Norfolk Southern Pivots to Serve Customers After Bridge Collapse

It’s been nearly a month since a cargo ship hit the Francis Scott Key Bridge in Baltimore, Maryland, resulting in six deaths, the destruction of the bridge and the shuttering of an important East Coast port.

- But thanks to hard behind-the-scenes work by Norfolk Southern railway since the accident, customers aren’t feeling the supply chain pinch the way they otherwise would.

What happened: NAM President and CEO Jay Timmons, along with an NAM delegation, visited the Port of Baltimore last Friday to tour Norfolk Southern’s operations there. The port is the largest for vehicle shipping in the U.S. and was the 17th biggest in the nation by total tonnage in 2021.

- On March 26, the day the Singapore-flagged Dali cargo vessel hit the Key Bridge, Norfolk Southern—which moves 7 million carloads of cargo annually—began strategizing ways to support increased shipping volumes on behalf of its customers. And it’s been doing that ever since.

- “We often say the weight of the world moves on rail … and it’s true,” Norfolk Southern Chief Marketing Officer and NAM board member Ed Elkins told the NAM during the site visit. “Our ability to serve the market through temporary disruption is really a demonstration of our strategy in action, where we leverage the experience of our railroaders and the strength of our franchise to find a Better Way to provide safe, reliable service.”

Quick adaptation: Norfolk Southern’s strategy for adapting to the closure of Baltimore’s port has included:

- The launch early this month of a dedicated new service to move freight between the ports of New York and New Jersey and Baltimore’s Seagirt Marine Terminal;

- The facilitation by the railway’s Triple Crown Services Inc.—a door-to-door East Coast truckload transit network—of a dedicated intermodal service for cargo owners who require door-to-door service;

- The use of “Go Teams,” groups of employees ready for rapid response service and created by Norfolk Southern during the pandemic; and

- Regional collaboration with the Port of Virginia to leverage service points including the Virginia Inland Port and others.

Reopening: The Port of Baltimore could be back to full functionality by the end of May, the U.S. Army Corps of Engineers said earlier this month.

- “The NAM will stay in close coordination with our members regarding supply chain impacts stemming from the collapse of the Francis Scott Key Bridge,” said NAM Director of Transportation, Infrastructure and Labor Policy Max Hyman. “We also remain engaged with leading federal officials on recovery efforts and will continue to support critical infrastructure projects such as the Port of Baltimore.”

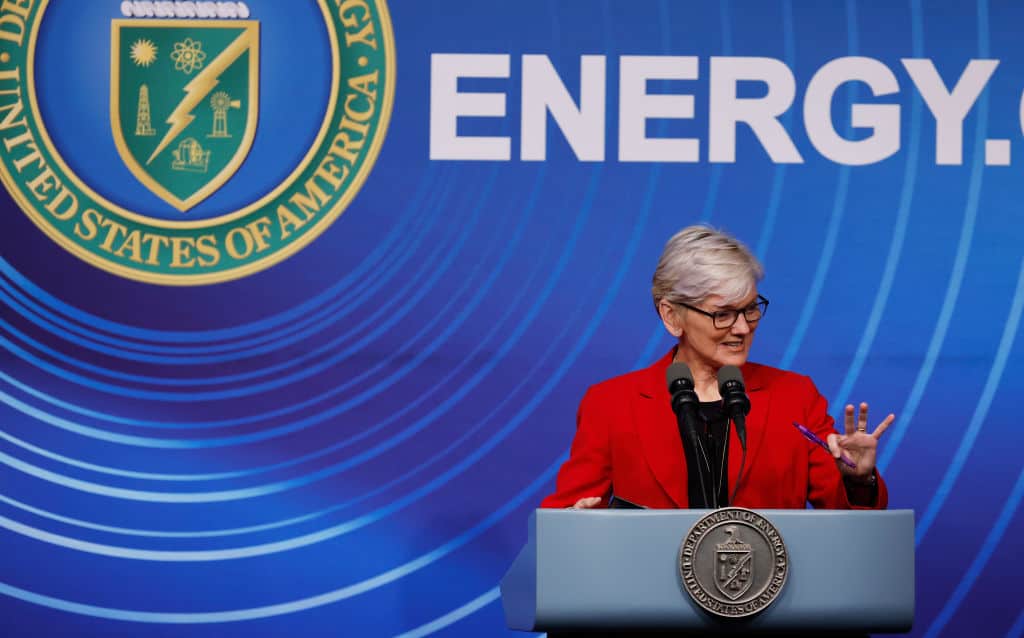

Granholm: LNG Export Permit Freeze “a Study”

Energy Secretary Jennifer Granholm called the Biden administration’s recent moratorium on liquefied natural gas export permits “a pause for a study” at a Senate Energy and Natural Resources Committee hearing Tuesday, according to POLITICO Pro (subscription).

