Manufacturers Help Those Affected by Hurricane Helene

Within days of Hurricane Helene’s landfall, manufacturers were reaching out to help those who had been affected.

What’s going on: Companies from an array of industries are volunteering their resources, time and energy to getting storm victims essential items. Helene, which made landfall in Florida last Thursday, has killed at least 189 people and left more than 1.2 million customers without power (ABC News).

- Toyota is matching donation contributions made by its U.S.-based employees to the American Red Cross, disaster relief organization SBP and other nonprofits. The auto manufacturer is also offering payment relief options to those affected.

- Norfolk Southern Corp. has donated $100,000 to the American Red Cross, which is undertaking relief work across multiple states, including North Carolina, Florida, Georgia and Tennessee. The company’s Employee Disaster Relief Program is also giving employees affected by the storm grants for qualified expenses and losses.

- DENSO North America Foundation, the philanthropic group of global automotive components manufacturer DENSO, is donating $200,000 to the American Red Cross in support of disaster relief across southeastern states.

- Procter & Gamble’s Disaster Relief is partnering with Walmart and Matthew 25: Ministries, an international aid organization, in their recovery efforts in the hard-hit Florida cities of Perry and St. Petersburg. P&G resources will go toward a Tide Loads of Hope Mobile Laundry Unit, powered by Matthew 25: Ministries, to offer free, full-service laundry to responders and affected residents. Shower trailers with hot water will also be provided.

Additional resources: SBP and Good360 offer manufacturers disaster preparedness resources and training when natural disasters hit.

- “Hurricane Helene has been devastating, leaving many without access to power and vital resources,” NAM President and CEO Jay Timmons wrote in a social post Wednesday. “Manufacturers looking for recovery resources or looking to provide supplies can connect with SBP via sbpusa.org and Good360 via good360.org.”

Share your stories: Are you helping those affected by Helene? Tell us how by emailing [email protected].

R&D Expensing: Q&A with Sen. Young

The NAM recently talked to Sen. Todd Young (R-IN) about the importance of reinstating immediate expensing for research-and-development expenditures. Here’s the full interview:

NAM: Sen. Young, Congress is facing a “Tax Armageddon” next year, as crucial provisions from 2017’s Tax Cuts and Jobs Act are set to expire. As a member of the Senate Finance Committee, what is your focus moving into next year’s debate?

Sen. Young: The Tax Cuts and Jobs Act was a great success—millions of Americans, especially those in the middle class—saw their taxes go down. Corporate tax receipts went up. We stemmed the tide of corporate inversions, and many companies chose to return their operations and tax bases to the United States. If Congress does not act next year to extend provisions of the TCJA, we will undo all of these victories and inflict long-lasting damage on our economy. As we prepare for next year, I am focused on evaluating how best we can build upon our TCJA successes and continue to adopt pro-growth, fiscally responsible tax policy that helps hardworking Americans thrive.

NAM: As you know, for nearly 70 years, manufacturers in the U.S. were able to fully deduct their R&D expenses in the year incurred. Beginning in 2022, however, manufacturers were forced to spread their deductions over several years, greatly harming our ability to grow and compete. What is Congress doing to restore immediate R&D expensing?

Sen. Young: For several years now, I have advocated for the American Innovation and Jobs Act (S. 866), my bill with Sen. Maggie Hassan (D-NH) that would restore full and immediate expensing of R&D expenditures. We first introduced the bill back in 2020 well before the provision expired, and I am disappointed that we are now reaching the end of 2024—nearly three years after the law shifted to amortization of R&D investments—and Congress has yet to pass our bill to fix this crucial issue. As our global competitors, like China, are expanding their R&D incentives, we simply cannot allow our nation and our economy to be left behind. Congress must work to restore our R&D incentives as soon as possible, and this will be one of my top priorities heading into next year’s tax negotiations.

NAM: As a senator who was there during the Tax Cuts and Jobs Act, you know how impactful the legislation was for manufacturers to be able to compete on a global level. As we get closer to next year, what are you hearing from stakeholders on the need for pro-growth tax policy so American businesses can engage and grow around the world?

Sen. Young: At the risk of oversimplifying the issue, it really comes down to competitiveness. A lot of the work I have done in the tax space as well as in other areas is focused on ensuring that America’s position as a global leader remains strong. Without growth, our economy suffers and our ability to remain internationally competitive is diminished. This is a massive national security risk. So, as I look ahead to what next year may hold in the tax arena, I am focused on pro-growth tax policy. We need to be thinking creatively about ways we can add value to our economy and, in turn, ensure Americans are better off.

