Rockwell CEO Blake Moret Talks Supply Chains

Blake Moret thinks a lot about supply chains. The chairman and CEO of Rockwell Automation—the world’s largest company devoted exclusively to industrial automation and digital transformation—Moret is helping other manufacturers navigate the disruptions of the pandemic and the painful shortage of semiconductors.

On his way back from sharing his experiences and best practices at the World Economic Forum in Davos, Moret spoke with the NAM about the current state of the industry, his predictions for the future and what manufacturers should do to prepare.

What’s happening: Moret sees a few “overarching trends” in manufacturing:

- First is the historically high levels of demand, which had been pent up during the pandemic and is also caused by businesses trying to expand their market share.

- Second, there is also a historic shortage of components, especially the very disruptive shortage of semiconductor chips.

- Last, of course, labor and material inflation is putting additional pressure on manufacturers’ operations.

The chip shortage: The shortage of semiconductors poses the biggest near-term problem for Rockwell and the industry, Moret notes. But the demand for chips isn’t just as simple as supply chain snarls and post-pandemic rebound; it is also caused by manufacturers working to make their products “smarter than ever before”—an industry trend that isn’t likely to change anytime in the future.

- Rockwell’s solution, says Moret, is to reduce pressure on its customers by “strengthening long-term relationships and tightly aligning technology roadmaps with existing suppliers and deploying our engineering resources to find alternatives for the most severely constrained types of chips.”

When can manufacturers expect relief from this chip crunch?

- Chip manufacturers are adding “incremental capacity,” says Moret, but “it will take a while for supply and demand to balance out.”

- “Over the next year, the situation will improve,” he adds, though manufacturers may still be dealing with constraints.

Redundancy: To cope with supply chain disruptions, Rockwell has also been adding redundant capacity into its worldwide network.

- The company is increasing the number of products that can be made in more than one facility around the world.

- “Just-in-time principles are very efficient when every link in the supply chain is doing what is expected. But with disruptions like the pandemic and chip shortages, that sort of efficiency is not totally possible,” Moret says.

- “Elements of redundancy that in the past were not able to attract funding will get funded now.”

The U.S. market is a top priority, Moret adds, and Rockwell has extensive operations here.

- “Even in a high labor-cost market, the high-trained [U.S.] workforce, coupled with advanced technology, can make products that can successfully compete anywhere on earth,” he says.

After the pandemic: Now that COVID-19 restrictions are all but over, what’s in store for Rockwell?

