Ways and Means Tax Bill Will Drive Manufacturing Investment and Job Creation

Bill Reflects Full Range of Manufacturing Priorities

Washington, D.C. – The National Association of Manufacturers commends Chairman Jason Smith (R-MO) and the House Ways and Means Committee for their bold leadership in acting on manufacturers’ top policy priority in our comprehensive manufacturing strategy: preserving and extending President Trump’s historic 2017 tax reforms. Today’s monumental action marks a vital step forward in securing a competitive tax environment that empowers manufacturers to create jobs, invest, grow and compete.

“Chairman Smith and the Ways and Means Committee are delivering what manufacturers in America have called for and what our industry needs to compete and win,” said NAM President and CEO Jay Timmons. “The 2017 tax reforms were rocket fuel for manufacturers—driving job growth, higher wages and investment in communities. This bill brings us closer to the vision of a 15% effective tax rate for manufacturers that President Trump and I discussed in 2016.

“For the 96% of manufacturers that are organized as pass-through businesses, this bill is more than policy—it’s a path to growth. It means the ability to buy equipment, hire workers, increase pay and expand operations with greater certainty and confidence. Not only is the Ways and Means Committee preserving the benefits of the Tax Cuts and Jobs Act for these businesses—this bill makes the law even more competitive, including by increasing and making permanent the job-creating pass-through deduction.

“The Ways and Means Committee’s bill reflects the full range of NAM tax priorities, which will drive manufacturing growth in America. To support small business job creation, the bill increases and makes permanent the pass-through deduction, also protects more family-owned manufacturers from the estate tax and maintains the TCJA’s pro-growth tax rates. To bolster America’s competitiveness on the world stage, the bill preserves the 21% corporate tax rate as well as the TCJA’s international tax provisions. And to incentivize investment and innovation in the United States, the bill revives and extends immediate R&D expensing, full expensing for capital equipment purchases and a pro-growth standard for interest deductibility.

“The stakes are clear: failing to preserve these policies will put nearly 6 million American jobs at risk. To keep the rocket fueled, Congress must act on the Ways and Means bill and make these pro-growth tax provisions permanent—because when manufacturing wins, America wins.”

Timmons joins Chairman Smith to discuss the results of the NAM’s groundbreaking tax study at an event in January along with House Speaker Mike Johnson (R-LA), House Majority Leader Steve Scalise (R-LA) and Senate Finance Committee Chairman Mike Crapo (R-ID).

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

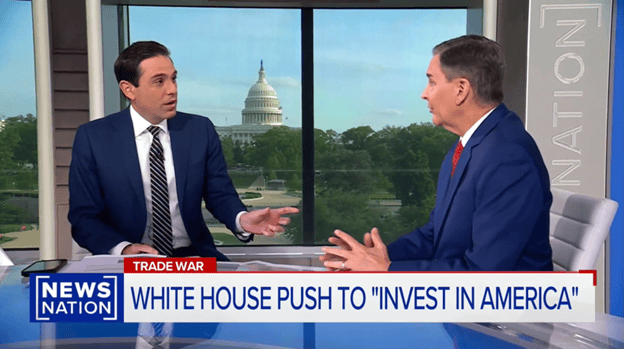

Timmons Presses for Comprehensive Manufacturing Strategy in NewsNation, FOX Business Interviews

In a one-on-one interview with NewsNation’s Blake Burman just hours before President Trump spoke at a town hall with the same network, NAM President and CEO Jay Timmons continued to underscore the need for a comprehensive manufacturing strategy to make long-term investments.

- “First and foremost, we have got to get those tax reforms from 2017—that rocket fuel that President Trump announced at our board meeting in 2017—renewed, and Congress needs to move that forward,” Timmons said.

- “Regulatory rebalancing is something that’s very important. It’s about $50,000 per employee per year in compliance costs; that’s pretty expensive. We also need energy dominance. [Trump is] well on his way to making that happen.”

- He added that we need “good, solid trade policy” so manufacturers don’t see added costs. “We’re waiting to see how all this comes out. And we’re hopeful.”

