Nexteer Displays Advanced Manufacturing in Action

Would you like to see the latest advanced technologies exhibited and explained for your benefit, all without leaving your office? The NAM’s Manufacturing Leadership Council’s virtual plant tours provide just such an opportunity, taking you inside cutting-edge processes and complex systems at manufacturing facilities across the country. Most recently, the MLC dropped in on Nexteer Automotive, where tour participants got to see its innovative Digital Trace Manufacturing™ (DTM) System in action.

Who they are: Nexteer specializes in electric and hydraulic power steering systems, steering columns and driveline systems, as well as advanced driver assistance systems and automated driving-enabling technologies. The company serves more than 60 customers around the world, including BMW, Ford, GM, Toyota and Volkswagen.

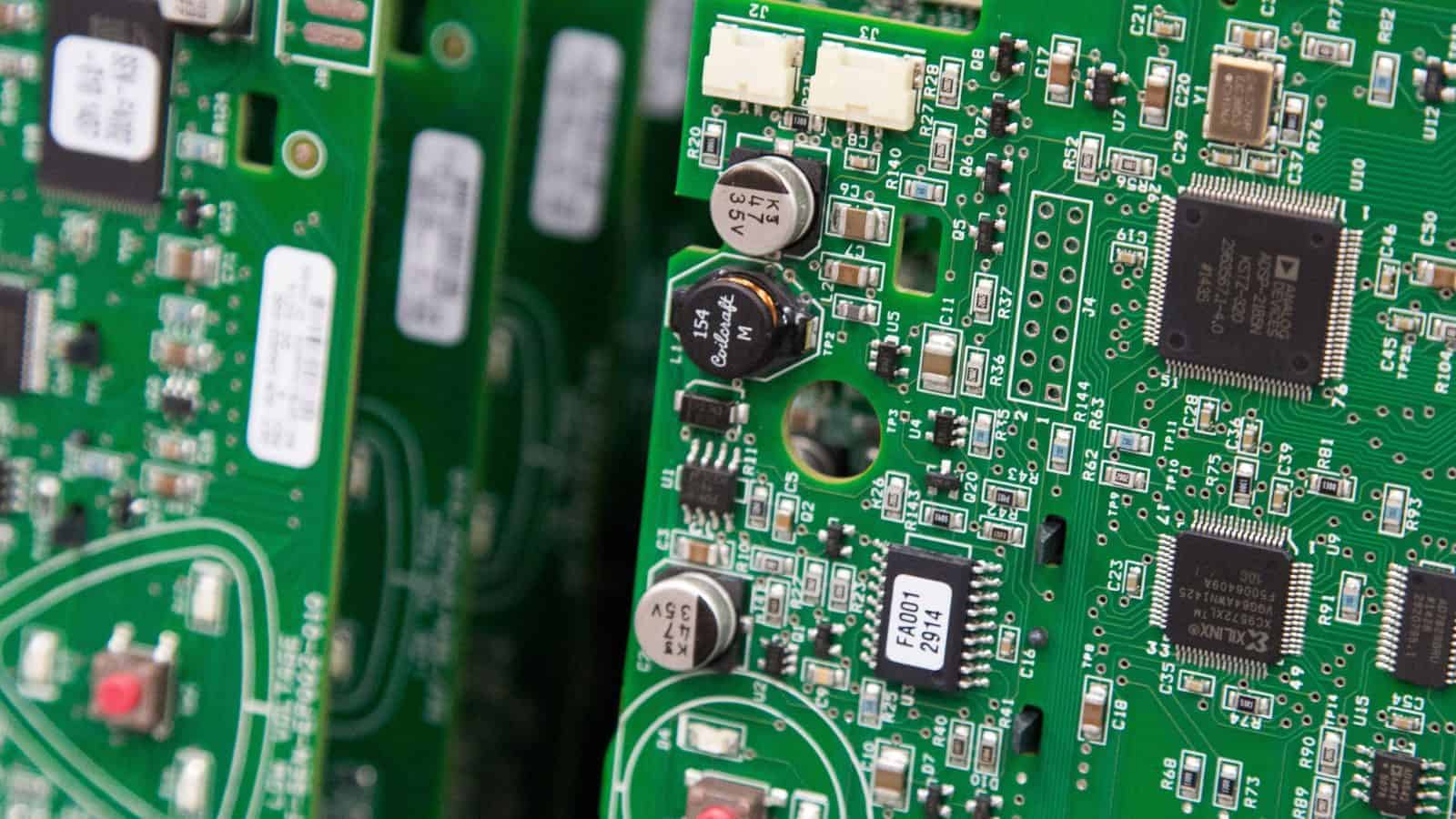

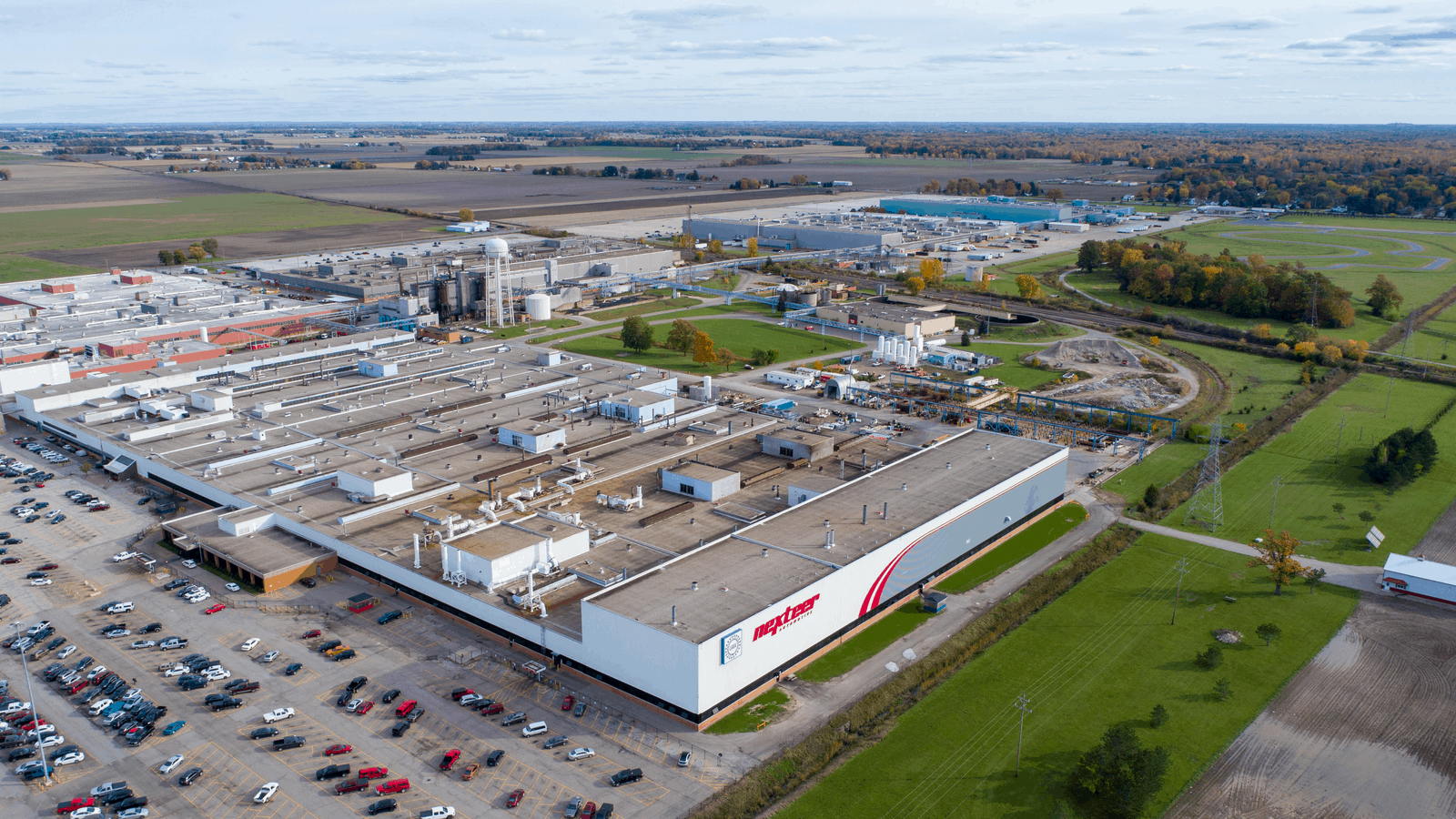

What is DTM? Nexteer’s DTM System connects and standardizes the company’s entire operations—including thousands of data-production components in 27 manufacturing plants around the world. To showcase the system’s capabilities, Nexteer took tour participants inside its Saginaw, Michigan, site, which includes six manufacturing plants comprising 3.1 million square feet of manufacturing floor space.

