Promises Kept, Progress at Risk: Manufacturers Urge Swift Action to Preserve Tax Reform

Washington, D.C. – As manufacturers call on Congress to urgently pass the One Big Beautiful Bill Act, the National Association of Manufacturers released a report today, “Keeping Our Promises: Manufacturers on Eight Years of Tax Reform,” that highlights the transformative impact of the 2017 Tax Cuts and Jobs Act on manufacturing in the U.S. From small family-run operations to global enterprises, the report shows how manufacturers delivered on their promises to invest, hire and grow, thanks to the savings from tax reform. It also warns of the serious risks to jobs and growth if pro-manufacturing tax policies are allowed to expire.

“The evidence is clear: manufacturing had its best job creation in more than two decades, the strongest wage growth in 15 years and significant investment in capital equipment after the passage of the TCJA in 2017,” said NAM Executive Vice President Erin Streeter. “But several of these tax provisions have expired already—and the rest are scheduled to sunset at the end of this year—putting at risk 6 million American jobs, more than $500 billion in wages and benefits and more than $1 trillion in GDP.”

The report features firsthand accounts from manufacturers like Westminster Tool, Click Bond, Ketchie, Gentex, Winton Machine, Jamison Door Company and more that transformed tax reform savings into tangible investments in the future, leveraging tax reform to:

- Raise wages and expand benefits;

- Invest in advanced machinery and technology;

- Strengthen R&D and innovation;

- Build new facilities and expand existing ones; and

- Create jobs and economic opportunity in their communities.

“This is a success story we’re proud to share—told through the experiences of manufacturers that delivered on their commitments and backed by research that reinforces what they’ve witnessed firsthand over the past eight years: tax reform worked,” Streeter added. “Congress faces a straightforward choice to make the TCJA’s manufacturing-empowering provisions permanent, or risk undermining the foundation of our economic competitiveness.”

Read the full report and manufacturing success stories from across the country here.

Learn more about the NAM’s Manufacturing Wins campaign to protect 2017 tax reform here.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

Manufacturers Asked and EPA Delivered: Repeal of Unworkable Power Plant Rule a Victory for Grid Reliability, Protecting America’s Energy Future

Washington, D.C. – In response to the EPA’s decision to repeal the 2024 power plant rule, a key priority for the National Association of Manufacturers’ ongoing efforts to rebalance federal regulations and unleash American energy, NAM President and CEO Jay Timmons issued the following statement:

“The EPA’s decision to repeal the unworkable power plant rule for existing coal-fired and new natural gas-fired power plants is a critical and welcome step toward rebalanced regulations and American energy dominance. This change will strengthen grid reliability and support manufacturing growth in the United States.

“From the onset, the NAM has warned that this rule would undermine the stability of our electric grid and impose unworkable mandates on critical energy infrastructure. The rule’s unrealistic timeline for power plants to adopt certain emerging technologies to commercial scale made it infeasible—undermining America’s energy security and hampering America’s leadership in next generation technologies like AI. Existing natural gas plants are critical to powering manufacturing in the United States—providing affordable, reliable baseload energy to continuously support industry. By layering new regulations on an already overburdened electric grid, the rule was putting our energy security at risk. Repealing this unbalanced rule will enhance manufacturers’ access to America’s abundant energy resources and ensure that the industry has the power it needs to drive the American economy.”

Background: Today’s action builds on the momentum from a December 2024 NAM-led letter to the transition team, signed by more than 100 manufacturing organizations, detailing regulatory actions the incoming administration could take to right-size regulations that stunted manufacturing growth and job creation—including the power plant rule. It also implements one of the key recommendations from the letter the NAM sent to 10 federal agencies in April, including the EPA, identifying the power plant rule as one of the most burdensome regulations facing manufacturers and urging a rebalanced approach to strengthen, rather than strain, U.S. manufacturing. Last year, the NAM endorsed Rep. Balderson’s (OH-12) Congressional Review Act resolution that would have blocked implementation of this rule.

-NAM-

The National Association of Manufacturers is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 13 million men and women, contributes $2.93 trillion to the U.S. economy annually and accounts for 53% of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States. For more information about the NAM or to follow us on Twitter and Facebook, please visit www.nam.org.

NAM: Proposed NAAQS Legislation Would Boost Manufacturing in the U.S.

The previous administration’s significant regulatory changes issued under the Clean Air Act—in particular, its unworkable tightening of allowable soot levels—will create hardship for local economies and must be revised, the NAM told the House Energy and Commerce Subcommittee on Environment ahead of a hearing today.

- Manufacturers that fail to meet the National Ambient Air Quality Standards will be unable to obtain permits to either construct new facilities or expand existing facilities, the NAM pointed out.