- “If you have a comprehensive manufacturing strategy that you’re implementing … that includes all of those things I just mentioned to bring down the cost of business doing business here in the United States, you absolutely will see more investment,” he continued. Trump “announced that $5 trillion has already been committed. You’ll see more jobs, and you’ll also see higher wages and benefits.”

The long view: “Massive facilities … take a little while,” Timmons told Burman. “That is a realization that I need Americans to understand.”

- Such sites typically take years, he said, with the exact number depending “on how localities and states are moving along the permitting process.”

- “I was George Allen’s chief of staff when he was governor of Virginia,” Timmons went on, “and he made a commitment that he was going to move large scale projects in a very expeditious way. And we had a huge chip manufacturer that made an announcement, and [the company] said the doors will open in one year. [T]hey did, and that’s because all of government was really focused on doing that. You’ve got that commitment from this administration, there’s no doubt about that, but it’s typically three to five years for a large-scale manufacturing operation to come to fruition, and you’re talking about a 30-year commitment.”

- “So that’s another reason we need permanence when it comes to tax policy and trade policy.”

FOX Business: Timmons recently spoke with a group of FOX Business reporters to discuss the comprehensive strategy needed from Congress, focusing specifically on tax, trade and the manufacturing workforce.

- In a story from that interview published today, he said: “The 2017 tax reforms that President Trump actually announced at our board meeting in 2017, [which he said] would be rocket fuel for the economy … indeed were. Those tax reforms led to record investment and job creation and wage growth for three years running after they were in enacted.”

NAM: Comprehensive Manufacturing Strategy Will “Ignite” Renaissance

The NAM’s comprehensive manufacturing strategy will be fundamental in “igniting the Industrial Renaissance of the United States,” the NAM told a House committee today ahead of a hearing of the same name.

What’s going on: “Manufacturers call on President Trump and Congress to implement a comprehensive manufacturing strategy that would create predictability and certainty to invest, plan and hire in America,” the NAM told the House Committee on Oversight and Government Reform.

- The purpose of the hearing was to examine how “cheap labor abroad, combined with overregulation and obstacles to permitting in the United States, contributed to the offshoring of American manufacturing and an overreliance on China to fulfill manufacturing needs.” It also emphasized “the importance of bringing manufacturing back to the United States.”

What we’re saying: The NAM has been advocating that the administration adopt a multipoint plan to see the manufacturing sector flourish. Today it urged President Trump and Congress to take the following actions from that strategy as soon as possible:

- Make 2017 tax reform permanent: Make permanent the pro-manufacturing tax measures scheduled to sunset at the end of 2025 and bring back already expired provisions. Failure to do so will put almost 6 million U.S. jobs at risk, according to a recent EY–NAM study.

- Rebalance federal regulations: Manufacturers now spend $350 billion a year to comply with federal regulations. That’s money that could be spent on factory expansions, hiring and/or wage raises, as NAM President and CEO Jay Timmons has pointed out. The NAM also recently urged 10 key federal agencies to revise or rescind dozens of onerous, anachronistic regulations.

- Expedite permitting reform: “America should be the undisputed leader in energy production and innovation, but we will not reach our full potential without permitting reform.” This must include expediting judicial review, accelerating the permitting process, creating enforceable deadlines and more.

- Implement commonsense trade policies: “Building things in America only works if we can sell them around the world,” the NAM told the House members. “That is why manufacturers urge President Trump and Congress to provide greater predictability and a clear runway to allow them to adjust to new trade realities, while also making way for exemptions for critical inputs, enabling reciprocity in manufacturing trade.”

Manufacturers Share Immediate Impacts Under Latest Tariffs

As three of the largest U.S. retailers—Walmart, Home Depot and Target—this week warned President Trump that his tariff policy could empty store shelves within weeks, upend supply chains and raise consumer prices, the tariffs already in place on imported goods are having effects on those who make things in America.

Speaking up: Manufacturers in the U.S. are sharing their stories of increased cost pressures and uncertainty, both the result of new tariffs. Makers of everything from machinery to bicycles to food service equipment are reporting ill effects.

- For Craig Souser, president and CEO of robotic packaging solutions manufacturer JLS Automation in York, Pennsylvania, steel tariffs in particular have had a big—and negative—effect on business.

