Manufacturing Real GDP Grew in Q4 2022

Manufacturing saw robust growth in the fourth quarter of 2022, according to newly revised real GDP estimates from the Commerce Department.

What’s going on: While the overall U.S. economy grew 2.6% at the annual rate in Q4 of last year, real GDP in the manufacturing industry rose by an annualized 5.5%. That’s a sizable increase from the 0.5% seen in the third quarter.

Q4 details: Value-added output in manufacturing increased to $2.895 trillion at the annual rate—an all-time high—from $2.809 trillion in Q3.

- Value-added output hit record levels for both durable goods (up to $1.595 trillion from $1.544 trillion) and nondurable goods (up to $1.299 trillion from $1.265 trillion).

- Manufacturing made up 11.1% of value-added output in the U.S. economy, an increase from Q3’s 10.9% and the most since 2019.

- Manufacturing gross output also rose to a record number, $7.359 trillion from $7.339 trillion at the annual rate.

However … Real value-added output in manufacturing remained lower than the record high in 2021.

- Real value-added output rose to $2.283 trillion from $2.259 trillion at the annual rate, as expressed in 2012 dollars.

- The record high, in 2021, was $2.325 trillion.

The NAM’s take: “Despite numerous challenges, manufacturing continues to prove its resilience, hitting new records for the sector’s contributions to the U.S. economy,” said NAM Chief Economist Chad Moutray. “These data also suggest that in real terms, manufacturing output has pulled back recently, which points to inflation having buoyed these numbers.”

AB InBev Uses Smart Manufacturing for Award-Winning Results

What does it take to be a digital transformation champion? Anheuser-Busch InBev can tell you.

The world’s largest brewer won four Manufacturing Leadership Awards in 2022, including the highly coveted Manufacturer of the Year. (The honors are given annually by the Manufacturing Leadership Council, the NAM’s digital transformation arm.) The MLC chatted with AB InBev Global Vice President Marcelo Ribeiro recently to get his insights on the processes, technologies and strategies driving the company’s success.

Business transformation drivers: “We have a dream at ABI, which is ‘to create a future with more cheers,’” said Ribeiro. “[That means] a clear strategy to lead and grow, to digitize and monetize our ecosystem and to optimize our business.” Here are a few ways AB InBev is pursuing that dream:

- Developing and delivering products that give consumers what they want, when they want it

- Making sure the supply chain can adapt quickly to consumer needs

- Increasing capacity without compromising safety, quality or sustainability

Rising to challenges: “The future is becoming less predictable,” Ribeiro said. “We need to prepare for that, so we have to build a more resilient, flexible supply chain.” Additional opportunities include:

- Moving from transactional relationships with vendors and suppliers to partnerships

- Looking beyond operations and across the entire supply chain to meet sustainability goals

- Creating a collaborative manufacturing ecosystem that fosters the sharing of ideas

Meeting the digital future: Ribeiro says that ABI’s digital strategy has three key aspects:

- Making data more accessible and available to frontline workers

- Creating a template for digital technology that can be easily tailored to the unique needs of each business

- Using advanced analytics to contextualize data and discover where it can best be applied to aid decision making

Leaders required: Ribeiro noted that leadership is essential for making this vision a reality.

- “It is critical to empower the front line,” he said. “Leaders should be focused on providing the resources to allow people to do the work and achieve excellence themselves. In the end, people are key for any business transformation.”

Find additional insights into AB InBev’s digital transformation in DIALOGUE: AB InBev’s Award-Winning Dream, or make plans to attend Rethink, where Ribeiro will present a keynote address on “Building Your Enterprise into a Digital Transformation Champion.”

The Top 8 Manufacturing Trends for 2023

The NAM recently released its Top 8 Manufacturing Trends for 2023—a guide to the opportunities ahead and the resources that the NAM can offer. Here is what to look out for this year and beyond.

Advanced and emerging technology: Manufacturers are investing in a multitude of new technologies, including artificial intelligence, virtual reality, machine learning and more. Automation and robotics are enhancing workers’ abilities but will also require many more high-skilled employees. Though the workforce shortage is a challenge, digital technologies will help manufacturers become more resilient, efficient and profitable.

