House Passes Emissions-Rules Measure

In a victory for manufacturers, the House yesterday passed an NAM-backed bill that would prohibit states from banning the sale of new gas-powered vehicles, the Washington Examiner reports.

What’s going on: “Lawmakers voted 222–190 to pass the Preserving Choice in Vehicle Purchases Act, which would amend federal law to block state attempts to eliminate the sale of vehicles with internal combustion engines as well as prohibit the Environmental Protection Agency from issuing waivers that ban such sales.”

The background: In recent months, the EPA, National Highway Traffic Safety Administration and state of California have all proposed measures to limit emissions from light- and medium-duty vehicles.

Why it’s important: The range of frequently conflicting regulations is creating confusion and regulatory uncertainty for manufacturers.

- The Preserving Choice in Vehicle Purchases Act would eliminate that confusion by “harmoniz[ing] vehicle emissions standards,” NAM Managing Vice President of Policy Chris Netram told lawmakers. “When manufacturers have regulatory clarity, we can focus on what we do best—innovating, creating jobs and investing in America.”

What’s next: The measure now moves to the Senate.

Judge Rules DACA Illegal

A federal policy that prevents the deportation of thousands of immigrants brought to the U.S. as children was deemed illegal for a second time on Wednesday by a federal judge, according to Reuters (subscription).

What’s going on: “The decision by Texas-based U.S. District Court Judge Andrew Hanen deals a fresh setback to the program, called Deferred Action for Childhood Arrivals (DACA), and its 579,000 enrollees and other immigrants who might have hoped to be approved.”

- In 2021, Hanen found the policy unlawful, and in his decision this week found that a 2022 regulation issued by the Biden administration had not fixed the “legal deficiencies” he’d found the year before.

What it means: The Department of Homeland Security will be able to renew the immigration status of those enrolled in DACA before Hanen’s 2021 ruling, according to Reuters.

- This week’s ruling—a response to a suit brought by Texas and eight other states that say the policy breaches federal regulatory law—doesn’t require U.S. immigration officials “to take any immigration, deportation or criminal action against any DACA recipient, applicant or any other individual that would otherwise not be taken,” Hanen wrote.

The administration responds: The White House responded that in keeping with the order, it would continue to process renewals for current DACA enrollees.

- Department of Homeland Security Secretary Alejandro Mayorkas said in a separate statement that the ruling “undermine[s] the security and stability of more than half a million Dreamers who have contributed to our communities.”

Why it’s important: Ending the DACA program—particularly at a time when there is an acute worker shortage—does a tremendous disservice to U.S. manufacturing competitiveness, according to the NAM, which has long advocated fixing the broken American immigration system.

- This week’s ruling “only underscores the need to protect those who have never known a home other than the U.S.,” the NAM said Wednesday. “Manufacturers urge Congress to reform our immigration system, using the principles laid out in … ‘A Way Forward,’” the NAM’s immigration-policy blueprint.

New Study: U.S. Health Care Supply Chain Resilience Demands Balanced Regulatory Environment

Washington, D.C. – The National Association of Manufacturers released a new study outlining steps to improve health care supply chain resilience to allow manufacturers in the United States to better prepare for and adapt to the next disruption. The study analyzes lessons learned from the COVID-19 pandemic, during which manufacturers across the United States produced critical health care supplies in a highly unpredictable environment that affected every industry level.

“During the COVID-19 pandemic, manufacturers in the United States helped lead our response and recovery and learned many lessons in the process,” said NAM Chief Economist Chad Moutray. “Policymakers should utilize these lessons to bolster our supply chain for the next disruption. This analysis, which was conducted by the Manufacturing Policy Initiative at Indiana University, reveals that there are key policy actions needed to strengthen the manufacturing supply chain. Research shows a more balanced regulatory agenda, with an emphasis on clarity, predictability and coordination, will help mitigate the effects of the next disruption.”

