conference, discussions focused on three components of a successful North American economy—growth, resilience and competitiveness—and the critical role manufacturers play in that system.

- “Today, we live in a new reality,” CONCAMIN President José Antonio Abugaber Andonie said. “The commercial competition with China, the pandemic, the conflict in Ukraine … [all] place us before a second great industrial transformation in North America. … Some call it nearshoring, friend-shoring, ally-shoring or reshoring. No matter the name, the truth is that this phenomenon is modifying the structure of international industrial organization. North America is the epicenter of this transformation.”

- Added CME President and CEO Dennis A. Darby: “Manufacturers are an important driver of economic development and prosperity. We are key players in the changes and challenges of the 21st century.”

Maersk Introduces First Green-Methanol Container Ship

In a milestone for the logistics sector, Danish shipping firm Maersk recently unveiled “its first container vessel moved with green methanol,” CNBC reports.

What’s going on: “The new container ship, ordered in 2021, has two engines: one moved by traditional fuels and another run with green methanol—an alternative component, which uses biomass or captured carbon and hydrogen [for] renewable power. Practically speaking, the new vessel emits 100 tons of carbon dioxide fewer per day compared to diesel-based ships.”

- The ship is the first of a larger order of 25 due for delivery next year.

- Other shipping firms have placed orders for similar vessels.

Why it’s important: Because it’s a global industry—with approximately 90% of the world’s traded products traveling by sea—ocean shipping has typically been less receptive to transitioning to new energy sources, Danish Minister of Industry Morten Bodskov said, according to the article.

- For example, “[i]n June, a group of 20 nations supported a plan for a levy on shipping industry emissions. But China, Argentina and Brazil were among the nations pushing back against such an idea.”

Climate goals: Maersk aims to be “climate neutral” by 2040, making the green-methanol vessels a key part of its approximately 700-ship fleet.

However … “[A]nalysts are worried that Maersk and its competitors might struggle to find enough supply of green methanol. The fuel is scarce and costly to transport.”

The last word: “Manufacturers are leading the way on developing and scaling up new clean energy sources,” said NAM Vice President of Domestic Policy Brandon Farris. “The NAM continues to advocate for policies and programs that foster and encourage that innovation.”

House Passes Emissions-Rules Measure

In a victory for manufacturers, the House yesterday passed an NAM-backed bill that would prohibit states from banning the sale of new gas-powered vehicles, the Washington Examiner reports.

What’s going on: “Lawmakers voted 222–190 to pass the Preserving Choice in Vehicle Purchases Act, which would amend federal law to block state attempts to eliminate the sale of vehicles with internal combustion engines as well as prohibit the Environmental Protection Agency from issuing waivers that ban such sales.”

The background: In recent months, the EPA, National Highway Traffic Safety Administration and state of California have all proposed measures to limit emissions from light- and medium-duty vehicles.

Why it’s important: The range of frequently conflicting regulations is creating confusion and regulatory uncertainty for manufacturers.

- The Preserving Choice in Vehicle Purchases Act would eliminate that confusion by “harmoniz[ing] vehicle emissions standards,” NAM Managing Vice President of Policy Chris Netram told lawmakers. “When manufacturers have regulatory clarity, we can focus on what we do best—innovating, creating jobs and investing in America.”

What’s next: The measure now moves to the Senate.

Preparing the Supply Chain for Future Pandemics

Manufacturers can take specific steps to improve the resilience of the health care supply chain, the NAM’s latest health care study found.

What’s going on: The study—conducted by the Manufacturing Policy Initiative at Indiana University—analyzes data from the COVID-19 pandemic, when manufacturers in the U.S. had to produce large quantities of critical health care equipment under difficult, fast-evolving conditions.

Building resilience: The study found that to prepare the supply chain for a future disruption of similar magnitude, manufacturers should focus on seven areas:

- Speed: Manufacturers must be able to satisfy demand quickly.

- Information: Manufacturers require timely access to accurate information.

- Cost: Firms face the costs of taking action within the supply chain, as well as the costs of managing market unpredictability and policy environment uncertainty.

- Networks: Partnerships can support information sharing and networks to help manufacturers navigate the disruption.

