President Trump Seeks to Export “American AI Technology Stack”

Alongside the president’s AI Action Plan and subsequent directive encouraging the buildout of AI data centers, President Trump signed another executive order aimed at exporting American AI technology.

- The NAM is seeking manufacturers’ opinions on how this EO should be implemented.

The big picture: The goal of the EO is to “preserve and extend American leadership in AI and decrease international dependence on AI technologies developed by our adversaries by supporting the global deployment of United States–origin AI technologies.”

- It orders the creation of an American AI Exports Program, which allows AI companies to seek federal support in competing for business deals abroad.

- An interagency body called the Economic Diplomacy Action Group, chaired by the Secretary of State, will help facilitate foreign commercial deals, using both diplomacy and financing tools.

Full-stack: Most notably, the EO mandates that any “consortium” seeking federal support must be exporting “full-stack AI technology packages,” not just individual products or services (hence the assumption that many companies will band together to make one proposal).

- “AI-optimized computer hardware (e.g., chips, servers and accelerators), data center storage, cloud services and networking, as well as a description of whether and to what extent such items are manufactured in the United States”

- “Data pipelines and labeling systems”

- “AI models and systems”

- “Measures to ensure the security and cybersecurity of AI models and systems”

- “AI applications for specific use cases (e.g., software engineering, education, health care, agriculture or transportation)”

Preference for U.S. sources: The EO says that proposals whose hardware, storage, cloud and networking components are “manufactured in the United States” will receive preferential treatment, though this is not a hard requirement.

- However, other components of the “stack,” from data pipelines to cybersecurity, don’t carry this proviso.

Feedback wanted: Please contact NAM Senior Director of Technology Policy Franck Journoud ([email protected]) or NAM Manager of International Policy Ellie Leontis ([email protected]) to provide your thoughts on this EO.

Trump Signs EO Accelerating Permitting for AI Data Centers

Following his release of the White House’s AI Action Plan yesterday—which the NAM embraced for reflecting manufacturers’ priorities—President Trump signed executive orders that will help put that plan into action. These include an important EO aimed at accelerating and streamlining the permitting process for data centers, which aligns with many of the NAM’s AI permitting policy recommendations.

The big picture: The EO directs agencies to accelerate permitting and offer financial incentives to “covered components”—key energy products and infrastructure essential to the buildout of data centers.

- These include infrastructure such as transmission lines, natural gas pipelines, substations and much more, along with natural gas turbines, nuclear power equipment and other power-generating systems. Also included are semiconductors and related materials.

Environmental review: Importantly, the EO directs the Council on Environmental Quality to speed up the interagency permitting process via existing categorial exclusions under the National Environmental Policy Act.

- It also requires the CEQ to coordinate the development of new categorical exclusions to that statute.

- In addition, any federal loans or other financial incentives below 50% of a project’s cost won’t qualify as “major Federal action” under NEPA and therefore won’t incur additional review requirements.

More speed: The EO directs the Federal Permitting Improvement Steering Council to work with executive agencies and project sponsors to expedite permitting reviews by listing projects on the FPISC’s Permitting Dashboard.

- A “covered project” designation on the FPISC dashboard helps projects by providing expedited interagency reviews, dispute resolution and timeline accountability.

Mobilizing the EPA: The Environmental Protection Agency will help expedite permitting by developing or modifying regulations under the Clean Air Act; the Clean Water Act; the Comprehensive Environmental Response, Compensation and Liability Act; and the Toxic Substances Control Act.

- The exact details of these regulatory changes are under development. The NAM will continue to engage with policymakers as they develop these procedures.

- Meanwhile, the EPA will also identify appropriate Superfund and Brownfield sites that can be used for projects.

Water and endangered species: The EO also directs several agencies to identify typical construction activities at qualifying projects over the next 10 years that could be eligible for expedited review under Section 7 of the Endangered Species Act.

- Meanwhile, the Army Corps of Engineers will determine whether an activity-specific nationwide permit under Section 404 of the Clean Water Act and Section 10 of the Rivers and Harbors Act should be issued, which would also speed up the permitting process.

Federal lands: Lastly, the EO directs the Departments of Energy, Interior and Defense to make federal lands available for the development of AI data centers and related infrastructure.