Key Themes

Seven key lessons from the pandemic can be examined for future efforts to build resilience:

- Speed matters: Manufacturers need to be able to serve demand quickly.

- Information matters: Manufacturers need timely access to accurate information.

- Costs matter: Firms face the costs of taking action within the supply chain, as well as the costs of managing market unpredictability and policy environment uncertainty.

- Networks matter: Partnerships can support information sharing and networks to help manufacturers navigate the disruption.

- Size matters: Small and medium-sized manufacturers and new firms can be differently—and uniquely—challenged compared with established larger manufacturers.

- Technology matters: Technology can enable manufacturers to enhance production, innovate or improve efficiency, as well as support broader efforts to build partnerships.

- Flexibility matters: Responses can come from unexpected sources and need a flexible policy environment.

Areas of Opportunity

The report identifies four key areas of opportunity to enhance health care supply chain resilience:

- Fostering a conducive regulatory environment: Manufacturers and their partners need clear and streamlined regulations as well as a flexible regulatory framework in advance of the next disruption.

- Supporting partnerships for stronger information sharing and networks: Sustained information channels between manufacturers and policymakers will improve access to information for all parties and mitigate disruptions.

- Ensuring a healthier “baseline” industry: Small business plays a pivotal role in the U.S. Robust entrepreneurship and scaling of new manufacturers contribute to a more competitive industry.

- Prioritizing changing workforce needs: Workforce development must be prioritized so that manufacturers can pivot across product lines and sectors to meet the needs of the next disruption.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM, KAM Bring Suit Against SEC

The NAM and the Kentucky Association of Manufacturers are hitting back against an attempt by the Securities and Exchange Commission to force privately held businesses to make public financial disclosures.

What’s going on: On Tuesday, the NAM and KAM filed suit in federal court challenging the SEC’s novel reinterpretation of its Rule 15c2-11.

- The reinterpretation—on which the SEC has not granted companies the opportunity to comment—would require private firms to release confidential financial information publicly.

The background: Rule 15c2-11 requires disclosures to protect investors in publicly traded companies issuing so-called “penny stocks.” But the SEC has broadened the rule’s application to include privately held companies that issue corporate bonds to large institutional investors under an entirely different regulation, called Rule 144A.

- Everyday investors can’t purchase corporate bonds issued under Rule 144A, so there is no reason to require public disclosures from these businesses.

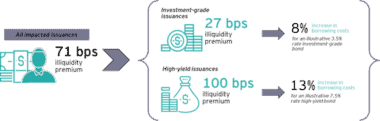

Why it’s important: Expanding Rule 15c2-11 will mean higher borrowing costs and reduced liquidity in both the manufacturing industry and throughout the larger economy, according to a new EY report released by the NAM.

- The reinterpretation would lead to job losses of more than 100,000 every year, according to the analysis.

Manufacturers speak out: “The SEC never allowed public comment on its novel reinterpretation of Rule 15c2-11, there is no conceivable benefit to the new standard and the SEC did not consider the impact that its about-face will have on privately held businesses,” said NAM Chief Legal Officer Linda Kelly. “The NAM Legal Center is filing suit to hold the SEC accountable and protect manufacturing growth, job creation and U.S. competitiveness.”

- KAM President and CEO Frank Jemley added: “The SEC’s unlawful overreach threatens privately held manufacturers in Kentucky and across the country, so the Kentucky Association of Manufacturers is proud to join the NAM in this important litigation.”

Manufacturers Sue SEC to Protect Private Businesses, Release Data on Harmful Impact of Novel Rule Interpretation

Washington, D.C. – The National Association of Manufacturers and the Kentucky Association of Manufacturers filed a lawsuit in federal court today challenging the Securities and Exchange Commission’s attempt to impose unwarranted public disclosure requirements on privately held businesses.

