Manufacturers Back Chips Bill, Call for Further Action from Congress

Timmons: “A vote for the CHIPS Act funding is a vote for a stronger, more competitive manufacturing industry in America.”

Washington, D.C. – Ahead of consideration of legislation to bolster U.S. semiconductor manufacturing, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“A vote for the CHIPS Act funding is a vote for a stronger, more competitive manufacturing industry in America. But if Congress fails to pass this investment in the coming days, they will hand other countries a competitive advantage and weaken our own economy at a precarious moment.

“Other provisions of the China competition bill still under negotiation also need to make it to the president’s desk, and manufacturers firmly support their inclusion in this package. We will continue our advocacy for the anti-counterfeiting measures, trade provisions, supply chain investments and more. Congress must get those done.

“This week, we can take a powerful step forward with chips funding and move toward a future where semiconductor shortages—and the disruptions they’ve created—are a thing of the past. Other nations are not waiting around to ramp up semiconductor manufacturing. America should be leading, not falling behind.”

Background:

According to the NAM’s latest Manufacturers’ Outlook Survey, more than 88% of respondents said it was important for the federal government to take steps to support the domestic manufacturing sector in the face of increased global competition for industrial investment, with nearly 58% saying “very important” and 30.7% saying “somewhat important.” When asked about what aspects of the China competition legislation were most important for supporting manufacturing activity, the top choices were addressing port congestion and competition issues in ocean shipping (70.9%), eliminating ill-conceived labor provisions that facilitate unionization campaigns (61.3%), strengthening U.S. leadership in energy innovation and competitiveness (58.2%), funding to increase domestic semiconductor production capacity (57.9%), investments to support the critical minerals supply chain (55.7%) and ensuring the tax code provides a full deduction for research expenses (48.3%), among others.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.8 million men and women, contributes $2.77 trillion to the U.S. economy annually and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturing Leadership Council Recognizes Pfizer CEO

The Manufacturing Leadership Council—a division of the NAM that helps manufacturers leverage digital transformation—named Pfizer CEO Dr. Albert Bourla the 2022 Manufacturing Leader of the Year at the 18th annual Manufacturing Leadership Awards Gala.

The details: The ML Awards are the U.S. manufacturing industry’s biggest stage for recognizing excellence in digital manufacturing. Since the program’s founding in 2005, more than 1,000 high-performing projects and individual leaders have been honored with an award. Winners represent companies of varying sizes in a wide array of industries.

The big award: The Manufacturing Leader of the Year award was presented to Bourla for Pfizer’s extraordinary and ongoing contributions in fighting the COVID-19 pandemic.

- “Manufacturing in America today is stronger thanks to the leadership of Dr. Bourla and his team at Pfizer, including our Executive Committee member Mike McDermott,” said NAM President and CEO Jay Timmons. “Albert and Mike’s passion and dedication to defeating COVID-19 set an example for thousands of companies as our industry navigated and responded to the evolving pandemic, and their leadership and innovation will make us better prepared to respond to the next crisis.”

Other honorees: Awards were given to companies that excelled in various categories of manufacturing, including Protolabs for collaborative ecosystems, AB InBev for digital network connectivity and operational excellence, Dow for digital supply chains, General Motors for engineering and production technology, Flex and Johnson & Johnson for enterprise integration technology, AUO Corporation for sustainability and ALOM Technologies for transformative cultures.

Manufacturers of the Year: Protolabs was named the Small/Medium Enterprise Manufacturer of the Year, and AB InBev was named the Large Enterprise Manufacturer of the Year.

The last word: “Manufacturers continue to be the driving force for global economic recovery and pandemic response as they establish innovative ways to problem-solve in an increasingly complex environment,” said MLC Co-Founder, Vice President and Executive Director David R. Brousell. “Those recognized tonight have helped establish a roadmap for the future of the sector and highlight the importance of Manufacturing 4.0.”

NAM Drives Conversation on Innovation and Competition

The NAM is urging Congress to bolster American innovation and make the U.S. more competitive with China.

