NAM to Congress: Reauthorize Cybersecurity Law Before It Expires

A critical law that safeguards Americans from cybersecurity threats is due to expire on Sept. 30—and Congress must reauthorize it before that happens, the NAM told Congress this week.

What’s going on: “The Cybersecurity Information Sharing Act of 2015 (CISA 2015) has been instrumental over the past decade in protecting Americans from cybersecurity threats by supporting companies’ efforts to share cybersecurity information with one another and with the federal government,” NAM Managing Vice President of Policy Charles Crain told the House Committee on Homeland Security and the Senate Committee on Homeland Security and Governmental Affairs on Monday.

- Through their relationships with customers, vendors, suppliers and governments, manufacturers are entrusted with vast amounts of sensitive data and intellectual property. With its information-sharing requirements, CISA 2015 has been instrumental in helping them keep that information safe.

- Prior to the law’s enactment, many businesses were reluctant to share cyberthreat information due to liability and public disclosure concerns.

How it works: “By enabling the rapid dissemination of security intelligence, information sharing diminishes the ability of malicious actors to gain economies of scale as they seek to replicate attacks against multiple targets,” the NAM continued.

- “It also allows government agencies and private sector Information Sharing and Analysis Centers to develop a comprehensive and authoritative view of patterns and trends across industries and geographies, and thus to promote effective systemic responses.”

- It also helps create trust between cybersecurity personnel across various organizations.

What Congress should do: “With less than four months before the expiration of CISA 2015, manufacturers call on Congress to make its reauthorization a priority,” the NAM urged.

Lubrizol Chills Out with Liquid-Based Data Center Cooling

Everyone’s talking about where artificial intelligence is taking us, but few are discussing the immense amount of energy that will be needed to get there. That’s where Lubrizol comes in.