The SEC has adopted a novel reinterpretation of SEC Rule 15c2-11, imposing the rule’s public disclosure requirements on private companies that raise capital via corporate bond issuances under SEC Rule 144A—without giving manufacturers the opportunity to provide comment on the damaging impacts of such a consequential change.

According to EY economic analysis released by the NAM today, the SEC’s expansion of Rule 15c2-11 will result in decreased liquidity and increased borrowing costs in the manufacturing industry and throughout the economy—leading to job losses exceeding 100,000 annually.

“The SEC’s attempt to force private companies to disclose confidential financial information publicly is a clear violation of the Administrative Procedure Act,” said NAM Chief Legal Officer Linda Kelly. “The SEC never allowed public comment on its novel reinterpretation of Rule 15c2-11, there is no conceivable benefit to the new standard, and the SEC did not consider the impact that its about-face will have on privately held businesses—which could exceed 100,000 lost jobs each year. The NAM Legal Center is filing suit to hold the SEC accountable and protect manufacturing growth, job creation and U.S. competitiveness.”

“The SEC’s unlawful overreach threatens privately held manufacturers in Kentucky and across the country, so the Kentucky Association of Manufacturers is proud to join the NAM in this important litigation on behalf of all manufacturers in the U.S. to counter the SEC’s regulatory onslaught,” said KAM President and CEO Frank Jemley.

EY analysis highlights the damaging economic impacts of the SEC’s actions:

The economic impacts of the SEC’s expansion of Rule 15c2-11 will be felt disproportionately in the manufacturing industry, which accounts for more than half of all nonfinancial issuers of corporate bonds under Rule 144A. Across the economy, the change will result in 30,000 jobs lost each year over the first five years the new interpretation is in effect. The job losses will increase over time—rising to 50,000 jobs lost each year after five years and 100,000 jobs lost each year after 10 years.

These job losses are attributable directly to the decreased liquidity and increased borrowing costs associated with the SEC’s new interpretation.

Background:

- SEC Rule 15c2-11 requires broker-dealers to ensure that key information about companies issuing over-the-counter equity securities is current and publicly available prior to quoting those issuers’ securities.

- SEC Rule 144A allows for resales of securities (primarily corporate debt issuances) to qualified institutional buyers—large financial institutions that own or manage more than $100 million in securities. Retail investors cannot purchase Rule 144A securities. Notably, under Rule 144A, issuers are obligated to make their financial and operational information available to QIBs.

- In September 2021, the SEC’s Division of Trading and Markets issued a no-action letter applying Rule 15c2-11 to Rule 144A debt. This decision contradicted the historical application of Rule 15c2-11 to OTC equity securities and bypassed important rulemaking safeguards required by the Administrative Procedure Act.

- The NAM and the KAM filed petitions for rulemaking with the SEC in November 2022 seeking both permanent and temporary relief from the application of Rule 15c2-11 to Rule 144A securities. Following the petitions, the SEC temporarily delayed enforcement of its novel reinterpretation until January 2025, but the agency has not acted to reverse this damaging decision permanently.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

ANWR Lease Holder Will Fight Cancelation

The owner of seven oil-and-gas leases that were recently canceled by the Biden administration is readying for a legal fight, according to POLITICO’s ENERGYWIRE (subscription).

What’s going on: The Alaska Industrial Development and Export Authority—which bought the leases from the federal government in 2021—“has vowed to pursue legal action against the federal government for the cancellation of the leases spanning 365,000 acres in the coastal plain of the Arctic National Wildlife Refuge.”

- Last week, the Interior Department announced that it would nullify the leases “based on what the administration called an inadequate National Environmental Policy Act review process.”

- “A willingness to circumvent laws passed by Congress has consequences reaching far beyond ANWR’s boundaries, and will impact future development across this country,” the economic development organization responded in a statement.

Required by law: While canceling the leases appears to fall under Interior’s purview, the agency is obligated by the 2017 tax law to offer two lease sales in ANWR, according to former Interior Secretary David Bernhardt, ENERGYWIRE reports.

