How Johnson & Johnson Supports the Military Community

For more than a century, Johnson & Johnson has been a steadfast supporter of military service members. Today, one of the ways Johnson & Johnson fulfills this mission is by partnering with the Manufacturing Institute’s Heroes MAKE America initiative, which connects members of the military community with rewarding careers in manufacturing.

Both Johnson & Johnson and HMA firmly believe that military experience is invaluable for manufacturing careers. Veterans often have advanced problem-solving abilities, leadership skills and a strong work ethic—qualities that are essential in the fast-paced, dynamic environment of manufacturing.

The partnership: Since 2021, Johnson & Johnson has been the official health care sponsor of HMA. With their support, the initiative has continued to expand in-person and virtual training programs and helped more service members transition into rewarding manufacturing careers.

- Johnson & Johnson is a frequent host of facility tours for HMA students, as well as an active participant in Heroes Connect. These events provide military members with valuable insights into the manufacturing sector and allow them to connect with potential employers.

- The company also hires HMA graduates itself, employing three so far at its facilities.

Bringing careers into focus: On Nov. 15, Johnson & Johnson hosted 22 HMA participants from Fort Stewart in Georgia at its Vision Care site in Jacksonville, Florida.

- Johnson & Johnson Executive Vice President, Chief Technical Operations & Risk Officer and NAM Board Chair Kathy Wengel, MI President and Executive Director Carolyn Lee and NAM President and CEO Jay Timmons also joined the tour. (The MI is the workforce development and education affiliate of the NAM.)

- Wengel, Lee and Timmons participated in group discussions with HMA participants and held a fireside chat where they discussed their careers in manufacturing and Johnson & Johnson’s commitment to military hiring. They also gave advice to the HMA participants about working in the industry.

- “Veterans embody resilience, adaptability and dedication—qualities that are at the heart of manufacturing excellence,” said Wengel. “At Johnson & Johnson, we’re honored to work alongside Heroes MAKE America to support veterans in their transition to civilian careers, providing them with opportunities to build rewarding futures in manufacturing.”

From the MI: “Johnson & Johnson’s partnership has been crucial to our efforts to connect the military community with meaningful career opportunities in manufacturing,” said Lee. “They are an example of what it means to invest in veterans and support their transition into civilian careers.”

Get involved: To learn more about HMA and its incredible pool of talent, attend a virtual information session or email [email protected].

NLRB Overturns 40-Year Precedent

When employers tell workers that unionizing would harm employee–manager relationships, they might be violating federal law, the National Labor Relations Board ruled last week (Law360, subscription).

What’s going on: “Telling workers that a union would come between them and their bosses may violate the National Labor Relations Act because it’s an effective threat to end workers’ direct relationships with management, a majority comprising the board’s three Democrats said [last] Friday in a case involving Starbucks.”

- The groundbreaking decision overturns nearly four decades of precedent. In its 1985 Tri-Cast ruling, the NLRB allowed employers to tell employees that unionization would strain worker–manager relationships “so long as they didn’t explicitly or implicitly threaten employees” when doing so (JD Supra).

- The NLRB said such cases will now be decided on a case-by-case basis.

Looking ahead: The ruling will only apply to future cases, however, “allowing past communications under the Tri-Cast standard to stand without retroactive penalties” (JD Supra).

WIN’s First Event Is a Roaring Success

The inaugural “Empowering Women’s Leadership in Manufacturing” event was a smash hit.

What’s going on: The newly minted Women in National Association of Manufacturers—a group composed of women executives at NAM member companies—gathered for the first time last month at Johnson & Johnson’s World Headquarters in New Brunswick, New Jersey.

- Headlining the event were Johnson & Johnson Executive Vice President and Chief Technical Operations and Risk Officer (and NAM Board Chair) Kathy Wengel and Cornerstone Building Brands President and Chief Executive Officer (and NAM Executive Committee member) Rose Lee.

- NAM Executive Vice President of External Affairs Erin Streeter also spoke at the event, conducting a conversation with New Jersey State Senator Linda Greenstein, who is a co-chair of her state’s manufacturing caucus.

The background: WIN arose out of discussions among several women leaders on the NAM’s executive committee, including Wengel and Lee, who hosted introductory sessions at the NAM’s spring and fall board meetings. The goals of the new group include:

- Amplifying the voice of women leaders in manufacturing advocacy;

- Supporting professional growth for women in manufacturing; and

- Promoting the growth of women executives in NAM membership.