In different industries this takes on different forms; however, one common thread is the need for R&D. To grow and develop new products, businesses have to put significant amounts of capital into R&D costs, both domestically and internationally. That is why one of my core areas of focus continues to be restoring full and immediate expensing of R&D costs. It is vital for the health of our economy that we take this action, which allows safer and more innovative products to be brought to the marketplace; increases the number of [well]-paying, high-skilled jobs; and secures U.S. interests abroad by ensuring we remain globally competitive.

NAM: Thank you, Sen. Young. What else can NAM members do to stay engaged and be a resource for you going into next year?

Sen. Young: I have always appreciated the NAM’s partnership and advocacy as we work together on these important issues. I would encourage NAM members to continue sharing stories with their elected federal officials of the importance of these tax incentives, like R&D, that enable the creation of high-quality jobs, promote our national competitiveness and strengthen our economy. Your voice matters.

R&D Expensing: Q&A with Rep. Estes

The NAM recently talked to Rep. Ron Estes (R-KA), chair of the U.S. Innovation Tax Team, to learn what he and his colleagues are doing to fight for the return of immediate research-and-development expensing. Here’s the full interview:

NAM: Rep. Estes, Congress is facing a “Tax Armageddon” next year, as crucial provisions from 2017’s Tax Cuts and Jobs Act are set to expire. As a member of the Ways and Means Committee, what is your focus moving into next year’s debate?

Rep. Estes: The Tax Cuts and Jobs Act did so much to encourage economic growth and make the United States competitive globally. Today, about half of the members serving in Congress weren’t in office in 2017 when we passed this landmark legislation, so there’s a lot of educating that’s been happening, not just for the general public but for our members as well. Ways and Means Republicans are taking this opportunity to examine what worked and ways to improve and expand the legislation. Ways and Means Chairman Jason Smith (R-MO) established 10 tax teams to address various parts of the bill, and I’ve been leading the U.S Innovation Tax Team.

NAM: As you well know, for nearly 70 years, manufacturers in the U.S. were able to fully deduct their R&D expenses in the year incurred. Beginning in 2022, however, manufacturers were forced to spread their deductions over several years, greatly harming our ability to grow and compete. What is Congress doing to restore immediate R&D expensing?

Rep. Estes: I’ve introduced legislation—the American Innovation and R&D Competitiveness Act—to address this issue. It’s bipartisan legislation that is supported by 220 colleagues, nearly evenly divided between Republicans and Democrats. Those provisions were also included in the House-passed Tax Relief for American Families and Workers Act, which would have been a welcome fix. However, election-year politics has stalled that bill in the Senate. But manufacturers and innovators need action on immediate R&D expensing now, and it’s something the Senate should still address before the next Congress begins in January.

NAM: Your U.S. Innovation Tax Team has been very busy this year, as you’ve held several roundtables and been receiving feedback focused on the importance of U.S. manufacturers having a chance to compete around the globe. As we get closer to next year, what is your tax team hearing from stakeholders on the need for American businesses to engage and grow around the world?

Rep. Estes: The U.S. Innovation Tax Team has hosted roundtables and listening sessions with innovators and manufacturers across the country. Their message has been consistent and clear: we need a stable tax code that encourages innovation through R&D immediate expensing, continues good policies like FDII [the foreign-derived intangible income deduction] and discourages foreign extraterritorial taxes that are out to pilfer from American innovators. A manufacturer in rural Kansas told me about how the change in immediate R&D expensing has changed their plans for expansion. This is a major employer in a small town, so the impact isn’t just about the business, but it’s also about the jobs that are impacted when R&D is stifled. At the same time, China is offering a 200% super deduction and is working to expand R&D in their country. We can’t cede our dominance in manufacturing, research and development.

NAM: Thank you, congressman. What else can NAM members do to stay engaged and be a resource for you going into next year?

Rep. Estes: The best thing for NAM members to do is to continue talking about the benefits of the Tax Cuts and Jobs Act and the importance of R&D expensing for manufacturers and workers. Unfortunately, there’s a lot of misinformation about the impact of the 2017 tax law, but even the New York Times admitted in 2019 that the Tax Cuts and Jobs Act benefitted most Americans, saying in their headline, “Face It: You (Probably) Got a Tax Cut,” and going on to say, “Studies consistently find that the 2017 law cut taxes for most Americans. Most of them don’t buy it.” Americans, small businesses, innovators and manufacturers need us to extend and expand the 2017 tax law to encourage the kind of economic growth we experienced just several years ago.

