Overregulation and Workforce Challenges Weigh Heavily on Manufacturing Sector

Optimism Sinks to Pandemic Lows in Q3 Outlook Survey

Washington, D.C. – The National Association of Manufacturers released its Manufacturers’ Outlook Survey for the third quarter of 2023, which registered the lowest level of optimism among NAM members (65.1%) since Q2 2020, as the sector continues to confront a tight labor market, unbalanced federal regulations and critical policy debates in Congress.

“Manufacturers continue to be challenged in today’s economy, but what this survey makes clear is that unbalanced federal regulations are harming families and communities, with nearly two out of three manufacturers reporting that the regulatory burden is preventing them from hiring more workers or increasing pay and benefits,” said NAM President and CEO Jay Timmons. “Congress and the administration can help correct this trend by restoring sensible regulations, enacting further permitting reforms, taking action to keep our tax code competitive and other bipartisan steps to strengthen manufacturing in America and build on the progress we achieved with tax reform, the Bipartisan Infrastructure Law, the CHIPS and Science Act and more.”

Key Survey Findings:

- Only 65.1% of respondents felt positive in their company’s outlook, edging down from 67.0% in the second quarter. It was the fourth straight reading below the historical average (74.9%).

- Concern about an unfavorable business climate was the highest in six years (Q2 2017).

- The survey found that 69.1% of small manufacturers, and 63.2% of all respondents, would hire more workers or increase compensation if the regulatory burden decreased.

- More than 70% of manufacturers would purchase more capital equipment if the regulatory burden on manufacturers decreased, with 48.6% increasing compensation, 48.6% hiring more workers, 42.5% expanding their U.S. facilities and 38.4% investing in research.

- The top challenges facing manufacturers include attracting and retaining a quality workforce (72.1%), weaker domestic economy (60.7%), rising health care/insurance costs (60.1%), unfavorable business climate (56.7%), increased raw material costs (45.5%) and supply chain challenges (37.8%).

You can learn more at the NAM’s online regulatory action center here.

The NAM releases these results to the public each quarter. Further information on the survey is available here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM, KAM Bring Suit Against SEC

The NAM and the Kentucky Association of Manufacturers are hitting back against an attempt by the Securities and Exchange Commission to force privately held businesses to make public financial disclosures.

What’s going on: On Tuesday, the NAM and KAM filed suit in federal court challenging the SEC’s novel reinterpretation of its Rule 15c2-11.

- The reinterpretation—on which the SEC has not granted companies the opportunity to comment—would require private firms to release confidential financial information publicly.

The background: Rule 15c2-11 requires disclosures to protect investors in publicly traded companies issuing so-called “penny stocks.” But the SEC has broadened the rule’s application to include privately held companies that issue corporate bonds to large institutional investors under an entirely different regulation, called Rule 144A.

- Everyday investors can’t purchase corporate bonds issued under Rule 144A, so there is no reason to require public disclosures from these businesses.

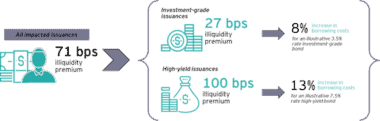

Why it’s important: Expanding Rule 15c2-11 will mean higher borrowing costs and reduced liquidity in both the manufacturing industry and throughout the larger economy, according to a new EY report released by the NAM.

- The reinterpretation would lead to job losses of more than 100,000 every year, according to the analysis.

Manufacturers speak out: “The SEC never allowed public comment on its novel reinterpretation of Rule 15c2-11, there is no conceivable benefit to the new standard and the SEC did not consider the impact that its about-face will have on privately held businesses,” said NAM Chief Legal Officer Linda Kelly. “The NAM Legal Center is filing suit to hold the SEC accountable and protect manufacturing growth, job creation and U.S. competitiveness.”

- KAM President and CEO Frank Jemley added: “The SEC’s unlawful overreach threatens privately held manufacturers in Kentucky and across the country, so the Kentucky Association of Manufacturers is proud to join the NAM in this important litigation.”