What’s going on: In 2024, the Environmental Protection Agency lowered the primary annual standard for fine particulate matter (PM2.5, or soot) from 12 micrograms per cubic meter to 9 μg/m3 .

- “By lowering the standard to 9 μg/m3, which is essentially the same as the background levels that naturally occur in the environment across the nation, the Biden EPA was increasing the number of industrial centers and U.S. population hubs that would be placed into nonattainment status,” NAM Managing Vice President of Policy Charles Crain said.

- In the past 25 years, thanks to manufacturer-developed technologies, U.S. air quality has seen a 37% reduction in PM2.5, Crain continued, adding that an EPA analysis found that less than 20% of PM2.5 emissions come from industrial processes or stationary fuel consumption. Most of it is from sources well outside manufacturers’ control, such as wildfires and crop and livestock dust.

Why it’s important: Enacting the Biden-era tightened standards would mean severe economic losses for the U.S., the NAM told the subcommittee.

- An NAM-commissioned Oxford Economics study found that a standard just slightly stricter than the one set by the Biden administration—8 μg/m3—“would result in a loss of $162.4 billion to $197.4 billion in economic activity and put 852,100 to 973,900 jobs at risk, both directly from manufacturing and indirectly from supply chain spending.”

What they’re doing: In today’s hearing, the House Energy and Commerce Committee discussed two draft pieces of legislation, both supported by the NAM, that would reform the process for establishing NAAQS, which the Clean Air Act mandates the EPA set. The measures include:

- The Clean Air and Economic Advancement Reform (CLEAR) Act, which would make the NAAQS process more workable for manufacturers while “maintaining the regulatory guardrails that protect the health and welfare of our local communities,” according to the NAM; and

- The Clean Air and Building Infrastructure Improvement Act, which “seeks to inject clearer guidance into the process for obtaining preconstruction permits and meeting compliance requirements under a revised NAAQS.”

Our take: “Manufacturers strongly support the Energy and Commerce Committee’s efforts to address policy challenges with the NAAQS and to explore solutions that will pave the way for greater investment in the infrastructure that will allow America to compete in the 21st century,” Crain concluded.

GE Appliances Opens Onsite Clinic for Employees in Tennessee

GE Appliances, a Haier company, has opened an advanced primary care clinic onsite at its Monogram Refrigeration LLC plant in Selmer, Tennessee, the company announced this week.

What it does: The third onsite clinic at a GE Appliances facility, the Selmer clinic will serve employees and covered family members who are at least 2 years old. It is offered in addition to traditional health care benefits, the company said, and it will be managed by third-party health care provider CareATC. The clinic’s services include:

- Advanced primary care;

- Mental health services;

- Access to a registered dietician; and

- Prescription services for common medications.

Impressive results: GE Appliances’ existing two clinics have shown impressive results in caring for employees, most notably a 35% increase in preventative care visits and a 70% reduction in avoidable ER visits among employees using the clinics.

- Employees average 4.82 visits per year—which is far more than the industry benchmark, according to GE Appliances.

GE Appliances says: “In today’s fast-paced world, providing accessible and comprehensive health care is more important than ever—especially in rural manufacturing communities,” said GE Appliances Chief Human Resources Officer Rocki Rockingham.

- “This clinic is more than a benefit; it’s a key part of our strategy to be an employer of choice and attract and retain the talent we need to operate and grow in a competitive labor market. Our employees deserve the best, and that includes health care that’s close to work, easy to access and focused on their whole well-being.”

The MI says: The Manufacturing Institute, the workforce development and education affiliate of the NAM, supports manufacturers in their efforts to offer high-quality benefits to workers, including medical care.

- “When manufacturers invest in the holistic well-being of their workforce, they’re doing more than offering benefits—they’re making a powerful statement that their people are their greatest asset,” said MI President and Executive Director Carolyn Lee.

- “These investments in people play a critical role in both attracting and retaining talent. At the MI, our research consistently shows that team members are more likely to stay—and thrive—when they believe their employer truly cares about them. It’s not just the right thing to do; it’s a smart strategy for attracting and retaining the skilled talent that drives our industry forward.”

Lubrizol Chills Out with Liquid-Based Data Center Cooling

Everyone’s talking about where artificial intelligence is taking us, but few are discussing the immense amount of energy that will be needed to get there. That’s where Lubrizol comes in.

Cool operator: The global specialty chemicals company, with headquarters in Ohio, has a unique method of cooling IT in data centers, those behemoth facilities that power generative AI. As anyone who’s used a computer for long periods of time knows, that equipment can get hot.

