NAM Sees Strength for Manufacturing as Washington Transitions

With a new administration and Congress on the horizon, the NAM is signaling confidence in its ability to secure wins for manufacturing in the United States, highlighting both recent achievements and policy priorities moving forward.

“The NAM has always focused on what’s best for manufacturing in America, and our track record speaks to that,” said NAM Executive Vice President Erin Streeter. “Our approach is consistent because we know what it takes to get results.”

What we’ve delivered: With post-partisan engagement, the NAM has achieved historic policy wins across both recent administrations, including:

- Tax reform: The NAM’s advocacy helped shape the 2017 tax cuts, driving billions in savings that manufacturers have reinvested in jobs, innovation and facility upgrades.

- Regulatory certainty: The NAM has played a pivotal role in streamlining regulations, reducing compliance costs under the Trump administration and working to slow regulatory expansion during the Biden years.

- United States-Mexico-Canada Agreement: The NAM was a key advocate for USMCA, safeguarding U.S. jobs by ensuring fairer competition and greater access to key markets.

- Energy advances: NAM-backed policies have supported growth in domestic energy production, creating a more stable energy market.

- Infrastructure and CHIPS Act: The NAM was instrumental in securing the historic Bipartisan Infrastructure Law and the CHIPS and Science Act, both critical for modernizing the economy, bolstering national security and ensuring a reliable semiconductor supply.

“These wins demonstrate what we bring to the table,” Streeter said. “By staying focused on manufacturing’s priorities, we can partner effectively with the new administration and Congress to create and protect jobs and strengthen communities.”

Looking ahead: The NAM’s focus on core issues remains critical for keeping the sector competitive and resilient, Streeter continued. These issues include:

- Securing tax reform: The NAM’s “Manufacturing Wins” campaign aims to lock in key 2017 tax provisions that manufacturers rely on for stability and growth. “Tax reform has been a game-changer,” said Streeter. “Protecting that progress means more jobs and manufacturing-led growth across the country.”

- Regulatory certainty: The NAM is advocating for balanced regulations that support competitiveness. “Manufacturers thrive with clear, fair rules,” Streeter noted. “We’re making sure Washington understands the importance of regulatory stability—and the danger of excessive regulation.”

- Energy security: The NAM is working to secure reliable, affordable energy while fostering innovation in sustainability. “Energy security and grid reliability are top of mind for every manufacturer,” Streeter added. “We’re ensuring manufacturers can continue to innovate, grow and drive America forward.”

Bottom line: The NAM remains focused on advocating for policies that strengthen U.S. manufacturing. “Our success is built on trust and influence,” Streeter said. “Our members know the NAM is a constant force, with the relationships and expertise to deliver, regardless of political changes.”

In related news, President-elect Trump has named campaign manager Susie Wiles as White House chief of staff (Reuters, subscription), a choice NAM President and CEO Jay Timmons called “a powerful move to bring bold, results-driven leadership to the White House from day one.”

Department of Energy’s LNG Export Pause Puts 900,000 Jobs at Risk According to New Research

Economic Cost Could Exceed $216 Billion, Climate Goals At Risk

Washington, D.C. – As the Biden administration continues its efforts to boost the availability of clean energy in the United States and around the world, an ongoing pause in liquefied natural gas export licenses threatens economic stability as well as progress made by manufacturers in America. A staggering 900,000 jobs could be at risk according to a new study released today by the National Association of Manufacturers.

“With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential. LNG exports also play a key role in meeting clean energy goals. But clamping down on our energy sector unnecessarily puts jobs and economic growth at risk, while pushing other nations to use higher emissions alternatives,” said NAM President and CEO Jay Timmons. “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

Conducted in partnership with PwC, the analysis uses the government’s own projections to conclude that robust LNG export activities could contribute up to $216 billion to U.S. GDP and generate $46 billion in tax revenue in 2044 if projects proceed as planned. A pause on LNG exports threatens these gains.