Manufacturers Sue SEC to Protect Private Businesses, Release Data on Harmful Impact of Novel Rule Interpretation

Washington, D.C. – The National Association of Manufacturers and the Kentucky Association of Manufacturers filed a lawsuit in federal court today challenging the Securities and Exchange Commission’s attempt to impose unwarranted public disclosure requirements on privately held businesses.

The SEC has adopted a novel reinterpretation of SEC Rule 15c2-11, imposing the rule’s public disclosure requirements on private companies that raise capital via corporate bond issuances under SEC Rule 144A—without giving manufacturers the opportunity to provide comment on the damaging impacts of such a consequential change.

According to EY economic analysis released by the NAM today, the SEC’s expansion of Rule 15c2-11 will result in decreased liquidity and increased borrowing costs in the manufacturing industry and throughout the economy—leading to job losses exceeding 100,000 annually.

“The SEC’s attempt to force private companies to disclose confidential financial information publicly is a clear violation of the Administrative Procedure Act,” said NAM Chief Legal Officer Linda Kelly. “The SEC never allowed public comment on its novel reinterpretation of Rule 15c2-11, there is no conceivable benefit to the new standard, and the SEC did not consider the impact that its about-face will have on privately held businesses—which could exceed 100,000 lost jobs each year. The NAM Legal Center is filing suit to hold the SEC accountable and protect manufacturing growth, job creation and U.S. competitiveness.”

“The SEC’s unlawful overreach threatens privately held manufacturers in Kentucky and across the country, so the Kentucky Association of Manufacturers is proud to join the NAM in this important litigation on behalf of all manufacturers in the U.S. to counter the SEC’s regulatory onslaught,” said KAM President and CEO Frank Jemley.

EY analysis highlights the damaging economic impacts of the SEC’s actions:

The economic impacts of the SEC’s expansion of Rule 15c2-11 will be felt disproportionately in the manufacturing industry, which accounts for more than half of all nonfinancial issuers of corporate bonds under Rule 144A. Across the economy, the change will result in 30,000 jobs lost each year over the first five years the new interpretation is in effect. The job losses will increase over time—rising to 50,000 jobs lost each year after five years and 100,000 jobs lost each year after 10 years.

These job losses are attributable directly to the decreased liquidity and increased borrowing costs associated with the SEC’s new interpretation.

Background:

- SEC Rule 15c2-11 requires broker-dealers to ensure that key information about companies issuing over-the-counter equity securities is current and publicly available prior to quoting those issuers’ securities.

- SEC Rule 144A allows for resales of securities (primarily corporate debt issuances) to qualified institutional buyers—large financial institutions that own or manage more than $100 million in securities. Retail investors cannot purchase Rule 144A securities. Notably, under Rule 144A, issuers are obligated to make their financial and operational information available to QIBs.

- In September 2021, the SEC’s Division of Trading and Markets issued a no-action letter applying Rule 15c2-11 to Rule 144A debt. This decision contradicted the historical application of Rule 15c2-11 to OTC equity securities and bypassed important rulemaking safeguards required by the Administrative Procedure Act.

- The NAM and the KAM filed petitions for rulemaking with the SEC in November 2022 seeking both permanent and temporary relief from the application of Rule 15c2-11 to Rule 144A securities. Following the petitions, the SEC temporarily delayed enforcement of its novel reinterpretation until January 2025, but the agency has not acted to reverse this damaging decision permanently.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

ANWR Lease Holder Will Fight Cancelation

The owner of seven oil-and-gas leases that were recently canceled by the Biden administration is readying for a legal fight, according to POLITICO’s ENERGYWIRE (subscription).

What’s going on: The Alaska Industrial Development and Export Authority—which bought the leases from the federal government in 2021—“has vowed to pursue legal action against the federal government for the cancellation of the leases spanning 365,000 acres in the coastal plain of the Arctic National Wildlife Refuge.”

- Last week, the Interior Department announced that it would nullify the leases “based on what the administration called an inadequate National Environmental Policy Act review process.”

