A Rocky Relationship Between the U.S. and China

The U.S. is considering cracking down further on Chinese human rights abuses in Xinjiang, while President Trump had tough words about the U.S.–China relationship. Here’s an update on some important recent developments.

Human rights: The Trump administration is considering a ban on some or all products that include cotton from Xinjiang, the region where China has carried out the mass detention of mostly Muslim minorities. The order could have a substantial impact on global apparel makers.

Technology: The administration is also considering sanctioning China’s largest chipmaker, SMIC. The Department of Defense may add it to the “Entity List,” thereby restricting the company’s purchases of equipment made in the U.S. Beijing, as you might imagine, was not happy.

“Decoupling”?: In a Monday press briefing, President Trump discussed the possibility of “decoupling” the U.S. from China. “If we didn’t do business with [China], we wouldn’t lose billions of dollars. . . . It’s called decoupling. So you’ll start thinking about it,” he said.

A data security standoff: As the U.S. continues to crack down on Chinese telecommunications companies, claiming that they pose national security threats, China has developed its own set of “global standards on data security,” reports the WSJ (subscription). It’s trying to prevent the U.S. from convincing other countries to restrict Chinese access to or construction of key networks.

Canceled plans: About 100 official exchange forums between Chinese and U.S. officials have been canceled during the Trump presidency, reports Bloomberg. This means diplomats don’t know what the other side is doing on a long list of policy issues, from pharmaceuticals to tech and more.