- Size: Supply chain challenges can look different for small, medium-sized and new manufacturers than for larger, established firms.

- Technology: Tech can help manufacturers increase production, improve efficiency and speed up innovation.

- Flexibility: Responses can come from unexpected sources and need a flexible policy environment.

The NAM says: “Policymakers should utilize these lessons to bolster our supply chain for the next disruption,” NAM Chief Economist Chad Moutray said. “This analysis … reveals that there are key policy actions needed to strengthen the manufacturing supply chain. Research shows a more balanced regulatory agenda, with an emphasis on clarity, predictability and coordination, will help mitigate the effects of the next disruption.”

Chevron Now Majority Stakeholder in Hydrogen Project

Chevron Corp. has bought a majority stake in a federal government–supported “green” hydrogen project in Utah that, once completed, will “produce massive volumes” of the renewable energy source, according to E&E News’ ENERGYWIRE (subscription).

What’s going on: Chevron said on Tuesday that it had completed a deal with fuel-storage developer Magnum Development LLC to take over full ownership of the Utah salt caverns where green hydrogen production and storage is set to take place.

- This purchase gives the energy giant “a majority interest in the joint venture that is developing the [Advanced Clean Energy Storage] project.”

- ACES—in which Mitsubishi Power Americas Inc. and private-equity firm Haddington Ventures LLC are also partners—won a $504 million loan guarantee from the Department of Energy in 2022.

- The project is part of a larger effort by Chevron to develop emerging energy technologies through 2028.

Why it’s important: “We seek to leverage the unique strengths of each partner to develop a large-scale, hydrogen platform that provides affordable, reliable, ever-cleaner energy and helps our customers achieve their lower carbon goals,” Chevron New Energies Vice President Austin Knight said in a statement.

- The plan is to make the hydrogen in the salt caverns in Delta, Utah, “for use at a nearby power plant” looking to diversify its energy mix—and aiming to run entirely on hydrogen by 2045.

Another effort: In partnership with ExxonMobil Corp. and Shell PLC, Chevron is also part of a Texas industry group asking for $1.25 billion in 2021 Bipartisan Infrastructure Law funds to construct hydrogen “hubs,” large-scale demonstrations of hydrogen production, transportation, usage and storage.

A model project: “Currently under construction, the ACES project could become one of the western U.S.’s most important demonstrations of what a low-carbon hydrogen industry might look like,” ENERGYWIRE reports.

The NAM’s take: “Manufacturers view clean energy solutions, such as hydrogen, as an important part of our country’s energy present and future—and the industry is used to leading the charge in developing and scaling hydrogen projects for widespread use,” said NAM Vice President of Domestic Economic Policy Brandon Farris.

- “The NAM is committed to ensuring that the hydrogen tax credit and other incentives help build the appropriate market conditions for hydrogen projects to succeed.”

Factory Orders Declined, Shipments Rose in July

Factory orders for manufactured products declined 2.1% in July, after having risen for four consecutive months, while factory shipments increased 0.5%, according to U.S. Census Bureau data.

Orders: Durable goods orders fell 5.2% in July, mostly due to declines in orders of aircraft and aircraft parts.

- However … excluding transportation equipment, factory orders increased 0.8% in July, with durable goods up 0.5%.

- Nondurable goods orders rose 1.1% in the same period.

A spending proxy rises: New orders for core capital goods—nondefense capital goods excluding aircraft, a proxy for capital spending in the U.S. economy—inched up 0.1% in July to $73.60 billion, just shy of the record high of $73.87 billion in May.

- Year-over-year, core capital goods orders have increased 0.8%.

The long view: Orders for new manufactured goods have decreased 0.7% in the past year, with factory orders excluding transportation declining 2.5% year-over-year.

Shipments: July marked the third consecutive month of increases for factory shipments.

- But in the past 12 months, total factory shipments have declined 0.6%, or 2.3% year-over-year excluding transportation equipment.

- Core capital goods shipments fell 0.3% in July, pulling back for the second month in a row from May’s record high of $74.05 billion.

In related news: Economic activity in the U.S. services sector continued to grow last month, with the ISM® Services PMI recording its eighth straight month of growth, the strongest pace since February, according to Markets Insider.