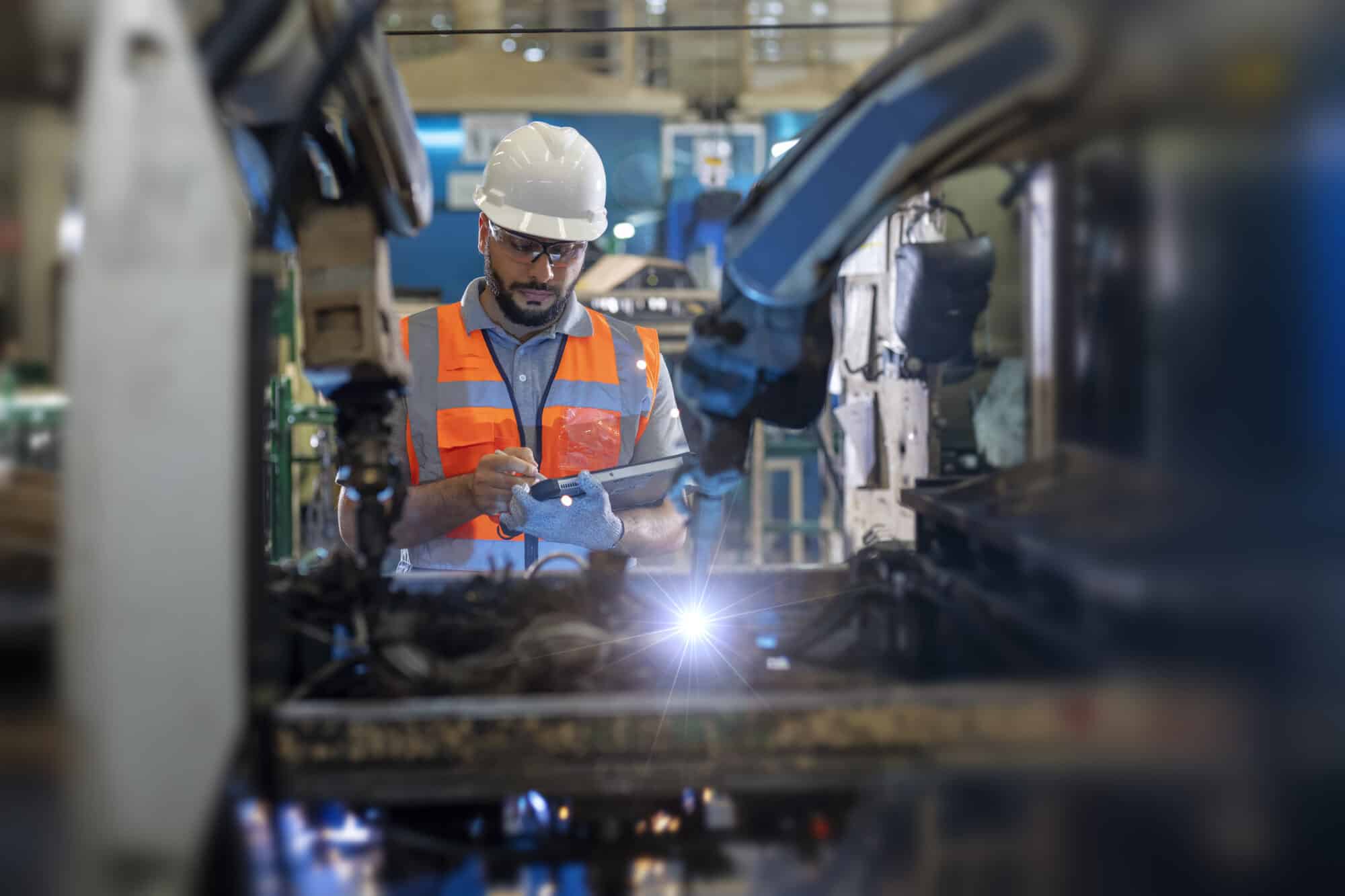

Why Manufacturers Need Immediate R&D Expensing

For more than two years, manufacturers have not been able to immediately deduct their R&D expenses—and it’s taken a toll, particularly on small businesses.