A major advance: There remains a great deal of specificity to be filled in by executive agencies for implementation,” said NAM Vice President of Domestic Policy Chris Phalen, “but this EO represents a major advance for American technological and energy dominance.”

The MI’s take on the White House’s AI Action Plan: Upon release of the AI Action Plan, Manufacturing Institute President and Executive Director Carolyn Lee applauded the plan in posts on X and LinkedIn, noting it “ensure[s] the manufacturing workforce has the necessary skills to leverage AI.

- Lee added, “[As] AI becomes a national priority, long-term success in manufacturing hinges on how well we prepare our workers to integrate it. But the success of any AI strategy depends on workforce readiness. Tools and tech can enhance production but only if the workers utilizing them are prepared to adapt, apply and lead with AI.

- “That’s why the Manufacturing Institute is focused on leading efforts to close that skills gap. Transformation of American manufacturing won’t come from technology alone, but from the trained and empowered workers who know how to use it. …”

- “We are glad to see an emphasis on AI skill development in publicly funded programs to support this. Ensuring that AI training programs qualify as eligible educational assistance will amplify the investment manufacturers make to skill their workforce and meet AI-driven career opportunities.”

- “The administration’s responsiveness to the rapid piloting of new approaches to workforce challenges created by AI is necessary and will be welcomed by manufacturers as they navigate AI innovations.”

Included in the mix: The White House featured the NAM’s statement alongside other industry leaders in a write-up touting broad support for the plan.

SkyWater Strengthens U.S. Chip Supply Chains

SkyWater Technology is leading the effort to rebuild domestic semiconductor manufacturing in the United States. As the only U.S. investor-owned and -operated pure-play semiconductor foundry in the U.S., SkyWater plays a critical role in reshoring key parts of the global supply chain and reducing America’s reliance on foreign-made chips.

The approach: SkyWater’s approach goes beyond traditional manufacturing. Its “Technology as a Service” model combines advanced R&D with wafer fabrication, allowing customers to co-develop new technologies using custom manufacturing processes.

- This collaborative model accelerates innovation and enables a flexible, secure production pipeline for customers, so they don’t have to build their own fabrication infrastructure.

The expansion: Today, SkyWater is expanding its U.S. footprint. The company recently finalized its acquisition of Infineon Technologies’ semiconductor fab in Austin, Texas—an investment that will allow SkyWater to scale its operations, support commercial and government partners and create a more complete domestic supply chain from chip design through packaging and testing.

- “The United States has operated in a global supply chain with regional centers of excellence—but now, those regional centers are getting reconfigured,” said SkyWater CEO Thomas Sonderman. “That comes with new opportunities.”

The challenge: Still, semiconductor manufacturing also comes with significant financial challenges. The industry is capital intensive, and investments in new infrastructure or equipment can require years of lead time and billions of dollars.

- That’s why federal support through stable and predictable tax policy is essential to SkyWater’s success—and to America’s semiconductor future, said Sonderman.

The policy: SkyWater welcomed Congress’s recent passage of the reconciliation package that made permanent vital pro-manufacturing tax provisions, including immediate R&D expensing and full capital equipment expensing. The law also increased the advanced manufacturing investment credit, an incentive for semiconductor manufacturing, from 25% to 35%.

- “In our industry, if you don’t stay at the leading edge, somebody will pass you by,” said Sonderman. “The United States is in a vulnerable state now, because we’re telling people we want to make stuff in the U.S., but we don’t have the capabilities to make stuff in the U.S. at scale today.”

- “Having the tax incentives is absolutely critical,” he emphasized. “If they go away, it’ll be much harder to establish manufacturing independence for the United States.”

The competition: The stakes are high. China leads the world in chipmaking investments, according to industry researchers, and the U.S. cannot afford to fall behind. And as Sonderman put it, tax incentives aren’t just about finance—they’re about building national capability and ensuring the next generation of technology is made in America.

- “The money is important,” said Sonderman. “But the money is not as important as the commitment.”

Milo’s Tea: From a Single Menu Item to a Household Name

What started as a menu item at a single burger restaurant has become a summer staple and a household name across the U.S.: Milo’s Tea.

What’s going on: “Today we’re a tea and lemonade company, but it didn’t start that way,” Milo’s Tea Company Chair and CEO Tricia Wallwork, a member of the NAM Board of Directors, told the “Today” show last week. “There actually was a guy named Milo, and he was my granddad.”