The word from Wengel: At the October event, the Johnson & Johnson leader paid homage to the women of J&J who led critical operations for the organization over 100 years ago.

- “During World War I, Edith H. led a team of 140 women—running J&J’s sterile suture manufacturing operation round-the-clock to meet demand for our products on the front lines,” Wengel said.

- “Yes, we’ve come a long, long way [since WWI],” she continued, “but all of us know there’s still so much more we want and need to accomplish.”

- “With WIN, we want to transform the industry as a whole—creating momentum for meaningful reforms to policy and corporate culture that support professional growth for all women in manufacturing.”

A conversation with Lee: After her speech kicking off the event and introducing WIN, Wengel conducted a dialogue with Cornerstone President and CEO Lee, who also stressed the importance of spotlighting women’s experiences in manufacturing.

- “For most of us it’s been a long and sometimes tough journey,” Lee said. “But once we get here, it can be easy for some of the hard realities of the journey to fade as we deal with day-to-day challenges of running our company, division, business or team.”

- “For WIN to be effective, we need to stay in touch with the front lines where we make our great products, and with what the customers want and need. We also need to support and lift up one another to be the most effective women in manufacturing today,” she added.

Why it’s important: “Our companies are better, our industry is better, the world is better when women are an equal part of the leadership team and decision-making process,” Wengel said. “Everybody wins when we have more women in manufacturing leadership positions.”

Get involved: If you are a female leader in manufacturing, WIN is eager to hear your perspective. Please take the survey here to tell us your views on supporting women throughout the industry.

NAM Sees Strength for Manufacturing as Washington Transitions

With a new administration and Congress on the horizon, the NAM is signaling confidence in its ability to secure wins for manufacturing in the United States, highlighting both recent achievements and policy priorities moving forward.

“The NAM has always focused on what’s best for manufacturing in America, and our track record speaks to that,” said NAM Executive Vice President Erin Streeter. “Our approach is consistent because we know what it takes to get results.”

What we’ve delivered: With post-partisan engagement, the NAM has achieved historic policy wins across both recent administrations, including:

- Tax reform: The NAM’s advocacy helped shape the 2017 tax cuts, driving billions in savings that manufacturers have reinvested in jobs, innovation and facility upgrades.

- Regulatory certainty: The NAM has played a pivotal role in streamlining regulations, reducing compliance costs under the Trump administration and working to slow regulatory expansion during the Biden years.

- United States-Mexico-Canada Agreement: The NAM was a key advocate for USMCA, safeguarding U.S. jobs by ensuring fairer competition and greater access to key markets.

- Energy advances: NAM-backed policies have supported growth in domestic energy production, creating a more stable energy market.

- Infrastructure and CHIPS Act: The NAM was instrumental in securing the historic Bipartisan Infrastructure Law and the CHIPS and Science Act, both critical for modernizing the economy, bolstering national security and ensuring a reliable semiconductor supply.

“These wins demonstrate what we bring to the table,” Streeter said. “By staying focused on manufacturing’s priorities, we can partner effectively with the new administration and Congress to create and protect jobs and strengthen communities.”

Looking ahead: The NAM’s focus on core issues remains critical for keeping the sector competitive and resilient, Streeter continued. These issues include:

- Securing tax reform: The NAM’s “Manufacturing Wins” campaign aims to lock in key 2017 tax provisions that manufacturers rely on for stability and growth. “Tax reform has been a game-changer,” said Streeter. “Protecting that progress means more jobs and manufacturing-led growth across the country.”

- Regulatory certainty: The NAM is advocating for balanced regulations that support competitiveness. “Manufacturers thrive with clear, fair rules,” Streeter noted. “We’re making sure Washington understands the importance of regulatory stability—and the danger of excessive regulation.”

- Energy security: The NAM is working to secure reliable, affordable energy while fostering innovation in sustainability. “Energy security and grid reliability are top of mind for every manufacturer,” Streeter added. “We’re ensuring manufacturers can continue to innovate, grow and drive America forward.”

Bottom line: The NAM remains focused on advocating for policies that strengthen U.S. manufacturing. “Our success is built on trust and influence,” Streeter said. “Our members know the NAM is a constant force, with the relationships and expertise to deliver, regardless of political changes.”

In related news, President-elect Trump has named campaign manager Susie Wiles as White House chief of staff (Reuters, subscription), a choice NAM President and CEO Jay Timmons called “a powerful move to bring bold, results-driven leadership to the White House from day one.”