- NAM resources: How do you maximize these opportunities? The NAM has resources for you, including the Manufacturing Leadership Council (the NAM’s digital transformation arm), the Innovation Research Interchange (the NAM’s innovation division) and the MLC’s Manufacturing in 2030 Project.

Supply chain resilience: As manufacturers face long lead times, increased costs and a scarcity of raw materials, they are taking steps to boost supply chain resilience through reshoring, cybersecurity, increased supplier pools and more.

- NAM resources: Manufacturers can benefit from resources like CONNEX Marketplace, which helps connect nearby manufacturers and suppliers; the NAM’s Supply Chain Hub—a continually updated collection of webinars and policy documents focusing on supply chain issues; and useful case studies highlighting best practices.

Talent disruptions and opportunities: Manufacturers are confronting a range of challenges around the workforce, including labor shortages and skills gaps, while also figuring out how to take advantage of previously untapped talent pools.

- NAM resources: If you are searching for ways to enhance your employee benefits, The NAM Manufacturers Retirement 401(k) and Savings Plan offers manufacturing employees secure benefits for the future, while Innovation Management Workshops give manufacturing leaders the skills to build innovative and creative teams. Meanwhile, the Manufacturing Institute—the 501(c)3 nonprofit workforce development and education partner of the NAM—promotes a range of events and initiatives designed to expand and diversify the manufacturing workforce as a whole.

Cybersecurity: The threat from bad actors is real, and strong cybersecurity has become critical to manufacturing operations up and down the supply chain. At the same time, manufacturers will have to be on the lookout for new cybersecurity reporting requirements.

- NAM resources: The NAM can help, with support like the NAM’s complimentary Cyber Risk Assessment. NAM Cyber Cover offers cyber insurance and risk mitigation, and you can check out these videos from manufacturing executives laying out best practices for cybersecurity defenses.

Post-pandemic growth and expansion: Long-term goals shouldn’t be downgraded, despite an uncertain economy. Manufacturers should keep pursuing technological advances, navigate government incentives and stay open to mergers, acquisitions and other investments.

- NAM resources: The NAM Incentives Locator helps manufacturers find funds and tax credits to help their business, while the MLC offers networking opportunities for manufacturing leaders.

Tough economic outlook: There’s no doubt that manufacturers face economic headwinds. That means manufacturers need to look for ways to be nimble and responsive to changing realities and able to work more efficiently than ever.

- NAM resources: Tools like NAM Shipping & Logistics give manufacturers discounts on shipping and freight, while NAM Energy offers conversations with energy advisers who can help adjust energy use strategies. IRI Coffee Houses promote virtual conversations with innovation leaders to discuss new developments and opportunities.

Sustainability: Manufacturers are committed to strengthening operations and maintaining a healthy planet at the same time. More than ever, manufacturing companies are looking for ways to reduce carbon emissions.

- NAM resources: The NAM provides resources that can help manufacturers with innovating for sustainability, as well as rethinking end-of-life technology value. Manufacturers can also learn about how digital solutions drive sustainability in manufacturing.

Looking ahead to 2030: Changes in the manufacturing industry and in the world around us—from population growth to the rise of a new middle class to increased interconnectivity—have manufacturers planning for big changes in the next decade.

- NAM resources: The IRI offers a forum for manufacturers to connect with R&D leaders, while the MLC’s Next Phase of Digital Evolution report shows how manufacturing leaders can plan their long-term futures.

Learn more: Take a look at the full guide for more details and to find out more about the NAM resources that will help manufacturers deal with these key trends.

Timmons: Debt Ceiling Uncertainty Will Derail Manufacturing Growth

Manufacturers Call on Administration and Congress to Act Swiftly

Washington, D.C. – National Association of Manufacturers President and CEO Jay Timmons released the following statement regarding negotiations to raise the debt ceiling:

“It is imperative that Congress and the administration reach a resolution to the debt limit issue as swiftly as possible. Waiting to act until extraordinary measures are exhausted constitutes dangerous brinkmanship that would inject uncertainty into the global economy and increase the risk of a default that would derail manufacturing growth in America, tank markets and put jobs at risk.