Committee Chairman Sen. Joe Manchin (D-WV) questioned several recent energy-related moves by the Biden administration.

What’s going on: “It is a pause for a study. You don’t need to hype it out beyond what it is,” Granholm told the committee on Tuesday. “It is a pause to get data.”

- The administration has received bipartisan criticism for the freeze of LNG export permits since announcing the move in January. NAM President and CEO Jay Timmons said the pause “undercut[s] President Biden’s own stated goals” and “weakens our country while giving Russia an upper hand.”

An examination of prices: Granholm told the committee the pause “was needed to examine prices and market demand since the last time a study was conducted.”

- She said the study will take into account foreign nations’ emissions “that may be linked to the absence of U.S. natural gas shipments.”

45V guidance: Sen. Manchin asked Granholm about proposed guidance on the Inflation Reduction Act’s first tax credit, known as the 45V. In a news release from the committee, Sen. Manchin said the proposed guidance, “if implemented … would jeopardize the viability of the industry before it even has a chance to get off the ground.”

- Sen. Manchin mentioned a recent letter to the administration from all seven “hydrogen hubs”—locations designated late last year by the administration to scale up the nation’s clean hydrogen production—saying the centers would “no longer be economically viable” without revision to the 45V proposed guidance.

- “Do you think we should heed the warning of [the Department of Energy]’s own seven hubs, and do you have any insight into what might be changed?” he asked.

- Granholm responded that the administration has “gotten over 30,000 responses, and they are working through those responses.”

- She added, according to POLITICO Pro, “The bottom line is clearly we want the hubs to succeed.”

Our take: “No matter what you call it, the administration’s pause on LNG export permits runs counter to the wishes of the American people and the interests of the United States and our allies,” said NAM Director of Energy and Resources Policy Michael Davin.

- “According to a recent NAM survey, 87% of Americans believe the U.S. should continue to export natural gas. The administration should listen.”

Biden Calls for Tax Hikes in Hometown Speech

President Biden called for tax increases during a visit to his hometown of Scranton, Pennsylvania, on Tuesday, the Associated Press reports.

What’s going on: “Biden used Scranton, a city of roughly 75,000 people, as the backdrop to argue that getting rich in America is fine, but should come with heftier tax bills.”

What he said: President Biden—who has proposed a 25% minimum “billionaires tax”—used the bulk of his speech to call for tax hikes.

- “The president said decades of Republicans’ policies that cut taxes for the wealthy with the idea of stimulating the economy ‘failed America.’”

- President Biden has said raising taxes on the wealthiest Americans is “how we invest in the country.”

However … The Tax Cuts and Jobs Act of 2017 was “rocket fuel” for manufacturing, NAM President and CEO Jay Timmons said during his 2024 State of Manufacturing Address in February.

- In fact, as we discuss in another story in this edition of Input, the expiration of three pro-growth tax provisions from that law has harmed manufacturers throughout the U.S. And more tax hikes are scheduled to take effect at the end of 2025.

- It is critical to a healthy manufacturing industry and U.S. economy in general that expired, pro-growth provisions be reinstated—and that Congress act to forestall further tax increases next year.

The final say: “[T]he path is clear,” Timmons said in his February address. “No new taxes on manufacturers.”

Renewable-Energy Backlog Grew in 2023

The number of renewable energy projects awaiting entry onto the power grid rose significantly in 2023, according to POLITICO Pro (subscription).

What’s going on: There were “2,600 gigawatts of energy and storage capacity trying to connect [last year], according to a report released Wednesday by the Energy Department’s Lawrence Berkeley National Laboratory.”

- The waiting projects—most of which are wind, solar and storage capacity initiatives kickstarted with incentives from the Inflation Reduction Act of 2022—could more than double current grid capacity, the report says.

- Solar accounts for most of the generation.

The problem: Despite an order passed by the Federal Energy Regulatory Commission last year intended to speed up the process of getting new resources connected, “most regions have not yet implemented the new rule, leaving power systems across the country jammed.”

- The need to link in new energy sources quickly will only grow in the coming years, as the U.S. moves more toward electrification.

