Policymakers Demand Tax Action

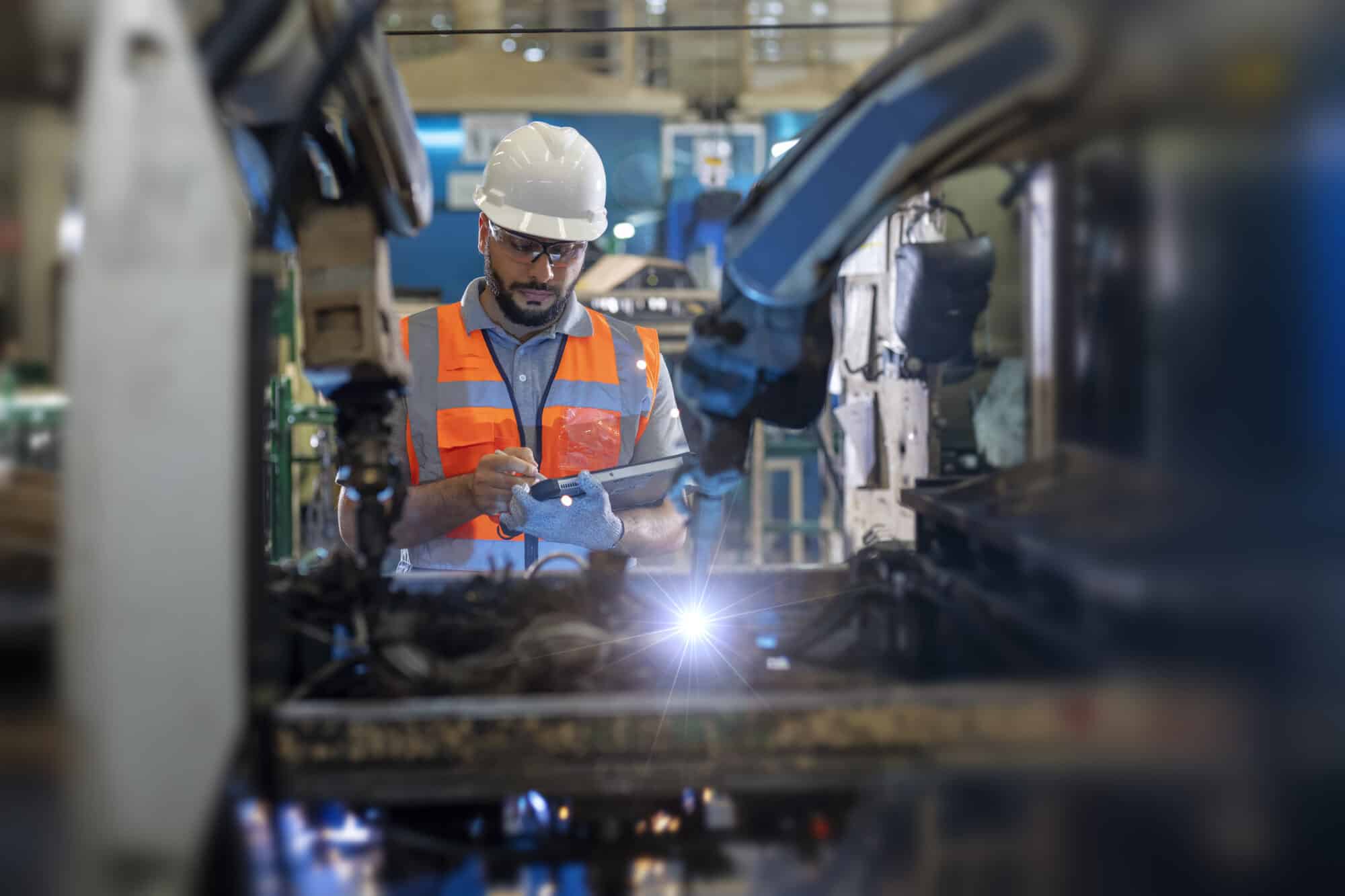

On Thursday, members of Congress took to the House floor to show their strong support for manufacturers’ top tax priorities.