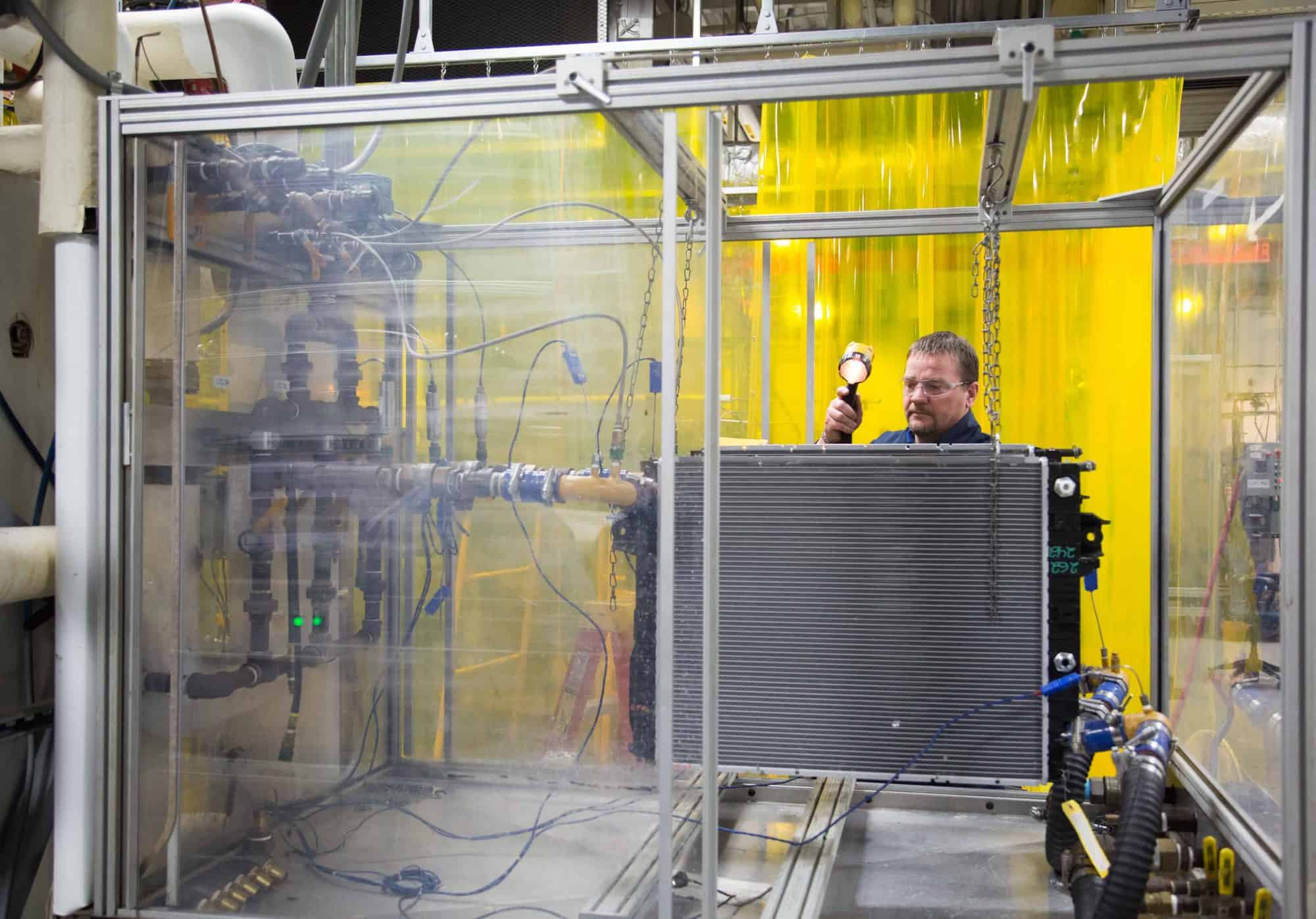

Tour highlights: Participants learned about the complexities of running a large-scale automotive component manufacturing plant, as well as how Nexteer uses the DTM System to maximize efficiency.

- Nexteer team members explained how they design and program machines for data processing, showing how they determine where data will be sent and how they use barcode scanners and other methods to track components’ serial numbers.