Our view: “Energy security is more important than ever,” NAM Director of Domestic Policy Michael Davin said. “Manufacturers need affordable, reliable energy to power economic growth. This is why we greatly need comprehensive permitting reform to expedite these projects and many more.”

Baltimore Port Could Be Fully Operational by May’s End

The Port of Baltimore could be reopened fully by the end of May, according to POLITICO.

What’s going on: “The U.S. Army Corps of Engineers said it is aiming to reopen the channel leading to the Port of Baltimore by the end of May, a timeline [Maryland Gov. Wes] Moore confirmed Sunday [on CBS’ “Face the Nation”] is ‘realistic.’”

- The port has been closed since March 26, when a Singapore-flagged cargo ship hit the Francis Scott Key Bridge, destroying the bridge and killing six construction workers.

- While Gov. Moore did not give an estimate of the cost to rebuild the bridge, the closure is costing the port about $15 million a day in economic activity, the Baltimore Sun reports.

- And business analytics group Dun & Bradstreet has estimated the weekly economic impact of the closure on trade at about $1.7 billion, according to The Wall Street Journal (subscription).

“Absolutely committed”: The governor’s remarks came just days after the Office of Management and Budget urged Congress to authorize covering the full cost of rebuilding the bridge, according to Punchbowl News.

- “My administration is committed—absolutely committed to ensuring that the parties responsible for this tragedy pay to repair the damage,” President Biden said during a visit to the site of the bridge on Friday. “But I also want to be clear: We will support Maryland and Baltimore every step of the way to help you rebuild and maintain all the business and commerce that’s here now.”

The NAM’s view: “The NAM applauds the bipartisan efforts of federal and state officials to reopen the Port of Baltimore and rebuild the Key Bridge,” said NAM Director of Transportation, Infrastructure and Labor Policy Max Hyman. “It’s important to note that reforming our broken permitting system would significantly speed up projects such as this, returning much-needed economic activity and jobs to communities throughout the U.S.”

If you’ve been affected: Manufacturers affected by the bridge collapse and port disruption can access vital resources at the new online Resources and Info Hub of NAM state partner the Maryland Chamber of Commerce.

- The chamber and its partners are committed to helping manufacturers navigate this disruption and get on the path to recovery.

- Share your thoughts on the disaster and recovery efforts by filling out this survey.

Manufacturers: Complex EPA Rule Will Disrupt Manufacturing Supply Chain

Washington, D.C. – Following the release of the Environmental Protection Agency’s recent rulemaking regarding limitations on emissions of ethylene oxide, National Association of Manufacturers Managing Vice President of Policy Chris Netram released the following statement:

“While the EPA listened to some of manufacturers’ concerns, such as allowing more time for companies throughout the supply chain to assess the impact on their operations, the rulemaking adds to the ongoing regulatory onslaught our industry has been facing.

“The agency’s decision to maintain the fenceline monitoring schedule at every five days for ethylene oxide creates a significant compliance burden for manufacturers, and the rule’s mandate that operations are completely shut down when small repairs are required will impact manufacturers’ ability to maintain consistent operations. The potential disruption to supply chains could make it more difficult to create jobs in communities across the country.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.89 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

EPA Awards $20 Billion in “Green Bank” Funds

The EPA late last week awarded $20 billion to community development banks and nonprofit organizations to combat climate change in disadvantaged communities in the U.S., the Associated Press reports.

What’s going on: Money from the “green bank” initiative “could fund tens of thousands of eligible projects ranging from residential heat pumps and other energy-efficient home improvements to larger-scale projects such as electric vehicle charging stations and community cooling centers.”

- Previously called the Greenhouse Gas Reduction Fund, the $27 billion “green bank” overseeing the grants was created by the 2022 Inflation Reduction Act. Its aim is “to reduce climate and air pollution and mobilize public and private capital in the communities that need it most.”

Where the money went: At least $14 billion of the funding is reserved for low-income and rural areas, neighborhoods of color and communities with shuttered coal mines, among other locations.

- One of the bank’s funds is the National Clean Investment Fund. Grants from that pot include nearly $7 billion to help consumers, schools and small businesses and farms, $5 billion to “leverage the existing and growing national network of green banks” and $2 billion for decarbonized, affordable housing, according to Axios.

- Another fund, the $6 billion Clean Communities Investment Accelerator, is for centers that offer technical help and lending to clean-technology projects.

How it works: “Recipients committed to spending $7 in private sector funding for each $1 from the federal investment money, to ‘reduce or avoid’ 40 million metric tons of carbon dioxide each year and earmark 70% of the money for disadvantaged and low-income communities. These groups are often passed over by commercial banks and investors yet are disproportionately impacted by climate change.”