“We did not become the greatest nation in the world by shirking our responsibilities. Manufacturers have been working overtime to rebuild our economy, strengthening supply chains, creating jobs at record rates and helping defend against threats from around the world. All of those achievements will be erased if the United States does not find a path forward on the debt limit and fiscal responsibility. Let’s rise above this challenge so that manufacturers can do what we do best: improve lives and livelihoods here and around the world.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.9 million men and women, contributes $2.81 trillion to the U.S. economy annually and accounts for 55% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers Concerned of Recession Threat in 2023

Congress failed to act on essential tax reforms, which complicates investment, increases inflationary pressures, could stifle economic growth

Washington, D.C. – The National Association of Manufacturers released its Manufacturers’ Outlook Survey for the fourth quarter of 2022. It illustrates manufacturers’ concerns around a challenging economic environment characterized by inflation, supply chain disruption and the workforce crisis. It also demonstrates the consequences of Congress’s continued inaction on key manufacturing priorities. The NAM conducted the survey from Nov. 29 to Dec. 13, 2022.

“The majority of manufacturers expect a recession this year. Congress failed to act on essential tax reforms, which complicates investment, increases inflationary pressures and could stifle economic growth,” said NAM President and CEO Jay Timmons. “Much needed permitting reforms and provisions to strengthen our ability to conduct research and development, buy machinery and finance job-creating investments—which we need to promote growth within the sector—were left on the cutting room floor last year. Those reforms, combined with manufacturers’ ongoing efforts to inspire, educate and empower the future workforce, are critical to our competitiveness.”

Workforce shortages ranked as the industry’s number one concern, and there were 779,000 open jobs in manufacturing in the most recent data. This is why the NAM has pressed Congress to address immigration reform—as both a humanitarian solution and to help the sector grow its talent pool—and other solutions outlined in “Competing to Win,” the NAM’s policy roadmap to bolster manufacturers’ competitiveness.

Timmons added, “We’re looking to the new Congress and the administration for leadership and to focus on policies that remove barriers to manufacturing growth in the United States and fend off a severe downturn.”

Key Findings:

- More than 62% of manufacturing leaders believed that the U.S. economy would slip officially into a recession in 2023.

- More than three-quarters of respondents (75.7%) listed attracting and retaining a quality workforce as a primary business challenge, with supply chain challenges (65.7%) and increased raw material costs (60.7%) the next biggest impediments.

- Even in a recession, manufacturers plan to do the following: capital spending on new equipment and technological investments (65.3%), upskilling and training of existing workforce (64.1%), seeing solid demand for their company’s products (63.2%), hiring new employees (55.1%), investing in research and development (52.1%) and spending on new structures and existing facilities (38.6%).

- More than three-quarters of respondents (75.8%) said pushing back against regulatory overreach should be the top priority of the 118th Congress. Other priorities included supporting increased domestic energy production (69.3%), passing comprehensive immigration reform (65.4%), maintaining and permanently extending tax reform (63.0%), controlling rising health care costs (55.5%), addressing the skills gap facing manufacturers (50.5%) and modernizing permitting to reduce red tape (40.0%).

Due to the consistent economic headwinds, manufacturers’ confidence has declined, with 68.9% of respondents having a positive outlook for their company, the lowest since the third quarter of 2020.

Conducted by NAM Chief Economist Chad Moutray, the Manufacturers’ Outlook Survey has surveyed the association’s membership of 14,000 manufacturers of all sizes on a quarterly basis for the past 25 years to gain insight into their economic outlook, hiring and investment decisions and business concerns.

The NAM releases these results to the public each quarter. Further information on the survey is available here. Click here for more on “Competing to Win.”

Manufacturers Release New Economic Analysis Pushing Back on SEC Bond Rule Interpretation

NAM and Kentucky Association of Manufacturers File Rulemaking Petitions to Protect Private Companies from Harmful Public Disclosure Mandate

Washington, D.C. – The National Association of Manufacturers released a new economic analysis on the damaging impact of the Securities and Exchange Commission’s attempt to force private companies to disclose financial information publicly.