- Participants also got a virtual walk-through of Nexteer’s tracking system, which follows material from receiving and shipping through the production line with single-box precision. They also learned how Nexteer uses its Center of Analysis to correct any issues that arise.

Why it matters: It’s one thing to have a large system collecting data, and it’s another to be able to use that data effectively. The Nexteer virtual plant tour provided participants with practical takeaways, which will help them adopt similar innovations at their own facilities—for the benefit of employees, customers and shareholders alike.

Coming soon: Don’t miss the MLC’s upcoming tour of Johnson & Johnson’s facility on Wednesday, Dec. 1, from 11:00 a.m. to 1:00 p.m. EST. You will see how Johnson & Johnson uses mobility tools, advanced robotics and material handling and adaptive process controls to improve its operations. After the tour, stay for the panel discussion on how to scale advanced manufacturing technologies to create a sustainable, reliable and adaptable product supply. Sign up here.

New NAM Report Highlights the Impact and Importance of Pharmaceutical Manufacturing

Timmons: Pharmaceutical manufacturers are essential to America’s health and well-being and to the success of our economy.

Washington, D.C. – After the publication today of the National Association of Manufacturers’ latest report, “Ensuring a Healthy Future: The Impact and Importance of Pharmaceutical Manufacturing,” NAM President and CEO Jay Timmons released the following statement:

“Pharmaceutical manufacturers are essential to America’s health and well-being and to the success of our economy. They have helped lead our country through crisis, fight the pandemic and drive our recovery. The sector creates hundreds of thousands of jobs, and the work its quarter of a million employees perform is literally lifesaving, improving society in ways that are almost impossible to overstate.”

The report finds that not only have pharmaceutical manufacturers been pioneers in improving the human condition, but the industry also fuels other sectors of the economy.

According to the report:

- Pharmaceutical and medicine manufacturing directly employs an estimated 267,000 workers in the United States and supports nearly 1.9 million more jobs across the country.

- One job in the industry helps support six other jobs in the overall workforce.

- Pharmaceutical and medicine manufacturing generates nearly $339 billion in output. Further, $1.00 in pharmaceutical and medicine manufacturing output generates $1.09 in output elsewhere in the economy.

- For every $1.00 earned by an employee within the industry, $2.42 is earned by others elsewhere in the economy.

“The American public and policymakers too often overlook these accomplishments,” Timmons added. “Traditional economic analysis ignores the way this industry extends and enriches lives, and the public is not fully aware of pharmaceutical manufacturers’ constant focus on innovation and improving the quality of life for everyone. Pharmaceutical manufacturers are always researching, discovering and developing new medicines and treatments, operating at the core of our modern health care system. Their products make it possible for medical professionals to introduce and manage innovative new therapies, and of course, these manufacturers helped create lifesaving COVID-19 vaccines. Moreover, the industry has high economic multipliers that drive production and job creation in other industries.”

Additional Key Findings:

- A successful pharmaceutical ecosystem requires strong private-sector investment.

- In 2019, American pharmaceutical companies invested more than $83 billion in research and development, topping off nearly $1 trillion in R&D investment over the past 20 years. A recent study from the National Science Foundation’s National Center for Science and Engineering Statistics estimates that the pharmaceutical and medicine manufacturing sector alone accounts for roughly 17% of total R&D investment in the United States.

- The pharmaceutical industry invests nearly 11.4% of its sales back into R&D. Indeed, the U.S. pharmaceutical industry invests on average roughly three times more in R&D as a percentage of sales than all other manufacturing industries.

- The industry creates valuable STEM jobs.

- While roughly 6.7% of the U.S. workforce has a STEM occupation, 29.9% of all jobs in pharmaceutical and medicine manufacturing are STEM related. The pharmaceutical manufacturing sector employs more than four times the percentage of STEM workers employed in the overall workforce.

- Industry employees are highly productive.

- Industry employees produce $1.3 million in output per employee. This is nearly seven times greater than the U.S. economy’s average output per employee ($188,000).

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.4 million men and women, contributes $2.44 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Hologic Supports Women’s Health via Innovation

Nilo Caravaca, Hologic’s vice president of operations for Costa Rica and Latin America, says the company has an “important purpose”: to improve and save women’s lives around the world. At the Costa Rica facility that he manages, the company manufactures diagnostic and imaging equipment that protects women’s health, such as mammography systems and bone density scanners.

