U.S. “Very Concerned” About Critical Minerals

The Biden administration is “very concerned” about U.S. reliance on China for critical minerals, U.S. Energy Secretary Jennifer Granholm said Wednesday, according to CNBC.

What’s going on: China’s dominance in the world’s critical minerals supply chain is “one of the pieces of the supply chain that we’re very concerned about in the United States,” Granholm told the news outlet on the sidelines of the International Energy Agency’s 2024 Ministerial Meeting in Paris.

- China produces approximately 60% of all rare earth elements, which are critical to alternative-energy technologies, such as electric vehicles.

Why it’s important: “As part of a rapid uptick in demand for critical minerals, the IEA has warned that today’s supply falls short of what is needed to transform the energy sector,” according to the article.

What the administration is doing: Both production and processing of critical minerals “have to be addressed,” Granholm said.

- “And that’s why we are working very closely to ensure that we have identified which raw materials [or] critical minerals we need to be able to do our transition to a clean energy economy.”

The NAM says: “Other countries are taking all possible measures to develop domestic sources of critical minerals, and it should be a wake-up call to the U.S. that we need to be doing the same,” said NAM Vice President of Domestic Policy Brandon Farris. “We also need to reform our broken permitting system to get these projects operational as soon as possible.”

Timmons: Biden Administration’s Agencies Are Undercutting the President’s Own Stated Goals Again with LNG Decision

Washington, D.C. – Following the Department of Energy’s announced freeze on export permits for new liquified natural gas projects, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Once again the Biden administration’s agencies are undercutting President Biden’s own stated goals. The president has said the following:

- ‘Where is it written that America can’t lead the world in manufacturing again? … Now, thanks to all we’ve done, we’re exporting American products and creating American jobs.’[1]

- ‘This nation used to lead the world in manufacturing, and we’re going to do it again.’[2]

- ‘We just have to remember who we are. We’re the United States of America…There’s not a single thing we can’t do when we put our minds to it. And we can strengthen our energy security now, and we can build a clean energy economy for the future at the same time. This is totally within our capacity.’’[3]

- ‘[W]e’re working closely with Europe and our partners to develop a long-term strategy to reduce their dependence on Russian energy.’[4]

- ‘[W]e’re a great nation. We’re the greatest nation on the face of the earth. We really are. That’s the America I see in our future.”[5]

“Manufacturers call on the president to direct his agencies to support his agenda and to end their political war on the manufacturers who power American jobs, our economy and our national security. Today’s decision weakens our country, while giving Russia an upper hand as Europe and Asia look to transition their energy needs.”

[1] State of the Union Address, Feb. 7, 2023.

[2] Remarks at a Political Rally Hosted by Union Members, June 17, 2023.

[3] Remarks on Actions to Strengthen Energy Security and Lower Costs, Oct. 19, 2022.

[4] Remarks Announcing U.S. Ban on Imports of Russian Oil, Liquefied Natural Gas and Coal, March 8, 2022.

[5] Remarks at First Campaign Speech of the 2024 Election, Jan. 5, 2024.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.85 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM Pushes for Sensible Clean Hydrogen Regulations

Manufacturers are working constantly to develop energy approaches that reduce emissions and promote sustainability—and hydrogen energy is an important part of that mix. But upcoming decisions from the U.S. Treasury Department may make it more difficult for manufacturers to achieve their goals.

That’s why the NAM has been advocating for guidance that implements a hydrogen tax credit in a manner that supports manufacturers’ investments in this technology.

The background: Through the Inflation Reduction Act, Congress established this tax credit, called 45V, to incentivize companies to develop, produce and use clean hydrogen.

- “Hydrogen is the Swiss army knife of decarbonization—you can use it for nearly everything you can use natural gas for,” said NAM Vice President of Domestic Policy Brandon Farris. “And this credit can be the most significant tool across the globe to bring down the cost of clean hydrogen.”

The problem: As the U.S. Treasury Department finalizes rules around the use of the tax credit, their decisions may undercut manufacturers’ ability to take full advantage of it. Three provisions in particular are at the center of the NAM’s advocacy.

Additionality: The Treasury Department is considering a policy called “additionality,” which would mean that only hydrogen power created through the use of new renewable energy would be eligible for the credit.

- Meanwhile, clean hydrogen energy created with renewable energy that is already on the grid would not qualify—a real problem as our permitting system can often take half a decade or more to add additional clean power to the grid.