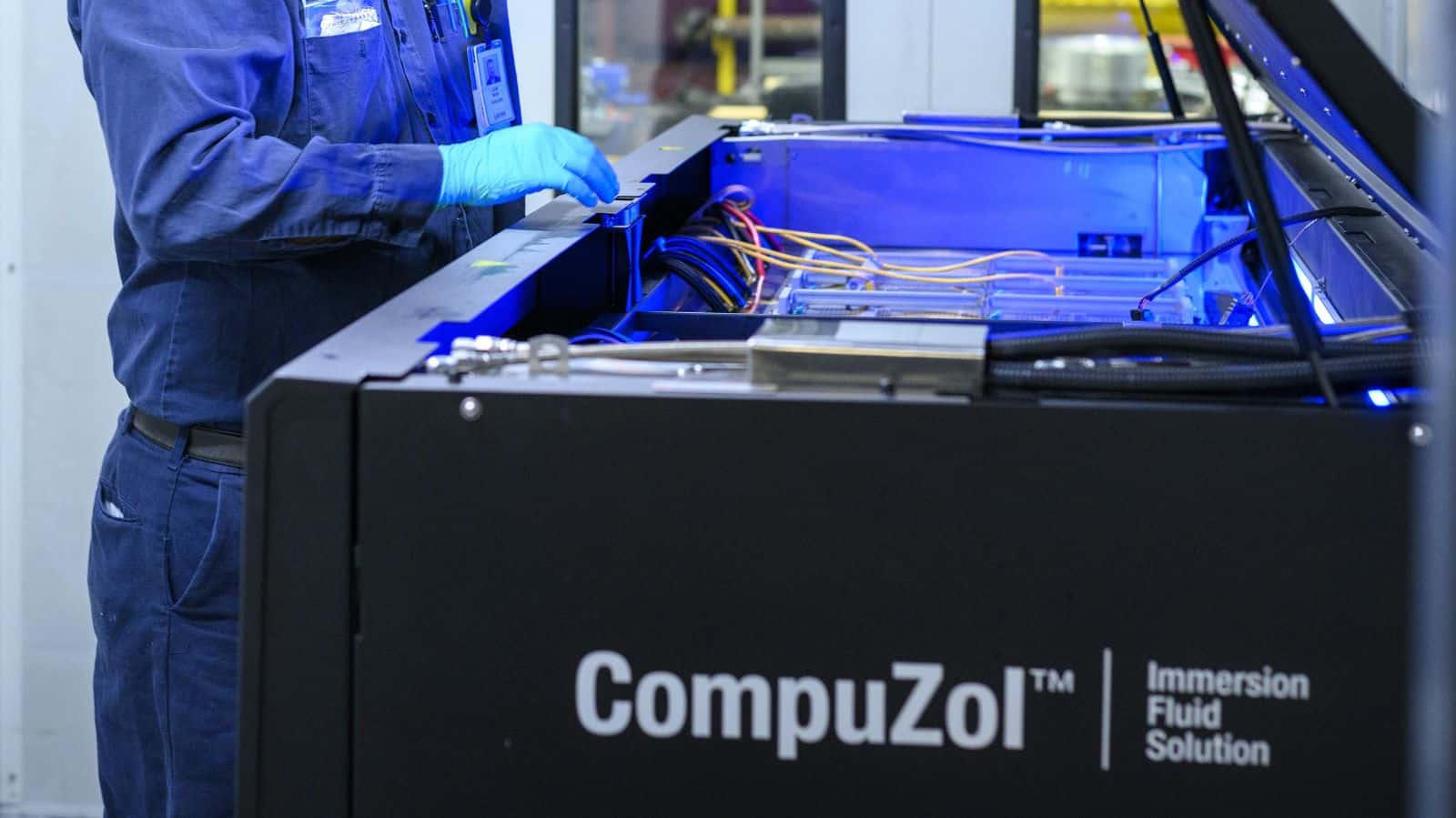

Cool operator: The global specialty chemicals company, with headquarters in Ohio, has a unique method of cooling IT in data centers, those behemoth facilities that power generative AI. As anyone who’s used a computer for long periods of time knows, that equipment can get hot.

- To cool high-performance data centers’ graphics processing units—powerful accelerators that enable AI and other technologies and can generate huge amounts of heat—Lubrizol employs immersion cooling, a method of heat removal that uses liquid.

- “It’s like a blacksmith—when you try to remove heat from hot metal, you immerse it in cold water and the water removes the heat,” Lubrizol Vice President of Corporate Innovation Abhishek Shrivastava told us.

- But at Lubrizol, “we are immersing the computer chips in a formulated oil” instead of water. “These GPUs are working so hard with higher power consumption, they can actually melt if they get too hot. So, you need to remove the heat quickly and efficiently.”

Why we need it: Most current data centers use air cooling, but their increasing workloads and processing capacity—driven by the fast-growing appetite for AI—will require something more efficient, Shrivastava said.

- Meanwhile, next-generation processing units will maintain a thermal design power (i.e., heat) of more than three times today’s commonly used systems, according to Lubrizol.

- “AI is needed for the future—for economic development, for global leadership,” Shrivastava said. “It will come down to who can deploy it faster.”

The tech: Lubrizol believes its method of immersion cooling—which relies on nonconducting, dielectric fluids, or liquids that act as electrical insulators—is the key to winning that race.

- “As AI infrastructure is deployed [in the U.S.], there must be efficient cooling in place too,” Shrivastava continued. “It’s going to require a lot of infrastructure-level investment.”

- Up to 40% of data centers’ total annual energy consumption goes to their cooling systems, according to a recent study by the Electric Power Research Institute. Lubrizol’s technology greatly reduces that percentage for its customers.

Getting started: Lubrizol’s immersion cooling technology has been deployed at multiple data centers, and the company is working with its customers to scale up installations. “A lot of small players are using it, because if you’re small, your risk is low and deployment is fast, but there are some large-scale deployments across the world including in China and the U.S. that show the big players have identified the value,” Shrivastava said.

