NAM Gives DOE Recommendations on Critical Materials

To secure the stable, diversified critical materials supply chains that the U.S. needs to remain globally competitive and achieve energy dominance, changes must be made to the 2026 Energy Critical Materials Assessment, the NAM said today.

What’s going on: “Manufacturers in America utilize critical materials and minerals extensively, deploying them in a wide array of manufactured products throughout the U.S. economy,” NAM Vice President of Domestic Policy Chris Phalen told the Department of Energy in response to a request for information seeking public input on the assessment.

- The NAM recommended the DOE take certain steps regarding the assessment, including adding certain materials to its list and ensuring others remain on it. It also urged the DOE to collaborate with other agencies and Congress to “streamline permitting processes to ensure greater domestic access to these materials.”

Other actions: The NAM also urged the DOE to:

- Maintain “the critical materials that are currently listed within the DOE’s Energy Critical Materials Assessment,” including aluminum, cobalt, copper, electrical steel, lithium and graphite;

- Add iron nitride and zirconium to the assessment;

- Remove permitting barriers that are “restricting the United States from being able to mine, process and access domestic resources, modernize infrastructure and shore up supply chains”;

- Offer financial tools—including investment tax credits, production tax credits and grants—to help “de-risk technological advancement”;

- Align the DOE’s critical materials list with the U.S. Geological Survey’s separate critical minerals list; and

- Add fluorine to the USGS list.

The final say: These recommendations will “ensure [that] manufacturers of all sizes and in all segments of the industry have access to the materials necessary for modern, innovative manufactured products,” Phalen continued.

- They will also allow manufacturers to do what they “do best—put more Americans to work, more factories into motion, more innovation into the marketplace and more investments into our communities while strengthening the hand of the United States on the world stage.”

White House AI Plan Reflects Manufacturers’ AI Priorities

Underscores How Manufacturers Are Already Leading in AI Innovation

Washington, D.C. – Following the release of the White House’s AI Action Plan today, National Association of Manufacturers President and CEO Jay Timmons issued the following statement:

“Reflecting President Trump’s vision for the United States to lead on artificial intelligence, the White House’s AI Action Plan underscores what manufacturers across the country already know: AI is no longer a future ambition—it is already central to modern manufacturing. For years, manufacturers have been developing and deploying AI-driven technologies—machine vision, digital twins, robotics and more—to make shop floors safer, strengthen supply chains and drive growth.

“Manufacturers have been leading the charge to shape AI policy that accelerates innovation while ensuring appropriate guardrails. The White House’s plan reflects many of the recommendations we’ve put forward—from permitting reform for all energy sources so we can unleash American energy dominance, to a smarter, more targeted regulatory approach, to supporting workforce development and ensuring small and medium manufacturers can access these technologies. With nearly 400,000 open jobs in manufacturing, we need to invest in the workforce of tomorrow—training existing workers to use AI technologies and attracting new high-skilled talent into the sector.

“We’ve been calling for a pro-AI policy environment—one that supports innovation and responsible integration of AI into real-world operations. That means not rushing to impose burdensome laws or regulations when workable rules already exist. It means adopting requirements that are tailored to specific use cases of AI. It also means light-touch regulations that limit compliance costs so small and medium-sized manufacturers aren’t locked out of this technology.

“The White House plan answers that call.”

Background:

Manufacturers have been at the forefront of developing and implementing cutting-edge AI systems that are transforming shop floors and revolutionizing operations.

In March, the NAM submitted comments to inform the White House’s development of an AI Action Plan, explaining how manufacturers are using AI on shop floors and in operations, with specific recommendations on rebalancing and right-sizing AI regulations to enhance America’s global AI dominance.

In May, the NAM proposed a series of policy recommendations for policymakers to drive AI development and adoption in manufacturing, and the Manufacturing Leadership Council, the digital transformation division of the NAM, released a groundbreaking report, “Shaping the AI-Powered Factory of the Future,” revealing that 51% of manufacturers already deploy AI in their operations, and 80% say AI will be essential to growing or maintaining their business by 2030. This is not just about efficiency—it’s about competitiveness, innovation and the future of American industry.