- The NAM is waging an all-out campaign to restore these pro-growth provisions, and key House members added their voices by calling on congressional leadership to schedule a vote as soon as possible.

What’s going on: Yesterday evening, a group of House members lined up for short speeches urging their peers in the chamber to join them in making three immediate tax changes: reinstating immediate R&D expensing; loosening a strict interest limitation; and returning to full expensing (also known as 100% accelerated depreciation) for capital investments.

- Kevin Hern (R-OK) highlighted the harm to America’s competitiveness caused by Congress’ failure to act, asking, “How can we expect to compete with China when it is more expensive to invest, innovate and grow here in the United States of America?”

- Jodey Arrington (R-TX) echoed that message, saying Congress can “supercharge America’s competitiveness” by giving businesses the certainty to plan job-creating investments.

Why it’s important: Without the restoration of immediate R&D expensing, a pro-growth interest deductibility standard and full expensing for capital investments, manufacturing jobs, R&D and competitiveness will all be in jeopardy.

- In the NAM’s Q4 2023 Manufacturers’ Outlook Survey, 89% of respondents said higher tax burdens on manufacturing activities would make it more difficult to expand their workforces, invest in new equipment or expand their facilities.

Take action: Manufacturers’ voices are crucial during the ongoing negotiations. Visit our Tax Action Center to send your own message about these tax priorities directly to Congress.

ICYMI: House Members Urge Passage of Critical Manufacturing Tax Policies

Washington, D.C. – Following a series of speeches on the House floor calling for swift passage of legislation that will restore pro-growth manufacturing tax policies, National Association of Manufacturers Managing Vice President of Policy Chris Netram released the following statement:

“House and Senate tax leaders reaching a bipartisan agreement on key manufacturing priorities is a positive development—but it is only a critical first step. Now the whole of Congress must approve legislation that restores immediate R&D expensing, a pro-growth interest deductibility standard and full expensing for capital investments. Every day that they fail to act makes it more difficult for manufacturers to drive innovation and investment and hampers our ability to create jobs and raise wages in the United States.”

Below are select remarks from congressional members on the importance of restoring pro-growth tax policies.

“Since the beginning of 2022, businesses have been required to spread out or amortize R&D expenses.… Since amortization took place, the growth rate of R&D spending has slowed dramatically, from 6.6% on average over the previous six years to less than one half of 1% over the last 12 months.

“The time to address R&D amortization was at the end of 2021. The next best time is now. We need to pass R&D immediate expensing for the American people and our U.S. economy.”

“Last year, the U.K. announced its commitment to make permanent its pro-growth policy for full expensing. The U.S. should be looking to do the same to remain competitive in the global marketplace…. This is more than just an economic issue. This is a national security issue.

“How can we expect to compete with China when it is more expensive to invest, innovate and grow here in the United States of America?”

“It is imperative that we make the TCJA permanent. For example, if we cement the Tax Cuts and Jobs Act, we can reverse the current limitation on the deductibility of interest payments on business loans that will save over 850,000 American jobs.

“Another example is in research and development. While it was once a paid expense, R&D is now a cost that many small businesses cannot afford. China is subsidizing their R&D costs, giving them a huge advantage over the United States. Modernization and national security shouldn’t suffer because of an elapsed tax change. Our tax code should work for American workers and businesses and not against them.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.85 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturer Optimism Still Low

The higher tax burden being levied on manufacturers continues to hit home.

That’s the message from respondents to the NAM’s just-released Q4 2023 Manufacturers’ Outlook Survey.

What’s going on: Historically low levels of optimism persisted among small and medium-sized manufacturers—which compose the majority of the manufacturing sector—in the final quarter of 2023, according to the survey, which was conducted from Nov. 14 to Dec. 1, 2023.