- Among the company’s next steps: getting the solution deployed at larger centers—though that will take some time. “Larger-scale operations need more data, more confidence in [new] technology,” Shrivastava noted.

Years, not decades: In the long term, however, the cost-benefit analysis is very favorable, said Shrivastava, even with infrastructure development outlay. And Shrivastava foresees widespread use of the technology.

- Awareness of the need for high-powered, efficient cooling is growing. “We’re not talking about a matter of decades” before it’s in wide use; “it’s a matter of years and months.”

The last word: “The industry needs to pick up the pace” on the data center cooling front, Shrivastava told the NAM. “Otherwise, we’re not going to realize the full potential of AI.”

AI Is Transforming Appalachia

The spotlight is on Western Pennsylvania—and EQT Corp.’s Toby Rice (The Washington Post, subscription).

What’s going on: The region’s plentiful natural gas is making it a crucial location as energy demand surges thanks to artificial intelligence. At the center of things is Toby Rice, president and CEO of energy company EQT Corp., the largest natural gas producer in the Appalachian Basin.

- “The size of [AI’s energy appetite] … it’s crazy,” Rice told opinion writer Salena Zito. “We are hearing estimates for power demand for AI that’s anywhere [from] 50 to 75 gigawatts of power, which is the equivalent of the power needed to power 10 to 15 New York Cities.”

- EQT is expected to be among the few natural gas providers in contention to support the switchover of the Homer City Generating Station, formerly Pennsylvania’s largest coal-fired power plant, “to natural gas to power an adjacent AI data center.”

From baseball to energy: Massachusetts native Rice wanted to make his career in professional baseball, but after he was passed over by Major League Baseball in college, his father suggested he go into the oil and gas industry.

- After moving to Texas, Rice started out working on an oil rig and eventually founded his own company, Rice Energy.

- “There was a lot of sweat along the way—he left Texas for Appalachia, and slowly grew Rice Energy from a no-name company to a top 10 producer of natural gas in the country.”

- It merged with EQT in 2017, creating America’s biggest independent producer of natural gas.

AI revolution—and opposition: “This is the biggest gas field in the world. This is the biggest energy source,” Rice told the Post. “Pittsburgh has powered, has been the ground zero, for the industrial revolutions that have taken place in this country. This AI revolution that’s taking place—no different.”

- However, AI growth has a sizable hurdle in its way in the form of opposition to natural gas.

- Said Rice: “We’re going to do everything we can to make sure they have all the energy they need to meet their AI aspirations. But we should still have the ability to build more infrastructure here.”

States Look to Satellite Internet for Faster, Cheaper Rural Access

With a large number of Americans still lacking reliable internet access, some states are looking to space to fix the problem (The Wall Street Journal, subscription).

What’s going on: “From Maine to Nevada, states are starting to help some of the 24 million Americans who lack reliable broadband pay for satellite internet, rather than focusing such aid primarily on fiber connectivity as they have in the past.”

- Providers including Amazon have launched new endeavors to increase internet access worldwide, and they could benefit from these states’ push. Amazon’s Project Kuiper, for example, launched its first operational satellites in April and expects to deploy thousands more in the coming years.

The details: “Louisiana set aside $28.7 million of the funds it expects from a federal broadband subsidy program for satellite service, and Nevada has agreed to spend $12.7 million of its funds from the same program on Project Kuiper to serve about 4,400 rural addresses.”

- The Biden administration’s $42.5 billion Broadband Equity, Access and Deployment Program favored fiber over satellite, but the Commerce Department announced earlier this year it will overhaul the program to make it “tech-neutral.”

Why didn’t they do it sooner? Some officials have been reluctant to subsidize satellite internet because it provides slower service than fiber. It’s also susceptible to more frequent outages and requires satellite updates every few years.