Trump’s First Term: A Historic Era for Manufacturing

President Trump’s first term delivered significant wins for manufacturing in the United States, from tax reform to a regulatory overhaul to new trade agreements. Now, as the president-elect gears up for a second term, we look back on the transformational achievements and the NAM’s role in shaping policies that revitalized manufacturing in the U.S.

“Rocket fuel”: President Trump took the stage at the NAM’s board meeting in September 2017, where he laid out his tax reform agenda, describing it as “rocket fuel” for the U.S. economy. This was no ordinary policy effort—it was a generational initiative that would reshape industry in the United States.

- The impact: The Tax Cuts and Jobs Act delivered a 21% corporate tax rate while instituting full and immediate expensing for capital investments, improved interest deductibility and provided other critical provisions for small manufacturers and the entire industry.

- As a result, manufacturers nationwide reported record optimism, expanded operations, hired more workers, increased wages and benefits and reinvested in their communities.

Regulatory certainty: Recognizing that excessive regulations were stifling growth, the Trump White House asked then-NAM Board Chair David Farr in the first half of 2017 to compile a report from NAM members on the regulations causing them the most harm. The NAM team worked closely with administration leaders to address these pain points, compiling a list of 158 regulations for reform, with an emphasis on regulatory predictability and simplicity.

- The impact: By the close of Trump’s first term, more than 90% of the NAM’s regulatory recommendations were addressed or nearing completion. This unprecedented relief helped manufacturers focus on growth, product innovation and expansion.

Stronger deals: The Trump administration kept manufacturers and the NAM at the table, forging a trilateral deal to strengthen manufacturing’s competitive edge.

- The impact: Thanks in large part to manufacturers’ persistent advocacy work with lawmakers on Capitol Hill, the United States–Mexico–Canada Agreement was signed into law, restoring trade certainty for the North American markets that support millions of manufacturing jobs in the United States.

- While the NAM continues to pressure Mexico and Canada to live up to their commitments, the agreement strengthened businesses in the U.S. by ensuring updated trade standards, bolstering protections for intellectual property and digital trade and enhancing cooperation among North American partners.

Energy independence: Under President Trump’s administration, the NAM advanced an all-of-the-above energy strategy that included expanded domestic energy production and efficiency efforts. The NAM partnered with the Environmental Protection Agency and the Department of Energy to promote practices that both protected the environment and advanced innovation for a sustainable future.

- The impact: As former Trump EPA Administrator Andrew Wheeler pointed out recently at NAM headquarters in Washington, the rollback of restrictive energy regulations and the decision to maintain workable standards empowered manufacturers to increase domestic energy production, which reduced costs and bolstered energy independence.

- This balanced approach allowed manufacturers to meet consumer demand, strengthen supply chains and make greater contributions to America’s economy and environmental stewardship.

Safeguarding American IP: Confronting unfair trade practices with China was another priority. In 2019, the NAM worked closely with the White House to secure the “phase one” trade deal with China, which was designed to strengthen protections for American IP and help level the playing field for manufacturers in the U.S.

- The impact: The agreement established enforceable trade standards with China, aiming to protect U.S. innovations and support American jobs.

Operation Warp Speed: As the COVID-19 pandemic unfolded, manufacturers were at the forefront of the response. The NAM and its members partnered with the Trump administration to secure essential operations activity to implement Operation Warp Speed, a public–private partnership that fast-tracked the development, manufacturing and distribution of vaccines.

- The impact: Operation Warp Speed delivered lifesaving vaccines in record time, saving millions of lives, ending the global pandemic and demonstrating the unequaled capacity of American innovation and manufacturing.

Dignity of work: To address the skills gap, the Trump White House created the American Workforce Policy Advisory Board, naming NAM President and CEO Jay Timmons a member. Alongside other manufacturing leaders, and with the support of the NAM’s workforce development and education affiliate, the Manufacturing Institute, Timmons worked with the administration to elevate manufacturing careers and expand access to training. In a key event, the NAM and Ivanka Trump, who received the Alexander Hamilton Award for her leadership in championing manufacturing, launched the Creators Wanted Tour in 2020 to inspire the next generation of manufacturers and close the skills gap.

