Previewing the SEC’s Climate Rule

For the past two years, the U.S. Securities and Exchange Commission has been considering a rule that would require businesses to report huge amounts of information about companies’ climate-related risks, strategies and impacts. As the SEC prepares to release its final version of the rule this Wednesday, we spoke with NAM Vice President of Domestic Policy Charles Crain about what manufacturers should expect.

The background: In March 2022, the SEC proposed what the NAM has called an overreaching, unworkable and burdensome climate disclosure rule. According to Crain, the initial proposal would have required extensive disclosures as well as invasive tracking procedures to gauge climate impact and emissions throughout companies’ supply chains—significantly increasing costs and liability for manufacturers.

- “The proposal would have had major implications for the entire manufacturing sector, including both large and small public companies—and even privately held businesses throughout manufacturing supply chains,” said Crain. “As proposed, the rule represents a significant threat to manufacturing competitiveness.”

The pushback: In the two years since the rule was first proposed, the NAM has pressed for significant changes—in detailed letters to the SEC, in congressional testimony and in meetings with SEC commissioners and staff.

- “Manufacturers have made it a top priority over the past two years to convince the SEC that they need to change their approach,” said Crain. “The NAM has spent significant time and effort explaining to the SEC why its proposal was unworkable and likely unlawful and illustrating the impact of the rule’s overwhelming cost burden on manufacturers.”

- “But we also offered specific and actionable suggestions to help the agency tailor the rule, make it more workable to manufacturers and bring it back within the SEC’s statutory authority.”

The preview: With the SEC set to publish its final rule tomorrow, Crain says the NAM is keeping an eye on key inflection points, including the following:

- Scope 3 emissions reporting: The proposal’s Scope 3 mandate would require public companies to disclose the emissions of their supply chain partners—including small and family-owned businesses. If Scope 3 is curtailed or absent, that would represent significant progress for manufacturers.

- Financial statement reporting requirements: The NAM will be tracking the degree to which companies are required to incorporate climate information into their financial statements. The NAM called the proposal’s approach to financial statement reporting “unworkable [and] highly burdensome.”

- Materiality: The SEC is only allowed by law to require “material” disclosures—i.e., financial information that allows investors to make informed decisions. Mandates in the final rule that require immaterial disclosures or seek to redefine materiality could exceed the SEC’s legal authority.

- Implementation: The NAM will consider when and how the rule takes effect, and whether the SEC has provided scaled requirements for smaller companies or tailored implementation plans for certain provisions within the rule.

- Small-business impact: The proposal would have harmed small and privately held businesses disproportionately. The SEC must do a better job at protecting these companies in the final rule.

The expectation: Crain says the NAM’s advocacy appears to have made a difference.

- “Recent news reports suggested that some provisions in the rule may have been modified in alignment with the NAM’s suggested changes,” said Crain. “But it remains to be seen whether the final rule, taken as a whole, is actually workable for manufacturers.”

The next step: The NAM’s next moves will depend on the specifics of the final rule—but the conversation is unlikely to end there.

- “The NAM has been clear that a failure to bring the rule back within the agency’s statutory authority could invite legal action. On the other hand, a balanced, workable rule could obviate the need for litigation,” said Crain.

- “Regardless of the exact content of the rule, the NAM is committed to providing resources to our members to help companies understand and comply with any new requirements. We will also continue to engage with the SEC and Congress to address any implementation issues, seek guidance on any unclear provisions and, if necessary, push for changes to the final rule.”

- “As we have for the past two years, the NAM will continue to advocate on manufacturers’ behalf.”

DOE, NAM Urge Flexible 45V Rules

The Department of Energy is urging Treasury to loosen proposed rules for the Inflation Reduction Act’s first tax credit—the 45V, or clean hydrogen tax credit, POLITICO Pro (subscription) reports.

- The request is in line with suggestions the NAM made to the Internal Revenue Service—which, with Treasury, set forth the guidance for claiming the credit—earlier this week.

What’s going on: “The Department of Energy is pushing Treasury to relax the rules to give the industry time to embark on a massive expansion, according to three people familiar with the discussions.”