- “[W]e’re seeing increased costs [in steel] that will eventually get passed along to the customer,” Souser told the York Dispatch (subscription).

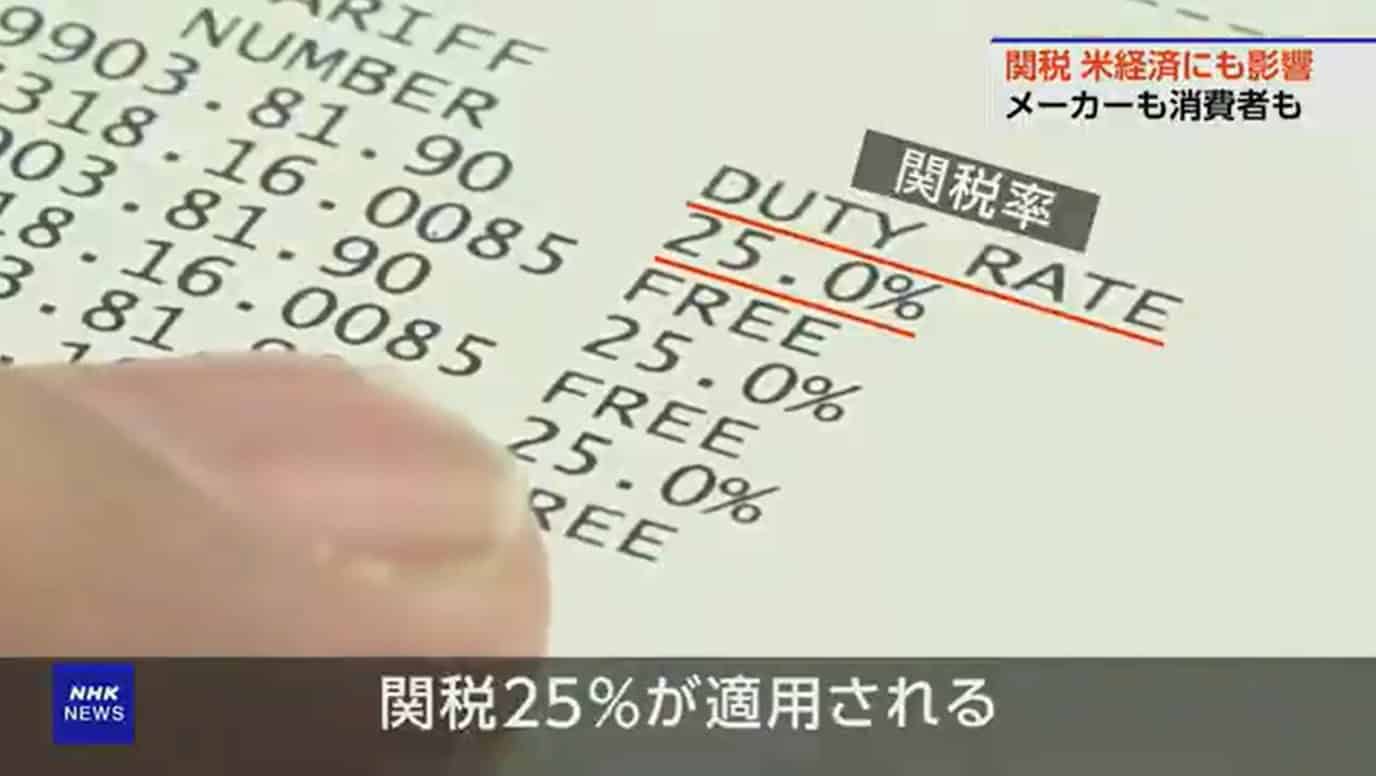

“Writing the checks”: Chuck Dardas, president and chief operating officer of Michigan automotive parts manufacturer AlphaUSA, told NHK News recently that his small business and others like it are the ones “writing the checks for” the new tariffs—and it’s not something they can keep up.

- “To absorb 25% or 50% in tariffs, it’s a task that we cannot in the long term endure,” Dardas said. “It’ll cause our company and many other companies our size to probably go out of existence.”