What’s going on: For more than 70 years, the U.S. tax code allowed manufacturers to immediately deduct their R&D expenditures. But since the expiration of this key provision in 2022, manufacturers have been required to amortize their R&D costs over a period of years.

Why it’s important: As a direct result of the expiration, manufacturers’ tax bills have increased, according to a new NAM tax explainer released as part of the NAM’s “Manufacturing Wins ” campaign. This means manufacturers are now less able to conduct groundbreaking research and support well-paying R&D jobs.

Uneven playing field: The U.S. is now one of just two developed nations that requires the amortization of R&D expenses.

- The policy makes the U.S. less competitive against China, which offers companies a 200% “super deduction” for R&D costs.

- In 2022, the first full year after the expiration of immediate R&D expensing, the European Union’s R&D growth surpassed that of the U.S. for the first time in nearly a decade—and China’s R&D growth was triple that of the U.S.

What should be done: The NAM is calling on Congress to restore immediate R&D expensing, along with other pro-growth tax provisions.

The last word: “It is imperative that the U.S. tax code support job-creating, life-changing R&D,” said NAM Vice President of Domestic Policy Charles Crain. “Congress must act to bolster manufacturing innovation and American competitiveness by reinstating immediate R&D expensing.”

Consumer Confidence Drops in September

Consumer confidence fell dramatically in September to 98.7 from 105.6 in August. September’s decline was the largest since August 2021, with all five components of the index deteriorating.

The Present Situation Index, reflecting current business and labor market conditions, dropped 10.3 points to 124.3. The Expectations Index, which reflects consumers’ short-term outlook for income, business and labor market conditions, declined 4.6 points to 81.7, slightly above the recession signal threshold of 80. Consumers’ assessments of current business conditions turned negative, with only 18.8% of consumers saying business conditions were “good,” while views of the current labor market situation softened further. Consumers also felt more pessimistic about future labor market conditions, with more consumers anticipating fewer jobs to be available than more. Consumers also felt less positive about future business conditions and future income.

Consumers’ views of their current financial situation weakened further, with 18.0% anticipating income growth, down from 18.6% in August. Despite slower overall price increases, inflation expectations increased to 5.2% in September, but expectations for higher interest rates continued to decline. Buying plans for homes and new cars improved slightly, while purchase plans for big-ticket appliances were mixed. Despite the largely negative responses, concerns about a recession remained stable and low.

Tenth District Factory Activity Falls, Optimism for Future Grows

Kansas City Fed Manufacturing Survey: Manufacturing activity declined further in the Tenth District in September, but expectations for future activity stayed positive. The Tenth Federal Reserve District encompasses the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma and Wyoming; and the northern half of New Mexico. The month-over-month composite index fell from August but is up from July. The decline was primarily driven by durable goods, particularly machinery, transportation, nonmetallic mineral and wood manufacturing. All month-over-month indexes were negative and lower than last month’s readings, except the raw materials prices and inventories indexes.

Volume of shipments and new orders fell somewhat, while production and backlogs declined substantially. The year-over-year composite index for factory activity reached its lowest level since September 2020, as production and new orders decreased substantially. The backlog of new orders decreased to its lowest level since June 2020. Employment levels fell moderately while capital expenditures stayed steady. On the other hand, the future composite index ticked up, as production and employment are expected to increase substantially.

This month, survey respondents were asked how they expect their current investment in technology to likely impact employment levels over the next year. A majority of firms (63%) said their technology investment will have no impact on employment, but around a quarter (23%) reported they expect a slight decrease, 11% expect a slight increase and 3% anticipate a substantial decrease. Firms were also asked if they’ve seen any change in the flow of job applicants per job opening since last year. About half of firms (45%) reported an increase in the number of job openings, while 32% did not have a change, 17% saw a decrease and 6% have not had any openings.

Fifth District Manufacturing Slumps Further in September

Richmond Fed Survey of Manufacturing Activity: Manufacturing activity in the Fifth District remained sluggish in September. The Fifth Federal Reserve District consists of Virginia, Maryland, the Carolinas, the District of Columbia and most of West Virginia. The composite manufacturing index slipped from -19 in August to -21 in September. Among its components, shipments decreased from -15 to -18, new orders increased from -26 to -23, and employment dropped from -15 to -22. The vendor lead time index remained in negative territory but at the same level as August, and firms continued to report declining backlogs. Companies also grew slightly less pessimistic about local business conditions, but the index remained solidly in negative territory. The average growth rate of prices paid increased in September, while the rate of prices received decreased modestly.