- The 45V was intended as a longer-term accompaniment to the DoE’s $7 billion regional hydrogen hubs program, which agency officials are concerned will be hamstrung if the tax guidance is too stringent, according to the article.

- The credit “will directly impact how much hydrogen the U.S. produces and the financial bottom line for many companies.”

Why it’s important: The 45V is a major pillar of the Biden administration’s climate agenda, which seeks to make low-carbon hydrogen cost-effective enough to help decarbonize various industries, according to E&E News’ ENERGYWIRE (subscription).

The NAM’s view: “If implemented properly, the 45V credit would provide the certainty needed for manufacturers to make investment decisions that encourage further production, transportation and use of clean hydrogen,” NAM Vice President of Domestic Policy Brandon Farris said.

- “However, the NAM is concerned Treasury is considering renewable sourcing provisions regarding incrementality, temporal-matching and deliverability requirements, which would limit the amount of energy sources available to power the hydrogen production process.”

What should be done: To create a workable, fair 45V framework, Treasury and the IRS should do the following:

- Lengthen the three-year time frame for incrementality, the time frame within which new electricity must be put into service.

- Push back to 2032 (at the earliest) the date by which energy projects must match clean electricity and hydrogen production at an hourly level.

- Recognize energy attribute certificates from outside manufacturers’ own regions as capable of delivering electricity or natural gas into the region where the clean hydrogen production is taking place.

- Follow congressional intent and provide a more reasonable process for taxpayers to prove their food stocks are lower in carbon intensity and therefore eligible for the maximum credit.

NAM Election Playbook: Synergies, Not Sides

The NAM isn’t playing favorites in an election year. Instead, it’s redoubling its post-partisan approach to advocacy. NAM President and CEO Jay Timmons’ message to manufacturers: the association will leverage its hard-won, bipartisan influence to advance manufacturers’ priorities, no matter who’s in charge.

- “That’s what we’re about. Policy that helps people. Policy—not politics, personality or process. That’s what will guide us in 2024 and beyond,” Timmons said in a speech that helped kick off the NAM board meeting this week, before more than 200 of manufacturing’s leading executives in Phoenix, Arizona.

Why it’s important: “Both sides want us on their side,” Timmons emphasized while recounting a recent legislative debate. That trust and respect, he said, translates into wins: agencies modifying rules to avoid lawsuits and high-level White House officials acknowledging the impact of NAM campaigns.

Battles loom: But the very system enabling these victories is under threat, Timmons warned, placing the onus on manufacturers to not just build products, but to empower the NAM to utilize their voices and stories to advance policies that strengthen the economy and underpin democracy and free enterprise.

- Tax showdown: Any new taxes on manufacturers are a nonstarter, Timmons vowed, staking a claim in the looming 2025 tax fight and reiterating manufacturers’ call for immediate passage in the Senate of full capital expensing, R&D expensing and interest deductibility.

- Regulatory onslaught: From new Environmental Protection Agency air standards to the broader regulatory agenda, Timmons argued that overzealous rules impede manufacturing competitiveness. He specifically criticized the new PM2.5 standards, saying the EPA “set them at a level that is lower than the EU or the UK, and imposed a compliance timeline that is far more aggressive.”

- LNG halt: Timmons blasted the Biden administration’s liquefied natural gas export permit freeze, calling it shortsighted and detrimental to both manufacturers and broader U.S. energy and climate goals. “They want to address climate change?” he asked. “So they’re going to have other countries buying and burning dirtier energy? They want to support our allies around the world? So they’re going to force Europe and Japan and others to get their fuel from the likes of Russia?”

- Immigration deadlock: He criticized inaction on both sides of the aisle, saying border security and workforce solutions can—and must—coexist.

Opportunity ahead: Despite considerable challenges, Timmons sees an opportunity for manufacturers to take the lead in promoting American values and sound policies that fuel the industry’s strength.

- “This election year, manufacturers can help renew a shared sense of purpose,” Timmons told executives. “Remind Americans why our country—our system rooted in God-given human rights and fundamental freedom—is worth celebrating and defending.” At stake is not just the next regulatory win, but the very system that made U.S. manufacturing a global powerhouse, he said.