- Among firms with fewer than 50 employees, 65.9% reported feeling positive about their own company’s outlook, while 63.0% of companies with between 50 and 499 employees reported the same.

- Overall, 66.2% of respondents felt either somewhat or very positive about their company’s outlook, edging up slightly from 65.1% in the third quarter. It was the fifth straight reading below the historical average of 74.8%.

Burdensome taxes: Some 89% of respondents said higher taxes on manufacturing activities would make it more difficult for them to hire additional workers, invest in new equipment and/or expand their facilities.

Other top challenges: The majority of respondents—61.1%—cited an unfavorable business climate as a top challenge to their company.

- Hiring and retaining quality employees was high on the list of challenges, too, with 71.4% of manufacturers calling it a primary concern.

A bright spot: Fewer manufacturers now expect a recession in 2024, at just over 34%. In Q3, the figure was 42.2%.

Congressional Inaction on Tax Priorities Holds Small and Medium-Sized Manufacturers’ Optimism Near Pandemic Lows

Eighty-nine percent say higher tax burdens would make it more difficult to hire, invest or expand facilities

Washington, D.C. – The National Association of Manufacturers released its Manufacturers’ Outlook Survey for the fourth quarter of 2023, showing that small companies with fewer than 50 employees and medium-sized firms with between 50 and 499 employees, which make up a vast majority of the sector, continued to have historically lower levels of optimism with 65.9% and 63.0% positivity rates in Q4, respectively.

“It’s clear that Congress’ failure to enact pro-growth tax policies to support innovation and investment before year-end is affecting the manufacturing outlook,” said NAM President and CEO Jay Timmons. “Combined with the ongoing regulatory onslaught from the Biden administration, we’re facing economic headwinds that threaten all of the bipartisan wins achieved in recent years.”

Overall, 66.2% of respondents felt either somewhat or very positive about their company’s outlook, edging up slightly from 65.1% in the third quarter. It was the fifth straight reading below the historical average of 74.8%.

The NAM has been urging Congress to swiftly restore three critical manufacturing tax policies: immediate R&D expensing, a pro-growth interest deductibility standard and full expensing (100% accelerated depreciation). These competitive tax policies are critical to empowering manufacturers to grow their operations, hire more workers, increase wages, expand facilities and invest for the future.

Key Survey Findings:

- Eighty-nine percent of respondents said higher tax burdens on manufacturing activities would make it more difficult to expand their workforce, invest in new equipment or expand facilities.

- Workforce challenges also continue to dominate the sector, with more than 71% of manufacturers citing the inability to attract and retain employees as their top primary challenge.

- A weaker domestic economy and sales for manufactured products (63.7%), an unfavorable business climate (61.1%) and rising health care and insurance costs (59.8%) are also impacting manufacturing optimism.

You can learn more at the NAM’s online tax action center here.

The NAM releases these results to the public each quarter. Further information on the survey is available here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.75 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM Redoubles Tax-Priority Push

With tax bill negotiations left unfinished before lawmakers left for the holiday break, the NAM is hitting the ground running in 2024.

- The NAM continues to push for manufacturers’ top three tax priorities: immediate R&D expensing, a pro-growth interest deductibility standard and full expensing for capital investments.

What’s going on: Congress has just a few weeks to reach a government funding deal before a Jan. 19 deadline, “when funding for a range of government agencies is scheduled to lapse,” according to POLITICO. There is a second funding deadline on Feb. 2.

- The NAM has been calling on Congress to prioritize inclusion of the three tax provisions in any measure it passes.

- The NAM recently led a coalition of more than 1,300 businesses and associations in highlighting the urgent need for congressional action.

What’s needed: Congress must reinstate immediate R&D expensing; loosen a strict interest limitation; and return to full expensing (also known as 100% accelerated depreciation) for businesses, the NAM said.

