NAM to Congress: Advance R&D Tax Fix Now

To restore a U.S. tax landscape that promotes manufacturing competitiveness, Congress should act quickly in advancing bicameral, bipartisan legislation that would ensure the tax code once again supports innovation.

That was the message from the NAM and several manufacturers to lawmakers last week.

What’s going on: The NAM and company leadership from manufacturers Westminster Tool and Brewer Science visited Capitol Hill last week to brief legislators on a harmful change to the tax treatment of research and development.

- The briefing was held by the NAM-led R&D Coalition in cooperation with the offices of Reps. John Larson (D-CT) and Ron Estes (R-KS) and Sens. Maggie Hassan (D-NH) and Todd Young (R-IN).

- Larson and Estes introduced the American Innovation and R&D Competitiveness Act in the House, while Sens. Hassan and Young introduced the American Innovation and Jobs Act in the Senate. These are the measures manufacturers are urging legislators to pass.

Why it matters: “We paid $26,679 per full-time employee in additional federal tax this past year” because of the change, Westminster Tool Chief Financial Officer Colby Coombs told lawmakers at the briefing.

- “This increased federal tax on R&D forced us to cancel a major aviation contract that would have added … new jobs in our community and forgo a significant capital investment. Without fixing this issue, in 2023, we expect an additional tax bill of almost $18,000 per employee,” he continued.

- Added Brewer Science Government Programs Director Doyle Edwards: “We have lost IP to China in the past, and fight[ing] that in the courts is a no-win situation. So the only way to win is to out-invent them. And that’s what we invest our money to do. However, with [the tax change] … we’re allowing China to actually catch up.”

The background: For nearly seven decades, manufacturers could deduct their R&D expenses fully in the year in which the costs were incurred. However, since the change last year, businesses must instead deduct these expenses over a period of years, making R&D more costly.

Legislative fix: To protect manufacturers’ R&D, jobs and competitiveness, Congress should move immediately on bipartisan legislation to restore R&D expensing.

- “R&D is the lifeblood of advanced technology development for our company, for our industry, but really for the nation,” Edwards continued. “And so our message is, we need your help. We need your leadership to resolve this policy issue.”

Take action: Learn more about what the NAM is doing to advocate for sound tax policy at our R&D action center.

A Footwear Company Strives for Circularity

Within the footwear business, Okabashi is unique. The company, based in Buford, Georgia, is not only a family-owned company focused on sustainability, but also, according to the company’s leadership, producing part of the 1% of footwear still made in the United States.

For third-generation shoemaker Sara Irvani, this choice to build a sustainable and successful business in the U.S. was made possible only thanks to constant research and development.

The backstory: Irvani’s family started the company 40 years ago, and it always tried to reduce waste, both for the positive environmental impact as well as to improve its bottom line.

- “By developing closed-loop manufacturing processes, we were able to reuse some of the materials that otherwise might have gone to waste,” said Irvani. “That helped us stay more competitive—and from there we’ve developed innovations in processes and systems and materials that build on that foundation.”

The process: Okabashi’s sustainable processes extend throughout the product lifecycle—from incorporating recycled or biological elements (like soy) that ensure products last longer to preventing disposable waste to recycling post-consumer shoes into new ones.

- “When we look at sustainability of a product, we do it holistically—we look at what it’s made of, where it’s made, how it’s made, the lifecycle, the quality—and we’ve been able to innovate and develop so that our manufacturing process doesn’t create waste,” said Irvani.

- “Without R&D, we would not only be creating the additional cost basis of throwing away all those scraps, but we would also not be able to eliminate waste that is by default landfill or ocean bound.”

The circular economy: In the traditional, linear economic model, inputs go into production, a product reaches a consumer, the consumer uses the product and eventually throws it away. In contrast, Okabashi is working to perfect a circular economic model for its products, said Irvani.

- “If you are designing for circularity, you might use renewable and recycled resources, develop them into that same product with a level of quality that lasts longer, and when the customer is ready to move on, it can be remade into something else,” said Irvani. “That’s how the loop continues. When we talk about circularity, we’re creating that virtuous cycle.”