- The impact: Creators Wanted became the largest industry campaign to build excitement about modern manufacturing careers, highlighting the industry’s high-tech, well-paying jobs and reinforcing its role in supporting the American Dream. The campaign helped shift parents’ positive perception of manufacturing careers from 27% to 40% and signed up more than 1.5 million students and career mentors to learn more about manufacturing careers.

Bottom line: “President Trump’s first term reshaped what’s possible for manufacturing in the United States,” said NAM Executive Vice President Erin Streeter. “As he prepares to lead again, manufacturers have the benefit of building on a strong foundation with the president-elect as well as the purpose and pride that the industry brings out in lawmakers on both sides of the aisle.”

Heroes MAKE America Is Growing

Manufacturers employ more veterans than any other private industry, with roughly 980,000 veterans working in manufacturing in 2023. That is an encouraging number, yet there are still many more veterans who remain untapped by the manufacturing industry. And manufacturers need them: with 481,000 open jobs in the sector, companies have much to gain by exploring this promising talent pool.

That’s where the Manufacturing Institute’s Heroes MAKE America initiative comes in. Since its launch in 2018, it has assisted more than 42,000 members of the military community who are looking for their next career. Now, Heroes is expanding its reach via collaborations with the U.S. Department of Labor and Walmart, which will further boost manufacturers’ access to this skilled and dedicated workforce.

Walmart.org: Heroes’ collaboration with Walmart.org began in 2022, when Walmart funded the development of a model that translates military-acquired skills into competencies that are recognized by employers in the manufacturing industry, enhancing veterans’ visibility to employers.

- The project built, tested and evaluated a platform that allows military-connected individuals to showcase their qualifications through verifiable digital badges.

- This approach helps civilian employers recognize the skills of service members and veterans, making it easier for these job seekers to transition into high-demand roles while enhancing workforce readiness.

- New funding from Walmart.org will further expand the translation of military skills, painting fuller pictures of job seekers’ abilities and exploring avenues to increase the usage and acceptance of digital skills and badging systems, both among users and employers.

DOL: In June, the U.S. Department of Labor announced that Heroes would become a partner of the Veterans’ Employment and Training Service’s Employment Navigator & Partnership Program, which provides transitioning service members and their spouses with personalized employment assistance.

- Through its partnership with ENPP, Heroes will extend its reach to 36 additional military installations worldwide, significantly expanding its role as a premier employment resource for the military community.

The MI says: “Our existing offerings coupled with added valuable collaborations with Walmart.org and DOL will help Heroes connect more manufacturers with military talent, supplying them with qualified, dedicated workers who will strengthen manufacturing in America for decades to come,” said MI President and Executive Director Carolyn Lee.

Interested in learning more? Check out the HMA website, follow HMA on LinkedIn or send an email to [email protected].

Manufacturer Sentiment Declines

Manufacturer sentiment fell in the third quarter of this year, according to the NAM’s Q3 2024 Manufacturers’ Outlook Survey, out Wednesday.

What’s going on: Results of the survey, which was conducted Sept. 5–20, reflect “preelection uncertainty,” NAM President and CEO Jay Timmons said—but also larger economic concerns.

- “The good news is that there is something we can do about it,” said Timmons. “We will work with lawmakers from both parties to halt the looming tax increases in 2025; address the risk of higher tariffs; restore balance to regulations; achieve permitting and energy security; and ease labor shortages and supply chain disruptions.”

Key findings: Notable data points from the survey include the following:

- Some 62.9% of respondents reported feeling either somewhat or very positive about their business’s outlook, a decline from 71.9% in Q2.

- A weaker domestic economy was the top business challenge for those surveyed, with 68.4% of respondents citing it.

- Nearly nine out of 10 manufacturers surveyed agreed that Congress should act before the end of 2025 to prevent scheduled tax increases on manufacturers.

- The overwhelming majority—92.3%—said the corporate tax rate should remain at or below 21%, with more than 71% saying a higher rate would have a negative impact on their businesses.

- More than 72% said they support congressional action to lower health care costs through the reform of pharmacy benefit managers.

The last word: “When policymakers take action to create a more competitive business climate for manufacturers, we can sustain America’s manufacturing resurgence—and strengthen our can-do spirit,” Timmons said.

- “This administration and Congress—and the next administration and Congress—should take this to heart, put aside politics, personality and process and focus on the right policies to strengthen the foundation of the American economy.”

