Why Policymakers Should Support—Not Hinder—R&D

This story can also be found within the NAM’s R&D action center.

Manufacturing is an industry built on innovation—but with a recent change in tax law, manufacturers are encountering a new and major obstacle to the critical research and development investments they need to make in order to compete at home and around the world.

The background: Up until January 2022, a business could deduct 100% of their R&D expenses in the same year those expenses were incurred. But a change to the law that took effect this year now requires businesses to spread those deductions over a period of years, making investment in innovation more expensive.

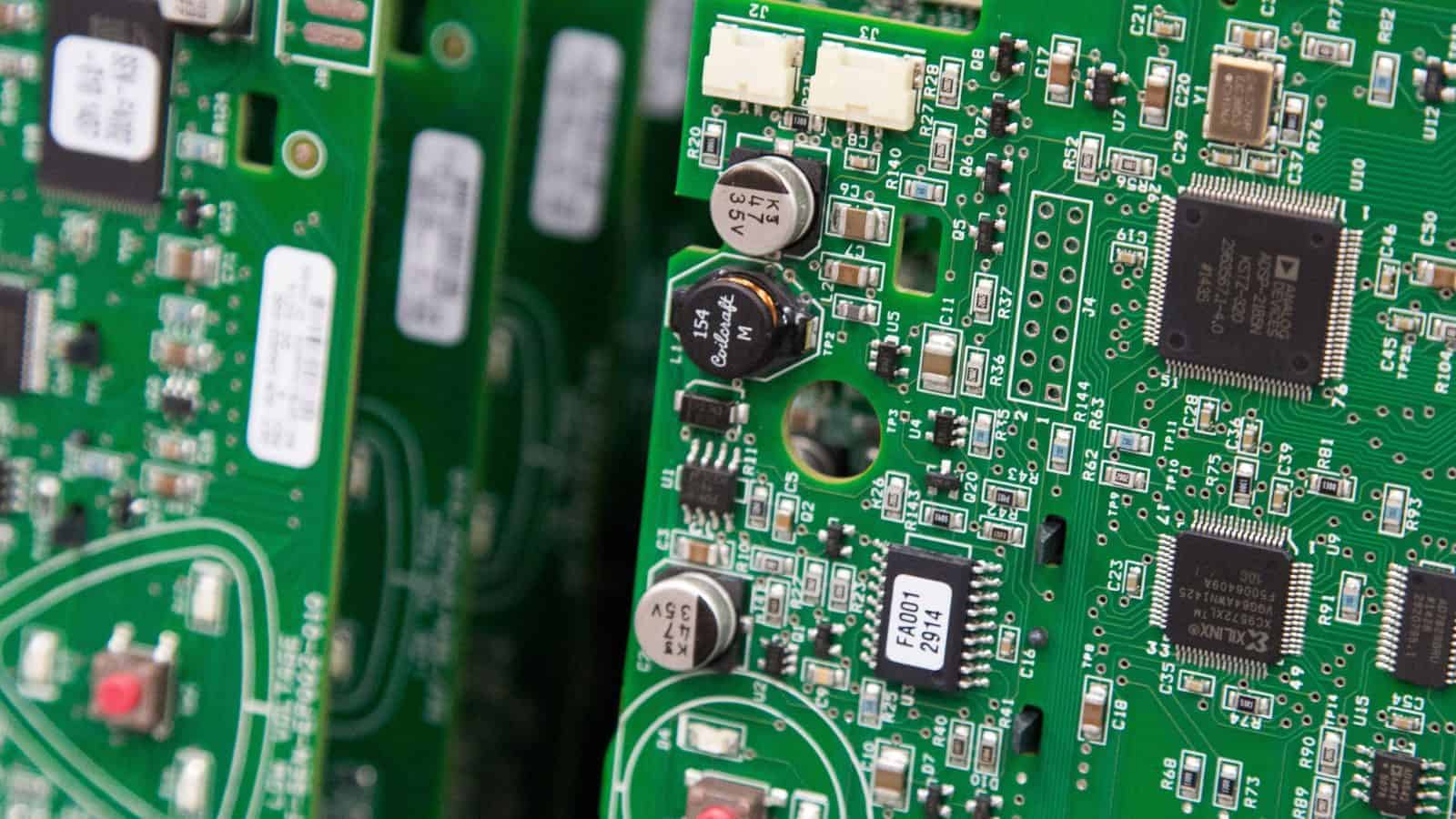

The manufacturer: At Brewer Science—a Missouri-based manufacturer in the semiconductor industry—this issue has become an urgent challenge. The company is a top producer of materials needed to make semiconductor chips.