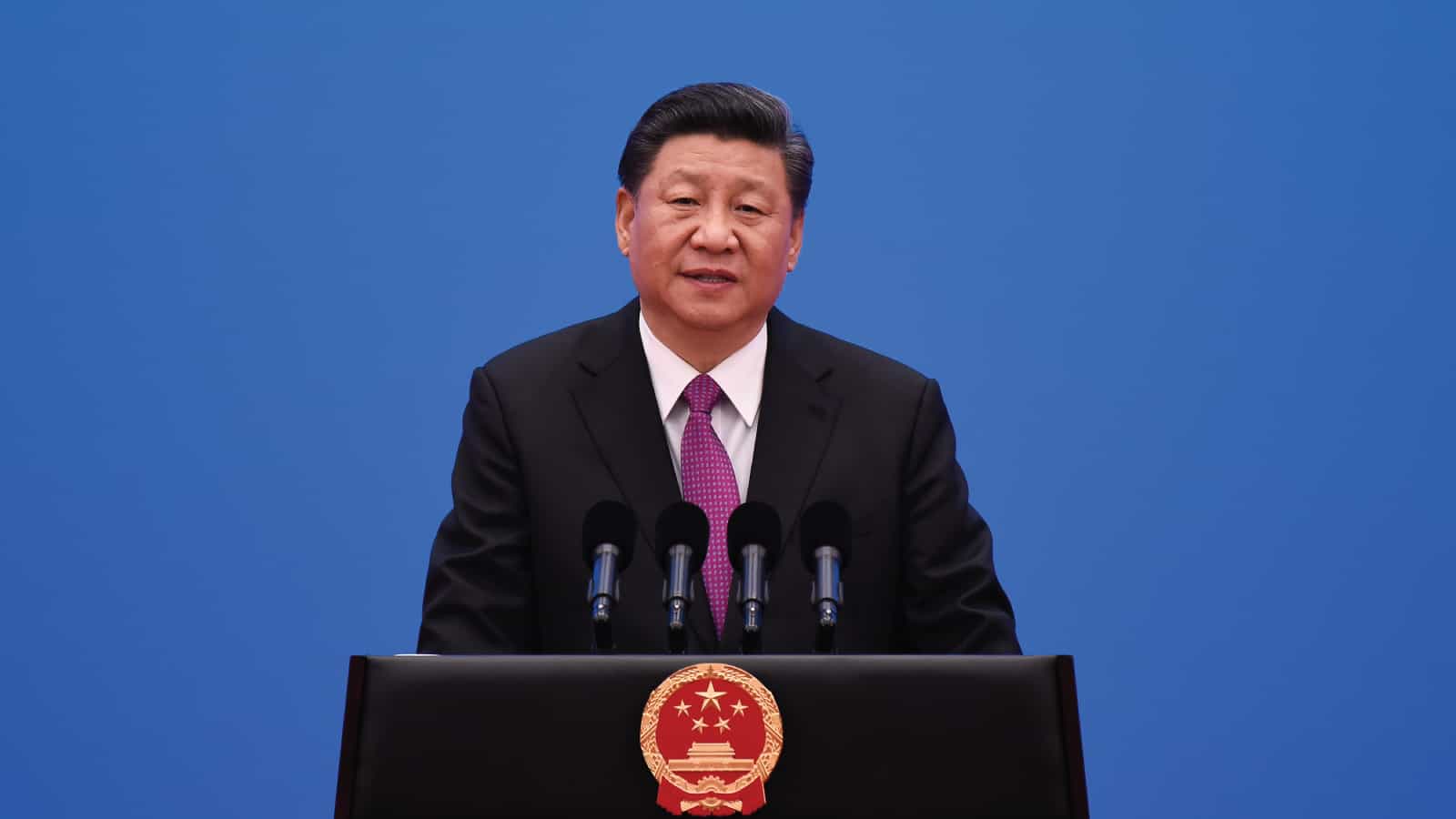

China Turns Inward with Domestic Economy Plan

Chinese President Xi Jinping has been outlining an economic plan that will focus more on domestic consumption and markets, easing back from China’s reliance on trade and foreign investment, the Wall Street Journal (subscription) reports.

Xi has been speaking publicly about this “domestic circulation” (as it’s translated) since May, according to Chinese officials. The details haven’t emerged yet, but more news should come out of the October “plenum,” the meeting of the Communist Party’s top leaders.

The chips are down: U.S. sanctions are already having an effect, with telecom company Huawei reporting a shortage of processor chips that will stall production. The Chinese government recently announced it would provide tax cuts and other forms of financial help to its domestic chip industry.

What’s the prognosis? Some experts think these measures won’t make much of a difference, however. As Paul Triolo, head of the geo-technology practice at Eurasia Group, told CNBC, “The preferential treatment outlined in the new policies will help in some areas, but in the short-term will have only marginal impact [on] the ability of Chinese semiconductor firms to move up the value chain and become more competitive globally.”

Interpreting China: The Financial Times (subscription) gives another read on U.S.–China relations: that China has taken a much more cautious attitude toward confrontation in the past month or two. For example, top Chinese officials have seemed to suggest that China is willing to talk and unwilling to let the relationship degrade further.

Meanwhile, in Taiwan . . . U.S. Health Secretary Alex Azar discussed a trade deal with Taiwan on a high-profile visit to the country (though he didn’t spell out the details). While he was there, Chinese fighter jets flew across the median line in the Taiwan Strait.

What’s Going on in China?

U.S.–China relations are at a low ebb, after a matched pair of consulate closings in recent days. Last week, the U.S. ordered the Chinese consulate in Houston to be closed, whereupon the Chinese closed the U.S. consulate in Chengdu.

That’s the headline story, but a number of other stories are important for evaluating U.S.–China relationships—and Chinese strength—going forward. Here are some recent data points.

A potential catastrophe: First, there’s another horrible development for 2020: China’s massive Three Gorges dam is under some strain, thanks to the worst rains the surrounding region has seen in decades. Though Chinese officials assure the public and the world that the dam is holding, its reservoir is alarmingly full. Tens of millions of people have already been affected by severe flooding.

COVID-19 returns? On Sunday, China reported its highest rate of infections since March 6. (Though the emphasis there should probably be on reported).

Meanwhile, on the diplomatic front . . .

Human rights abuses: The United States has sanctioned 11 Chinese companies for involvement in the persecution of Muslim minorities, including for the use of forced labor. The sanctions forbid U.S. companies from selling parts or technology to these Chinese companies, not from purchasing anything. But in practice, The New York Times (subscription) says, American firms are likely to forgo doing business with them entirely.