- But it’s also quicker and less expensive to implement. (For some remote locations, the price tag for laying fiber can go well into six figures for a single home.)

A stopgap solution: To meet needs while BEAD is rejiggered, Maine and South Carolina have started state-funded programs that subsidize satellite broadband for some rural addresses—but only from a specific provider.

- Texas has a similar program and has accepted applications from providers, and following the Commerce Department’s BEAD announcement, West Virginia is considering spending some of its funds on satellite internet, too.

EIA: China Monopolizes Global Critical Minerals Market

China dominates the global battery mineral market, from sourcing and mining to production, according to the U.S. Energy Information Administration.

What’s going on: “China imported almost 12 million short tons of raw and processed battery minerals, accounting for 44% of interregional trade, and exported almost 11 million short tons of battery materials, packs and components, or 58% of interregional trade in 2023, according to regional UN Comtrade data.”

- These minerals’ importance will only increase as the appetite for electric vehicles and renewable energy technologies grow.

- However, as the NAM recently told the Commerce Department, Section 232 tariffs will not increase domestic sourcing of these critical minerals or decrease U.S. reliance on China for them.

- Instead, to shore up domestic critical minerals supply, the U.S. needs permitting reform, incentives for producers and enhanced trade relationships with partners other than China.

Mining and production: China either produces domestically or has large ownership stakes in companies that produce these minerals.

- In 2023, the country produced about 18% (33,000 short tons) of the world’s mined lithium, and Chinese firms “control 25% of the world’s lithium mining capacity.”

- Chinese companies also have sizable investments in mining operations in the “lithium triangle,” an area in Chile, Argentina and Bolivia that holds half of the world’s lithium stores.

- “China produced 79%, or 1.27 million short tons, of the world’s natural graphite in 2024, according to the U.S. Geological Survey.”

- Chinese firms own 80% of cobalt production in Congo-Kinshasa, the location of more than 50% of the world’s cobalt production.

Trade: After production, raw battery minerals are exported—and in 2023, China accounted for nearly half (46%) of global raw battery mineral import trade.

- That year, the world’s largest lithium producer, Australia, sent almost all its lithium exports to China.

Processing: China has the global critical minerals processing market cornered, too.

- It processes more than 90% of the world’s graphite.

- In 2022, “Chinese companies accounted for over two-thirds of the world’s cobalt and lithium processing capacity.”

- The next year, China imported 20% of global processed battery minerals, mostly African cobalt. Also in 2023, China exported 58% of the world’s processed battery minerals, primarily synthetic graphite, elsewhere in Asia and to Oceania.

Battery materials manufacture and trade: “China accounted for 53% of the world’s battery material export trade in 2023.”

- In 2022, the country made 85% of the world’s anodes, 82% of its electrolytes, 74% of its separators and 70% of its cathodes.

- In 2023, China controlled almost 85% of “battery cell production capacity by monetary value.”

NAM: Manufacturers Need “Smarter” AI Policy Solutions

A big majority of manufacturers expect AI to become essential to their operations by 2030—but they need policymakers to support all that growth and innovation, as a new report from the Manufacturing Leadership Council, the NAM’s digital transformation division, lays out.

By the numbers: The report found that 51% of manufacturers already use AI in their operations.

- Meanwhile, 61% expect investment in AI to increase by 2027.

- That number only grows as manufacturers look further into the future. By 2030, 80% say AI will be essential to growing or maintaining their business.

Current barriers: Right now, manufacturers say some barriers prevent them from implementing AI to its fullest potential.

- They name data quality and availability as the top challenges, with 65% of respondents reporting they lack the right data for AI applications and 62% citing data that is unstructured or poorly formatted.

The policy angle: Manufacturers don’t just need to overcome the technical, logistical or workforce challenges of rolling out AI solutions—challenges that include everything from modernizing data architectures to upskilling and training workers on new tools. They also need a pro-growth policy framework, which the NAM has supplied for policymakers. The key recommendations are:

- Adopt a pro-AI regulatory approach: Given the growing number and variety of use cases of AI in manufacturing, the industry requires an optimized regulatory environment.