Timmons added, “The Biden administration’s ill-advised decision to stop LNG exports could cost Americans dearly, while leaving our geopolitical allies—particularly in Europe—out in the cold. The data is clear: halting LNG export licenses puts nearly a million jobs at risk. The LNG freeze also deprives us of an important tool of soft power to bolster trading partners who share our values. This study provides policymakers—present and future—a clear path to create jobs and hundreds of billions of dollars in economic growth by harnessing America’s abundant supply of LNG.”

Current Economic Benefits by the Numbers:

- Job creation: U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- Economic output: The LNG industry contributes $43.8 billion to U.S. GDP.

- Tax revenue: Federal, state and local governments receive $11.0 billion in tax revenues, thanks to U.S. LNG exports.

Future Benefits Undermined by an LNG Export Ban:

- Jobs threatened: Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk if the ban on U.S. LNG exports continues through 2044.

- The economic fallout: An LNG export ban would stifle between $122.5 billion and $215.7 billion in annual contributions to U.S. GDP during the same period.

- Communities shortchanged: Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.91 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM: Biden’s LNG Ban Threatens 900,000 Jobs

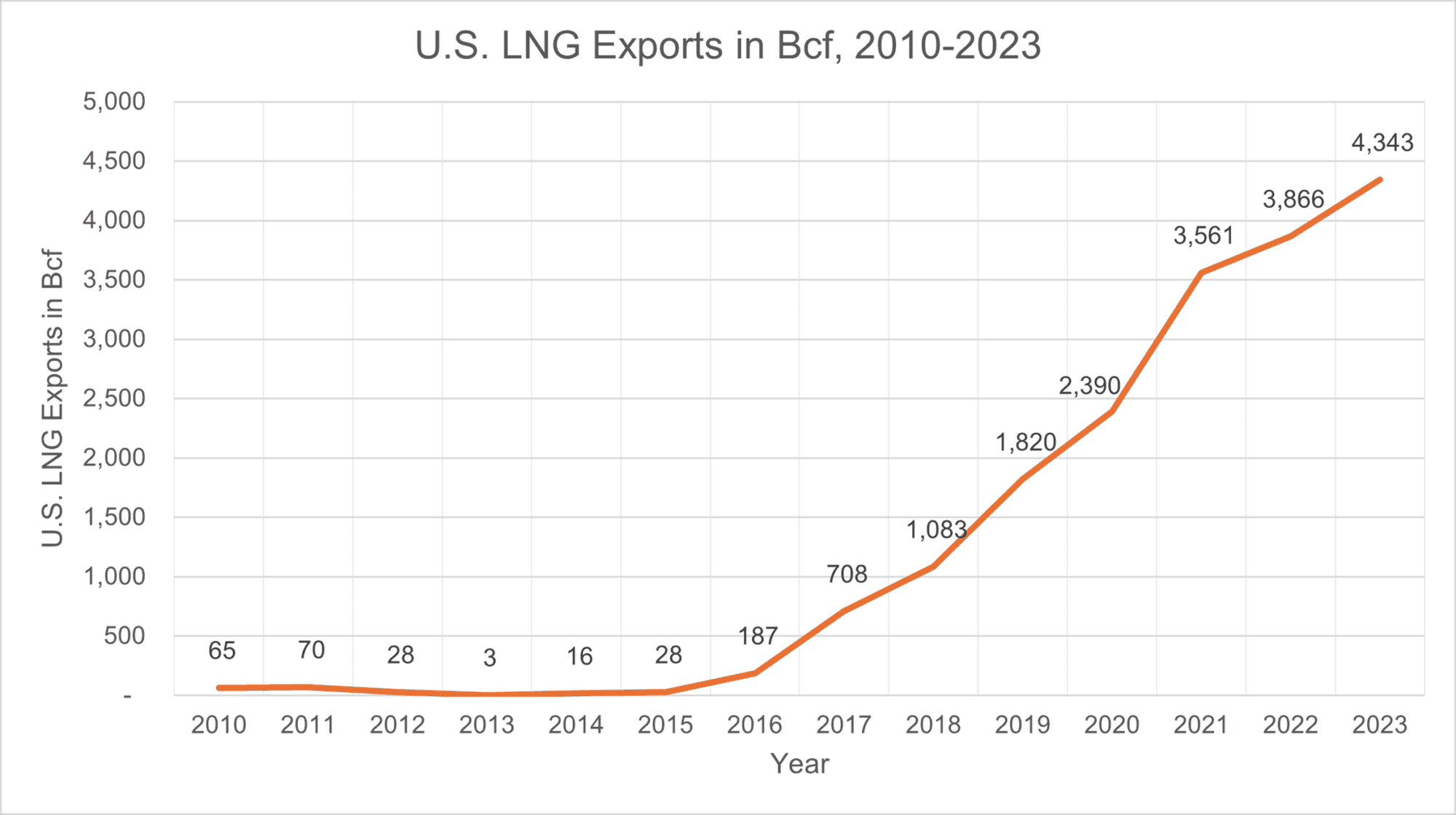

The liquefied natural gas export industry has turned the U.S. into a powerhouse of cleaner energy, benefiting its trading partners around the world. The Biden administration’s ongoing ban on new LNG export licenses, however, is throttling an industry that could produce many more billions in revenue and a startling 900,000 jobs by 2044.

The data: A new study from the NAM and PwC shows that the U.S. LNG revolution could extend its upward climb, as shown on the graph above. Today, the industry is a huge source of jobs and profit:

- U.S. LNG exports support 222,450 jobs, resulting in $23.2 billion in labor income.

- The LNG industry contributes $43.8 billion to U.S. GDP.

- And lastly, federal, state and local governments receive $11.0 billion in tax and royalty revenues, thanks to U.S. LNG exports.

