Americans Oppose LNG Export Pause, NAM Poll Finds

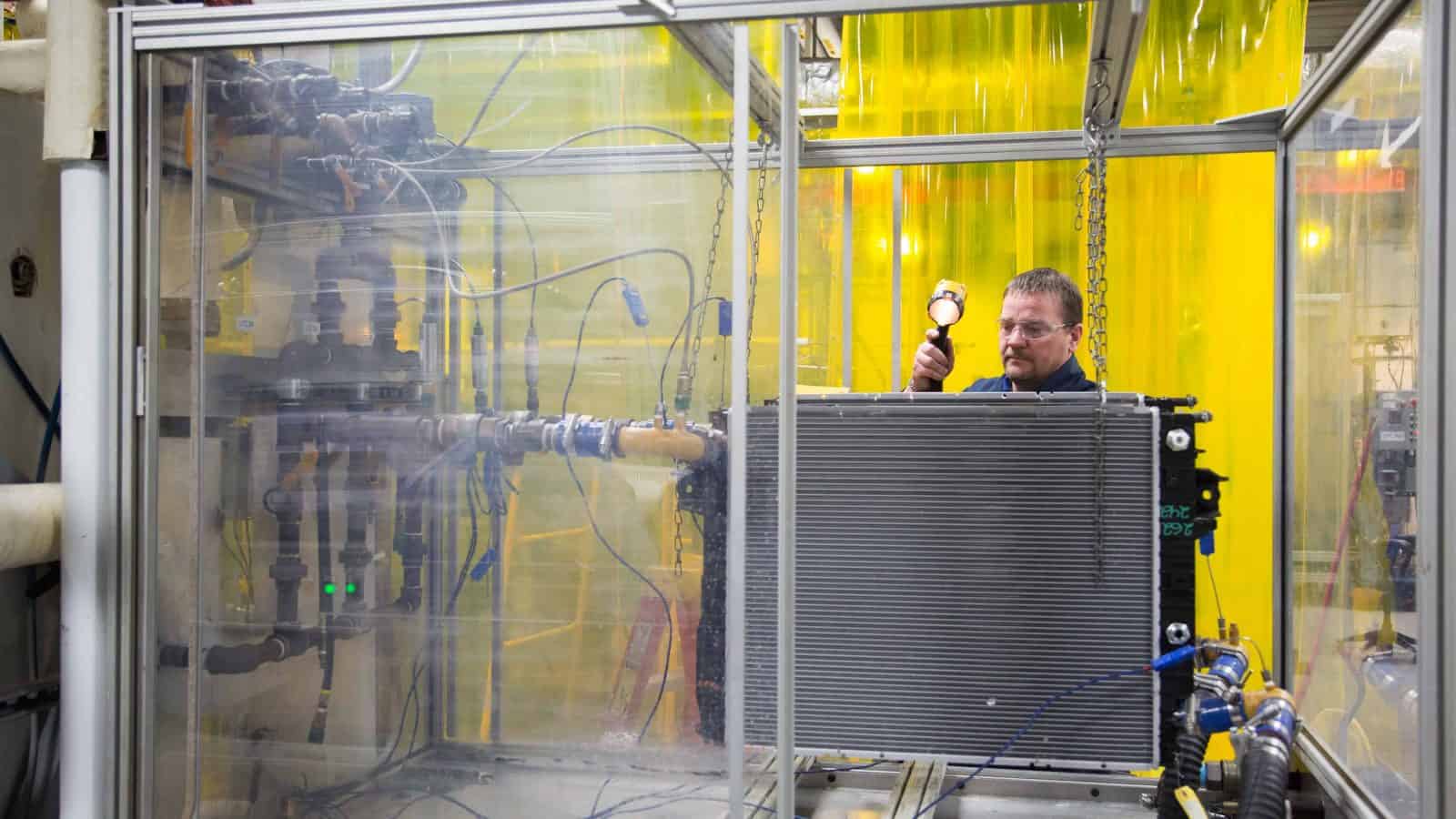

Americans overwhelmingly support exporting U.S. natural gas, a new NAM poll reveals.

What’s going on: In addition to wanting continued exports of LNG, respondents believe the U.S. must boost its production of oil and natural gas, build more energy infrastructure and reform the broken permitting system, according to the findings of an NAM survey of 1,000 registered voters conducted March 15–18.