The unknown: Perhaps the hardest part about the new tariffs: the uncertainty they bring, NAM board member Lisa Winton, CEO and co-owner of Georgia-based machinery maker Winton Machine Company, told NPR earlier this month.

- “We just noticed our first invoice that had a tariff line on it,” she said. “There’s just so much unknown right now, and I think that’s the most difficult thing—to make decisions for your company financially when you just don’t know all the pieces to the puzzle.”

No time: Arnold Kamler, chairman of Kent International, a New Jersey bicycle manufacturer, told Fox Business last week that while his business was already moving overseas production to the U.S. when tariffs hit, it has yet to complete the move—and that’s been a problem for his small outfit.

- “We’ve managed to move almost half of our production out of China already, but that’s only [almost] half,” he said. “We need more time. … [W]e’re a small company.”

- During the pandemic, “[e]verybody bought a bicycle”—but “things got very slow after that. … All the money we made during the pandemic is all gone, plus a lot more. Then we have these tariffs. [If the Trump administration had said], ‘Look … in nine months, 10 months, this will be the tariff,’” that might have been doable, he went on. “But we g[ot] two weeks’ notice. It’s impossible to run a company to plan for” that.

Passing on the costs: In Ohio, Wasserstrom Company President Brad Wasserstrom told 10 WBNS that his Columbus-based food service and supply company will most likely have to raise customer prices to pay for the new tariffs.

- “[W]e’re negotiating with suppliers when we can, if there’s any flexibility in what they’re passing on to us,” Wasserstrom said. “Some have been able to do something to help us out. They’re not passing through maybe the full tariff. But very few have said they’re going to pass on nothing.”

Timmons, NAM Members Meet with Bessent, Congressional Leaders on Tax Reform

NAM President and CEO Jay Timmons will join congressional leaders for an “Invest in America” roundtable on Capitol Hill today to highlight the urgency of making the pro-manufacturing 2017 tax reforms permanent and more competitive.

The details: House Majority Whip Tom Emmer (R-MN), Treasury Secretary Scott Bessent, House Ways and Means Committee Chairman Jason Smith (R-MO) and other key Members of Congress will be in attendance. They will be joined by a group of NAM members of all sizes, representing manufacturing sectors such as metal fabricators, defense and pharmaceuticals and consumer-packaged goods, among others.

Timmons and Emmer: This morning, ahead of the closed-press meeting, Timmons and Emmer appeared on Fox Business’ “Mornings with Maria.” They reinforced the urgency of making these tax provisions permanent. Otherwise, “businesses in America are not going to invest” and “small businesses will get hit the worst,” according to Timmons.

Also this morning, Timmons and Emmer published a joint op-ed in Fox Business, which the White House amplified on social media.

- “The expiration of the Tax Cuts and Jobs Act would be detrimental to American businesses, manufacturers, consumers and families,” Timmons and Emmer wrote. “If Congress does not act to ensure President Donald Trump’s successful tax plan stays in place, taxes will go up for Americans at every income level. The average American would see a tax hike of 22 percent, over $1,600.”

- “A recent National Association of Manufacturers study indicated that failing to preserve these tax reforms will cost America 6 million jobs, $540 million in wages, and our economy will suffer a $1.1 trillion hit.”

GOP says: Emmer said on Monday that preserving tax reform was a “top priority” for Republican leaders.

- “The American people are hungry for an economic boom that is already underway,” Emmer told Fox News Digital. “But [it] will only be fully realized if Congress acts to continue the 2017 Trump tax cuts through reconciliation.”

- Bessent told the news outlet that “making President Trump’s Tax Cuts and Jobs Act permanent will help to secure the stable business environment that investors are seeking.”

- Timmons also spoke to Fox News Digital in an exclusive interview, saying “every day without action harms manufacturers’ ability to invest in America and plan for the future.”

NAM in action: The NAM is also launching a series of ads today featuring shop floor manufacturers advocating that the 2017 tax reforms be made permanent.

In the news: The roundtable was also covered by POLITICO’s Inside Congress and Morning Tax newsletters as well as Punchbowl.

