How Close Is the Smart Factory of the Future?

Manufacturing is marching toward a future that is highly automated, intelligent and flexible.

Increasingly, smart factories are made up of connected machines that generate large amounts of data. This opens the door for artificial intelligence–driven analysis and new opportunities for insights on improving supply chains, processes, the customer experience, product quality and more.

But realizing this transformation can be difficult. Not all manufacturers have the resources, capital or talent required for a smart factory future. How are companies progressing on this journey, and what challenges stand in the way? To find out, the Manufacturing Leadership Council—the NAM’s digital transformation arm—conducted its Smart Factories and Digital Production survey.

Manufacturers are committed to M4.0: When it comes to digital technology, manufacturers are spending at a steady—and in some cases growing—basis.

- Nearly 69% of survey respondents said their M4.0 investments this year would continue unchanged from last year.

- Nearly 19% said they would increase investments, while just 10% said their investments would likely decline.

- Some 58% assessed their company’s digital maturity level in manufacturing operations at three to five on a scale of 10, suggesting the industry has moved beyond the initial stages of M4.0 and has reached an early majority of digital-model adoption.

How widespread are digital factories? Only about 7% of manufacturers say they have digitized their factory operations extensively.

- Approximately 15% expect to have their manufacturing operations digitized end-to-end by 2026.

- About 5% say their factories are already “very smart.”

- Approximately 53% say their factories and plants are getting smarter but are still works in progress.

In the future, will factories run themselves? While some manufacturers foresee a future of “lights out” factories, or those that mostly run themselves, most don’t think they will ever reach that state.

- About 49% of respondents expect fully or partially autonomous factories in the future.

- Some 40% say AI will be either very significant or somewhat significant in the years to come.

- Approximately 56% cite organizational resistance to change as the top barrier to implementing a smart factory.

For more details on these findings and the impact of smart factories as a whole, read the survey report: Smart Factories Are Still a Work in Progress.

NAM, Allies File Suit Against EPA Over Air Standard

The NAM and seven association partners have filed suit against the Environmental Protection Agency to challenge the office’s overly stringent, recently finalized rule on particulate matter, or PM2.5, the NAM said Wednesday.

What’s going on: The eight groups filed suit in the D.C. Circuit to push back on the EPA’s National Ambient Air Quality Standards rule, which last month it lowered from 12 micrograms per cubic meter of air to 9, a 25% reduction and a stifling burden on manufacturers, the NAM said.

- “In pursuing this discretionary reconsideration rule, the EPA should have considered the tremendous costs and burdens of a lower PM2.5 standard,” said NAM Chief Legal Officer Linda Kelly. “Instead, by plowing ahead with a new standard, the agency not only departs significantly from the traditional NAAQS process, but also gravely undermines the Biden administration’s manufacturing agenda—stifling manufacturing investment, infrastructure development and job creation in communities across the country.”

- Participating in the suit with the NAM—which has repeatedly urged the EPA against overtightening the standard—are the American Chemistry Council, the American Forest & Paper Association, the American Petroleum Institute, the American Wood Council, the U.S. Chamber of Commerce, the National Mining Association and the Portland Cement Association.

Why it’s important: If it’s enacted, the stricter PM2.5 standard would cost businesses and the U.S. economy huge sums, hampering company operations and job growth and forcing tough choices on states and towns nationwide.

- The total cost of complying with the new acceptable concentration level could be as much as $1.8 billion, according to the EPA’s own estimates—and that number could go up.

- What’s more, it would make the U.S. less competitive globally. “Europe’s current PM standard is 25; China’s is 35,” NAM Managing Vice President of Policy Chris Netram told the House Energy and Commerce Subcommittee on Environment, Manufacturing and Critical Materials last month. “If we want the next manufacturing dollar to be spent in America rather than abroad, a standard of 9 is simply not feasible.”

NAM in the news: The New York Times (subscription) covered the lawsuit.

Previewing the State of the Union

With President Biden set to deliver the State of the Union address Thursday, manufacturing is likely to be in the spotlight once again. At the NAM, we will be listening closely for our key priorities—those that have been achieved and those still in progress.

Promises kept: President Biden has been a partner on a range of issues that are key to manufacturers across the United States. We hope he will outline how pro-growth legislation has helped set the stage for manufacturing growth, with industry employment reaching a 15-year high.

- CHIPS Act: The CHIPS and Science Act marked a major push to boost manufacturers’ competitiveness, supporting large and small businesses up and down the supply chain by investing in domestic semiconductor production and funding programs to support the STEM workforce, advanced technology development, excavation of critical minerals, clean energy and more.