- In January, the Biden administration announced a moratorium on LNG export permits.

- Europe is the primary destination of exported U.S. LNG.

The details: Among the survey’s key findings:

- Some 87% believe the U.S. should continue exporting natural gas.

- About 86% say the permitting system must be changed so energy projects are approved and online in less time.

- Approximately 76% say the U.S. needs more energy infrastructure, such as port terminals.

- About 74% say the U.S. needs to increase domestic oil and natural gas production.

- And 72% would like to see the U.S. use an all-of-the-above energy approach that includes both traditional and renewable energy sources.

The last word: “The American public agrees: LNG exports are critical to U.S. energy security, creating well-paying jobs and supporting our allies in Europe and Asia,” said NAM President and CEO Jay Timmons.

- “This poll underscores the need for President Biden to immediately direct the Department of Energy to roll back this misguided and counterproductive policy.”

Top DOE Official to NAM: You’re Critical to America’s Energy Future

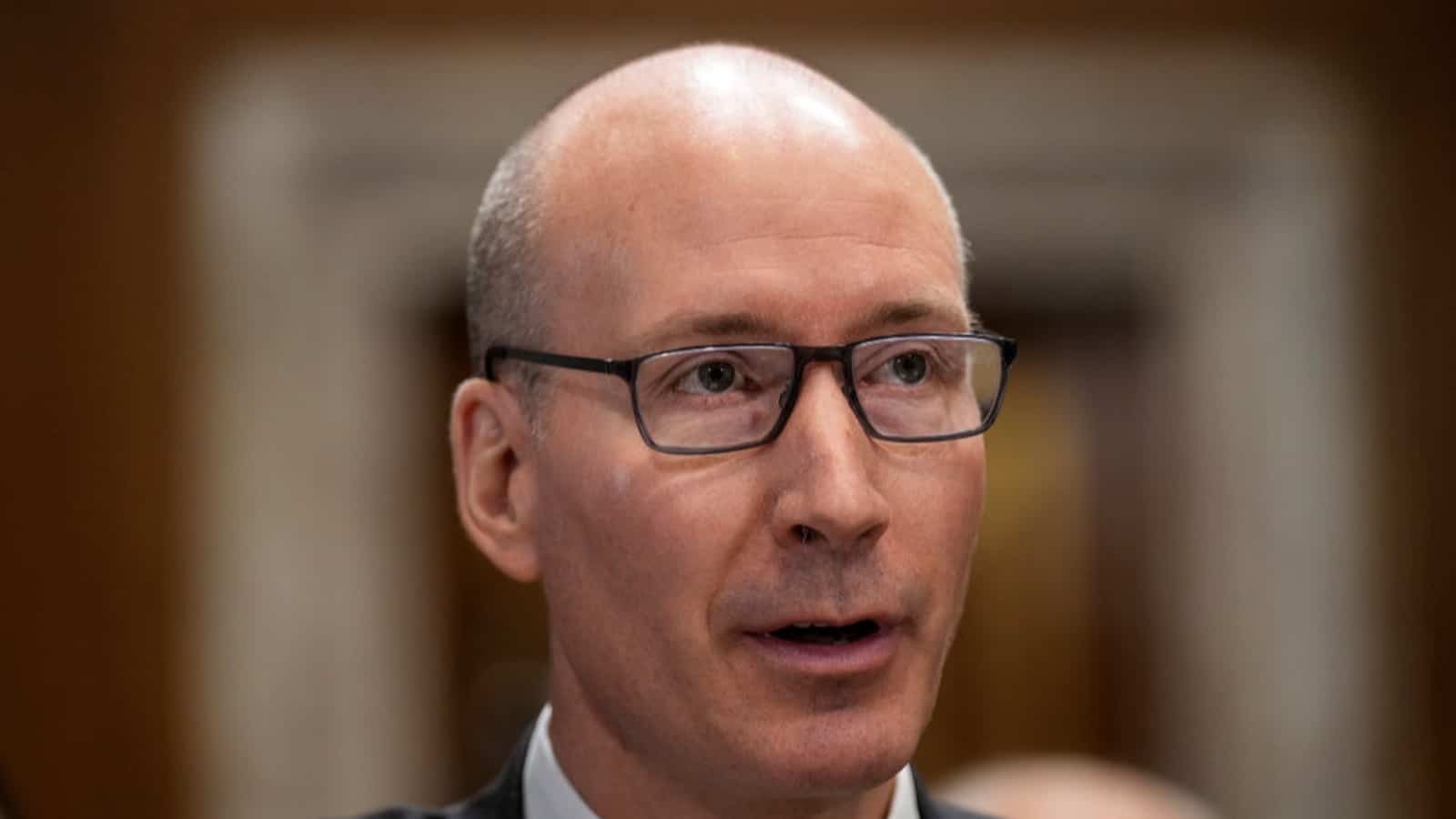

The Biden administration sees private-sector partners as essential to the future of American energy policy and production, Deputy Secretary of Energy David Turk told NAM board members in Phoenix, Arizona, recently.

What’s going on: “I don’t think we can do anything in the federal government that impacts the real world without enabling, listening to, supporting and trying to be very thoughtful” with private-sector partners, Turk said, calling manufacturers a key force in helping the United States “accelerate our energy independence.”

- In a discussion about energy policy in the clean energy transition—with a focus on nuclear energy, hydrogen and the role of the federal government—Turk took questions and comments from leading figures in the private-sector energy economy on issues ranging from the Biden administration’s freeze on liquefied natural gas export permits, to the need for a robust hydrogen economy, to the implementation of long-awaited transmission infrastructure to ensure energy reliability and affordability.

- The talk also touched on the potential impact of increased natural gas exports on domestic prices and consumers. NAM board members argued that higher exports would not make gas more expensive for U.S. consumers and LNG exports are vital to ensure energy security for our allies.

The conversation: In a roundtable lunch, NAM board members told Turk that the push and pull of the Biden administration’s policies on energy—calling on U.S. producers to increase energy output to reduce consumer prices while calling for an overall reduction in fossil fuel production—makes their goal of increasing American energy reliability and independence more difficult to realize, while creating market gaps that can be filled by cheap energy from Russia and other geopolitical rivals.