As Tariffs Hit, Manufacturers Brace for Impact

Urge Congress to Act Now on a Comprehensive Manufacturing Strategy That Starts with Making the 2017 Tax Reforms Permanent

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement on the latest tariffs announced today:

“Needless to say, today’s announcement was complicated, and manufacturers are scrambling to determine the exact implications for their operations. The stakes for manufacturers could not be higher. Many manufacturers in the United States already operate with thin margins. The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations and lead as the preeminent manufacturing superpower.

“Manufacturers build things in America to sell around the world—and manufacturers in America share President Trump’s goal of supporting manufacturing investment, growth and expansion here at home. The president has the opportunity to achieve this vital goal while also minimizing disruptions and cost increases across our industry. To empower manufacturers to drive the U.S. economy, the administration should:

- minimize tariff costs for manufacturers that are investing and expanding in the U.S.;

- ensure tariff-free access to critical inputs that manufacturers use to make things in America; and

- secure better terms for manufacturers by negotiating ‘zero-for-zero’ tariffs for American-made products in our trading partners’ markets—that means they don’t charge us, and we don’t charge them.

“A clear, strategic approach to trade must be part of a comprehensive manufacturing strategy that starts with an urgent appeal to Congress to make the 2017 tax reforms permanent. When these tax cuts were signed into law, it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale. Manufacturers will work with the Trump administration and Congress to advance policies that help manufacturers grow and thrive—because when manufacturing wins, America wins.”

Background: In March, the NAM released its Q1 2025 Manufacturers’ Outlook Survey, highlighting rising concerns within the industry over trade uncertainties and increasing raw material costs. Trade uncertainties surged to the top of manufacturers’ challenges, cited by 76.2% of respondents—up 20 percentage points from the last quarter of 2024 and 40 points from the third quarter. Increased raw material costs was the second most cited concern, noted by 62.3% of respondents. These trade-related pressures contributed to a slight dip in overall optimism for their companies in the first quarter of 2025, down modestly from 70.9% in the fourth quarter to 69.7%.

According to another recent NAM survey of its members regarding the impact of tariffs on manufacturers, 87% of small and medium-sized manufacturers indicated that they may need to raise prices, and one-third could slow hiring.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Timmons: Tariffs Will Add Costs for Manufacturers

As manufacturers await the announcement of the Trump administration’s sweeping reciprocal tariffs at approximately 4:00 p.m. EDT today, NAM President and CEO Jay Timmons warned that “any scenario … is going to add cost[s] to manufacturers.”

What’s going on: Timmons, appearing on CNBC’s “Worldwide Exchange” this morning, told show anchor Frank Holland that while the world still doesn’t know what the latest tariffs will include, manufacturers are concerned—and they have good reason to be.

- Some 56% of imports to the U.S. are inputs for manufacturing, Holland said, citing NAM data. “That’s why you’re seeing this type of concern and sentiment among manufacturers,” Timmons said in response to a question about what the figure means for tariffs’ impact on the industry.

- Trade uncertainty is the top concern of the majority of manufacturers right now, Timmons said, citing the NAM’s most recent Manufacturers’ Outlook Survey. “That is up 40 percentage points over the last six months,” he told Holland. “That’s a huge jump.”

What it means: While “everybody would like more things made here in this country, because that’s good for the economy, that’s good for jobs,” new tariffs will drive “up the cost of actually making those things here in the United States,” Timmons continued.

What should be done: Manufacturers need certainty, not the nail-biting anxiety that comes from constant changes to the rules.

- “The first thing that we need to see is we need to see Congress do its job and get the tax reforms from 2017 renewed so that we have the certainty in the tax code,” said Timmons.

- Manufacturers also require relief from arduous regulatory burdens, which comes to “about $50,000 per employee per year for a small manufacturer,” Timmons told Holland, adding that the Trump administration is already working to cut those costs.

The bottom line: “There was a lot of enthusiasm when the president came in and talked about strengthening manufacturing here in the United States [and] talked about an agenda that would lower costs,” Timmons concluded.

- “But … if we don’t get the tax reforms renewed, that is an additional cost. If tariffs are imposed, that’s an additional cost. … Manufacturers … are waiting to see whether they should invest and hire. That’s not good for the economy.”