Why it’s important: If these fixes aren’t made, manufacturing R&D, jobs and competitiveness could all suffer.

- Some 78% of manufacturers say the higher tax burden has decreased the funds available to expand their manufacturing activities within the U.S., according to the Q2 2023 NAM Manufacturers’ Outlook Survey.

The last word: “These tax provisions are some of the most critical issues facing manufacturers today,” said NAM Vice President of Domestic Policy Charles Crain.

- “Congress must act immediately to protect manufacturing jobs and maintain America’s competitiveness on the world stage.”

Act now: Visit the NAM’s Tax Action Center to send a message directly to Congress about these critical priorities.

Manufacturers Should Think Local When Addressing the Workforce Crisis

No man is an island, and neither is any manufacturer. Indeed, local and regional ties have never been more important to the industry’s success, as companies seek to fill hundreds of thousands of open positions and secure a talent pipeline for the next decade.

That’s why building partnerships with local organizations, schools and leaders was a key topic at the Manufacturing Institute’s 2023 Workforce Summit in October.

- As MI President and Executive Director Carolyn Lee put it, “The current state of the economy calls for new ideas for solutions…. We’ll need to build more diverse talent pipelines and connect with our partners in the workforce ecosystem.”

The problem has changed: “The workforce challenges we are seeing are not transitory; they’re structural,” emphasized MI Vice President of Workforce Solutions Gardner Carrick. “Addressing these structural challenges are going to require local, regional solutions.”

- In this case, “regional” means approximately a 40-mile radius around a facility. Manufacturers should focus on sourcing the bulk of their workforce from this immediate area, said Carrick, since it is unlikely that workers outside of that radius would be willing to commute.

- Carrick noted that manufacturers will need other organizations to help their outreach. “We need to collaborate. This is not a problem that can be solved individually.”

Which partners? Manufacturers should seek out economic development boards, education partners and community-based organizations, as well as individual leaders within their local communities.

- “With every new partnership, identify the point person and the decision-makers,” Carrick advised. “Work with them to maximize the relationship. You want to build awareness and institutional memory of your company within that organization.”

- In addition, manufacturers can seek out regional chapters of the MI’s Heroes MAKE America, Women MAKE America and FAME USA initiatives—which help members of the military community, women and others find rewarding manufacturing careers.

Connecting industries: Manufacturers can also find partners within their industry sectors and create relationships with local schools.

- In another session at the summit, MI Director of Workforce Initiatives Pooja Tripathi pointed out that “A group of employers can sponsor a noncredit pathway—which is relatively inexpensive—at a community college, which can then use it to attract the workforce manufacturers are looking for.”

- Fresno Business Council CEO Genelle Taylor Kumpe added that manufacturers could work with high school counselors to challenge perceptions of manufacturing and the need for a four-year college degree. “We’ve seen internships and other short-term exposure programs work in attracting youth to the manufacturing industry,” she noted.

- Fresno Economic Development Corporation Vice President of Workforce Development Chris Zeitz gave general guidance on approaching industry partners: “Different manufacturers and organizations have different incentives and ropes to navigate. The speed at which different sectors like manufacturing, education and economic development boards make decisions and move can also vary.”

The final word: Caterpillar Foundation President Asha Varghese emphasized the importance of seeking local solutions for workforce challenges, a key element of the foundation’s efforts to strengthen communities nationwide. As she rightly noted, “A business cannot thrive unless the community is successful.”