“Why did this happen? Why did it come out? How does that achieve any of our shared objectives on the national security stage in terms of climate change?” NAM President and CEO Jay Timmons asked Turk, noting that the Biden administration’s decision to stop approving new export licenses for U.S. LNG undercuts its own stated carbon agenda in the long run.

Turk told NAM board members that U.S. consumers pay roughly one-fifth as much for LNG as those in Asia and Europe, which he called “huge” for economic competitiveness, but still acknowledged that the differential doesn’t accommodate the needs of all manufacturers involved in the energy economy.

“There’s a competitive advantage if our manufacturers are paying less for a key input than others,” Turk said. “There’s a benefit and a difference between the price right now that we pay in the U.S. versus others internationally.”

Meeting matters: The U.S. is the world’s top exporter of LNG, an affordable, plentiful energy source that’s in growing demand and is much cleaner than traditional forms of coal-powered energy—especially in Europe, where LNG has been critical in keeping allied countries from seeking Russian energy sources. For NAM board members to be able to confront Biden administration officials on energy policy directly is a huge win for LNG producers and for manufacturers overall.

“We have more dialogue, more discussion, more interaction with members of the Biden administration than any administration that I’ve been involved in with the NAM,” Timmons said. “Where we have differing opinions, we do get feedback”—and, in the case of the meeting in Phoenix, we provide it.

Manufacturing Front and Center in State of the Union Address

But Biden Misses Marks with Attack on Sector

Washington, D.C. – Following President Biden’s State of the Union address, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Tonight, President Biden celebrated manufacturing’s accomplishments during his presidency, and rightly so. He signed into law some of the most consequential pro-manufacturing legislation in recent years—the Bipartisan Infrastructure Law, the CHIPS and Science Act and even key provisions of the Inflation Reduction Act. What’s more, manufacturers have stood proudly with him in his efforts to champion democracy abroad, most notably in Ukraine, and to reach solutions to address our broken immigration system. These are urgent priorities on which Congress should heed his call and act swiftly.

“But President Biden missed the mark tonight in several key areas when he laid out his plans going forward. If the cost of manufacturing in America is driven up by his agencies’ continued regulatory onslaught and a successful push to raise taxes, investment will be driven overseas and Americans will be driven out of work. If his campaign to ‘march-in’ to manufacturers and seize their intellectual property advances, it will rob Americans and the world of future cures and chill research into new breakthroughs across the manufacturing industry. And if President Biden continues to heap blame on pharmaceutical manufacturers, rather than reining in pharmacy benefit managers with cost-saving reforms, Americans and their employers will continue to endure rising health care costs.