Competition over rare earths: In a bid to find sources for rare earths that aren’t in China (which now supplies 80% of what the United States uses), the U.S. Department of Defense is funding Lynas Corp.’s rare earths processing plant in Texas—slated to be completed by mid next year.

And lastly . . .

Now that’s just weird: Bewilderingly, many Americans are receiving unsolicited packets of unidentified seeds in the mail—sent from China. Several states have had to warn residents not to plant them.

What Will the Fed Say?

With the end to the COVID-19 pandemic nowhere in sight, all eyes are on the Federal Reserve as officials meet today.

The Fed is expected to stick with its low interest rates, according to Yahoo! News. This week’s meeting could give us a clue about how long rates are likely to remain where they are and what the Fed’s approach will be as infections increase around the country.

Here’s something we do know: the Fed is extending its emergency lending programs until the end of the year. According to CNBC, a series of initiatives that were set to expire on Sept. 30 will now run until at least Dec. 31. Those programs include:

- Facilities for primary dealers and money markets;

- Corporate bond purchases on the primary and second markets;

- The Main Street Lending Program;

- The Term Asset-Backed Securities Loan Facility; and

- The Paycheck Protection Program.

Some good news: CNBC reports that June’s new orders for U.S.-made capital goods saw their biggest increase in nearly two years. Non-defense capital goods gained 3.3%—the biggest increase since July 2018. The rise was likely driven by renewed demand as businesses began to open after months of closures.

But it’s not all good news. While the U.S. manufacturing sector has been showing strength, the surge of COVID-19 cases across the country threatens to wipe out gains as businesses nationwide are forced to close or pause reopenings. That threat to the industry—and to the reopening—continues to spur the NAM’s PSA campaign. Take a look at the latest artwork making the simple but powerful point: #MasksEqualMoney.

The NAM Takes Aim at Counterfeiting

Business advocates and policymakers have a new tool for waging an aggressive effort against counterfeiting during the pandemic and beyond. The NAM has released a new report, “Countering Counterfeits,” which includes proposed solutions for Congress, the administration and the private sector to pursue.

The numbers: According to the NAM’s research, fake and counterfeit products cost the United States $131 billion and 325,000 jobs in 2019 alone.

The rising tide: The rise of e-commerce has caused an explosion in fake products, particularly from China. E-commerce has created a pipeline to consumers that counterfeiters can exploit while hiding their identities and evading oversight. Estimates now indicate that global trade in counterfeits exceeds $500 billion per year.

The plan: The NAM’s proposal pushes for a series of actions to help curb counterfeiting, including:

- Requiring e-commerce platforms to reduce the availability of counterfeits;

- Modernizing enforcement laws and tactics to keep pace with counterfeiting technology;

- Streamlining government coordination to tackle counterfeit items;

- Improving private-sector collaboration; and

- Empowering consumers to avoid counterfeit goods.

The NAM says: President and CEO Jay Timmons said in his introduction to the report, “The prevalence of counterfeits in the COVID-19 response has brought new urgency to this long-simmering issue. So the National Association of Manufacturers is leading the charge against fake and counterfeit goods, bringing together diverse stakeholders and driving innovative policy solutions to address these issues once and for all and to ensure the long-term success of our sector and the safety and security of the people who rely on our products.”

NAM Leads Fight Against Counterfeits During COVID-19 Pandemic

Fake and Counterfeit Products Cost Nation $131 Billion and 325,500 Jobs in 2019

Washington, D.C. – The nation is counting on manufacturers to respond to the COVID-19 pandemic and help spur the recovery and renewal of the U.S. economy. But counterfeiters have tried to take advantage of the situation, and their fake goods and products now pose an even greater threat to the health and safety of all Americans. To fight this growing problem, the National Association of Manufacturers has released its latest research, “Countering Counterfeits,” which includes proposed solutions for Congress, the administration and the private sector to pursue.