- In such a fast-moving industry, staying competitive requires nonstop innovation—and that demands constant investment in new products and processes. According to Brewer Science Executive Vice President Dan Brewer, a significant percentage of the company’s revenue goes back into R&D every year.

- “Semiconductors are everywhere, and new generations are constantly being created,” said Mr. Brewer. “The only way to compete abroad in our industry is to out-invent the competition.”

The impact: By making R&D investments more expensive, the tax code hinders manufacturers’ ability to make necessary expenditures not only on innovation, but also on other kinds of growth. Already, the harmful tax change has impacted Brewer Science’s bottom line and put a hitch in its plans for the future.

- Because the new law requires a deduction to be spread out over five years, companies are paying more in taxes than they were a year ago—a result that is causing them to reassess future investments.

- “We have a long list of new hires that we’re trying to bring on board and new projects we’d like to begin, and now we’re looking to make adjustments,” said Mr. Brewer. “Which projects can we put on hold? Which hires can we delay? It’s unfortunate that the same people who want investment in onshoring our industry are penalizing those that are already here.”

The ask: Brewer Science’s request is simple: return the tax treatment of R&D expenses to the way it was so that manufacturers are not penalized for pursuing the R&D that is necessary to spur economic growth and maintain America’s global leadership in innovation. There is still time to undo this for the current 2022 tax year, but time is quickly running out.

- “We’re not asking for a handout,” said Mr. Brewer. “We’re just asking Congress to allow us to immediately deduct these expenses as has been the case for nearly 70 years, since before Brewer Science was even a company.”

The big picture: Mr. Brewer is also quick to point out the widespread impact of this change, especially for smaller companies.

- “There are some companies that can’t make it five years without the ability to immediately deduct their R&D expenses,” he said.

Our move: The NAM has been leading the charge to ensure the tax code continues to support innovation by allowing businesses to fully deduct their R&D expenses in the year in which they are incurred.

The last word: “Our industry moves extremely fast,” said Mr. Brewer. “We must invest aggressively in research and development to stay relevant and stay competitive.”

How Adaptive Skills Can Play a Pivotal Role in Building the Manufacturing Sector of the Future

This new research from MI and EY on adaptive skills in the manufacturing workplace. What are adaptive skills? Simply put, they are skills or traits that enable individuals to transform their abilities as their demands and environment change. There is a need for broader and evolving skillsets in the manufacturing sector and for building a workforce motivated by opportunities for growth. Doing this will help manufacturers transition to workplaces to a point where forward-thinking, engaging, and digitally enabled work is the norm.

Future Skills Needs in Manufacturing: A Deep Dive

The Manufacturing Institute, in partnership with Rockwell Automation and PTC, released a forward-looking study on where the manufacturing sector will be headed over the next 5 to 10 years and how those changes will impact the necessary skills that will be required of employees. More advanced processes and innovations will necessitate enhanced data and technological skills. As a result, manufacturers will need to support or provide new elements of continuous learning for existing employees, and the skill sets of new employees will need to become increasingly more sophisticated. At the same time, soft skills will always be important. This need for advanced skills sets for modern manufacturers comes against a backdrop of a tight labor market, complicating the search and heightening the already fierce competition for talent.