- “We have a lot of renewables on the grid already to spur the hydrogen industry. Using existing clean generation should qualify for the credit,” said Farris.

Time matching: Treasury may also impose a provision called “time matching,” which would mean companies would only receive the tax credit if they produce hydrogen energy at the exact same time that they are producing renewable energy.

- According to Farris, this rule misunderstands the energy production process. A company might only produce solar power for a few hours during the day when the sun is shining, for example, but it could still continue to produce clean hydrogen energy overnight using the grid. Yet under the time matching rule, they would be unable to claim a tax credit for the full amount.

- “This provision would create such tight restrictions that it would chill investment and innovation,” said Farris.

Carbon capture: According to the IRA, clean hydrogen created using natural gas with carbon capture also qualifies for the credit.

- However, the IRA also says taxpayers applying for the credits should have a mechanism to demonstrate that their feedstocks are lower in carbon intensity—yet has not specified what that mechanism will be.

- “Taxpayers applying for the credits should be able to prove that their feedstocks have less carbon,” said Farris. “The law says the less carbon they produce, the higher the credit they should receive. We’re just asking for a mechanism that allows taxpayers to prove it.”

The bottom line: Investments in clean hydrogen energy could be a game-changer for America’s energy future, but only if manufacturers have the opportunity to make them. That’s why the NAM has been urging the Treasury Department to create a flexible credit that rejects the additionality and time matching provisions and provides a mechanism that supports carbon capture.

- “Hydrogen is one of the most promising decarbonization technologies available,” said Farris. “If we can make these changes, we can achieve greater hydrogen production and more significant infrastructure investments and expedite decarbonization efforts across hard-to-abate sectors.”

NAM Fights Restrictive Power Plant Rule

The Environmental Protection Agency is considering a rule that would change the way power plants operate in America—but without significant adjustments, it could have devastating consequences.

The background: Right now, about 60% of America’s power generation comes from a combination of coal and natural gas.

- The EPA’s proposed rule would require coal and natural gas–fired power plants to deploy either carbon capture technology or hydrogen power within 10 years to lower emissions.

- If unable to deploy these technologies at the scale required in that timeframe, these power plants would be forced to shut down.

The problem: While carbon capture and hydrogen power technologies are vital to decarbonization, the required scale and timeline make implementing this rule difficult.

- “Carbon capture and hydrogen are tremendously promising—and manufacturers are leading the way in developing these technologies. But neither have been deployed at the scale needed to support 60% of our entire power generation within a short timeframe,” said NAM Vice President of Domestic Policy Brandon Farris.

The timeline: The EPA’s proposed 10-year timeline leaves little room for flexibility when it comes to implementing the order. According to Farris, environmental impact studies alone could take more than four years.

- “We’re talking about 10 years to essentially retrofit more than half of our power generation,” said Farris. “You would need this permitted, installed and operational within those 10 years, which would be difficult even if the technology was available today at scale.”

The impact: The rule would require plants that do not meet the new standard in 10 years to shut down entirely. As a result, many plants would have to shift resources immediately to plan for a likely shutdown.

- “The big hammer is these plants having to shut down in 10 years if these technologies are not installed,” said Farris.

- “So you’ll see a lot of money spent and not a lot of progress made because this technology isn’t ready at scale, and we have only a few years to permit, install and operate.”

The next steps: The NAM has submitted comments on the rule, and the EPA is working on a final version now.

- “We’ve emphasized that the timeline is not workable,” said Farris. “You would need to have a longer off-ramp and a way to ensure that the technologies required are proven at scale.”

IEA: World Needs More Transmission Lines

The world must add or replace nearly 50 million miles of transmission lines in the next 17 years to allow countries to meet climate goals and achieve energy security, according to a new report by the International Energy Agency covered by CNBC.

What’s going on: The amount of transmission line needed—49.7 million miles—“is roughly equivalent to the total number of miles of electric grid that currently exists in the world, according to the IEA.”

- The undertaking “will require the annual investment in electric grids of more than $600 billion per year by 2030,” double current global investment levels in transmission lines.

- Countries must also make changes to the way they operate and regulate their grids.

Why it’s important: Investment in global transmission lines has not kept pace with the growing appetite for renewables, and without replacements and additions to transmission lines, power bottlenecks will become “ever larger.”

