Data sourced from the Bureau of Economic Analysis and the Census Bureau.

Manufacturing inputs are classified as all goods that fall under the capital goods, industrial supplies, and auto parts end use categories.

Trading to Win

Manufacturers are offering a clear, actionable agenda to strengthen U.S. manufacturing through common-sense trade policy.

-

1

Go for Zero-for-Zero Tariffs

We’re calling on negotiators to secure better terms for manufacturers by adopting zero-for-zero tariffs for American-made products in our trading partners’ markets. That means they don’t charge us, and we don’t charge them.

-

2

Secure Access to Inputs That Power U.S. Production

More than half of U.S. imports are manufacturing inputs. These include critical minerals, chemicals and machinery essential for making things in America. On the path to zero-for-zero, we urge negotiators not to put tariffs on specific manufacturing inputs we need to make things in America.

-

3

Create American Investment Incentives

If tariffs remain in place, we propose specific incentives, such as tariff rebates for manufacturing companies investing in manufacturing in the U.S. to accelerate the growth of the American industrial base.

U.S. Manufacturing Investment Accelerator Program

To give manufacturers a runway of predictable access to critical materials and leading technologies from reliable suppliers that will accelerate the long-term investments needed to maintain America’s global edge, the NAM is proposing a U.S. Manufacturing Investment Accelerator Program.