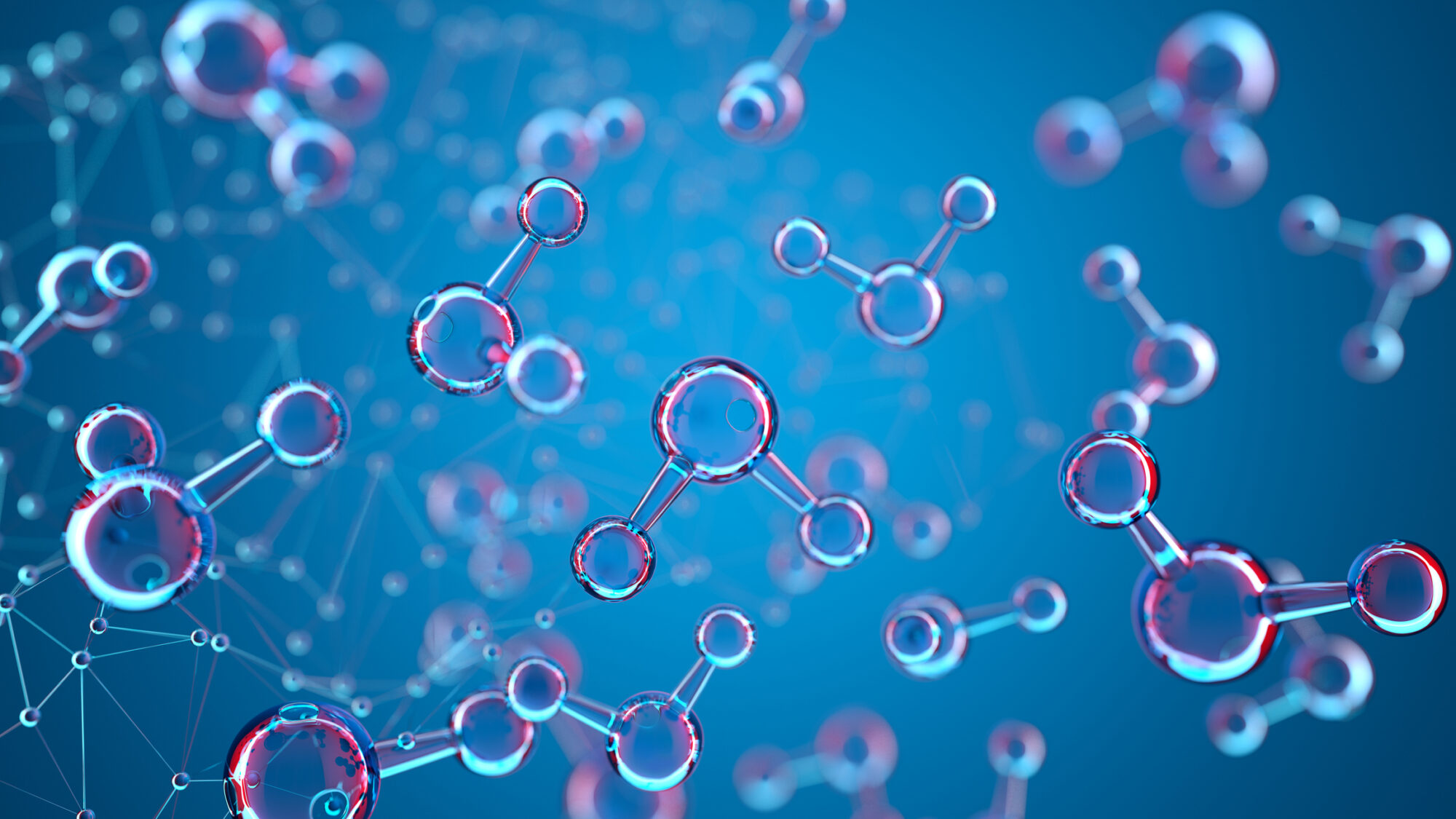

Manufacturers: New Hydrogen Tax Credit Regulations Fail to Incentivize Growth and Investment

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement in response to new proposed regulations on the Clean Hydrogen Production Tax Credit:

“The hydrogen tax credit has the potential to be the world’s strongest tool to build a hydrogen economy, but the Treasury Department proposal would impose so many hurdles to qualifying for the credit that the Biden administration will be left unable to achieve some of its top economic and environmental goals. Manufacturers are deeply disappointed with today’s announcement.