Manufacturers on the Hill Urge Action on Tax Reform Permanency

Shop floor manufacturers and NAM staff met with members of Congress yesterday and continue these meetings today on Capitol Hill to hammer home the importance of making the 2017 tax reforms permanent and getting a comprehensive reconciliation bill done now. House and Senate Republicans are working on a strategy for a tax package as part of a reconciliation bill that includes extending the 2017 Tax Cuts and Jobs Act.

- In its Morning Tax newsletter, POLITICO (subscription) reported on this week’s fly-in, naming the NAM “a powerhouse business lobby” meeting with several members of Congress as the 2025 tax bill continues to “get more intense.”

Why this is a critical moment: When the 2017 tax cuts were signed into law, “it was rocket fuel for manufacturing in America and made the U.S. economy more competitive on a global scale,” said NAM President and CEO Jay Timmons earlier this month.

- “That fuel is about to run out as key provisions have expired, and others are about to lapse. … We must ensure these historic, pro-growth manufacturing provisions are made permanent and even more competitive so manufacturers can plan, grow and succeed.”

“Exactly what the country needed”: Manufacturers traveled hundreds of miles from their shop floors to urge Congress to keep the rocket fuel for manufacturers and the American economy.

- “The Tax Cuts and Jobs Act of 2017 was huge for us,” said Tom Onsrud, CEO of the 51-year-old industrial CNC machine maker C.R. Onsrud, Inc., in Troutman, North Carolina. “It was rocket fuel. As soon as it passed, our backlog exploded. We started employing more people. We went from about 100 people to 220 people. Our floor space was maxed out. … It was exactly what the country needed.”

- One of the provisions, the immediate research and development tax credit, allowed the family-owned business to “expense equipment [costs] quickly,” Onsrud added. “That was huge for us.” That provision, however, expired in 2022.

“Vital to our company”: Stephen Bullock, president of concrete paving equipment manufacturer Power Curbers in Salisbury, North Carolina, is in Washington this week to make sure Congress knows just how important the tax reform measures have been to his small company.

- “We rely on them,” Bullock said. “We spend a lot of time and resources and money in research and development. Without [the tax provisions], it would be impossible for our company to support manufacturing. We’ve got to stay ahead of the game with new machinery, new offerings for our customers. So … anything we can do to realize those tax advantages sooner rather than later helps us very much from a cash-flow standpoint.”

- The TCJA “allowed us to expand and hire additional staff so that we [could] fund new programs, new machinery.”

“Tripled our business”: Steve Macias, co-owner of machining company Pivot Manufacturing, traveled from even farther away—Phoenix, Arizona—to make sure Congress heard what he had to say.

- “The tax reforms of 2017 … allowed us to grow our company in a way that we hadn’t [been able to] previously,” Macias told the NAM. “We were a small machine shop that did prototype and R&D work, and we’d been in business for 17 years. The tax cuts kind of gave us the kick … to take a leap and buy some production equipment, which has allowed us to virtually triple our business over the last eight years.”

- “Legislators need to understand the impact of tax reform,” Macias went on. “I’m a machine shop in Phoenix, Arizona, and there are hundreds of machine shops across the U.S., but there are also thousands upon tens of thousands of small manufacturing companies that made the same decisions we did based on those tax policies.”

Burgum Talks Taxes, Permitting and More

At an NAM-sponsored breakfast at energy conference CERAWeek in Houston on Tuesday, Interior Secretary Doug Burgum assured NAM board members that the administration has a manufacturing strategy in place, particularly regarding permitting, infrastructure development and manufacturers’ access to reliable and affordable energy.

A comprehensive strategy: In his remarks opening the event, NAM President and CEO Jay Timmons discussed the five-pillar, comprehensive manufacturing strategy that the NAM has been urging the Trump administration to implement.

- “Secretary Burgum, I just want you to know we’ve been making the case for a coordinated, comprehensive manufacturing strategy to give us the predictability and the certainty that manufacturers need to plan, to invest and to hire here in the United States, and that strategy has five pillars—goals that I know you share,” Timmons said.