- America’s bicentennial celebration helped us see beyond the divisions of the day, Timmons observed. As we approach the 250th anniversary of the signing of the Declaration of Independence, “it’s manufacturers who are positioned to cultivate that patriotic spirit,” Timmons said. It’s more than just bottom lines. “We can help mend the divides—so that we can promote policy that will strengthen manufacturing in America.”

U.S. “Very Concerned” About Critical Minerals

The Biden administration is “very concerned” about U.S. reliance on China for critical minerals, U.S. Energy Secretary Jennifer Granholm said Wednesday, according to CNBC.

What’s going on: China’s dominance in the world’s critical minerals supply chain is “one of the pieces of the supply chain that we’re very concerned about in the United States,” Granholm told the news outlet on the sidelines of the International Energy Agency’s 2024 Ministerial Meeting in Paris.

- China produces approximately 60% of all rare earth elements, which are critical to alternative-energy technologies, such as electric vehicles.

Why it’s important: “As part of a rapid uptick in demand for critical minerals, the IEA has warned that today’s supply falls short of what is needed to transform the energy sector,” according to the article.

What the administration is doing: Both production and processing of critical minerals “have to be addressed,” Granholm said.

- “And that’s why we are working very closely to ensure that we have identified which raw materials [or] critical minerals we need to be able to do our transition to a clean energy economy.”

The NAM says: “Other countries are taking all possible measures to develop domestic sources of critical minerals, and it should be a wake-up call to the U.S. that we need to be doing the same,” said NAM Vice President of Domestic Policy Brandon Farris. “We also need to reform our broken permitting system to get these projects operational as soon as possible.”

Timmons: Biden Administration’s Agencies Are Undercutting the President’s Own Stated Goals Again with LNG Decision

Washington, D.C. – Following the Department of Energy’s announced freeze on export permits for new liquified natural gas projects, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Once again the Biden administration’s agencies are undercutting President Biden’s own stated goals. The president has said the following:

- ‘Where is it written that America can’t lead the world in manufacturing again? … Now, thanks to all we’ve done, we’re exporting American products and creating American jobs.’[1]

- ‘This nation used to lead the world in manufacturing, and we’re going to do it again.’[2]

- ‘We just have to remember who we are. We’re the United States of America…There’s not a single thing we can’t do when we put our minds to it. And we can strengthen our energy security now, and we can build a clean energy economy for the future at the same time. This is totally within our capacity.’’[3]

- ‘[W]e’re working closely with Europe and our partners to develop a long-term strategy to reduce their dependence on Russian energy.’[4]

- ‘[W]e’re a great nation. We’re the greatest nation on the face of the earth. We really are. That’s the America I see in our future.”[5]

“Manufacturers call on the president to direct his agencies to support his agenda and to end their political war on the manufacturers who power American jobs, our economy and our national security. Today’s decision weakens our country, while giving Russia an upper hand as Europe and Asia look to transition their energy needs.”

[1] State of the Union Address, Feb. 7, 2023.

[2] Remarks at a Political Rally Hosted by Union Members, June 17, 2023.

[3] Remarks on Actions to Strengthen Energy Security and Lower Costs, Oct. 19, 2022.

[4] Remarks Announcing U.S. Ban on Imports of Russian Oil, Liquefied Natural Gas and Coal, March 8, 2022.

[5] Remarks at First Campaign Speech of the 2024 Election, Jan. 5, 2024.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.85 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM Pushes for Sensible Clean Hydrogen Regulations