“Hydrogen is vital to reducing carbon emissions and to energy security efforts. If these regulations are put into place, America will lose out on job-creating investments across the country. To incentivize truly transformative growth in the necessary infrastructure to produce, transport and use hydrogen, the Biden administration should finalize a flexible credit that rejects additional requirements that were not included in the original legislation. And to realize the full potential of Inflation Reduction Act provisions, the CHIPS and Science Act and more, permitting reform must be a top priority in the new year.”

Background: The NAM has been urging the Treasury Department to create a flexible credit that rejects additionality and time matching provisions and provides a mechanism that supports carbon capture. More information on the NAM’s advocacy and the impact of these tax credit provisions can be found here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.75 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM Goes All Out for Tax Priorities

The NAM is firing on all cylinders to accomplish manufacturers’ top tax priorities: restoring immediate R&D expensing, pro-growth interest deductibility and full expensing.

Time is running out, as Congress must act by early 2024 to allow manufacturers to benefit from these provisions for the 2022 and 2023 tax years. Here’s what the NAM is doing to reach the finish line and why it matters so much to the industry and to the economy as a whole.

What we’re doing: The Executive Committee of the NAM Board of Directors recently sat down with House Speaker Mike Johnson (R-LA) to emphasize the importance and urgency of these measures. The Executive Committee has also raised the issue directly with the White House, and the NAM’s members—90% of which are small and medium-sized firms—have been contacting legislators to urge immediate action since early this year.

- In addition, while pressing the case relentlessly with the White House and congressional leaders himself, NAM President and CEO Jay Timmons has met personally with House and Senate tax negotiators to make manufacturers’ case for these reforms.

- NAM experts have also hosted multiple briefings for key legislators and congressional staffers, featuring manufacturers who explained how the withdrawal of these policies has harmed their businesses.

- Ratcheting up the ante on air and online, the NAM has applied pressure publicly in key districts, running a new ad campaign urging congressional action that has garnered about 80 million impressions so far. It also launched an action center to help manufacturers contact their legislators and spotlight the numerous companies that will be hard hit if pro-growth policies are not reinstated.

Why it matters: All three of these tax provisions are crucial to manufacturers’ ability to innovate, invest in their employees and make the American economy more competitive.