Final Heavy-Duty Tailpipe Rule Presents Challenges

The Environmental Protection Agency’s new heavy-duty tailpipe emissions rule is unrealistic and unfeasible, the NAM said Friday.

What’s going on: “The rule—proposed in April 2023—is part of the ‘Clean Trucks Plan’ unveiled in 2023, which includes light-duty tailpipe and nitrogen oxide rules,” Bloomberg Law (subscription) reports.

- “The[se] ‘Phase 3’ standards build on previous phases of a broader regulatory program to stem greenhouse gas emissions from vehicles such as delivery trucks, long-haulers, and buses.”

- The Phase 1 rule was finalized in 2011, and the Phase 2 rule in 2016.

Why it’s problematic: While the new regulation grants automakers more time for implementation than previous versions did—thanks to input from manufacturers and their advocates, including the NAM—it still “fails to reconcile with the realities of current U.S. infrastructure,” according to an NAM social post.

- “Critical permitting reforms to strengthen transmission systems and a technology-neutral approach for manufacturers are essential to reaching U.S. climate goals,” the NAM wrote.

What should be done: Congress must reform the broken U.S. permitting system so we can build the electric vehicle charging station infrastructure required to implement a rule of this magnitude, the NAM said earlier this month.

DOE to Award Record-Setting Decarbonization Funds

The Department of Energy on Monday announced record-setting funding aimed at decarbonizing energy-intensive sectors, POLITICO Pro (subscription) reports.

What’s going on: The nearly $6 billion in “funding from the Democrats’ climate law and the bipartisan infrastructure law for industrial decarbonization will be spread across 33 projects and 20 states,” where it “will apply to some of the highest-emitting industrial manufacturing sectors—often described as ‘hard-to-decarbonize’ industries—including iron and steel, aluminum, cement, concrete, chemicals, food and beverages, and pulp and paper.”

Where it’s coming from: The money will be drawn from funds set aside under the Inflation Reduction Act ($5.47 billion) and the Bipartisan Infrastructure Law ($489 million).

Why it’s important: The many projects to be funded—which include groundbreaking recycling initiatives, hydrogen-use projects, decarbonization of thermal processes and more—will remove approximately 14 million metric tons of emissions every year, the DOE estimates.

- Five of the highest-dollar-value projects, at half a billion dollars each, “are focused on decarbonizing cement, concrete, aluminum, iron and steel.”

- The work will take place in five states—Indiana, Ohio, California, Iowa and Mississippi—and a still-to-be-determined spot on the Mississippi River Basin.

- Many of the projects are spearheaded by NAM members, who have been critical in innovating decarbonization efforts from within the industry.

The NAM’s take: “Manufacturers are innovating and making tremendous investments to decarbonize their processes and products,” said NAM Vice President of Domestic Policy Brandon Farris. “It is great to see the Department of Energy recognize multiple NAM members for their industry-leading initiatives.”

Baltimore Bridge Collapse to Hit Shipping, Port Jobs

Vessel traffic in and out of the Port of Baltimore—which contributes $15 million a day in economic activity, Business Insider reports—was suspended Tuesday after a container ship hit the Francis Scott Key Bridge in the early morning. The collision caused the bridge to collapse, sending at least seven vehicles and their occupants into the Patapsco River, according to the Baltimore Sun (subscription).

What’s going on: “Officials, who spoke amid a continuing and massive search and rescue mission, said the port was not shut down and remained open to process trucks inside terminals.”

- Other ports are likely to be able to absorb container ships headed for Baltimore, The New York Times (subscription) reports.

Why it’s important: “The port, which generates more than 15,300 direct jobs, had rebounded from global supply chain difficulties and disruptions during the coronavirus pandemic and hit records last year for handling cargo,” according to the Baltimore Sun. “It is the nation’s 16th busiest port, ranking first for volume of autos and light trucks, roll-on/roll-off heavy farm and construction machinery, imported sugar and imported gypsum.”

- Baltimore is the closest Atlantic port to major Midwestern manufacturing hubs.

- Truckers are concerned about increased congestion resulting from the closure, “particularly because deliveries such as hazardous material loads cannot travel through Interstate 895 or I-95 tunnels.” Trucking companies are already warning customers of delays for shipments going through the Mid-Atlantic, according to The Wall Street Journal (subscription).

- In addition to affecting consumers in the Baltimore area, the traffic stoppage is likely to affect jobs at the port.