But that pales in comparison to the industry’s potential over the next two decades. The study projects the likely growth of the industry through 2044, showing all that is at stake if the ban remains in place until then:

- Between 515,960 and 901,250 jobs, resulting in $59.0 billion to $103.9 billion in labor income, would be at risk.

- The ban would also stifle between $122.5 billion and $215.7 billion in contributions to U.S. GDP during the same period.

- Between $26.9 billion and $47.7 billion in tax and royalty revenues meant to benefit communities across the United States would also be at risk in 2044.

Public opinion: The American public is squarely behind the LNG export industry, showing overwhelming approval in an NAM poll taken in March.

- Eighty-seven percent of respondents agreed the U.S. should continue to export natural gas.

- Seventy-six percent of respondents agreed with building more energy infrastructure, such as port terminals.

The last word: “With LNG exports, we do not have to choose between what’s good for the economy and good for the planet. Today’s research shows the massive opportunity America has when we unleash our economic and energy potential,” said NAM President and CEO Jay Timmons.

- “Building LNG export facilities and expanding natural gas production are not just good for our industry—they also cut emissions and help power manufacturing around the world.”

New DOD Loan to Fund “Critical Technologies” Manufacturing

The Defense Department’s Office of Strategic Capital is now accepting applications for flexible direct loans to build, expand and/or modernize “critical technologies” facilities (Federal Register).

- It’s also seeking input from companies and trade associations on the Defense Department’s loan program, via a Request for Information open through Oct. 22 (Federal Register).

What’s going on: The OSC’s credit program, launched Sept. 30, aims “to attract and scale private capital in industries and technologies that are critical to America’s national and economic security,” according to the Defense Department. This is part one of the application process.

- The financing is geared toward manufacturers that must spend significantly on industrial or specialty equipment to create new assembly lines in existing facilities.

- The money is also intended to help them cover “soft” expenses, such as factory preparation and installation, associated with critical technology projects.