- Develop the manufacturing workforce of the AI age: Policymakers should support training programs, career and technical education institutions and STEM education and immigration. According to the MLC’s report, 82% of manufacturers cite a lack of AI-ready skills as the top workforce challenge.

- Advance energy and permitting reform: AI needs a lot of power, and energy and permitting reform is necessary to support AI-related data center growth.

- Protect personal data: Congress should pass a comprehensive privacy law that preempts state laws, provides liability protections that prevent frivolous litigation and adopts a risk-based approach that enables innovation and AI.

- Support U.S. manufacturing of AI chips: Policymakers should execute funding agreements with chip manufacturers and renew the Advanced Manufacturing Investment Credit.

- Incentivize U.S. AI innovation: Congress must pass the One Big Beautiful Bill Act that preserves pro-manufacturing tax policies.

Manufacturers say: “AI continues to drive innovation, efficiency and better outcomes for manufacturers across America. From accelerating drug discovery and development to optimizing manufacturing operations, AI enables companies to make smarter, faster and more impactful decisions,” said Johnson & Johnson Executive Vice President and Chief Technical Operations and Risk Officer and NAM Board Chair Kathy Wengel.

- “Importantly, AI empowers employees at all levels, when we equip them with the knowledge and understanding to help shape the implementation of these new technologies. AI is proving to be an essential partner on the shop floor, and we must continue to ensure manufacturing employees have the skills they need to build the future of our industry.”

The last word: “The latest report from the MLC reinforces the need for modernized, agile, pro-manufacturing AI policy solutions, so that manufacturers can continue to innovate on shop floors across America,” said NAM President and CEO Jay Timmons.

- “Manufacturers welcomed President Trump’s early commitment to maintaining and advancing America’s global AI dominance, and we look forward to continuing to champion American AI leadership and manufacturing in America, which starts with adopting a pro-AI regulatory framework and pursuing policies that bolster innovation.”

Supreme Court Clears Way for Rio Tinto Copper Mine

The U.S. Supreme Court rejected an appeal by a Native American group that would have halted the development of North America’s largest copper mine, a partnership between Rio Tinto and BHP Group (Bloomberg, subscription).

The situation: The appeal attempted to prevent the transfer of federal land to the mining project, due to the religious significance of one area to some members of the San Carlos Apache Tribe.

Why it matters: This site is the third-largest known copper deposit in the world and will be instrumental in the efforts—led by the Trump administration and backed by the NAM—to increase domestic sources of key minerals.

- “Projects such as Resolution have been tied up in legal challenges for years, making the U.S. one of the most challenging places to develop new mines,” Bloomberg noted.

The benefits: “The companies say the mine would supply as much as 25% of U.S. demand and as much as 40 billion pounds of copper over 40 years amid a soaring need for the metal in electric vehicles.”

Next steps: The land transfer may occur as soon as June 16, once the U.S. Forest Service issues a mandatory draft environmental impact statement and record of decision. The companies are still awaiting several federal, state and local permits, however.

The NAM says: “Manufacturers are eager for Resolution Copper to get underway to support strong domestic supply chains of critical materials after years of permitting delays, as well as to create thousands of high-paying jobs,” said NAM Vice President of Domestic Policy Chris Phalen. “The U.S. has an acute need for more mineral production and processing capacity. Policymakers should work to support many more such projects.”

NAM Highlights Manufacturers’ Energy Needs in the AI Age

The NAM is continuing to advise policymakers on the opportunities and hurdles facing the industry as it seeks to support AI innovation. This week, the NAM responded to a request for information from the House’s AI and Energy Working Group, led by Rep. Julie Fedorchak (R-ND), addressing concerns about “American energy dominance and artificial intelligence’s energy demands, securing the energy grid and outpacing and outcompeting China.”