- Bipartisan Infrastructure Bill: President Biden secured a bipartisan $1.2 trillion infrastructure bill, a long-sought, major achievement for manufacturers throughout the country, offering transformational upgrades and significant investments in America’s manufacturing capabilities.

- Inflation Reduction Act: Some of the provisions in the Inflation Reduction Act supported manufacturers across the United States, with direct investments and tax credits generating a major increase in manufacturing construction and jobs.

- Ukraine: The Biden administration has been unwavering in its support of Ukraine. The NAM—which in March 2022 passed a unanimous resolution denouncing Russia’s invasion of the country—has kept the pressure on Congress to pass the stalled Ukraine aid bill.

Progress to come: But this progress will be undermined if the Biden administration continues to issue onerous regulations and call for policies that make it harder to innovate, invest and expand in America. The NAM is working hard to push back against items that would harm manufacturers and encourage the president to refrain from pursuing policies that will make us less competitive.

- Taxes: The NAM is pushing back against any new taxes or attempts to increase tax rates on manufacturers, and we are pressing for tax policies that will make it easier to invest in the future—including the “tax trifecta” found in the recently House-passed Tax Relief for American Families and Workers Act. The NAM urges the Senate to approve these business tax provisions quickly.

- Protecting intellectual property: Late last year the administration proposed invoking “march-in” rights to seize the patents of any products it deems too costly—if those innovations were developed in any part with federal dollars. This move, which would open the door to similar actions in other sectors of manufacturing, would undermine manufacturers’ IP rights, disincentivize early-stage entrepreneurship and dissuade capital investment, all of which could jeopardize our ability to develop future cures. This is just one example of how actions that undermine manufacturers’ IP can have dangerous unintended consequences.

- Regulations: Burdensome rules—such as the tighter National Ambient Air Quality Standards from the Environmental Protection Agency and the Department of Energy’s recent freeze of liquefied natural gas export permits—are preventing manufacturers from creating jobs and harming U.S. competitiveness. We need to end the regulatory onslaught and give manufacturers the chance to grow.

- Energy: Manufacturers in America are at the forefront of the planet’s work to reduce emissions and promote sustainable energy. But to be effective, we need to embrace an all-of-the-above energy strategy that uses the fuel we have while developing the tools we need.

- Immigration: Immigration and border security reforms must be a priority for the administration and Congress. Inaction poses significant economic risks—especially at a time when manufacturers have 600,000 open jobs. Manufacturers are leading on bipartisan solutions, like those found in our A Way Forward plan.

The last word: “Our commitment is to work with anyone, and I truly mean anyone, who will put policy—policy that supports people—ahead of politics, personality or process,” said NAM President and CEO Jay Timmons. “Because here’s what I know: Manufacturers are building an incredible future for our country and our world. And we need partners in the federal government who will work with us to reduce burdens on manufacturers and manufacturing workers, rather than creating barriers to our success.”

Learn more: For more information on the state of manufacturing, check out the 2024 NAM State of Manufacturing Address here.

Previewing the SEC’s Climate Rule

For the past two years, the U.S. Securities and Exchange Commission has been considering a rule that would require businesses to report huge amounts of information about companies’ climate-related risks, strategies and impacts. As the SEC prepares to release its final version of the rule this Wednesday, we spoke with NAM Vice President of Domestic Policy Charles Crain about what manufacturers should expect.

The background: In March 2022, the SEC proposed what the NAM has called an overreaching, unworkable and burdensome climate disclosure rule. According to Crain, the initial proposal would have required extensive disclosures as well as invasive tracking procedures to gauge climate impact and emissions throughout companies’ supply chains—significantly increasing costs and liability for manufacturers.

- “The proposal would have had major implications for the entire manufacturing sector, including both large and small public companies—and even privately held businesses throughout manufacturing supply chains,” said Crain. “As proposed, the rule represents a significant threat to manufacturing competitiveness.”

The pushback: In the two years since the rule was first proposed, the NAM has pressed for significant changes—in detailed letters to the SEC, in congressional testimony and in meetings with SEC commissioners and staff.

- “Manufacturers have made it a top priority over the past two years to convince the SEC that they need to change their approach,” said Crain. “The NAM has spent significant time and effort explaining to the SEC why its proposal was unworkable and likely unlawful and illustrating the impact of the rule’s overwhelming cost burden on manufacturers.”

- “But we also offered specific and actionable suggestions to help the agency tailor the rule, make it more workable to manufacturers and bring it back within the SEC’s statutory authority.”