Route 250 Diner: Testing the Power of Business

In a politically divided time, the NAM set out to answer an important question: Can businesses build trust, brighten views about America’s creators and rekindle belief in the American Dream? The answer, tested over three-and-a-half days at the Circleville Pumpkin Show in Ohio: “Yes, they can—and we probably should,” said NAM Managing Vice President of Brand Strategy Chrys Kefalas.

Why it matters: Declining American pride is more than just a cultural shift—it’s a business problem. “When people lose faith in the American Dream, they lose faith in manufacturers and the business community’s ability to drive progress, leading to skepticism, division and fewer supporters of the environment that manufacturers and businesses need to succeed,” said Kefalas.

- This challenge comes at a pivotal moment: America’s 250th anniversary—its Semiquincentennial—arrives in 2026. This milestone offers a once-in-a-generation opportunity to reignite pride and belief in the country’s future.

What we built: With funding from Stand Together Trust, the NAM and its partners developed the Route 250 Diner, a pop-up experience that combined stories about community creators, snack giveaways, career resources and service opportunities. It brought together businesses, trade groups and civic organizations to see if they could elevate creators locally and nationally while inspiring civic pride and acts of service.

The results: Nearly 4,700 visitors of many ages and political affiliations pledged to undertake service opportunities and shared overwhelmingly positive feedback. Some even contributed cash to survey boxes as a gesture of gratitude. The concept clearly resonated.

- “We need more of this,” “Love this” and “I hope y’all be back” were frequent refrains among survey respondents. “I believe that how towns like Circleville go, so goes America,” said Circleville Mayor Michelle Blanton. “What resonates here can inspire communities across the country.”

Leading brands take part: The concept won early supporters like Snap-on, Johnson & Johnson and The J.M. Smucker Company, as well as growing enterprises like Seaman Corporation and Centrus Energy. The Honda–LG Energy Solution battery plant joint venture team participated on-site, highlighting the 2,200 job opportunities at the new plant in Fayette County, Ohio.

- The National Restaurant Association and the International Franchise Association, which represent two vital sectors of the American economy, joined the effort, as well as state business groups The Ohio Manufacturers’ Association and the Ohio Restaurant & Hospitality Alliance.

Support: The NAM set out to complement national and state efforts to celebrate America’s 250th anniversary and promote civic education. The concept enjoyed the participation of the congressionally chartered, nonpartisan U.S. Semiquincentennial Commission (America 250), state-chartered America 250-Ohio, the Bill of Rights Institute and the Edward M. Kennedy Institute.

What they’re saying: Gov. Mike DeWine (R-OH) highlighted the initiative on social media, focusing on advancing participants’ career aspirations. “Empowered individuals and driving positive change in their communities are vital to America’s next 250 years,” said Stand Together Vice President Sarah Cross, stressing another key point of the activation.

- NAM President and CEO Jay Timmons: “By strengthening civic pride, inspiring acts of service and deepening our connections to our communities, we can ensure that manufacturers and enterprises across the nation shape a brighter future for America.”

- America250 Chair Rosie Rios: “The Route 250 Initiative is an important celebration of America’s creators and makers who play a vital role in strengthening our communities through meaningful acts of service as we approach America’s 250th anniversary in 2026.”

- National Restaurant Association President and CEO Michelle Korsmo: “The Route 250 Initiative reminds us that in every community, there are people creating opportunities for themselves and others—and that’s something worth celebrating as we help more people learn how to make America’s next 250 years better than our first.”

- Bill of Rights Institute President and CEO David Bobb: “By engaging in meaningful, constructive dialogue and celebrating the individuals who by their hands, hearts and minds are creating a better future, we can inspire a renewed commitment to those enduring ideals.”

- America 250-Ohio Executive Director Todd Kleismit: “By sharing stories of creators and community heroes and inviting us all to learn what we’re doing to serve our community, we’re not just celebrating the past—we’re inviting people to see themselves in America’s future.”

- The Ohio Manufacturers’ Association President Ryan Augsburger: “As we look ahead to America’s 250th anniversary, Ohio manufacturers will continue to lead the way. This diner and the Route 250 Initiative give us the chance to reflect on our past while also inspiring the next generation to shape the future—one innovation, one community, one creator at a time.”

- Ohio Restaurant & Hospitality Alliance Managing Director of External Affairs and Government Relations Tod Bowen: “As we look ahead to America’s 250th anniversary in 2026, we’re reminded of the importance of spaces like this. The diner invites us all to reflect on how we’re contributing to our communities and how, by coming together, we can make the next 250 years even better.”