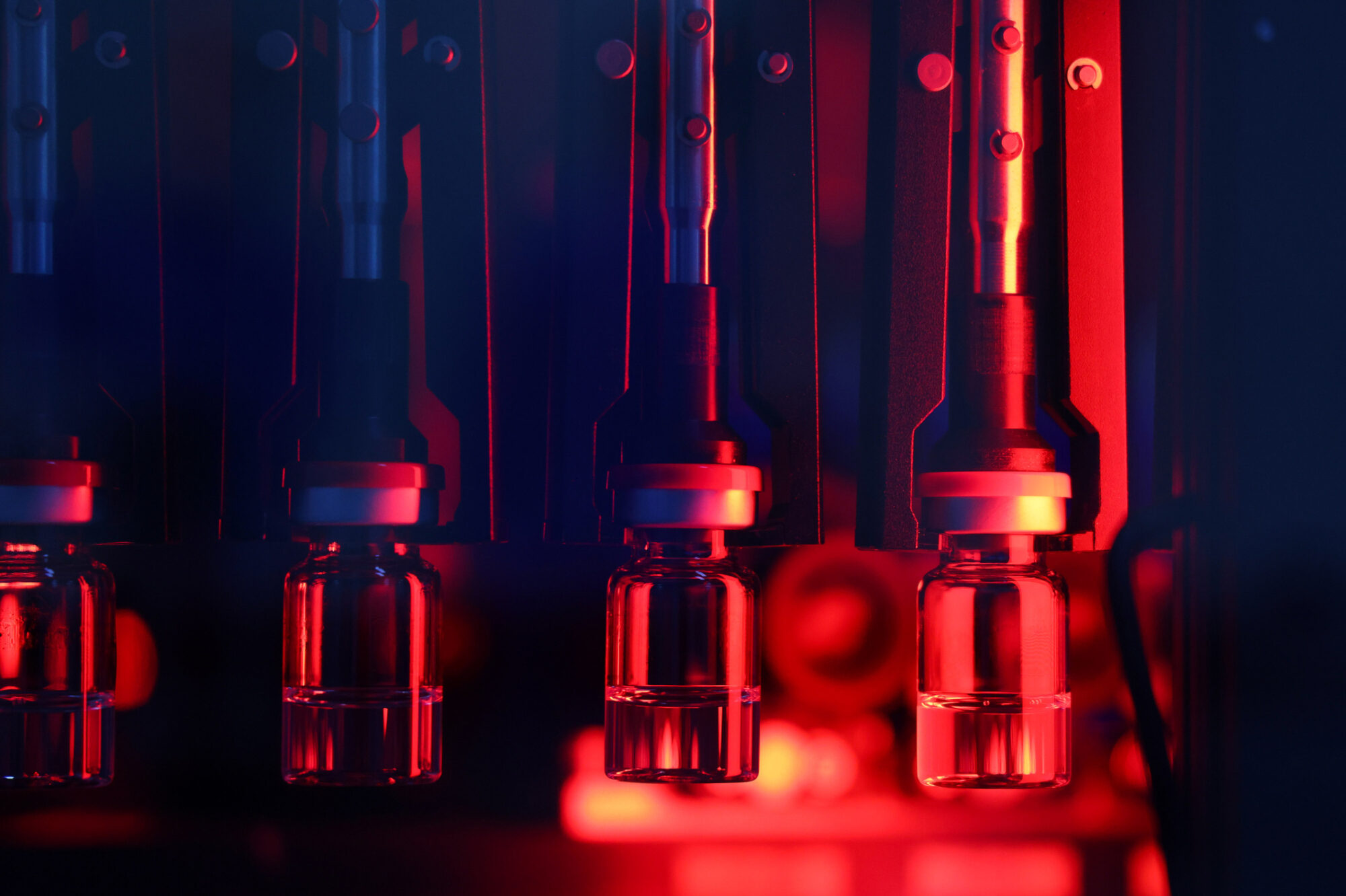

- Moret says that his company found that many of its jobs could be done from home. Its team buckled down during the pandemic, contributing to the production of essential products, such as packaged food and vaccines.

- Now, as workplaces have returned to “normal,” Rockwell continues to embrace a flexible work culture. Moret says its next challenge is ensuring that a workforce with such flexibility stays engaged and able to form productive collaborations.

“Workforce is very near and dear to my heart,” explains Moret. A former chair of The Manufacturing Institute’s Board of Trustees (and a current member of the NAM Executive Committee), Moret is a big proponent of developing flexible, targeted training programs.

- One such program at Rockwell, the Academy of Advanced Manufacturing, trains veterans for roles in manufacturing plants (much like the MI’s Heroes MAKE America program).

- It provides “outcome-based training,” Moret says, offering a “quicker and more hard-hitting program” that is 12 weeks long and does not necessarily require two- or four-year degrees.

What should manufacturers do? Moret has some advice for other manufacturers seeking to build more resiliency into their operations.

- He recommends developing a “product resiliency index,” which accounts for factors that affect production—the value of the product, its manufacturing complexity, how distributed the manufacturing needs to be, how many vendors are needed and more. Manufacturers should consider this right from the start of developing a product, Moret says.

- It’s also important to talk to key suppliers “to understand what their roadmaps are.” You need to know when you are relying on suppliers for products that aren’t “strategic” for them, he explains—as that could pose a problem for you down the line.

- Moret also recommends conducting this audit on both new and old products. “We’ve had to go back [to established products] to assess them with this resiliency index to make sure we’re not vulnerable.”