“President Biden and Congress have a choice to make: they can take bipartisan action on the priorities manufacturers have outlined in our ‘Competing to Win’ agenda, an agenda that will unquestionably lift the quality of life for all Americans, or they can retreat to partisan corners and put our future in jeopardy.

“The president spoke passionately tonight about protecting democracy and our way of life at home and around the world. Manufacturers share a profound commitment to democracy and to the values that have made America exceptional and keep manufacturing strong—free enterprise, competitiveness, individual liberty and equal opportunity. And one of the surest ways to restore faith in democracy is for both parties to work together and prove that this experiment still works—by delivering smart policies for the American people and by bolstering the industry that is the backbone of our economy and improves lives for all.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.85 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

SEC Finalizes Scaled-Back Climate Rule

The Securities and Exchange Commission has approved new climate disclosure requirements that have been in the works for the past two years. Changes made to the rule represent progress for manufacturers—though the industry will still face new cost burdens, the NAM said Wednesday night.

What’s going on: The SEC voted Wednesday in favor of requiring public companies to disclose greenhouse gas emissions and other climate-related information. Thanks in part to ongoing NAM advocacy—which Law360 (subscription) covered this week—the agency dropped its onerous, unworkable Scope 3 emissions mandate.

- That provision would have forced public companies to divulge information about emissions coming from anywhere in their supply chains—including from small and family-owned businesses.

Heeding the NAM: “The NAM demonstrated for the SEC the practical realities of such a sweeping proposed rule, encouraging the SEC to make significant changes to remove inflexible and infeasible mandates, require disclosure only of material information and protect small manufacturers from the impact of these requirements,” NAM President and CEO Jay Timmons said following the vote.

Key changes: In addition to the Scope 3 change, the SEC exempted smaller public companies from Scope 1 and Scope 2 emissions reporting and delayed the rule’s effective dates. The final rule also is more narrowly focused on so-called “material” information (data investors need to make informed decisions) than what had been proposed previously.

Keeping a close watch: The final rule “remains imperfect,” Timmons continued. “[A]nd it remains to be seen whether the rule in its entirety is workable for manufacturers.”

- “The NAM remains committed to ensuring the SEC acts within its statutory authority, prioritizes flexibility and provides much-needed guidance—just as we are committed to providing leadership in addressing environmental challenges. This is why the NAM is keeping all options on the table as we evaluate the rule’s potential impacts on the manufacturing sector.”

NAM, Allies File Suit Against EPA Over Air Standard

The NAM and seven association partners have filed suit against the Environmental Protection Agency to challenge the office’s overly stringent, recently finalized rule on particulate matter, or PM2.5, the NAM said Wednesday.

What’s going on: The eight groups filed suit in the D.C. Circuit to push back on the EPA’s National Ambient Air Quality Standards rule, which last month it lowered from 12 micrograms per cubic meter of air to 9, a 25% reduction and a stifling burden on manufacturers, the NAM said.

- “In pursuing this discretionary reconsideration rule, the EPA should have considered the tremendous costs and burdens of a lower PM2.5 standard,” said NAM Chief Legal Officer Linda Kelly. “Instead, by plowing ahead with a new standard, the agency not only departs significantly from the traditional NAAQS process, but also gravely undermines the Biden administration’s manufacturing agenda—stifling manufacturing investment, infrastructure development and job creation in communities across the country.”

- Participating in the suit with the NAM—which has repeatedly urged the EPA against overtightening the standard—are the American Chemistry Council, the American Forest & Paper Association, the American Petroleum Institute, the American Wood Council, the U.S. Chamber of Commerce, the National Mining Association and the Portland Cement Association.

Why it’s important: If it’s enacted, the stricter PM2.5 standard would cost businesses and the U.S. economy huge sums, hampering company operations and job growth and forcing tough choices on states and towns nationwide.

- The total cost of complying with the new acceptable concentration level could be as much as $1.8 billion, according to the EPA’s own estimates—and that number could go up.