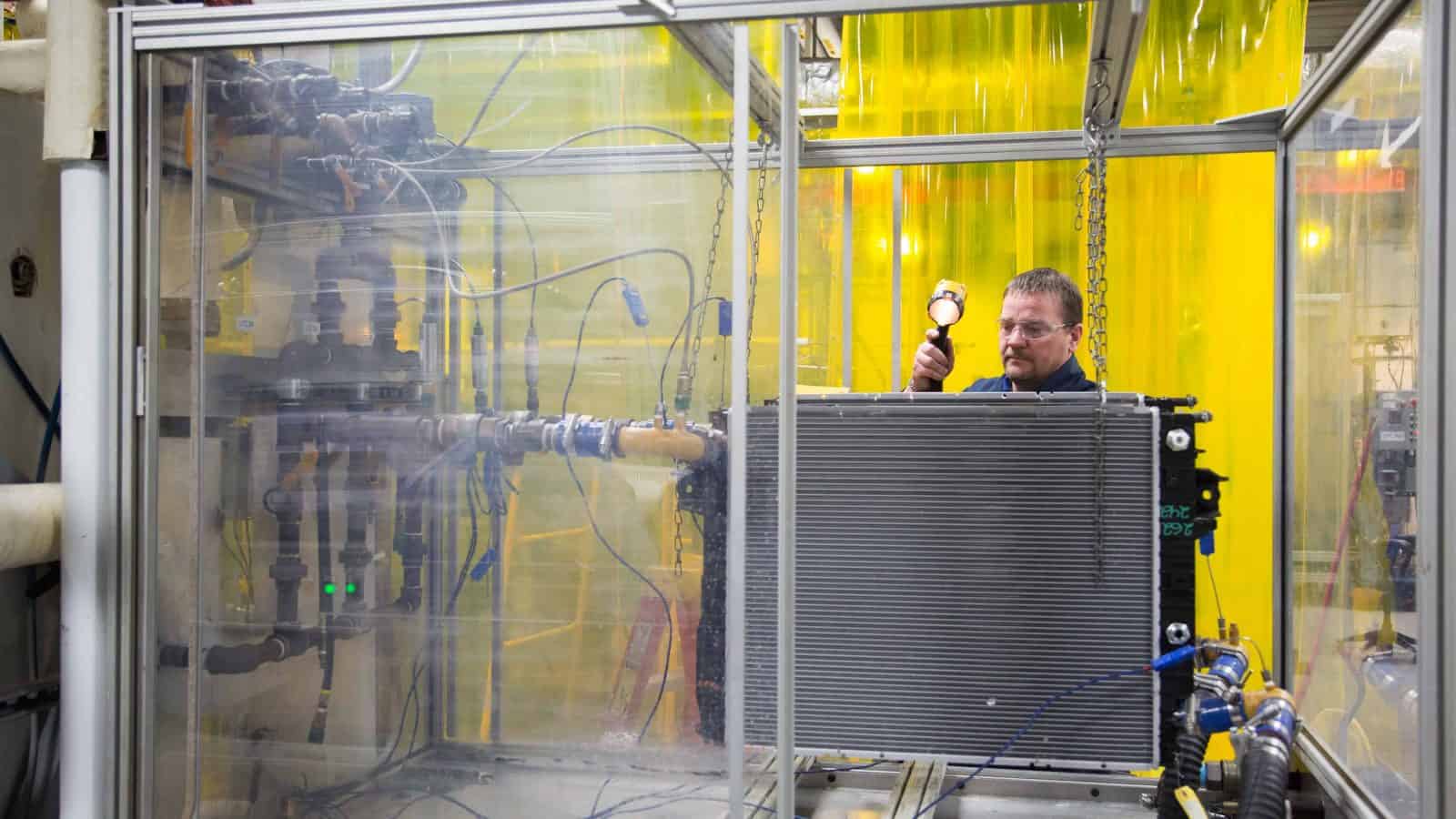

Manufacturers are working constantly to develop energy approaches that reduce emissions and promote sustainability—and hydrogen energy is an important part of that mix. But upcoming decisions from the U.S. Treasury Department may make it more difficult for manufacturers to achieve their goals.

That’s why the NAM has been advocating for guidance that implements a hydrogen tax credit in a manner that supports manufacturers’ investments in this technology.

The background: Through the Inflation Reduction Act, Congress established this tax credit, called 45V, to incentivize companies to develop, produce and use clean hydrogen.

- “Hydrogen is the Swiss army knife of decarbonization—you can use it for nearly everything you can use natural gas for,” said NAM Vice President of Domestic Policy Brandon Farris. “And this credit can be the most significant tool across the globe to bring down the cost of clean hydrogen.”

The problem: As the U.S. Treasury Department finalizes rules around the use of the tax credit, their decisions may undercut manufacturers’ ability to take full advantage of it. Three provisions in particular are at the center of the NAM’s advocacy.