Why it’s important: “The funding from this program could benefit manufacturers of all sizes that are working to expand their businesses and product lines in critical areas of the economy,” said NAM Director of Energy and Natural Resources Policy Mike Davin.

- The OSC loans offer flexible terms, a U.S. Treasury-comparable interest rate, long repayment periods and deferred payments.

Who’s eligible: Manufacturers within the 31 “Covered Technology Categories”— which include advanced manufacturing, cybersecurity, battery storage and spacecraft—are encouraged to apply.

- There is no company-size or employee-number threshold or limit, and manufacturers with existing federal grants are eligible.

NAM, Allies Urge Court to Vacate PFAS Rule

The EPA’s final rule setting national drinking water standards for PFAS should be vacated in its entirety, the NAM and two allies said in an opening brief filed in federal court Monday.

What’s going on: The NAM, the American Chemistry Council and U.S. chemical company Chemours asked the U.S. Court of Appeals for the D.C. Circuit to overturn the EPA’s rule, announced in April, which requires that municipal water systems nationwide remove six types of per- and polyfluoroalkyl substances from drinking water. Trade groups representing the water systems have also sued to overturn the rule.

The grounds: The rule is unlawful and must be set aside for the following reasons:

- The EPA used a deeply flawed cost-benefit analysis to justify the rule.

- The EPA conducted a woefully incomplete feasibility analysis that ignores whether the technology and facilities necessary for compliance actually exist.

- Critical parts of the rule exceed the agency’s statutory authority under the Safe Drinking Water Act and flout the act’s express procedural requirements.

- The EPA failed to consider reasonable alternatives or respond meaningfully to public comments that undercut its judgment.

- The agency “lacked sufficient data to regulate” HFPO-DA, one of the PFAS chemicals that falls under the rule.

Why it’s important: PFAS “are substances at the center of modern innovation and sustain many common technologies including semiconductors, telecommunications, defense systems, life-saving therapeutics and renewable energy sources,” according to the brief.

- The NAM and its co-petitioners “support rational regulation of PFAS that allows manufacturers to continue supporting critical industries, while developing new chemistries and minimizing any potential environmental impacts. But that requires a measured and evidence-based approach that the [r]ule lacks.”

What’s next: Briefing in this case will continue through the spring, with oral argument to follow and a decision from the D.C. Circuit expected in late 2025.

BLM Proposal Restricts Access to Energy Sources

The Interior Department is seeking to close hundreds of thousands of acres of land in Wyoming to traditional and renewable energy development, a plan that would cut crucial natural resource development off at the knees (POLITICO Pro, subscription).

What’s going on: Though the Bureau of Land Management’s plan, released Thursday, scales back from previous iterations the acreage recommended for conservation, it still considerably “throttles back how much of the federally administered area’s 3.6 million acres is in play for different forms of energy development.”

- The final announcement, part of the BLM’s proposed Resource Management Plan for the Rock Springs Field Office, is tantamount to “pushing Wyoming off an economic cliff with nothing more than a tattered parachute,” said John Barrasso (R-WY), ranking member of the Senate Committee on Energy and Natural Resources. “This plan isn’t designed to manage Wyoming’s natural resources. It is designed to suffocate them. … [It] directly jeopardizes Wyoming’s economy and our way of life.”

What it would do: If approved, the blueprint would replace its 27-year-old predecessor document and prohibit drilling on nearly 1.08 million acres—almost twice the number currently off-limits to new oil leases.

- It would “also [exclude] 494,350 acres from wind and solar power development and [close] 536,018 acres for geothermal power projects.”

Why it’s important: The plan could reduce economic activity in Wyoming’s oil and gas sector by some $907 million each year and cost the state nearly 3,000 jobs, according to estimates by several energy groups (Cowboy State Daily).