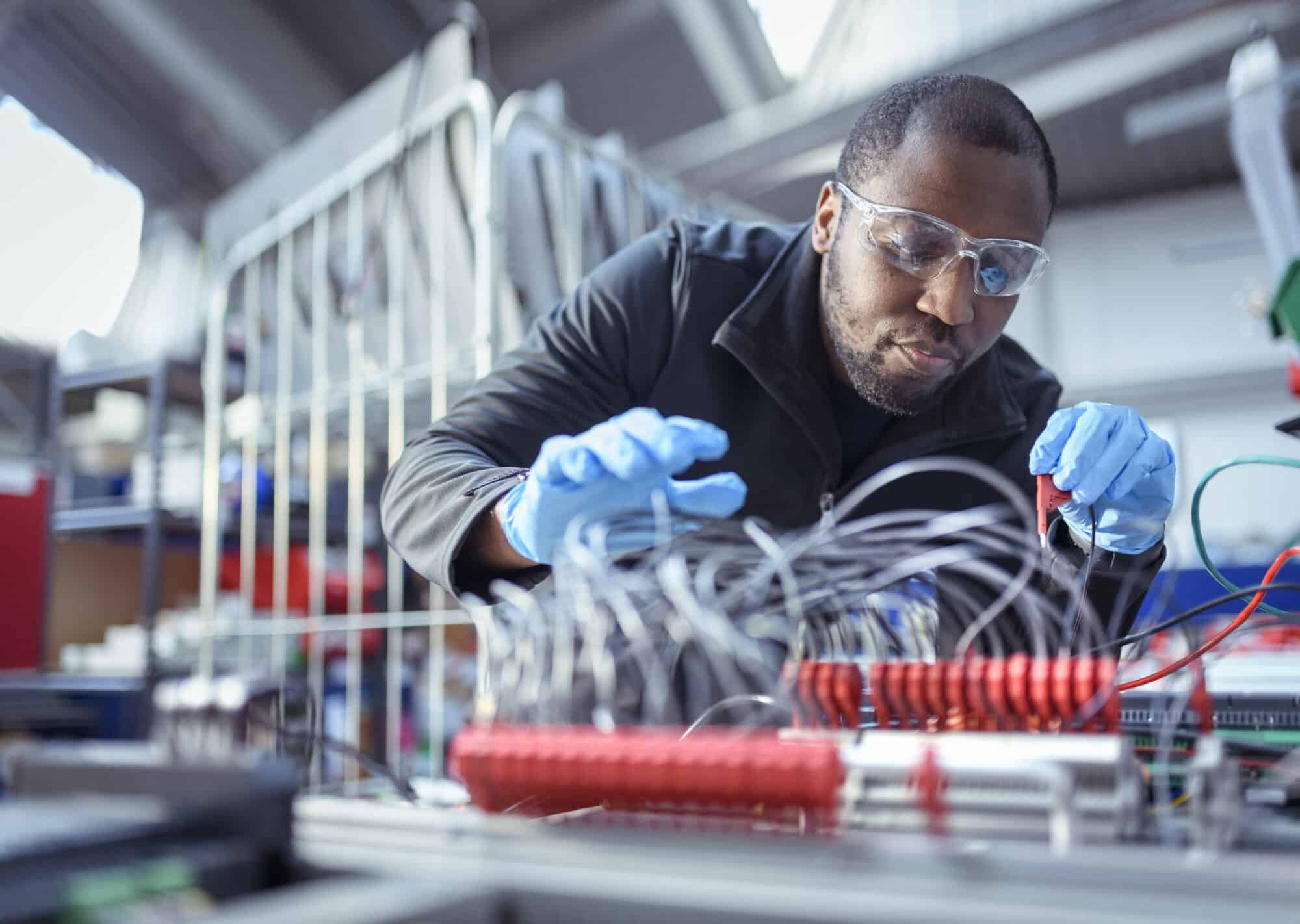

- R&D: The U.S. is one of only two countries (the other being Belgium) that doesn’t permit immediate expensing of R&D costs, a vital incentive for innovation. China, on the other hand, gives companies a “super deduction” for R&D expenses.

- Interest deductibility: A recent tax policy change made it more expensive for manufacturers to make critical purchases for their facilities, by imposing a stricter standard for deducting interest. This is a particularly heavy burden for a capital-intensive industry like manufacturing, amounting to a tax on companies’ investments in their operations and workers.

- Full expensing: This provision allows companies to expense their equipment purchases in the year they are made, supporting manufacturers’ investments in their businesses. But the policy is set to be phased out soon and must be saved, as it is crucial for small and medium-sized manufacturers looking to expand their operations.

The last word: “Manufacturing is the backbone of America, and the NAM is going all-out to make sure Congress acts on these critical priorities,” said NAM Managing Vice President of Policy Chris Netram. “Right now, leaders on Capitol Hill need to hear from manufacturers in their communities with a simple, clear message—act on our critical tax priorities now.”

Take action: Congressional leaders, including Speaker Johnson, have recently pointed out a need to hear from more manufacturers. Lend your voice—check out the resources in the action center to learn more.

NAM Pushes for Sensible Clean Hydrogen Regulations

Manufacturers are working constantly to develop energy approaches that reduce emissions and promote sustainability—and hydrogen energy is an important part of that mix. But upcoming decisions from the U.S. Treasury Department may make it more difficult for manufacturers to achieve their goals.

That’s why the NAM has been advocating for guidance that implements a hydrogen tax credit in a manner that supports manufacturers’ investments in this technology.