The last word: Collaboration with partners on supply chain issues and workforce development is key. “No one company can do it all. Being able to assemble the right team is maybe the most important starting point to emerging stronger than ever.”

For policy recommendations that address the supply chain and other challenges, and which can enhance U.S. manufacturing competitiveness, visit https://nam.org/competing-to-win/.

NAM Urges Biden Administration to Protect Innovation

NAM President and CEO Jay Timmons urged Biden administration officials to support innovative manufacturers and reject a dangerous proposal to waive intellectual property rights for COVID-19 vaccines, therapeutics and other products.

- Timmons’ call went out to U.S. Trade Representative Katherine Tai, Secretary of State Antony Blinken, Secretary of Commerce Gina Raimondo and senior White House officials.

The situation: Timmons’ advocacy comes in response to a World Trade Organization proposal that would waive IP rights for a broad range of COVID-19 products, putting American innovation and jobs at risk.

- As this goes to press, the U.S. and other countries are actively negotiating potential text ahead of the WTO’s forthcoming ministerial conference that kicks off this Sunday.

The issue: IP rights have been crucial in supporting American innovation and manufacturing during the pandemic. They have incentivized the rapid development of vaccines, COVID-19 therapeutics, personal protective equipment and other essential products and created the legal certainty for hundreds of innovative partnerships to ramp up their production.

The challenge: The controversial WTO proposal is rooted in the false premise that global vaccination efforts are lagging due to a lack of supply.

- “The primary challenge to global COVID-19 vaccination is not supply, but distribution and demand,” said Timmons.

- Facilitating global COVID-19 vaccination will take solving supply chain bottlenecks and logistical challenges while improving the ability of local health systems to deliver the vaccines and effective treatment.

The way forward: Instead of the waiver, the U.S. should push for creative efforts to fight COVID-19, including building consensus for the Trade in Health Initiative, working with like-minded countries to develop practical innovations that leverage increased trade and targeting WTO-identified trade bottlenecks.

- “The NAM and its members stand ready to work with you and your agencies to advance solutions that will, once and for all, tackle this devastating pandemic,” said Timmons.

NAM in action: The NAM recently launched an advertising campaign in key states and districts on the issue, urging the administration to protect American jobs and innovation.

How Manufacturers Can Amp Up Their Cyber Protections

Manufacturers are used to compliance requirements. These requirements are a part of daily life; from safety to quality, manufacturers must constantly track and adhere to rules that ensure their products and processes meet certain standards.

For manufacturers that work with the Department of Defense, that includes meeting Defense Federal Acquisition Regulation Supplement cybersecurity requirements, including the highly anticipated “cybersecurity maturity model certification.”

The basics: CMMC is the U.S. Defense Department’s proposed method for checking that their suppliers have strong enough cybersecurity protections to safeguard the Department’s information. Whether it’s a prime, subcontractor or sub-tier supplier, every company doing business with the Defense Department will need to comply with CMMC to receive a contract.

The big picture: All manufacturers should secure their businesses against cyberattacks, whether or not they are obligated to under DFARS or other requirements. According to the National Institute of Standards and Technology Manufacturing Extension Partnership Cybersecurity Services Lead Celia Paulsen, one of the most important—and most often neglected—steps manufacturers can take is simply to understand the structure and information flow within their own companies.

- “A lot of companies don’t know how information flows in their companies and how their companies work,” said Paulsen. “Once you have that information, you’ll be able to scope out the rest of the compliance efforts.”

- “In some cases, you might find that all of your controlled information can be limited to one computer. If so, great! Keep it separate and you won’t need to worry as much about the rest of the business,” she added.

- “In other cases, you might find that there’s no easy way to cordon off CUI, and it might be cheaper to secure the whole business. That’s something you wouldn’t have known otherwise.”

All aspects of the business, from physical structures to software, should be considered when thinking about security. According to Paulsen, looking at your business from the outside-in can turn up problems that are easily fixed.