The NAM says: “This latest move by the Interior Department undermines U.S. energy security by needlessly restricting access to available domestic sources of critical natural resources as part of an all-of-the-above energy future,” said NAM Director of Energy and Resources Policy Michael Davin. “We urge the agency to reexamine and revise its plan.”

Energy Permitting Reform Act Will Help Unlock the Full Potential of Manufacturing Industry, Is Critical for Competing with China

Washington, D.C. – Following the bipartisan passage of the Energy Permitting Reform Act of 2024 markup in the Senate Energy and Natural Resources Committee, National Association of Manufacturers President and CEO Jay Timmons released the following statement:

“Manufacturers have been calling attention to the consequences of America’s broken permitting process for years, while building a case for reform. Both sides of the aisle now realize that these critical updates will enable Congress to achieve its broader energy goals and the development of:

- Renewable energy projects;

- Pipelines for traditional energy, hydrogen and carbon capture storage;

- Critical mineral mines and processing facilities;

- Semiconductor and battery manufacturing fabs;

- Interstate transmission lines; and

- Hydroelectric and nuclear power plants.

“These developments are absolutely critical for us to be able to compete with China. As this legislation progresses, many of the commonsense policies outlined in the Energy Permitting Reform Act will help unlock the full potential of our industry, bolster our nation’s energy security and create American jobs. Streamlining permitting processes, cutting red tape, requiring that federal agencies make timely decisions and reducing the potential for baseless litigation will help prevent years-long delays for manufacturers—delays that give other countries a distinct advantage and put our own security at risk. America should never be content with a system that can take 10 or 15 years to approve urgently needed projects, when approval can take a fifth of that time in other countries that still adhere to high standards.

“We thank Chairman Manchin and Ranking Member Barrasso for introducing this legislation and look forward to working with lawmakers to advance it.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.89 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Emerson Finds Energy in Sustainability

When Emerson’s first-ever Chief Sustainability Officer Mike Train talks about his company, his enthusiasm shines through.

- “What we do to enable our customers is huge,” said Train. “We have an important role to play—and I get a lot of energy out of that.”

An aggressive push: The technology and engineering company, headquartered in St. Louis, Missouri, has been making big moves in sustainability over the past few years—beginning with a goal in 2018 to reduce some of its greenhouse gas intensity by 20% over 10 years.

- At the time, the goal was ambitious, and the company wasn’t quite sure how it would achieve it. But employees banded together and pulled it off.

- “We actually achieved the goal in 2022—six years early,” said Train. “But the act of putting out a goal and not knowing exactly how we’d solve for it … has been driving the culture of our company. Our employees are proud we put it out there, proud to have participated, and it’s activated thousands of people to get excited about what we’re doing.”

An inclusive approach: Since then, the company has applied a range of tactics. From “energy treasure hunts,” in which teams search for energy waste in facilities, to renewable energy procurement and collaborations with supply chain partners, Emerson is finding interesting and inclusive ways to make an impact.

- The company has gone from getting 3% of its power from renewables to getting to 49% from those sources. And it now has a commitment to use 100% renewable energy by 2030.

- Emerson is setting other big goals, too, from net-zero operations by 2030 to a zero-waste-to-landfill pledge, along with other water and biodiversity actions.

An effective framework: The company has a three-part approach to its sustainability practices.

- Greening Of Emerson involves the actions Emerson is taking to reduce its own footprint by minimizing waste and engaging its supply chain.

- Greening By Emerson involves the company’s activities to help a wide range of manufacturing customers improve their own sustainability, often through Emerson’s automation portfolio and expertise. This, according to Train, is where Emerson has its biggest opportunity for impact.

- Greening With Emerson refers to the company’s work with government and research organizations on policy and innovation, offering technical expertise and manufacturing perspective to help drive action.

A group effort: Train has seen the company coalesce around these goals—from the sustainability team he works with every day (“they bring a lot of energy and passion to what we’re doing”) to the rest of the company’s 74,000-person workforce.