- After serving in World War II, Milo Carlton—who had “always had a passion for food” and had been a cook in the army—opened a burger restaurant in Birmingham, Alabama.

- His biggest hit? The eatery’s sweet tea. In 1946, Carlton and his family decided to start the beverage business.

- In 2022, the firm became the top-selling refrigerated tea brand in the U.S. It’s also the fastest-growing refrigerated lemonade brand.

A manufacturing powerhouse: In April, the beverage maker opened its fourth manufacturing site, a 10,000-square-foot brewing and packaging facility in Spartanburg County, South Carolina.

A major success story: Today Milo’s Tea is available for sale in all 50 states at more than 55,000 retail locations—but it remains family-owned. (It’s also a certified women-owned business.)

- When Wallwork took the helm in 2012, “we had [maybe] 40 people,” she said. Now, “we’re going to end this year with over 1,000.”

Making Milo proud: Still, despite its explosive success, the company—which will release a zero-sugar lemonade this year—is faithful to its roots.

- “It was my grandfather’s recipe, and it’s still the same formula we use today,” Wallwork told “Today’s” Kathy Park.

- “I think my grandparents would be so proud of the wonderful jobs we’ve been able to create and the many lives that we’ve been able to touch through our business and through our flavors and our brands.”

Success of Targeted Cancer Therapies Underscores Need for Pro-Innovation R&D Environment

A class of targeted cancer therapies could one day replace traditional chemotherapy as a first-line treatment, shining a spotlight on the need for a regulatory environment that supports continued innovation—and stays away from price controls that reduce R&D budgets.

What’s going on: “Antibody-drug conjugates (ADCs) have taken major strides in recent years, as companies … are developing drugs in the space that could ease the trials of cancer treatment,” according to CNBC.

- ADCs are designed to target cancer cells using chemotherapy without harming surrounding healthy tissue and may have fewer side effects than traditional chemotherapy.

- Though ADCs have been on the market since 2000, biopharmaceutical manufacturers have made significant strides improving them in recent years, and some ADCs have become the preferred treatment for certain cancers.

- Biopharmaceutical firms including AstraZeneca, Pfizer, Lilly and Merck have invested heavily in the development of ADCs.

Who’s doing what: Pfizer’s Enhertu is approved in the U.S. for the treatment of certain lung, gastric and breast cancers. In a trial in which it was used as a first treatment, Enhertu stalled the growth—by more than a year—of a common type of breast cancer.

- Merck’s Keytruda is viewed and used as a first-line treatment for bladder cancer. With Keytruda’s patent expiration nearing, Merck has been co-developing three new ADCs with global health care company Daiichi Sankyo.

- Pharmaceutical company Lilly is developing ADCs that do not use chemotherapy, according to Lilly Oncology President Jake Van Naarden. New kinds of payloads, Van Naarden said, could help cancer “patients who relapse on existing ADCs, shrinking their ‘newly growing cancers’ again in ‘a durable way.’”

- And just this week, drugmaker Roche announced that it has “demonstrated the power of combining two of oncology’s hottest modalities—bispecifics and antibody-drug conjugates (ADCs)—in a Lunsumio-Polivy regimen in large B-cell lymphoma (LBCL),” according to Fierce Pharma.

What it means for innovation: ADCs are just one example of how the biopharmaceutical industry’s leadership is improving and lengthening lives. So it can continue that mission, the U.S. must stay away from drug price fixing, according to the NAM.

- “Manufacturers in America are driving global pharmaceutical innovation, and importing foreign price controls on innovative biopharmaceutical products would undercut innovation in the pharmaceutical industry, threaten patient access and weaken U.S. competitiveness,” NAM Director of Health Care Policy Jess Wysocky said in May.

AI’s Rising Power in Manufacturing Spurs Call for Smarter AI Policy Solutions

New Report from the Manufacturing Leadership Council Shows More Than Half of Manufacturers Expect Investment in AI to Increase in the Next Two Years

Washington, D.C. – The Manufacturing Leadership Council, the digital transformation division of the National Association of Manufacturers, today released a groundbreaking report, “Shaping the AI-Powered Factory of the Future,” that reveals how manufacturers are embracing artificial intelligence on shop floors. The report, a product of the MLC’s “Future of Manufacturing Project,” underscores the need for a policy framework that supports U.S. AI growth, innovation and leadership—one that streamlines compliance, fosters transparency and aligns energy, workforce, privacy and innovation rules with the realities of smart manufacturing.