The big picture: “With the digitalization of manufacturing … manufacturers are increasingly dependent on a robust network of cutting-edge data centers for the smooth execution of their core business operations. AI in particular has become integral to modern manufacturing, as it increasingly transforms and supports a multitude of aspects of manufacturing, from product design to shop floor operations to supply chain management.”

- “Manufacturers also rely on the same energy sources as data centers to power their operations. As demand grows and supply remains relatively static, there is a pressing need to use all policy levers available to ensure sufficient, reliable, resilient and affordable energy for all users.”

Permitting reform: The NAM’s first recommendation to the working group was that policymakers must enact permitting reform—and fast. “Wood Mackenzie has predicted that U.S. demand for power could increase by 15% by the end of this decade,” the NAM noted.

- The NAM advised policymakers to take certain crucial steps, including expediting judicial review, accelerating the permit process for energy infrastructure—including more transmission and distribution lines, pipelines and permanent carbon sequestration sites—and providing greater regulatory certainty.

A secure electric grid: Manufacturers are concerned about service disruptions caused by severe weather and aging infrastructure, the NAM said. “A reliable, resilient modern grid is required to enable the historic growth in data centers—which in turn can contribute to manufacturing growth.”

- The NAM recommended the build-out of natural gas generation and transportation infrastructure, as well as the permitting and construction of more transmission and distribution, as mentioned above.

The AI future: Manufacturers also recognize the importance of enabling AI innovation and the risks of imposing an overly restrictive regulatory regime on the fast-evolving technology.

- To that end, the NAM recommended “a regulatory approach that is based on reviews of existing regulations before enacting new ones … a strategy of international engagement that keeps foreign markets open to the use of American AI … and developing the manufacturing workforce of the AI age by supporting science, technology, engineering and mathematics education programs at all levels,” among other policies.

The last word: “Maintaining a favorable policy environment for AI will provide certainty to the private sector, which in turn will spur additional multibillion-dollar investments in U.S. manufacturing and innovation,” said NAM Managing Vice President of Policy Charles Crain.

Timmons Talks to Governors at SelectUSA

NAM President and CEO Jay Timmons moderated a panel of state governors at SelectUSA on Monday, discussing the effects of AI and the policies that have aided manufacturers in the leaders’ respective states.

The panel: Four governors participated in the “Governors Investing in American Technological Competitiveness” panel—Govs. Mike Dunleavy of Alaska, Wes Moore of Maryland, Gretchen Whitmer of Michigan and Glenn Youngkin of Virginia.

- SelectUSA, a U.S. government program led by the U.S. Department of Commerce, aims to promote and support job-creating investment in the U.S.

Timmons says: “I want to thank you so much for your leadership on behalf of manufacturers everywhere,” said Timmons, as he kicked off the panel discussion.

- “You’ve got an important perspective serving both in the State House and on the front lines to tell us how manufacturing is evolving and also the opportunities that AI presents, as well as emerging technology. Now by harnessing these technologies, it becomes clear that the United States is the best place to invest the next dollar in manufacturing.”

The AI transformation: When asked how AI is transforming their states, the governors had a range of answers.

- “We are a logistics state, and for us, our oil and gas industries are huge,” said Dunleavy. “Our mining industries are huge. Our fishing industries are huge, and those industries are capitalizing on AI for a whole host of reasons and methods. I know in the oil industry it’s making drilling a lot more efficient. And so these efficiencies are going to result in better approaches, better products, better services.”

- “If you think about the assets that the state of Maryland has, the reason that AI was so important is … that Maryland has such uniquely tethered assets to our state that made AI … desirable there,” said Moore. “[I]n the state of Maryland, you have the Johns Hopkins data center and AI initiative and the University of Maryland AI center, and you also have the University of Maryland serving as a capital of quantum. … We think it’s important for our states to be on the front edge of this, instead of waiting for consequences.”