PALIoT Takes on Supply Chain Challenges

Supply chain problems, PALIoT Solutions is coming for you.

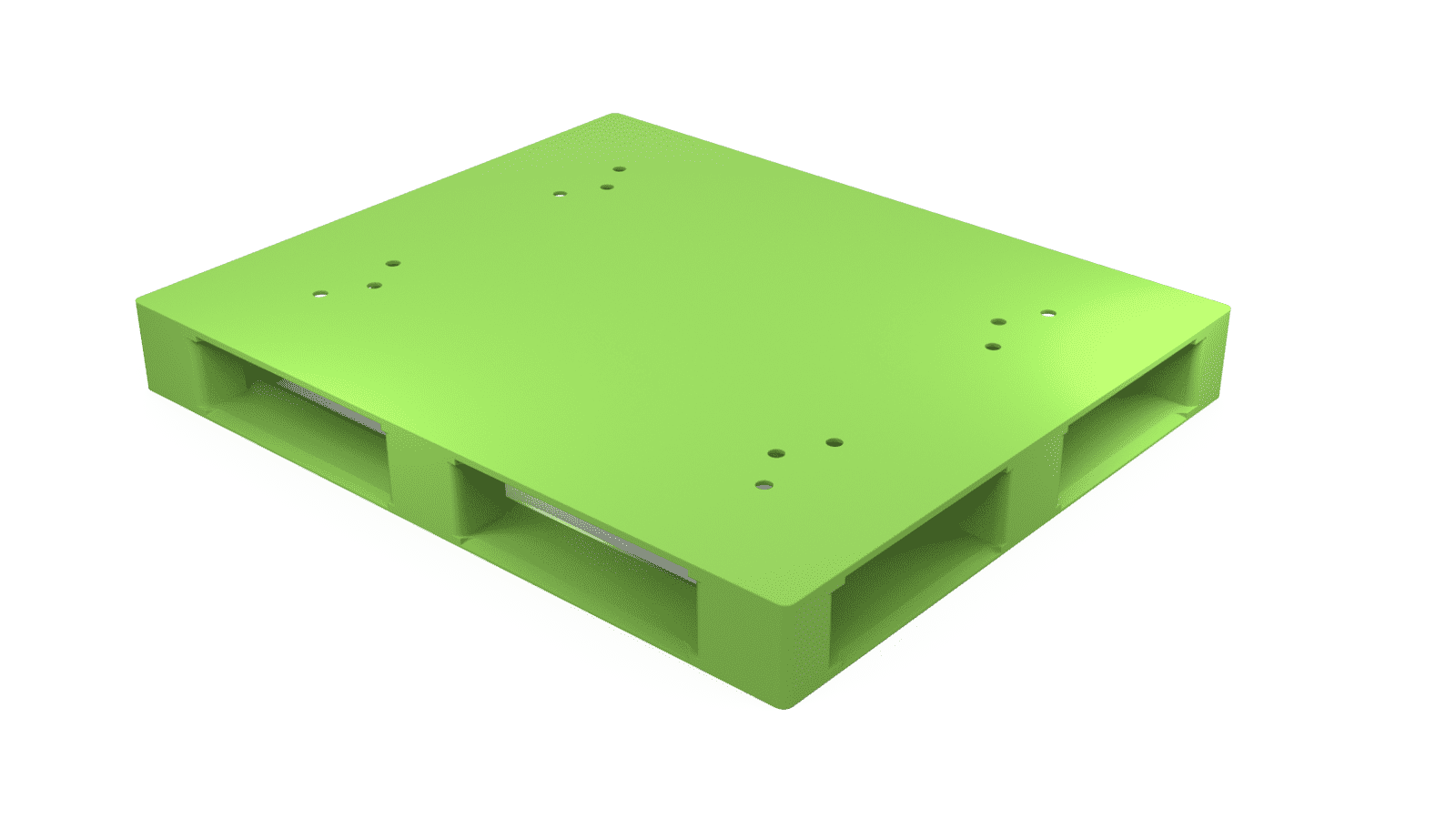

This fall, the New-York-state-based startup, whose name derives from a combination of “pallet” and “IoT,” will begin production of its smart shipping pallets. According to company leaders, these products will do nothing less than revolutionize the way food and goods are transported.