AI has become essential to modern, competitive manufacturing in America: for example, manufacturers use cutting-edge AI tools like AI-powered cameras to enhance worker safety and eliminate product defaults, AI simulations to design new products and optimize shop floor operations, and AI data analytics to control costs and manage supply chains more efficiently. Manufacturers are also embedding AI in new, intelligent products. The report shows that 51% of manufacturers already use AI in their operations, with 61% expecting investment in AI will increase by 2027. By 2030, 80% say AI will be essential to growing or maintaining their business.

The report also illustrates that manufacturers face ongoing barriers to using and scaling AI—indicating data quality and accessibility as the top challenges, with 65% of respondents reporting they lack the right data for AI applications and 62% citing data that is unstructured or poorly formatted.

“Artificial intelligence isn’t new to manufacturing. For years, manufacturers have been developing and deploying AI-driven technologies—machine vision, digital twins, robotics and more—to make shop floors smarter, supply chains stronger and workplaces safer,” said NAM President and CEO Jay Timmons. “The latest report from the MLC reinforces the need for modernized, agile, pro-manufacturing AI policy solutions, so that manufacturers can continue to innovate on shop floors across America. Manufacturers welcomed President Trump’s early commitment to maintaining and advancing America’s global AI dominance, and we look forward to continuing to champion American AI leadership and manufacturing in America, which starts with adopting a pro-AI regulatory framework and pursuing policies that bolster innovation.”

As manufacturers seek to expand their use of AI and unlock its full potential at scale, the report also highlights areas where manufacturers may face challenges and require additional investment, such as modernizing data architectures, developing a more knowledgeable workforce, building organizational trust and accelerating legacy infrastructure upgrades.

The NAM has proposed a series of policy recommendations for policymakers to drive AI development and adoption in manufacturing:

- Adopt a pro-AI regulatory approach given the growing number and variety of use cases in AI in manufacturing, which require an optimized regulatory environment.

- Develop the manufacturing workforce of the AI age by supporting training programs, career and technical education institutions and STEM education and immigration. According to the MLC’s report, 82% of manufacturers cite a lack of AI-ready skills as the top workforce challenge.

- Advance energy and permitting reform to support AI-related data center growth.

- Protect personal data by passing a comprehensive privacy law that preempts state laws, provides liability protections that prevent frivolous litigation and adopts a risk-based approach that enables innovation and AI.

- Support U.S. manufacturing of AI chips by executing funding agreements with chip manufacturers and renewing the Advanced Manufacturing Investment Credit.

- Incentivize U.S. AI innovation by passing the One Big Beautiful Bill Act that preserves pro-manufacturing tax policies.

“A worldwide competition for AI supremacy is underway, and manufacturers have the opportunity to lead the charge with this game-changing technology,” said MLC Founder, Vice President and Executive Director David R. Brousell. “Fast-moving developments in the technology have turbo-charged interest and adoption of AI in its many forms, intensifying competition. To win, manufacturers in America need a strong ecosystem of partners and support to create new, competitive advantages in all facets of the manufacturing industry, from operations, to supply chains, to the workforce—and in their efforts to innovate for the future.”

Background:

Manufacturers have been at the forefront of developing and implementing cutting-edge AI systems that are transforming shop floors and revolutionizing operations.

In March, the NAM submitted comments to inform the White House’s development of an AI Action Plan, explaining how manufacturers are using AI on the shop floor and in operations, with specific recommendations on rebalancing and right-sizing AI regulations to enhance America’s global AI dominance.

In May 2024, the NAM published “Working Smarter: How Manufacturers Are Using Artificial Intelligence”—a report that explains the ways in which manufacturers are already using AI, making the technology integral to modern manufacturing with manufacturers at the forefront of developing and implementing AI systems.