- “A willingness to circumvent laws passed by Congress has consequences reaching far beyond ANWR’s boundaries, and will impact future development across this country,” the economic development organization responded in a statement.

Required by law: While canceling the leases appears to fall under Interior’s purview, the agency is obligated by the 2017 tax law to offer two lease sales in ANWR, according to former Interior Secretary David Bernhardt, ENERGYWIRE reports.

Why it’s important: ANWR is estimated to hold more than 10 billion barrels of technically recoverable oil. Drilling for it would create more than 100,000 jobs while generating hundreds of billions of dollars in new government revenue, according to data from the House Committee on Natural Resources cited in USA Today.

Our take: “The administration should be taking actions that strengthen energy security, not weaken it,” said NAM Vice President of Domestic Economic Policy Brandon Farris.

- “The cancellation of the ANWR leases based on the NEPA review process underscores our need to continue to reform our broken permitting system. The NAM continues to push Congress and the administration to develop policies that cut through red tape to develop all energy projects, including renewables, nuclear, oil and gas, hydrogen and more.”

Employee Overtime Rule Would Cost Manufacturers

An overtime pay rule proposed last week by the Biden administration could cost employers—including manufacturers—up to $664 million over a decade, according to Inc. magazine.

What’s going on: A draft regulation set forth last week by the Labor Department “would require employers to provide overtime pay to salaried workers who earn less than $1,059 per week, or around $55,000 per year. The current overtime threshold is $35,568. The Labor Department is responsible for setting the threshold that requires employers to pay out overtime.”

- In compliance with the Fair Labor Standards Act, many companies already pay overtime to hourly employees who work more than 40 hours a week. While the FLSA doesn’t apply to salaried workers, the new requirement would.

Why it’s problematic: If the rule goes into effect, its cost to employers could be as high as “$664 million (with a 7 percent discount rate) over a 10-year period,” according to the Labor Department—and that’s a price manufacturers can ill afford, according to the NAM.

- “Manufacturers have spent the past several years adapting operations and personnel management resources to meet the evolving needs of their workforce in a post-pandemic environment, including through improved wages and benefits and productive workplace accommodations,” said NAM Managing Vice President of Policy Chris Netram.

- “The … proposed rule would inject new regulatory burdens and compliance costs to an industry already reeling from workforce shortages and an onslaught of other unbalanced regulations.”

What’s next: Once published in the Federal Register, the draft regulation will be subject to a 60-day public comment period.

West Coast Dockworkers Ratify Contract

Late last week, West Coast dockworkers voted to ratify a long-term employment contract that was agreed upon earlier this summer, The Wall Street Journal (subscription) reports.

What’s going on: Approximately 75% of International Longshore and Warehouse Union members voted in favor of the six-year labor contract with the Pacific Maritime Association.

- This ratification vote formalizes the tentative agreement reached in June, which was preceded by several brief work stoppages, and is the culmination of negotiations that began in May 2022.

- “The ILWU represents about 22,000 workers at 29 ports from California to Washington state.”

Why it’s important: These negotiations, which ultimately took 14 months to resolve, were at times tumultuous, and the resulting supply chain disruptions led to a significant loss of West Coast cargo business to the East and Gulf coasts.

- Together the ports of Los Angeles and Long Beach constitute the busiest ocean trade gateway in the U.S., handling almost 40% of U.S. imports from Asia, according to the Los Angeles Times.

- The NAM consistently advocated for a resolution to these talks and commissioned an economic impact study in 2022 that found even a 15-day shuttering of these two West Coast ports would cost the U.S. economy nearly half a billion dollars a day and 41,000 jobs.

The NAM says: “Ratification of this six-year contract provides manufacturers with the supply chain reliability they need for operational planning and stability,” said NAM Director of Infrastructure and Labor Policy Ben Siegrist.

- “NAM members have overcome countless shipping challenges over the past few years and were at the forefront of calling for this resolution. We are pleased the contract has been ratified.”