In May 2024, the NAM published “Working Smarter: How Manufacturers Are Using Artificial Intelligence”—a report that explains the ways in which manufacturers are using AI already, making the technology integral to modern manufacturing with manufacturers at the forefront of developing and implementing AI systems.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.90 trillion to the U.S. economy annually and accounts for 53% of private-sector rese arch and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Indium Corporation Builds a Supply Chain for Gallium

Indium Corporation, founded in Upstate New York, has a long record of turning challenges into innovations.

Not long after its namesake element, indium, failed as an anti-tarnish silverware coating, the company discovered during World War II that it could be used instead in aircraft bearings. Then once jet engines made that application obsolete, the company began using indium to coat glass in everything from electronics to supermarket refrigeration units. Today, indium is used in all sorts of fields, from aerospace, to telecommunications, to tumor eradication.

- “We’re always exploring how we can add ingredients to a material, or find a new way of looking at something, or solve a problem in a different way,” said President and CEO Ross Berntson. “At Indium Corporation, we believe that materials science changes the world.”

Now, Indium Corporation is turning its attention to a new and pressing issue: creating a North American supply chain for a critical mineral.

Exploring challenges: Gallium is a byproduct of aluminum production that is essential for everything from semiconductors, to electric vehicles, to wearable electronics. But while demand for gallium is rising, 98% of gallium today comes from China—creating a single supply chain that is vulnerable to international challenges and disruptions.

- “That’s just simply not a robust supply chain, right?” said Berntson. “We need to make a stronger, more robust global supply chain. And the first step is to bring on a North American supply.”

Developing solutions: Indium Corporation is working with Rio Tinto, one of the world’s largest aluminum producers, to extract gallium from North American bauxite sources in Canada.

- With a strong stable of engineers, proximity to a tremendous amount of hydroelectric power and a commitment to sustainability, Indium Corporation sees Rio Tinto as the perfect partner for this effort.

Setting goals: Through the partnership, Indium Corporation and Rio Tinto aim to produce up to 40 tons of gallium per year in North America—a significant portion of the 600–700 tons of gallium that is used annually. And for Berntson, the innovation that will result is the most exciting part.

- “Not only does this work secure the supply chain for existing applications, but it also creates a robust source of gallium so people can get creative with it—for new alloys and new compounds that nobody ever thought of before,” said Berntson. “It’s exhilarating to think about having more gallium available, and what we can do with a bunch of creative minds working with that element.”

Calling for partnership: While Indium Corporation is investing heavily in gallium production, Berntson believes that public–private partnerships are key to mitigating risk and ensuring that gallium exists as a resource that can enable American competitiveness.

- “The availability of gallium is bigger than any one company,” said Berntson.

The key to success: Berntson credits his company’s talented engineers with Indium Corporation’s success—and emphasizes the need to let brilliant minds find unexpected solutions.

- “There’s a ton of talent in the world,” said Berntson. “Bringing them in, helping them to grow and giving them enough space to be innovative—time and time again, that’s how we’re able to be at the leading edge of our industry.”

President Trump Sends Tariff Letters to Canada, Mexico and the EU

President Trump issued more tariff letters late last week, warning major U.S. trading partners of the tariffs that will go into effect if negotiations do not lead to agreements by Aug. 1. Tariffs on Canadian imports will be assessed at 35%, while Mexican and European Union imports will see new tariffs of 30%.

Canada: The letter to Canada accuses the country of failing to stop the flow of fentanyl drugs into the U.S., while also citing tariff and nontariff trade barriers, including dairy policies.

- Canada is subject to an International Emergency Economic Powers Act fentanyl tariff rate of 25%. According to an April 2 executive order, if IEEPA fentanyl tariffs are withdrawn, a 12.5% IEEPA “reciprocal” tariff rate would replace them.

- USMCA-compliant goods are exempt from the existing Canada tariffs. The July 10 letter does not specify whether goods that qualify for an exception under the USMCA will continue to be exempt. It also does not say whether energy and energy resources from Canada will still be subject to the lower 10% tariff.

- The letter also warns that goods that are transshipped will be subject to an unspecified, higher tariff, and that an additional 35% tariff will be imposed should Canada retaliate.

Mexico: The letter to Mexico cites the country’s “failure to stop the Cartels,” while also mentioning trade barriers.

- Mexico is subject to the same arrangement as Canada under the April 2 executive order—IEEPA fentanyl tariffs of 25%, which if withdrawn would be replaced by a 12.5% “reciprocal” tariff.