Expectations for future shipments and new orders both decreased but remained positive, suggesting that firms still anticipate improvement in these areas. Meanwhile, expectations for backlogs improved but remained in negative territory. While the outlook for future local business conditions improved dramatically, the indicator also stayed negative. Firms continue to exhibit a more cautious approach to equipment and software spending, as expectations became more negative. On the other hand, spending on capital expenditures improved, but was still slightly negative.

Housing Prices Hit Record Highs Despite Slowdown

S&P CoreLogic Case-Shiller Home Price Index: Housing prices have set new all-time highs once again. In July, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index recorded a 5.0% annual gain, down from 5.5% in June. Similarly, the 10-City Composite saw an annual increase of 6.8% in July, a decrease from 7.4% the previous month, while the 20-City Composite rose 5.9% year-over-year, down from 6.5% in June. Among the 20 cities, New York again posted the highest annual gain at 8.8%, followed by Las Vegas at 8.2% and Los Angeles at 7.2%. Portland, Oregon, had the lowest annual increase at 0.8%, the same increase as the previous month.

On a month-over-month basis, the U.S. National Index increased 0.1% before seasonal adjustment and 0.2% after adjustment. The 20-City and 10-City Composites remained unchanged pre-adjustment, while both posted a 0.3% increase post-adjustment.

Despite the slowdown, home prices are still rising faster than inflation. There have been 14 consecutive record highs in the National Index after accounting for seasonality of home purchases. The growth has come at a cost, with all but two markets decelerating in July, eight markets seeing monthly declines and the slowest annual growth nationally in 2024.

PMI Falls as New Orders Drop

S&P Flash Manufacturing PMI: The S&P Global Flash U.S. Manufacturing PMI dropped from 47.9 in August to 47, tumbling for the third consecutive month and at the steepest rate since June 2023. The largest negative contribution to the PMI came from new orders, which fell at the fastest rate since December 2022.

Manufacturing output dropped modestly for the second consecutive month but fell at a slower rate than August. Delivery times shortened to a degree not witnessed since February, which indicates spare supply chain capacity amid weakened demand. Factory production was also a drag on PMI, albeit less so than in August. Excluding the pandemic, the decline in factory jobs was the steepest since January 2010 as more firms reported the need to reduce operating capacity due to weak sales. Manufacturing input cost growth cooled to a six-month low thanks to lower energy prices and the spare supply chain capacity. Inventories were unchanged.