The background: Through the Inflation Reduction Act, Congress established this tax credit, called 45V, to incentivize companies to develop, produce and use clean hydrogen.

- “Hydrogen is the Swiss army knife of decarbonization—you can use it for nearly everything you can use natural gas for,” said NAM Vice President of Domestic Policy Brandon Farris. “And this credit can be the most significant tool across the globe to bring down the cost of clean hydrogen.”

The problem: As the U.S. Treasury Department finalizes rules around the use of the tax credit, their decisions may undercut manufacturers’ ability to take full advantage of it. Three provisions in particular are at the center of the NAM’s advocacy.

Additionality: The Treasury Department is considering a policy called “additionality,” which would mean that only hydrogen power created through the use of new renewable energy would be eligible for the credit.

- Meanwhile, clean hydrogen energy created with renewable energy that is already on the grid would not qualify—a real problem as our permitting system can often take half a decade or more to add additional clean power to the grid.

- “We have a lot of renewables on the grid already to spur the hydrogen industry. Using existing clean generation should qualify for the credit,” said Farris.

Time matching: Treasury may also impose a provision called “time matching,” which would mean companies would only receive the tax credit if they produce hydrogen energy at the exact same time that they are producing renewable energy.

- According to Farris, this rule misunderstands the energy production process. A company might only produce solar power for a few hours during the day when the sun is shining, for example, but it could still continue to produce clean hydrogen energy overnight using the grid. Yet under the time matching rule, they would be unable to claim a tax credit for the full amount.

- “This provision would create such tight restrictions that it would chill investment and innovation,” said Farris.

Carbon capture: According to the IRA, clean hydrogen created using natural gas with carbon capture also qualifies for the credit.

- However, the IRA also says taxpayers applying for the credits should have a mechanism to demonstrate that their feedstocks are lower in carbon intensity—yet has not specified what that mechanism will be.

- “Taxpayers applying for the credits should be able to prove that their feedstocks have less carbon,” said Farris. “The law says the less carbon they produce, the higher the credit they should receive. We’re just asking for a mechanism that allows taxpayers to prove it.”

The bottom line: Investments in clean hydrogen energy could be a game-changer for America’s energy future, but only if manufacturers have the opportunity to make them. That’s why the NAM has been urging the Treasury Department to create a flexible credit that rejects the additionality and time matching provisions and provides a mechanism that supports carbon capture.

- “Hydrogen is one of the most promising decarbonization technologies available,” said Farris. “If we can make these changes, we can achieve greater hydrogen production and more significant infrastructure investments and expedite decarbonization efforts across hard-to-abate sectors.”

Right-to-Repair Laws Harm Manufacturers and Consumers

So-called “right-to-repair” policies undo many of the federal and state laws designed to protect consumers and manufacturers—and they could result in “steep cost[s] to quality, performance, consumer safety, the environment and the broader U.S. economy,” according to a new NAM-commissioned study.

What’s going on: “The Economic Downsides of ‘Right-to-Repair,’” by Capital Policy Analytics’ Ike Brannon and Kerri Seyfert, finds that enacting right-to-repair laws could disrupt supply chains, leave manufacturers open to intellectual property theft, drive up costs for consumers and manufacturers and increase greenhouse emissions in the atmosphere.

- Right-to-repair policies, currently in place in more than 30 states, generally require manufacturers to make all tools, guides and parts required to repair their devices available to everyone, including independent repair outfits.

- A federal right-to-repair law “would ultimately alter how manufacturers operate their businesses, and there is no guarantee that consumers would benefit, as manufacturers would be forced to change the way their products perform,” according to the study.

Why it’s important: “There is a wide range of unintended and potentially harmful consequences that would arise if the most commonly introduced versions of ‘right-to-repair’ go into effect,” Brannon and Seyfert write.

- In addition to making product repair more difficult, such policies could drastically increase compliance costs for manufacturers and drive up prices for consumers.