How Johnson & Johnson Supports the Military Community

For more than a century, Johnson & Johnson has been a steadfast supporter of military service members. Today, one of the ways Johnson & Johnson fulfills this mission is by partnering with the Manufacturing Institute’s Heroes MAKE America initiative, which connects members of the military community with rewarding careers in manufacturing.

Both Johnson & Johnson and HMA firmly believe that military experience is invaluable for manufacturing careers. Veterans often have advanced problem-solving abilities, leadership skills and a strong work ethic—qualities that are essential in the fast-paced, dynamic environment of manufacturing.

The partnership: Since 2021, Johnson & Johnson has been the official health care sponsor of HMA. With their support, the initiative has continued to expand in-person and virtual training programs and helped more service members transition into rewarding manufacturing careers.

- Johnson & Johnson is a frequent host of facility tours for HMA students, as well as an active participant in Heroes Connect. These events provide military members with valuable insights into the manufacturing sector and allow them to connect with potential employers.

- The company also hires HMA graduates itself, employing three so far at its facilities.

Bringing careers into focus: On Nov. 15, Johnson & Johnson hosted 22 HMA participants from Fort Stewart in Georgia at its Vision Care site in Jacksonville, Florida.

- Johnson & Johnson Executive Vice President, Chief Technical Operations & Risk Officer and NAM Board Chair Kathy Wengel, MI President and Executive Director Carolyn Lee and NAM President and CEO Jay Timmons also joined the tour. (The MI is the workforce development and education affiliate of the NAM.)

- Wengel, Lee and Timmons participated in group discussions with HMA participants and held a fireside chat where they discussed their careers in manufacturing and Johnson & Johnson’s commitment to military hiring. They also gave advice to the HMA participants about working in the industry.

- “Veterans embody resilience, adaptability and dedication—qualities that are at the heart of manufacturing excellence,” said Wengel. “At Johnson & Johnson, we’re honored to work alongside Heroes MAKE America to support veterans in their transition to civilian careers, providing them with opportunities to build rewarding futures in manufacturing.”

From the MI: “Johnson & Johnson’s partnership has been crucial to our efforts to connect the military community with meaningful career opportunities in manufacturing,” said Lee. “They are an example of what it means to invest in veterans and support their transition into civilian careers.”

Get involved: To learn more about HMA and its incredible pool of talent, attend a virtual information session or email [email protected].

NLRB Overturns 40-Year Precedent

When employers tell workers that unionizing would harm employee–manager relationships, they might be violating federal law, the National Labor Relations Board ruled last week (Law360, subscription).

What’s going on: “Telling workers that a union would come between them and their bosses may violate the National Labor Relations Act because it’s an effective threat to end workers’ direct relationships with management, a majority comprising the board’s three Democrats said [last] Friday in a case involving Starbucks.”

- The groundbreaking decision overturns nearly four decades of precedent. In its 1985 Tri-Cast ruling, the NLRB allowed employers to tell employees that unionization would strain worker–manager relationships “so long as they didn’t explicitly or implicitly threaten employees” when doing so (JD Supra).

- The NLRB said such cases will now be decided on a case-by-case basis.

Looking ahead: The ruling will only apply to future cases, however, “allowing past communications under the Tri-Cast standard to stand without retroactive penalties” (JD Supra).

NAM Sees Strength for Manufacturing as Washington Transitions

With a new administration and Congress on the horizon, the NAM is signaling confidence in its ability to secure wins for manufacturing in the United States, highlighting both recent achievements and policy priorities moving forward.

“The NAM has always focused on what’s best for manufacturing in America, and our track record speaks to that,” said NAM Executive Vice President Erin Streeter. “Our approach is consistent because we know what it takes to get results.”

What we’ve delivered: With post-partisan engagement, the NAM has achieved historic policy wins across both recent administrations, including:

- Tax reform: The NAM’s advocacy helped shape the 2017 tax cuts, driving billions in savings that manufacturers have reinvested in jobs, innovation and facility upgrades.

- Regulatory certainty: The NAM has played a pivotal role in streamlining regulations, reducing compliance costs under the Trump administration and working to slow regulatory expansion during the Biden years.

- United States-Mexico-Canada Agreement: The NAM was a key advocate for USMCA, safeguarding U.S. jobs by ensuring fairer competition and greater access to key markets.