The preview: With the SEC set to publish its final rule tomorrow, Crain says the NAM is keeping an eye on key inflection points, including the following:

- Scope 3 emissions reporting: The proposal’s Scope 3 mandate would require public companies to disclose the emissions of their supply chain partners—including small and family-owned businesses. If Scope 3 is curtailed or absent, that would represent significant progress for manufacturers.

- Financial statement reporting requirements: The NAM will be tracking the degree to which companies are required to incorporate climate information into their financial statements. The NAM called the proposal’s approach to financial statement reporting “unworkable [and] highly burdensome.”

- Materiality: The SEC is only allowed by law to require “material” disclosures—i.e., financial information that allows investors to make informed decisions. Mandates in the final rule that require immaterial disclosures or seek to redefine materiality could exceed the SEC’s legal authority.

- Implementation: The NAM will consider when and how the rule takes effect, and whether the SEC has provided scaled requirements for smaller companies or tailored implementation plans for certain provisions within the rule.

- Small-business impact: The proposal would have harmed small and privately held businesses disproportionately. The SEC must do a better job at protecting these companies in the final rule.

The expectation: Crain says the NAM’s advocacy appears to have made a difference.

- “Recent news reports suggested that some provisions in the rule may have been modified in alignment with the NAM’s suggested changes,” said Crain. “But it remains to be seen whether the final rule, taken as a whole, is actually workable for manufacturers.”

The next step: The NAM’s next moves will depend on the specifics of the final rule—but the conversation is unlikely to end there.

- “The NAM has been clear that a failure to bring the rule back within the agency’s statutory authority could invite legal action. On the other hand, a balanced, workable rule could obviate the need for litigation,” said Crain.

- “Regardless of the exact content of the rule, the NAM is committed to providing resources to our members to help companies understand and comply with any new requirements. We will also continue to engage with the SEC and Congress to address any implementation issues, seek guidance on any unclear provisions and, if necessary, push for changes to the final rule.”

- “As we have for the past two years, the NAM will continue to advocate on manufacturers’ behalf.”

Trend of the Week: Process Innovation

Amid an uncertain economy, manufacturers will have to reinvent and upgrade their processes, from training employees to organizing supply chains and more. For today’s manufacturing trend of 2024, we’re looking at manufacturers’ efforts to improve their processes across their operations.

What manufacturers should do: Manufacturers looking to guard against economic upheaval should consider these steps, according to NAM experts:

- Consider improvements to techniques, tools, software, technologies and behaviors.

- Streamline customer service and the way products are sold to customers.

- Optimize the supply chain with help from partners, automation and design improvements.

- Reinvent processes to realize benefits (e.g., speed time to market, cut costs, work around supply challenges).

Expert opinion: Manufacturers are investing heavily in innovation, even as budgets have become tighter, according to EY Americas Industrial Products Sector Leader Brian M. Legan.

- As he points out, “Nearly half (49%) of manufacturing CEOs who participated in the EY CEO Outlook Survey plan on accelerating or maintaining current levels of innovation investment and portfolio transformation.”

- Meanwhile, “more than half of these CEOs (56%) also indicated that the main source of financing for these investments will be from savings generated from business performance improvements.”

Resources for you: Check out these NAM resources to learn more about manufacturers’ process improvements:

- The Innovation Research Interchange is an NAM division devoted to studying the next wave of manufacturing innovation and providing manufacturers with the resources they need to benefit from it.

- You can also get an inside look at process innovation by attending the Manufacturing Leadership Council’s plant tours. (The MLC is the NAM’s digital transformation division.)

Read the full 2024 trends report here.

NAM: Withdraw Administration March-in Framework Now

The Biden administration’s proposed “march-in” framework would be devastating for American innovation and competitiveness and must be withdrawn immediately, according to the NAM.

What’s going on: In December, the administration issued proposed guidelines to enable the government to “march in” and seize manufacturers’ patents if their products were developed in any part with federal dollars.

- But the move—which a bipartisan group of 28 legislators opposed in a letter to the White House last week—would be fundamentally ruinous to manufacturing in the U.S., according to the NAM.

- “Undermining America’s world-leading patent system is a recipe for reduced innovation and significant economic damage, with a disproportionate impact on small manufacturers,” said NAM Vice President of Domestic Policy Charles Crain.

Price controls: The proposal is tantamount to government price controls, the NAM said.

- “If finalized, this threat to innovation would for the first time enable the government to set price controls on products that incorporate [intellectual property] from early-stage federally funded research.”