Additionality: The Treasury Department is considering a policy called “additionality,” which would mean that only hydrogen power created through the use of new renewable energy would be eligible for the credit.

- Meanwhile, clean hydrogen energy created with renewable energy that is already on the grid would not qualify—a real problem as our permitting system can often take half a decade or more to add additional clean power to the grid.

- “We have a lot of renewables on the grid already to spur the hydrogen industry. Using existing clean generation should qualify for the credit,” said Farris.

Time matching: Treasury may also impose a provision called “time matching,” which would mean companies would only receive the tax credit if they produce hydrogen energy at the exact same time that they are producing renewable energy.

- According to Farris, this rule misunderstands the energy production process. A company might only produce solar power for a few hours during the day when the sun is shining, for example, but it could still continue to produce clean hydrogen energy overnight using the grid. Yet under the time matching rule, they would be unable to claim a tax credit for the full amount.

- “This provision would create such tight restrictions that it would chill investment and innovation,” said Farris.

Carbon capture: According to the IRA, clean hydrogen created using natural gas with carbon capture also qualifies for the credit.

- However, the IRA also says taxpayers applying for the credits should have a mechanism to demonstrate that their feedstocks are lower in carbon intensity—yet has not specified what that mechanism will be.

- “Taxpayers applying for the credits should be able to prove that their feedstocks have less carbon,” said Farris. “The law says the less carbon they produce, the higher the credit they should receive. We’re just asking for a mechanism that allows taxpayers to prove it.”

The bottom line: Investments in clean hydrogen energy could be a game-changer for America’s energy future, but only if manufacturers have the opportunity to make them. That’s why the NAM has been urging the Treasury Department to create a flexible credit that rejects the additionality and time matching provisions and provides a mechanism that supports carbon capture.

- “Hydrogen is one of the most promising decarbonization technologies available,” said Farris. “If we can make these changes, we can achieve greater hydrogen production and more significant infrastructure investments and expedite decarbonization efforts across hard-to-abate sectors.”

NAM Fights Restrictive Power Plant Rule

The Environmental Protection Agency is considering a rule that would change the way power plants operate in America—but without significant adjustments, it could have devastating consequences.

The background: Right now, about 60% of America’s power generation comes from a combination of coal and natural gas.

- The EPA’s proposed rule would require coal and natural gas–fired power plants to deploy either carbon capture technology or hydrogen power within 10 years to lower emissions.

- If unable to deploy these technologies at the scale required in that timeframe, these power plants would be forced to shut down.

The problem: While carbon capture and hydrogen power technologies are vital to decarbonization, the required scale and timeline make implementing this rule difficult.

- “Carbon capture and hydrogen are tremendously promising—and manufacturers are leading the way in developing these technologies. But neither have been deployed at the scale needed to support 60% of our entire power generation within a short timeframe,” said NAM Vice President of Domestic Policy Brandon Farris.

The timeline: The EPA’s proposed 10-year timeline leaves little room for flexibility when it comes to implementing the order. According to Farris, environmental impact studies alone could take more than four years.

- “We’re talking about 10 years to essentially retrofit more than half of our power generation,” said Farris. “You would need this permitted, installed and operational within those 10 years, which would be difficult even if the technology was available today at scale.”

The impact: The rule would require plants that do not meet the new standard in 10 years to shut down entirely. As a result, many plants would have to shift resources immediately to plan for a likely shutdown.

- “The big hammer is these plants having to shut down in 10 years if these technologies are not installed,” said Farris.

- “So you’ll see a lot of money spent and not a lot of progress made because this technology isn’t ready at scale, and we have only a few years to permit, install and operate.”

The next steps: The NAM has submitted comments on the rule, and the EPA is working on a final version now.

- “We’ve emphasized that the timeline is not workable,” said Farris. “You would need to have a longer off-ramp and a way to ensure that the technologies required are proven at scale.”

IEA: World Needs More Transmission Lines

The world must add or replace nearly 50 million miles of transmission lines in the next 17 years to allow countries to meet climate goals and achieve energy security, according to a new report by the International Energy Agency covered by CNBC.