- The letter to Mexico is likewise unclear about the USMCA exceptions and contains similar warnings about transshipment penalties and an additional 30% tariff in the case of retaliation.

EU: The European Commission also received a letter, which threatens the EU with a 30% tariff, a number “far less than what is needed to eliminate the trade deficit.” The letter also says that the U.S. expects “complete, open market access.”

- EU retaliatory tariffs were set to take effect this week but have been suspended pending negotiations.

The response: In a post on X, Canadian Prime Minister Mark Carney said, “We are committed to continuing to work with the United States to save lives and protect communities in both our countries. … We are strengthening our trading partnerships throughout the world.”

- In a statement, EU Commissioner Ursula von der Leyen said the EU is “working towards an agreement by August 1,” adding that the EU “will take all necessary steps … including the adoption of proportionate countermeasures if required.”

Tech Manufacturers, NAM Call for Consistent, Light-Touch AI Rules

Technology firms are urging the administration to create a federal artificial intelligence framework following Congress’ removal from the recently passed budget bill of a 10-year moratorium on state AI laws (The Wall Street Journal, subscription).

What’s going on: “Tech industry insiders are lobbying for nationwide regulations that pre-empt a jumble of state laws … in part to simplify compliance with a single set of requirements,” according to one tech leader.

- California, Texas, Colorado and Utah have passed AI legislation, and an additional 15 states are considering similar laws.

- Almost “every state has adopted privacy and data-security legislation that touches on AI in some way, lawyers say.”

Manufacturers’ take: Large companies have indicated their willingness to comply with AI laws, with manufacturers backing national regulation.

- AI regulations at the federal level would “establish consistent standards and promote the secure, fair development of AI,” an Amazon spokesperson told the Journal. “We will continue to work with legislators at both the federal and state level to ensure any regulation drives standards that support U.S. leadership on AI.”

The “patchwork” problem: The creation of 50 different, often-conflicting rules will limit manufacturers’ ability to operate and innovate, as they have told Congress repeatedly.

- The NAM, which advocated for a decade-long pause on state-level AI regulations, told the Senate last month that the moratorium would “support AI innovation and American AI leadership by protecting manufacturers from a [50]-state patchwork of conflicting, and potentially stifling, AI laws and regulations. … [M]anufacturers need a policy and regulatory framework that … streamlines compliance to enable rather than hinder manufacturers’ development and adoption of AI systems.”

More to comply with: Technology companies with global reach must now also comply with the stringent EU Artificial Intelligence Act, which took effect earlier this year and “aims to control runaway AI development.”

Ongoing advocacy: The NAM continues to advocate for “the importance of a light-touch regulatory framework to support the development and use of artificial intelligence” at the federal level, including eschewing AI-specific regulations to address challenges that are not AI-specific and instead rely on technology-neutral laws, as NAM Managing Vice President of Policy Charles Crain told the House in May.

NAM to Congress: Reauthorize Cybersecurity Law Before It Expires

A critical law that safeguards Americans from cybersecurity threats is due to expire on Sept. 30—and Congress must reauthorize it before that happens, the NAM told Congress this week.

What’s going on: “The Cybersecurity Information Sharing Act of 2015 (CISA 2015) has been instrumental over the past decade in protecting Americans from cybersecurity threats by supporting companies’ efforts to share cybersecurity information with one another and with the federal government,” NAM Managing Vice President of Policy Charles Crain told the House Committee on Homeland Security and the Senate Committee on Homeland Security and Governmental Affairs on Monday.

- Through their relationships with customers, vendors, suppliers and governments, manufacturers are entrusted with vast amounts of sensitive data and intellectual property. With its information-sharing requirements, CISA 2015 has been instrumental in helping them keep that information safe.

- Prior to the law’s enactment, many businesses were reluctant to share cyberthreat information due to liability and public disclosure concerns.

How it works: “By enabling the rapid dissemination of security intelligence, information sharing diminishes the ability of malicious actors to gain economies of scale as they seek to replicate attacks against multiple targets,” the NAM continued.

- “It also allows government agencies and private sector Information Sharing and Analysis Centers to develop a comprehensive and authoritative view of patterns and trends across industries and geographies, and thus to promote effective systemic responses.”

- It also helps create trust between cybersecurity personnel across various organizations.

What Congress should do: “With less than four months before the expiration of CISA 2015, manufacturers call on Congress to make its reauthorization a priority,” the NAM urged.