- “Manufacturers that do not comply with the proposal’s arbitrary and uncertain pricing criteria could see the government march in, seize their IP and license it to a competitor.”

Undoing advancements: Prior to the 1980 enactment of the Bayh-Dole Act, which allowed for the commercialization of federally funded research, groundbreaking discoveries “often remained stuck in the lab, as private-sector entrepreneurs and investors were unwilling to license innovative technologies given the uncertain path to commercialization,” the NAM said.

- “Limiting manufacturers’ ability to commercialize groundbreaking innovation means that early-stage research will remain on the shelf in university labs.”

Table Saw Standard Would Cost Manufacturers

If implemented, a safety standard proposed by the Consumer Product Safety Commission for table saws will harm manufacturing in the U.S., the NAM told the CPSC this week.

What’s going on: “The Commission’s proposed rule itself outlines that, if implemented, the cost of table saws would more than double, small manufacturers may be forced to exit the market, businesses may be unable to operate and sales of table saws will decrease,” NAM Senior Director of Tax Policy Alex Monié said during testimony at a hearing Wednesday.

- The rule would require table saws—those motor-driven, wood-mounted, circular saw blades used daily in multiple industries to cut wood, plastic and other materials—to come equipped with patented active injury mitigation technology.

- Bringing currently on-the-market table saws into compliance could cost manufacturers from $100,000 to $700,000 per model and take up to three years, Monié said.

The background: In October 2023, the CPSC voted to issue a Supplemental Notice of Proposed Rulemaking promulgating the table saw safety guideline, in response to the petition of a company that holds more than 100 patents “related to the AIM technology the Commission would mandate,” Commissioner Peter A. Feldman told fellow commissioners that month.

- There are voluntary safety standards in place for table saws, requiring modular blade-guard systems, and these “are working as the market demands,” Monié told the commissioners.

Instituting a monopoly: In addition to costing manufacturers huge sums, the proposed standard “would have the effect of instituting a monopoly, as the proposed rule is the latest in a series of Commission actions to impose a standard that could be achieved only through the use of one claimed patented technology,” Monié continued.

Unjustifiable rulemaking: Under the Consumer Product Safety Act, the CPSC cannot issue a mandatory standard unless it has found that an existing voluntary standard fails to or does not adequately prevent or reduce the risk of injury.

- “The CPSC admits that it does not have adequate data to determine that the current voluntary standard will not reduce the risk of injury,” Monié went on.

What should be done: The CPSC should withdraw the proposed standard, he said, and “readdress the cost and burden analysis in the proposed rule, with a more tailored focus on small manufacturers.”

WTO Meeting Kicks Off to Challenges; “Big Deals Unlikely”

With economic challenges and “geopolitical tensions” threatening international commerce, the World Trade Organization faces a difficult job at the 13th Ministerial Conference, according to AFP.

What’s going on: At the meeting, which began Monday in Abu Dhabi and is expected to conclude on Thursday, “[t]he WTO is hoping for progress, particularly on fishing, agriculture and electronic commerce. But big deals are unlikely as the body’s rules require full consensus among all 164 member states—a tall order in the current climate.”