Most recently, the House-passed reconciliation bill included language to prevent a patchwork of state AI regulations that would impede AI innovation and development, in line with the NAM’s advocacy for workable, flexible national standards.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector rese arch and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Featured Quotes from NAM Board Chair Kathy Wengel and Partners of the MLC’s Future of Manufacturing Project

“AI continues to drive innovation, efficiency and better outcomes for manufacturers across America. From accelerating drug discovery and development to optimizing manufacturing operations, AI enables companies to make smarter, faster and more impactful decisions,” said Kathy Wengel, Executive Vice President and Chief Technical Operations and Risk Officer at Johnson & Johnson and Board Chair at the National Association of Manufacturers (NAM). “Importantly, AI empowers employees at all levels, when we equip them with the knowledge and understanding to help shape the implementation of these new technologies. AI is proving to be an essential partner on the shop floor, and we must continue to ensure manufacturing employees have the skills they need to build the future of our industry.”

“The Manufacturing Leadership Council survey shows that while continuous improvement remains a key performance indicator for AI in manufacturing, more manufacturers are starting to see greater value in automation and prediction moving forward. From identifying improvement opportunities to analyzing how people interact with systems, AI is enhancing workplace safety and amplifying the power of the leaders on the floor to solve problems faster before any potential disruption to operations. With 63% of manufacturers meeting or exceeding their targets with AI, this survey shows that this trend is only expected to grow as companies prepare their factories for the future.” – Tim Buschur, Chief Strategy Officer, Invisible AI

“Smart manufacturing is advancing rapidly as manufacturers invest in AI and emerging technologies to drive efficiency and long-term business value. Rockwell Automation is helping address key challenges, such as workforce gaps and technology readiness, through strategic partnerships that accelerate digital transformation. The broader manufacturing sector can benefit from initiatives like this, which share practical expertise and clear guidance to demystify AI and empower organizations at any stage of digital maturity to adopt advanced technologies with confidence.” – Austin Locke, Global Lead of Data Science and AI at Kalypso, a Rockwell Automation business

“AI is rapidly becoming central to manufacturing operations, yet nearly a third of survey respondents are unsure who oversees AI governance at their company. To fully realize AI’s potential, organizations can build a stronger foundation by implementing robust governance strategies that go beyond the technology itself—fostering cross-functional collaboration among leadership and frontline teams to ensure that data, systems, and people are equipped to use AI effectively in real-world settings.” – Kris Slozak, Director of Consumer and Industrial Products, West Monroe

“Business leaders are already seeing immediate benefits with the use of AI; however, manufacturers still face challenges around inaccessible data, limited employee skillset to leverage AI effectively, and outdated systems and operations. Companies that invest early in strong data governance, smart integration, and cross-functional collaboration will be better positioned to compete and grow.” – Prasoon Saxena, Global Co-Lead Products Industries, NTT DATA

“AI is already driving measurable value for manufacturers by enhancing decision-making and transforming critical supply chain operations. To fully unlock its potential at scale, investing in modern data infrastructure, enhancing workforce knowledge and skills, and adopting new processes to embrace new ways of working will be essential to help manufacturers remain competitive now and in the future.” – Richard Weng, Managing Director, Accenture

Komatsu Expands and Innovates in the U.S.

Komatsu is a household name in Japan, but it’s making big moves in the U.S., too.

An all-of-the-above strategy: The commercial equipment maker, whose product catalogue runs the gamut from bulldozers and log loaders to autonomous haulage systems for mines, has launched multiple new innovations in recent months.

- In March, it introduced two new wheel loader models with improved fuel efficiency, more engine power and faster speeds.

- Last fall, Komatsu announced the launch of its first commercialized truck in its Power Agnostic series, vehicles capable of running on multiple fuel types, including diesel, hydrogen fuel cells and batteries.

Expansions underway: The global manufacturing giant is also expanding. In late 2024, it announced the construction of new facilities in Mesa, Arizona, and Peoria, Illinois.

- The Mesa project, slated for completion in 2026, will triple the square footage of the company’s current operational footprint in the area. The new sales and service facility will support the company’s mining customers throughout the Southwestern U.S.

- The Peoria expansion, which will replace an existing structure built in the 1970s, “will provide a collaborative space for engineering, sales, manufacturing, management and other functions,” according to the company. It will incorporate solar panels, stormwater reclamation systems and other sustainable technologies.