From vision to reality: PALIoT cofounders Paul Barry and Richard MacDonald envisioned pallets “whose positive impact on the environment keeps increasing as more of them are manufactured and deployed,” according to the firm’s website.

- To accomplish this feat, the pallets had to be both far lighter and more durable than typical pallets, which are made of wood and nails.

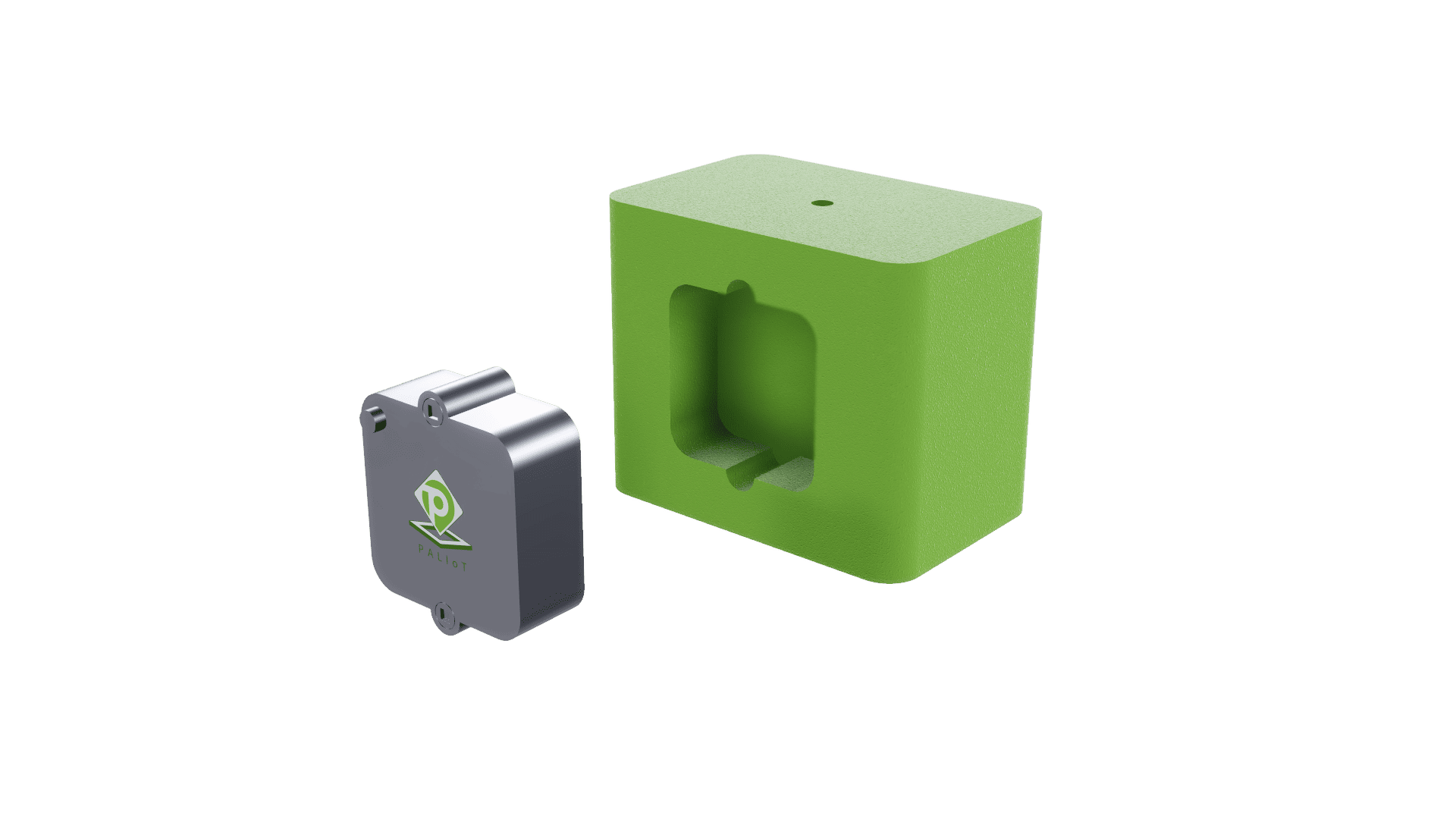

- After significant research and development, Barry and MacDonald came up with the solution: a polyurea-coated, engineered-plywood pallet that was 20 pounds lighter than its traditional peers and contained a proprietary sensor capable of instant communication with the cloud, making inventory tracking a cinch.