The big picture: NAM Senior Vice President of Policy and Government Relations Aric Newhouse wrote to Congress, “we urge the completion of a strong, bipartisan agreement that strengthens domestic manufacturing, increases our global competitiveness and provides opportunities for the more than 12.7 million people who make things in America.” The NAM’s recommendations include the following:

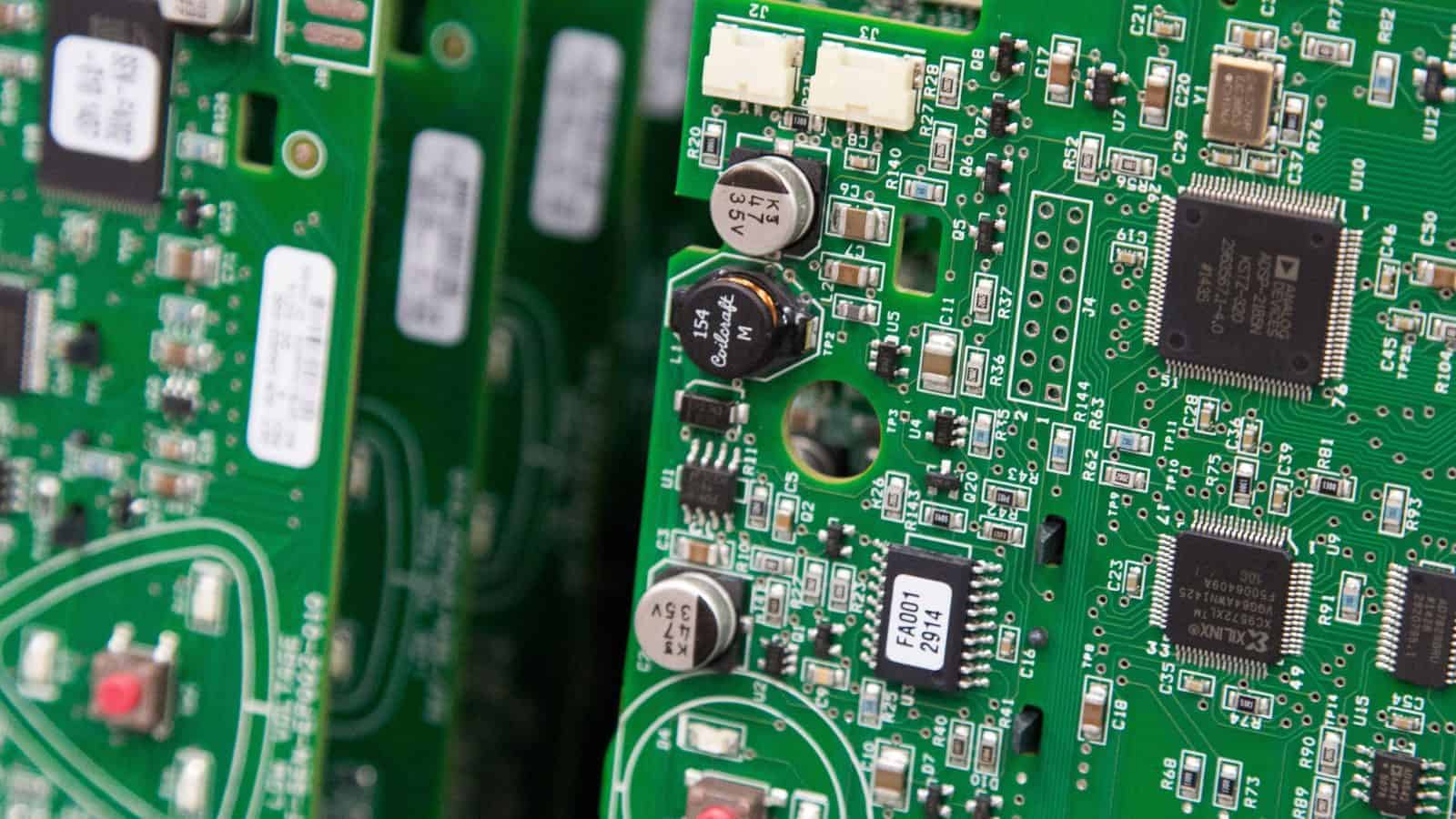

- Semiconductor manufacturing: Newhouse emphasized the NAM’s support for the $52 billion provided to bolster domestic semiconductor manufacturing in both the Senate’s United States Innovation and Competition Act (USICA) and the House’s America COMPETES Act.

- Supply chain resilience: 88.1% of manufacturers report supply chain issues as their primary business challenge, which is why the NAM supports the creation of the Manufacturing Security and Resilience Program and the $45 billion investment to support supply chain resilience included in the America COMPETES Act.

- Shipping: The Ocean Shipping Reform Act, which has passed both chambers of Congress in some form, is aimed at increasing port efficiency, reducing shipping delays and decreasing transportation costs through the improvement of ocean shipping standards and implementation of better oversight mechanisms.