Growing gridlock—and demand: “There are currently 1,500 gigawatts of renewable clean energy projects in what the IEA calls ‘advanced stages of development’ that are waiting to get connected to the electric grid around the world.”

- Meanwhile, demand for electricity will only rise as more of the globe moves to electric power.

- But building new transmission lines takes time, owing to lengthy permitting processes—which is why the NAM has long advocated speeding the process in the U.S.

Our view: “The NAM has identified building additional transmission lines as a top priority for the next round of permit reform negotiations,” said NAM Vice President of Domestic Policy Brandon Farris.

- “We will continue to fight to break down barriers to building new projects, including manufacturing facilities, energy generation, transmission lines, bridges, roads and more.”

Ship with Legs Will Be World’s Biggest Wind Farm

A planned offshore wind farm whose developers are billing it as the largest in the world has produced electricity for the first time, according to CNBC.

What’s going on: “Located in the North Sea, over 130 kilometers off England’s northeast coast, the Dogger Bank Wind Farm still has some way to go before it’s fully operational, but the installation and powering up of its first turbine is a major feat in itself. That’s because GE Vernova’s Haliade-X turbines stand 260 meters tall—that’s higher than San Francisco’s Golden Gate Bridge—and have blades measuring 107 meters.”

- Once the installation is complete, the ship will have 277 Haliade-X turbines.

Why it’s a game-changer: “Described by Dogger Bank as the ‘largest offshore jack-up installation vessel ever built,’ in many ways, it’s the pinnacle of an extensive supply chain involving numerous businesses and stakeholders.”

- Thanks to four legs that allow the vessel to lift itself above the water’s surface, the wind farm will be able to operate in depths of up to 80 meters—some 30 meters deeper than fixed-foundation wind farms.

Power producer: Once fully up and running, project developers say the Dogger Bank Wind Farm will have a capacity of 3.6 gigawatts, enough “to power as many as 6 million homes per year.”

- For the sake of comparison, the U.K.’s fully operational Hornsea 2—considered a major wind farm—has a capacity of just over 1.3 GW, according to another CNBC piece.

A complex project: The totality of the undertaking is “huge,” according to one source, and being made more complex “by the use of next-generation turbines and a next-generation installation vessel.”

- Given the immense size of the Haliade-X turbines, “we use a number of specially designed pieces of equipment to transport” them, a GE Offshore Wind spokesperson said.

The NAM’s view: “Offshore wind can be an important part of an all-of-the-above energy strategy that helps meet energy security and decarbonization goals,” said NAM Vice President of Domestic Policy Brandon Farris. “Manufacturers keep leading the way with investments in the next generation of energy technologies—and the NAM will continue to advocate energy policies that provide manufacturers affordable, reliable energy.”

Producer Prices Rise More Than Anticipated

U.S. producer prices for final demand goods and services rose more than expected last month, largely owing to higher energy costs, Reuters (subscription) reports.

What’s going on: “The producer price index for final demand rose 0.5% last month, the Labor Department said on Wednesday. Data for August was unrevised to show the PPI accelerating 0.7%.”

- Reuters-polled economists had expected the PPI to increase 0.3%.

- “In the 12 months through September, the PPI increased 2.2% after advancing 2.0% in August.”

Core PPI: Core producer prices—prices excluding food, energy and trade services components—rose 0.2%, the same increase seen in August.

- “In the 12 months through September, the … core PPI increased 2.8% after climbing 2.9% in August.”

Coming up: The Federal Reserve is expected to leave current interest rates unchanged when it meets Oct. 31 and Nov. 1, according to Reuters.