The SEC’s new rule interpretation would apply to private companies that raise capital via corporate bond issuances under SEC Rule 144A. If the new interpretation takes effect as scheduled in January 2023, these businesses will face decreased liquidity and increased borrowing costs—leading to significant job losses and a decline in U.S. GDP.

Key Findings:

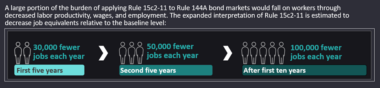

These impacts will be felt across the economy, resulting in 30,000 jobs lost each year over the first five years the new interpretation is in effect. The job losses will increase over time—rising to 50,000 jobs lost each year after five years and 100,000 jobs lost each year after 10 years.

These job losses are attributable directly to the decreased liquidity and increased borrowing costs associated with the SEC’s new interpretation.

NAM Speaks Out:

NAM Managing Vice President of Tax and Domestic Economic Policy Chris Netram released the following statement:

“At a time of rising interest rates and economic uncertainty, manufacturers cannot afford for the SEC to roil the bond markets arbitrarily. With tens of thousands of jobs at stake, the SEC must act by year’s end to reverse this misguided interpretation.”

NAM Action:

Today, the NAM and the Kentucky Association of Manufacturers are filing two petitions for rulemaking with the SEC seeking to stop the harm this new rule interpretation would cause.

The NAM and the KAM are calling on the SEC to reverse course by clarifying—either by rule or by exemptive order—that Rule 144A issuers are not required to make public financial disclosures. The NAM and the KAM are also seeking emergency interim relief to prevent the new interpretation from taking effect in January.

Background:

- SEC Rule 15c2-11 requires broker dealers to ensure that key information about issuers of over-the-counter equity securities is current and publicly available prior to quoting those issuers’ securities freely.

- SEC Rule 144A allows for resales of securities (primarily corporate debt issuances) to qualified institutional buyers—large financial institutions that own or manage more than $100 million in securities. Retail investors cannot purchase Rule 144A securities. Notably, under Rule 144A, issuers are obligated to make their financial and operational information available to QIBs.

- In September 2021 and December 2021, the SEC’s Division of Trading and Markets issued no-action letters applying Rule 15c2-11 to Rule 144A debt; the new requirements take effect in January 2023. This decision contradicted the historical application of Rule 15c2-11 to OTC equity securities and bypassed important rulemaking safeguards required by the Administrative Procedure Act.

- The NAM has weighed in with the SEC and Congress seeking to reverse this damaging interpretation.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.9 million men and women, contributes $2.77 trillion to the U.S. economy annually and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers’ Third Quarter Outlook Shows Continued Supply Chain Issues, Growing Workforce Needs and Rising Costs

Washington, D.C. – The National Association of Manufacturers released its Manufacturers’ Outlook Survey for the third quarter of 2022, which shows mixed results around a challenging economic environment, inflation, supply chains and the workforce. The NAM conducted the survey Aug. 16–30, 2022.

“Three out of four manufacturers still have a positive outlook for their businesses, but optimism has certainly declined. The majority of respondents are expecting a recession this year or next, and it’s clear the challenging environment is taking its toll. Manufacturers have shown incredible resilience through multiple crises, but the challenges of inflation, supply chain strains and the workforce shortage are taking a toll,” said NAM President and CEO Jay Timmons.

Key Findings:

- 78.3% of manufacturing leaders listed supply chain disruptions as a primary business challenge with only 10.8% believing improvement will occur by the end of the year.

- Attracting and retaining a quality workforce (76.1%), increased raw material costs (76.1%) and transportation and logistics costs (65.9%) were not far behind supply chain challenges as the biggest problems faced by manufacturers.

- More than three-quarters of manufacturers felt that rising material costs were a top business challenge (tied with workforce challenges and slightly below supply chain worries), and 40.4% said that inflationary pressures were worse today than six months ago. In addition, 53.7% noting that higher prices were making it harder to compete and remain profitable.

- The top sources of inflation were increased raw material prices (95.2%), freight and transportation costs (85.4%), wages and salaries (81.7%), energy costs (54.4%) and health care and other benefits costs (49.0%), with 21% also citing the war in Ukraine and global instability.