- What’s more, it would make the U.S. less competitive globally. “Europe’s current PM standard is 25; China’s is 35,” NAM Managing Vice President of Policy Chris Netram told the House Energy and Commerce Subcommittee on Environment, Manufacturing and Critical Materials last month. “If we want the next manufacturing dollar to be spent in America rather than abroad, a standard of 9 is simply not feasible.”

NAM in the news: The New York Times (subscription) covered the lawsuit.

Regulatory Onslaught and Inaction on Key Manufacturing Priorities Weigh on Industry Ahead of State of the Union Address

Nearly 94% of respondents believe federal tax code should promote R&D, capital and equipment expenditures

Washington, D.C. – The National Association of Manufacturers released its Manufacturers’ Outlook Survey for the first quarter of 2024, which reveals that the expiration of federal tax incentives related to R&D, interest deductibility and expensing for capital investments has already caused nearly 40% of respondents to pull back on hiring and investing due to increased taxes.

“Manufacturers’ concerns in this survey should provide a stark warning to both parties ahead of the State of the Union: If you want to continue America’s manufacturing resurgence, focus on constructive policies to strengthen our industry—reinstating key tax provisions, achieving immigration solutions and advancing permitting reform. But if President Biden wants to put his manufacturing legacy at risk, nothing will do that faster than raising taxes on manufacturers or continuing this regulatory onslaught,” said NAM President and CEO Jay Timmons.

The latest data show that two-thirds (65.5%) of manufacturers said that rules coming from the Biden administration will be costly to implement. Additionally, amid the regulatory onslaught, concern about the overall business climate was elevated and not far from levels last seen at the end of 2016.

“President Biden and Sen. Britt will opine on their parties’ respective priorities, many of which manufacturers share. But actions speak louder than words. Congressional inaction and the stream of senseless regulations from the EPA and elsewhere are creating greater uncertainty for businesses, which hurts manufacturers’ ability to create jobs and raise wages. All of this is undermining manufacturers’ confidence and has the potential to drive investment away from the United States,” added Timmons. “Our commitment is to work with anyone who will put policy—policy that supports people—ahead of politics, personality or process.”

Overall, 68.7% of respondents felt either somewhat or very positive about their company’s outlook, edging up slightly from 66.2% in the fourth quarter. It was the sixth straight reading below the historical average of 74.8%.

Key Survey Findings:

- Nearly 94% of respondents say that it is important for the federal tax code to help reduce manufacturers’ costs for conducting R&D, accessing capital via business loans and investing in capital equipment purchases, with 58% saying that it is very important.

- The majority of respondents (72.4%) said that the length and complexity of the current permitting reform process affects their investment decisions in various degrees, with 38.9% suggesting that they were extremely or moderately impacted. In survey responses throughout 2023, manufacturers stated that reform to the current system could allow them to hire more workers, expand their business and increase wages and benefits.

- More than 65% of manufacturers cited the inability to attract and retain employees as their top primary challenge.

- An unfavorable business climate (58.9%), rising health care and insurance costs (58.2%) and weaker domestic economy and sales for manufactured products (53.2%) are also impacting manufacturing optimism.

You can learn more at the NAM’s online tax action center here.

The NAM releases these results to the public each quarter. Further information on the survey is available here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.85 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Previewing the SEC’s Climate Rule

For the past two years, the U.S. Securities and Exchange Commission has been considering a rule that would require businesses to report huge amounts of information about companies’ climate-related risks, strategies and impacts. As the SEC prepares to release its final version of the rule this Wednesday, we spoke with NAM Vice President of Domestic Policy Charles Crain about what manufacturers should expect.

The background: In March 2022, the SEC proposed what the NAM has called an overreaching, unworkable and burdensome climate disclosure rule. According to Crain, the initial proposal would have required extensive disclosures as well as invasive tracking procedures to gauge climate impact and emissions throughout companies’ supply chains—significantly increasing costs and liability for manufacturers.

- “The proposal would have had major implications for the entire manufacturing sector, including both large and small public companies—and even privately held businesses throughout manufacturing supply chains,” said Crain. “As proposed, the rule represents a significant threat to manufacturing competitiveness.”

The pushback: In the two years since the rule was first proposed, the NAM has pressed for significant changes—in detailed letters to the SEC, in congressional testimony and in meetings with SEC commissioners and staff.

- “Manufacturers have made it a top priority over the past two years to convince the SEC that they need to change their approach,” said Crain. “The NAM has spent significant time and effort explaining to the SEC why its proposal was unworkable and likely unlawful and illustrating the impact of the rule’s overwhelming cost burden on manufacturers.”