In pursuit of their goal, Caravaca and his team have embraced innovative technologies as well as best practices in talent management. For their achievements in attracting, upskilling and retaining a world-class workforce, the NAM’s Manufacturing Leadership Council awarded Hologic the 2021 Manufacturer of the Year award in the small and medium enterprise category. But the company is not stopping there. Caravaca anticipates further innovations, as Hologic keeps prioritizing efficiency, safety and growth.

Here is a snapshot of Hologic’s two award-winning projects and a look at things to come.

Supply chain innovation: Almost every product made by Hologic’s Costa Rica facility serves a patient with an urgent medical issue. That means its supply chain must be incredibly resilient and reliable.

- To meet these critical needs, Hologic launched a project called “Impacting Lives Every Day,” which employed robots for moving materials and bots for automating processes, while improving operations using real-time data and analytics.

- The project has resulted in a more reliable supply chain that gets products to patients faster while improving quality and safety.

Talent management: Caravaca believes companies need to focus on people in addition to technology to make the transition to Manufacturing 4.0, the next wave of technological progress.

- To that end, his team developed a new set of talent management processes that helps attract and recruit the best employees on the market, as well as ensure they have the opportunity to perform at their highest level.

The last word: An engineer by trade, Caravaca has a simple “formula for the future” of manufacturing: “Find the right talent, fit that talent in the right position, engage it and add tenure over time.” That will allow people to grow into their roles and perform at their peaks—the best result for both the company and the employees themselves.

To learn more about the innovative technologies and processes at Hologic’s Costa Rica facility, read “Hologic’s Winning Formula” in the August 2021 issue of the Manufacturing Leadership Journal.

How Manufacturers Are Mastering Data

When it comes to data management, most manufacturers are basically teenagers. They’ve gotten past the early stages but have yet to reach full maturity and mastery in their approach. In fact, it is often unclear what the data strategy is, who is responsible for it or even what the data is worth in the first place.

A new survey from the NAM’s Manufacturing Leadership Council shows us how manufacturers are progressing in their quest to harness the power of data—a capability that could have transformative power for many manufacturers throughout their operations. Below are some highlights.

Data collection: Most manufacturers rate their organizational data skills as just average, saying they struggle to collect the right data and interpret it.

- Fifty-eight percent of respondents said their company had just a moderate ability to collect data that is meaningful for their business needs.

Data analysis: If gathering data is a challenge, gaining insights from that data is an even bigger one.

- Seventy-five percent of respondents ranked their organization as only somewhat capable in their ability to analyze their manufacturing operations data.

- Even more worrisome, 11% of respondents said their organization was not at all capable of this type of analysis.

Applying insights: The practical application of data to create value is also a challenge for many manufacturers.

- Almost one-third said they expend greater than 80% of their efforts on gathering and organizing data—as opposed to analyzing and applying insights from it.

Other stumbling blocks: The survey revealed additional impediments to using data:

- The lack of systems available to capture the data (46%)

- Data inaccessibility (43%)

- The lack of skills to analyze data effectively (39%)

Opportunities: The good news is that even with these imperfect efforts, organizations are largely leveraging the data they do have to make informed decisions.

- Forty-eight percent said their organization makes data-driven decisions frequently, while 18% said they make data-driven decisions constantly.

The bottom line: Seventy-five percent of respondents said data mastery will be essential for future competitiveness. Indeed, data mastery is crucial to the industry’s transition into Manufacturing 4.0—the next big wave of industrial innovation—and the MLC will be tracking the industry’s progress closely.

To see more insights from the latest MLC M4.0 Data Mastery Survey, read “Growing Pains” in the August 2021 issue of the Manufacturing Leadership Journal.

Rethink 2021: Manufacturing’s Future on Display

Hundreds of manufacturing leaders came together this summer to discuss the industry’s next century of technological dominance. Augmented reality, artificial intelligence, robotics and more were all on the schedule, with companies unveiling their cutting-edge techniques and exchanging invaluable knowledge.

This premier gathering of talent is called Rethink, and it is the Manufacturing Leadership Council’s yearly conference on Manufacturing 4.0—the next wave of industrial progress created by digitization. It offers manufacturers a range of ways to engage with leaders and experts, including interactive case studies, collaborative think tank sessions and keynotes.

This year’s Rethink showcased a number of innovative technologies that are already transforming companies around the world. Here are some highlights.