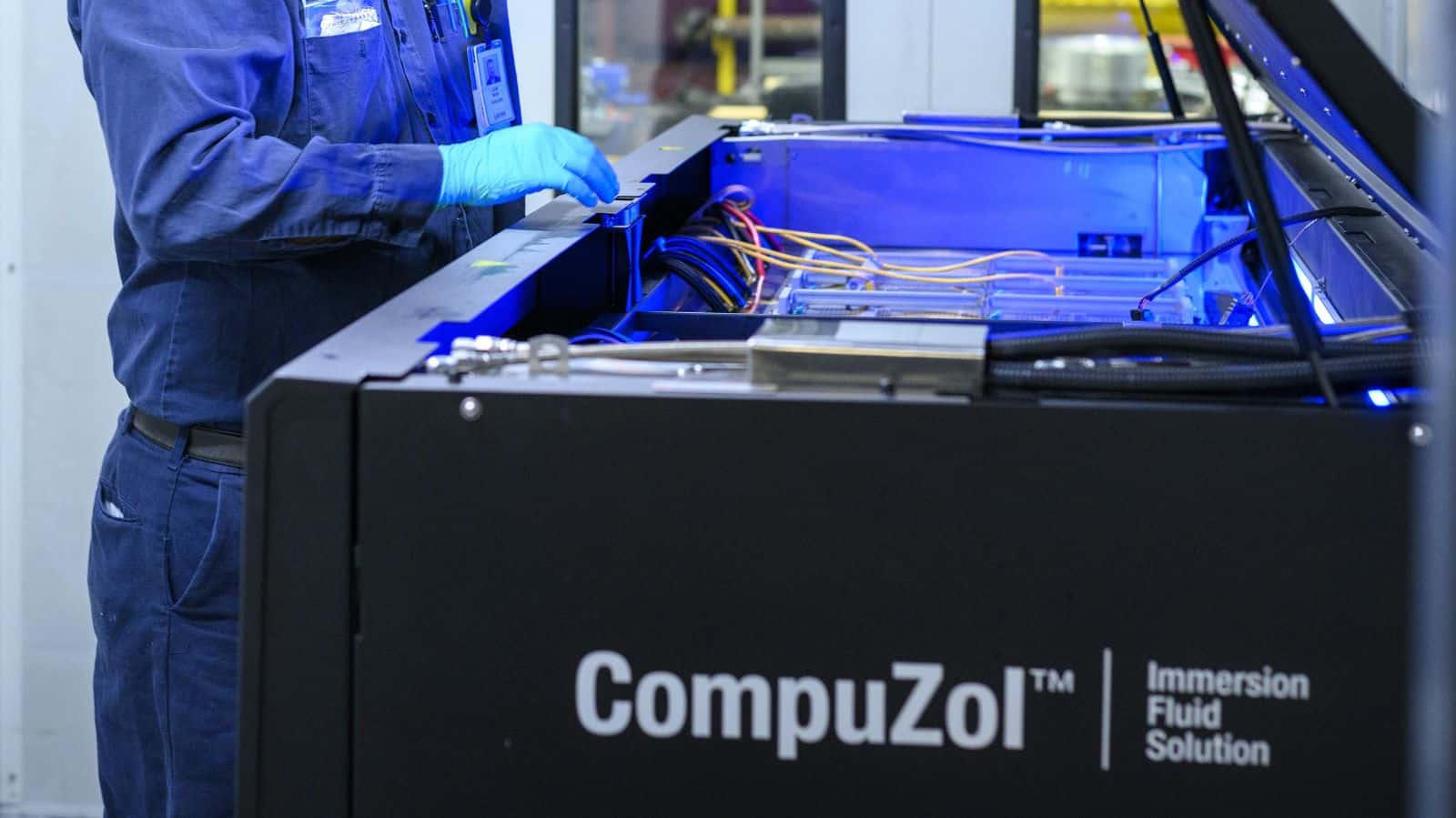

Lubrizol Chills Out with Liquid-Based Data Center Cooling

Everyone’s talking about where artificial intelligence is taking us, but few are discussing the immense amount of energy that will be needed to get there. That’s where Lubrizol comes in.