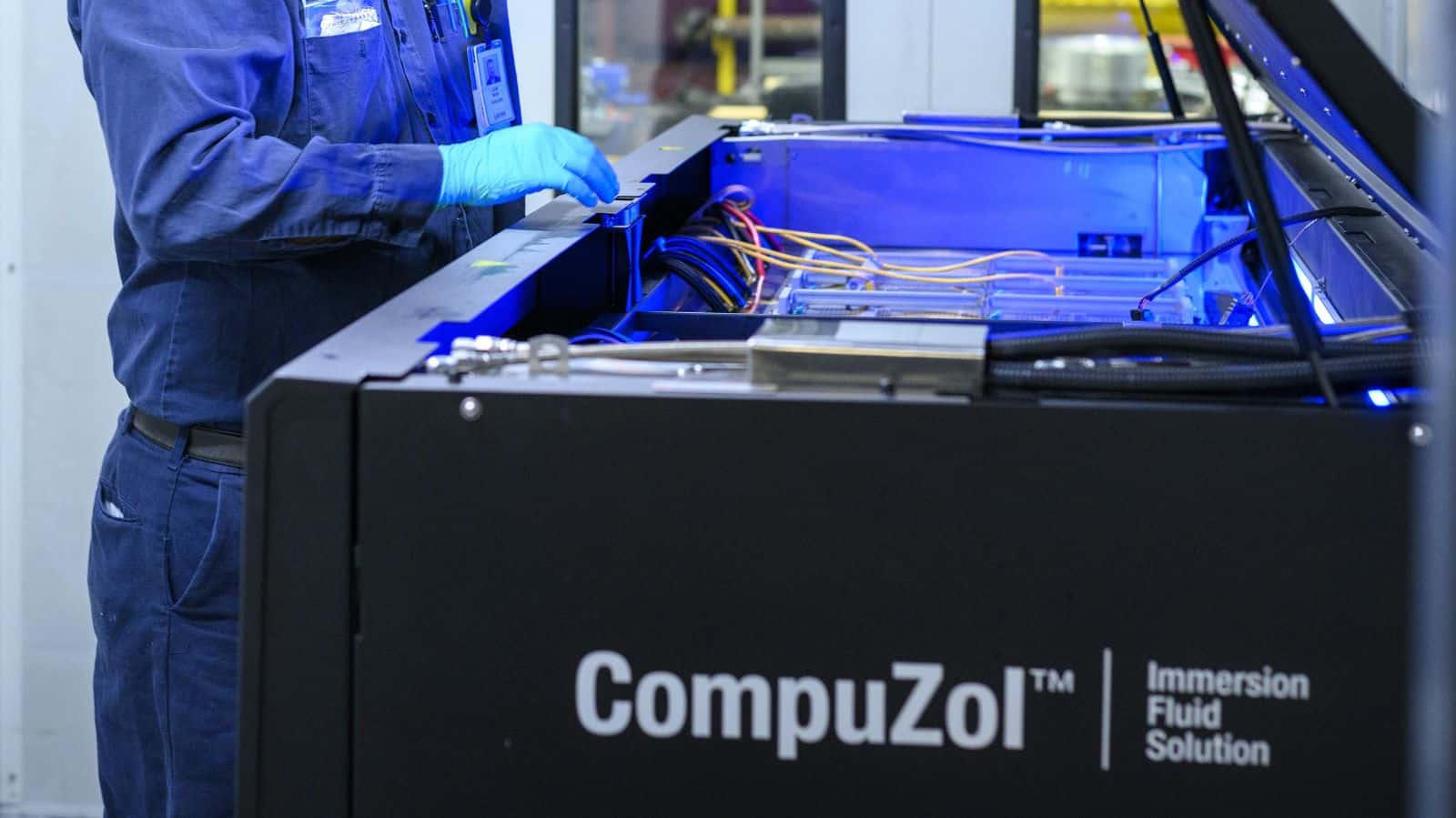

- To cool high-performance data centers’ graphics processing units—powerful accelerators that enable AI and other technologies and can generate huge amounts of heat—Lubrizol employs immersion cooling, a method of heat removal that uses liquid.

- “It’s like a blacksmith—when you try to remove heat from hot metal, you immerse it in cold water and the water removes the heat,” Lubrizol Vice President of Corporate Innovation Abhishek Shrivastava told us.

- But at Lubrizol, “we are immersing the computer chips in a formulated oil” instead of water. “These GPUs are working so hard with higher power consumption, they can actually melt if they get too hot. So, you need to remove the heat quickly and efficiently.”