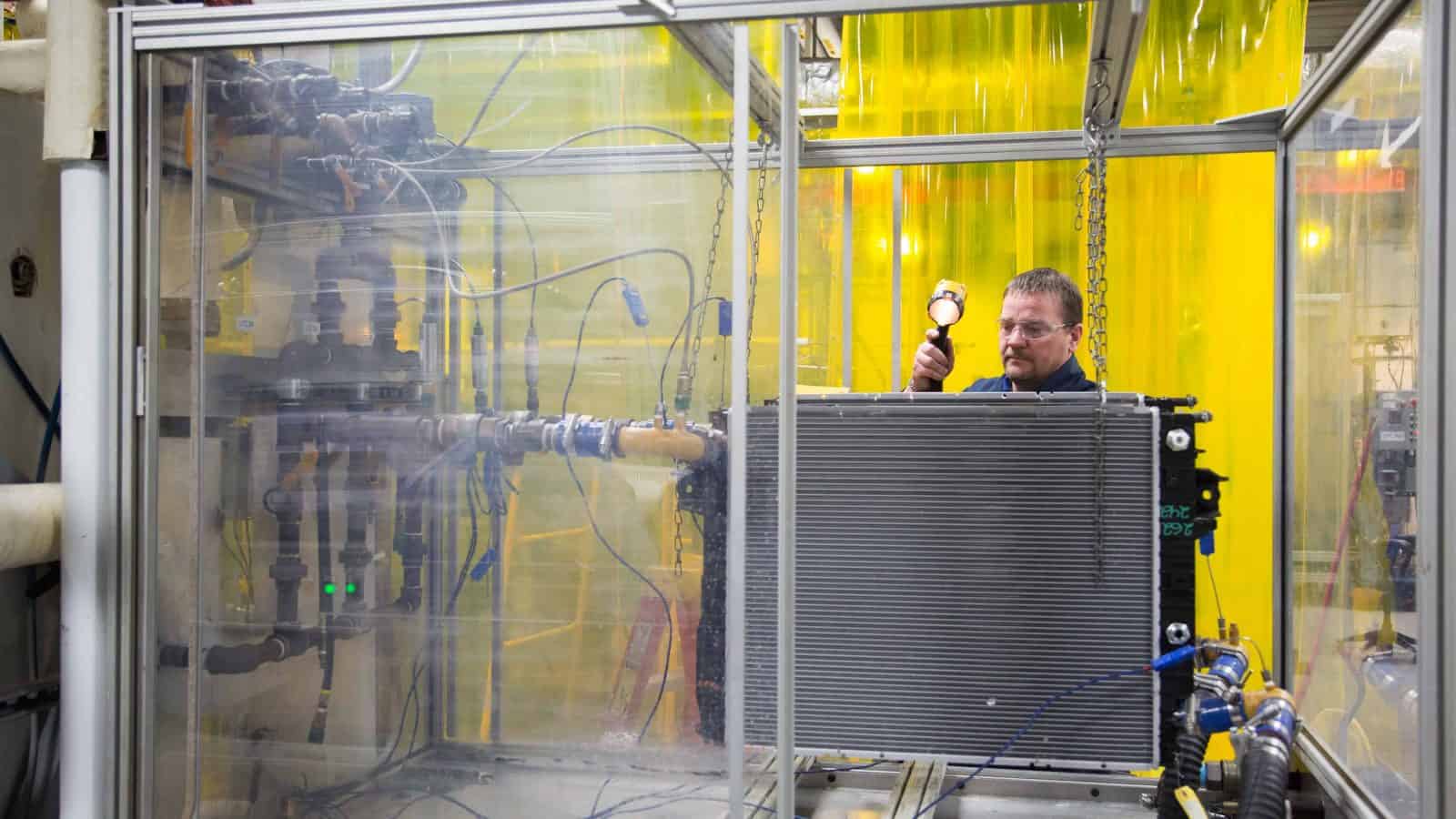

Startup Aims to Make Green Hydrogen Affordable

An energy startup that just hit the $1 billion investment mark thinks it holds the key to finally producing large quantities of “green” hydrogen, according to The Wall Street Journal (subscription).

What’s going on: “Electric Hydrogen believes the secret to success is finding a better way to split a [water] molecule. … Splitting it to create green hydrogen requires devices called electrolyzers. They are expensive and consume vast amounts of renewable electricity to make a small amount of hydrogen, making most projects uneconomical. Electric Hydrogen says its electrolyzer can produce much more hydrogen.”

- The company says its method of hydrogen production combined with “the generous tax subsidies on offer” from last year’s Inflation Reduction Act could finally make green hydrogen a market-competitive energy source.

Investors go all in: The company “recently raised $380 million from backers including BP, United Airlines, Microsoft and iron-ore producer Fortescue Metals,” helping it pass $1 billion in total investments.

Why it’s important: Green hydrogen “is one of the few options to eliminate emissions from trucks, planes, steel mills and chemical plants where renewable power and batteries alone can’t get the job done.”

- “Hydrogen is one of the few ways to move green power long distances. Potential demand is so great that the winner of the race for green hydrogen could dominate a market worth as much as $1 trillion in the coming decades.”