The homegrown production: Okabashi’s R&D efforts both help it stay in the United States by keeping costs down and require domestic production to work.

- “To remake and recycle a product into something new, you need to have local production,” said Irvani. “You can’t be sending things halfway across the world to be unmade and remade and sent back. That’s why R&D locally and domestically is so important, to help produce circular systems.”

The local benefit: Irvani is quick to point out that money spent on R&D creates significant financial benefits for local communities.

- “There’s a multiplier effect for commercially oriented R&D in terms of the jobs it can create and the impact on the local economy,” said Irvani. “You get a very strong return on investment for both the company and for the community.”

The global perspective: R&D is essential for U.S. companies competing with manufacturers abroad, Irvani added.

- “For U.S. manufacturing broadly, R&D is critical to stay at the forefront of the innovation curve,” said Irvani. “Unless we’re proactively investing and developing new and better ways of doing things, we won’t be globally competitive.”

The last word: “It is imperative industry and retail move toward a circular-based economy,” said Irvani. “That’s not something that just happens or falls from the sky. Consumers are demanding it, and R&D is our pathway to that future.”

Tech Firms Squeeze More Out of AI Chips

Looking to make the most of the AI computer chips they have, technology companies are increasingly “turning to software that can squeeze more performance out of available chips and help reduce costs,” The Wall Street Journal (subscription) reports.

What’s going on: While larger firms are using hard-to-get graphics processing units to build multiple different AI models that “do things such as detect cybersecurity threats and help improve network performance,” other businesses are using central processing units to do similar tasks.

- CPUs aren’t as powerful as GPUs, but they are easier to find.

- And when “tuned with open-source software tools to get more performance out of them,” CPUs can help businesses meet their processing needs.

Boosting performance: As GPU demand continues to outpace supply, companies are using third-party software to squeeze additional performance from existing GPUs, too.

- One Israeli start-up installs optimization software on client GPUs to “automatically put idle computing power to use to gain better processing efficiency,” according to The Wall Street Journal.

- A Seattle-based startup “is betting that most businesses won’t want to deal with owning and managing an array of AI hardware … so it rents out access to processing power from cloud providers that it speeds up on customers’ behalf.”

Renting the cloud: Indeed, cloud-company giants can offer access to much-needed processing power “by renting it out as they do with computer services,” one source told the Journal.

How Can Companies Boost Morale?

After a global pandemic and amid considerable economic strain, worker morale may not be everything a company hopes. So what can leaders do to boost communication and restore a sense of excitement and purpose?

The Innovation Research Interchange—the NAM’s innovation division—recently published a whitepaper on morale building, drawing on copious existing research as well as consultations with leaders in a range of industries (from aerospace to consumer goods). Here are some of its key recommendations.

Senior leaders in the trenches: The best way to understand company morale (or its absence) is to go looking for it. In one notable case, FM Global Chief Science Officer Lou Gritzo spent a day working in each company lab, so he could understand where communication and cooperation needed improvement.

- Thanks to this experiment, Gritzo was able to “open lines of communication up and down the organization,” according to the IRI, leading to both an improved flow of information and greater comfort among lab staff in making independent decisions.

- “For others looking to try their hand at being a (not so) undercover boss, [Gritzo] recommends setting out rules of the road in advance,” the IRI paper notes. “The goal is to create a dialogue, not make guarantees that things will change. The change comes from the relationships built.”

Support for midlevel managers: Many participants in the IRI’s roundtables and interviews agreed that midlevel managers have only become more crucial in recent years—which explains why these managers are often very stressed.

- Amid the pressures of the pandemic, companies began offering more support and coaching for middle managers, according to earlier IRI research.

- One organization studied by the IRI and its research partner, Babson College, brought in coaches to work with managers—but not just for one-off sessions. “The external coaches were brought in multiple times during a one-year period in order to observe leadership styles and gave feedback openly,” which led to improved communication and greater autonomy among the managers.

Everyone an innovator: Another way to boost morale is to make sure great ideas are always recognized, no matter who comes up with them.