- “Think of it as if you were looking to protect your house,” said Paulsen. “Begin by looking at the business physically – are there locks on the doors and windows? Do you have backup power?”

- “Then look inside the house: Where are your jewels (i.e. computers) located? Are they protected from curious eyes? Are your home, guest and business networks separated?”

- “Last, go to the software and data level. Do you have backups? What do you have in your computers that keeps sensitive information secure?”

Sensitive information doesn’t just flow through an individual manufacturer; it often travels up and down the supply chain, reaching other businesses that may not be taking the proper precautions.

- It’s imperative for manufacturers to discuss these issues with their connecting businesses, Paulsen notes They should determine what requirements apply, whether access to sensitive information is needed for either business, and if so, how it can be protected.

- “When you’re integrating IOT devices onto the shop floor or implementing AI or going to the cloud—anytime you’re purchasing something that is smart, or that has a chip—you need to consider the security of it,” said Paulsen.

- “A lot of breaches happen because of supply chain attacks where the products aren’t developed with security in mind. That is key to a long-term strategy: making sure that whatever you buy, they’re considering security.

Learn More: NIST provides additional resources, including the Small Business Cybersecurity Corner, and the Manufacturing Extension Partnership.

NAM resources: Are you prepared in the event of a ransomware attack? Built specifically for manufacturers, NAM Cyber Cover was designed to provide risk mitigation and protection. Find out more at www.namcybercover.com.

Meet the Manufacturing Leadership Council

How is digitization changing manufacturing? What can manufacturers do to stay competitive in a fast-shifting world? What does the future look like—and how can leaders prepare for success?

Those are the kinds of questions being asked and answered by the NAM’s Manufacturing Leadership Council—a member-driven global business leadership network focused on the intersection of manufacturing and technology. We spoke with David R. Brousell, MLC co-founder, vice president and executive director, who gave us more insight into what the MLC is, how it works and why it matters today more than ever.

An early start: The idea for the MLC was born nearly two decades ago, when manufacturers began turning to consumer technologies to strengthen their businesses.

- The convergence of these technologies with traditional operational technologies on factory floors sparked an idea. Brousell, who was running a publication called “Managing Automation,” recognized the trend—which he called “Progressive Manufacturing”—and founded an annual conference for manufacturers to discuss new approaches and best practices for the future.

- By 2008, that conference had given rise to a council designed to offer useful programming for manufacturers on the future of digitization. Ten years later, the council became a part of the NAM.

- “We realized that digitization was not a tactical or small change—it was a fundamental change in the industry,” said Brousell. “It was clear that manufacturers needed an informational resource or organization to bring them together to deal with what we now call Manufacturing 4.0 in a systematic way.”

A systematic approach: Today, the MLC represents what Brousell calls “the digital transformation arm of the NAM,” helping manufacturers meet future needs and address ongoing trends—through changes in technology, organization and leadership.

- “The transition to the digital model of manufacturing is only one part technical,” said Brousell. “The harder part is changing the organizational structure to be more collaborative and decentralized and making the leadership approach digital-first. We’re probably the only organization that has looked at it this way, in a systematic way, beyond technology alone.”

A critical focus: Every year, the MLC lays out a member-approved set of critical issues involved in the transition to Manufacturing 4.0 and offers resources and programming from thought leadership to plant tours to the Rethink Summit.

- This year’s critical issues include topics like factories of the future; transformative technologies, including AI and machine learning; augmented reality and virtual reality; Manufacturing 4.0 cultures; and cybersecurity.

A broad view: Digitization isn’t just an issue for individual manufacturers. Because manufacturing is so vital to economic and societal growth, it’s also important to the future of the United States and the world.

- “Manufacturing is one of the fundamental drivers of social and economic prosperity,” said Brousell. “Its growth will lead to a better life for people. No other industry can say that. And I believe that the countries whose companies are most successful in making the transition to the digital model are going to be the powers of this century. There’s a lot riding on this.”