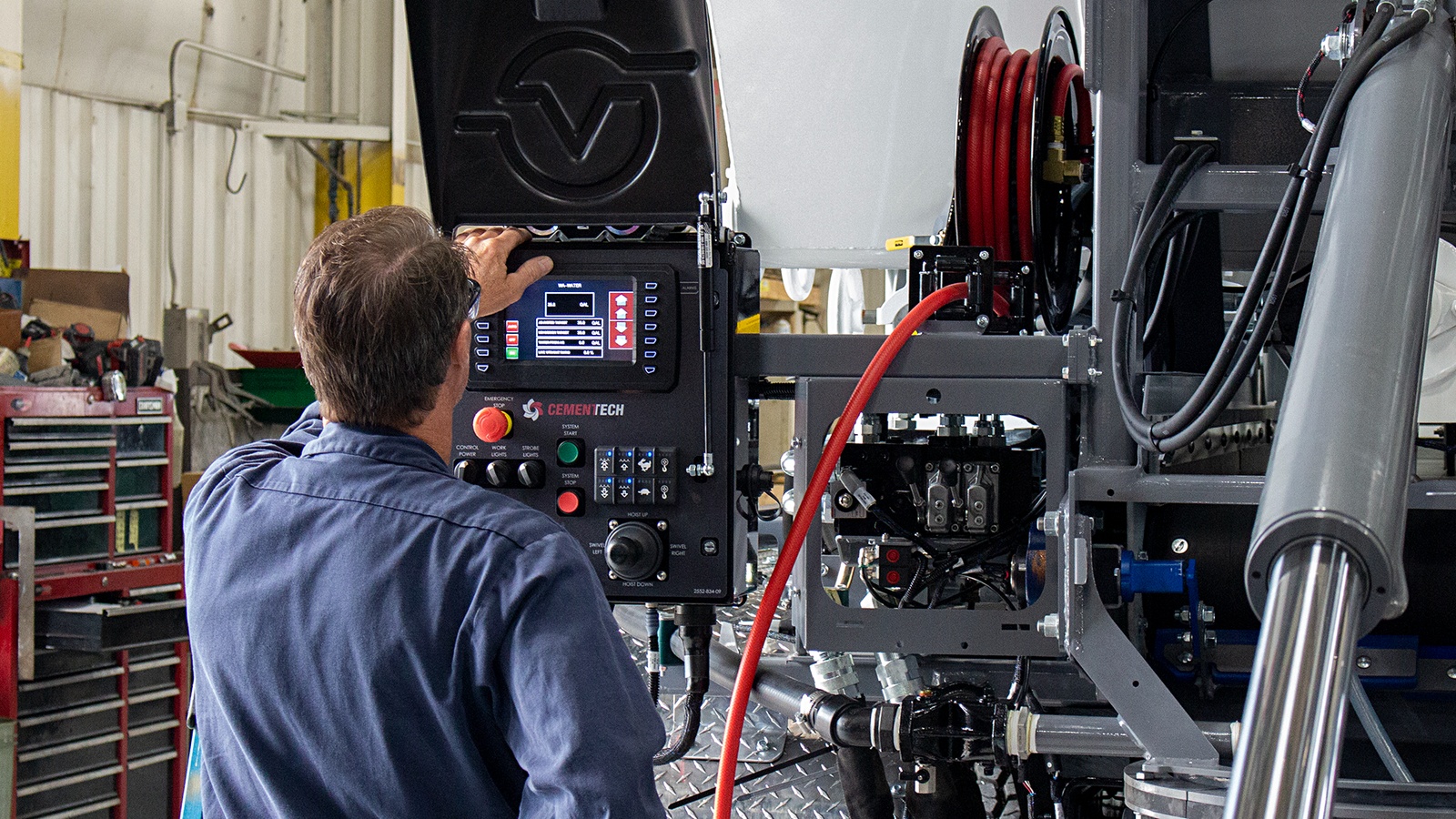

Concrete Mixer Maker Finds a Growth Formula

Even amid so much economic uncertainty, Cemen Tech is on track for a year of unprecedented growth. Leaders of the company, the world’s largest manufacturer of volumetric technology, attribute a good deal of its success to its loyal workforce.

Allegiance creator: Just what contributes to that worker loyalty? The answer may well be Cemen Tech’s unusual generosity.

- “We considered a number of new and different ways to continue to attract and retain good people,” Cemen Tech President and CEO Connor Deering said. “In September 2021, we made the decision to cover 100% of employee health insurance costs, the net effect of which is essentially our folks taking home more of the money they earn. That has really helped with retention.”