- A Komatsu 980E-5SE mining truck—winner of the Makers Madness contest’s “2024 Coolest Thing Made in Illinois” award from NAM state partner the Illinois Manufacturers’ Association—will be installed permanently outside the new Peoria building, which is scheduled to be finished by the end of 2025. The truck is manufactured at the site.

All in on mining: It’s fair to say Komatsu has a special focus on mining. In September, following its acquisition of German mining equipment manufacturer GHH Group GmbH, it showcased an expanded lineup of underground mining machinery at the MINExpo tradeshow in Las Vegas.

- It also recently unveiled its Modular ecosystem, an “interoperable mine management platform” to give mining customers access to all connected operational data in one place.

In the works: At the 2025 Consumer Electronics Show in Las Vegas in January, Komatsu exhibited some exciting in-development projects, including the prototype of an electric underwater bulldozer and artwork for planned construction machinery capable of working on the moon.

- The bulldozer—currently a concept vehicle with no planned introduction data as of yet—is a driverless, remote-controlled, electric-powered vehicle. This will be the second iteration of an underwater, battery-operated bulldozer from Komatsu; the first, the D155W, rolled off conveyor belts in Japan in the 1970s.

- “We’ve found that a lot of those machines built a long time ago are still in use,” said Komatsu Chief Digital Officer Michael Gidaspow. “People need this product, so they are keeping them running. Japan has a lot of coastline and coastal infrastructure to maintain, so this kind of dozer is so important there.” The planned update utilizes the latest technology, including automated blade control and teleoperation. It is powered by batteries, whereas the original had a diesel engine, Gidaspow added.

- Komatsu’s lunar construction machinery work is part of the Artemis Program aimed at getting humans back on the moon. “Life on the moon will demand roads, housing and other infrastructure, and lunar construction machines will be indispensable for building all this,” according to the company. “Once we only dreamed of humans living on the moon. Today we are making it a growing possibility.”