Augmented reality is the new reality: PTC President and CEO Jim Heppelmann explained the benefits of augmented reality, which can give much more information to frontline workers and help manufacturers bridge the skills gap—the lack of sufficient skilled workers to fill available jobs.

- For example, augmented reality allows companies to record the expertise of workers who may soon retire, thus improving the training programs for new workers, Heppelmann pointed out.

Read more of Heppelmann’s expert advice here.

Robotics will support workers: In a keynote address, MIT’s Dr. Daniela Rus explained the coming evolution in human-machine relationships. She predicted that robots will enable workers to control production lines more precisely and configure them for rapid, customized production.

Read more about Dr. Rus’s predictions here.

Intelligent platforms are key: Intelligent platforms help manufacturers capture and understand data—the key to success in manufacturing’s digital era, according to Sid Verma of Hitachi Vantara and Mike Lashbrook of JR Automation.

- One of the biggest challenges is learning how to collect data strategically—because a plant floor can generate tons of it. “Just collecting data on the [operational] side does not work for us,” said Verma. “We have seen horror stories where people spent their entire IT budget just collecting data because they didn’t know where to start.”

Read more of Verma and Lashbrook’s insights here.

The bottom line: No matter where you are in your digital transformation, Rethink can help you move forward. It is the perfect place to discover new technologies and learn best practices for implementation.

For more information about the MLC, including Rethink 2022, email [email protected].

Take an MLC Plant Tour and Discover Innovation

There’s no better way to see innovation at work than to visit a manufacturing facility. There’s also no better way for manufacturing leaders to learn from one another. The Manufacturing Leadership Council’s plant tours are designed to give manufacturers unparalleled insight into each other’s innovations—and you won’t want to miss the next one.

The MLC’s plant tours have long been some of its most popular offerings. Back before COVID-19, these multiday events included a site visit, an executive roundtable discussion and ample time for networking and exchanging ideas. Now the events take place virtually, a change that has several advantages: more manufacturers can conveniently attend from their desks, and companies can showcase several facilities (and more innovation) in the same tour.

But most importantly, whether online or in person, an MLC plant tour offers a one-of-a-kind opportunity to connect and collaborate. The adoption of advanced manufacturing technologies can be dauntingly complex, and the best guides are those who have already done it.

Here’s just a taste of the innovations that participants get to see.

A whirlwind tour of IBM: This past April, participants took a virtual tour of IBM’s high-end storage facility in Vác, Hungary. They got to see how IBM uses automation, augmented reality, artificial intelligence, IoT technology and data visibility throughout its operations.

- Among the many innovations that IBM’s executives discussed on the tour were its acoustic insights products. The company trains AI models to recognize sounds that could indicate a potential machine failure so that it can be fixed preemptively—a technology it developed in house.

MxD x 2: Participants also attended two tours through MxD’s facilities earlier this year, each of which showcased a number of different innovations.

- Teaching old systems new tricks: On the first tour, visitors got a look at MxD’s Innovation Center in Chicago, a facility where manufacturers conduct experiments and demonstrations. They saw how MxD retrofits legacy equipment to keep up with the digital times—such as by outfitting a type of manual milling machine in use since the 1930s with digital sensors. The total cost of the upgrade? Less than $150.

- Cybersecurity in action: On a second trip through MxD’s Chicago facility, visitors saw the company’s cybersecurity demonstration areas. One of them included the excitingly named Cyber Wall, which helps manufacturers understand and guard against threats to their operational technology systems.

Sign up for Nexteer: You won’t want to miss the MLC’s upcoming tour of Nexteer Automotive, coming up on Aug. 11 (from 11:00 a.m. to 1:00 p.m. EDT). Nexteer is a global leader in the steering and driveline business, serving such major customers as BMW, Ford, Toyota, GM and more.

This virtual trip will take you inside the company’s Saginaw, Michigan, facilities and show you how Nexteer uses data to manage and improve its processes and products. Sign up today!

UL Helps Manufacturers Keep Their Air Healthy

With the highly infectious Delta variant causing concern even among vaccinated people in the U.S., manufacturers are thinking about the quality of their air yet again.

Now they can benefit from additional expert advice. In a recent webinar, the NAM’s Leading Edge program hosted an expert from global safety company UL to discuss how manufacturers can keep their air (and their employees) safe. Here are some of his recommendations.