- The Indianola, Iowa–based company also raised wages across the board and began offering employees season tickets for local sports teams.

A new approach: Full health insurance coverage made a difference when it came to attracting and keeping workers, but the volumetric concrete mixer manufacturer was still hitting another roadblock when it came to employment: finding people with the right qualifications. So, it set out to solve the problem in house.

- As part of a planned facility expansion, the company is setting aside space for the new “Cemen Tech University,” an innovative answer to the question of how to develop employees with highly desired, specialized skills. Classes are tentatively set to start in January 2023.

- The company is also working with area high schools and technical schools to forge partnerships in which students work for Cemen Tech part time, while still pursuing their diplomas or degrees.

- “This way, we train applicants for immediate success on the job, helping to ensure a strong fit between the employee and the company from the start,” Deering said. “It also gives us an opportunity to teach new hires about our organizational culture. … I believe [our education efforts] will help support an educated team member who’s connected to our culture, resulting in a happier, better and more long-term employee.”

More incentives: Last March, Cemen Tech found a way to boost shift-worker attendance with a points-based rewards system.

- “We implemented an attendance bonus—if an employee stays within a certain number of points [for coming to work], they can earn an additional $90 a week,” said Cemen Tech Director of Human Resources Emily Lyons. “We have seen that help in terms of attracting and retaining employees and further incentivizing employees to achieve consistent attendance.”

- The company has also increased the referral bonus given to existing employees who bring in new hires, Lyons said.

Advice: Manufacturers looking to see similar growth to Cemen Tech, which is set to expand 65% this year, should consider implementing some of the firm’s ideas (if financially feasible). But companies should be prepared to incur some financial cost along the way.

- “Our growth has helped offset the profitability loss [from the increased benefits], but the reality is that our business is people,” Deering said. “If we don’t have people—good people—we’re not going anywhere. So, the fact that we’re little less profitable at the moment is OK, as long as we can continue to grow.”

Manufacturers Call for Repeal of Anti-Competitive R&D Tax Policy

This story can also be found within the NAM’s R&D action center.

In an industry where technology and processes can change quickly, manufacturers in the United States must be able to invest, grow and maintain their edge against foreign competitors. At a time when China is providing extensive support for its manufacturing industry, the NAM is pushing to ensure that the men and women who make things in America have the tools they need to succeed.

The challenge: Right now, China’s tax policies offer significant incentives for research and development. For example, China offers a super deduction for manufacturers performing R&D by allowing them to deduct 200% of their R&D expenses. This policy makes it more attractive for manufacturers in China to invest in innovation—and to out-compete manufacturers in the United States.

The comparison: Meanwhile, U.S. manufacturers, who drive more innovation than any other sector, face a harmful tax change that if not reversed will hurt jobs, innovation and competitiveness.

- Up until January 2022, a business in the United States could deduct 100% of their R&D expenses in the year during which those expenses occurred.

- But a change in the tax code that took effect this year now requires businesses to spread those deductions over a period of years—the so-called amortization requirement—making investment in innovation more expensive to conduct.

Recent action: This week, the NAM rallied the business community to urge Congress to repeal the recent tax change, so that businesses can continue to innovate, bolster the economy and create well-paying jobs.

- “Failing to reverse this change will cost well-paying jobs and reduce future innovation-directed R&D,” according to the NAM’s letter, which was signed by more than 400 companies and business organizations.

- “Requiring the amortization of research expenses will reduce R&D spending and lead to a loss of more than 20,000 R&D jobs in the first five years with the number of lost jobs rising to nearly 60,000 over the following five years. Moreover, when accounting for the spillover effect from R&D spending, nearly three times as many jobs will be affected.”

- “At a time of increasingly fierce global competition for research dollars, this change will make it harder for the next R&D dollar to be spent in the U.S. which will ultimately hurt future U.S. competitiveness.”

What we’re saying: “Research and development is the lifeblood of manufacturing,” said NAM Senior Director of Tax Policy David Eiselsberg. “It is what drives innovation, competitiveness, economic growth and the creation of high-paying jobs. But that is all at risk unless Congress quickly acts to repeal the harmful change in the tax treatment of R&D expenses.”