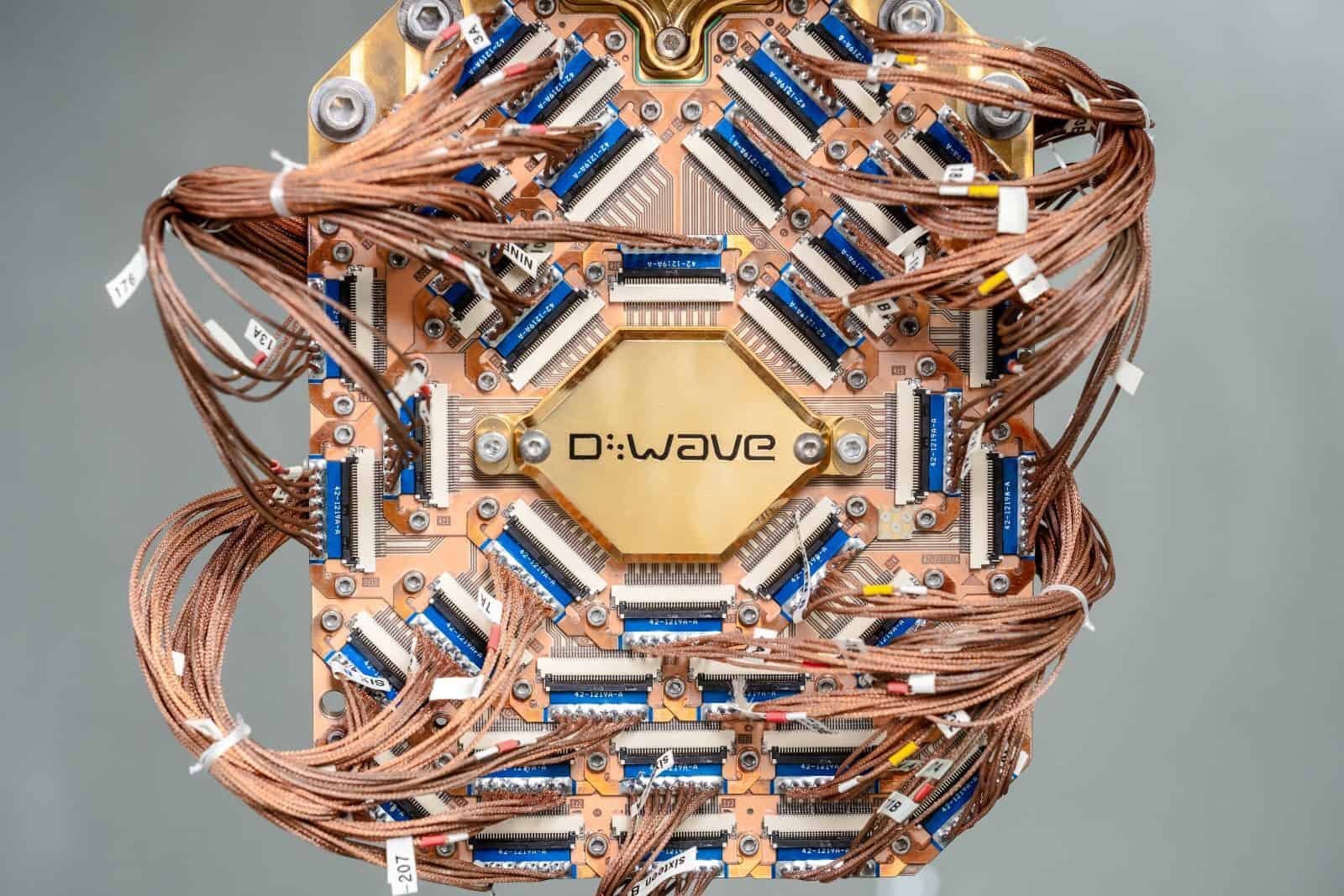

D-Wave Achieves “Quantum Supremacy”

Quantum computing firm D-Wave has achieved a singular breakthrough: it has simulated the “properties of magnetic materials,” opening up the opportunity to “invent” new materials without having to produce them physically in a lab, as D-Wave CEO Alan Baratz told Fast Company.

What it means: The achievement, first published in Science earlier this month, marks the first time a quantum computer has solved a useful, real-world problem that a classical computer couldn’t manage.

- In fact, “To simulate the property of magnetic materials on a classical computer—as the D-Wave team recently did using its quantum computer—would require nearly 1 million years and more energy than the entire world utilizes over the course of a year. D-Wave’s team did it in 20 minutes,” according to Fast Company.

Quantum vs. classical: “Rather than store information using bits represented by 0s or 1s as conventional digital computers do, quantum computers use quantum bits, or qubits, to encode information as 0s, 1s or both at the same time,” D-Wave explains on its site.

- “This superposition of states—along with the other quantum mechanical phenomena of entanglement and tunneling—enables quantum computers to manipulate enormous combinations of states at once.”

- D-Wave’s annealing quantum computer uses these capabilities to solve problems by finding the “lowest energy state” in an enormous range of possible solutions.

- “To imagine this, think of a traveler looking for the best solution by finding the lowest valley in the energy landscape that represents the problem,” as D-Wave puts it.

The possibilities are vast: Being able to simulate materials without creating and testing them in the lab offers significant opportunities for the manufacturing industry and could save companies huge amounts of time and resources. D-Wave foresees that these simulated materials could have applications in everything from “pacemakers to cellphones,” as it told Fast Company.

- “There’s no shortage of potential applications,” said D-Wave Chief Scientist Mohammad Amin.

Further innovation: Another impact of quantum computing is its potential to revolutionize blockchain technology, D-Wave told us.

- “Manufacturers are increasingly adopting blockchain technology to enhance supply chain transparency, track product origins, improve inventory management, and streamline operations. This adoption has led to increased efficiency and reduced costs,” said D-Wave Global Government Relations and Public Affairs Leader Allison Schwartz.

- “Annealing quantum computing offers a potential solution by providing a faster and more environmentally friendly alternative to manufacturers’ current mining operations using classical computers.”

Schneider Electric to Invest More Than $700 Million in U.S.

Global energy management and digital transformation giant Schneider Electric will invest more than $700 million in U.S. operations over the next two years, the company announced yesterday (The Dallas Morning News, subscription).

What’s going on: “Schneider said it intends to leverage the investment to ‘support the country’s focus on bolstering the nation’s energy infrastructure to power AI growth, boost domestic manufacturing and strengthen energy security.’”

- The investment—the largest planned single capital expenditure in Schneider Electric’s 135-plus-year history—will be used to expand manufacturing facilities across the U.S. and to boost “smart factory transformation” across Texas, Massachusetts, Missouri and Tennessee, among other states.