In their own category: “Manufacturing facilities … are unique, in many respects,” UL Director of Assets and Sustainability, Real Estate and Properties Sean McCrady said. “You have all of these activities where there’s going to be regulatory safeguards in place for worker protection that are likely going to [act as] guidance for IEQ [indoor environmental quality].”

- In fact, many manufacturers worked quickly to improve their air quality when the pandemic started, the webinar’s moderator, NAM Director of Labor and Employment Policy Drew Schneider, noted. But though manufacturers may be ahead of the game on air quality, there’s more still to consider.

UL’s work: In response to the pandemic, UL developed what Fast Company magazine has called “LEED for the COVID-19 era”: its Verified Healthy Buildings program.

- To date, hundreds of buildings, including the Walt Disney Concert Hall in Los Angeles and the Cira Centre in Philadelphia, have had their IAQ (indoor air quality) tested, along with water purity, ventilation efficacy and other environmental factors.

- With UL’s guidance, building owners have made systemic changes, such as HVAC-system mold remediation, ventilation upgrades, air-filter unclogging and more.

So what can manufacturers do? “There’s a lot of opportunity to maintain that positive momentum” from behaviors that arose in response to COVID-19, McCrady said during the webinar.

- For manufacturers, this includes extending the IAQ- and IEQ-safety measures in place on the facility floor to their administrative areas, which may not be as well-ventilated, McCrady advised.

- “People know a lot more these days,” he said. They “want transparency” about their air quality.

Tips and tricks: McCrady offered additional advice for manufacturers:

- “Number one is ventilation. You want to make sure you’re bringing in enough fresh air” from outside, as well as doing proper and routine maintenance of ventilation systems.

- “Focus on source control,” McCrady added, referring to the elimination of individual sources of pollution. “And limit the migration of harmful contaminants”—for example, by carefully maintaining HVAC systems.

- Lastly, it’s important to fit air filters properly. Filters that have gaps or are otherwise incorrectly installed “won’t work,” McCrady said.

Not a magic pill: While high-quality filtration, ventilation and purification can go a long way toward stopping the spread of disease (particularly airborne illnesses such as the coronavirus), people must take other precautionary measures, too, McCrady noted. These include getting vaccinated and washing hands frequently and thoroughly.

The final say: “The things that can and should be done aren’t new, they’re just kind of under a spotlight right now,” McCrady said. “Focus on the fundamentals.”

Interested in hearing more from UL? Register for our Leading Edge Growth Series: Preparing for the Future of Manufacturing.

The Companies Leading the Way into Manufacturing 4.0

We all learn by example. That simple principle lies behind an ambitious undertaking by the World Economic Forum: to build a network of manufacturers that have succeeded in adopting Manufacturing 4.0 technologies, and that can act as ambassadors and educators for the whole global industry.

It’s called the WEF Global Lighthouse Network, and it’s already yielding fruitful partnerships and useful information. Recently, WEF Head of Advanced Manufacturing Francisco Betti sat down with the MLC to explain how it works.

Lighting the way: The Global Lighthouse Network emerged from a research partnership with McKinsey, which looked into what holds manufacturers back from embracing M4.0 technologies.

- After talking to more than 400 senior leaders, the researchers discovered that only 30% of companies were benefitting from technology adoption in their facilities and supply chains.

- As Betti puts it, “The majority were stuck in what we define as ‘Pilot Purgatory.’ There were massive investments being made in new technologies, and thousands of pilot projects underway, but very few were making it to the shop floor or delivering real operational financial value.”

That’s where the Lighthouse companies come in—the WEF decided to ask some of that 30% to open their doors and teach the rest of the industry how to make the digital jump.

How it’s going: Currently, the Lighthouse network has 69 members, assessed by a rigorous and independent review process. Betti says, “What is interesting is that we have companies from a large variety of sectors, and that is by design. . . . The opportunity for cross-learning here is massive.”

- The project is looking for use cases at factories, but also beyond. Many of the real winners in the digital game transform their entire supply chains, and the WEF is also looking to add those sorts of companies to their network.

Get involved: Companies can apply to be a part of the network, says Betti. The process involves an application, which covers both achievements and strategies, and culminates in a site visit.

- “The panel convenes on a quarterly basis to assess all the applications, vote and decide on those who finally get recognized as Lighthouses in the network.”