- “But we also offered specific and actionable suggestions to help the agency tailor the rule, make it more workable to manufacturers and bring it back within the SEC’s statutory authority.”

The preview: With the SEC set to publish its final rule tomorrow, Crain says the NAM is keeping an eye on key inflection points, including the following:

- Scope 3 emissions reporting: The proposal’s Scope 3 mandate would require public companies to disclose the emissions of their supply chain partners—including small and family-owned businesses. If Scope 3 is curtailed or absent, that would represent significant progress for manufacturers.

- Financial statement reporting requirements: The NAM will be tracking the degree to which companies are required to incorporate climate information into their financial statements. The NAM called the proposal’s approach to financial statement reporting “unworkable [and] highly burdensome.”

- Materiality: The SEC is only allowed by law to require “material” disclosures—i.e., financial information that allows investors to make informed decisions. Mandates in the final rule that require immaterial disclosures or seek to redefine materiality could exceed the SEC’s legal authority.

- Implementation: The NAM will consider when and how the rule takes effect, and whether the SEC has provided scaled requirements for smaller companies or tailored implementation plans for certain provisions within the rule.

- Small-business impact: The proposal would have harmed small and privately held businesses disproportionately. The SEC must do a better job at protecting these companies in the final rule.

The expectation: Crain says the NAM’s advocacy appears to have made a difference.

- “Recent news reports suggested that some provisions in the rule may have been modified in alignment with the NAM’s suggested changes,” said Crain. “But it remains to be seen whether the final rule, taken as a whole, is actually workable for manufacturers.”

The next step: The NAM’s next moves will depend on the specifics of the final rule—but the conversation is unlikely to end there.

- “The NAM has been clear that a failure to bring the rule back within the agency’s statutory authority could invite legal action. On the other hand, a balanced, workable rule could obviate the need for litigation,” said Crain.

- “Regardless of the exact content of the rule, the NAM is committed to providing resources to our members to help companies understand and comply with any new requirements. We will also continue to engage with the SEC and Congress to address any implementation issues, seek guidance on any unclear provisions and, if necessary, push for changes to the final rule.”

- “As we have for the past two years, the NAM will continue to advocate on manufacturers’ behalf.”

DOE, NAM Urge Flexible 45V Rules

The Department of Energy is urging Treasury to loosen proposed rules for the Inflation Reduction Act’s first tax credit—the 45V, or clean hydrogen tax credit, POLITICO Pro (subscription) reports.

- The request is in line with suggestions the NAM made to the Internal Revenue Service—which, with Treasury, set forth the guidance for claiming the credit—earlier this week.

What’s going on: “The Department of Energy is pushing Treasury to relax the rules to give the industry time to embark on a massive expansion, according to three people familiar with the discussions.”

- The 45V was intended as a longer-term accompaniment to the DoE’s $7 billion regional hydrogen hubs program, which agency officials are concerned will be hamstrung if the tax guidance is too stringent, according to the article.

- The credit “will directly impact how much hydrogen the U.S. produces and the financial bottom line for many companies.”

Why it’s important: The 45V is a major pillar of the Biden administration’s climate agenda, which seeks to make low-carbon hydrogen cost-effective enough to help decarbonize various industries, according to E&E News’ ENERGYWIRE (subscription).

The NAM’s view: “If implemented properly, the 45V credit would provide the certainty needed for manufacturers to make investment decisions that encourage further production, transportation and use of clean hydrogen,” NAM Vice President of Domestic Policy Brandon Farris said.

- “However, the NAM is concerned Treasury is considering renewable sourcing provisions regarding incrementality, temporal-matching and deliverability requirements, which would limit the amount of energy sources available to power the hydrogen production process.”

What should be done: To create a workable, fair 45V framework, Treasury and the IRS should do the following:

- Lengthen the three-year time frame for incrementality, the time frame within which new electricity must be put into service.

- Push back to 2032 (at the earliest) the date by which energy projects must match clean electricity and hydrogen production at an hourly level.

- Recognize energy attribute certificates from outside manufacturers’ own regions as capable of delivering electricity or natural gas into the region where the clean hydrogen production is taking place.

- Follow congressional intent and provide a more reasonable process for taxpayers to prove their food stocks are lower in carbon intensity and therefore eligible for the maximum credit.