Why it’s important: ANWR is estimated to hold more than 10 billion barrels of technically recoverable oil. Drilling for it would create more than 100,000 jobs while generating hundreds of billions of dollars in new government revenue, according to data from the House Committee on Natural Resources cited in USA Today.

Our take: “The administration should be taking actions that strengthen energy security, not weaken it,” said NAM Vice President of Domestic Economic Policy Brandon Farris.

- “The cancellation of the ANWR leases based on the NEPA review process underscores our need to continue to reform our broken permitting system. The NAM continues to push Congress and the administration to develop policies that cut through red tape to develop all energy projects, including renewables, nuclear, oil and gas, hydrogen and more.”

NLRB Revives Troubling “Card Check” Process

Bringing back parts of a policy it dropped more than half a century ago, the National Labor Relations Board moved late last week to reinstate an abridged version of “card check,” according to Reuters (subscription).

What’s going on: In a “3-1 decision in a case involving building materials company Cemex Construction Materials,” the NLRB unveiled a new framework last Friday that revives the 1949 Joy Silk doctrine, which holds that “employers must bargain with unions unless they have a good-faith doubt that majority support exists.”

The background: The board had tossed out the doctrine in the early 1970s after the Supreme Court’s decision in NLRB v. Gissel Packing Co., in which the court held that “the NLRB could force employers to bargain with unions when they engage in misconduct so severe that any election would be tainted.”

- This new decision “could provide a major boost to unions by allowing them to represent workers in certain cases when a majority sign cards in support of unionizing, rather than going through the lengthy and often litigious election process.”

- Last week’s move also came a day after the board finalized a return to Obama-era regulations purportedly aimed at speeding up union elections.

Why it’s problematic: Card check—which the NAM has long opposed—is inherently unfair and insecure, and it strips employees of their right to secret ballots, said NAM Director of Infrastructure & Labor Policy Ben Siegrist.

- “The NLRB’s decision could create a glide path to force unionization on workers without the necessary safeguards of an election, and it runs counter to 50 years of precedent established by the Supreme Court,” he said. “Effectively, this action contradicts the rights all employees have in determining their own representation.”

Small Business Administration Relaxes Lending Rules

The Small Business Administration is streamlining its lending process, according to The Wall Street Journal (subscription).

What’s going on: “The Small Business Administration is simplifying loan requirements, automating more of the process and expanding the pool of nonbank lenders licensed to issue SBA loans. The moves, many of which take effect Aug. 1, will make it easier for financial-technology firms to participate.”

- The goal: to increase credit extended to small businesses that have typically struggled to get it.

The concern: “[T]he changes—and the decision to couple relaxed requirements with new lenders—have drawn criticism from the industry and members of Congress, who say the revisions could jeopardize the program by increasing loan defaults.”

- Some worry that without “firm guardrails from the SBA” lenders will make risky loans, resulting in more defaults.

- Even if defaults don’t increase, loans could get more expensive for borrowers, as lenders will now be able to charge flat fees.

Why it’s important: “The SBA is authorized by Congress to guarantee as much as $34 billion in loans annually through its main lending program” but qualifying for the funds requires adhering to a set of burdensome rules—and that’s led to underutilization of available funds, according to the Journal.

The changes: “Under the new SBA rules, lenders can use their own standard credit policies to make SBA loans of as much as $500,000 instead of following government guidelines. Lenders are encouraged to check a box to indicate why borrowers can’t get credit elsewhere, a crucial program requirement, instead of providing a detailed written explanation.”

- Revisions to the loan requirements include reduced or eliminated downpayments for some borrowers.