- “The fun part of sustainability is everyone is learning it together,” Train continued. “You’re allowed and encouraged to borrow ideas from each other, so the collaborative part of sustainability is an awful lot of fun.”

Senior Sinema Advisor Chris Phalen to Lead NAM’s Energy and Environment Policy Team

Washington, D.C. – The National Association of Manufacturers announced that Chris Phalen, most recently a senior policy advisor to Sen. Kyrsten Sinema (I-AZ), is joining the NAM as vice president of domestic policy:

“As the NAM continues to be at the forefront of energy policy debates before Congress and federal agencies, Chris’ depth of experience and record of accomplishments will help us further stand out and influence outcomes in support of an all-of-the-above energy policy,” said NAM President and CEO Jay Timmons. “Manufacturers are facing a political war on energy. Permitting reform, securing critical mineral supply chains and regulatory barriers slowing the clean energy transition are just some of the defining issues impacting our industry’s ability to create well-paying jobs, as well as our nation’s energy security. Chris will help us steer policymakers in the right direction.”

Sen. Sinema has been a key figure in negotiating solutions to manufacturing priorities, and as her advisor, Phalen was a leader in negotiating and implementing critical energy policies and in writing the permitting reform provisions in the Fiscal Responsibility Act and key sections of the Infrastructure Investment and Jobs Act, including all provisions on energy and mining. Phalen brings a record of active engagement with key agencies, including the Environmental Protection Agency, the Department of Energy, the Department of the Interior, the Department of Agriculture, the White House Council on Environmental Quality, the Federal Energy Regulatory Commission and the Federal Permitting Improvement Steering Council. Phalen previously worked for leading energy companies, including Chevron and the Rio Tinto Group.

Timmons added, “Manufacturers are leading the global effort to fight climate change and develop the technologies needed to achieve climate goals. With Chris’ keen insight into these important policy discussions, the NAM will become an even more effective voice for the 13 million people who make things in America.”

Phalen will report to NAM Managing Vice President of Policy Chris Netram and work closely with NAM Executive Vice President Erin Streeter. His policy portfolio will include sustainability, climate, permitting reform, labor, transportation and infrastructure, and he will work alongside NAM Vice President of Domestic Policy Charles Crain and NAM Vice President of International Policy Andrea Durkin.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.89 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers Rally to Advance Nuclear Energy

The NAM is pressing the U.S. Senate to support a bill that would promote clean nuclear energy development.

What it does: The legislation, called the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act, offers a number of components to accelerate the development and commercialization of advanced nuclear reactor technologies. It includes:

- Permitting and approval reform to make it easier for reactor projects to locate on brownfield sites, land that is underused or has been abandoned because of industrial waste;

- “Early licensing work” provisions to help deploy reactors more quickly at national security infrastructure sites;

- A series of awards to encourage companies to develop advanced-reactor technology; and

- Hiring support for the Nuclear Regulatory Commission, which is understaffed to deal with the level of applications for new reactors.

Where it stands: The legislation was reported out of the Senate Environment and Public Works Committee with a bipartisan vote of 16–3, and companion legislation was passed in the House of Representatives by an overwhelming vote of 365–36. Now, the NAM is pushing the Senate to pass the bill.

Why it matters: “Nuclear-generated power is an important part of an all-of-the-above energy strategy, which is necessary to meet the power needs of a growing manufacturing sector,” said NAM Managing Vice President of Policy Chris Netram. “The ADVANCE Act would accelerate the development and commercialization of advanced nuclear reactor technologies through reforms to the existing licensing and permitting systems.”

Our action: The NAM is urging Congress to support the bill ahead of the Senate’s vote, detailing its benefits in a letter to senators.

The last word: “Manufacturers create jobs that support families, and develop and deploy innovative technologies that make our environment cleaner,” said Netram. “Increasing our nation’s energy supply, including the growth of nuclear power, will support manufacturing investments and jobs across America.”