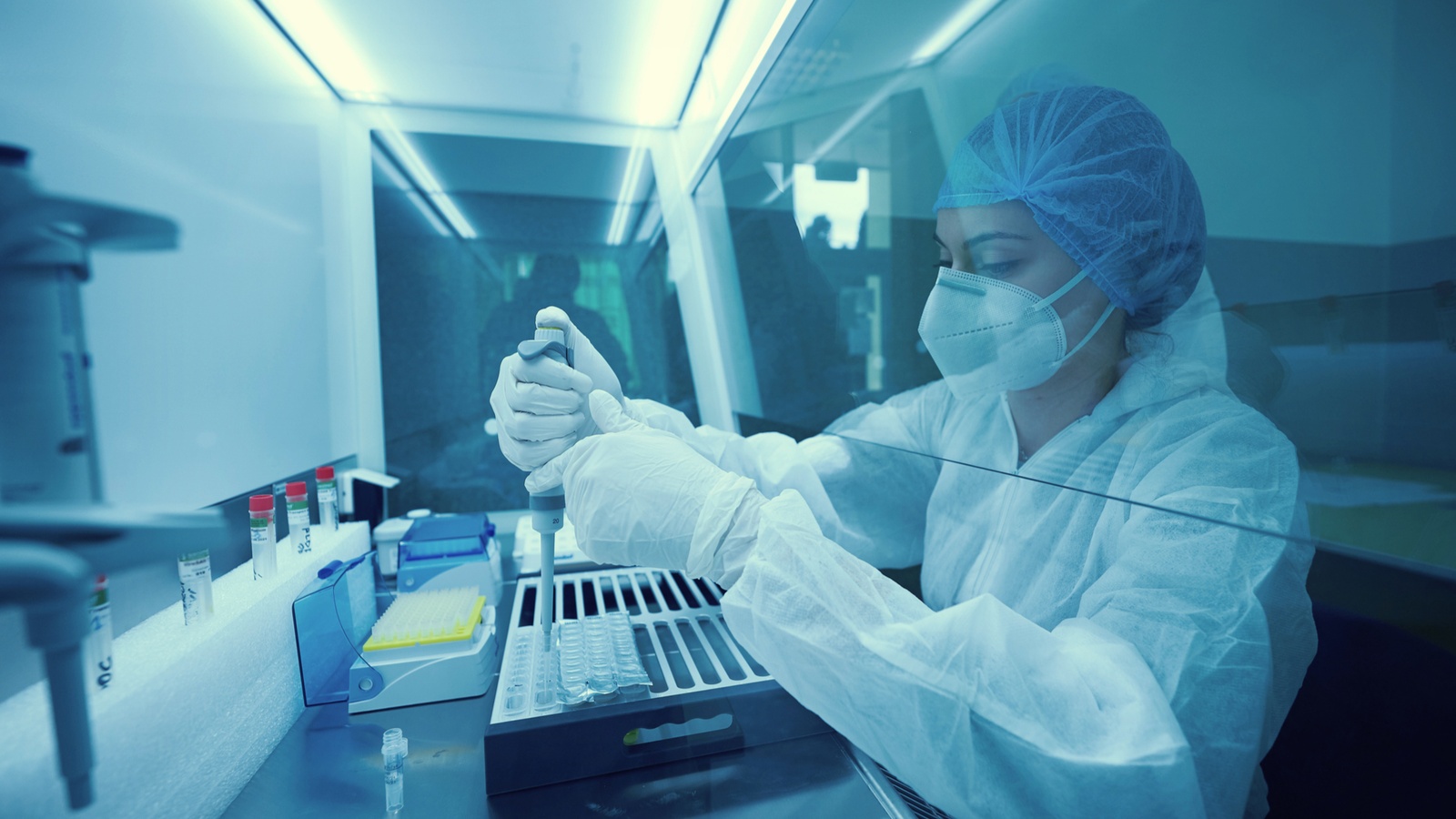

- The organization could also decide on whether to expand a 2022 TRIPS waiver to include COVID-19 therapies—a move that would be damaging to manufacturing in the U.S.

- “The WTO committee in charge of discussing intellectual property rights recently told the WTO General Council that it had been unable to reach agreement on the issue after more than 18 months of discussion,” POLITICO reports. “That could signal the end of the road for efforts to expand the waiver, but [there is] fear it could still be approved by ministers at MC13 as part of the final horse-trading that occurs to reach some deal.”

Reform needed: “Speaking on the first day of MC13, WTO Director-General said that ‘multilateralism is under attack,’ highlighting a need to ‘reform the multilateral trading system’ and boost international cooperation,” according to AFP.

- European Trade Commissioner Valdis Dombrovskis echoed the call for reform, saying, “The world has changed. And institutions like the WTO need to evolve too. We are faced with crises wherever we look.”

No waiver expansion: One change that should not take place, however, is the TRIPS waiver expansion, the NAM told U.S. lawmakers ahead of the WTO meeting. NAM President and CEO Jay Timmons met with Okonjo-Iweala and WTO Deputy Director General Angela Ellard in Geneva last March to discuss the waiver.

- “The proposed expansion of the TRIPS waiver to include diagnostics and therapeutics would jeopardize American innovation, endanger U.S. jobs, undermine future investment and research and development for lifesaving products that are fundamental to fighting global crises, including many diseases and health conditions other than COVID-19, and pose serious safety concerns,” the NAM and six association partners told Secretary of State Antony Blinken, Commerce Secretary Gina Raimondo, U.S. Trade Representative Katherine Tai and White House Chief of Staff Jeffrey Zients last week.

Digital commerce: There are some concrete actions that should be taken regarding the WTO, the NAM told the House Ways and Means Subcommittee on Trade this month.

- The USTR should reverse a decision it made in October 2023 to “drop the longstanding digital trade position of the U.S. at the WTO. This longstanding position, which has clear bipartisan support from the U.S. Congress, seeks to protect cross-border data flows, prohibit costly data localization requirements abroad, defend American digital products from discrimination and protect American IP.”