Cool operator: The global specialty chemicals company, with headquarters in Ohio, has a unique method of cooling IT in data centers, those behemoth facilities that power generative AI. As anyone who’s used a computer for long periods of time knows, that equipment can get hot.

- To cool high-performance data centers’ graphics processing units—powerful accelerators that enable AI and other technologies and can generate huge amounts of heat—Lubrizol employs immersion cooling, a method of heat removal that uses liquid.

- “It’s like a blacksmith—when you try to remove heat from hot metal, you immerse it in cold water and the water removes the heat,” Lubrizol Vice President of Corporate Innovation Abhishek Shrivastava told us.

- But at Lubrizol, “we are immersing the computer chips in a formulated oil” instead of water. “These GPUs are working so hard with higher power consumption, they can actually melt if they get too hot. So, you need to remove the heat quickly and efficiently.”

Why we need it: Most current data centers use air cooling, but their increasing workloads and processing capacity—driven by the fast-growing appetite for AI—will require something more efficient, Shrivastava said.

- Meanwhile, next-generation processing units will maintain a thermal design power (i.e., heat) of more than three times today’s commonly used systems, according to Lubrizol.

- “AI is needed for the future—for economic development, for global leadership,” Shrivastava said. “It will come down to who can deploy it faster.”

The tech: Lubrizol believes its method of immersion cooling—which relies on nonconducting, dielectric fluids, or liquids that act as electrical insulators—is the key to winning that race.

- “As AI infrastructure is deployed [in the U.S.], there must be efficient cooling in place too,” Shrivastava continued. “It’s going to require a lot of infrastructure-level investment.”

- Up to 40% of data centers’ total annual energy consumption goes to their cooling systems, according to a recent study by the Electric Power Research Institute. Lubrizol’s technology greatly reduces that percentage for its customers.

Getting started: Lubrizol’s immersion cooling technology has been deployed at multiple data centers, and the company is working with its customers to scale up installations. “A lot of small players are using it, because if you’re small, your risk is low and deployment is fast, but there are some large-scale deployments across the world including in China and the U.S. that show the big players have identified the value,” Shrivastava said.

- Among the company’s next steps: getting the solution deployed at larger centers—though that will take some time. “Larger-scale operations need more data, more confidence in [new] technology,” Shrivastava noted.

Years, not decades: In the long term, however, the cost-benefit analysis is very favorable, said Shrivastava, even with infrastructure development outlay. And Shrivastava foresees widespread use of the technology.

- Awareness of the need for high-powered, efficient cooling is growing. “We’re not talking about a matter of decades” before it’s in wide use; “it’s a matter of years and months.”

The last word: “The industry needs to pick up the pace” on the data center cooling front, Shrivastava told the NAM. “Otherwise, we’re not going to realize the full potential of AI.”

AI Is Transforming Appalachia

The spotlight is on Western Pennsylvania—and EQT Corp.’s Toby Rice (The Washington Post, subscription).

What’s going on: The region’s plentiful natural gas is making it a crucial location as energy demand surges thanks to artificial intelligence. At the center of things is Toby Rice, president and CEO of energy company EQT Corp., the largest natural gas producer in the Appalachian Basin.

- “The size of [AI’s energy appetite] … it’s crazy,” Rice told opinion writer Salena Zito. “We are hearing estimates for power demand for AI that’s anywhere [from] 50 to 75 gigawatts of power, which is the equivalent of the power needed to power 10 to 15 New York Cities.”

- EQT is expected to be among the few natural gas providers in contention to support the switchover of the Homer City Generating Station, formerly Pennsylvania’s largest coal-fired power plant, “to natural gas to power an adjacent AI data center.”

From baseball to energy: Massachusetts native Rice wanted to make his career in professional baseball, but after he was passed over by Major League Baseball in college, his father suggested he go into the oil and gas industry.

- After moving to Texas, Rice started out working on an oil rig and eventually founded his own company, Rice Energy.

- “There was a lot of sweat along the way—he left Texas for Appalachia, and slowly grew Rice Energy from a no-name company to a top 10 producer of natural gas in the country.”

- It merged with EQT in 2017, creating America’s biggest independent producer of natural gas.

AI revolution—and opposition: “This is the biggest gas field in the world. This is the biggest energy source,” Rice told the Post. “Pittsburgh has powered, has been the ground zero, for the industrial revolutions that have taken place in this country. This AI revolution that’s taking place—no different.”