- When asked about what aspects of the CHIPS and Science Act were most important for supporting manufacturing activity, 69.6% of respondents cited strengthening U.S. leadership in energy innovation and competitiveness.

“This is a clear indication that we need urgent action to beat back the macroeconomic problems that are causing headwinds and preventing manufacturers in the U.S. from their full potential. Our ‘Competing to Win’ agenda gives policymakers the roadmap for solutions manufacturers need now to make our industry more globally competitive and, in turn, to boost optimism and confidence.

“Federal policies alone won’t solve everything, which is why we will continue to be part of the solution—innovating ways to deliver for our customers and spearheading efforts like the NAM and The Manufacturing Institute’s Creators Wanted workforce campaign.”

Due to the consistent economic headwinds, manufacturers’ confidence has declined, with 75.6% of respondents having a positive outlook for their company, the lowest since Q4 2020.

Conducted by NAM Chief Economist Chad Moutray, the Manufacturers’ Outlook Survey has surveyed the association’s membership of 14,000 manufacturers of all sizes on a quarterly basis for the past 20 years to gain insight into their economic outlook, hiring and investment decisions and business concerns.

The NAM releases these results to the public each quarter. Further information on the survey is available here. Click here for more on “Competing to Win.”

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.8 million men and women, contributes $2.77 trillion to the U.S. economy annually and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers Remain Resilient as Recession Concerns Rise

Washington, D.C. – The National Association of Manufacturers released its Q2 2022 Manufacturers’ Outlook Survey, which shows manufacturers’ significant concerns around recession, inflation, hiring and China competition legislation. The NAM conducted the survey May 17–31, 2022.

“Through multiple crises, manufacturers have proven remarkably resilient, but there’s no mistaking there are darker clouds on the horizon. A majority of our surveyed members believe inflationary pressures are making a recession more likely within the next year,” said NAM President and CEO Jay Timmons.

“Russia’s war on Ukraine has undeniably exacerbated higher energy and food costs. This, along with record deficit spending since the pandemic began, has created the highest inflation since 1981. But actions here at home can help ease these pressures, including first and foremost harnessing every energy resource available to us domestically and quickly—and refraining from imposing new taxes on manufacturers or families. It also means acting on manufacturers’ solutions to our supply chain challenges and passing the China competition bill—or Bipartisan Innovation Act. Though it won’t solve every issue, this will give us many of the tools needed to ramp up domestic manufacturing and strengthen our supply chains. That’s why 88% of manufacturers in our survey see it as an important piece of legislation—and Congress needs to move swiftly to get it to President Biden’s desk.”

Key Findings:

- In the survey, 59.3% of manufacturing leaders believed inflationary pressures would make a recession more likely in the next 12 months.

- Increased raw material costs topped the list of primary business challenges in the second quarter, cited by 90.1% of respondents.

- Three-quarters of manufacturers felt inflationary pressures were worse today than six months ago, with 53.7% noting that higher prices were making it harder to compete and remain profitable.

- The top sources of inflation were increased raw material prices (97.2%), freight and transportation costs (83.9%), wages and salaries (79.5%) and energy costs (55.9%), with 49.4% also citing a shortage of available workers.

- When asked about what aspects of the China competition legislation were most important for supporting manufacturing activity, 70.9% of respondents cited addressing port congestion and competition issues in ocean shipping.

Despite ongoing economic headwinds, manufacturers remain largely optimistic, with 82.6% of respondents maintaining a positive outlook for their company.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.7 million men and women, contributes $2.71 trillion to the U.S. economy annually and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

SEC Releases Climate Rule

The U.S. Securities and Exchange Commission has released a rule that would require public companies to make disclosures about their greenhouse gas emissions, climate-related financial metrics and climate-related risks.

The background: Since the early days of the Biden administration, the SEC has said that investors need “consistent, comparable and decision-useful information” about public companies’ climate-related risks. SEC Commissioner Allison Lee, a longtime champion of climate disclosures, called yesterday’s announcement “a watershed moment for investors and financial markets.”