- “We know that some of our natural assets, like having the most engineers in the country per capita, like institutions like the University of Michigan or Wayne State or Michigan State University … give us an opportunity when it comes to AI,” said Whitmer. “Michigan will be the first state in the nation, perhaps the first place in North America, to restart a nuclear facility. … [T]here’s no question [that] if we are going to meet our clean energy goals and power the technology that is going to drive … almost every facet of our life, we’ve got to have the clean energy to do that.”

- “It’s estimated that 70% of the internet traffic of the world goes through Virginia, and that gives us a great opportunity to not just lead the nation, but lead the world in the advancement of AI,” said Youngkin. “And we’ve seen huge investment across the state. What that also requires is collaboration with our university and high school education system . . . and that allows us to really develop a unique pipeline of talent. … [A]t the heart of the application of AI is how it translates into driving efficiencies and opportunities and new capabilities in manufacturing.”

The bottom line: “As you heard from these four leaders—manufacturing powers the economic prosperity of the United States,” Timmons said in conclusion. “New technology opens new doors to do so, and the right policy decisions—and the right leadership—will make all the difference.”

Watch the whole thing: You can view the panel discussion on C-SPAN here.

How to Turbocharge Your R&D Leaders’ Careers

Every manufacturing executive has talented innovation leaders in the middle ranks of his or her company—managing a lab or department, but eager to move up. How do you prepare them for the next step in leadership so they can become the executives of tomorrow?

The Innovation Research Interchange, the NAM’s innovation division, offers a program designed to fill this gap in manufacturing professionals’ career development. The Shaping Innovation Leaders program, a partnership with Northwestern University, takes place over one packed week in June every year, and gives these midlevel managers a comprehensive introduction to business strategy, accounting and finance, organizational behavior, brand management and much more.

It’s the starter pack for those seeking to advance in the manufacturing industry. If you have someone on your team who could benefit, here’s what you need to know.

Who it’s for: The course is targeted at managers who have 10–15 years of experience and usually a graduate degree (most often a Ph.D.). These managers typically have several direct reports, oversee a lab or department and handle their own budgets.

- Past participants have worked at major manufacturers and related companies of all sectors, including Mars and FM Global.

What they’ll learn: This one-week intensive residential program—this year taking place June 8–13—features classes in the morning and afternoon, and also includes lunch, dinner and evening study and networking sessions. The courses include:

- Understanding Financial Statements;

- Evaluating Financial Results and Investment Projects;

- Financial Strategy and Cost of Capital;

- Driving Profitable Growth;

- Defending Your Brand; and,

- Law for Technical Executives.

Who’s teaching: The program is taught by eminent Northwestern faculty, including award-winning professors in marketing, management and finance.

- The program’s director, Adjunct Professor of Executive Education Marian Powers, boasts a long career of developing finance textbooks and software and specializes in teaching financial reporting and analysis to executives.

Inside the classroom: Every session of the program introduces participants to skills they may not have encountered in their technical positions. To take just one example, the High-Performance Negotiation Skills session introduces these managers to the framework and tactics that high-level leaders use in handling challenges.

- The course helps participants answer essential questions, such as “How should you think differently about negotiating as part of a team? How should you think about coalition-building in deals with many parties? How can you negotiate effectively from positions of weakness as well as strength?”

- To answer these questions, participants will examine case studies from the manufacturing industry. All the program’s sessions draw on real-world, relevant examples, ensuring that participants receive a useful toolkit of strategies.

What they’re saying: “Above all, this course illustrates a framework behind the motivations of our marketing and business/finance counterparts,” said one participant.

- “We no longer have the excuse of ‘why do they do it that way!?’ but rather, we can help those functions more effectively and proactively.”

Learn more and register: To learn more about the Shaping Innovation Leaders program or to register, visit the IRI site. This year’s program is still accepting applicants.