Finer point: “If Congress and the administration do nothing, small manufacturers will face a huge tax increase at the end of the year,” NAM Executive Vice President Erin Streeter warned. “This will have a crippling effect—and we’re mobilizing support at the NAM across the industry to get another hard-fought priority done.”

New NAM Board Members to Bolster Manufacturing Competitiveness

The NAM is constantly working to support and strengthen the men and women who make things in America. That mission is upheld by outstanding members of the NAM Board of Directors and their commitment to promoting the industry’s competitiveness on the global stage—a goal laid out in the NAM’s “Competing to Win” agenda.

Welcoming new faces: A number of new members have been elected to the board and will begin their two-year terms in January. They come from many sectors of the industry and companies both large and small, holding an array of leadership roles and boasting a wide range of experience. All of them are dedicated to ensuring that manufacturers in the U.S. have the tools they need to prosper.

The new members include the following:

- Edward Blair, president, Lutron Electronics Co., Inc.

- Sara Beth Burton, senior vice president, global supply chain, Hallmark Cards, Inc.

- Richard Cammarano, president and chief executive officer, Tech-Etch, Incorporated

- Karl Ehemann, vice president, global manufacturing and quality, Corning Incorporated

- Ed Elkins, executive vice president and chief marketing officer, Norfolk Southern Corporation

- Cynthia Farrer, senior vice president, global operations and integrated supply chain, Allegion plc

- Aimee Gregg, vice president and general manager, containerboard and recycling, International Paper

- John Hartner, founder, Digital Industrialist LLC

- Christopher Kastner, president and chief executive officer, Huntington Ingalls Industries

- Ram Krishnan, executive vice president and chief operating officer, Emerson

- Reece Kurtenbach, chief executive officer and president, Daktronics, Inc.

- Rose Lee, president and chief executive officer, Cornerstone Building Brands

- Thomas Long, co-chief executive officer, Energy Transfer LP

- Michael McGarry, chairman and chief executive officer, PPG

- Lori Miles-Olund, president, Miles Fiberglass & Composites, Inc.

- Christopher Perkins, president North America and senior vice president Taste & Beyond North America, Firmenich, Inc.

- Kimberly Ryan, president and chief executive officer, Hillenbrand, Inc.

- Karin Shanahan, executive vice president, global product development and supply, Bristol-Myers Squibb Company

- Matt Shields, senior vice president, global animal health manufacturing, Merck & Co., Inc.

- Sachin Shivaram, chief executive officer, Wisconsin Aluminum Foundry

- Shruti Singhal, chief executive officer, Chroma Color Corporation

- Mark Smucker, president and chief executive officer, The J.M. Smucker Company

- Matt Wood, national industry leader, commercial products practice, FORVIS

- Brent Yeagy, president and chief executive officer, Wabash

- Renée Zemljak, executive vice president, midstream, marketing & fundamentals, Ovintiv USA Inc.

What we’re saying: “The diverse backgrounds of our new board members, and their varied experience across many manufacturing sectors, make their counsel invaluable to the NAM in its efforts to bolster the industry’s competitiveness,” said NAM Chief of Staff Alyssa Shooshan. “We are counting on their insights and dedication to help steer manufacturers through this turbulent time and into a position of even greater strength.”

NAM Competes to Win on Taxes

The NAM is leading the way forward on a range of policies to help boost innovation, opportunity and competitiveness for manufacturers in the United States—and that includes tax policies that ensure manufacturers can continue to compete and win.

The record: During tax reform, the NAM achieved its key priorities—a lower corporate income tax rate, a reduced tax burden on pass-through business income, the adoption of a modern territorial tax system, the retention of the R&D tax credit and the adoption of incentives for capital equipment purchases.

- Thanks to a more competitive tax code, manufacturers across America have been investing in jobs, facilities and their communities.

The road ahead: Of course, the NAM isn’t taking its eye off the ball. We are committed to protecting our gains and furthering progress—and that means ensuring the tax code continues to incentivize manufacturers’ ability to invest in innovation and growth. We’re focusing on three important tax priorities in the months ahead.