The rule: The proposed rule would institute a wide range of new climate disclosure obligations for publicly traded companies.

- GHG reporting: All companies would be required to report Scope 1 and Scope 2 greenhouse gas emissions—those generated directly by a company’s operations or indirectly by a company’s energy usage. If “material” to investors, companies would also have to report their Scope 3 emissions—those resulting from upstream and downstream activities in their value chain.

- Financial metrics: Companies would be required to analyze climate impacts on their existing financial statement line items (like revenues, cash flow and capital expenses).

- Climate risk disclosures: This set of disclosures involves companies’ assessment of their “physical risks” (like fires and floods) and “transition risks” (like climate regulations or new green business models) related to climate change. Businesses would have to evaluate these risks and then disclose their potential impact as well as what steps the company is taking to mitigate them.

- Targets and goals: Many companies set public goals related to greenhouse gas emissions, water usage and the like. Under the SEC’s rule, companies would have to report information on how these goals are set, tracked and accomplished.

The SEC hopes to finalize its proposed rule by the end of this year, which means the largest companies would have to comply as of their FY2023 filings (submitted in early 2024).

Our action: Protecting manufacturers and their shareholders as the SEC works to mandate climate disclosures is a top NAM priority. NAM members can learn more about the SEC’s climate rule during our March 29 webinar, which you can register for here. We will be providing comment on the SEC’s proposal, and manufacturers are encouraged to share their feedback with NAM Senior Director of Tax and Domestic Economic Policy Charles Crain.

The last word: “Manufacturers support key disclosures related to publicly traded companies’ climate strategies, as this information can help shareholders make informed decisions,” said NAM President and CEO Jay Timmons.

“However, broad, sweeping disclosures could be counterproductive—requiring manufacturers to waste time and resources reporting irrelevant information that will not be decision-useful for shareholders. The SEC should focus on requiring disclosure of material information, and the NAM looks forward to working with the SEC to ensure that its proposed climate reporting rule enables smart, company-specific disclosures that are tailored and targeted.”

Supply Chain, Rising Raw Material Costs and Workforce Shortages Top Concerns for Manufacturers

Washington, D.C. – The National Association of Manufacturers released its Q1 2022 Manufacturers’ Outlook Survey, which shows manufacturers’ significant concerns around inflation, hiring and potential tax increases. The NAM conducted the survey Feb. 11–25, 2022.

Key Findings:

- 88.1% of respondents cited supply chain challenges as a primary business challenge in the first quarter, 85.7% cited increased raw material costs, and 79.0% cited the inability to attract and retain a quality workforce.

- 88.6% of respondents said their company would find it more difficult to expand their workforce, invest in new equipment or expand facilities if the tax burden on income from manufacturing activities increased.

- 89.4% had unfilled positions within their companies for which they were struggling to find qualified applicants.

“The humanitarian crisis and economic disruptions of Russia’s war on Ukraine, as well as the resulting sanctions that manufacturers fully support, will exacerbate these supply chain challenges and could impact energy costs even more as we move into the second quarter. We’re looking to policymakers to take bold action, while manufacturers do everything in our power to help the nation and world persevere through another crisis,” said NAM President and CEO Jay Timmons.

“Federal leaders should give energy manufacturers the tools to ramp up production here at home and improve our energy security. At the same time, we need Congress to finish the China competition bill to increase domestic semiconductor production and bolster supply chains, among other manufacturing priorities. Any discussion of raising taxes on manufacturers will create uncertainty and make it difficult to invest, hire and expand, hurting the broader economy.

“Although job growth last year rose at the best pace since 1994, and wage growth is now at a 40-year high, the survey shows workforce shortages are still a major challenge. That’s why the NAM and The Manufacturing Institute continue leading our industry-wide Creators Wanted campaign—to inspire, educate and empower the manufacturing workforce of today and tomorrow.”

While manufacturers remain mostly optimistic in their economic outlook (88.8%, up from 86.8% in Q4), the survey was conducted prior to the Russian invasion of Ukraine.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs more than 12.5 million men and women, contributes $2.57 trillion to the U.S. economy annually and has the largest economic multiplier of any major sector and accounts for 58% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.