- R&D: The NAM recommends reversing a new provision in the tax code that requires companies to deduct research and development expenses over a period of years rather than the year the costs are incurred—a provision that effectively makes R&D and innovation more expensive and more difficult for American companies.

- Eliminating card check: “Manufacturers are strongly opposed to the labor and card check provisions included in the America COMPETES Act,” wrote Newhouse. “Implementing ill-considered labor and card check provisions would upend decades of labor precedent with an anti-competitive, anti-democratic process that abolishes the secret ballot and eliminates appropriate oversight.”

Other recommendations: Newhouse also expressed the NAM’s support for policies that reduce emissions and promote sustainability to make the U.S. a global leader in energy efficiency. The letter recommends the reauthorization of the Miscellaneous Tariff Bill, the implementation of strong anti-counterfeiting legislation to protect consumers and small businesses and federal investment to improve the domestic critical mineral supply chain.

Take action on these issues and more at Manufacturers United.

Case Studies for Success in the Factory

There’s nothing quite like a real-world test run to determine whether a new technology is right for your business. That’s where Rethink, the annual summit of the NAM’s Manufacturing Leadership Council, comes in.

The world’s leading event on Manufacturing 4.0, Rethink boasts an agenda packed with case studies to help manufacturing leaders see exactly how various digital technologies might help them improve their operational quality and efficiency.

The featured case studies coming to Rethink include the following:

- The Expanding Reach of Collaborative Robots: Examine practical applications for collaborative robots in manufacturing. Discover the benefits already being realized from the use of robots and identify ways to maximize the benefits.

- Extracting Insights from Plant Floor Data: See firsthand how to use data to monitor equipment performance, predict conditions and take preemptive action to avoid downtime. Gain practical takeaways on how to leverage data for bottom-line benefits.

- How AR/VR Can Empower Frontline Workers: Take a deep dive into one company’s advanced deployment of augmented and virtual reality technologies. Explore how these technologies helped transform operational activities and empower frontline workers.

- Fostering Data Literacy: The What, Why and How: Learn how to manage and analyze data from all aspects of your operations and use it effectively to improve decision making. Gain an understanding of the emerging discipline of data literacy as a way to overcome business culture hurdles.

How to participate: The Rethink summit takes place June 27–29 in Marco Island, Florida.

- In addition to case studies, the agenda will include inspirational keynote speeches, thought-provoking panel discussions and hands-on think tanks.

- More than 300 top-level executives and their teams attend each year.

- Participants include professionals in operations, IT, supply chain, engineering, C-level management, HR and more.

Click here to browse the agenda and to register.

How a 5G Smart Factory Doubled Ericsson’s Output

How will the 5G transition affect manufacturing? If you ask Ericsson Senior Vice President Åsa Tamsons, enormously.

5G will help drive global transformation, innovation and sustainability in our sector, Tamsons recently told the NAM’s Manufacturing Leadership Council. She sat down with MLC Co-Founding Executive Editor and Senior Content Director Paul Tate at Ericsson’s new 5G Smart Factory in Lewisville, Texas, to tell us more.

About Ericsson: Founded in 1876, Ericsson Inc. is a leading provider of information and communication technology. The company is now a $25 billion global enterprise with 100,000 employees serving clients in 180 countries.

About the Lewisville plant: Ericsson describes its Lewisville plant, which opened in March 2020, as a “5G-enabled, digital native” facility.

- “We wanted to be able to obtain data from every single source, device, machine and person operating in the facility, both now and in the future,” she said. “One part was implementing 5G, but we also needed a data architecture to secure that and to use equipment that is able to extract both production data and operational status.”

Development process: In its journey to Manufacturing 4.0, Ericsson used a particularly agile development process.

- “We had a mission to develop 25 use cases within a year,” Tamsons said. “In the first eight months, we launched seven of those 25 use cases. In the remaining four to five months, we launched the other 18. It just shows the power of doing that groundwork, while also demonstrating that you can launch end-to-end solutions in rapid time. Then you really start to have platforms that you can scale.”

Measuring impact: The Lewisville facility serves one of Ericsson’s biggest and most important markets in the world—yet it is operated by just 100 people.

- The plant delivers 2.2 times more output than similar sites that don’t have the same degree of automation or technology in place.

Lighthouse status: Lewisville is also one of the world’s first manufacturing plants to achieve Global Lighthouse Network status under the World Economic Forum’s new sustainability category.