NLRB Revives Troubling “Card Check” Process

Bringing back parts of a policy it dropped more than half a century ago, the National Labor Relations Board moved late last week to reinstate an abridged version of “card check,” according to Reuters (subscription).

What’s going on: In a “3-1 decision in a case involving building materials company Cemex Construction Materials,” the NLRB unveiled a new framework last Friday that revives the 1949 Joy Silk doctrine, which holds that “employers must bargain with unions unless they have a good-faith doubt that majority support exists.”

The background: The board had tossed out the doctrine in the early 1970s after the Supreme Court’s decision in NLRB v. Gissel Packing Co., in which the court held that “the NLRB could force employers to bargain with unions when they engage in misconduct so severe that any election would be tainted.”

- This new decision “could provide a major boost to unions by allowing them to represent workers in certain cases when a majority sign cards in support of unionizing, rather than going through the lengthy and often litigious election process.”

- Last week’s move also came a day after the board finalized a return to Obama-era regulations purportedly aimed at speeding up union elections.

Why it’s problematic: Card check—which the NAM has long opposed—is inherently unfair and insecure, and it strips employees of their right to secret ballots, said NAM Director of Infrastructure & Labor Policy Ben Siegrist.

- “The NLRB’s decision could create a glide path to force unionization on workers without the necessary safeguards of an election, and it runs counter to 50 years of precedent established by the Supreme Court,” he said. “Effectively, this action contradicts the rights all employees have in determining their own representation.”

Manufacturers Signal Concerns with Proposed DOL Overtime Rule

NAM: DOL’s proposed rule would inject new regulatory burdens and compliance costs to an industry already reeling from workforce shortages

Washington, D.C. – In response to the U.S. Department of Labor’s issuance today of a proposed rule altering the exemptions for overtime eligibility under the Fair Labor Standards Act, National Association of Manufacturers Managing Vice President of Policy Chris Netram issued the following statement:

“Manufacturers have spent the past several years adapting operations and personnel management resources to meet the evolving needs of their workforce in a post-pandemic environment, including through improved wages and benefits and productive workplace accommodations. The DOL’s proposed rule would inject new regulatory burdens and compliance costs to an industry already reeling from workforce shortages and an onslaught of other unbalanced regulations.

“Creating new regulatory processes and imposing additional mandatory costs will act as a drag on the sector and upend productive employer–employee relations. We look forward to expressing our concerns with this proposal directly to the DOL and administration leaders as the process moves forward.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM: Auto Worker Strike Would Harm Economy

As manufacturers continue to reel from supply chain disruptions, the NAM is calling for a swift resolution to forestall a potentially devastating United Auto Workers strike.

What’s going on: The UAW is negotiating a new labor agreement with important automotive manufacturers, as the current contract expires Sept. 14.

Why it’s important: The automotive manufacturing industry in the U.S. is one of the strongest and most productive in the world, and it significantly supports the health of the U.S. economy.

- A strike of 143,000 UAW members against Detroit’s “Big Three” auto manufacturers could mean an economic loss of $5.617 billion after just 10 full days, according to a new report by Anderson Economic Group.

- Nationwide, every $1 spent in the transportation-equipment sector causes another $1.59 to be spent elsewhere—for a total economic impact of $2.59, according to NAM calculations using 2021 IMPLAN data.

- In 2022, the total value-added in motor vehicles and parts in the U.S. was $171.6 billion, according to the Bureau of Economic Analysis.

State-level impact: In 2019, a 42-day auto-worker strike at one of the Detroit manufacturers “sent the state of Michigan into a one-quarter recession” and resulted in an economic loss of $4.2 billion, according to reporting by The Detroit News.

- As of 2021, the latest year for which this data is available, Michigan’s total output from motor vehicles, bodies and trailers, and parts manufacturing was $37.5 billion, accounting for 37% of total manufacturing output in the state, according to the BEA.

- At the same time, Michigan had 175,745 full- and part-time employees in the sector, or 28.7% of all manufacturing employees in the state.