- At ICL Group, leaders devised a novel way to encourage innovative thinking: “an online platform that allowed anyone at ICL Group to propose an idea, have it reviewed by management, voted on by frontline staff and assigned to the appropriate team for implementation.”

- The platform has proved very popular, according to one senior leader, who said, “Everybody has just been blown away by how many ideas people have entered and [how many employees] continue to do it.”

Read the whole thing: Check out many more useful details and expert advice in the full whitepaper, which you can find here.

How Manufacturing 4.0 Got Its Name—and Why It Matters

Flashback to 2015: “Hamilton” debuted on Broadway, millennials surpassed baby boomers as the largest U.S. generation and the term “Industry 4.0” was gaining traction in manufacturing circles. It was also when the Manufacturing Leadership Council created a conceptual framework called “Manufacturing 4.0.”

So what is the difference between Industry 4.0 and Manufacturing 4.0? While the terms may not sound all that distinct from each other, Manufacturing 4.0 represents the MLC’s commitment to a far-sighted, holistic approach to manufacturing’s tech-enabled metamorphosis—one that has served it well in over the past eight years.

The background: The 4.0 movement started in Germany in 2011 when the German ministries for education, research, economic affairs and energy developed a strategic initiative that would push forward the digital transformation of industrial manufacturing.

- They named this initiative Industrie 4.0. It featured an action plan that combined policy initiatives, public–private funding, strategies for technology implementation and the identification of business drivers and barriers.

The difference: For the MLC and its members, Manufacturing 4.0 is made up of transformations in three different arenas: technology, organization and leadership.

- Contrast this with Industry 4.0, which covers only technology topics—specifically nine pillars of technological innovation, which include autonomous robots, big data, cloud computing, IoT, cybersecurity, systems integration, simulation, AR/VR and additive manufacturing.

- “MLC, of course, covers all of these technologies, but, importantly, adds the dimensions of organizational and leadership change as part of its perspective on manufacturing’s digital transformation,” says David R. Brousell, the MLC’s founder, vice president and executive director.

MLC in action: While the MLC does provide member resources that focus on specific technologies and their uses in manufacturing operations, it also covers topics such as how leaders can prepare their workforce for digital transformation, how organizations should be structured to make business decisions based on manufacturing data and how leaders can ensure they set their teams up for digital success.

- Additionally, the annual Manufacturing Leadership Awards recognize not only high-performing digital manufacturing projects but also outstanding individuals who demonstrate both technological understanding and strong personal leadership.

M4.0’s continued evolution: Today, the MLC continues to use Manufacturing 4.0 as the overarching framework for its member companies’ activities.

- Its influence is apparent in the MLC’s annual Critical Issues Agenda, a member-created list of key business drivers and enablers of digital manufacturing.

- The agenda covers technological advances like smart factories and data analytics, alongside the organizational ecosystems that put such advances into operation—from the leaders who direct them to the cultures that make them succeed.

The Future of M4.0: As the MLC gets ready to set its 2023–2024 Critical Issues Agenda, it will continue to take a holistic approach to the technological changes sweeping the industry by recognizing the importance of people in making those transformations happen.

Go deeper: You can learn more about Manufacturing 4.0 by downloading the MLC’s white paper, Manufacturing in 2030: The Next Phase of Digital Evolution; reading a recent report, The Future of Industrial AI in Manufacturing; or attending its Aug. 30 virtual Executive Interview, Shifting from Disruption to Growth.