- A combination of recyclable and reused materials, renewable energy, an ideal location close to a major airport and advanced manufacturing technologies supported this award.

- “Innovation is not all about technology,” Tamsons said. “It’s about how you apply it and how you can use the best of technology to create better solutions that are also more sustainable.”

What’s next: The Lewisville plant has plans for further innovation.

- “We’ll continue to build out the data structure and cloud capability, really focusing on how we can scale up the value of existing use cases and applications and on what the next use cases will be,” she said. “We’re continuing to invest in upgrading our manufacturing sites to develop a reliable, sustainable, global supply chain, not only in Lewisville, but across the world.”

Attend a plant tour: Join the MLC in Texas for the Ericsson Lewisville Plant Tour on Oct. 4–5 to see Ericsson’s 5G-enabled digital native, double Lighthouse award-winning plant for yourself. Save the date and watch for more details.

Meet the 2022 Winners of the Manufacturing Leadership Awards

A group of world-class manufacturers and their leaders have been recognized for their achievements by the 2022 Manufacturing Leadership Awards.

About the awards: Presented by the Manufacturing Leadership Council, a division of the NAM, the awards recognize excellence in digital manufacturing. Since the program’s founding in 2005, more than 1,000 high-performing projects and individual leaders have been honored with an award. Winners represent companies of varying sizes in a wide array of industries.

This year’s awards were given in nine project categories and two individual categories. Some project categories include AI and Machine Learning, Digital Supply Chains and Digital Network Connectivity. Judging is done by a panel of industry experts, many of whom are past winners themselves.

Why it matters: The movement toward smart factories allows manufacturers to leverage data to become more efficient, productive, sustainable and competitive. In the difficult business conditions that many are experiencing, data-driven operations can mitigate disruptions and even predict them before they happen.

“This year’s winners are exemplary for their compelling use of technology, innovative approach to problem solving and overall commitment to furthering the progress of Manufacturing 4.0,” said Manufacturing Leadership Council Co-Founder, Vice President and Executive Director David R. Brousell.

Gala coming in June: Winners will be honored at the Manufacturing Leadership Awards Gala on Wednesday, June 29, 2022, at the JW Marriott Marco Island Beach Resort in Florida. The gala will also feature the announcement of this year’s Large Enterprise Manufacturer of the Year, Small/Medium Enterprise Manufacturer of the Year and Manufacturing Leader of the Year.

Select winners will present their projects at Rethink: The Manufacturing Leadership Council Summit, the industry’s premier event focused on Manufacturing 4.0.

See the complete list of winners here.

2022 STEP Ahead Award Winners Announced

Word is out – the recipients of this year’s STEP Ahead Awards have been announced.

What’s happening: Bestowed each year by the Manufacturing Institute, the NAM’s workforce development partner, the STEP Ahead Awards recognize outstanding women in the fields of science, technology, engineering and production (STEP). This year marks the honor’s 10th anniversary.

Why it matters: “The STEP Ahead Awards are central to the industry’s efforts to recognize and empower women,” said MI President Carolyn Lee. “Manufacturing is averaging more than 800,000 open jobs a month in the past year, and we can’t close that gap without closing the gender gap.”

- Recipients “serve as role models and have their own multiplier effect on the number of women in the workforce, paying it forward to help others find their way into a successful, rewarding career in modern manufacturing,” Lee said.

- Agreed 2022 STEP Ahead Chair Denise Rutherford: “The 2022 STEP Ahead Honorees and Emerging Leaders are excellent representatives of the exciting opportunities available in manufacturing. These remarkable women and the leadership they show help inspire the next generation of female leaders to consider careers in manufacturing.”

Gala to follow: The 130 recipients of the 2022 awards will be honored at an in-person Aril 28 gala in Washington.

See the full list of 2022 award recipients here.

Manufacturers Explore New Tech and Best Practices at MLC Master Class Series Events

To help manufacturers navigate Manufacturing 4.0, the NAM’s Manufacturing Leadership Council launched the MLC Master Class Series. This series includes regular virtual events designed to explore new technologies, address pain points and showcase opportunities—all while connecting forward-thinking manufacturing leaders. Sessions in the series include interactive webinars, Technology Deep Dives and Tech Talks.