Cracking the code: While electrolyzers have been typically small devices used in the aerospace and chemical industries, Electric Hydrogen thinks it can make the devices both larger and more affordable “by starting from scratch and using new plate engineering focused on the performance of bigger electrolyzers.”

The NAM’s take: “Clean hydrogen is critical to decarbonizing hard-to-abate industries, and manufacturers are leading the way in developing and scaling it for widespread use,” said NAM Vice President of Domestic Policy Brandon Farris.

- “The NAM is working to ensure that the incentives available for clean hydrogen help create the right market incentives for producers—as well as manufacturers and other end users—to meaningfully contribute to decarbonization while boosting domestic job growth and global competitiveness.”

Maersk Introduces First Green-Methanol Container Ship

In a milestone for the logistics sector, Danish shipping firm Maersk recently unveiled “its first container vessel moved with green methanol,” CNBC reports.

What’s going on: “The new container ship, ordered in 2021, has two engines: one moved by traditional fuels and another run with green methanol—an alternative component, which uses biomass or captured carbon and hydrogen [for] renewable power. Practically speaking, the new vessel emits 100 tons of carbon dioxide fewer per day compared to diesel-based ships.”

- The ship is the first of a larger order of 25 due for delivery next year.

- Other shipping firms have placed orders for similar vessels.

Why it’s important: Because it’s a global industry—with approximately 90% of the world’s traded products traveling by sea—ocean shipping has typically been less receptive to transitioning to new energy sources, Danish Minister of Industry Morten Bodskov said, according to the article.

- For example, “[i]n June, a group of 20 nations supported a plan for a levy on shipping industry emissions. But China, Argentina and Brazil were among the nations pushing back against such an idea.”

Climate goals: Maersk aims to be “climate neutral” by 2040, making the green-methanol vessels a key part of its approximately 700-ship fleet.

However … “[A]nalysts are worried that Maersk and its competitors might struggle to find enough supply of green methanol. The fuel is scarce and costly to transport.”

The last word: “Manufacturers are leading the way on developing and scaling up new clean energy sources,” said NAM Vice President of Domestic Policy Brandon Farris. “The NAM continues to advocate for policies and programs that foster and encourage that innovation.”

Chevron Now Majority Stakeholder in Hydrogen Project

Chevron Corp. has bought a majority stake in a federal government–supported “green” hydrogen project in Utah that, once completed, will “produce massive volumes” of the renewable energy source, according to E&E News’ ENERGYWIRE (subscription).

What’s going on: Chevron said on Tuesday that it had completed a deal with fuel-storage developer Magnum Development LLC to take over full ownership of the Utah salt caverns where green hydrogen production and storage is set to take place.

- This purchase gives the energy giant “a majority interest in the joint venture that is developing the [Advanced Clean Energy Storage] project.”

- ACES—in which Mitsubishi Power Americas Inc. and private-equity firm Haddington Ventures LLC are also partners—won a $504 million loan guarantee from the Department of Energy in 2022.

- The project is part of a larger effort by Chevron to develop emerging energy technologies through 2028.

Why it’s important: “We seek to leverage the unique strengths of each partner to develop a large-scale, hydrogen platform that provides affordable, reliable, ever-cleaner energy and helps our customers achieve their lower carbon goals,” Chevron New Energies Vice President Austin Knight said in a statement.

- The plan is to make the hydrogen in the salt caverns in Delta, Utah, “for use at a nearby power plant” looking to diversify its energy mix—and aiming to run entirely on hydrogen by 2045.

Another effort: In partnership with ExxonMobil Corp. and Shell PLC, Chevron is also part of a Texas industry group asking for $1.25 billion in 2021 Bipartisan Infrastructure Law funds to construct hydrogen “hubs,” large-scale demonstrations of hydrogen production, transportation, usage and storage.

A model project: “Currently under construction, the ACES project could become one of the western U.S.’s most important demonstrations of what a low-carbon hydrogen industry might look like,” ENERGYWIRE reports.

The NAM’s take: “Manufacturers view clean energy solutions, such as hydrogen, as an important part of our country’s energy present and future—and the industry is used to leading the charge in developing and scaling hydrogen projects for widespread use,” said NAM Vice President of Domestic Economic Policy Brandon Farris.

- “The NAM is committed to ensuring that the hydrogen tax credit and other incentives help build the appropriate market conditions for hydrogen projects to succeed.”