Why we need it: Most current data centers use air cooling, but their increasing workloads and processing capacity—driven by the fast-growing appetite for AI—will require something more efficient, Shrivastava said.

- Meanwhile, next-generation processing units will maintain a thermal design power (i.e., heat) of more than three times today’s commonly used systems, according to Lubrizol.

- “AI is needed for the future—for economic development, for global leadership,” Shrivastava said. “It will come down to who can deploy it faster.”

The tech: Lubrizol believes its method of immersion cooling—which relies on nonconducting, dielectric fluids, or liquids that act as electrical insulators—is the key to winning that race.

- “As AI infrastructure is deployed [in the U.S.], there must be efficient cooling in place too,” Shrivastava continued. “It’s going to require a lot of infrastructure-level investment.”

- Up to 40% of data centers’ total annual energy consumption goes to their cooling systems, according to a recent study by the Electric Power Research Institute. Lubrizol’s technology greatly reduces that percentage for its customers.

Getting started: Lubrizol’s immersion cooling technology has been deployed at multiple data centers, and the company is working with its customers to scale up installations. “A lot of small players are using it, because if you’re small, your risk is low and deployment is fast, but there are some large-scale deployments across the world including in China and the U.S. that show the big players have identified the value,” Shrivastava said.

- Among the company’s next steps: getting the solution deployed at larger centers—though that will take some time. “Larger-scale operations need more data, more confidence in [new] technology,” Shrivastava noted.

Years, not decades: In the long term, however, the cost-benefit analysis is very favorable, said Shrivastava, even with infrastructure development outlay. And Shrivastava foresees widespread use of the technology.

- Awareness of the need for high-powered, efficient cooling is growing. “We’re not talking about a matter of decades” before it’s in wide use; “it’s a matter of years and months.”

The last word: “The industry needs to pick up the pace” on the data center cooling front, Shrivastava told the NAM. “Otherwise, we’re not going to realize the full potential of AI.”

Tariff Pressures Mount: Prices and Supplier Delays Hit New Highs

The S&P Global U.S. Manufacturing PMI was 52.0 in May, the fifth consecutive month of growth and up from 50.2 in April. PMI growth was led by a rise in new orders and a dramatic increase in input inventories, which rose at a pace not seen in the indicator’s 18-year history even amid higher prices. Domestic demand was the primary driver to new order growth, along with efforts to frontload production ahead of greater tariff impacts. Additionally, optimism increased slightly after falling sharply in April, and employment advanced for the first time in three months. On the other hand, production declined for the third month in a row and at a slightly faster pace than in April.

Tariffs led to steep increases in both input and output costs, which rose at the highest rate since November 2022. Raw material prices remained elevated, despite dropping to a three-month low, amid reports of manufacturers passing on higher tariff-related costs. Additionally, tariffs continue to cause supply-side disruptions, as supplier delays have risen to the highest degree since October 2022 and are leading to growing vendor shortages. Small manufacturers and those in consumer-facing markets seem to be hit most severely by the impact of tariffs on prices and supply.

Nevertheless, manufacturers felt more optimistic that economic conditions will be more stable in a year’s time, particularly expecting tariff disruptions to dissipate in the months ahead. Therefore, confidence reached a three-month high to right above the survey average.

Unfilled Orders Hold Steady; Inventory Levels Flatten

New orders for manufactured goods fell 3.7% in April following four consecutive monthly increases. When excluding transportation, new orders slipped 0.5%. Orders for durable goods dropped 6.3%, following a 7.6% increase in March. Year to date, durable goods orders are up 4.2%. Nondurable goods orders ticked down 0.9% in April after declining 0.7% in March. Nondurable goods orders are down 0.1% over the year.

New orders for nondefense aircraft and parts led the decrease in durable goods, falling 51.5%, after leaping 158.5% in March. In April, the largest monthly increase occurred in ships and boats, which rose 92.1%, after slipping 4.7% the month prior. The largest over-the-year changes also occurred in nondefense aircraft and parts (up 85.5%) and mining, oil field and gas field machinery (down 9.7%).

Factory shipments decreased 0.3% in April, after slipping 0.2% in March. Shipments over the year increased 0.9%. Shipments excluding transportation fell 0.6% in April, following a 0.3% decrease the previous month. Shipments for durable goods improved 0.3% in April, up from a 0.2% increase in March and up 1.8% year to date. Meanwhile, nondurable goods shipments declined 0.9% in April and are down 0.1% year to date.

Unfilled orders for all manufacturing industries stayed the same in April, following a 1.6% increase in March. Inventories edged down 0.1%, after rising 0.1% for the past four months, and the inventories-to-shipments ratio rose to 1.58 from 1.57. The unfilled orders-to-shipments ratio for durable goods decreased to 6.77 from 6.86 in March.