Webinars: With formats such as panel discussions, use cases and executive interviews, the Master Class webinars are especially beneficial to manufacturers who want to learn about the innovative technologies that have the potential to enhance their operations. These virtual sessions are a chance to hear directly from the digital manufacturing experts moving our industry forward. Content and discussions during these sessions provide insights on identifying, evaluating and implementing new technologies as well as providing strategies for leadership in the age of digital progress.

Deep dives: Deep dives are 60-minute interactive sessions that continue and expand the learning necessary to be successful with new technologies. They provide a more in-depth understanding of specific technologies, where they can be applied and how they can lead to new competitive advantages. Each deep dive also features short breakout sessions focused on either “How Do I Get Started?” or “How Do I Further Leverage?”

Tech talks: Tech talks are 30-minute candid conversations with subject-matter experts who provide insights into how specific technologies are designed to accelerate and drive the journey to Manufacturing 4.0. From purpose and adoption, to challenges with implementation and best practices on operations, MLC’s tech talks will enable you to stay abreast of new and evolving manufacturing technologies within the marketplace.

Master Class events take place throughout the year. Manufacturers at all stages of digital transformation are invited to participate in the entire series or choose individual events based on their needs and interests. To see upcoming classes and access recordings of past sessions, click here.

What Will Manufacturing Look Like in 2030?

Given the many uncertainties brought about by COVID-19, supply chain disruptions, labor shortages and more, it might seem as though what happens in the coming decade is anyone’s guess. But on closer examination, there are signposts signaling some of what’s to come—and a closer look at them can help manufacturers plan for the coming years.

At the recent “Manufacturing in 2030: The Shape of Things to Come” event hosted by the NAM’s Manufacturing Leadership Council, in-person and virtual attendees heard from experts, examined trends, explored technologies and discussed upcoming challenges. The goal: to look into the future of manufacturing.

“We can’t be certain about what tomorrow will bring, let alone what might be in 2030,” said MLC Co-Founder David Brousell in his opening remarks. However, “we can project or extrapolate based on current trends and conditions, with a reasonable amount of probability, what the shape of manufacturing will look like in 10 years’ time.”

Why Manufacturing in 2030: Everything in manufacturing is changing, driven by technologies capable of giving decision makers more information than ever before. Prior to the pandemic, companies were already making changes to their organizational structures, shifting from hierarchical models to more collaborative means of organizing people and processes. COVID-19 has only accelerated this change.

Brousell explained: “All around us, conventional notions of what can be accomplished in production … are being reimagined.”

Challenges and opportunities: Upcoming challenges discussed included continued global supply chain disruptions, climate change and the redefinition of the human–machine relationship. Speakers examined the technological, organizational and leadership characteristics that can set manufacturers apart and provide them with a competitive advantage.

What’s next: The MLC will soon launch its yearlong “Manufacturing in 2030” project, which will help manufacturers explore, understand and plan for the future of the manufacturing industry in the next decade.

Said Brousell: “If we do things right in the next 10 years, we have the opportunity to create the greatest engine of manufacturing production humankind has ever seen.”

COMPETES Act Supports Manufacturers’ Call for Stronger Stance on China, Addresses Inflation

Timmons: Lawmakers can feel confident that supporting this bill means supporting the future of manufacturing in America

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement today on the introduction of the America COMPETES Act by the U.S. House of Representatives:

“The introduction of the America COMPETES Act, which includes many components of the overwhelmingly bipartisan U.S. Innovation and Competition Act, is a major step forward, and lawmakers can feel confident that supporting this bill means supporting the future of manufacturing in America. Not only would its provisions help address inflation and alleviate supply chain challenges we’re facing today, but the bill provides significant investment in U.S. semiconductor manufacturing, which would also help us avert future crises. This bill also includes funding for a Supply Chain Resilience and Crisis Response Office at the Department of Commerce. I’ve discussed the programs that this office would oversee with Secretary Raimondo, and manufacturers strongly back these initiatives, which would include game-changing grants, loans and loan guarantees.

“This legislation would strengthen U.S. leadership in global climate innovation, improve environmental research and fill critical gaps in data—all while holding China accountable as the world’s biggest emitter. Manufacturers look forward to working with Congress on all elements of this legislation to ensure it meets the needs of our industry and supports America’s manufacturing workers and American families by putting the United States in a much stronger competitive position toward China.

“We will work to get it passed through the House and then work with the Senate to ensure that final legislation achieves the critical shared goals of this bill and the U.S. Innovation and Competition Act and makes it to the president’s desk.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs 12.5 million men and women, contributes $2.52 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.