Sign up: Come learn from leading manufacturers at the Rethink Summit, June 27–29, in Marco Island, Florida. It’s the premier event for senior operational executives and their teams as they continue to navigate disruption.

Why You Should Attend the IRI Annual Conference

“I’ve attended the IRI Annual Conference many times,” says Dr. Martha Gardner, “and I have taken many things that I’ve learned back to my company.” Gardner is the executive quality leader for process improvement at GE Aviation. She plans to attend this year’s IRI Annual Conference in person.

What it is: The IRI Annual Conference is where innovation leaders of all industries come together to share key emerging trends, technologies, critical skills and best practices. This year’s agenda includes four tracks:

- Strategic leadership practices for next-generation innovation managers

- The future of work

- Operationalizing sustainability strategies

- Digitalization of business and industry

Relevant content: “One reason to go is certainly the content,” Gardner says. “I leave with best practices, information on building future-ready leaders and more. The content is really relevant for the things I’m thinking about right now.”

- If possible, Gardner attends with multiple team members: “You can cover concurrent sessions. This year, there’s a breakout session on domestic supply chain resilience, which I will definitely attend. But there are other breakouts at the same time that will have useful nuggets for my company.”

Valuable networking: Connecting with peers is also a big reason Gardner attends. “I’m looking forward to the extra networking we get from being there in person,” she explains. “I’ve missed this during the virtual events of the past few years. There are people like me who have gone for several years, and there are always new people. I always get different points of view.”

Fresh perspective: Gardner believes the IRI Annual Conference is well worth her time away from the office: “It gives me perspective to think about the future and what I would like to drive differently in my organization. I use some of the takeaways to develop new strategies.”

How to participate: The 2022 IRI Annual Conference takes place June 7–9 in New Orleans. Innovation leaders from across companies and industries are welcome to attend. You do not need to be a member of the IRI to participate. Click here to view the agenda and to register.

NAM Drives Conversation on Innovation and Competition

The NAM is urging Congress to bolster American innovation and make the U.S. more competitive with China.

The big picture: NAM Senior Vice President of Policy and Government Relations Aric Newhouse wrote to Congress, “we urge the completion of a strong, bipartisan agreement that strengthens domestic manufacturing, increases our global competitiveness and provides opportunities for the more than 12.7 million people who make things in America.” The NAM’s recommendations include the following:

- Semiconductor manufacturing: Newhouse emphasized the NAM’s support for the $52 billion provided to bolster domestic semiconductor manufacturing in both the Senate’s United States Innovation and Competition Act (USICA) and the House’s America COMPETES Act.

- Supply chain resilience: 88.1% of manufacturers report supply chain issues as their primary business challenge, which is why the NAM supports the creation of the Manufacturing Security and Resilience Program and the $45 billion investment to support supply chain resilience included in the America COMPETES Act.

- Shipping: The Ocean Shipping Reform Act, which has passed both chambers of Congress in some form, is aimed at increasing port efficiency, reducing shipping delays and decreasing transportation costs through the improvement of ocean shipping standards and implementation of better oversight mechanisms.

- R&D: The NAM recommends reversing a new provision in the tax code that requires companies to deduct research and development expenses over a period of years rather than the year the costs are incurred—a provision that effectively makes R&D and innovation more expensive and more difficult for American companies.

- Eliminating card check: “Manufacturers are strongly opposed to the labor and card check provisions included in the America COMPETES Act,” wrote Newhouse. “Implementing ill-considered labor and card check provisions would upend decades of labor precedent with an anti-competitive, anti-democratic process that abolishes the secret ballot and eliminates appropriate oversight.”

Other recommendations: Newhouse also expressed the NAM’s support for policies that reduce emissions and promote sustainability to make the U.S. a global leader in energy efficiency. The letter recommends the reauthorization of the Miscellaneous Tariff Bill, the implementation of strong anti-counterfeiting legislation to protect consumers and small businesses and federal investment to improve the domestic critical mineral supply chain.

Take action on these issues and more at Manufacturers United.