The “secret sauce”: “The ‘secret sauce’ is essentially a smart mesh network,” said Barry, who hails from Ireland and has an electrical engineering and investment banking background. “The PALIoT pallets in a shipment will all talk to each other, say, ‘Hey, I’m here.’ And [after shipping,] because they know they’ve been on a truck, they know they have to report all that valuable inventory and environmental data back to the cloud.”

- PALIoT, which will rent its pallets to customers using a per-pallet, pooling model (with an optional subscription service), acquired exclusive global use of the mist® Mesh Networking protocol. This ensures that communication is highly secure and battery sensitive at all times.

- The company estimates it will initially produce between 650,000 and 700,000 pallets a year in the first phase of the launch.

Savings for all: PALIoT’s groundbreaking sensors promise to save buyers both resources and money.

- “Food producers see tens of millions of dollars a year in food waste,” Barry said. With PALIoT technology, those producers will be able to track their perishable food shipments’ temperature and humidity conditions, viewing that information in the cloud so handlers can take swift action to cut down on spoilage.

- And because real-time asset protection is a PALIoT priority, the pallets will help companies cut down on theft and losses. As Barry put it, “If a pallet gets stolen, we will know where and when.”

A “smart” solution: Typical asset-embedded IoT sensors fail long before the assets themselves, making them impractical for longer-term use. Not so with PALIoT’s pallets, which can be used for a decade before they will need to be “retired and recycled,” according to Barry.

- “How can you justify having an expensive piece of hardware with a battery that needs replacing every few years?” he continued. “Using a combination of communications technologies, we’ve been able to solve the key problems of battery life and cost for large-scale asset-pooling companies.”

What’s next: Having recently relocated its manufacturing operations from Colorado to just outside Rochester, New York, PALIoT has its sights set on doing business with the dairy farms of the Northeast. It also plans to expand its manufacturing footprint across the U.S.

- “Demand is not the issue,” Barry told us. ”People just want a better solution, and we think this is it.”

West Coast Dockworkers Ratify Contract

Late last week, West Coast dockworkers voted to ratify a long-term employment contract that was agreed upon earlier this summer, The Wall Street Journal (subscription) reports.

What’s going on: Approximately 75% of International Longshore and Warehouse Union members voted in favor of the six-year labor contract with the Pacific Maritime Association.

- This ratification vote formalizes the tentative agreement reached in June, which was preceded by several brief work stoppages, and is the culmination of negotiations that began in May 2022.

- “The ILWU represents about 22,000 workers at 29 ports from California to Washington state.”

Why it’s important: These negotiations, which ultimately took 14 months to resolve, were at times tumultuous, and the resulting supply chain disruptions led to a significant loss of West Coast cargo business to the East and Gulf coasts.

- Together the ports of Los Angeles and Long Beach constitute the busiest ocean trade gateway in the U.S., handling almost 40% of U.S. imports from Asia, according to the Los Angeles Times.

- The NAM consistently advocated for a resolution to these talks and commissioned an economic impact study in 2022 that found even a 15-day shuttering of these two West Coast ports would cost the U.S. economy nearly half a billion dollars a day and 41,000 jobs.

The NAM says: “Ratification of this six-year contract provides manufacturers with the supply chain reliability they need for operational planning and stability,” said NAM Director of Infrastructure and Labor Policy Ben Siegrist.

- “NAM members have overcome countless shipping challenges over the past few years and were at the forefront of calling for this resolution. We are pleased the contract has been ratified.”

DOE Proposes Power-Line Fast Tracking

The federal permitting process for major transmission lines should soon get a lot easier to navigate, according to POLITICO’s ENERGYWIRE (subscription).

What’s going on: Last Thursday, the Department of Energy proposed “completing environmental reviews and other federal approvals for electric power lines within two years.”

- In addition, “DOE would be the lead agency conducting environmental impact statements and other federal reviews for transmission projects so that developers wouldn’t need to go through multiple federal agencies.”