Supply Chains Tighten Even as Demand Softens

In May, global manufacturing activity contracted for the second consecutive month and at a slightly faster pace, falling from 49.8 to 49.6. For the first time in five months, output fell back into negative territory as a result of declining new orders and export business. Supply chains are stretched despite reduced purchase volumes, with vendor lead times lengthening and delivery times increasing to the greatest extent in six months. Nevertheless, the outlook strengthened, with business optimism rising from April’s two-and-a-half-year low.

India, Greece and Colombia had the highest PMI readings in May, while the Eurozone’s pace of contraction continued to improve for the third consecutive month. On the other hand, China, Japan and the U.K. were some of the larger nations to register declines in activity, and those contractions more than offset activity growth in the U.S. The overall downturn in manufacturing output reflected weakness in the intermediate and investment goods sectors. On the other hand, consumer goods production rose for the 22nd month in a row.

Additionally, manufacturing employment fell for the 10th consecutive month in May but at a slower pace than the prior month. Although staffing levels rose in the U.S., Japan and India, they sank notably in China, the Eurozone and the U.K. While remaining high, both input costs and selling price increases eased to the slowest pace in several months.

Labor Market Still Tight Despite Slower Hiring in Industry

Job openings for manufacturing decreased by 16,000, from 397,000 in March to 381,000 in Furthermore, the March job openings level of 397,000 was revised downward dramatically from 449,000 in the previous report. Nondurable goods job openings in April stayed the same at 136,000, while durable goods job openings declined by 16,000, from 261,000 in March to 245,000 in April. The manufacturing job openings rate edged down to 2.9% from 3.0% in March and fell from 3.7% the previous year. The rate for nondurable goods manufacturing stayed the same at 2.7%, while it slipped 0.2% to 3.0% for durable goods.

In the larger economy, the number of job openings rose to 7.4 million, an increase of 191,000 from the previous month but a decrease of 228,000 from the previous year. The job openings rate ticked up to 4.4%, up from 4.3% in March but down from 4.6% last year. This data reflects an overall labor market that has eased back to pre-pandemic levels, but remains strong and tight from a historical perspective.

The number of hires in the overall economy increased 169,000 to 5.6 million in April but dropped 11,000 from the previous year. The hires rate for the overall economy inched up 0.1% in April to 3.5%. Meanwhile, the hires rate for manufacturing similarly ticked up 0.1% in April to 2.6%. The hires rate for durable goods rose 0.2% to 2.6% but edged down 0.1% to 2.6% for nondurable goods.

In the larger economy, total separations, which include quits, layoffs, discharges and other separations, rose 105,000 from March to 5.3 million and dropped 100,000 from the previous year. The total separations rate stayed the same at 3.3% for the overall economy but inched up 0.1% for manufacturing to 2.5%. Within that rate, layoffs and discharges increased by 14,000 in April for manufacturing, while quits increased by 2,000. The quit and layoff rates continue to remain lower for manufacturing than the total nonfarm sector.

Job Gains Continue, Though Labor Force Shrinks Slightly

Nonfarm payroll employment increased by 139,000 in May, slightly beating expectations. On the other hand, April’s job gain was revised downward dramatically by 30,000, from 177,000 to 147,000. The 12-month average stands at 149,000 job gains per month. The unemployment rate stayed the same at 4.2%, while the labor force participation rate edged down 0.2% to 62.4%.

Manufacturing employment slipped by 8,000, but the April loss of 1,000 was revised upward by 6,000 jobs to an increase of 5,000. Durable goods manufacturing employment fell by 7,000, while nondurable goods employment declined by 1,000. The most significant gain in manufacturing in May occurred in food manufacturing, which added 3,900 jobs over the month. Meanwhile, the most significant losses occurred in machinery manufacturing, which shed 7,300 jobs over the month, followed by paper manufacturing, which lost 1,500 jobs.

The employment-population ratio slipped 0.3% to 59.7% and is down 0.4 percentage points from a year ago. Employed persons who are part-time workers for economic reasons decreased by 66,000 to 4.60 million but are up from 4.42 million in May 2024. Native-born employment is down 444,000 over the month but up 1,337,000 over the year. Meanwhile, foreign-born employment is down 224,000 over the month but up 683,000 over the year.

Average hourly earnings for all private nonfarm payroll employees rose 0.4%, or 15 cents, reaching $36.24. Over the past year, earnings have grown 3.9%. The average workweek for all employees stayed the same at 34.3 hours but ticked up 0.1 hour for manufacturing employees to 40.1 hours.