- And the U.S. should urge the WTO to institute a permanent e-commerce moratorium. Allowing the current “moratorium on customs duties for electronic transmissions … to expire would inject uncertainty and impose unfair burdens on manufacturers in the U.S.”

The last word: “The WTO remains a critical forum to advance free and fair trade globally,” said NAM Director of International Policy Dylan Clement.

- “The outcome of the 13th WTO Ministerial Conference is important because an expansion to the TRIPS waiver or letting the e-commerce moratorium expire could significantly harm manufacturers in the United States. As such, manufacturers will be watching the WTO Ministerial this week very closely.”

Arizona: Manufacturing’s Crossroads

In the heat of Arizona’s “Silicon Desert” and surrounding communities, the future of America’s global competitiveness and climate goals aren’t just being forged—they also hang in the balance.

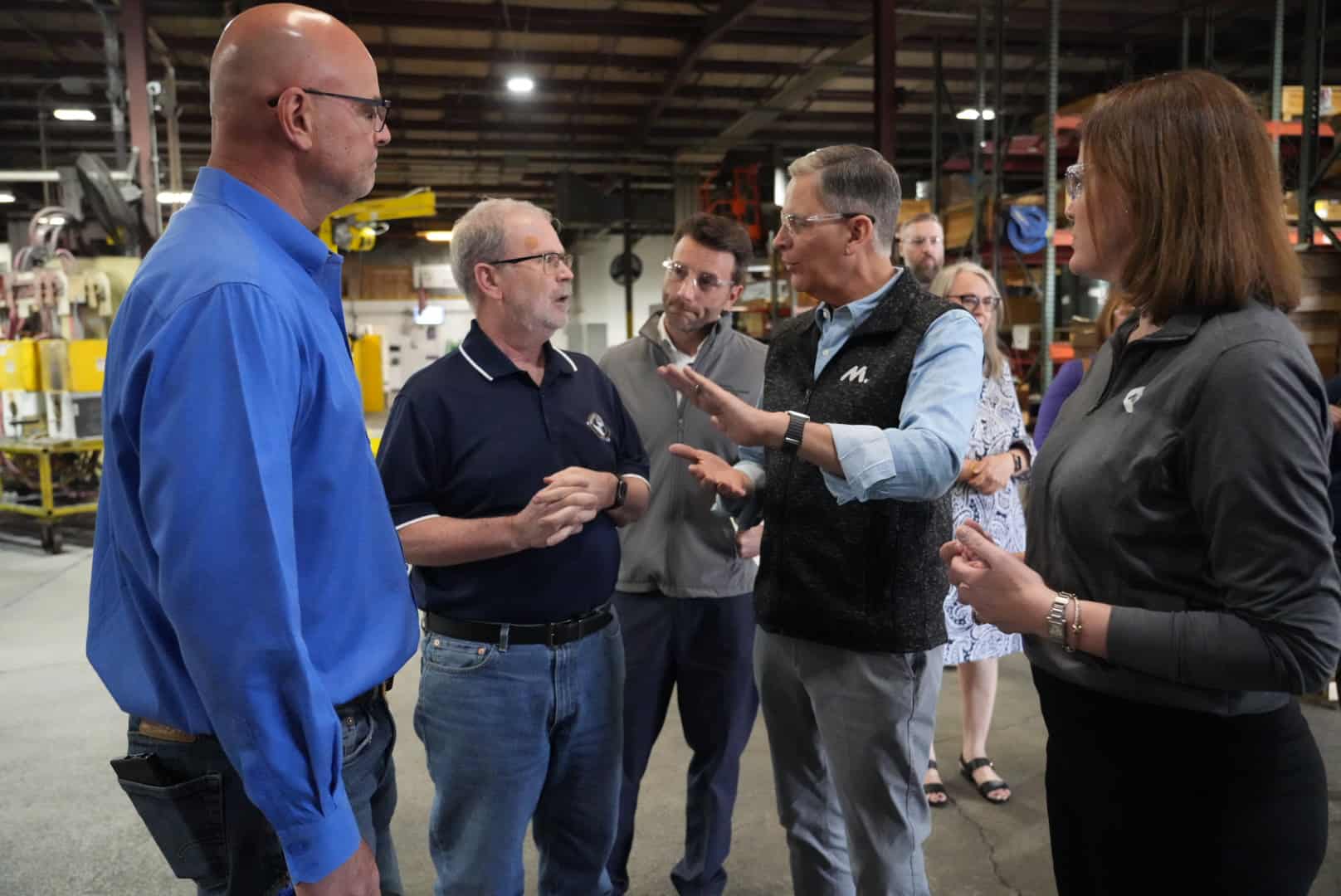

Last week for the first time in 2024, the NAM brought its Competing to Win Tour to Arizona, and that stark contrast between the status quo and the probable future was on display in Phoenix at global semiconductor equipment manufacturer Benchmark and small manufacturer Valley Forge & Bolt and at Resolution Copper in Superior.