Research and development: On Jan. 1 of this year, a harmful tax change went into effect that makes R&D more expensive in the United States by requiring businesses to deduct their R&D expenses over a period of years.

- The NAM has been leading the charge to ensure the tax code continues to support innovation by allowing businesses to fully deduct their R&D expenses in the year in which they are incurred. Check out these company stories on the importance of tax policies that support R&D.

Interest deductibility: When manufacturers borrow funds to buy capital equipment, the interest they pay on those loans is tax deductible up to a certain limit. But a recent change in the tax law modified how that limit is calculated—shrinking the deduction, making debt financing more expensive and leaving less capital for job creation and investment.

- The U.S. is the only OECD country with such a strict interest limitation, so the NAM is working with members of both parties in Congress to reverse the new limit calculation and enhance manufacturers’ ability to compete. Read more about the NAM’s work on this provision here.

Full expensing: Under present law, manufacturers can deduct 100% of their investments in assets with long useful lives, supporting their ability to acquire vital equipment and strengthening their competitiveness. However, the ability to deduct 100% of these costs begins to phase down at the beginning of 2023 and is set to completely expire in 2027.

- The NAM is leading the business community in advocating for full expensing permanency, joining with members of Congress to support legislation that would create certainty for manufacturers. See how full expensing has benefited small manufacturers in the United States here.

The last word: “The NAM is fighting to protect manufacturers across the country,” said NAM Senior Director of Tax Policy David Eiselsberg. “Protecting R&D, interest deductibility and full expensing will provide the tax certainty necessary for manufacturers to continue to invest in jobs and growth.”

Learn more: Check out the NAM’s full tax agenda in “Competing to Win.”

How to Get the Most Out of R&D

How should companies design R&D teams and processes to create the best possible results? That’s the challenge that Babson College Professor of Innovation Management Gina O’Connor addressed in her talk at the Innovation Research Interchange’s annual conference back in June. The IRI is a division of the NAM that advances the field of innovation management by creating contemporary practices—in R&D and many other areas.

A common problem: In an extensive research project at Babson College, O’Connor worked with experts from Goodyear, Synthomer and Diageo to study companies and decipher best R&D practices. She noticed a recurring theme: R&D professionals were being used by companies to solve urgent technical issues rather than to discover and invent.

- “In many organizations R&D has this feeling of being an order taker and of having to solve problems that are finely tuned and narrowly scoped,” said O’Connor. “That erodes confidence—and eroded confidence reduces empowerment.”

Empowerment and autonomy: O’Connor described empowerment as the authority to determine which projects and initiatives to take on and what problems to tackle. Meanwhile, autonomy refers to the authority to make final decisions.

- So, what do R&D professionals need? According to O’Connor, most want a moderate amount of empowerment, but not complete control over what to do.

- “We want to make sure that there’s organizational commitment somewhere associated with what we are doing, but we don’t just want to be told what to do,” as she put it.

So, what works? O’Connor explained that organizations with structureless R&D systems often had erratic decision making, sudden disruptions and unexpected changes in direction that left employees feeling powerless.

- Similarly, organizations with R&D processes that were too formal were also alienating to employees, who felt there wasn’t any room for flexibility or discussion.

- In contrast, the best systems included strong project leaders, consistent back and forth between the R&D group and organizational leadership, constructive communication, clearly outlined goals and trust in employees.

A last piece of advice: Training and developing project leaders is among the most essential steps in achieving successful R&D, said O’Connor.

- “What you need to be doing as a team leader every day is checking in with every member of your team, seeing what they need, where they are, what has happened,” said O’Connor. “It has to be an interactive, interpersonal kind of a thing.”

Learn more: Head on over to the IRI website to check out more of its programs and events.