- Energy advances: NAM-backed policies have supported growth in domestic energy production, creating a more stable energy market.

- Infrastructure and CHIPS Act: The NAM was instrumental in securing the historic Bipartisan Infrastructure Law and the CHIPS and Science Act, both critical for modernizing the economy, bolstering national security and ensuring a reliable semiconductor supply.

“These wins demonstrate what we bring to the table,” Streeter said. “By staying focused on manufacturing’s priorities, we can partner effectively with the new administration and Congress to create and protect jobs and strengthen communities.”

Looking ahead: The NAM’s focus on core issues remains critical for keeping the sector competitive and resilient, Streeter continued. These issues include:

- Securing tax reform: The NAM’s “Manufacturing Wins” campaign aims to lock in key 2017 tax provisions that manufacturers rely on for stability and growth. “Tax reform has been a game-changer,” said Streeter. “Protecting that progress means more jobs and manufacturing-led growth across the country.”

- Regulatory certainty: The NAM is advocating for balanced regulations that support competitiveness. “Manufacturers thrive with clear, fair rules,” Streeter noted. “We’re making sure Washington understands the importance of regulatory stability—and the danger of excessive regulation.”

- Energy security: The NAM is working to secure reliable, affordable energy while fostering innovation in sustainability. “Energy security and grid reliability are top of mind for every manufacturer,” Streeter added. “We’re ensuring manufacturers can continue to innovate, grow and drive America forward.”

Bottom line: The NAM remains focused on advocating for policies that strengthen U.S. manufacturing. “Our success is built on trust and influence,” Streeter said. “Our members know the NAM is a constant force, with the relationships and expertise to deliver, regardless of political changes.”

In related news, President-elect Trump has named campaign manager Susie Wiles as White House chief of staff (Reuters, subscription), a choice NAM President and CEO Jay Timmons called “a powerful move to bring bold, results-driven leadership to the White House from day one.”

Manufacturer Sentiment Declines

Manufacturer sentiment fell in the third quarter of this year, according to the NAM’s Q3 2024 Manufacturers’ Outlook Survey, out Wednesday.

What’s going on: Results of the survey, which was conducted Sept. 5–20, reflect “preelection uncertainty,” NAM President and CEO Jay Timmons said—but also larger economic concerns.

- “The good news is that there is something we can do about it,” said Timmons. “We will work with lawmakers from both parties to halt the looming tax increases in 2025; address the risk of higher tariffs; restore balance to regulations; achieve permitting and energy security; and ease labor shortages and supply chain disruptions.”

Key findings: Notable data points from the survey include the following:

- Some 62.9% of respondents reported feeling either somewhat or very positive about their business’s outlook, a decline from 71.9% in Q2.

- A weaker domestic economy was the top business challenge for those surveyed, with 68.4% of respondents citing it.

- Nearly nine out of 10 manufacturers surveyed agreed that Congress should act before the end of 2025 to prevent scheduled tax increases on manufacturers.

- The overwhelming majority—92.3%—said the corporate tax rate should remain at or below 21%, with more than 71% saying a higher rate would have a negative impact on their businesses.

- More than 72% said they support congressional action to lower health care costs through the reform of pharmacy benefit managers.

The last word: “When policymakers take action to create a more competitive business climate for manufacturers, we can sustain America’s manufacturing resurgence—and strengthen our can-do spirit,” Timmons said.

- “This administration and Congress—and the next administration and Congress—should take this to heart, put aside politics, personality and process and focus on the right policies to strengthen the foundation of the American economy.”

NAM: Biden’s LNG Ban Threatens 900,000 Jobs

The liquefied natural gas export industry has turned the U.S. into a powerhouse of cleaner energy, benefiting its trading partners around the world. The Biden administration’s ongoing ban on new LNG export licenses, however, is throttling an industry that could produce many more billions in revenue and a startling 900,000 jobs by 2044.