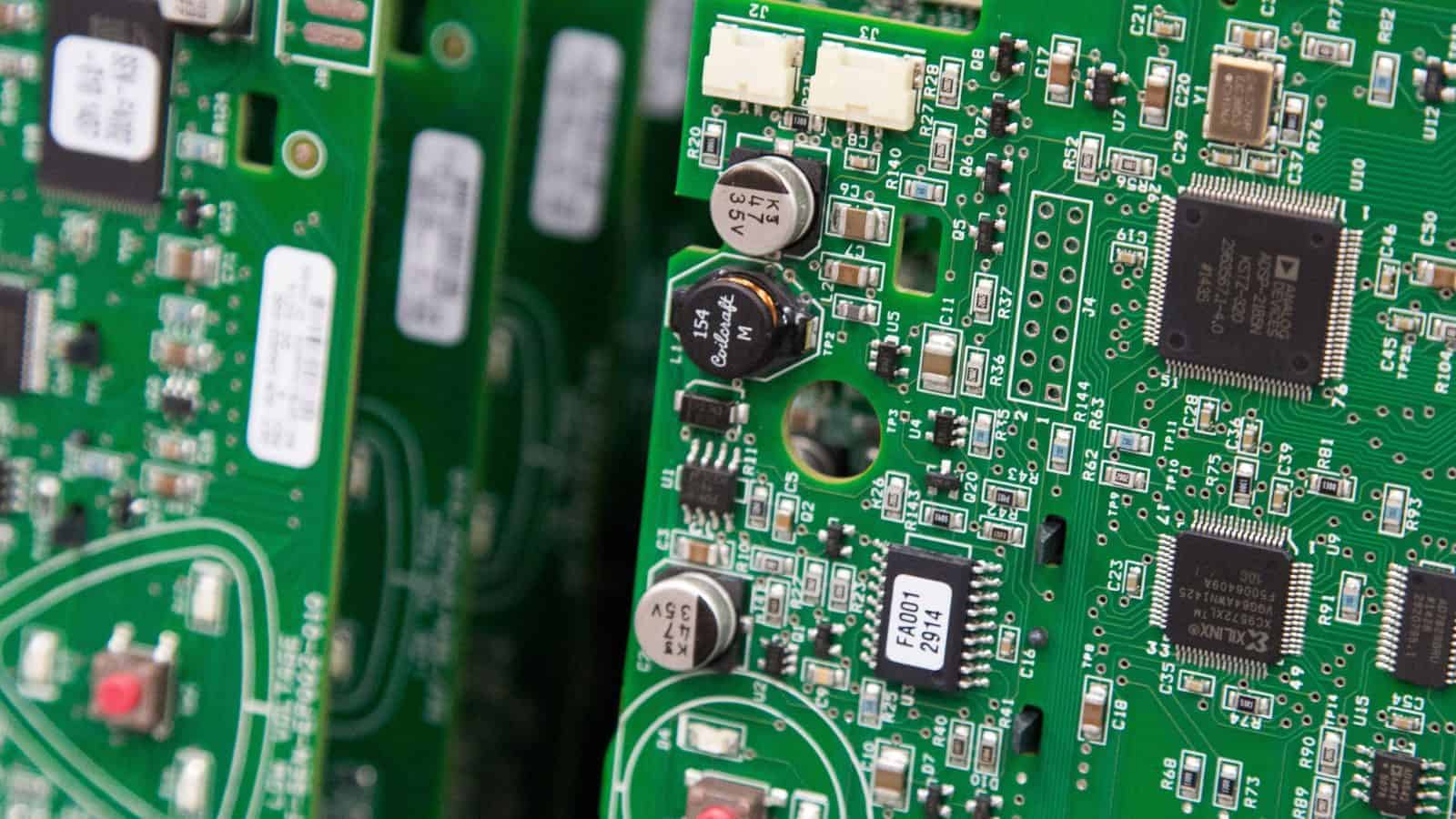

China’s Legacy-Chip Investments Trouble U.S., Europe

The U.S. and Europe are working to address “China’s accelerated push into the production of older-generation semiconductors,” Bloomberg (subscription) reports.

What’s going on: Last year, the U.S. imposed restrictions on the export of certain advanced technologies to China. Beijing has reacted by investing heavily in building facilities making older chips that do not face such U.S. restrictions.

- Legacy chips—those produced using 28-nanometer-and-larger equipment—remain critical in the global economy as components of everything from electric vehicles to military devices.

- China is on track to build 26 semiconductor factories through 2026, while the U.S. is forecast to construct 16 facilities “that use 200-millimeter and 300-mm wafers.”