“As Americans battle an unprecedented global health crisis, we are also battling a second threat: fake and counterfeit products that harm consumers and undermine manufacturing in the United States,” said NAM Senior Vice President of Policy and Government Relations Aric Newhouse. “COVID-19 has provided new opportunities for counterfeiters to prey on consumers’ anxiety and use the high demand for online goods to boost their illicit profits—all at the expense of American workers, consumers and businesses. The NAM is leading the fight against counterfeiters to ensure the strength and stability of our economy and the health of the American people.”

Counterfeiters target a variety of products, from automotive parts and children’s toys to medical devices and pharmaceuticals. The rise of e-commerce has caused an explosion in fake products, particularly from China. E-commerce has created a pipeline to consumers that counterfeiters can exploit while hiding their identities and evading oversight. Estimates now indicate that global trade in counterfeits exceeds $500 billion per year.

The NAM’s white paper describes a series of specific actions that all stakeholders can take to reverse the rising tide of counterfeit products including the following:

- Requiring E-Commerce Platforms to Reduce the Availability of Counterfeits

- Modernizing Enforcement Laws and Tactics to Keep Pace with Counterfeiting Technology

- Streamlining Government Coordination to Tackle Counterfeits

- Improving Private-Sector Collaboration in the Fight Against Counterfeits

- Empowering Consumers to Avoid Counterfeits

To fight this growing problem, manufacturers must spend more and more money to guard against counterfeiters. This especially hurts small and medium-sized manufacturers. The NAM’s research estimates that counterfeiting subtracted nearly $131 billion from the U.S. economy in 2019, including $22.3 billion in lost labor income and more than 325,500 fewer American jobs.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 11.7 million men and women, contributes $2.37 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 63% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org

North American Trade Gets a Makeover

The United States-Mexico-Canada Agreement (USMCA) goes into effect today—after years of advocacy by the National Association of Manufacturers and its partners.

So what does that mean for the American and global economies? NAM Senior Director of Trade Policy Ken Monahan’s answer: “The agreement will help strengthen supply chains, restore certainty, enable growth, bolster America’s competitiveness and support manufacturing jobs in the United States.” Here’s a condensed interview with Monahan that lays out the USMCA’s importance.

What’s in it: The USMCA updates and replaces the 26-year-old North American Free Trade agreement to ensure open, rules-based trade across North America. Monahan summarizes its long list of provisions: “intellectual property protections, new standards for the digital economy, reduction in red tape and unnecessary regulations, fair standards for competition and binding enforcement to protect all parties.”

Why it matters: The strength of America’s economy and markets is connected to the way we interact with our closest trading partners, Monahan emphasizes. Some numbers to keep in mind:

- Canada and Mexico alone purchase one-fifth of the total value of U.S. manufacturing output.

- Canada and Mexico purchase more U.S.-made goods than our next 11 trading partners combined despite representing only 6 percent of the world’s population.

- In addition to more than 2 million American manufacturing jobs, more than 40,000 small and medium-sized businesses depend on exports to Canada and Mexico.

What’s next: “Manufacturers are committed to working with the U.S., Mexican and Canadian governments to ensure that the USMCA is implemented in a manner that will support the recovery and renewal of the U.S. manufacturing economy,” says Monahan.

The last word: NAM President and CEO Jay Timmons summed it up: “The landmark trade agreement we fought hard to secure now enters into force at a critical time. It will help restore certainty, ensure supply chain continuity and provide opportunities for economic growth—all of which will help our industry lead the nation’s recovery and renewal.”

Manufacturers Mark USMCA Milestone

Timmons: USMCA will help us lead our economic recovery and renewal

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement on the entry into force of the United States–Mexico–Canada Agreement.

“This is a milestone day for manufacturers, years in the making. The landmark trade agreement we fought hard to secure now enters into force at a critical time. It will help restore certainty, ensure supply chain continuity and provide opportunities for economic growth—all of which will help our industry lead the nation’s recovery and renewal.

“The United States, Mexico and Canada must continue working together to ensure that the USMCA is implemented in a way that will bolster that recovery and renewal and maintain broad support for open, rules-based North American trade—this year, next year and well into the future. The stakes have never been higher.”