- The goals are making the 2017 tax reforms even more competitive and permanent; securing regulatory certainty; expediting permitting reform to unleash American energy dominance; increasing the talent pool; and implementing a commonsense trade policy—to expand access to markets while keeping manufacturing competitive.

- Timmons warned of the dire consequences the U.S. economy and manufacturers will face if lawmakers fail to extend the 2017 tax reforms. Among them: the loss of some 6 million American jobs, according to a recent NAM–EY study.

An economic backbone: “Manufacturing, as you know, has been the backbone” of the economy, Burgum said. “President Trump ran on bringing manufacturing back to the United States. His policies are driving to do that.”

Unleashing U.S. energy: Timmons praised President Trump for his day-one lifting of the previous administration’s liquefied natural gas export permit moratorium.

- The “recent NAM LNG study found that the U.S. LNG export industry could support more than 900,000 jobs and add $216 billion to GDP by 2044,” he said.

- Said Burgum: “We are looking at everything to try to, for the first time, [have] streamlined government. … [and] it’s happening. It’s happening quickly.”

“Optimistic about the future”: The administration’s commitment to “low taxes and cutting red tape”—on which President Trump’s recently created National Energy Dominance Council is focusing—“are all things that are going to help lower your cost and create opportunities,” Burgum continued.

- “Capital is flowing to the U.S. at record levels. … I’m very optimistic about the future.”

The last word: At another event at CERAWeek, a roundtable sponsored by Natural Allies for a Clean Energy Future, Timmons summed up manufacturers’ commitments.

- “Yes, we care about developing our natural resources to power our economy, certainly through manufacturing, but it’s also about people, here in the United States and around the world,” said Timmons. “The energy that we export, that is soft power for the United States. That expands our influence. That allows us to export not only our energy, but also our values. So I think that’s very, very important for our future.”

Timmons: “Stakes Couldn’t Be Higher for Manufacturers Right Now”

If Congress doesn’t act soon, manufacturers could face higher costs—not just due to the new tariffs on goods from China, Canada and Mexico, but from expiring tax provisions, too, NAM President and CEO Jay Timmons told the Houston Business Journal (subscription) in an interview during the first leg of the NAM’s 2025 Competing to Win Tour. The interview was published late last week.

A quick recap: Tariffs on Chinese imports went into effect last month, and tariffs on goods from Canada and Mexico began last Tuesday.

- Last Thursday, President Trump signed two executive orders adjusting the tariffs for Mexican and Canadian imports that qualify under the U.S.–Mexico–Canada Agreement, allowing them to enter the U.S. duty-free. Goods that cannot claim USMCA preferential treatment are subject to the new tariffs.

Why it’s important: “With some tariffs against Mexico, Canada and China in effect, manufacturers and consumers could be facing higher prices as the industry is heavily reliant on imports of goods the U.S. does not manufacture,” the HBJ noted.

- “Trade is very important to manufacturers,” Timmons told the publication, adding that investments in domestic supply chains and manufacturing can take years to plan and develop, something that tariff policy should take into account.

The tax angle: The 2017 Tax Cuts and Jobs Act—which President Trump first laid out in a speech to the NAM Board during the same year—contained pro-growth tax provisions that were like “rocket fuel” for the manufacturing industry. But the continuation of those provisions is at stake: some of them have expired already, harming manufacturers, and others are scheduled to sunset at the end of this year.

What should be done: The impact of tariffs on manufacturers and consumers can be mitigated and the problem of expiring tax policies solved with a commonsense strategy from the administration and Congress, Timmons told the HBJ.

- On tariffs, there needs to “be some sort of a runway to allow us to start lower and then perhaps ramp up over time to give manufacturers the ability to pivot and make those long-term investment decisions here in the United States,” he said. “If [tariffs] are implemented in a very thoughtful, common-sense and strategic way, the impact on manufacturers will be minimized.”

- As for the tax provisions set to be eliminated, congressional leaders must remain focused on keeping them. “When President Trump signed those reforms in 2017, the following year, we had the best job creation in manufacturing that we’ve had in this country in 21 years,” Timmons said.