- NAM President and CEO Jay Timmons, Manufacturing Institute President and Executive Director Carolyn Lee—who leads the NAM’s 501(c)3 workforce development and education affiliate—and Arizona Chamber of Commerce & Industry President and CEO Danny Seiden met with local manufacturers to gain their perspective and insights.

Why it matters: The Biden administration and Congress have secured key measures to bolster manufacturing in the U.S., including the NAM-championed CHIPS and Science Act and tax credits in the Inflation Reduction Act to manufacturers investing in advanced production and energy projects. But raw material, workforce and tax and regulatory policy challenges threaten to undermine policy aspirations.

Silicon Desert expansion: With the CHIPS and Science Act poised to transform the sector, Benchmark President and CEO Jeff Benck and Executive Vice President and Chief Operating Officer Dave Valkanoff led the tour of their state-of-the-art Phoenix facility.

- In a good spot: Benchmark is well-positioned for the coming growth in semiconductor equipment demand. It is focused on securing its workforce and navigating a complex regulatory landscape to maximize the opportunity.

- Workforce woes: Even with the NAM and the MI’s Benchmark-supported Creators Wanted campaign boosting the industry’s image and the MI’s FAME initiative training thousands of technicians, finding skilled labor remains the top challenge. Benchmark advances earn-and-learn programs and partnerships with Arizona State University and community colleges to help fill the pipeline, actions that, according to Lee, “can help change the game.”

- Red tape delays: Regulatory hurdles pose obstacles. Benchmark seeks streamlined permitting and sensible rules to maintain their global edge.

- Bullish outlook: Benck is optimistic about the future of U.S. manufacturing and semiconductor demand. Investments in people and technology position the company well to deliver the next generation of innovation.

Taxes and immigration: The NAM’s return visit to Valley Forge & Bolt, after a stop last year with Sen. Kyrsten Sinema (I-AZ), shone a spotlight on the real-world impact of stalled tax policy and the urgent need for reform.

- Valley Forge & Bolt saw record sales in 2023 thanks to 2017 tax reforms boosting its equipment upgrades. Now, with provisions like full capital investment expensing stalled in Congress, orders have slowed.

- CEO Michele Clarke and COO Bret Halley made the case for R&D expensing, interest deductibility and a return to full capital investment expensing. Without these, they said, job growth and America’s manufacturing competitive edge are at risk.

- Skilled workers needed: Despite its success, Valley Forge says finding skilled workers is a constant struggle. Immigration reform is a must to secure the right talent pipeline, said Clarke. “Did you notice our engineers? Most of them are under 30 because we’re snatching them right out of college,” added Clarke. “The engineering talent in this country is dwindling, and we’re not authorizing enough green cards. I, myself, was a green card holder before I became a citizen.”

Policy roadblocks: The NAM’s visit to Rio Tinto’s Resolution Copper site highlighted the urgency of permitting reform in the face of critical mineral needs.

- Copper’s critical role: Copper is essential for clean energy. Electric vehicles, solar power grids and wind turbines all demand huge quantities. Yet, the U.S. remains heavily reliant on imported copper, jeopardizing progress.

- Massive potential: The domestic solution lies within the stalled Resolution Copper mine. With its potential to supply 25% of U.S. copper demand, it’s poised to be a key piece of the puzzle.

- Project in limbo: Despite a 350-strong workforce modernizing and maintaining the mine, permitting delays stifle the project’s full impact.

- Sustainable practices: “Resolution Copper is the future of eco-conscious mining,” said NAM Managing Vice President of Brand Strategy Chrys Kefalas, who toured the site. “Their team innovates sustainable practices, leads in water conservation and even supplies 7 billion gallons of water to Arizona farms. And what is more, it isn’t just the facts of the matter or what you saw that drives this point home, but the people who have worked on the site for years make all that clear with the pride they have about the project and their determination to see Resolution Copper through to making lives better for everyone.”

- Jobs and growth: Led by President and General Manager Vicky Peacey, the project promises to contribute $1 billion annually to the economy and more than 1,500 Arizona jobs. “This is about people, jobs and supply chains; and it’s also about realizing clean energy ambitions at the speed and scale that climate goals demand,” said Kefalas.