- Once finalized, the framework will be called the Coordinated Interagency Transmission Authorization and Permits Program.

Why it’s important: The draft revision—a response to the recent debt-ceiling deal—could slash the time it takes to get long-distance power lines built and operational.

- This “could help integrate more solar and wind into the U.S. energy resource mix,” according to ENERGYWIRE.

- Though Congress authorized the DOE as lead federal agency in reviewing electric power lines, this proposal marks the first time the authority has been “formally proposed,” a source told the news outlet.

Developers’ role: The proposal details what developers would have to do under the new process.

- “For example, DOE would require developers to complete resource reports about potential environmental impacts from construction or operation of their projects. Applicants would also need to submit plans for engaging with communities affected by a new transmission line.”

However … CITAP wouldn’t cancel the need for local and state permits.

- “Rather, the goal is to ensure that developers have a clearer and smoother process for obtaining necessary federal permits.”

The NAM’s take: “This is a step in the right direction,” said NAM Vice President of Domestic Economic Policy Brandon Farris. “As part of our push for permitting reform, the NAM has long advocated for a lead federal agency to run point and streamline the permitting process.”

- “The NAM will continue to work with Congress and the administration to make the permitting process more predictable and consolidate the many complex layers of review so the U.S. can continue to build on our shared goals of boosting domestic manufacturing.”

A Homegrown Solution: Schweitzer Engineering Laboratories Makes Printed Circuit Boards

With one of its key components—printed circuit boards—in short supply, Schweitzer Engineering Laboratories chose the proactive solution: it would begin making them itself. Now that its new factory is up and running, SEL is receiving unexpectedly keen interest from other companies, and considering ramping up production for outside sales.

Fixing a supply chain problem: The Pullman, Washington–based electric power system protection solution manufacturer began manufacturing PCBs at its new $100 million, 162,000-square-foot factory in Moscow, Idaho, back in March.

- “Printed circuit boards take electronic components and interconnect them so they can interact with each other,” SEL CEO David Whitehead said. “Without them, you can forget about AI, forget about your cell phones—they’re in just about any electronic device.”

- The Moscow factory is running at about 25% capacity. When it reaches full production later this year, it will be one of the top PCB manufacturers in the U.S., according to Whitehead.

Domestic and accessible: The PCB “is a critical component that goes into our devices,” Whitehead continued. “Now, instead of sourcing PCBs from around the U.S., we can produce them ourselves.”

- The Moscow facility—which only produces the circuit boards for SEL—has increased the company’s supply chain resiliency and sped up its output, Whitehead told us. “Now, in a handful of days after designing a printed circuit board for a product, our engineers are in their labs testing it. It’s a big win for us.”

- Nearly half of manufacturers in the U.S.—44.9%—cite supply chain hurdles as one of their top business challenges, according to the NAM’s Q2 2023 Manufacturers’ Outlook Survey.

Self-funded and viable: SEL funded 100% of the facility’s construction costs, and it will have paid for itself in two to three years, Whitehead said.

- “I think that’s really a big deal for not only taxpayers but the local community generally,” he said. State and local governments “can take the funds [they didn’t use on us] and invest” elsewhere.

A good neighbor: The Moscow plant—which features a fume scrubber system that exceeds Environmental Protection Agency standards for volatile organic compounds—also uses a “zero-liquid discharge water treatment system that recycles and reuses all the water used to manufacture the printed circuit boards,” Whitehead said.

- A comparable factory would use about 90,000 gallons of water each day of production, while SEL uses about 500 to 600 gallons—the equivalent of only a few households’ daily usage, according to Whitehead. Most of that is for worker needs (drinking water and restrooms).

- The company also reclaims and reuses metals, such as tin, silver and gold, that are used in the production process.

- “We are very environmentally conscious about how we produce these boards,” Whitehead said.

What’s next? Since the facility began production, SEL has gotten numerous inquiries from other manufacturers interested in buying the PCBs. The company is likely to oblige them soon.

- “This is our next opportunity,” Whitehead said of producing boards for other manufacturers. “We love being vertically integrated, building as much as we can close to where we’re going to use the products. … As we get better at it for our own consumption, I can see us expanding it.”