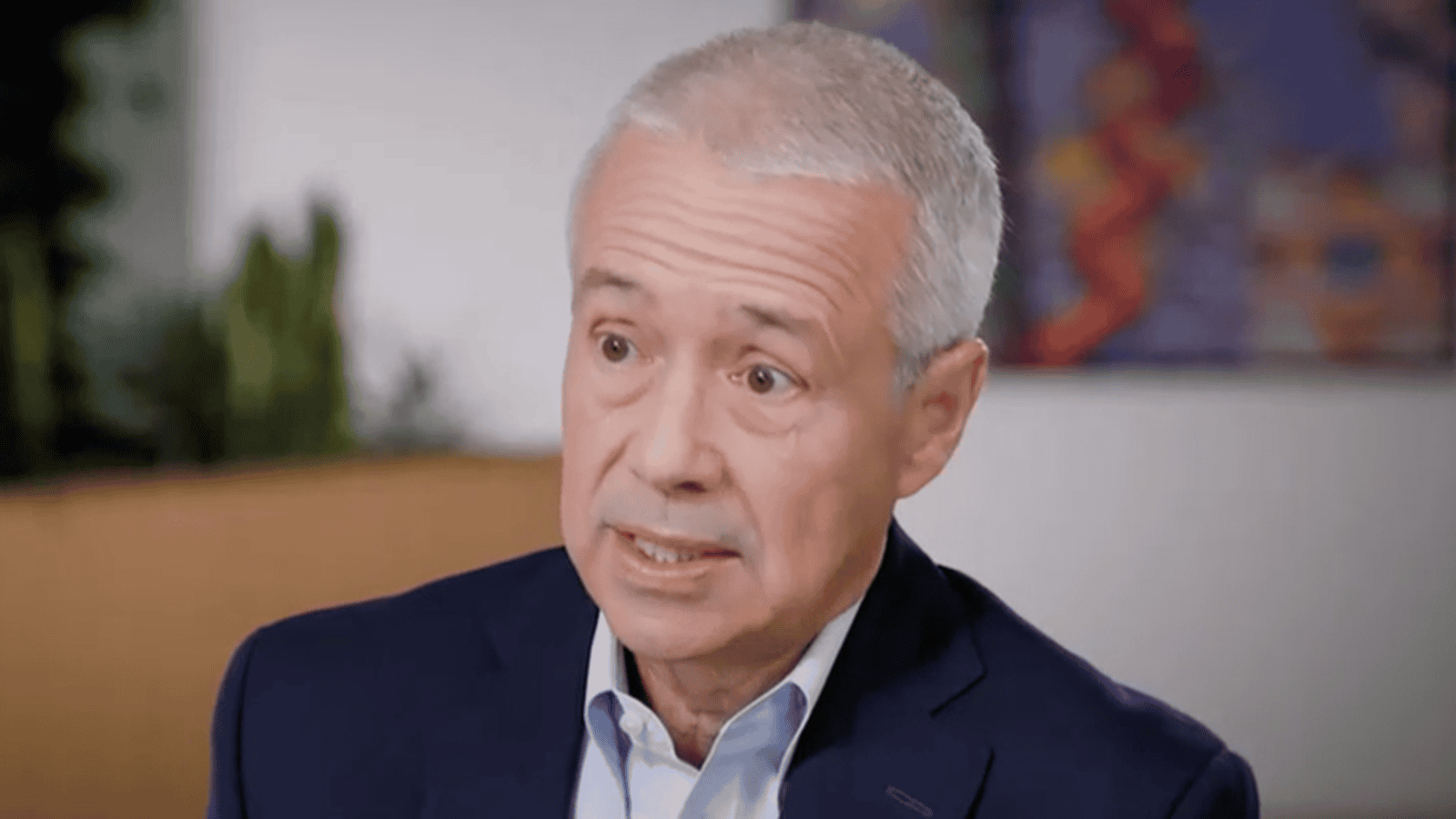

J&J: Price Controls, PBMs Problematic

Drug price controls will “chill” critical innovation in pharmaceutical manufacturing and do nothing to address the underlying causes of high medication costs, Johnson & Johnson leaders said recently.

What’s going on: J&J Chairman and CEO Joaquin Duato and Executive Vice President and Chief Financial Officer Joseph Wolk told Bloomberg TV earlier this month that the pharmaceutical price controls mandated by the 2022 Inflation Reduction Act do a disservice to patients everywhere.

- “[T]he Inflation Reduction Act … is something that is misguided, and it’s going to chill innovation,” Duato told Bloomberg’s David Gura earlier this month. “When you chill innovation on investment in [research and development], then you have [fewer] cures.”

- The IRA gave the federal government authority to set prices for certain prescription medications in Medicare. In August, the Biden administration released the first 10 Medicare prescription drugs subject to those price controls, which go into effect in 2026.

- “I’d like to see a much more fact-based dialogue around the topic of drug pricing,” Wolk added. “About six years ago, Johnson & Johnson … was paying about 25% in discounts and rebates off [the] list price [of medications]. Today, that [figure is] 60%, yet the patients aren’t receiving the benefit of those discounts.”

The background: Pharmacy benefit managers are supposed to pass the manufacturer discounts they receive on to health plans and patients—but instead, they frequently pocket the discounts, the NAM has told Congress on several occasions.

- That’s one of several problematic business practices Congress must end by enacting comprehensive PBM reform, the NAM has said.

- Such legislation would do far more to benefit consumers than capping drug prices.

Cause and effect: The result of price controls will be fewer breakthrough cures and treatments for patients suffering from various illnesses, J&J told Bloomberg TV.

- “The number of medicines that will be there will be [lower], just because [fewer] investors would be putting money into developing new medicines,” Duato continued. “It’s going to be less attractive for investors to put money there.”

- And as Wolk said in another Bloomberg segment: “Investing in R&D, prioritizing R&D years in advance for [a drug] that may happen 10 years down the road is critically important.”

What should be done: If Congress truly wants to help patients with the cost of medications, it must focus on “the middlemen who are really driving up prices: pharmacy benefit managers,” NAM President and CEO Jay Timmons said recently.