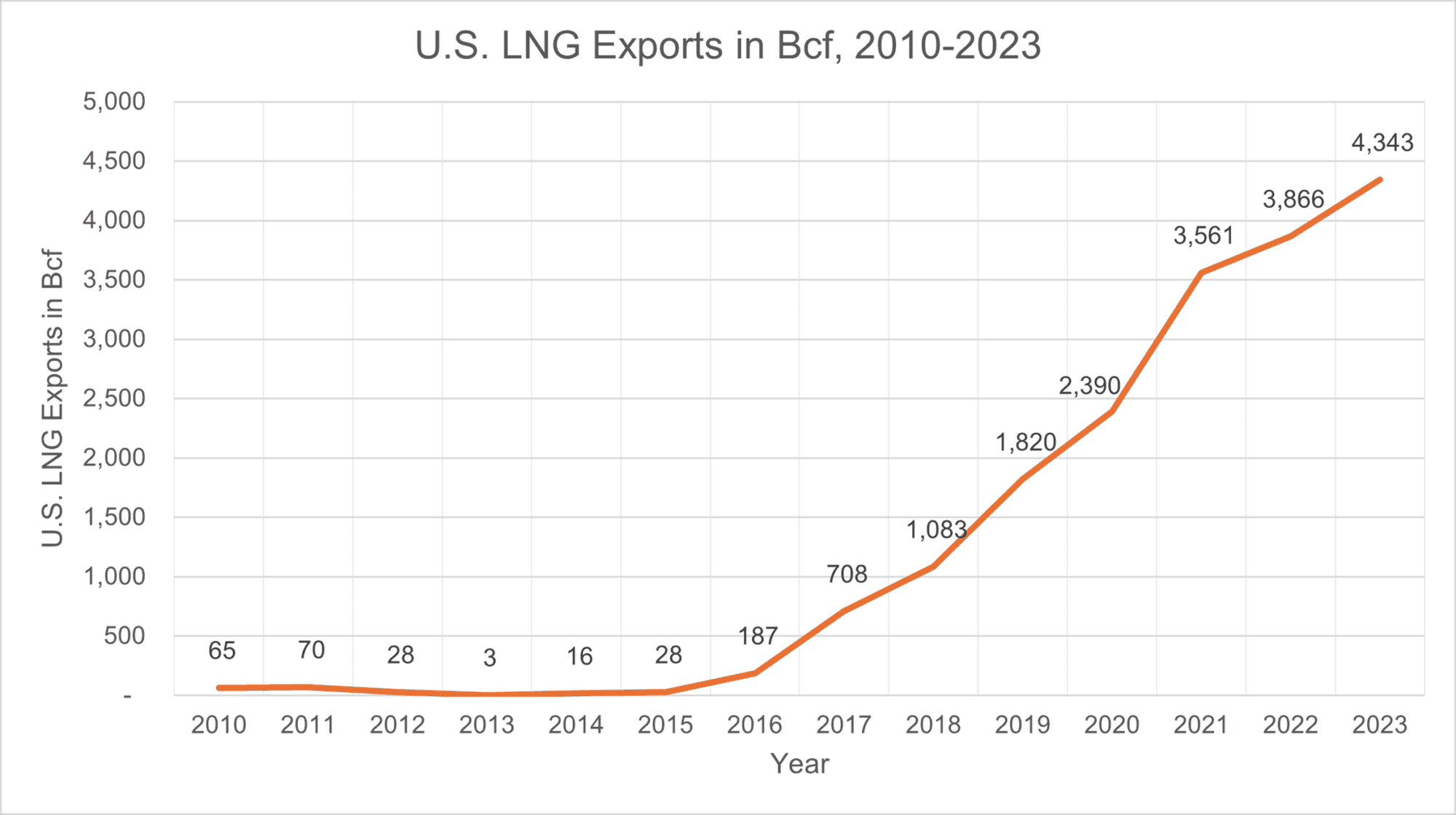

The data: A new study from the NAM and PwC shows that the U.S. LNG revolution could extend its upward climb, as shown on the graph above. Today, the industry is a huge source of jobs and profit:

- U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- The LNG industry contributes $43.8 billion to U.S. GDP.

- And lastly, federal, state and local governments receive $11.0 billion in tax and royalty revenues, thanks to U.S. LNG exports.

But that pales in comparison to the industry’s potential over the next two decades. The study projects the likely growth of the industry through 2044, showing all that is at stake if the ban remains in place until then:

- Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk.

- The ban would also stifle between $122.5 billion and $215.7 billion in contributions to U.S. GDP during the same period.

- Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

Public opinion: The American public is squarely behind the LNG export industry, showing overwhelming approval in an NAM poll taken in March.

- Eighty-seven percent of respondents agreed the U.S. should continue to export natural gas.

- Seventy-six percent of respondents agreed with building more energy infrastructure, such as port terminals.