- However, AI growth has a sizable hurdle in its way in the form of opposition to natural gas.

- Said Rice: “We’re going to do everything we can to make sure they have all the energy they need to meet their AI aspirations. But we should still have the ability to build more infrastructure here.”

States Look to Satellite Internet for Faster, Cheaper Rural Access

With a large number of Americans still lacking reliable internet access, some states are looking to space to fix the problem (The Wall Street Journal, subscription).

What’s going on: “From Maine to Nevada, states are starting to help some of the 24 million Americans who lack reliable broadband pay for satellite internet, rather than focusing such aid primarily on fiber connectivity as they have in the past.”

- Providers including Amazon have launched new endeavors to increase internet access worldwide, and they could benefit from these states’ push. Amazon’s Project Kuiper, for example, launched its first operational satellites in April and expects to deploy thousands more in the coming years.

The details: “Louisiana set aside $28.7 million of the funds it expects from a federal broadband subsidy program for satellite service, and Nevada has agreed to spend $12.7 million of its funds from the same program on Project Kuiper to serve about 4,400 rural addresses.”

- The Biden administration’s $42.5 billion Broadband Equity, Access and Deployment Program favored fiber over satellite, but the Commerce Department announced earlier this year it will overhaul the program to make it “tech-neutral.”

Why didn’t they do it sooner? Some officials have been reluctant to subsidize satellite internet because it provides slower service than fiber. It’s also susceptible to more frequent outages and requires satellite updates every few years.

- But it’s also quicker and less expensive to implement. (For some remote locations, the price tag for laying fiber can go well into six figures for a single home.)

A stopgap solution: To meet needs while BEAD is rejiggered, Maine and South Carolina have started state-funded programs that subsidize satellite broadband for some rural addresses—but only from a specific provider.

- Texas has a similar program and has accepted applications from providers, and following the Commerce Department’s BEAD announcement, West Virginia is considering spending some of its funds on satellite internet, too.

EIA: China Monopolizes Global Critical Minerals Market

China dominates the global battery mineral market, from sourcing and mining to production, according to the U.S. Energy Information Administration.

What’s going on: “China imported almost 12 million short tons of raw and processed battery minerals, accounting for 44% of interregional trade, and exported almost 11 million short tons of battery materials, packs and components, or 58% of interregional trade in 2023, according to regional UN Comtrade data.”

- These minerals’ importance will only increase as the appetite for electric vehicles and renewable energy technologies grow.

- However, as the NAM recently told the Commerce Department, Section 232 tariffs will not increase domestic sourcing of these critical minerals or decrease U.S. reliance on China for them.

- Instead, to shore up domestic critical minerals supply, the U.S. needs permitting reform, incentives for producers and enhanced trade relationships with partners other than China.

Mining and production: China either produces domestically or has large ownership stakes in companies that produce these minerals.

- In 2023, the country produced about 18% (33,000 short tons) of the world’s mined lithium, and Chinese firms “control 25% of the world’s lithium mining capacity.”

- Chinese companies also have sizable investments in mining operations in the “lithium triangle,” an area in Chile, Argentina and Bolivia that holds half of the world’s lithium stores.

- “China produced 79%, or 1.27 million short tons, of the world’s natural graphite in 2024, according to the U.S. Geological Survey.”

- Chinese firms own 80% of cobalt production in Congo-Kinshasa, the location of more than 50% of the world’s cobalt production.

Trade: After production, raw battery minerals are exported—and in 2023, China accounted for nearly half (46%) of global raw battery mineral import trade.

- That year, the world’s largest lithium producer, Australia, sent almost all its lithium exports to China.

Processing: China has the global critical minerals processing market cornered, too.

- It processes more than 90% of the world’s graphite.

- In 2022, “Chinese companies accounted for over two-thirds of the world’s cobalt and lithium processing capacity.”

- The next year, China imported 20% of global processed battery minerals, mostly African cobalt. Also in 2023, China exported 58% of the world’s processed battery minerals, primarily synthetic graphite, elsewhere in Asia and to Oceania.

Battery materials manufacture and trade: “China accounted for 53% of the world’s battery material export trade in 2023.”

- In 2022, the country made 85% of the world’s anodes, 82% of its electrolytes, 74% of its separators and 70% of its cathodes.

- In 2023, China controlled almost 85% of “battery cell production capacity by monetary value.”