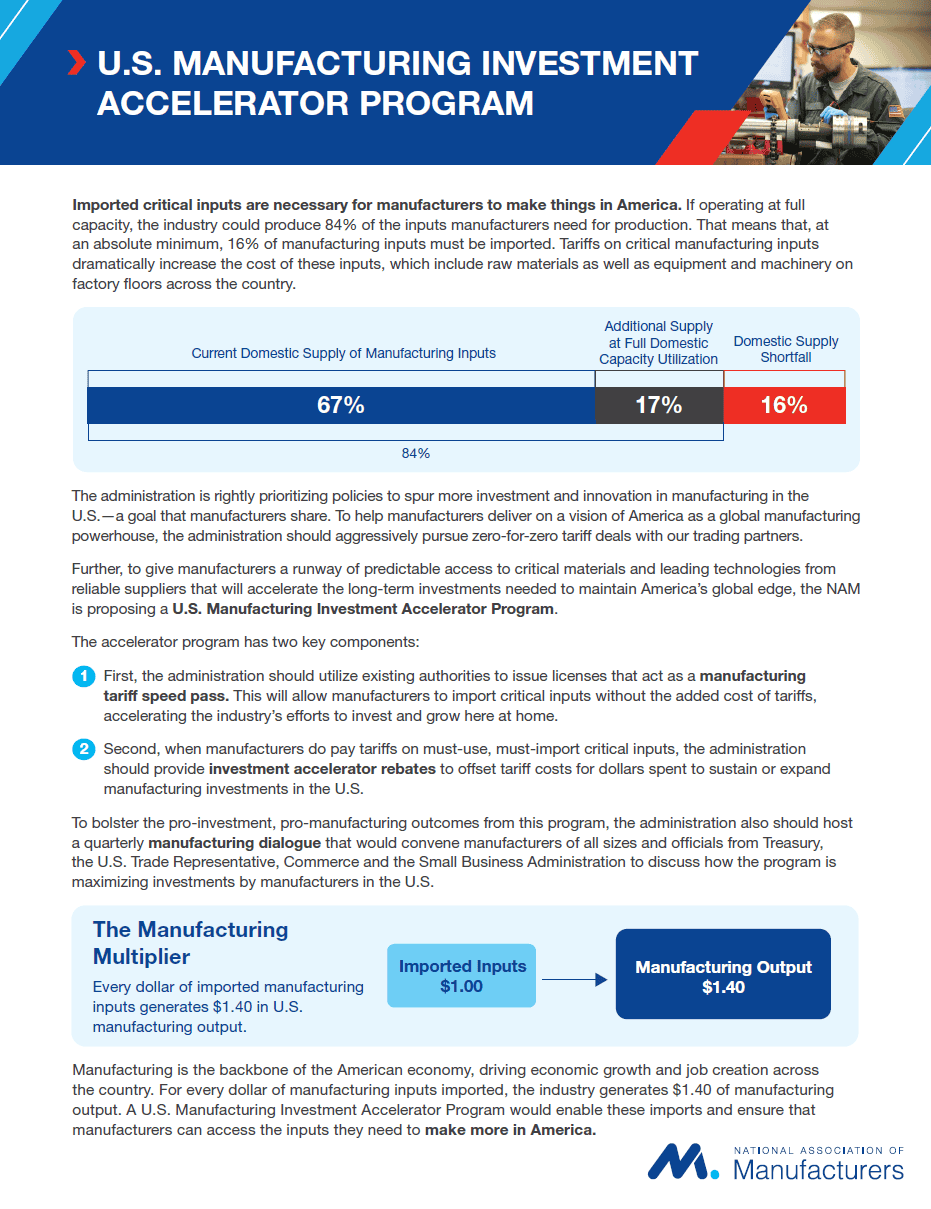

Imported critical inputs are necessary for manufacturers to make things in America. If operating at full capacity, the industry could produce 84% of the inputs manufacturers need for production. That means that, at an absolute minimum, 16% of manufacturing inputs must be imported. Tariffs on critical manufacturing inputs dramatically increase the cost of these inputs, which include raw materials as well as equipment and machinery on factory floors across the country.

The accelerator program has two key components:

- First, the administration should utilize existing authorities to issue licenses that act as a manufacturing tariff speed pass. This will allow manufacturers to import critical inputs without the added cost of tariffs, accelerating the industry’s efforts to invest and grow here at home.

- Second, when manufacturers do pay tariffs on must-use, must-import critical inputs, the administration should provide investment accelerator rebates to offset tariff costs for dollars spent to sustain or expand manufacturing investments in the U.S.

1. A Manufacturing Tariff Speed Pass

The administration should implement a general licensing system that grants preapprovals for duty-free imports of inputs and materials necessary for manufacturing activities in the U.S.

How It Works: Self-Certification Under a “General License”

- General licenses would provide preexisting approval for any company meeting the criteria to import qualifying items free of duty.

- Use would be self-determined by eligible parties, subject to U.S. Customs and Border Protection verification.

- The president can direct the Treasury to implement the program under existing authorities.

What Qualifies for a General License?

- Materials, equipment, machinery, and parts used in manufacturing or maintenance.

- Essential raw materials, chemicals, and other inputs in limited supply but needed for U.S. manufacturing.

- Materials for R&D in the U.S.

- Materials transferred intercompany and used for further processing in the U.S.

2. A Manufacturing Investment Accelerator Rebate

The administration should provide a rebate to offset tariff costs when dollars are spent to expand or maintain manufacturing investments in the U.S. The rebate should be available on a rolling basis for actual dollars spent after April 5, 2025.

What Qualifies for a Rebate?

- Dollars spent on new greenfield or brownfield investments.

- Dollars spent on expanding or upgrading existing capacity, including capital improvements and maintenance.

- Dollars spent to add full-time manufacturing employment.

- Dollars spent on R&D in the U.S.

Trade Intelligence Center

Manufacturers across America depend on critical inputs imported from around the world. Increasing the cost of inputs will lead to shrinkage, not growth for American manufacturing.

United States

| Increase in effective tariff rate on manufacturing inputs1 | +15% | ||||||

| Imports of manufacturing inputs2 | $1.1T | ||||||

| Manufacturing output per dollar of inputs imported | $1.40 | ||||||

Top 3 Input Imports

|

|||||||

Domestic Supply of Manufacturers’ Input and Capital Goods Needs

|

|||||||

| Manufacturing GDP | $2.94T |

| Manufacturing employment | 12.7M+ |

1Benchmark date set to Dec. 31, 2024. Updates daily. 22023 import volumes Click here for methodology statement.

Key Facts

What Manufacturers Are Saying on Tariffs

Key Policy Actions

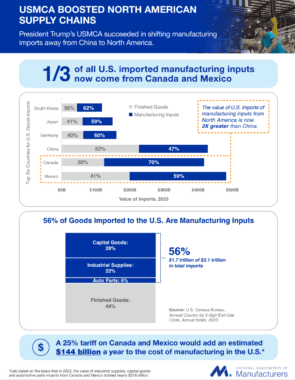

The Promise of the USMCA

President Trump’s USMCA succeeded in shifting manufacturing imports away from China to North America. In this new phase of U.S. trade policy, strengthening the United States–Mexico–Canada Agreement will be critical in helping North America restore balance and combat disruptive, problematic trade practices coming out of other countries, specifically China.

View and download the NAM’s new one pager that assesses the impact and value of U.S imports of manufacturing inputs from North America.