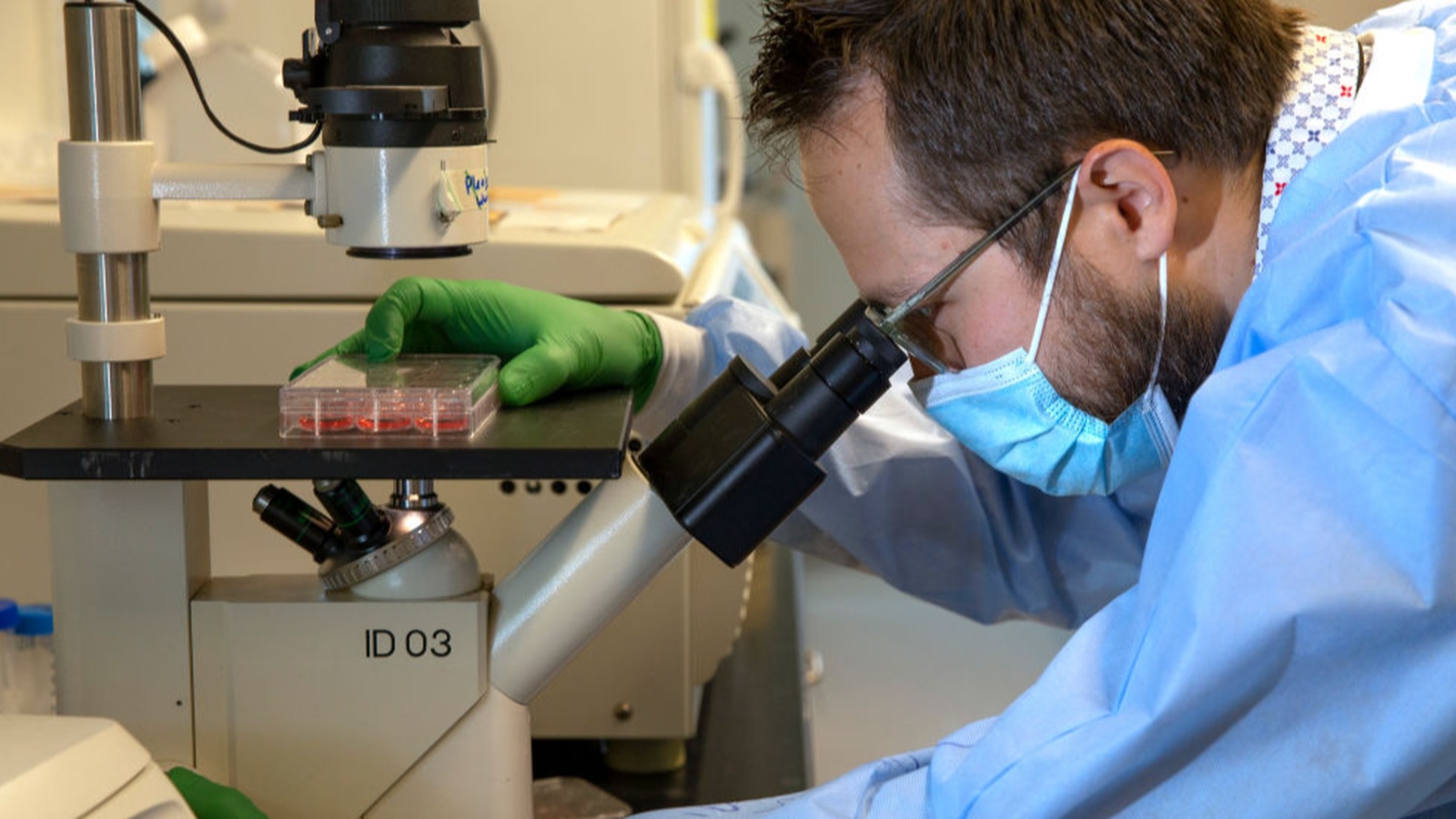

CHIPS and Science Act Becomes Law

![]()

President Biden has signed into law the CHIPS and Science Act of 2022, legislation that promises to bolster manufacturers’ competitiveness, according to the NAM.

Supercharging manufacturing: “The CHIPS and Science Act [is] a once-in-a-generation investment in America itself, a law that people in America can be proud of,” Biden said today. It “supercharges our efforts to make semiconductors here in America. … [We] must lead the world in the production of these chips. This law will do exactly that.”

- NAM President and CEO Jay Timmons was on hand for the signing, along with many other business leaders.

- “Manufacturers thank congressional leaders from both parties who got this bill across the finish line and President Biden and Secretary Raimondo for their leadership,” Timmons said following the signing.