What’s going on: The amount of transmission line needed—49.7 million miles—“is roughly equivalent to the total number of miles of electric grid that currently exists in the world, according to the IEA.”

- The undertaking “will require the annual investment in electric grids of more than $600 billion per year by 2030,” double current global investment levels in transmission lines.

- Countries must also make changes to the way they operate and regulate their grids.

Why it’s important: Investment in global transmission lines has not kept pace with the growing appetite for renewables, and without replacements and additions to transmission lines, power bottlenecks will become “ever larger.”

Growing gridlock—and demand: “There are currently 1,500 gigawatts of renewable clean energy projects in what the IEA calls ‘advanced stages of development’ that are waiting to get connected to the electric grid around the world.”

- Meanwhile, demand for electricity will only rise as more of the globe moves to electric power.

- But building new transmission lines takes time, owing to lengthy permitting processes—which is why the NAM has long advocated speeding the process in the U.S.

Our view: “The NAM has identified building additional transmission lines as a top priority for the next round of permit reform negotiations,” said NAM Vice President of Domestic Policy Brandon Farris.

- “We will continue to fight to break down barriers to building new projects, including manufacturing facilities, energy generation, transmission lines, bridges, roads and more.”

Ship with Legs Will Be World’s Biggest Wind Farm

A planned offshore wind farm whose developers are billing it as the largest in the world has produced electricity for the first time, according to CNBC.

What’s going on: “Located in the North Sea, over 130 kilometers off England’s northeast coast, the Dogger Bank Wind Farm still has some way to go before it’s fully operational, but the installation and powering up of its first turbine is a major feat in itself. That’s because GE Vernova’s Haliade-X turbines stand 260 meters tall—that’s higher than San Francisco’s Golden Gate Bridge—and have blades measuring 107 meters.”

- Once the installation is complete, the ship will have 277 Haliade-X turbines.

Why it’s a game-changer: “Described by Dogger Bank as the ‘largest offshore jack-up installation vessel ever built,’ in many ways, it’s the pinnacle of an extensive supply chain involving numerous businesses and stakeholders.”

- Thanks to four legs that allow the vessel to lift itself above the water’s surface, the wind farm will be able to operate in depths of up to 80 meters—some 30 meters deeper than fixed-foundation wind farms.

Power producer: Once fully up and running, project developers say the Dogger Bank Wind Farm will have a capacity of 3.6 gigawatts, enough “to power as many as 6 million homes per year.”

- For the sake of comparison, the U.K.’s fully operational Hornsea 2—considered a major wind farm—has a capacity of just over 1.3 GW, according to another CNBC piece.

A complex project: The totality of the undertaking is “huge,” according to one source, and being made more complex “by the use of next-generation turbines and a next-generation installation vessel.”

- Given the immense size of the Haliade-X turbines, “we use a number of specially designed pieces of equipment to transport” them, a GE Offshore Wind spokesperson said.

The NAM’s view: “Offshore wind can be an important part of an all-of-the-above energy strategy that helps meet energy security and decarbonization goals,” said NAM Vice President of Domestic Policy Brandon Farris. “Manufacturers keep leading the way with investments in the next generation of energy technologies—and the NAM will continue to advocate energy policies that provide manufacturers affordable, reliable energy.”

Producer Prices Rise More Than Anticipated

U.S. producer prices for final demand goods and services rose more than expected last month, largely owing to higher energy costs, Reuters (subscription) reports.

What’s going on: “The producer price index for final demand rose 0.5% last month, the Labor Department said on Wednesday. Data for August was unrevised to show the PPI accelerating 0.7%.”

- Reuters-polled economists had expected the PPI to increase 0.3%.

- “In the 12 months through September, the PPI increased 2.2% after advancing 2.0% in August.”

Core PPI: Core producer prices—prices excluding food, energy and trade services components—rose 0.2%, the same increase seen in August.

- “In the 12 months through September, the … core PPI increased 2.8% after climbing 2.9% in August.”

Coming up: The Federal Reserve is expected to leave current interest rates unchanged when it meets Oct. 31 and Nov. 1, according to Reuters.