NAM Election Playbook: Synergies, Not Sides

The NAM isn’t playing favorites in an election year. Instead, it’s redoubling its post-partisan approach to advocacy. NAM President and CEO Jay Timmons’ message to manufacturers: the association will leverage its hard-won, bipartisan influence to advance manufacturers’ priorities, no matter who’s in charge.

- “That’s what we’re about. Policy that helps people. Policy—not politics, personality or process. That’s what will guide us in 2024 and beyond,” Timmons said in a speech that helped kick off the NAM board meeting this week, before more than 200 of manufacturing’s leading executives in Phoenix, Arizona.

Why it’s important: “Both sides want us on their side,” Timmons emphasized while recounting a recent legislative debate. That trust and respect, he said, translates into wins: agencies modifying rules to avoid lawsuits and high-level White House officials acknowledging the impact of NAM campaigns.

Battles loom: But the very system enabling these victories is under threat, Timmons warned, placing the onus on manufacturers to not just build products, but to empower the NAM to utilize their voices and stories to advance policies that strengthen the economy and underpin democracy and free enterprise.

- Tax showdown: Any new taxes on manufacturers are a nonstarter, Timmons vowed, staking a claim in the looming 2025 tax fight and reiterating manufacturers’ call for immediate passage in the Senate of full capital expensing, R&D expensing and interest deductibility.

- Regulatory onslaught: From new Environmental Protection Agency air standards to the broader regulatory agenda, Timmons argued that overzealous rules impede manufacturing competitiveness. He specifically criticized the new PM2.5 standards, saying the EPA “set them at a level that is lower than the EU or the UK, and imposed a compliance timeline that is far more aggressive.”

- LNG halt: Timmons blasted the Biden administration’s liquefied natural gas export permit freeze, calling it shortsighted and detrimental to both manufacturers and broader U.S. energy and climate goals. “They want to address climate change?” he asked. “So they’re going to have other countries buying and burning dirtier energy? They want to support our allies around the world? So they’re going to force Europe and Japan and others to get their fuel from the likes of Russia?”

- Immigration deadlock: He criticized inaction on both sides of the aisle, saying border security and workforce solutions can—and must—coexist.

Opportunity ahead: Despite considerable challenges, Timmons sees an opportunity for manufacturers to take the lead in promoting American values and sound policies that fuel the industry’s strength.

- “This election year, manufacturers can help renew a shared sense of purpose,” Timmons told executives. “Remind Americans why our country—our system rooted in God-given human rights and fundamental freedom—is worth celebrating and defending.” At stake is not just the next regulatory win, but the very system that made U.S. manufacturing a global powerhouse, he said.

- America’s bicentennial celebration helped us see beyond the divisions of the day, Timmons observed. As we approach the 250th anniversary of the signing of the Declaration of Independence, “it’s manufacturers who are positioned to cultivate that patriotic spirit,” Timmons said. It’s more than just bottom lines. “We can help mend the divides—so that we can promote policy that will strengthen manufacturing in America.”

U.S. “Very Concerned” About Critical Minerals

The Biden administration is “very concerned” about U.S. reliance on China for critical minerals, U.S. Energy Secretary Jennifer Granholm said Wednesday, according to CNBC.

What’s going on: China’s dominance in the world’s critical minerals supply chain is “one of the pieces of the supply chain that we’re very concerned about in the United States,” Granholm told the news outlet on the sidelines of the International Energy Agency’s 2024 Ministerial Meeting in Paris.

- China produces approximately 60% of all rare earth elements, which are critical to alternative-energy technologies, such as electric vehicles.

Why it’s important: “As part of a rapid uptick in demand for critical minerals, the IEA has warned that today’s supply falls short of what is needed to transform the energy sector,” according to the article.

What the administration is doing: Both production and processing of critical minerals “have to be addressed,” Granholm said.

- “And that’s why we are working very closely to ensure that we have identified which raw materials [or] critical minerals we need to be able to do our transition to a clean energy economy.”

The NAM says: “Other countries are taking all possible measures to develop domestic sources of critical minerals, and it should be a wake-up call to the U.S. that we need to be doing the same,” said NAM Vice President of Domestic Policy Brandon Farris. “We also need to reform our broken permitting system to get these projects operational as soon as possible.”