The background: The bipartisan measure, previously called the CHIPS-Plus Act, was passed by the U.S. Senate and House of Representatives in July. It provides more than $52 billion in funding to semiconductor manufacturing and scientific research.

- “Every manufacturer in America will benefit from [this legislation], whether they make chips, make products that require chips or are part of a supply chain disrupted by the semiconductor shortage,” Timmons said.

Other components: In addition to provisions for the domestic manufacturing of semiconductor chips, the CHIPS and Science Act also:

- Supports new research on critical minerals;

- Increases funding for the Department of Energy’s Office of Science, the National Science Foundation and the National Institute of Standards and Technology;

- Sets new policies for sending humans back to the moon and ultimately to Mars; and

- Expands rural STEM education.

Still work to do: Though the legislation will be a boon to manufacturers, it omits solutions to some critical challenges facing the U.S., Timmons said. These include:

- China competition legislation;

- Anti-counterfeiting measures;

- Critical trade provisions; and

- Further investments in supply chain resilience and workforce development.

Why it’s crucial: “Our economic future and America’s leadership in the world depend on a competitive manufacturing industry,” Timmons continued.

- “Congress has acted wisely with the CHIPS and Science Act. Now we need Congress to continue standing with manufacturers and focus on policies that will help us compete with China and other countries, not make it more expensive to make things in America.”

A Summer Reading List for Innovative Manufacturers

Heading to the beach? Take along the Manufacturing Leadership Council’s summer reading list to catch up on today’s top trends in digital manufacturing while you catch some rays. With these articles, you’ll discover new ideas, technologies and best practices to give your company a competitive edge.

Workforce: Leading the Way to Workforce Optimization. As digitization changes employees’ expectations of their employers, manufacturers must adapt. Examples include options for remote work, interactive training, agile and rapid collaboration platforms, career development, work-life balance and more.

Industrial automation: Camozzi’s Autonomous Vision. Successful autonomous manufacturing will depend on the fundamental relationship between humans and machines, says Camozzi Group CEO Lodovico Camozzi, whose company makes industrial machinery. In a recent interview with the MLC, Camozzi shared his view of manufacturing’s autonomous future, including:

- How advanced additive manufacturing approaches promise new production paradigms;

- The importance of collaboration in driving innovation and excellence; and,

- Why the industry must maintain a human focus in today’s digital world.

Cybersecurity: Ransomware Attacks Increasingly Targeting Manufacturers. Think your business is safe from hackers? Think again. Ransomware attacks against manufacturers are on the rise. All businesses should be on guard against cyber extortion, advises Peter Vescuso, vice president of marketing for industrial cybersecurity provider Dragos and a member of the MLC.

Supply chain: How Manufacturers Can Navigate Supply Chain Challenges.

As global supply chain woes, worker shortages and wage inflation challenges intensify, manufacturers everywhere want to know the best way to navigate them. In this article, a panel of industry experts shares top tips to sustainably and profitably overcome current obstacles.

Artificial Intelligence: AI Roadmap: How Manufacturers Can Amplify Intelligence with Artificial Intelligence. Artificial intelligence offers manufacturers a host of benefits, including better visibility into supply chains, insights from predictive analytics and the ability to quickly respond to unexpected changes in demand. A six-step road map can help manufacturers looking to integrate AI into their businesses.

5G: 5G Will Help Unlock M4.0’s Potential. 5G technology offers speed and capacity advantages to manufacturing companies. According to the MLC’s recent Transformative Technologies survey, 26% of manufacturers have already invested in 5G technology. More than half expect to invest or are considering investing in the technology over the next two years to take advantage of 5G’s benefits.

Sustainability: Overcoming Roadblocks to Advance Sustainability Programs.

The manufacturing industry is expected to improve its sustainability and keep leading the fight against climate change. However, making green changes to processes and procedures can be costly. To get the most bang out of their sustainability investments, manufacturers should focus on data-driven initiatives and indicators.

Looking for more digital manufacturing insights? Browse the Manufacturing Leadership Journal for additional information on technology, organizational structure and leadership in manufacturing’s digital era.