Manufacturing Supply Disruptions Could Last into 2023

Supply chain disruption could continue for more than another year, according to the newest Resilient M4.0 Supply Chain survey conducted by the NAM’s Manufacturing Leadership Council. The MLC is the digital transformation arm of the NAM.

What’s the holdup? A combination of factors is causing fundamental shifts in supply chain approaches across the industry. These include pandemic lockdowns, blocked shipping lanes, container scarcity, material and component shortages, extreme weather events, rising prices and military conflict.

What manufacturers are doing about it: Supply chain organizations are reassessing traditional supply chain strategies, reducing network complexity and integrating key functions.

- They are also redesigning processes and harnessing the power of digital tools to transform their supply chain ecosystems.

Universal disruption: Even supply chain structures with some local or regional networks have been affected by recent events, according to the MLC’s survey.

- Ninety percent of respondents reported suffering either significant (52.5%) or partial (39%) disruption in the past two years. Just 0.5% said they had seen no disruption.

Improving resilience: While many manufacturers have taken action to reduce supply vulnerabilities, 73% of companies said their current supply chains are not fully protected, and 12% said they believe their supply chains lack resilience.

Integrated supply chains: While today just 19% of companies said their supply chain structures are fully integrated, this proportion is set to more than double (to 47%) within the next two years.

- The number of companies that remain dependent on siloed operations is set to fall from 14% to 4% over the same period.

Digital opportunities: The race to fully digitize more supply chain operations is picking up speed.

- In nearly every supply chain function, companies said they are planning significant increases in digital adoption in the next two years to streamline their supply chain organizations.

Obstacles to progress: Many obstacles to future supply chain development involve issues with industry partners. Among the challenges cited by manufacturers in the survey were the following:

- Differences in digital maturity among partners (54%)

- A lack of common data platforms (53%)

- Problems transforming traditional supply chain processes (29%)

- Upgrading legacy equipment (26%)

- A lack of skilled employees (22%)

Review the data: Click here to review the data in detail and read manufacturer responses to survey questions.

“A Win-Win-Win”: How Tax Reform Transformed Pivot Manufacturing

Today, Pivot Manufacturing is a far cry from the shop it was just five years ago.

Starting small: “For the first 15 or so years of our existence, we were a company that did small-run prototypes, R&D work,” said company co-owner Steve Macias of his Phoenix machining and mechanical assembly services firm, which he started in 2000 with longtime friend Jack Cuddihy.

- “We wanted to get into production because that’s how you grow a company in this industry,” said Macias. “But our equipment didn’t lend itself to that work, and we couldn’t [afford new equipment].”

The transformation: That all changed in 2017 with the passage of tax reform legislation. “We had already started thinking, ‘We’re going to have to change something.’ We didn’t want to be a little R&D shop forever,” Macias recalled.

- Thanks in great part to full expensing—a key pro-growth incentive in the new law that reduces after-tax costs by providing a 100% deduction for machinery purchases—Pivot was able to invest in the new equipment it needed to take on the more lucrative production orders.

- “It really has been transformative,” Macias said of the 2017 legislation.

Five years on: For the past five years, the bulk of Pivot’s work has been with government contractors, including Raytheon and General Dynamics. These days, the average age of the manufacturer’s machines is 2.5 years; before tax reform, that number was 14.

- “We were able to sell our old equipment, buy new high-speed CNC mills and start bidding jobs—and we got them,” Macias said. “Every year since, we’ve bought two or three machines. Our accountant was telling us, ‘If you guys can [keep] filling these machines up, keep doing it.’”

Growth mode: Pivot’s exceptional growth has enabled it to raise wages and increase benefits. The manufacturer pays its machinists above the going rate, Macias said, and offers its employees medical, dental and vision coverage in addition to a matching 401(k) program.

- The shop has added talent since 2017, too, growing from around a dozen employees to 19 today.

- In addition, the growth has enabled the firm to give back to the community. “Before [tax reform], we might write a couple of $500 checks,” Macias said. “Last year, we probably donated $10,000…to seven or eight charitable groups.”