- The company is the latest in a string of large manufacturers to announce sizeable domestic investments. Last week, biopharmaceutical firm Johnson & Johnson said it would spend more than $55 billion in the U.S. over the next four years.

- The announcement comes less than a year after the opening of Schneider Electric’s 105,000-square-foot facility in Red Oak, Texas, to support the data center boom in the Dallas–Fort Worth area.

Where else funds will go: The money will also be used to expand a campus in El Paso, Texas, “to keep up with growing demand to increase production of switchgear and power distribution products,” and to open a Houston innovation center that will offer AI-powered automation solutions.

Our take: “Schneider Electric’s significant investment is a clear sign that manufacturing in America is moving forward—driving economic growth, innovation and job creation across the country,” NAM President and CEO Jay Timmons said in a statement quoted in the article.

- “By expanding their operations with a focus on energy security, automation and AI, Schneider Electric is not only strengthening America’s competitiveness but also creating new opportunities and powering our nation’s future.”

Manufacturing Wins: J&J Invests More Than $55 Billion

Johnson & Johnson will spend more than $55 billion on manufacturing, research and technology in the U.S. over the next four years, the biopharmaceutical company announced (Axios). These investments include a long-planned $2 billion state-of-the-art biologics facility in Wilson, North Carolina.

What’s going on: The NAM joined J&J for the groundbreaking of the 500,000-square-foot biologics manufacturing plant in Wilson on Friday.

- The White House praised the announcement and J&J’s commitment to manufacturing in America. North Carolina Gov. Josh Stein and Rep. Don Davis (D-NC) also attended the ceremony to highlight the facility’s importance to the state economy and the jobs it will bring to the state.

Other projects across the total investment will include:

- Three new advanced manufacturing sites and the expansion of several facilities in J&J’s Innovative Medicine and MedTech businesses;

- Significant spending on research-and-development infrastructure “aimed at developing lifesaving and life-changing treatments in areas such as oncology, neuroscience, immunology, cardiovascular disease and robotic surgery,” according to the company; and

- More investment aimed at speeding drug discovery and development, supporting workforce training and improving business operations.

Common goal: The Wilson site demonstrates the power of collaboration, Johnson & Johnson Executive Vice President and Chief Technical Operations & Risk Officer and NAM Board Chair Kathy Wengel said at the groundbreaking.

- “Today is a tangible example of how J&J is bringing communities, government, education and industry together to achieve the common goal of creating a future-ready workforce that is ready to tackle the toughest health challenges and achieve new breakthroughs.”

Why it’s important: The investments will strengthen not only North Carolina’s economy, but the U.S. economy as a whole, NAM President and CEO Jay Timmons said at the event.

- “Every $1 invested in manufacturing adds more than $2.60 to the economy. That’s top-of-the-line ROI for communities, neighborhoods and cities like Wilson—among the best ROIs you can get. And every new manufacturing job supports, on average, five additional jobs in other industries.”

The big picture: The new Wilson facility will generate a $3 billion impact across North Carolina in its first decade of operation.

- It will support about 5,000 jobs during construction and create more than 500 permanent positions—paying an average of $109,000 a year—in the state (WRAL News).

Certainty and predictability: These investments illustrate why policymakers must ensure that manufacturers have more certainty and predictability, not less, Timmons added.

- “Manufacturing—especially biopharmaceutical manufacturing—requires years of planning, ingenuity and investment decisions,” he said. “When there’s stability, common sense and competitive policies, companies like Johnson & Johnson can plan for the future—and plan big.”

- Timmons said that to “make more wins like this happen,” elected officials must stay focused on a comprehensive manufacturing strategy, including a “competitive tax policy, balanced regulations, prompt permitting, abundant energy and smart trade policies.”

The tax factor: J&J credits the 2017 Tax Cuts and Jobs Act with allowing it to increase its investment, according to MassDevice.

- Investments like J&J’s “are why it is critical that pro-growth provisions of the 2017 tax law be made permanent and more competitive,” Timmons wrote in a social post. “If Congress fails to act, 6 million American jobs—184,000 in North Carolina—will be wiped out. We can’t let that happen.”

- But if Congress does preserve the measures, manufacturing will win, Timmons said. “And when manufacturing wins, America wins.”