The bottom line: “The future of U.S. manufacturing might hinge on these contrasting stories. Are we a nation that champions innovation, attracts and keeps the brightest here, supports our manufacturers and tackles climate goals with homegrown solutions, or one that stalls progress in its own backyard,” said Timmons.

- “Arizona is at the epicenter of American manufacturing’s next chapter, and with smart policies and fewer unforced errors at the federal level, we can clear the runway for growth,” added Seiden.

State of Manufacturing: Strong, But Not Guaranteed

What’s the state of manufacturing in the U.S.? Strong and resilient—but under threat.

That was the message delivered by NAM President and CEO Jay Timmons and other speakers at the NAM’s 2024 State of Manufacturing Address at RCO Engineering in Roseville, Michigan, on Thursday.

- Attending the address were nearly 100 RCO Engineering team members—some of whom are second- or even third-generation manufacturing workers—as well as local education leaders, including Macomb Community College President James O. Sawyer IV and Macomb Intermediate School District Superintendent Michael R. DeVault.

- The address was the keystone event of this week’s launch of the 2024 Competing to Win Tour, an opportunity to visit local manufacturers and report on where the industry stands at the start of 2024.

A place of strength: “The state of the manufacturing industry depends on the people in it,” Timmons said in remarks covered by POLITICO Influence (subscription). “And we are now 13 million strong—the largest in more than 15 years. If we can continue on this trajectory, this resurgence, imagine what the state of manufacturing might look like in 2030.”

- Johnson & Johnson Executive Vice President and Chief Technical Operations & Risk Officer and NAM Board Chair Kathy Wengel echoed that sentiment in her opening remarks. “Manufacturers are improving the quality of life for everyone. … Together, we can lead the way.”

- And Michigan Manufacturers Association President and CEO John Walsh told the audience at RCO Engineering, “You are making parts here that are going everywhere. It’s a phenomenal story for us in Michigan. It not only helps you as employees here, but it helps your families, it helps your communities. It builds our state. It builds our nation.”

- “Manufacturing … is an industry that is vital to our economic competitiveness,” said Macomb County Executive Mark Hackel. “In Macomb County, we’re not just witnessing the growth of manufacturing; we’re actively contributing to it. What we are doing here is creating an environment where innovation thrives and where manufacturers can grow as well as compete.”

- RCO Engineering General Manager Jeff Simek agreed. “The manufacturing brand is coming back, and it’s coming back alive—and you guys are a big, huge piece of that,” he said to loud applause.

Fork in the road: But continued manufacturing strength isn’t guaranteed, Timmons said. Rather, it’s in large part contingent on sound policy decisions by U.S. leaders.

- “We will head in the wrong direction if Congress lets taxes go up on small businesses when rates expire next year,” Timmons said. “Or if they hit you with even more regulations—regulations even harsher than ones they have in Europe. Or if they fail to solve the immigration crisis because they put politics over good policy. Or choose trade barriers rather than trade agreements, or … abandon our allies overseas and put our national security at risk.”

- The recent regulatory onslaught by federal agencies—which Timmons discussed with Fox Business earlier this week—must stop and be replaced with sensible rulemaking done in cooperation with manufacturers, he said.

- He cited the Environmental Protection Agency’s recently finalized, overly stringent standard for particulate matter and the Biden administration’s decision to freeze liquefied natural gas export permits. This “forc[es] our allies, like Europe and Japan, to buy dirtier energy from countries we can’t trust, potentially enriching the likes of Russia … undercut[ting] our most basic national security objectives,” Timmons said.

No new taxes: The NAM’s message to Congress on taxes is simple: “No new taxes on manufacturers in America,” Timmons said.

- “And while we’re at it, Congress should bring back some of the tax policies that made it easier for manufacturers to invest in the future.”

On immigration: The U.S. needs a common-sense solution to immigration, and it needs it now, Timmons said.

- While manufacturers may not like every piece of the bipartisan border deal that was recently killed in the Senate, “here was my test: Does it make us more secure than we are today? Yes. Does it make our workforce stronger than it is today? Yes. And does it help our allies overseas? Yes,” said Timmons.

Come what may: No matter what the November elections bring, manufacturers will continue to do the jobs so many people depend on them to do, Timmons concluded.

- “Our commitment is to work with anyone, and I truly mean anyone, who will put policy—policy that supports people—ahead of politics, personality or process. We will stand with you if you stand with us in advancing the values that have made America exceptional and keep manufacturing strong.”