The transformation: Betti sees the M4.0 technologies as transforming whole economies and enabling “a new era of economic growth.” He makes a bold prediction about its effects on manufacturing leadership:

- “We are under the impression that there is a trend that we will most likely see going forward where chief operating officers will become the next generation of CEOs. Those who know how to successfully run operations by transforming them digitally are most likely going to provide top leadership positions in the near future.”

The last word: “If you transform digitally, and you do that by bringing your people on board, you have not only become more productive, you’re not only becoming more resilient, you’re not only becoming more sustainable, but you are setting your organization for growth in the years ahead.”

The Six Factors of Manufacturing 4.0 Success

In a world that only ever speeds up, manufacturers need to embrace technologies that let them shift operations quickly and seamlessly. Manufacturing 4.0 technologies like machine learning and robotics provide that power, but the scale of the M4.0 transformation can seem overwhelming.

In a recent edition of the Manufacturing Leadership Council’s Manufacturing Leadership Journal, Oracle Senior Director of Transformational Technologies Anant Kadiyala lays out six factors that make all the difference for successful M4.0 adaptation. Below is some of his advice.

Technology Adoption: Companies that consider the full range of technology’s benefits are setting themselves up for success. Some trends to consider:

- Software is becoming more integral to business operations and product functionality—allowing products to be configured and monitored in real time using analytics.

- On the operational side, the industrial internet of things and machine vision are enabling a whole host of advances in real-time monitoring, anomaly detection and worker safety, among other uses.

Data-Driven Decision Making: Companies that make good use of data achieve higher margins than their peers, according to a McKinsey study, but that requires some key ingredients, including:

- A unified data infrastructure, including APIs, applications, analytics, real-time systems and much more;

- The right tools to process the data; and

- Employees who are skilled in data-driven operations.

“In most companies, 90% of the data goes unused. In addition, more than 70% of the time and effort in data science projects is often spent on moving, cleaning and preparing data,” says Kadiyala.

New Business Models: “Modern technologies, such as cloud, IoT and AI/ML, enable every manufacturer to have the sophistication of business operations and real-time feedback loops that were only enjoyed by the big players,” says Kadiyala.

Innovation and Experimentation: Manufacturers can pursue different options for innovation, with partnerships being a common choice. Other methods might be design workshops or R&D investments, Kadiyala notes.

- “With the right people, processes and tools, companies can navigate faster and realize value quicker. The lean methodology that the manufacturing industry is renowned for also works very well for innovation.”

Well-Integrated Teams: The right talent is critical to business transformation—and good data, process automation and collaborative practices clear the way for employees’ success.

Culture: As Kadiyala puts it, “Successful companies start early innovation on the edges of their business, deliver a few wins and then gradually build their way into the rest of the organization. All successful transformations need employees to enjoy a strong sense of purpose and mission for the change.”

“The Culture Is the Company”: An Interview with ALOM’s Hannah Kain

With 19 global locations, ALOM Technologies Corporation specializes in technology-driven supply chains for Fortune 100 companies. ALOM President and CEO Hannah Kain recently sat down with the Manufacturing Leadership Council to share her thoughts on the state of the industry and the keys to successful leadership.

Taking on challenges: Over the long term, Kain sees workforce development—finding and training the next generation of manufacturing leaders—as a significant priority. But in the short term, she cites COVID-19- and trade-related supply chain disruptions as the most pressing issues.

- “Shifts in demand have increased the need for agility in manufacturing, yet U.S. infrastructure, from ports and roads to cybersecurity, is under extreme strain, and geopolitics have made goods movement more complex,” she said.

Meeting the moment: During the COVID-19 pandemic, ALOM manufactured millions of COVID-19 test kits for the medical sector while ensuring its own workers remained safe, Kain said. The company also met the past year’s challenges by investing in digitization to improve its productivity.

Finding opportunities: Kain cites a range of opportunities for manufacturers of the future, from fast-improving technologies to the availability of new manufacturing talent—if manufacturers can find and harness it.

The importance of culture: Kain believes in what she calls “servant leadership”—seeing yourself as a supporter of stakeholders like customers, employees and suppliers and working to put their needs first. She strives to create a culture of collaboration within her own company.

The last word: “In the end, culture is the company, and the company is the culture,” said Kain. “Our culture is inclusive, collaborative, improvement-oriented and quality-focused, with a strong sense of ownership. Supporting that culture may be the most important thing I do.”