Why it’s a problem: “Senior EU and U.S. officials are concerned about Beijing’s drive to dominate this market for both economic and security reasons, [sources] said. They worry Chinese companies could dump their legacy chips on global markets in the future, driving foreign rivals out of business…”

- If that were to happen, Western firms could become reliant on China for the chips, the sources say, and that could pose a national security risk.

Importance of legacy chips: The global pandemic demonstrated that older-model semiconductors remain important, as chip shortages hit companies’ bottom lines.

- The U.S. and Europe have been trying to expand their own chip production to avoid a repeat. Efforts have included the 2021 CHIPS and Science Act, which set aside $52 billion to bolster domestic semiconductor manufacturing in the U.S.

A problem to solve: “Commerce Secretary Gina Raimondo alluded to the problem during a panel discussion last week at the American Enterprise Institute. ‘The amount of money that China is pouring into subsidizing what will be an excess capacity of mature chips and legacy chips—that’s a problem that we need to be thinking about and working with our allies to get ahead of,’ she said.”

CHIPS Office Has Unique Job to Do

A new Commerce Department office tasked with dispensing tens of billions of federal funding for domestic semiconductor manufacturing faces a challenging job, according to Roll Call.

What’s going on: “The experts at the CHIPS program office are charged with enticing the world’s largest chipmakers to the U.S. to fashion cutting-edge semiconductors used in weapons and supercomputers, as well as in more ordinary devices like thermostats. The goal is to break the dependence that many American manufacturers of missiles, spy satellites, telecom gear and medical devices have on suppliers primarily based in Taiwan and South Korea.”

- Congress allocated $52 billion for the effort last year.

Why it’s important: “Deploying taxpayer funds and the federal government’s power puts the department and the CHIPS office in a unique position of executing a novel industrial policy: one focused on both national security as well as economic well-being, and one that is expected to back manufacturing plants as well [as] research and development efforts.”

- In recent decades, the most successful U.S. industrial policy interventions have been similar to this one: funding for “high-risk, high-reward” R&D, according to a Peterson Institute study cited by Roll Call.

Making it count: Sens. Mark Warner (D-VA) and John Cornyn (R-TX) are adamant that the money must be doled out judiciously.

- “This is not an economic proposition,” Sen. Cornyn said. “It’s obviously important from an economic standpoint, but national security is the main reason why Sen. Warner and I undertook the legislation.”

Keen interest: The new office has received more than 400 statements of interest from semiconductor manufacturers. Preliminary applications will be accepted starting in September.

- Top chipmakers, including Intel and others, “have indicated they may invest as much as $400 billion in the U.S. provided they get some support from the government.”

- Six expert teams will review the applications and decide on the amounts each firm will receive. National security experts will weigh applications based on companies’ security measures and supply chain resiliency capabilities.

The NAM says: “Bolstering domestic chip manufacturing is a security and economic imperative for the U.S.,” NAM Director of Domestic Policy Julia Bogue said.

- “That’s why the NAM supported passage of the CHIPS and Science Act and continues to advocate for actions that will see the U.S. manufacturing more semiconductors.”

Wisconsin Manufacturers & Commerce Honored with 2023 Leadership Award from Conference of State Manufacturers Associations

Bluffton, S.C. – Today, the Wisconsin Manufacturers & Commerce was honored with the 2023 Leadership Award from the Conference of State Manufacturers Associations, whose members also serve as the National Association of Manufacturers’ official state partners and drive manufacturers’ priorities on state issues, mobilize local communities and help move federal policy from the ground up in all 50 states and Puerto Rico. WMC was recognized for their work to attract and maintain the manufacturing workforce.

“We congratulate Kurt Bauer and the entire team at WMC for their incredible work this year to not only educate the next generation of manufacturing workers in Wisconsin, but also engage the business community at large to help spur investment in the state,” said Utah Manufacturers Association President and CEO, NAM board member and COSMA Chair Todd Bingham. “Their work shows the impact that we can all have to help make the United States the top destination in the world for manufacturing investment.”