Timmons on Regulations: Make Them “Sensible and Achievable”

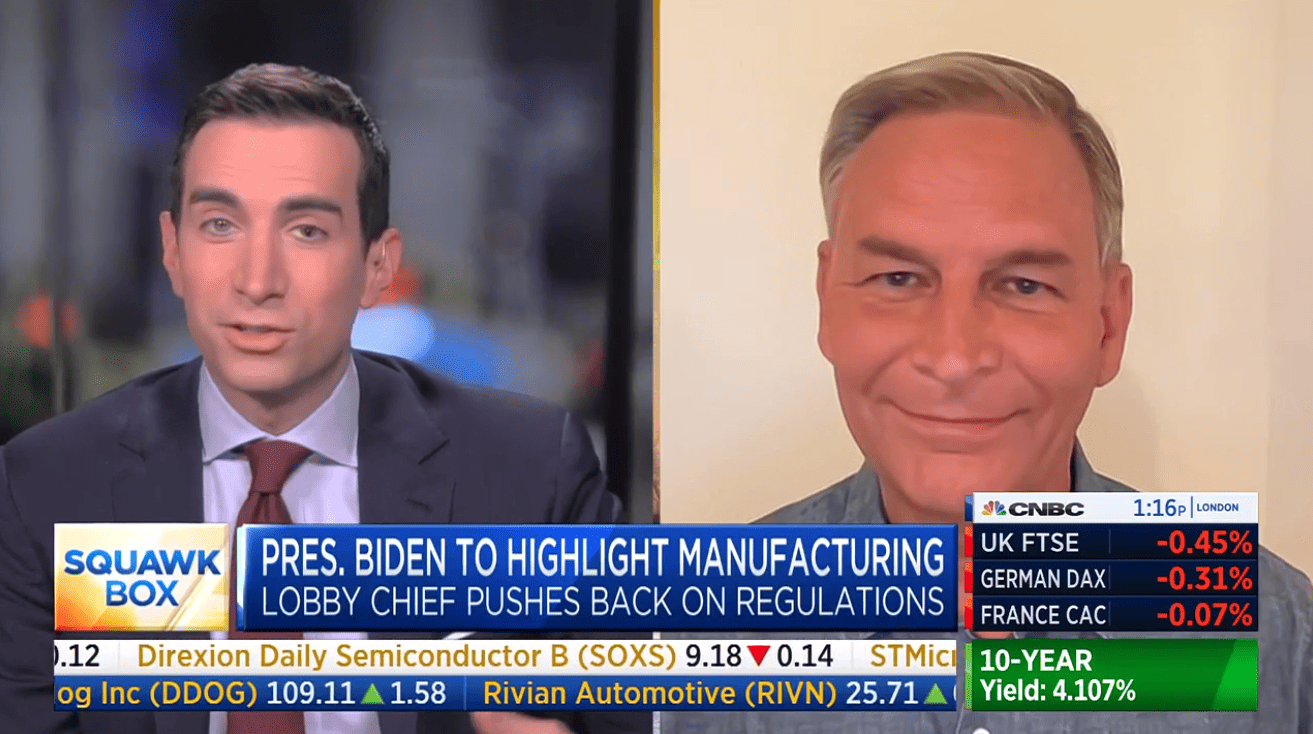

“There are good things coming from [the Biden] administration”—including the CHIPS and Science Act and historic infrastructure investment—but there are also several trends that spell trouble for manufacturing in the U.S., NAM President and CEO Jay Timmons said on CNBC’s “Squawk Box” on Monday.

A three-fold issue: “On the one hand we have a manufacturing strategy that Congress and the administration have been putting forward, which is … to prioritize growing manufacturing here in the United States,” Timmons told CNBC’s Andrew Ross Sorkin.

- “But … you’re compounding that with three things. One is the [number] of regulations coming down. … [Two is] slow permitting, which is making it difficult for manufacturers to build those facilities they’re willing to invest in. Thirdly, [in] some of the provisions that have been enacted, there’s been confusing guidance or no guidance when it comes to accessing the funds and credits that are available for manufacturing. All three of those things together are making it very difficult for manufacturers to compete and succeed in our global economy.”