- Meanwhile, the total output of Illinois’ auto sector accounted for 19.3% of the state’s total manufacturing output, while employment came to 23.6% of the state’s manufacturing employees.

Undermining manufacturing in the U.S.: “Manufacturers in America, especially in the automotive sector, operate in an integrated supply chain, which means that small and medium-sized manufacturers around the country—in union and non-union shops—would endure the consequences of a stoppage. As we continue to emerge from the global pandemic and work to get our economy on a sustainable track, a strike would be devastating for working families across our country,” said NAM President and CEO Jay Timmons.

- “President Biden has prioritized strengthening manufacturing in America, but that will be quickly undermined if a strike occurs. The administration should be encouraging a swift resolution to avoid ripple effects throughout the broader manufacturing economy and in communities from coast to coast.”

House Majority Whip Emmer, NAM Spotlight Cost of Regulations and Policies to Boost Manufacturing

Princeton, MN – The National Association of Manufacturers hosted House Majority Whip Tom Emmer (R-MN) at Glenn Metalcraft for a facility tour on Monday to discuss the impact of the current regulatory burden manufacturers are facing across federal agencies.

Leaders also discussed manufacturers’ policy priorities as outlined in the latest version of “Competing to Win,” the NAM’s comprehensive blueprint to bolster manufacturers’ competitiveness.

“My visit to Glenn Metalcraft demonstrated the need to address the regulatory state overwhelming manufacturers in the heartland. Small and medium-sized manufacturers are working hard to grow their businesses and increase compensation for employees, but those efforts are undermined by new regulations and the lack of permanent, competitive tax policies to promote research and development and capital investment,” said House Majority Whip Tom Emmer. “I want to thank the National Association of Manufacturers and Glenn Metalcraft for providing insight that will guide my work in Congress.”

“Manufacturers across the country are fighting to thrive under the weight of an increasing number of unbalanced and often unfeasible regulations from agencies across the federal government—all amid an uncertain economic environment,” said Glenn Metalcraft President and CEO Joe Glenn. “Glenn Metalcraft would like to thank Whip Emmer and the National Association of Manufacturers for giving us a voice and calling attention to this issue.”

“Manufacturers are struggling to navigate substantial regulations from Washington on top of the deluge of new laws from St. Paul. We appreciate Whip Emmer for expanding our state-level efforts on the national stage,” said Minnesota Chamber President and CEO Doug Loon. “The National Association of Manufacturers is an excellent partner in championing policies for businesses to grow and compete globally. We appreciate their efforts with the Biden administration and Congress to hold agencies accountable and deliver sensible regulations.”

“The barrage of federal regulations from Washington has created serious concern across our industry, with manufacturers reporting that it’s standing in the way of job creation, investment and wage growth. Manufacturers have made it clear that the administration’s regulatory agenda could easily derail manufacturing’s recent success. Glenn Metalcraft and so many others are forced to make tough decisions as agencies issue unbalanced regulations that threaten our sector’s ability to grow and compete,” said NAM President and CEO Jay Timmons. “The positive effects of tax reform, the Bipartisan Infrastructure Law and the CHIPS and Science Act are all being undermined by the growing regulatory burden, and I want to thank Whip Emmer for spotlighting this threat in his home state of Minnesota.”

Background: Recently, the NAM, members of the NAM’s Council of Manufacturing Associations and Conference of State Manufacturers Associations launched Manufacturers for Sensible Regulations, a coalition addressing the impact of the current regulatory onslaught coming from federal agencies.

According to the NAM’s Q2 2023 Manufacturers’ Outlook Survey, more than 63% of manufacturers report spending more than 2,000 hours per year complying with federal regulations, while more than 17% of manufacturers report spending more than 10,000 hours. The NAM survey also highlighted that only 67% of manufacturers are positive about their own company’s outlook, the lowest percentage since Q3 2019. It shows the consequences of regulations: If the regulatory burden on manufacturers decreased, 65% of manufacturers would purchase more capital equipment, and more than 46% would increase compensation.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.