The last word: “With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential,” said NAM President and CEO Jay Timmons.

- “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

MFG Day 2024: The MI Goes to Kansas

That’s another success for the books! Last week, manufacturers and their supporters nationwide celebrated MFG Day 2024, rolling out the red carpet for students, educators and jobseekers and showcasing modern manufacturing’s diverse career paths.

What’s going on: The Manufacturing Institute, the NAM’s 501(c)3 workforce development and education affiliate, was on the ground in Kansas for multiple plant tours and conversations.

Visiting Bradbury Group: On Thursday’s tour of the Bradbury Group’s plant in Moundridge, Kansas, about 400 students got a firsthand look at how roll-forming and coil-processing equipment is made.

- The company—whose CEO David Cox is an NAM board member—set up stations where attendees could learn about its many career tracks. In addition, local education and community training partners were on-site to showcase job-training initiatives.

- MI President and Executive Director Carolyn Lee participated in the events, touring Bradbury’s facility with approximately 70 students from Newton High School in Newton, Kansas.

Touring with Heroes: On Friday, Lee visited four McPherson, Kansas, manufacturing plants with participants from Heroes MAKE America, the MI initiative that makes connections between the military community and the manufacturing industry.

- The companies were piping-systems manufacturer Viega, insulation and commercial roofing maker Johns Manville, downstream equipment maker Plastics Extrusion Machinery LLC and sustainable construction materials manufacturer CertainTeed.

- At Viega on Friday, Lee spoke with local high school students viewing the facility at the same time as the HMA participants.

Focus on veterans: Friday’s events also featured a networking lunch for HMA participants, including transitioning service members, veterans and military spouses, with human resources representatives from McPherson manufacturers.

- The Bradbury Group—the parent company of four manufacturing businesses in addition to the Bradbury Company, which has participated in MFG Day for nine years—was represented at the lunch by one of its employees, a U.S. military veteran.

Made possible by: This year’s activities were made possibly by generous support from sponsors Union Pacific, Dominion Energy, Johnson & Johnson, Novonesis, UKG, the International Corrugated Packaging Foundation, Lutron Electronics Co. Inc, Winnebago Industries, Alfa Laval (US), Intertek Alchemy, the National Center for Next Generation Manufacturing and Seaway Bolt & Specials Corp.

Stay tuned: MFG Day events will continue across the U.S. throughout October and beyond. You can find the full list of registered events, and a handy map, here.

The last word: “MFG Day is the prime opportunity for manufacturers to demonstrate firsthand the vast career opportunities that exist in industry,” Lee said. “While students, parents and educators remain our primary focus, it’s also a great time to engage other career-seeking groups so that they, too, can see themselves in manufacturing.”

Manufacturers: Boeing Strike Is Poised to Have Significant Economic Consequences Across the Entire United States

Washington, D.C. – As a strike of 33,000 Boeing workers continued into its 20th day, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“The potential economic impact of this strike cannot be overstated. The aerospace industry directly supports more than 500,000 manufacturing workers in America, and the ongoing strike at Boeing’s Puget Sound facilities is poised to have significant economic consequences, not just in the Pacific Northwest but across the entire United States.”

The ongoing strike of 33,000 Boeing workers could total a regional economic loss of more than $1.65 billion after just 20 days, according to NAM calculations.

Timmons added, “This disruption will resonate far beyond Washington state. The aerospace supply chain and manufacturers in the U.S. are interconnected deeply, and a continued halt in production will have devastating effects on our country.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.87 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org

Texas Court Blocks FTC Noncompete Ban

The Federal Trade Commission does not have the authority to enact the sweeping noncompete ban it finalized in April, a federal judge ruled Tuesday (The Wall Street Journal, subscription).

What’s going on: “U.S. District Judge Ada Brown ruled that the commission’s authority to police unfair methods of competition couldn’t be used to issue substantive regulations that ban an entire category of conduct. ‘The role of an administrative agency is to do as told by Congress, not to do what the agency thinks it should do,’” she wrote, adding that the ban was “unreasonably overbroad without a reasonable explanation.”

- The rule—which had already caused companies’ costs to increase in anticipation of the Sept. 4 effective date—sought to prohibit noncompete agreements between employers and their employees.

The NAM’s role: In May, the NAM’s Legal Center filed an amicus brief asking Brown’s court to stay the rule on the grounds that a ban on noncompete agreements would “hamstring innovation in the manufacturing sector and damage the competitiveness of American industry.”