- The NAM is engaging on approximately 100 different regulations coming from 30 different government agencies, Timmons added.

Make regulation smart, achievable: Manufacturers are in favor of reasonable regulations that enable them to succeed, Timmons continued. “We’re not saying ‘No regulation’; we’ve never said that. What we’re saying is, ‘Let’s make these regulations essential, smart and achievable.’”

- He cited the National Highway Traffic Safety Administration’s new Corporate Average Fuel Economy Standards—which the NAM has told the administration are unworkably stringent and will drive up costs for manufacturers—as well as the Environmental Protection Agency’s new standards for ambient air quality, which a NAM-commissioned study found would threaten billions in economic activity and cost hundreds of thousands of jobs.

NAM in action: The NAM recently joined forces with members of its Council of Manufacturing Associations and the Conference of State Manufacturing Associations to launch Manufacturers for Sensible Regulations, a coalition created to address the negative effects of these federal regulations.

SEC Finalizes Cybersecurity Disclosures Rule

After an aggressive campaign by the NAM, the U.S. Securities and Exchange Commission has scaled back a damaging cybersecurity proposal that would have been deeply problematic for manufacturers. Yet, the final regulations still impose compliance burdens on publicly traded companies. Here’s what manufacturers can expect now that the rule is finalized.

The background: Last year, the SEC proposed a new set of cybersecurity disclosure requirements for public companies. The centerpiece of the rule was a mandate to disclose cybersecurity incidents to the public within four days. The proposal also would have required detailed reporting on companies’ policies and procedures for responding to cybersecurity threats.

The problem: Requiring detailed public disclosures about cybersecurity incidents and processes could provide a roadmap to potential hackers, and sharing information about ongoing incidents could compromise efforts to stop an attack.

The NAM response: The NAM urged the SEC to make commonsense adjustments to protect manufacturers from attacks and give companies the flexibility to respond to cybersecurity incidents appropriately.

The result: The final rule is more tailored than the initial proposal, reducing the risk that companies will be forced to expose sensitive information. But its requirements still impose new compliance burdens on manufacturers.

Incident reports: The rule still requires companies to report cybersecurity incidents publicly within four days, but companies will be able to request that the attorney general grant a 30-day extension to protect public safety or national security—a top priority for the NAM. The extension could be lengthened by an additional 30 days (for public safety) or 90 days (for national security) if warranted.

- Thanks to the NAM’s intervention, the SEC will require the disclosure of only limited information about an attack’s circumstances and impact, whereas the original proposal would have forced companies to disclose extensive details, including potentially sensitive data.

- In addition, a provision requiring companies to track, aggregate and disclose the impact of minor cybersecurity incidents—which the NAM opposed—was struck from the final rule.

Risk management and governance: Companies will be required to disclose information on cybersecurity oversight by their board and management, as well as how cybersecurity is incorporated into their overall risk management strategy.

- These disclosures must include “sufficient detail for a reasonable investor to understand” a company’s cybersecurity risk management—but will no longer include information on a company’s specific prevention and detection activities.

- A provision effectively requiring companies to have a cyber expert on their board, which the NAM strongly opposed, was not included in the final rule.

Our take: “The NAM is committed to a smart, flexible disclosure approach that ensures manufacturers—and their customers and shareholders—can stay protected from cybersecurity threats,” said NAM Senior Director of Tax and Domestic Economic Policy Charles Crain.

- “Manufacturers were glad to see that the SEC made some adjustments to its rule, but more must be done. The SEC and the Department of Justice must grant companies the flexibility to delay incident reporting to prevent threats to public safety and national security.”

Get protected: Every manufacturer should have the tools they need to protect themselves against cyberattacks. Check out NAM Cyber Cover—an exclusive cybersecurity and risk mitigation program for NAM member companies and organizations.