Prior to the USMCA’s entry into force, the NAM’s effort to secure congressional approval of the agreement activated manufacturing workers and supporters across the country, reaching members of Congress with thousands of pro-USMCA letters, calls and meetings. In doing so, manufacturers drove the narrative, making the USMCA not about partisan politics but about good policy for growing manufacturing in America.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 11.7 million men and women, contributes $2.37 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 63% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org

NAM Survey: Manufacturers Face Major Headwinds, but Continue Operating in Support of COVID-19 Response

Despite Drop in Optimism and Worsening Business Conditions, Majority of Industry Keeping Doors Open

Washington, D.C. – The National Association of Manufacturers today released the results of the Manufacturers’ Outlook Survey for the second quarter of 2020 showing that despite a historic drop in optimism, to nearly 34%, and challenging business conditions, the vast majority of manufacturers (98.7%) have continued or only temporarily halted operations. The survey also shows that manufacturers are innovating to find solutions to keep businesses running and to protect workers and communities, with almost 22% retooling to produce personal protective equipment, 67% reengineering processes to reflect COVID-19 safety protocols and 12% completely reevaluating the mission of the firm.

Manufacturers have led the country through the COVID-19 response, and America is counting on our industry to lead our recovery and renewal, said NAM President and CEO Jay Timmons. While these numbers show that we’ve faced difficult circumstances and that there is a challenging road ahead, manufacturers have proven that with our grit, determination and patriotic spirit, we can overcome any challenge facing the nation. And in our ‘American Renewal Action Plan,’ the NAM has shown the way forward.

As policymakers and regulators debate solutions to help the economy recover from this pandemic, the NAM urges them to focus on the renewal agenda laid out in the “American Renewal Action Plan.” We have been encouraged by actions taken thus far, but there is still greater need for targeted liability reform, tax provisions to ensure investment in manufacturing and measures to reaffirm the U.S. supply chain to protect those businesses that continue to work on the front lines of the COVID-19 response to ensure as swift a recovery as possible.

The Manufacturers’ Outlook Survey has surveyed the association’s membership of 14,000 large and small manufacturers on a quarterly basis since 1997 to gain insight into their economic outlook, hiring and investment decisions and business concerns. The NAM releases the results to the public each quarter. Further information on the survey is available here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 11.5 million men and women, contributes $2.38 trillion to the U.S. economy annually, has the largest economic multiplier of any major sector and accounts for more than three-quarters of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the Manufacturers or to follow us on Shopfloor, Twitter and Facebook, please visit www.nam.org.

NAM Releases Agenda to Strengthen Manufacturing Supply Chain

Launches Seven-Figure National Advertising Campaign to Bolster Business in America

Washington, D.C. – The National Association of Manufacturers has released a detailed agenda of supply chain policy recommendations to help policymakers as Congress and the administration look at ways to boost long-term economic growth. Manufacturers are also launching a seven-figure national advertising campaign on the importance of U.S. supply chains in the wake of COVID-19. The national television and digital advertising campaign urges leaders to make smart policy decisions that incentivize job creation and investment in America, without closing off critical global supply chains. Such a constructive approach will enable manufacturers to lead America’s recovery and renewal while continuing to produce the vital supplies, medicines and essential products on which Americans’ health and safety depends.

The policies that we are proposing will allow manufacturers to lead our economic recovery by strengthening supply chains and accelerating onshoring, through incentives for creating the next job or investing the next dollar right here in America. We also cannot close off access to critical components or resources that our lifesaving and life-changing products require, said NAM President and CEO Jay Timmons. Manufacturers are working around the clock to create the protective equipment, cleaning supplies, medicines and other essential products in the wake of COVID-19, and we need the right policies so we can make even more here at home and lead a truly historic American renewal.

In April, the NAM released its “American Renewal Action Plan,” which provides a comprehensive list of policy recommendations to guide the country through the stages of response, recovery and renewal.

More information on the campaign can be found at www.nam.org/recovery.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 11.5 million men and women, contributes $2.38 trillion to the U.S. economy annually, has the largest economic multiplier of any major sector and accounts for 63% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the Manufacturers or to follow us on Shopfloor, Twitter and Facebook, please visit www.nam.org