The big takeaway: “At the heart of this proof of concept is a message: manufacturers, creators and communities all play essential roles in writing the next chapter of America’s story,” said Timmons. “This is a model, showing how civic pride, community service and the power of industry can renew belief in the American Dream.”

- “Some argue that no single narrative can unite the American people, but the Route 250 Diner and manufacturing’s story in America prove otherwise,” Kefalas added. “The question isn’t if we can find a unifying narrative—it’s who will step up to lead it, and that’s why we tried to show the way forward.”

What’s next: The NAM will evaluate the full results of the proof of concept with its partners and other key stakeholders, continuing to look for ways of using America’s 250th anniversary to strengthen the industry and the country.

In the news: POLITICO Influence covered the launch announcement, and The Scioto Post of Pickaway County, Ohio, previewed the experience.

More: Watch highlights of the grand opening event.

NAM: Biden’s LNG Ban Threatens 900,000 Jobs

The liquefied natural gas export industry has turned the U.S. into a powerhouse of cleaner energy, benefiting its trading partners around the world. The Biden administration’s ongoing ban on new LNG export licenses, however, is throttling an industry that could produce many more billions in revenue and a startling 900,000 jobs by 2044.

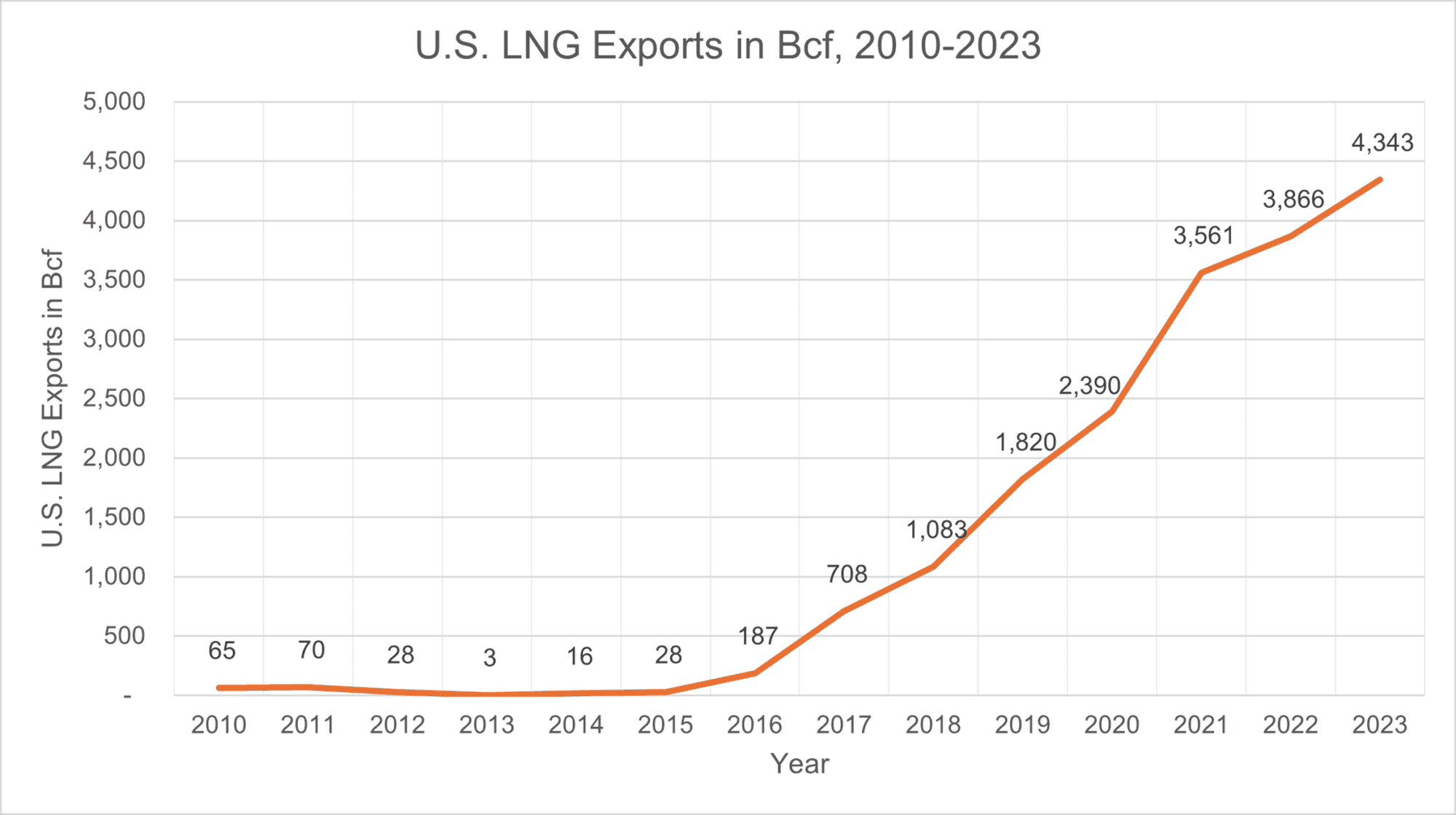

The data: A new study from the NAM and PwC shows that the U.S. LNG revolution could extend its upward climb, as shown on the graph above. Today, the industry is a huge source of jobs and profit:

- U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- The LNG industry contributes $43.8 billion to U.S. GDP.

- And lastly, federal, state and local governments receive $11.0 billion in tax and royalty revenues, thanks to U.S. LNG exports.

But that pales in comparison to the industry’s potential over the next two decades. The study projects the likely growth of the industry through 2044, showing all that is at stake if the ban remains in place until then:

- Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk.

- The ban would also stifle between $122.5 billion and $215.7 billion in contributions to U.S. GDP during the same period.

- Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

Public opinion: The American public is squarely behind the LNG export industry, showing overwhelming approval in an NAM poll taken in March.

- Eighty-seven percent of respondents agreed the U.S. should continue to export natural gas.

- Seventy-six percent of respondents agreed with building more energy infrastructure, such as port terminals.

The last word: “With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential,” said NAM President and CEO Jay Timmons.

- “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

MFG Day 2024: The MI Goes to Kansas