The Leadership Award recognizes the achievement of a state manufacturing association that has developed impactful initiatives to support manufacturers and strengthen manufacturing in their state. Some of the initiatives that set WMC apart were their Coolest Thing Made in Wisconsin and Business World, which teach young people about entrepreneurship and free enterprise and promote manufacturing job opportunities in the state. Additionally, as part of WMC’s official mission to make Wisconsin the best place for business, the Future Wisconsin Project brings together diverse interest groups to identify and address the state’s long-term economic challenges and opportunities, including solutions to workforce challenges.

“The work of WMC to inspire the workforce of the future is a prime example of what’s needed to address the critical challenges that our sector faces today,” said NAM President and CEO Jay Timmons. “Under Kurt Bauer’s leadership, the WMC is advancing the solutions needed to make manufacturers more competitive and ensure manufacturing remains a key driver of Wisconsin’s economy.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Semiconductor Makers Look to “Chiplets”

The explosive growth of artificial intelligence is leading semiconductor makers to move quickly to create “designs that stack chips together like high-tech Lego pieces,” according to The Wall Street Journal (subscription).

What’s going on: “‘Chiplets’ can be an easier way to design more-powerful chips, according to industry executives who call the technology one of the most significant advances since the dawn of the integrated circuit more than 60 years ago.”

- The technology has the potential to deliver more powerful, cost-effective semiconductors, sources told the Journal.

- Last year, some of the world’s largest technology companies, including Qualcomm and Intel—which recently announced products containing chiplets—formed a coalition to craft chiplet-designing standards.

How it works: “A typical consumer device such as a smartphone contains many types of chip[s] for functions including data processing, graphics processing, memory, telecommunications and power control.”

- “The chips are delicately tethered to minuscule wires and ensconced in a protective plastic casing, forming a package that can be fixed to a circuit board.”

- “With the new chiplet packaging, engineers have found ways to bolt together pre-existing chips, the equivalent of using a few Lego pieces to build a toy car.”

The caveats: Chiplet manufacturing is not cheap, however, and the technology requires its own performance-verification process.

- What’s more, chiplets “aren’t suited to every function,” and lend themselves better to high-end desktop computers than mass-marketed cell phones.

China’s role: It is estimated that China controls 38% of the semiconductor assembly, testing and packaging market, a fact that “poses two potential risks for the U.S. While many American companies have been working with factories in China to handle these specialist chip-making roles, the supply chains could be tangled by a geopolitical crisis or another pandemic.”

- “In addition, the U.S. has imposed export controls on advanced semiconductor technology and could seek to expand controls in the future.”

How Are Companies Using AI?

To learn how sectors and businesses are using artificial intelligence, The Economist (subscription) created an index of firms in the S&P 500—and the results show that “even beyond tech firms the interest in AI is growing fast.”

What’s going on: “We looked at five measures: the share of issued patents that mention AI; venture-capital (VA) activity targeting AI firms; acquisitions of AI firms; job listings citing AI; and mentions of the technology on earnings calls. … [C]lear leaders and laggards are already emerging.”

The findings: In the past three years, approximately two-thirds of the companies examined by The Economist have placed a job ad that refers to AI. One of the sharpest increases in such mentions has been among chipmakers.

- The number of registered AI-related patents rose between 2020 and 2022.

- This year, about 25% of venture deals by S&P 500 companies involved AI start-ups, an increase from 19% just two years ago.

Outside Silicon Valley: While the index found that the most “enthusiastic” users of AI are technology companies, “[b]eyond tech, two types of firms seem to be adopting AI the quickest.”

- Data-heavy sectors, including insurance, pharmaceutical and financial-services companies “account for about a quarter of our top 100.” In this category, Abbott is building AI-powered medical tools.

- The other category of company quickly adopting AI includes “industries that are already being disrupted by technology,” such as automakers, telecom, retail and media. Among these are Ford and General Motors, which are using AI in electric-vehicle manufacturing.

The last word: AI use may have some drawbacks, including cybersecurity risks, potential legal liability and possible inaccuracy of results. However, these “must be weighed against the potential benefits, which could be vast.”