What’s next: Pivot has been so successful in recent years that Macias and Cuddihy are in talks to purchase the building that houses their facility so they can expand even further.

- The purchase could enable the company, which is already on track in 2022 to double its 2016 numbers, to more than double its current revenue.

The final say: “Tax reform was a catalyst,” Macias said. “Before, we knew what we had to do, but the law was what pushed us … to take a leap of faith. It’s been a win-win-win.”

Manufacturers: Lawmakers Must Prioritize Provisions That Will Streamline Essential Domestic Supply Chains and the Production of Key Inputs

Washington, D.C. – Following today’s Senate–House conference committee meeting on the China competition legislation, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Manufacturers are encouraged by efforts in Congress to reach a strong, bipartisan agreement that strengthens domestic manufacturing, increases our global competitiveness and provides new opportunities for the more than 12 million people who make things in America. The first meeting of the conference committee to finalize legislation reconciling the United States Innovation and Competition Act and the America COMPETES Act is an important step toward overcoming ongoing supply chain disruptions, countering inflation and supporting U.S. manufacturing in the face of major global competitors, namely China.

“Lawmakers must prioritize provisions that will streamline essential domestic supply chains and the production of key inputs, such as an investment of $52 billion to bolster domestic semiconductor manufacturing, the creation of a fund to strengthen supply chain resiliency and inclusion of the Ocean Shipping Reform Act. Manufacturers also support policies to advance and grow U.S. international trade and provisions that strengthen U.S. energy innovation leadership. The conference committee should also avoid labor provisions that would harm American manufacturers and workers alike as we look to fill more than 800,000 jobs in the sector.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.7 million men and women, contributes $2.71 trillion to the U.S. economy annually and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Plant Tour Provides Firsthand Look at Digital Transformation

On a recent tour of Intertape Polymer Group’s Tremonton, Utah, plant, manufacturers saw disruptive technology in action. From employing 3D printing to slashing parts-making time to programming floor equipment to identify and fix problems quickly, the Manufacturing 4.0 processes and technologies were on full display. The NAM’s Manufacturing Leadership Council hosted the tour and brought 70 MLC members to the paper- and film-based packaging maker.

Growth: IPG, a Montreal-based manufacturer whose products include the cling film StretchFlex, has seen its revenue double in the past six years, from $750 million to $1.5 billion.

- The company now has approximately 4,000 employees across 34 locations, including 22 manufacturing facilities in North America.

What they saw: In addition to 3D printing and problem-solving floor equipment, tour participants got to see how IPG:

- Manages parts more effectively with an automated storage system; and

- Uses “hackathons” and employs a data-driven, digital-first mindset to find solutions to challenges.

Digital journey: In a briefing before the tour, IPG Vice President of Business Transformation Jai Sundararaman described why and how IPG undertook its digital transformation journey.

- First, the manufacturer conducted an in-depth investigation. This included studying 20 different technologies, attending more than 10 industry conferences, hosting technology summits with vendors and engaging in more than 25 networking sessions with fellow members of the MLC.

Phased transformation: IPG’s phased approach to digital transformation focused on delivering business value. The company undertook the following schedule:

- Phase 1: Align strategy and execution and “homogenize” operating culture. Upskill and retain talent with digital and process knowledge.

- Phase 2: Drive revenue and margin growth by applying digital technologies at scale in other functions, such as customer engagement.

- Phase 3: Leverage digital technologies for business model innovation.

M4.0 discussion: At the end of the IPG plant event, participants joined a panel discussion on data standards and analysis. Panelists discussed how to measure the return manufacturers get from implementing M4.0 technologies and how to get buy-in from employees and leadership.

Upcoming plant tour: Join the MLC’s next plant tour right from your desk on July 27. Participants will take a virtual look inside Accuray’s Global Manufacturing Center in Madison, Wisconsin. This virtual plant tour will highlight the challenges of a low-volume, high-complexity manufacturing and supply chain model. Register today to reserve your place.