- Brown issued a limited stay in July. Her ruling this week—echoing the NAM’s argument that the rule is “not reasonably explained”—prohibits enforcement of the FTC rule nationwide.

- “The NAM expressed concerns throughout the rulemaking process, and a 2023 NAM survey showed that a broad noncompete ban would disrupt most manufacturing operations in the U.S.,” NAM Director of Transportation, Infrastructure and Labor Policy Max Hyman said following Brown’s ruling this week.

What’s next: The FTC is considering an appeal of the decision, a spokeswoman told the Journal.

- But “[i]f lower courts remain split as the litigation moves through the legal system, the matter might ultimately fall to … [the] Supreme Court, [which] has taken a dim view of government agencies invoking new regulatory powers from long-ago statutes.”

This post has been edited.

Daines, Smucker Staffers Talk Pass-Through Deduction

What’s going on: On Thursday, as part of its 2025 tax campaign, “Manufacturing Wins,” the NAM hosted Noelle Britton, deputy chief of staff for Rep. Lloyd Smucker (R-PA), and Caroline Oakum, tax counsel for Sen. Steve Daines (R-MT), in a virtual roundtable to discuss what’s being done in Congress to maintain the Section 199A pass-through deduction.

- The 20% deduction—created by the 2017 Tax Cuts and Jobs Act to help the many small and medium-sized businesses in the U.S.—is among several vital tax provisions scheduled to expire at the end of 2025. (Pass-throughs are companies whose profits are “passed through” to the owners, who then pay taxes on the entities’ incomes on their personal tax returns.)

- Both Rep. Smucker, who leads the House Ways and Means Main Street Tax Team, and Sen. Daines are leaders of legislation that would make the deduction permanent.

What they’re doing: Sen. Daines introduced the Main Street Tax Certainty Act in the Senate last May, while Rep. Smucker introduced the House’s version of the measure last July.

- The legislation would make the pass-through deduction permanent, providing much-needed certainty to the small and medium-sized manufacturers that have relied on it to increase investments and job creation.

What you can do: The House Ways and Means Committee Tax Teams are collecting companies’ perspectives on how the pass-through deduction has helped manufacturers and other businesses. Similarly, the NAM is collecting stories that can be used as part of our Manufacturing Wins tax campaign.

- Manufacturers willing to share their own stories about the pass-through deduction can email [email protected] or contact the NAM’s tax team.

Heroes MAKE America Draws a Crowd

Nearly 100 veterans attended a manufacturing career fair at Fort Riley, Kansas, last week, including many who had prepared for their new careers via the Heroes MAKE America program (Kansas Biz News).

What’s going on: “The career fair and other events held by Heroes MAKE America and Manufacturing Institute [the NAM’s 501(c)3 workforce development and education affiliate] aim to grow the manufacturing industry’s workers for the advancement of modern manufacturing and offer programs, including informational sessions, career fairs, networking, career readiness, placement support and manufacturing tours.”

- More than 30 regional and national manufacturers had booths at the event.

How it helps: HMA—an MI program with a 90% graduate placement rate—offers career help to job seekers transitioning out of the military and into the civilian workforce. The aid is in the form of training and introductions to manufacturing leaders seeking employees.

- One military member who attended the fair said “she’s received help with resume writing, interviewing for jobs and how to translate military experience into tools you can use in the civilian world.”

- HMA, which hosts virtual career fairs throughout the year, also offers resources to employers. These include online training, courses and access to the research of the Society of Human Resource Management Foundation.

Why it’s important: The industry could create about 3.8 million new manufacturing jobs on net between this year and 2033, according to a new study by Deloitte and the MI.

- However, if the current manufacturing employee deficit is not shored up, approximately half of these jobs—or 1.9 million—could go unfilled.

What’s next: Interested employers can participate in an information session to be held later this month, where they can learn more about attracting, hiring and retaining military talent through upcoming career fairs and virtual hiring events.

The last word: “Members of the military community often possess valuable skills and qualities—such as discipline, teamwork, leadership and problem-solving abilities—that are in demand for manufacturing careers,” said MI President and Executive Director Carolyn Lee.

- “That’s why manufacturers are increasingly connecting with this top talent through an array of resources provided by the MI’s Heroes MAKE America initiative.”