That’s another success for the books! Last week, manufacturers and their supporters nationwide celebrated MFG Day 2024, rolling out the red carpet for students, educators and jobseekers and showcasing modern manufacturing’s diverse career paths.

What’s going on: The Manufacturing Institute, the NAM’s 501(c)3 workforce development and education affiliate, was on the ground in Kansas for multiple plant tours and conversations.

Visiting Bradbury Group: On Thursday’s tour of the Bradbury Group’s plant in Moundridge, Kansas, about 400 students got a firsthand look at how roll-forming and coil-processing equipment is made.

- The company—whose CEO David Cox is an NAM board member—set up stations where attendees could learn about its many career tracks. In addition, local education and community training partners were on-site to showcase job-training initiatives.

- MI President and Executive Director Carolyn Lee participated in the events, touring Bradbury’s facility with approximately 70 students from Newton High School in Newton, Kansas.

Touring with Heroes: On Friday, Lee visited four McPherson, Kansas, manufacturing plants with participants from Heroes MAKE America, the MI initiative that makes connections between the military community and the manufacturing industry.

- The companies were piping-systems manufacturer Viega, insulation and commercial roofing maker Johns Manville, downstream equipment maker Plastics Extrusion Machinery LLC and sustainable construction materials manufacturer CertainTeed.

- At Viega on Friday, Lee spoke with local high school students viewing the facility at the same time as the HMA participants.

Focus on veterans: Friday’s events also featured a networking lunch for HMA participants, including transitioning service members, veterans and military spouses, with human resources representatives from McPherson manufacturers.

- The Bradbury Group—the parent company of four manufacturing businesses in addition to the Bradbury Company, which has participated in MFG Day for nine years—was represented at the lunch by one of its employees, a U.S. military veteran.

Made possible by: This year’s activities were made possibly by generous support from sponsors Union Pacific, Dominion Energy, Johnson & Johnson, Novonesis, UKG, the International Corrugated Packaging Foundation, Lutron Electronics Co. Inc, Winnebago Industries, Alfa Laval (US), Intertek Alchemy, the National Center for Next Generation Manufacturing and Seaway Bolt & Specials Corp.

Stay tuned: MFG Day events will continue across the U.S. throughout October and beyond. You can find the full list of registered events, and a handy map, here.

The last word: “MFG Day is the prime opportunity for manufacturers to demonstrate firsthand the vast career opportunities that exist in industry,” Lee said. “While students, parents and educators remain our primary focus, it’s also a great time to engage other career-seeking groups so that they, too, can see themselves in manufacturing.”